Search Service

BUSINESS PLAN

THE SEARCHERS

9876 S.W. 17th St.

Alexandria, VA 22209

April 1994

This business plan is for a search and retrieval service providing clients with online transmission of data. This established business is seeking minority shareholder investors to contribute needed capital. Look for discussions on offering unique services to remain competitive and positioning oneself in a competitive market.

- EXECUTIVE SUMMARY

- NATURE OF VENTURE

- DESCRIPTION OF THE MARKET

- DESCRIPTION OF SERVICES

- MANAGEMENT TEAM AND OWNERSHIP

- GOALS AND OBJECTIVES

- BUSINESS STRATEGIES

- FINANCIAL DATA

EXECUTIVE SUMMARY

The Searchers will be a multi-service public record search, document retrieval and business information services company with corporate offices located in Alexandria, Virginia. The corporate mission of the Searchers will be delivery of prompt, accurate, high quality, cost-efficient services on a consistent basis backed by excellent customer service. These services will be delivered through a highly automated computer system that features PC to PC communication for timely ordering and information reporting. Our client base will consist of financial institutions (banks, thrift), mortgage companies, credit unions, finance companies, legal services companies and small to middle market size corporations located throughout the market area defined as Delmarva-Delaware, Maryland, and Virginia.

The Searchers offers a unique opportunity to become part of a business that does not require a huge investment and that provides a variety of search, retrieval and business information services that are in continuous demand from a large established client base. Our client base is in constant need of public record and business information services in order to verify the credit and collateral status of commercial and retail customers in connection with new financing/loan requests, refinancing and ongoing credit maintenance. As a result, by the end of the Searchers' second year the company is expected to have a consistent cash flow that strengthens as revenues and earnings steadily improve. The Searchers' financial goal is to reach revenues of $600M + generating after-tax profits of $65M + by the end of year five. The Searchers will be adequately capitalized by the end of year five allowing for investors to benefit from distributions via dividends, management fees or bonuses. The Searchers will achieve these goals by:

- Concentrating sales efforts on providing services where volume, demand and margins are highest.

- Providing a wide selection of basic and custom services through the use of state-of-the-art computer systems that feature electronic ordering, transmission and payment of search and information services.

-

Replacing competitors that have become order-takers with a sophisticated

and dynamic sales and marketing organization that is customer driven.

The Searchers will provide:

- a consistent calling effort via personal selling

- a monthly newsletter to inform clients of new services and improvements to existing services

- free seminars to educate clients on services offered, how they work and why they are important to the clients.

- Building long-term and loyal customer relationships through the implementation of the Searchers' relationship management selling approach. This approach emphasizes consultative selling that focuses on rapport-building and gaining a thorough understanding of the clients business and needs in order to increase selling opportunities.

- Fully utilizing the experience, skills and industry contacts of Mr. Smiley to build and develop a strong client base. Moreover, the Searchers will have a strong sales, management and support staff by recruiting talented, hard-working, dedicated employees.

- Offering additional services as the company grows such as title insurance, residential real estate appraisals, financial structuring/loan brokering, bank telemarketing programs and loan document preparation in order to maximize cross-selling opportunities with existing clients. This will diversify the revenue mix, improve margins and lead to increased profitability. The Searchers strategy is to eventually market itself as a "one stop provider" of certain business services to the financial marketplace.

The Searchers will be Delaware corporation in which George D. Smiley will maintain a majority ownership interest. Mr. Smiley will initially invest $20,000. This business plan seeks an additional infusion of approximately $254,000 in equity to underwrite start-up costs and provide needed working capital.

NATURE OF VENTURE

Background

The search and business information services industry is an established industry which has historically been slow to address and adapt to changes within the credit and lending environments with respect to market trends, regulation and technology. The primary competitors are mature companies that have developed into order takers relying on repeat business rather than aggressive sales and marketing companies that provide innovative, accurate, high quality search and business information services and prompt customer service on a consistent basis. There is a need for a sales oriented, professional, high-tech information services company that provides a wide selection of competitively priced services and is customer driven.

Nature of Services

The Searchers will provide a wide selection of services including public record searches, business information and miscellaneous document search and retrieval services. Public record searches include UCC-secured transaction searches, real property, deed information, legal descriptions, judgments, federal liens, environmental liens, litigation, assignment and bankruptcy searches, U.S. District Court searches, Superior Court searches and flood hazard reports. Business information services includes corporate status reports, incorporation searches, patent/trademark searches and fictitious names searches. Miscellaneous document search and retrieval services include copies of mortgages, motor vehicle record services, resume checks, social security number traces, criminal records reports, employment verification, and delinquent tax information. Business hours will be Monday through Friday 8:30 a.m. to 5:00 p.m.

Location of Venture

The Searchers will be located in the Town Square, Alexandria, VA. The office is centrally located to provide easy access to all the major surrounding county courthouses.

DESCRIPTION OF THE MARKET

The Searchers will target financial institutions (bank/thrift), mortgage companies, credit unions, finance companies, legal services companies, and middle market size corporations in the tri-state area. However, the Searchers will initially concentrate its sales and marketing efforts in the Chesapeake Bay area. The company will seek to develop a highly qualified network of correspondents to support client needs within the outside the market area. The Searchers will focus on developing relationships will the corporate and consumer lending, credit support, and collection departments of financial institutions, credit unions, and finance company clients. In addition, the Searchers will target the underwriting and processing departments of mortgage company clients. The company will seek to develop client relationships with legal service companies (attorneys/law firms/paralegals) and the accounting, accounts receivable and legal departments of corporate clients.

Market Trends

The growth in the number of regionally located financial institutions, credit unions, and finance companies within the market area is expected to be modest through the remainder of the 1990s. Major factors effecting growth include (1) the mature nature of the market and large number of competition (2) industry consolidation via verger and acquisitions (3) barriers to entry are high i.e. capital requirements (4) highly regulated by federal, state and local government (5) current recessionary environment. Merger and acquisition activity among financial institutions is expected to continue throughout the remainder of the 1990s according to the Standard and Poor Industry Survey Guide. The Guide indicates that from 1975 to 1992 the number of FDIC insured banks nationwide fell from 14,628 to 11,900 as a result of bank mergers, acquisitions and failures. By the year 2000, the number of banks in the U.S. could be reduced another 25%-50%. This consolidation is expected to continue within the Searchers target market area as the large money center and super-regional banks continue to grow through merger and acquisitions. From 1991 to 1992 the number of national and state-chartered commercial banks within the market area fell from approximately 475 to 449. Nevertheless, this decline is not expected to have a major impact on the Searchers' expected growth since much of the decline is due to consolidation via merger and acquisition. As a result, the client base will shrink, but the order volume is expected to remain consistent. Additionally, competition from non-bank corporations such as insurance companies and investment banks that are eager to enter the bank field may expand the target market.

The thrift industry (savings and loans/savings banks) has gone through a difficult period through the late 1980s and into the early 1990s. The industry has undergone significant shrinkage nationwide as a result of the many failed banks and continues to go through the final stage of a longstanding consolidation. However, the number of thrifts remained relatively stable at 275 between 1991 and 1992 within the market area. Nevertheless, their long term prospects are contingent upon their ability to profitably compete in increasingly open mortgage markets. Despite the consolidation and shrinkage among banks and thrifts, the high volume of potential business from the financially sound institutions makes them very attractive clients.

The mortgage company market includes primary and secondary mortgage bank and broker companies. The mortgage company industry realized substantial growth in the late 1980s as a result of strong economic conditions and again over the past several years due to the attractive interest rate environment. Between 1991 and 1992, the number of mortgage companies increased from 1,393 to 1,523. The Searchers will target established, financially sound medium to large size companies in order to take advantage of high volume.

The credit union market over the past decade has consolidated with over 300 voluntary mergers nationwide due primarily to the presence of more competition from banks and non-banks providers of financial services. Within the market area, the number of credit unions decreased from 540 in 1990 to 527 in 1992. In order to compete more effectively, credit unions are merging to form larger institutions which will enable them to offer more services. Nevertheless, their market share for long term loans has declined over the past ten years due to increased competition. Despite the decline in long term lending, the strength of the credit union industry and their strong niche in the consumer residential mortgage market make them attractive clients for the Searchers in which loan term, profitable relationships can be established.

The finance company market is expected to continue to gradually decline as a result of industry consolidation and from intense competition. There are over 1,000 consumer discount and sales finance companies in the market are. The Searchers will focus on high volume industry leaders such as GE, ITT, Sears, American Express and Prudential because of their large branch networks, as well as small-medium size companies where client relationships can be developed more quickly.

The legal service market is expected to grow due to growth among paralegals and the opening of paralegal firms. Independent paralegals have increased from about 200 individuals in 1985 to an estimated 6,000 in 1992 nationwide. The attorney market is expected to remain relatively stable despite some decline from mergers and consolidations. Nevertheless, receipts in 1994 are projected to increase 5%-6% as the demand for legal services increases. There are approximately 131,000 attorneys within the market area. Both paralegals and attorneys are candidates for real property and UCC searches/filing information, bankruptcy, litigation, judgement and lien searches.

The Searchers will target small to middle market size companies (generally sales of $2MM-$100MM) in the market area. Within this sales range there are approximately 49,000 businesses in Virginia, 2,500 in Delaware and 47,000 in Maryland. This large market provides the Searchers with significant opportunities to provide business information and search services to the accounting, accounts receivable and legal departments of these companies.

Demographics and Economic Trends

Changing demographics are not expected to have a large scale impact on the target market. The Searchers will deal primarily with business clients, thus demographic changes within the market area will have a minimal impact. However, population and income levels do effect the Bank's market, particularly from the consumer lending standpoint. The Searchers will be somewhat insulated due to the fact that the majority of clients will be business clients spread over a broad geographical area. However, economic trends can significantly impact credit standards, lending practices, interest rates and loan demand. The low interest rate environment over the past three years has spurred loan demand and the need for increased public record searches, document retrieval and business information services. The changing regulatory environment along with increasing interest rates could have an impact on the commercial and consumer lending practices of banks, thrifts, mortgage and finance companies which will ultimately impact commercial and consumer loan demand.

Current Competitors

There are several primary competitors in the Delmarva area. The principal competition of the Searchers will come from five to six established companies. They include Delmarva Abstracts Inc., Chesapeake Search and Abstract Co., Alexandrian Search Inc., ABC Credit Co., Bay Watch, and Virginia Research Inc. The most significant Alexandria-based competitor is Alexandrian Search, the leading provider of public record searches to banks, thrifts, mortgage companies and law firms in Alexandria and surrounding areas. Delmarva Abstracts employs approximately 140 people and maintains six branch offices in neighboring regions. The dominant competitor in Maryland is Bay Watch which employs 150 people with two offices. Additionally, both companies provide title agent and real estate appraisal services. ABC Credit and Virginia Research are smaller Alexandria-based firms covering the same marketplace as the larger competition but offering fewer services. Chesapeake Search and Abstract is a Delaware-based competitor with 10 offices nation-wide and is the dominant provider in the Delaware, Maryland, and Washington, DC area. Chesapeake was recently purchased by Information Inc., a Dallas-based information retrieval service company with over $15 billion in annual revenues. The company offers a wider selection of services than any of the aforementioned competitors and competes effectively on price and service.

All of the primary competitors are established and experienced providers of the services offered by the Searchers. However, Alexandrian Search and Chesapeake Search and Abstract are the only competition with a relatively consistent sales effort and marketing programs. Nevertheless, they lack a relationship management strategy that builds loyal customers and increases selling opportunities. The remaining competitors rely on repeat business from established customers.

DESCRIPTION OF SERVICES

Uniqueness of The Services

Since many of the search and business information services provided by the Searchers will be the same as the primary competition, the uniqueness of the services offered will come from how they are provided and delivered. The Searchers will highlight the electronic ordering, transmission and payment of information services from PC to PC which will appeal to those clients who have made substantial investments in computer systems and technology and demand more timely, efficient service. However, the most significant aspect of the Searchers will be the manner in which the company sells and markets its services. The concept of relationship management selling will appeal to those clients who demand accurate, high quality, prompt, cost-efficient search and information services backed with excellent customer service. By gaining a thorough understanding of the clients needs, miscommunication and mistakes are minimized, rapport building and customer loyalty is enhanced and additional selling opportunities are realized. Our highly knowledgeable and well-trained staff will provide seminars to educate clients regarding available services, industry information and terminology.

Advantages Over Competing Products

The Searchers' principal competitive advantage will come from its relationship management selling approach which will distinguish the company from competitors who have become order takers. Additionally, delivery of services through PC-to-PC communication will set the Searchers apart from the competition.

MANAGEMENT TEAM AND OWNERSHIP

George D. Smiley will maintain a majority ownership interest in the Searchers and will serve as President. He will be primarily responsible for sales, marketing and finance. Mr. Smiley had been a corporate lender for TriState Financial Inc. serving as Vice President in the regional lending area for the past 10 years. He brings extensive knowledge and experience in the field of banking, finance and credit. Specifically, he has a thorough understanding of the public record search and business information needs of the company's clients.

Mr. Smiley plans to hire an office/accounting manager who will be responsible for office operations and administration. This person will have prior office management/administration experience and an accounting/computer operations background. Three part-time computer operators/customer service/administrative employees will be hired to process, search and document retrieval requests, as well as handle customer questions and problems. These individuals will have prior computer operations experience and backgrounds in customer services. In addition, two document/information searchers will be hired on a part time/as needed basis to physically search document sources not available on databases. One additional experienced salesperson is expected to be hired by the end of the base year to strengthen revenues by providing improved and expanded market coverage. A second experienced salesperson will be hired by the end of year two.

GOALS AND OBJECTIVES

Short Term Goals

The initial major short-term goal of the Searchers is to obtain financing to launch the venture and provide adequate liquidity to fund ongoing working capital needs and support future growth. The Searchers' short-term financial goal is to generate a small profit by the end of the base year. The company will emphasize sales volume growth, strong cost controls and consistent improvement in cash flow and profitability. Profits will be retained to finance operations, pay off investor debt (if applicable) and support future growth.

Long Term Goals

The long-term of the Searchers is to become the leading provider of public record search and business information services within the market area. The Searchers will strive to increase profitability and cash flow and improve capitalization to support regional expansion of operations in the future.

BUSINESS STRATEGIES

The Searchers will employ a differentiation strategy that focuses on providing cost effective, high quality, prompt and accurate search and business information services that features a state-of-the-art information collection, delivery and payment system. Moveover, the company's relationship management strategy, which focuses on rapport building, understanding of the client's business and needs, communication, client satisfaction and superior service will distinguish the Searchers from its order-taker competitors.

Marketing Plan and Supporting Strategies

The Searchers will support its differentiation strategy by effective execution of its marketing plan which contains supporting strategies including promotional, service, pricing and distribution.

The Searchers will use multiple media sources which effectively utilize allocated promotional dollars while focusing on relatively short time periods. Although the primary competition does little in the way of advertising, the Searchers will need to have a well organized promotional strategy to make inroads and generate new business. The Searchers' target client base will be attracted primarily through personal selling. The Searchers' personal selling efforts will be supported by marketing brochures and pamphlets that provide company background information and highlight the features and benefits of our services. The effectiveness of personal selling will rely on the use of industry contacts, referrals and a consistent calling effort. This will be supported by advertisements in industry publications (i.e. Maryland Business Journal, American Banker) and yellow page advertisements. The Searchers will highlight specific services such as the ability of the client to order and receive information electronically. Other future promotional strategies will include a direct mail and telemarketing program to focus on specific client groups and market area. For example, most corporate clients are not aware that there are search services available that can help them with collection problems and provide judgement, lien and collateral information. A well designed and implemented direct mail and telemarketing program would target the best potential clients and create the most selling opportunities.

The Searchers will offer certain promotional items in conjunction with the company's personal selling strategy, such as cups, pens, golf balls and calendars. The company will also join certain industry associations such as the American Banker's Association, Mortgage Bankers Association, National Association of Credit Management and various local Chambers of Commerce. These associations provide a good way to develop industry contacts and create marketing and selling opportunities for the Searchers as well as build good community relations. Additionally, these associations are often times willing to sell mailing lists of members and subscribers. The Searchers will also seek referrals from industry contracts and consistently network to develop new referral sources.

The Searchers' service strategy will entail providing certain services such as real property, UCC, lien and judgement searchers as well as flood reports where demand and volume tend to be high, margins are strong and services are repeatedly ordered. The Searchers estimates that 75% of its revenues will be derived from these services because they are required by the bulk of the company's client base in connection with the approval and ongoing maintenance of corporate and consumer loans and mortgages.

The Searchers will utilize a competitor based pricing strategy that prices its services in line with the leading competitors. The company's strategy will be to position itself among the leading price. This strategy will allow the Searchers to be on the high-end of the pricing scale which will help to maintain targeted margins and profitability levels. By developing a high quality image and reputation, the Searchers will be a price leader within the industry. This will enable the company to command premium prices for special and customer services. In addition, the Searchers introduces new services (i.e. title insurance, real estate appraisals, document preparation) it can leverage off its quality image and maintain high end pricing.

The average client is expected to request several types of services with each other, especially among financial institutions, mortgage companies, finance companies and credit union clients. These client generally need several specific types of information to complete a new loan request and/or refinancing as well as for ongoing credit maintenance.

The average order is expected to be $30.00. The Searchers will group services together into four or give types of service packages. The price will be dependent on the type of service package ordered. The more services offered within a package, the higher the price. Prices are expected range from $10.00 to $60.00.

The Searchers will provide services and information as requested an forward the results via mail, fax or through PC-to-PC transmission. The client need only have a modem and basic communication software such as Cross Talk or ProComm. This software can be purchased easily and is relatively inexpensive at about $100-$150.

Human Resources Strategy

The Searchers will need an excellent support staff of well trained, knowledgeable, motivated and dedicated employees who can interact well with customers. Therefore, the Searchers will hire an office/accounting manager who is experienced with a strong office management/administrative/computer operations background and excellent customer services skills. Additionally, three part-time computer operator/customer service/administrative employees will be hired. These employees will have good computer operations, administrative, telephone and excellent customer service skills. The Searchers will also hire two document/information searchers on a part-time/as needed basis. The Searchers will hire only experienced searchers who have backgrounds in the area of public records, business information and archival research and are detail oriented. An additional salesperson is not expected to be hired until the end of the first year. The Searchers will look for experienced salespeople who are professional, self-starters, motivated and aggressive. The company will pay the prevailing rate for good computer operator/customer service employees. However for key positions such as office/accounting manager, searchers, and salespeople, the Searchers will pay higher than prevailing rates to attract and retain the best employees.

Financial Strategy

The Searchers will be owned by George Smiley who prefers to retain financial and managerial control. Mr. Smiley desires to maintain a controlling interest of no less than 51% of the company's capital stock. The Searchers will require $254,000 in equity funding to finance initial start-up costs and working capital needs. Equity financing will be sought from informal investors via venture capital networks, exchanges and clearinghouses. Growth stage funding will be provided from the retention of earnings as well as from SB A/bank financing and possibly subordinated debt from informal investors.

Overall Growth Strategy

The Searchers expects to realize strong consistent sales and earnings growth over the next five years. This growth will be principally attributable to the development of new and existing which will come at the expense of competitors. The Searchers expects to develop five to ten new clients by the end of the base year. TriState Financial is expected to be the primary client generating the bulk of sales. TriState Financial purchase volume of public record searches is approximately $300M-$350M annually. The remainder of new clients will be developed through a consistent and effective personal selling, telemarketing and advertising program and from the use of industry contacts and effective networking to develop good referral sources. Additionally, the Searchers will benefit from cross-selling of new services through its expanded sales force over the five year period. Management will effectively control labor expense and profitability. Additionally, operating expenses will be carefully managed to insure that the majority of incremented revenue growth results in increased bottom line profitability.

FINANCIAL DATA

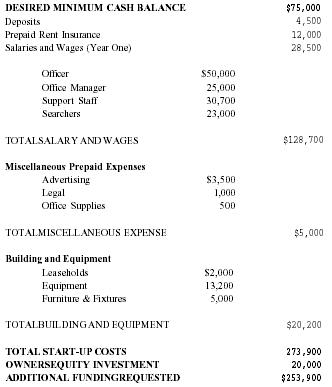

Estimated Start-Up Costs and First Year Operating Costs

| DESIRED MINIMUM CASH BALANCE | $75,000 | |

| Deposits | 4,500 | |

| Prepaid Rent Insurance | 12,000 | |

| Salaries and Wages (Year One) | 28,500 | |

| Officer | $50,000 | |

| Office Manager | 25,000 | |

| Support Staff | 30,700 | |

| Searchers | 23,000 | |

| TOTAL SALARY AND WAGES | $128,700 | |

| Miscellaneous Prepaid Expenses | ||

| Advertising | $3,500 | |

| Legal | 1,000 | |

| Office Supplies | 500 | |

| TOTAL MISCELLANEOUS EXPENSE | $5,000 | |

| Building and Equipment | ||

| Leaseholds | $2,000 | |

| Equipment | 13,200 | |

| Furniture & Fixtures | 5,000 | |

| TOTAL BUILDING AND EQUIPMENT | $20,200 | |

| TOTAL START-UP COSTS | 273,900 | |

| OWNERS EQUITY INVESTMENT | 20,000 | |

| ADDITIONAL FUNDING REQUESTED | $253,900 | |

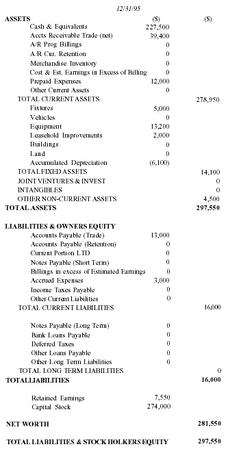

Balance Sheet

| 12/31/95 | ||

| ASSETS | ($) | ($) |

| Cash & Equivalents | 227,500 | |

| Accts Receivable Trade (net) | 39,400 | |

| A/R Prog Billings | 0 | |

| A/R Cur. Retention | 0 | |

| Merchandise Inventory | 0 | |

| Cost & Est. Earnings in Excess of Billing | 0 | |

| Prepaid Expenses | 12,000 | |

| Other Current Assets | 0 | |

| TOTAL CURRENT ASSETS | 278,950 | |

| Fixtures | 5,000 | |

| Vehicles | 0 | |

| Equipment | 13,200 | |

| Leasehold Improvements | 2,000 | |

| Buildings | 0 | |

| Land | 0 | |

| Accumulated Depreciation | (6,100) | |

| TOTAL FIXED ASSETS | 14,100 | |

| JOINT VENTURES & INVEST | 0 | |

| INTANGIBLES | 0 | |

| OTHER NON-CURRENT ASSETS | 4,500 | |

| TOTAL ASSETS | 297,550 | |

| LIABILITIES & OWNERS EQUITY | ||

| Accounts Payable (Trade) | 13,000 | |

| Accounts Payable (Retention) | 0 | |

| Current Portion LTD | 0 | |

| Notes Payable (Short Term) | 0 | |

| Billings in excess of Estimated Earnings | 0 | |

| Accrued Expenses | 3,000 | |

| Income Taxes Payable | 0 | |

| Other Current Liabilities | 0 | |

| TOTAL CURRENT LIABILITIES | 16,000 | |

| Notes Payable (Long Term) | 0 | |

| Bank Loans Payable | 0 | |

| Deferred Taxes | 0 | |

| Other Loans Payable | 0 | |

| Other Long Term Liabilities | 0 | |

| TOTAL LONG TERM LIABILITIES | 0 | |

| TOTAL LIABILITIES | 16,000 | |

| Retained Earnings | 7,550 | |

| Capital Stock | 274,000 | |

| NET WORTH | 281,550 | |

| TOTAL LIABILITIES & STOCK HOLKERS EQUITY | 297,550 | |

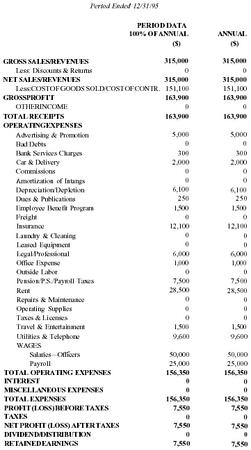

Income Statement

| Period Ended 12/31/95 | ||

|

PERIOD DATA

100% OF ANNUAL |

ANNUAL | |

| ($) | ($) | |

| GROSS SALES/REVENUES | 315,000 | 315,000 |

| Less: Discounts & Returns | 0 | 0 |

| NET SALES/REVENUES | 315,000 | 315,000 |

| Less: COST OF GOODS SOLD/COST OF CONTR. | 151,100 | 151,100 |

| GROSS PROFTT | 163,900 | 163,900 |

| OTHER INCOME | 0 | 0 |

| TOTAL RECEIPTS | 163,900 | 163,900 |

| OPERATING EXPENSES | ||

| Advertising & Promotion | 5,000 | 5,000 |

| Bad Debts | 0 | 0 |

| Bank Services Charges | 300 | 300 |

| Car & Delivery | 2,000 | 2,000 |

| Commissions | 0 | 0 |

| Amortization of Intangs | 0 | 0 |

| Depreciation/Depletion | 6,100 | 6,100 |

| Dues & Publications | 250 | 250 |

| Employee Benefit Program | 1,500 | 1,500 |

| Freight | 0 | 0 |

| Insurance | 12,100 | 12,100 |

| Laundry & Cleaning | 0 | 0 |

| Leased Equipment | 0 | 0 |

| Legal/Professional | 6,000 | 6,000 |

| Office Expense | 1,000 | 1,000 |

| Outside Labor | 0 | 0 |

| Pension/P.S./Payroll Taxes | 7,500 | 7,500 |

| Rent | 28,500 | 28,500 |

| Repairs & Maintenance | 0 | 0 |

| Operating Supplies | 0 | 0 |

| Taxes & Licenses | 0 | 0 |

| Travel & Entertainment | 1,500 | 1,500 |

| Utilities & Telephone | 9,600 | 9,600 |

| WAGES | ||

| Salaries—Officers | 50,000 | 50,000 |

| Payroll | 25,000 | 25,000 |

| TOTAL OPERATING EXPENSES | 156,350 | 156,350 |

| INTEREST | 0 | 0 |

| MISCELLANEOUS EXPENSES | 0 | 0 |

| TOTAL EXPENSES | 156,350 | 156,350 |

| PROFIT (LOSS) BEFORE TAXES | 7,550 | 7,550 |

| TAXES | 0 | 0 |

| NET PROFIT (LOSS) AFTER TAXES | 7,550 | 7,550 |

| DIVIDEND/DISTRIBUTION | 0 | 0 |

| RETAINED EARNINGS | 7,550 | 7,550 |

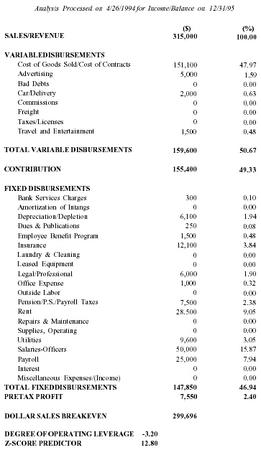

Breakeven Analysis

| Analysis Processed on 4/26/1994 for Income/Balance on 12/31/95 | ||

| SALES/REVENUE |

($)

315,000 |

(%)

100.00 |

| VARIABLE DISBURSEMENTS | ||

| Cost of Goods Sold/Cost of Contracts | 151,100 | 47.97 |

| Advertising | 5,000 | 1.59 |

| Bad Debts | 0 | 0.00 |

| Car/Delivery | 2,000 | 0.63 |

| Commissions | 0 | 0.00 |

| Freight | 0 | 0.00 |

| Taxes/Licenses | 0 | 0.00 |

| Travel and Entertainment | 1,500 | 0.48 |

| TOTAL VARIABLE DISBURSEMENTS | 159,600 | 50.67 |

| CONTRIBUTION | 155,400 | 49.33 |

| FIXED DISBURSEMENTS | ||

| Bank Services Charges | 300 | 0.10 |

| Amortization of Intangs | 0 | 0.00 |

| Depreciation/Depletion | 6,100 | 1.94 |

| Dues & Publications | 250 | 0.08 |

| Employee Benefit Program | 1,500 | 0.48 |

| Insurance | 12,100 | 3.84 |

| Laundry & Cleaning | 0 | 0.00 |

| Leased Equipment | 0 | 0.00 |

| Legal/Professional | 6,000 | 1.90 |

| Office Expense | 1,000 | 0.32 |

| Outside Labor | 0 | 0.00 |

| Pension/P.S./Payroll Taxes | 7,500 | 2.38 |

| Rent | 28.500 | 9.05 |

| Repairs & Maintenance | 0 | 0.00 |

| Supplies, Operating | 0 | 0.00 |

| Utilities | 9,600 | 3.05 |

| Salaries-Officers | 50,000 | 15.87 |

| Payroll | 25,000 | 7.94 |

| Interest | 0 | 0.00 |

| Miscellaneous Expenses/(Income) | 0 | 0.00 |

| TOTAL FIXED DISBURSEMENTS | 147,850 | 46.94 |

| PRETAX PROFIT | 7,550 | 2.40 |

| DOLLAR SALES BREAKEVEN | 299,696 | |

| DEGREE OF OPERATING LEVERAGE | −3.20 | |

| Z-SCORE PREDICTOR | 12.80 | |

12/31/95 Financial Projection Assumptions

- Sales are expected to reach $315M of which TriState Financial will represent approximately $50M. The remainder will be from the development of five to ten new clients throughout the year. This Figure also assumes $0 sales during months one and two and an average of $31.5M each month thereafter.

- The gross margin is expected to be strong at 52%. The margin is expected to remain strong going forward since the bulk of COS is comprised of labor. The Searchers will control labor expense carefully and will maximize usage of its labor force in order to realize increased operating efficiencies by the second half of the year.

- Operating expenses will appear high as a percentage of sales at 48.6% in year one. This is because these expenses will be comprised primarily of fixed costs such as salaries, rent and insurance. However, as sales grow the incremental increase will fall to the bottom line because the Searchers fixed cost structure can support significant volume increases with only minimal increases in operating expense dollars.

- Liquidity, as measured by the current ratio is strong at 17.4:1 as is working capital of $263M. This is principally due to strong initial capitalization of the company.

- Accounts receivable turnover is projected at 45 days although the Searchers' terms will be net 30. However, A/R quality is expected to be high and bad debts are expected to be minimal. The Searchers expects to improve A/R turnover going forward by encouraging payment through the electronic funds transfer system.

- Accounts payable turnover will be approximately 30 days. Payable will be comprised primarily of correspondent fees and computer access time costs. The Searchers will pay promptly and discount where possible to establish a strong credit history with major vendors.

- Equipment will consist of computer hardware and software, a telephone system, fax machine modem and printer. Equipment will be depreciated over three years. Furniture and fixtures will be depreciated over five years and leaseholds over the expected life of the lease which is projected to be three years. All items are depreciated assuming straight line depreciation.

- Leverage is minimal since the Searchers has been funded by the equity investments of the shareholders. As a result, net worth comprises 94.6% of total capitalization.

Financial Statement Projection

Income Statement

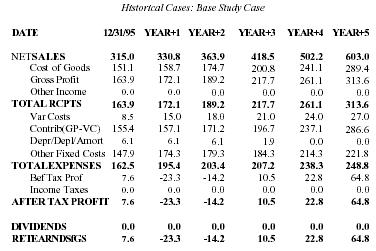

| Historical Cases: Base Study Case | ||||||

| DATE | 12/31/95 | YEAR+1 | YEAR+2 | YEAR+3 | YEAR+4 | YEAR+5 |

| NET SALES | 315.0 | 330.8 | 363.9 | 418.5 | 502.2 | 603.0 |

| Cost of Goods | 151.1 | 158.7 | 174.7 | 200.8 | 241.1 | 289.4 |

| Gross Profit | 163.9 | 172.1 | 189.2 | 217.7 | 261.1 | 313.6 |

| Other Income | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| TOTAL RCPTS | 163.9 | 172.1 | 189.2 | 217.7 | 261.1 | 313.6 |

| Var Costs | 8.5 | 15.0 | 18.0 | 21.0 | 24.0 | 27.0 |

| Contrib (GP-VC) | 155.4 | 157.1 | 171.2 | 196.7 | 237.1 | 286.6 |

| Depr/Depl/Amort | 6.1 | 6.1 | 6.1 | 1.9 | 0.0 | 0.0 |

| Other Fixed Costs | 147.9 | 174.3 | 179.3 | 184.3 | 214.3 | 221.8 |

| TOTAL EXPENSES | 162.5 | 195.4 | 203.4 | 207.2 | 238.3 | 248.8 |

| Bef Tax Prof | 7.6 | −23.3 | −14.2 | 10.5 | 22.8 | 64.8 |

| Income Taxes | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| AFTER TAX PROFIT | 7.6 | −23.3 | −14.2 | 10.5 | 22.8 | 64.8 |

| DIVIDENDS | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| RETEARNINGS | 7.6 | −23.3 | −14.2 | 10.5 | 22.8 | 64.8 |

Balance Sheet

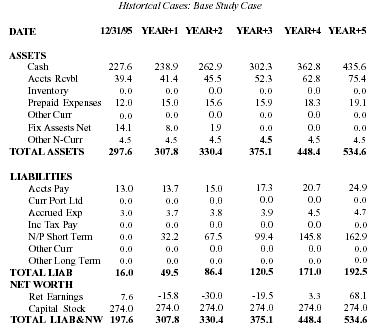

| Historical Cases: Base Study Case | ||||||

| DATE | 12/31/95 | YEAR+1 | YEAR+2 | YEAR+3 | YEAR+4 | YEAR+5 |

| ASSETS | ||||||

| Cash | 227.6 | 238.9 | 262.9 | 302.3 | 362.8 | 435.6 |

| Accts Rcvbl | 39.4 | 41.4 | 45.5 | 52.3 | 62.8 | 75.4 |

| Inventory | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Prepaid Expenses | 12.0 | 15.0 | 15.6 | 15.9 | 18.3 | 19.1 |

| Other Curr | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Fix Assests Net | 14.1 | 8.0 | 1.9 | 0.0 | 0.0 | 0.0 |

| Other N-Curr | 4.5 | 4.5 | 4.5 | 4.5 | 4.5 | 4.5 |

| TOTAL ASSETS | 297.6 | 307.8 | 330.4 | 375.1 | 448.4 | 534.6 |

| LIABILITIES | ||||||

| Accts Pay | 13.0 | 13.7 | 15.0 | 17.3 | 20.7 | 24.9 |

| Curr Port Ltd | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Accrued Exp | 3.0 | 3.7 | 3.8 | 3.9 | 4.5 | 4.7 |

| Inc Tax Pay | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| N/P Short Term | 0.0 | 32.2 | 67.5 | 99.4 | 145.8 | 162.9 |

| Other Curr | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Other Long Term | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| TOTAL LIAB | 16.0 | 49.5 | 86.4 | 120.5 | 171.0 | 192.5 |

| NET WORTH | ||||||

| Ret Earnings | 7.6 | −15.8 | −30.0 | −19.5 | 3.3 | 68.1 |

| Capital Stock | 274.0 | 274.0 | 274.0 | 274.0 | 274.0 | 274.0 |

| TOTAL LIAB & NW | 197.6 | 307.8 | 330.4 | 375.1 | 448.4 | 534.6 |

Projected Cash Flow Analysis

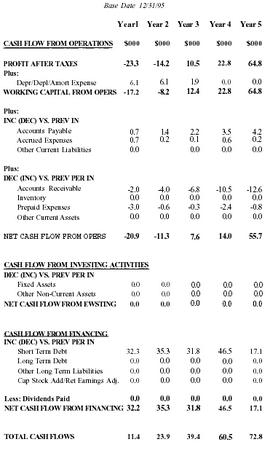

| Base Date 12/31/95 | |||||

| Year l | Year 2 | Year 3 | Year 4 | Year 5 | |

| CASH FLOW FROM OPERATIONS | $000 | $000 | $000 | $000 | $000 |

| PROFIT AFTER TAXES | −23.3 | −14.2 | 10.5 | 22.8 | 64.8 |

| Plus: | |||||

| Depr/Depl/Amort Expense | 6.1 | 6.1 | 1.9 | 0.0 | 0.0 |

| WORKING CAPITAL FROM OPERS | −17.2 | −8.2 | 12.4 | 22.8 | 64.8 |

| Plus: | |||||

| INC (DEC) VS. PREV IN | |||||

| Accounts Payable | 0.7 | 1.4 | 2.2 | 3.5 | 4.2 |

| Accrued Expenses | 0.7 | 0.2 | 0.1 | 0.6 | 0.2 |

| Other Current Liabilities | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Plus: | |||||

| DEC (INC) VS. PREV PER IN | |||||

| Accounts Receivable | −2.0 | −4.0 | −6.8 | −10.5 | −12.6 |

| Inventory | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Prepaid Expenses | −3.0 | −0.6 | −0.3 | −2.4 | −0.8 |

| Other Current Assets | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| NET CASH FLOW FROM OPERS | −20.9 | −11.3 | 7.6 | 14.0 | 55.7 |

| CASH FLOW FROM FINANCING | |||||

| INC (DEC) VS. PREV PER IN | |||||

| Fixed Assets | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Other Non-Current Assets | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| NET CASH FLOW FROM EWSTING | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| CASH FLOW FROM FINANCING | |||||

| INC (DEC) VS. PREV PER IN | |||||

| Short Term Debt | 32.3 | 35.3 | 31.8 | 46.5 | 17.1 |

| Long Term Debt | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Other Long Term Liabilities | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Cap Stock Add/Ret Earnings Adj. | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Less: Dividends Paid | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| NET CASH FLOW FROM FINANCING | 32.2 | 35.3 | 31.8 | 46.5 | 17.1 |

| TOTAL CASH FLOWS | 11.4 | 23.9 | 39.4 | 60.5 | 72.8 |

Five-Year Financial Statement Projections

- Sales are expected to increase by 5% in Year 1 as additional clients are developed. Year 2 sales increase 10% and Year 3 sales by 15%. The addition of a new salesperson in each year will result in development of new and existing clients are expanded market coverage. Years 4 and 5 sales increase by 20% due to an increase among existing clients, additional new clients and from cross-selling of new services.

- Cost of Sales are expected to remain relatively constant at 48%. The Searchers will continue to manage labor expenses carefully and will maximize usage of its labor force to realize operating efficiencies as revenues grow.

- Operating expenses will be high in Year 1 at 59% of sales. However, operating expenses will decline each year thereafter to 41.3% as a percentage of sales by Year 5. Operating expenses are comprised largely of fixed costs such as salaries, rent and insurance. The Searcher's fixed cost structure can support significant volume increases with only minimal increases in operating expense dollars. During Years 4 and 5 operating expenses dollars increase more quickly due primarily to salary increases.

- Liquidity and Working Capital as measured by the current ratio remains strong through the projection period despite losses in years 1 and 2. This is principally attributed to strong initial capitalization of the company.

- Accounts payable turnover will be approximately 30 days. Payable will be comprised primarily of correspondent fees and computer access time costs. The Searchers will pay promptly and discount where possible to establish a strong credit history with major vendors.

- Equipment will consist of computer hardware and software, a telephone system, fax machine, modem and printer. Equipment will be depreciated over three years. Furniture and fixtures will be depreciated over five years and leaseholds over the expected life of the lease which is projected to be three years. All items are depreciated assuming straight line depreciation.

- Leverage is minimal since the Searchers has been funded by the equity investments of the shareholders. As a result, net worth comprises 94.6% of total capitalization.

Comment about this article, ask questions, or add new information about this topic: