MANAGEMENT AUDIT

The term management audit is commonly used for examination and appraisal of the efficiency and effectiveness of management in carrying out its activities. Areas of auditor interest include the nature and quality of management decisions, operating results achieved, and risks undertaken.

The management audit focuses on results, evaluating the effectiveness and suitability of controls by challenging underlying rules, procedures, and methods. Management audits, which are generally performed internally, are both compliance reviews and goals-and-effect analyses. When performed correctly, they are potentially the most useful of evaluation methods, because they result in change.

The management audit is a process of systematically examining, analyzing, and appraising management's overall performance. The appraisal is composed of ten categories, examined historically and in comparison with other organizations. The audit measures a company's quality of management relative to those of other companies in its particular industry, as well as the finest management in other industries. The ten categories of the management audit are (1) economic function, (2) corporate structure, (3) health of earnings, (4) service to stockholders, (5) research and development, (6) directorate analysis, (7) fiscal policies, (8) production efficiency, (9) sales vigor, and (10) executive evaluation. These categories do not represent single functions of management.

ECONOMIC FUNCTION

The economic function category in the management audit assigns to management the responsibility for the company's importance to the economy. In essence, the public value of the company is determined. The value is based on what the company does, what products or services it sells, and how it goes about its business in a moral and ethical sense. It includes the company's reputation as well as management's view of the purpose of the company.

The public is defined in this sense not only as the consumers of the company's products or services and its shareholders, but also a number of groups that the company must seek to satisfy. These groups include its employees, suppliers, distributors, and the communities in which it operates. A company cannot have achieved maximum economic function unless it has survived trade cycles, met competition, developed and replaced management, and earned a reputation among its various publics.

CORPORATE STRUCTURE

The corporate structure review evaluates the effectiveness of the structure through which a company's management seeks to fulfill its aims. An organization's structure must strengthen decision-making, permit control of the company, and develop the areas of responsibility and authority of its executives. These requirements must be met regardless of the type of company. Companies that have established product divisions or other forms of organization have maximized the delegation of authority, but have not reduced the need for a clear understanding of authority.

Companies are generally decentralized after the lines of authority have been established; but even large

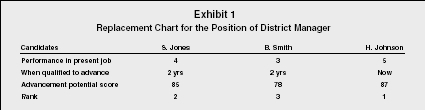

Replacement Chart for the Position of District Manager

| Candidates | S. Jones | B. Smith | H. Johnson |

| Performance in present job | 4 | 3 | 5 |

| When qualified to advance | 2 yrs | 2 yrs | Now |

| Advancement potential score | 85 | 78 | 87 |

| Rank | 2 | 3 | 1 |

companies have endured conflicts as the result of a breakdown in the acceptance of authority. An example of this is General Motors in the early 1920s, when the company endured an $85 million inventory loss because division leaders did not accept the authority of principal executives.

HEALTH OF EARNINGS

The health of earnings function analyzes corporate income in a historical and comparative aspect. The question this function seeks to answer is whether assets have been employed for the full realization of their potential. This can be assessed by a study of the risk assumed in the employment of resources, in the profit returns upon employment, and the distribution of assets among various categories. The actual value of the assets may not be able to be determined, but a company can trace the cost of acquisitions, rate of depreciation, and the extent to which assets have been fully profitable or not. The information needed for this category can usually be found within the company's annual reports.

SERVICE TO STOCKHOLDERS

The evaluation of a company's service to its shareholders can be assessed in three areas: (1) the extent to which stockholders' principal is not exposed to unnecessary risks; (2) whether the principal is enhanced as much as possible through undistributed profits; and (3) whether stockholders receive a reasonable rate of return on their investment through the form of dividends.

The evaluation also covers the quality of service provided by the company to its stockholders, mainly in the form of information and advice about their holdings. Although companies and industries vary widely on the amount of earnings they can pay out in the form of dividends, the rate of return and capital appreciation are the most important indicators of fairness to stockholders.

RESEARCH AND DEVELOPMENT

The evaluation of research and development is essential because R&D is often responsible for a company's growth and improvement in its industry. Analyzing research results can show how well research dollars have been utilized, but it does not show whether management has realized the maximum from it potential. Just like health of earnings, research should be examined from a historical and comparative standpoint in dollars expended; the number of research workers employed; the ratio of research costs and staff to total expenses; and new ideas, information, and products turned out. The examination of these figures compared with past results show management's willingness to employ research for future growth and health.

The American Institute of Management's evaluation attempts to determine what part of the company's past progress can properly be credited to research and how well research policies are preparing the company for future progress.

DIRECTORATE ANALYSIS

Directorate analysis covers the quality and effectiveness of the board of directors. Three principal elements are considered in the evaluation of the board. First, the quality of each director is assessed along with the quality and quantity of the contributions he or she makes to the board. Second, how well the directorate works together as a team is evaluated. Third, the directors are assessed to determine if they truly act as trustees for the company and act in the shareholders' best interest. This can best be examined in areas where a conflict of interest exists between a company's executives and its owners and public. One of the best areas to evaluate is corporate incentives. The manner in which a board handles conflicts of compensation provides a good key to its value.

FISCAL POLICY

The fiscal policy function of the management audit expresses the past and present financial policies. This function includes the company's capital structure; its organizations for developing fiscal policies and controls; and the application of these policies and controls in different areas of corporate activity.

PRODUCTION EFFICIENCY

Production efficiency is an important function for manufacturing companies as well as non-manufacturing companies. Production efficiency is divided into two parts. The first part, machinery and material management, evaluates the mechanical production of the company's products. The second aspect, manpower management, includes all personnel policies and practices for non-sales and non-executive employees developed by management. Only when both parts are analyzed can an overall evaluation of production be effectively performed.

SALES VIGOR

Sales vigor can be evaluated even though sales practices vary widely among industries. This can be accomplished after marketing goals have been determined and assessed. The goals must be assessed in terms of the overall goals of the company. Historical and comparative data are then analyzed to evaluate how well past sales potential has been realized and how well present company sales policies prepare the organization to realize future potential.

EXECUTIVE EVALUATION

Executive evaluation is the most important function of the management audit. The other nine functions indirectly evaluate the organization's management, since they represent the results of management's decisions and actions. This function addresses the quality of the executives and their management philosophy.

The American Institute of Management has found that the three essential elements in a business leader are ability, industry, and integrity. These elements provide a framework for the executive's evaluation in the management audit and should also be the criteria used in selecting and advancing executives. As a group, executives must regard the continuity of the organization as an important goal, assuring it by sound policies of executive selection, development, advancement, and replacement.

The most important management audit activity is an internal audit function. Each enterprise must have an independent source for developing and verifying controls, above and beyond what the external auditors might do in a financial audit.

The functions of the management audit remain the same regardless of the type of business. In order to get good results, companies must observe principles of sound management; the degree to which they succeed can be appraised by systems such as the one outlined here.

SEE ALSO: Effectiveness and Efficiency

Kevin Nelson

Revised by Charalambos Spathis ,

Eugenia Petridou , and

Constantine Zopounidis

FURTHER READING:

Craig-Cooper, Michael, and Philippe De Backer. The Management Audit: How to Create an Effective Management Team. Alexandria, VA: Financial Times Pitman Publishing, 1993.

Sayle, Allan J. Management Audits: The Assessment of Quality Management Systems. Brighton, MI: Allan Sayle Associates, 1997.

Torok, Robert M., and Patrick J. Cordon. Operational Profitability: Conducting Management Audits. Hoboken, NJ: John Wiley & Sons Inc., 1997.

Comment about this article, ask questions, or add new information about this topic: