Television Childproofer

BUSINESS PLAN

TELEVISION FOR KIDS

903 Bennington Rd.

Syracuse, NY 98239

November 1994

Television for Kids was created by a small team of professionals to market and distribute a unique and highly effective television childproofing system called SafeViewing. This plan studies current markets, demographics, competition, and the skills and equipment needed to successfully build a business in a multi-billion dollar industry.

- EXECUTIVE SUMMARY

- NATURE OF VENTURE

- MARKET DESCRIPTION AND ANALYSIS

- DESCRIPTION OF THE PRODUCT

- MANAGEMENT

- BUSINESS STRATEGIES

- FINANCIAL DATA

- PATENTS, TRADEMARKS AND REGULATORY APPROVAL

- EXHIBIT

EXECUTIVE SUMMARY

Television for Kids (TK) was formed to market and distribute SafeVie wing, a new product that represents a breakthrough in television childproofing. SafeViewing offers parents, grandparents, and other concerned caregivers a simple but fully effective method of screening the television programming available for viewing by children. The system enables adults to selectively eliminate violent or explicit programming from their children's viewing choices with the push of a button. At the same time, this user-friendly system makes it easy for adults to restore full program viewer capability to their television by simply entering a Personal Identification Number (PIN). SafeViewing is compatible with all televisions. Two models are available for basic cable systems and for systems with premium channel or pay-per-view cable descramblers.

The development of SafeViewing was prompted by the widely publicized need for a television parental control device that would be available to the general public and would be applicable to most if not all the different cable systems throughout the country. The goal of Television for Kids' SafeViewing project is to provide a comprehensive control system which is operator friendly, universally adaptable to all television and cable systems, and priced within the reach of the average middle income household. In addition, SafeViewing's development has been based on the belief that parents have the responsibility to monitor and provide guidance to their children through the formative years. SafeViewing allows parents to determine which programming content is acceptable for their children's viewing in lieu of the outside control methods presently being developed.

TK's corporate mission is to provide a highly effective, high quality, affordable childproofing system which gives parents a secure means of selecting specific television programming which they judge to be acceptable for viewing by their children while blocking out programming which they judge to be unacceptable. TK intends to market and distribute SafeViewing nationwide through a well designed and coordinated marketing plan. This plan will include the executive of a comprehensive multi-channel direct response marketing program featuring mass media advertising, direct response television, mail order, direct mail, and public relations. TK's customer base will consist of several million households with parents ages 25 to 55 and/or grandparents with children and/or grandchildren ages two through 13.

TK offers a unique opportunity to become part of a business that does not require an enormous capital investment. In addition, the company has developed a unique product which effectively protects children from violent and explicit television programming in response to a growing demand from a large number of concerned parents nationwide. TK expects to realize a steady increase in revenue and earnings in year one, along with a consistent improvement in cash flow. The company's financial goal is to reach revenues of $20 million, generating after-tax profits of $3.6 million by the end of year four.

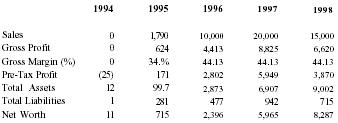

Summary Financial Projects

| 1994 | 1995 | 1996 | 1997 | 1998 | |

| Sales | 0 | 1,790 | 10,000 | 20,000 | 15,000 |

| Gross Profit | 0 | 624 | 4,413 | 8,825 | 6,620 |

| Gross Margin (%) | 0 | 34.96 | 44.13 | 44.13 | 44.13 |

| Pre-Tax Profit | (25) | 171 | 2,802 | 5,949 | 3,870 |

| Total Assets | 12 | 99.7 | 2,873 | 6,907 | 9,002 |

| Total Liabilities | 1 | 281 | 477 | 942 | 715 |

| Net Worth | 11 | 715 | 2,396 | 5,965 | 8,287 |

TK will achieve these goals by:

- Execution of a coordinated and comprehensive sales and marketing effort designed to maximize selling opportunities.

- Offering a unique and highly effective television childproofing system.

Safe Viewing features:

- Easy operation and programming

- Lets parents, grandparents and other responsible caregivers control what their children/grandchildren watch on television, tunes out violent or explicit television programming at the touch of a button

- Non-restrictive to adult users with easy PIN # release of the television to full channel capability

- Automatic lock function insures secure operation

- Full function remote control for channel and volume control

- Connects easily to all television sets

-

Two models available for all cable systems

- SJS100 for use with basic cable systems

- SJS200 for systems using channel descramblers

- Registered with the Federal Communications Commission

- UL listed and approved

- Full 90 day warranty

- Mastercard, Visa and American Express acceptance

Fully utilizing the experience, skills and industry contacts of Thomas Martin, Celeste Harding, and Casey Williams. TK's management team provides strong engineering and technical skills in combination with strong sales/marketing, financial, and administrative skills.

Offering high margin component parts including coaxial cables and connector head covers which will generate additional revenue and increase profitability.

The initial major short term goal for TK is to obtain start-up and early stage financing to provide adequate liquidity necessary to fund working capital needs and support growth. TK's short term financial goal is to realize strong revenue growth and increase profits through the projection period. The company will emphasize sales volume growth along with strong cost and inventory controls in order to achieve consistent cash flow and profitability improvement. Profits will be retained to finance operations, pay off investor debt and/or bank debt, and support future growth.

The long term goal of TK is to make SafeViewing the number one selling television childproofing system in the nation. TK will strive to substantially increase revenue, profitability, and cash flow as well as improve capitalization to support national and international distribution and future operations.

TK is currently seeking to raise capital through a private placement of securities. The company is initially seeking $625,000 by placing 416,667 shares of common stock representing an approximate 20.8% ownership interest. TK intends to use the proceeds of the offering to complete technical improvements, purchase inventory, establish sales, marketing and promotional programs, and for working capital purposes.

NATURE OF VENTURE

Background

The multi-billion dollar television and television products industry is undergoing continuous change due to changing consumer preferences, buying habits, social trends, and technological advancements. More recently, television programming has come under close scrutiny by the general public, parent groups, associations, coalitions, and the federal government. The principal concerns regard programs containing excessive violence, language, behavior, and explicit sexual content. In fact, an increasing number of Americans have expressed so much concern regarding the nature and content of much of the programming to which children—particularly their young children aged two through 13—are exposed that Federal lawmakers have drafted new legislation.

This new legislation would restrict violent and sexually explicit programming to times when children are unlikely to be in the audience. Additionally, cable television companies have agreed to develop a plan which would include a new program rating system (V-Chip Technology). In the meantime, parents continue to try to monitor their children's television viewing. Violence, sexual activity, language and behavior that many parents find unacceptable are graphically portrayed during all parts of the day, including afternoon and early evening hours that have traditionally been considered to be "family viewing time." However, no parent can be on guard all day, every day, to monitor every moment of television viewing by their children and the caregivers who are with them when the parents are not. Many so-called experts simply advise parents to "just turn off the set." But, when the parent is not at home, that advice is easier to give than it is to actually enforce. Therefore, many parents are looking for ways to ensure that their children have access only to programming that they judge to be valuable or, at the very least, acceptable in terms of personal task, judgment, and communication of moral values. At present, there are several devices available to parents who wish to pre-select the programming to which their children have access. These devices either control the flow of electricity to the television (leaving the parent to decide whether the set is to be "on" or "off) or work on a timing system which shuts the television completely off after a pre-determined period of time. None of these devices allow the parent to pre-select specific stations and "lock out" others.

Nature of the Product

SafeViewing represents a breakthrough in television childproofing. It offers parents a simple yet fully effective method of screening television programming and enabling them to selectively eliminate violent or explicit programming from their children's viewing choices without the loss of choices available to more mature audiences. Unlike any other device available on the market today, this system allows parents to select the stations to which they wish their children to have access and lock out those they judge to be unacceptable—all with just the touch of a button. Because there is no timing system, SafeViewing remains programmed until the adult enters a Personal Identification Number (PIN) which immediately unlocks the system and releases the television to full channel capability.

Extremely user-friendly, SafeViewing is easy to operate and program. After it is programmed by the adult, it may be operated by a child without compromising its security function. A full function remote control allows channel selection (pre-programmed channels when activated, full range of channels when de-activated) and volume control. SafeViewing is compatible with all televisions and comes in two models, one for basic cable systems and one for systems with descramblers.

Location of Venture

TK will initially operate out of the home-based office of Tom Martin and Celeste Harding, Syracuse, NY. The office is fully equipped and functional and will allow for cost-effective management of the operation.

MARKET DESCRIPTION AND ANALYSIS

TK's target market for SafeViewing will be households with basic cable service consisting of parents ages 25 to 55 or grandparents with children and/or grandchildren ages two through 13. The company will initially focus its sales and marketing efforts in the U.S. with the expectation of expanding internationally.

Market Trends and Customer Buying Habits

The concern of the general public regarding the types of programming on television is expected to heighten as more attention is drawn to issues such as excessive violence, language, behavior and explicit content by parents and lawmakers. Numerous studies by respected groups such as the American Medical Association, National Institute of Mental Health, American Psychological Association, and American Academy of Pediatrics have concluded that television violence is harmful to children and that viewing violence increases violent activity. These studies indicated that by the age of 18 the average American has viewed 200,000 acts of violence on television, including 40,000 murders. One study by the American Psychological Associates (APA) found "a significant relationship between exposure to television violence at eight years of age and antisocial acts—including serious, violent criminal offenses and spouse abuse—22 years later." Furthermore, studies have found that violence desensitizes the viewer, making him/her less likely to intervene on behalf of a victim when violence occurs in real life. These conclusions are not surprising when we consider that during prime time hours television portrays five to six violent acts per hour. Saturday morning children's programs are saturated with 20 to 25 violent acts per hour. In 1990, the American Academy of Pediatrics recommended pediatricians to advise "parents to limit their children's viewing to between one and two hours per day" because exposure to television violence was proven to increase a child's physical aggressiveness. Nevertheless, children between the ages of two and 11 watch television for an average of 28 hours each week.

The television networks and cable companies have been reluctant to address the problem of television violence aggressively although apian has been drafted to create a new program rating system. The Federal government has proposed legislation to help control and restrict TV violence, however, a great deal of debate is expected before passage of any new legislation. In the event such legislation is enacted, most parents are likely to be less than comfortable with a programming rating system in which levels of programming acceptability are determined and established by sources outside the home. As such, parents are still faced with the responsibility of monitoring their children's television viewing. SafeViewing provides parents with an affordable, high quality television childproofing system that ensures children have access to programming their parents determine as being acceptable.

TK's direct response marketing strategy is expected to be highly effective based on the buying habits of the target market. According to the Direct Marketing Association's 1993/1994 Statistical Fact Book (DMA Book), of the 102 million buyers ordering merchandise by mail or phone in 1992, approximately 35 million or 34.3% were adults from households with children between the ages of two and 11. The majority of these buyers are married females between the ages of 25 and 55 who are high school graduates with household incomes of $30,000 or more living and owning homes in the south.

The buying habits of the target market are further segmented by the following direct response programs: direct mail, catalog, print and television. According to the DMA Book, of the 19 million total buyers ordering from direct mail in 1992, 7.4 million were adults from households with children between the ages two and 11. Again, the largest numbers of buyers were married females, 25 to 55, high school educated with household incomes of $30,000 or more, living in the south. Overall, the statistics reveal an increase in respondents ordering from direct mail offers.

The buying habits of catalog buyers corresponds nicely with TK's profile customer. According to the DMA Book, of the 85.7 million adults who purchased from catalogs in 1992, 29.8 million were adults from households with children between ages two and 11. Most of the purchases are made by mail, despite the increase in the number of catalogues offering an 800 number for service, and are paid for by check.

The buying habits of those buyers ordering merchandise from advertisements in print media (newspaper and magazines) also reveals a large segment who fit TK's profile of the target market customer. Of the 48.5 million total adult buyers in 1992 ordering from magazines and newspapers, 14.1 million were adults from households with children between ages two and 11.

Television continues to be one of the most effective media alternatives influencing buyer purchases. According to Paul Kagen Associates, Inc., a respected market research firm, in 1993 there were approximately 94 million television households of which approximately 57 million were basic cable system subscribers. Consequently, home shopping programs (HSP' s) have continued to become popular. In 1992, 5.5% of U.S. adults reported buying from a HSP, up from 3.7% in 1991. In 1992, more than 12 million U.S. adults watched the Home Shopping Network (HSN) and more than 11 million tuned into QVC. Of the 22.8 million adults watching home shopping programs in 1992, approximately 8.8 million were adults from households with children between the ages of two and 11. Of the 8.8 million, 3.4 million bought items from home shopping programs within the last three months of 1992.

Demographic and Economic Trends

Changing demographics could have a large-scale impact on the target market. A significant change in the demographic profile or buying habits of TK's target market customer could impact revenue growth in future years. However, statistics reveal a large target market spread over a broad geographical area. Furthermore, a large percentage of buyers ordering merchandise from direct response programs match the demographic profile of TK's target market customer. Additionally, the demographic profile is expected to change slowly over time and have only a minimal effect on TK's target market. The median age of the U.S. population is forecasted to increase from age 33 in 1990 to 36 in the year 2000. In addition, population growth is expected to continue in the south and midwest. Median household income levels are projected to remain in the $15,000 to $50,000 range.

A change in economic conditions can influence the demographics and buying habits of the target market. The most recent recession and moderate economic recovery has caused consumer spending to be inconsistent despite modest inflation and an increase in per capita disposable personal income over the last 14 years.

Social and Technological Changes and Trends

Changing social trends can have significant implications as evidenced by the heightened attention given to excessive violence, language, behavior, and explicit content of television programming. This increased level of concern, in conjunction with the timely introduction of SafeViewing, is expected to create a strong demand for the product. Nevertheless, TK's management realizes social trends can quickly change, causing demand to decline sharply in a short period of time. Furthermore, management realizes the "window of opportunity" could be relatively short in duration.

TK faces the additional problem of changing technology and the subsequent impact on the window of opportunity. A limited number of television manufacturers are now including some form of parental blocking capability in higher-end televisions. In addition, Congress is pushing for passage of legislation which would require the inclusion of a "V-chip" in all new television sets to give viewers the option to block out violent and explicit programming. In the future, if forced by this new legislation, all televisions could have this capability. These expected technological changes could substantially impact demand for SafeViewing and quickly erode market opportunities. TK plans to act swiftly to capitalize on existing opportunities.

Current Competitors and Competitive Products

There are a variety of competitive products available throughout the U.S. which offer varying methods for regulating programming access. These devices are manufactured specifically for local cable broadcast systems by manufacturers such as General Instrument or Scientific Atlanta. The type of television converter offered by these companies is an addressable descrambling converter utilized for premium channel reception or "pay per view" applications. This type of converter, depending on which model is chosen for use by the cable system operator, may or may not have parental control as an integral part of its operating software.

The above systems allow the operator to preclude access to individual channels by programming them out of the standard channel selection sequence. Channels which are eliminated must be added back into the programming sequence on an individual basis each time the operator chooses to view that particular "restricted" channel. In addition, many of the converters offered have a parental control time limitation. Channels which are programmed in and restricted become available to the operator after a predetermined period of time. This time expiration feature is built into the software of the converter and cannot be eliminated by the operator/parent, thus requiring re-programming of the restricted channels when the time period has expired.

V-Chip technology, now in the development stages, will offer parents a method for precluding channel or programming availability by utilizing a rating system for channel programming. The parent would program the limits of programming acceptability based on a predetermined rating system into the device. Programs which are broadcast will initiate a coded signal to the receiving unit prior to airing of the program. This coded signal will be interpreted by the receiver at the owners home as either acceptable or rejected based on the viewer's selection. The inherent problem with this method is that the level of acceptability or rating system is determined at the broadcast center and that the system may or may not allow the parent a degree of restriction narrow enough to remain within the guidelines of acceptability as determined by the parent.

Alternate devices offer parental control by allowing a parent to program available channels into a grid on their television screen. Grimaldi Inc. based in Pittsburgh, Pennsylvania, has developed a computer chip known as the C-chip which is used in their cable box called QTV. The Q-TV box is expected to be introduced in 1995. The Q-TV system requires the parent fill in a grid with both channel selection and time slot which is accessible while in the lock mode. This method allows a parent to pick out specific programs which are available to a child at any given time. While this method is effective it requires that the grid be reviewed and reprogrammed on a weekly basis.

Several smaller companies provide competitive products with channel blocking and/or television monitoring capability. Stewart Research Inc. located in Alton, Illinois, developed "The Button" which is basically a childproof lock designed to prevent the child from turning on the television. Suntrex, Inc., based in Ft. Lauderdale, Florida, developed "Kid Watch." This timing device allows parents to program how long their children can watch television. When the designated time has elapsed, the TV shuts off. "Advantage" developed by Teck Associates based in Carmel, California, turns the TV on and off for two different time periods each day.

DESCRIPTION OF THE PRODUCT

Uniqueness of the Product

SafeViewing is a television childproofing system which is unlike any other device available on the market today. The system employs a unique technique for which the developer has acquired a patent pending status. This technique allows the user to easily change modes from "restricted" to "full access." Because there is no timing system, SafeViewing can be operated by the child without compromising its security function and is easy for the adult to program and operate. In addition to providing a unique childproofing system, TK will differentiate itself from the competition through execution of a sales and marketing plan designed to maximize selling opportunities. Unlike the competition, TK will market SafeViewing through many distribution networks including retailers, commissioned sales representatives, mail order houses, and directly to consumers. This multi-channel distribution will give the product significant exposure and brand name recognition. Most of the company's competitors rely on mail order to generate sales.

Advantages Over Competing Products

SafeViewing has several distinct advantages over the competition. The unique system, for which a patent is pending, is difficult for the competition to duplicate. The advantage of the parental control method as offered by the SafeViewing system is the ability to easily regulate the availability of selected channel programming. SafeViewing's primary function is to operate as a parental television control device and has been designed to be easily operated by both the adult and child user. The device puts the control of available programming in the hands of the parent. The system is designed to be usable in conjunction with the many different cable television broadcast systems and is non-restrictive to the adult user. The system is secure by virtue of the baseband converter technology incorporated in the design, as well as by the use of default programs which assure the user that the device remains in the locked mode when not in use by the adult operator. Competitive products do not incorporate a channel blocking system, using instead a lock-out feature based on television access time. Consequently, they are less secure and less effective than SafeViewing. However, the aforementioned products are also less expensive than SafeViewing and will compete on price rather than on security and effectiveness. The Q-TV cable box containing the C-chip offers channel blocking capability but is more difficult to program and does not permit the user to switch easily to full channel capability. Furthermore, the device is priced approximately $70 higher than the SafeViewing SJS100 model and is approximately four times as large. The channel blocking feature offered by cable companies and by competitors are effective. However, these systems do not give the user the ability to easily change modes from restricted to full access and, when available, must be rented from the local cable company.

Some of the devices discussed above remain in the development stages. Others are only available through local cable networks and would be cost prohibitive to the average user if they were available to the general public. The SafeViewing design, effective on all types of cable television broadcast systems, is designed to be extremely user friendly as well as affordable. These comprehensive features and its availability to the general public are the advantages to this system. No single system has yet become available on the market which offers the features available in SafeViewing.

MANAGEMENT

TK's management team is comprised of three highly focused, hard working, energetic and broadly experienced individuals whose combined talents provide a strong and qualified management team. Thomas Martin provides strong technical and engineering expertise and will be responsible for product development refinement, purchasing and operations, as well as overall company management. Celeste Harding provides strong administrative and organizational skills and is experienced and knowledgeable in the area of marketing and advertising production and programs. Casey Williams provides the needed experience and knowledge in the areas of office administration, finance and sales/marketing. His extensive business background and academic credentials compliment the strengths and talents of the other management team members.

BUSINESS STRATEGIES

TK will employ a strategy that will focus on providing a high quality, affordable television childproofing system which will be easier to operate and program, as well as more effective and less costly than comparable competitive products.

Production and Operations Strategy

The basic prototype design of SafeViewing parental control system is complete. TK will offer two distinct models of SafeViewing for use with basic cable systems or for systems with channel descramblers. Both models are registered with the Federal Communications Commission and are listed and approved by Underwriters Laboratories.

The methods of production associated with the SafeViewing products are intended to be kept within the Television for Kids, Inc. organization. The component parts for both the remote control and the baseband television converter associated with the system are available from numerous manufacturers within the United States. Customization of the base components is available from each of the manufacturers with pricing directly related to the quantity purchased. Base units will be purchased from the respective vendors. Remote control units are also available from a number of manufacturers.

Contec, L.P. has been contracted by Television for Kids, Inc. to provide both prototype design and testing as well as interfacing of the new design with existing baseband converter box control technology. Short term manufacturing requirements will be met by utilizing Contec, L.P. for short production runs of the remote control units. Contec, L.P. is a major manufacturer of television and converter box remote control devices in the United States and provides warranty and design services for the major cable converter box manufacturers for such clients as Zenith, General Instrument and Scientific Atlanta. Contec is based in Schenectady, New York and has engineering and manufacturing facilities in seven states, Mexico and overseas. The design work consisted of modifying a baseband television converter. Contec, L.P. has electronic design facilities for prototype hardware design development and testing as well as software development in their Schenectady facility. Contec was chosen for the base design work based on their ability to design, test and incorporate all aspects of the required project scope as well as their thorough knowledge of the equipment and practices of the cable converter industry.

Gemini Industries of Clifton, New Jersey has been contracted by TK to furnish "off the shelf converter boxes. Gemini Industries represents the largest U.S. manufacturer of video accessory products available. The units will be customized, tested and repackaged by Television for Kids, Inc, at our facility in Syracuse, New York.

Long term production requirements will require firm contractual agreements between Television for Kids, Inc. and vendors for both remote control and baseband converter manufacture. Television for Kids, Inc. is presently in negotiations with Gemini Industries and Contec, L.P. to acquire fixed pricing and delivery schedules for large quantity purchases of the required component parts. Customization of both the remote control and the baseband converter boxes will be incorporated into large quantity purchases of the component parts. Each component will be tested at its respective factory for initial quality assurance.

Final quality assurance testing of the completed units will be performed by Television for Kids prior to packaging. Each unit will be tested for proper operation and assembly and then packaged for shipment at our Syracuse facility.

Television for Kids, Inc. is presently having discussions with Gemini Industries, Inc. with regard to a licensing agreement for the SafeViewing system. Gemini's large size and strong market penetration make them a desired candidate for an alliance with Television for Kids, Inc. for national distribution of this product. Gemini Industries is a vendor to many of the nations largest distribution outlets for this type of video product including: Circuit City, QVC Network, Wal Mart, Kmart, Rickel Home Center, Best Products, and Channel Home Center.

Marketing Plan and Supporting Strategies

TK will support its differentiation strategy by effective execution of its marketing plan which contains several integral supporting strategies including promotional/sales, pricing, and distribution strategies.

TK will employ several well organized and effective promotional and sales strategies to target qualified potential buyers and generate new business and selling opportunities in the U.S. and abroad. SafeViewing will be positioned in the market as a highly effective, high quality, affordable television childproofing system which will distinguish it from those competitors providing less effective, more expensive alternatives. The principal marketing strategy will involve a comprehensive direct response marketing plan which will include mass media advertising, direct response television, direct mail, mail order, and public relations programs. Management plans to hire a professional direct marketing consultant to assist in the development and execution of the company's marketing plans and strategies, with specific emphasis on multi-channel direct response mass marketing programs. TK will also attract new business through personal selling and tradeshows.

The company's mass media advertising program will include the use of multiple media sources. Media sources will be selected to maximize the return on allocated advertising dollars. TK will utilize the resources of a professional public relations firm to assist in creating awareness of and demand for SafeViewing among concerned parents locally and nationally. Public relations activities will include press release and product information placement in local and national general interest print (newspapers, magazines) and broadcast media [television news (local and national), features ("talk" shows) and selected radio programs] and retail industry and trade media. A media kit will be developed to provide background for interested editors, reporters, and distributors. The kit will include a product information sheet, photograph, press release, news articles, and a biographical profile of the principals. Following distribution of the media kit, the public relations firm will telephone key media personnel to gauge interest and intent to use the information as a basis for a news story. TK plans to aggressively promote the product through direct response television advertising on home shopping channels such as QVC and Home Shopping Network. In addition, TK's future promotional plans include the hiring of a professional advertising firm to assist in the development of local and national direct response television spot advertisements and/or an infomercial. This will provide instant product awareness and immediate national exposure to the target audience.

TK will complement its mass media advertising program with a direct response mail program to target specific potential user groups. These include parents groups and organizations, day care centers, elementary schools, and associations such as the National PTA, National Association for the Education of Young Children, Coalition for the Code, and National Coalition on Television Violence. TK has received the endorsement of The National Coalition on Television Violence and will seek the endorsement of these associations to enhance credibility. Other groups include community organizations as well as religious groups. The direct response mail program will include monthly mailings to targeted user groups. TK expects to obtain the member and subscriber lists of those associations, organizations and/or parents groups who endorse the product. TK will investigate opportunities to purchase or rent targeted lists of potential customers if necessary. In addition, mailing lists of specific potential user groups will be purchased or rented from reputable list management companies. These lists will be used to create the company's database of customers and future customer prospects. A professional database management company will be hired to assist in the development, management and enhancement of the TK database.

The marketing program will include a professionally designed brochure intended to create awareness, educate the consumer and provide product information. In conjunction with the brochure, TK intends to create a professionally produced informative sales videotape on the SafeViewing childproofing system. The video will be made available to all potential customers who have responded to our direct mail advertisement by having them contact our Toll Free 800 number or request the free video. The video is intended to lower sales resistance, educate and inform potential buyers, build perceived value in the product and deliver a powerful sales message. Follow up telephone calls will be made to all video recipients to provide additional information, answer questions, and to close each sale.

The marketing plan will also feature a direct response mail order program. This program will target specific national and international catalogues and magazines, thus giving SafeViewing wide national and international exposure.

TK will also seek to develop sales through distribution to retail chains such as Circuit City, Silo, BEST, Sears, and Walmart. The company will also consider licensing agreements with cable networks for use of SafeViewing as rental equipment. The technology could also be licensed to television manufacturers as a built-in feature. In addition, TK will explore licensing opportunities with marketing companies and will consider joint venture opportunities with childproofing companies. TK will also seek to develop sales through personal selling via commissioned sales representatives and house-to-house salesmen. Other promotional strategies will include the use of resident buyers, dealers, and national trade show promotions. Additionally, management plans to join certain industry groups such as the National Cable Television Association, Direct Marketing Association and Mail Order Association of America, as well as various local chambers of Commerce in order to build good community relations. These associations provide valuable market information and are often willing to sell or rent mailing lists of members and subscribers.

TK will utilize a combination of competitor-based pricing and penetration pricing. This will ensure pricing is in line with leading competitors and will enable the company to maximize market share gains. The company's strategy will be to position itself among existing competitors and compete on quality, performance, and effectiveness while offering value-based pricing. By developing a high quality image and reputation for security and effectiveness, TK will become an industry leader. Furthermore, this will enable the company to increase pricing over time as new and improved models are introduced. The suggested retail price is expected to be $129.95 for the SJS100 model and $149.95 for the SJS200 model. TK expects to offer wholesale pricing to allow for mark-ups of 40-50% against the suggested retail pricing.

Safe Viewing will be produced and assembled by several manufacturers located in the northeastern U.S. The product will be shipped to the corporate office/warehouse location via UPS and orders shipped via UPS to specific buyer locations.

TK will provide a complete and detailed operating instruction booklet which will include an 800 number to call with problems and questions. In addition, the company will provide a 90 day limited warranty against defective material or workmanship. TK will also enclose a customer satisfaction response card with every unit to test for feedback on product quality and customer satisfaction.

Human Resources Strategy

TK will initially maintain a small employee base of non-management personnel which is expected to modestly increase despite strong anticipation revenue growth. Management will maintain a lean full-time staff by subcontracting for certain services such as fulfillment services, marketing specialists, and administrative support. Customer service representatives will be used for order taking, processing, and support services. In addition, TK will out-source for certain professional marketing, public relations, market research, testing, and analysis services.

Financial Strategy

TK will be owned and operated by Tom Martin and Celeste Harding who prefer to retain financial and managerial control.

The details of the financing sought and the risk of investment will be described in the Company's Subscription Agreement. All potential investors should read and thoroughly understand that Document.

TK is offering a maximum of 416,667 shares a Common Stock at a purchase price of $1.50 per share representing approximately 20.8% of the company's equity. Use of the proceeds will include ongoing product and technical development, product re-design and upgrades, general and administrative expenses, including salaries for existing employees and working capital through initial product launch. The company plans to use up to $96,918 to meet the costs of compensating its two key employees during the months June through December 1995 following the Private Offering. In addition, expenses related to the offering are estimated to be $10,000 to $20,000 which will be paid out of proceeds. TK expects that it will use the balance of the proceeds for market research and testing, sales and marketing programs and to support accounts receivable and inventory growth.

Overall Growth Strategy

TK expects to realize strong sales and earnings growth in year one which will increase significantly by year five. This growth will be principally attributable to the development of new customers nationally and internationally. Growing demand for SafeViewing is expected in response to TK's comprehensive multi-channel direct response marketing programs. Additionally, TK will benefit from sales of high margin component parts. Through the five year period, management will effectively control purchases and inventory and improve operating efficiency and profitability. In addition, operating expenses will be carefully managed to ensure incremental revenue growth results in increased bottom line profitability.

FINANCIAL DATA

Financial Statements

TK began operations on a very limited basis in early 1994. Expenses, particularly for development have increased throughout 1994. The company has not yet produced revenue and has experienced losses in each month as indicated in the 1994 monthly financial statements. A brief analysis of the actual results for 1994 are as follows:

1994 Income Statement

Sales

Because the company was still in a development stage, no sales were recorded in 1994 and therefore no costs were included in cost of goods sold.

Salaries

Management did not take salaries in 1994. Salaries are anticipated to begin in fiscal 1995. Salaries will be paid to full-time management only and are expected to cover living expenses.

Selling, General & Administrative Expenses

This included primarily legal expenses for both patent and general counsel as well as consultant fees and normal office operating expenditures.

Market Research

The principals of the company have conducted the majority of the market research to date. However, management may choose to use professional marketing research assistance to obtain an independent assessment of the target market.

Research and Development

All development costs are expenses as incurred and consist principally of prototype costs for software development and hardware configuration.

1994 Balance Sheet

Paid-in-Capital

There have been approximately $36 million in equity investments through December 1994. Management believes additional equity will be generated through the proceeds collected from additional investors; however, that is not reflected in this projection.

Inventory

Inventory as of 12/31/94 represents 100 SafeViewing units which have been tested and packaged and are ready to be sold.

Accounts Payable

This represents manufacturer and component supplier credit terms extended to TK through such companies as Contec and Gemini Industries.

Notes Payable

This represents the remaining balance of a note payable to Fred and JoAnne Dillard. The Dillards initially provided funding for the company in anticipation of becoming equity investors. Subsequently, they decided not to become equity investors and their investment was converted to a note payable. The principals are repaying the note from their personal cash investments into TK.

Financial Projects and Assumptions

The financial projections included are based on estimates and assumptions set forth therein, and have been delivered for the information and convience of persons who wish to evaluate the feasibility of the company's strategy and goals. Each such person who has received them realizes that financial projections are inherently speculative. The financial projections are based upon the company's assumptions reflecting conditions it expects to exist or the course of action it expects to take. As the company is in the late development to start-up stage and as such has limited operating experience, these projections are based on estimates and not on the company's historical results. Because events and circumstances do not occur as anticipated, there will be differences between the financial projections and actual results, and those differences may be material. The financial projections are based upon detailed underlying assumptions. Interested parties should consult their own professional advisors regarding the validity and reasonableness of the assumptions contained herein.

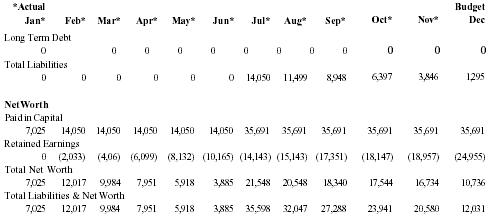

1994 Balance Sheet

| *Actual | Budget | |||||||||||

| Jan* | Feb* | Mar* | Apr* | May* | Jun* | Jul* | Aug* | Sep* | Oct* | Nov* | Dec | |

| Assets | ||||||||||||

| Cash | 7,025 | 12,017 | 9,984 | 7,951 | 5,918 | 3,885 | 35,598 | 32,047 | 19,409 | 14,994 | 10,913 | 2,364 |

| Accts Receivable | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Inventory | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 7,879 | 8,947 | 9,437 | 9,537 |

| Current Assets | 7,025 | 12,017 | 9,984 | 7,951 | 5,918 | 3,885 | 35,598 | 32,047 | 27,288 | 23,941 | 20,450 | 11,901 |

| Gross Fixed | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 130 | 130 |

| Accumulated Depreciation | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Fixed Assets | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 130 | 130 |

| Prepaid | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Other Assets | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Assets | 7,025 | 12,017 | 9,984 | 7,951 | 5,918 | 3,885 | 35,598 | 32,047 | 27,288 | 23,941 | 20,580 | 12,031 |

| Liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Accounts Payable | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Short Term Debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Notes Payable | 0 | 0 | 0 | 0 | 0 | 0 | 14,050 | 11,499 | 8,948 | 6,397 | 3,846 | 1,295 |

| Accruals | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Current Port Long Term Debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Current Liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 14,050 | 11,499 | 8,948 | 6,397 | 3,846 | 1,295 |

| *Actual | Budget | |||||||||||

| Jan* | Feb* | Mar* | Apr* | May* | Jun* | Jul* | Aug* | Sep* | Oct* | Nov* | Dec | |

| Long Term Debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 14,050 | 11,499 | 8,948 | 6,397 | 3,846 | 1,295 |

| Net Worth | ||||||||||||

| Paid in Capital | 7,025 | 14,050 | 14,050 | 14,050 | 14,050 | 14,050 | 35,691 | 35,691 | 35,691 | 35,691 | 35,691 | 35,691 |

| Retained Earnings | 0 | (2,033) | (4,06) | (6,099) | (8,132) | (10,165) | (14,143) | (15,143) | (17,351) | (18,147) | (18,957) | (24,955) |

| Total Net Worth | 7,025 | 12,017 | 9,984 | 7,951 | 5,918 | 3,885 | 21,548 | 20,548 | 18,340 | 17,544 | 16,734 | 10,736 |

| Total Liabilities & Net Worth | 7,025 | 12,017 | 9,984 | 7,951 | 5,918 | 3,885 | 35,598 | 32,047 | 27,288 | 23,941 | 20,580 | 12,031 |

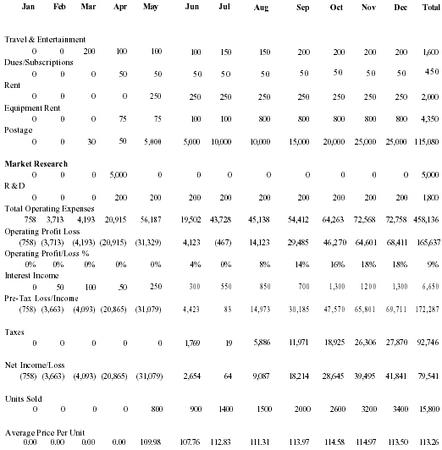

1995 Income Statement

Sales

Sales in each month equal the number of units sold multiplied by the sale price. All sales in 1995 are projected to be model SJS100 (sales cost and unit price would increase proportionally if there is a greater mix of SJS200 units). The sales price is primarily driven by the selling price of competitive products currently on the market which range from $29.00 to $250.00. The list price of the SJS100 model will be $129.95 and the SJS200 model will be $149.95. The wholesale price is expected to be $90.00 for the SJS100 and $109.00 for the SJS200 which will allow for mark-ups of 40% to 45% against the retail price.

Sales are projected to begin in May and are segmented as: Catalog and Other (Wholesale) and Direct Response Retail (Retail). Sales are projected to increase monthly in conjunction with the execution of TK's targeted sales and marketing programs. The companies direct marketing/video program will fuel retail sales which are projected to reach $1,195,540 (or 9200 units) and comprise 67% of total sales. The Catalog and Other sales segment will consist principally of wholesale sales and will comprise the remaining $594,000 in sales (or 6600 units).

Costs of Goods Sold

Per unit costs to produce are derived from firm component supplier quotes which are based on minimum purchasing requirements and include estimated costs for assembly, packaging and shipping. The total cost for the SJS100 is projected to average $81.68 per unit through July of 1995. Costs of Goods Sold are expected to decline to $71.68 per unit thereafter as a result of more favorable pricing from cable box and remote control suppliers due to an increase in minimum purchase quantities from 1500 units to 3600 units. The cost structure will vary depending on the sales mix of wholesale and retail units. Retail units will carry a slightly higher cost per unit but will maintain a significantly higher gross margin as compared to wholesale units.

Operating Expenses

Salaries

Management salaries are projected to begin in July of 1995. The remaining salaries will be for part-time assembly and packaging employees.

Selling, General and Administrative Expenses

The principal SG & A items include advertising and promotional costs, insurance, legal, consultants and postage. Advertising and promotional costs includes general and product liability expenses. Legal includes expenses for both patent and general council. Postage expenses correlate to the increasing level of the monthly mailing program.

Market Research

Includes expenses for focus groups, market testing and analysis.

Research and Development

Includes expenses relative to product refinement and enhancement.

Taxes

The effective tax rate is projected to be 40%. For the purposes of this projection, available tax losses are not carried forward but are available to be used in future periods to reduce taxable income.

1995 Balance Sheet

Paid-in-Capital

TK will be moving from a development stage to an early stage company in 1995 and as such will require significant capital. Projections are based on an investment of $625,000 into the company during 1995. Capital infusions are currently projected to occur from February to October. The capital infustions may be in the form of government grants, government backed or independently arranged long or short term debt, or some other form. However, it will must likely be in the form of equity, and for the purpose of these projections, will be shown that way.

Accounts Receivable

TK will offer terms of 2%/10 net 30 day terms to all wholesale clients. The company expects collection of receivables between 30 to 50 days from the invoice date. Receivable levels are calculated to be the current months sales plus 70% of the previous months sales.

Inventory

The projected sales levels assume a need for a 45 to 50 day inventory of completed units.

Fixed Assets

A minimum of fixed assets are expected to be purchased. Necessary items will include computer hardware and software, telephone system, fax machine, modem and printer. These items will be purchased or leased on an as needed basis. Equipment will be depreciated over two years assuming straight line depreciation.

Accounts Payable

TK has negotiated terms with most suppliers including Contec. TK expects to negotiate 30 day terms with Gemini Industries by August.

Short Term Debt

Upon achieving profitability in the late months of 1995, TK will attempt to establish a line of credit from a financial institution, however, no availability of funds is expected prior to year end.

Long Term Debt

The equipment needs for 1995 are projected to be financed by the proceeds provided by the principals and investors.

1995 Income Statement

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

| Sales | 0 | 0 | 0 | 0 | 87,980 | 96,980 | 157,960 | 166,960 | 227,940 | 297,920 | 367,900 | 385,900 | 1,789,440 |

| Costs of Goods Sold | 0 | 0 | 0 | 0 | 63,111 | 73,344 | 114,688 | 107,688 | 144,032 | 187,376 | 230,720 | 244,720 | 1,165,679 |

| Depreciation | 0 | 0 | 0 | 0 | 11 | 11 | 11 | 11 | 11 | 11 | 11 | 11 | 88 |

| Gross Profit | 0 | 0 | 0 | 0 | 24,858 | 23,625 | 43,261 | 59,261 | 83,897 | 110,433 | 137,169 | 141,169 | 623,773 |

| Gross Profit % | 0.0 | 0.0 | 0.0 | 0.0 | 28.3 | 24.4 | 27.4 | 35.5 | 36.8 | 37.1 | 37.3 | 36.6 | 34.9 |

| Operating Expenses | |||||||||||||

| Salaries & Benefits | 0 | 0 | 0 | 0 | 0 | 0 | 12,684 | 13,284 | 13,284 | 13,284 | 13,884 | 13,884 | 80,304 |

| Payroll Taxes | 0 | 0 | 0 | 0 | 0 | 0 | 1,395 | 1,461 | 1,461 | 1,461 | 1,527 | 1,527 | 8,833 |

| SG&A Expenses | |||||||||||||

| Advertising & Promotion | 0 | 0 | 0 | 4,700 | 34,000 | 5,400 | 9,400 | 9,400 | 12,800 | 17,200 | 19,100 | 19,100 | 131,100 |

| Bank Charges | 0 | 0 | 0 | 0 | 650 | 659 | 1,040 | 1,040 | 1,559 | 1,559 | 1,949 | 1,949 | 10,396 |

| Car/Delivery | 0 | 0 | 0 | 59 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 850 |

| Depreciation/Amortization | 0 | 0 | 0 | 0 | 0 | 146 | 146 | 146 | 146 | 146 | 146 | 146 | 876 |

| Insurance | 0 | 0 | 0 | 0 | 4,532 | 4,532 | 4,532 | 4,532 | 4,532 | 4,532 | 4,532 | 4,532 | 36,258 |

| Telephone | 100 | 100 | 100 | 150 | 300 | 300 | 400 | 400 | 400 | 500 | 500 | 600 | 3,850 |

| Utilities | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 600 |

| Legal/Accounting | 0 | 2,000 | 2,250 | 8,777 | 8,777 | 777 | 777 | 777 | 777 | 777 | 777 | 777 | 27,243 |

| Consultants | 600 | 1,555 | 1,555 | 1,555 | 1,555 | 1,555 | 1,555 | 1,555 | 1,555 | 1,555 | 1,555 | 1,555 | 17,705 |

| Office Supplies | 0 | 0 | 0 | 50 | 440 | 330 | 790 | 835 | 1,140 | 1,490 | 1,840 | 1,930 | 8,845 |

| Office Expenses | 0 | 0 | 0 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 900 |

| Taxes & Licenses | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 96 |

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

| Travel & Entertainment | 0 | 0 | 200 | 100 | 100 | 100 | 150 | 150 | 200 | 200 | 200 | 200 | 1,600 |

| Dues/Subscriptions | 0 | 0 | 0 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 50 | 450 |

| Rent | 0 | 0 | 0 | 0 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 2,000 |

| Equipment Rent | 0 | 0 | 0 | 75 | 75 | 100 | 100 | 800 | 800 | 800 | 800 | 800 | 4,350 |

| Postage | 0 | 0 | 30 | 50 | 5,000 | 5,000 | 10,000 | 10,000 | 15,000 | 20,000 | 25,000 | 25,000 | 115,080 |

| Market Research | 0 | 0 | 0 | 5,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 5,000 |

| R & D | 0 | 0 | 0 | 200 | 200 | 200 | 200 | 200 | 200 | 200 | 200 | 200 | 1,800 |

| Total Operating Expenses | 758 | 3,713 | 4,193 | 20,915 | 56,187 | 19,502 | 43,728 | 45,138 | 54,412 | 64,263 | 72,568 | 72,758 | 458,136 |

| Operating Profit Loss | (758) | (3,713) | (4,193) | (20,915) | (31,329) | 4,123 | (467) | 14,123 | 29,485 | 46,270 | 64,601 | 68,411 | 165,637 |

| Operating Profit/Loss % | 0% | 0% | 0% | 0% | 0% | 4% | 0% | 8% | 14% | 16% | 18% | 18% | 9% |

| Interest Income | 0 | 50 | 100 | 50 | 250 | 300 | 550 | 850 | 700 | 1,300 | 1,200 | 1,300 | 6,650 |

| Pre-Tax Loss/Income | (758) | (3,663) | (4,093) | (20,865) | (31,079) | 4,423 | 83 | 14,973 | 30,185 | 47,570 | 65,801 | 69,711 | 172,287 |

| Taxes | 0 | 0 | 0 | 0 | 0 | 1,769 | 19 | 5,886 | 11,971 | 18,925 | 26,306 | 27,870 | 92,746 |

| Net Income/Loss | (758) | (3,663) | (4,093) | (20,865) | (31,079) | 2,654 | 64 | 9,087 | 18,214 | 28,645 | 39,495 | 41,841 | 79,541 |

| Units Sold | 0 | 0 | 0 | 0 | 800 | 900 | 1400 | 1500 | 2000 | 2600 | 3200 | 3400 | 15,800 |

| Average Price Per Unit | 0.00 | 0.00 | 0.00 | 0.00 | 109.98 | 107.76 | 112.83 | 111.31 | 113.97 | 114.58 | 114.97 | 113.50 | 113.26 |

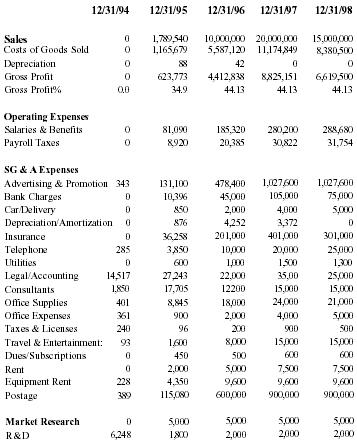

Annual Projections

Income Statement

Sales from 1996 to 1998 equal the number of units sold multiplied by the average sale price. TK expects sales to increase significantly through the projection period due to the success of the company's multi-level mass marketing programs. Approximately 70% of the company's sales are projected to be retail sales to the consumer as a result of orders generated primarily from the company's direct response mail/video program. Due to the changing technology and anticipated increase in competition, sales are projected to decline approximately 25% beginning in mid 1998.

Cost of Goods Sold

TK expects to realize improvement in the cost of goods in 1996 and thereafter due to improved pricing from component suppliers of both remote control units and converter boxes. Management believes that more favorable prices will be attainable as a result of design improvements and quantity purchase discounts.

Operating Expenses

Salaries

Salaries are anticipated to begin in July of 1995. Salaries will be paid to full time management and part time personnel. Management salaries are expected to be at the minimum level required to cover living expenses.

Selling, General and Administrative Expenses

Due to substantial sales growth from 1996 through 1998, selling, general and administrative expenses are forecast to increase due principally to the higher level of expenditures related to the company's mass marketing programs. In addition, SG & A expenses decline as a percentage of sales during 1996 (14.2%) and 1997 (12.9%) due to tight expense controls. These expenses are projected to increase slightly in 1998 (16.2%) due to anticipated sales declines.

Market Research

These expenditures remain steady through the projection period and include expenses for market testing and analysis.

Research and Development

These expenses will continue as the company invests in new product development as well as product refinement and enhancement.

Balance Sheet

Accounts Receivable

The company expects to generate accounts receivable from wholesale customers including catalog and mail order companies. Management projects collections to average 50 days despite sales terms of 2% 10 days net 30 days.

Inventory

These estimates are driven by the annual costs of goods sold projections. Management projects a need for a 45 to 50 day inventory of finished product to fulfill customer requirements.

Fixed Assets

Fixed asset purchases will include primarily computer and office equipment. The bulk of equipment will be purchased or leased on an as needed basis and will be depreciated over two years assuming straight line depreciation.

Accounts Payable

Component suppliers are expected to extend 30 day terms and TK will generally pay within these terms.

Short Term Debt

No short term debt is expected, however, the company expects to establish a bank line of credit by mid-1996 to support accounts receivable and inventory if required prior to year end.

Net Worth

TK is expected to achieve profitability in 1996 and thereafter. The company expects to finance its growth out of cash flow from operations. No additional equity will be required after 1995.

Annual Projections Income Statement

| 12/31/94 | 12/31/95 | 12/31/96 | 12/31/97 | 12/31/98 | |

| Sales | 0 | 1,789,540 | 10,000,000 | 20,000,000 | 15,000,000 |

| Costs of Goods Sold | 0 | 1,165,679 | 5,587,120 | 11,174,849 | 8,380,500 |

| Depreciation | 0 | 88 | 42 | 0 | 0 |

| Gross Profit | 0 | 623,773 | 4,412,838 | 8,825,151 | 6,619,500 |

| Gross Profit% | 0.0 | 34.9 | 44.13 | 44.13 | 44.13 |

| Operating Expenses | |||||

| Salaries & Benefits | 0 | 81,090 | 185,320 | 280,200 | 288,680 |

| Payroll Taxes | 0 | 8,920 | 20,385 | 30,822 | 31,754 |

| SG & A Expenses | |||||

| Advertising & Promotion | 343 | 131,100 | 478,400 | 1,027,600 | 1,027,600 |

| Bank Charges | 0 | 10,396 | 45,000 | 105,000 | 75,000 |

| Car/Delivery | 0 | 850 | 2,000 | 4,000 | 5,000 |

| Depreciation/Amortization | 0 | 876 | 4,252 | 3,372 | 0 |

| Insurance | 0 | 36,258 | 201,000 | 401,000 | 301,000 |

| Telephone | 285 | 3,850 | 10,000 | 20,000 | 25,000 |

| Utilities | 0 | 600 | 1,000 | 1,500 | 1,300 |

| Legal/Accounting | 14,517 | 27,243 | 22,000 | 35,00 | 25,000 |

| Consultants | 1,850 | 17,705 | 12,200 | 15,000 | 15,000 |

| Office Supplies | 401 | 8,845 | 18,000 | 24,000 | 21,000 |

| Office Expenses | 361 | 900 | 2,000 | 4,000 | 5,000 |

| Taxes & Licenses | 240 | 96 | 200 | 900 | 500 |

| Travel & Entertainment : | 93 | 1,600 | 8,000 | 15,000 | 15,000 |

| Dues/Subscriptions | 0 | 450 | 500 | 600 | 600 |

| Rent | 0 | 2,000 | 5,000 | 7,500 | 7,500 |

| Equipment Rent | 228 | 4,350 | 9,600 | 9,600 | 9,600 |

| Postage | 389 | 115,080 | 600,000 | 900,000 | 900,000 |

| Market Research | 0 | 5,000 | 5,000 | 5,000 | 5,000 |

| R & D | 6,248 | 1,800 | 2,000 | 2,000 | 2,000 |

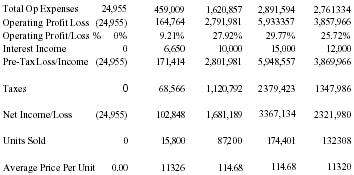

| Total Op Expenses | 24,955 | 459,009 | 1,620,857 | 2,891,594 | 2,761,334 |

| Operating Profit Loss | (24,955) | 164,764 | 2,791,981 | 5,933,357 | 3,857,966 |

| Operating Profit/Loss % | 0% | 9.21% | 27.92% | 29.77% | 25.72% |

| Interest Income | 0 | 6,650 | 10,000 | 15,000 | 12,000 |

| Pre-Tax Loss/Income | (24,955) | 171,414 | 2,801,981 | 5,948,557 | 3,869,966 |

| Taxes | 0 | 68,566 | 1,120,792 | 2,379,423 | 1,547,986 |

| Net Income/Loss | (24,955) | 102,848 | 1,681,189 | 3,567,134 | 2,321,980 |

| Units Sold | 0 | 15,800 | 87,200 | 174,401 | 132,508 |

| Average Price Per Unit | 0.00 | 113.26 | 114.68 | 114.68 | 113.20 |

Annual Projections Balance Sheet

| 12/31/94 | 12/31/95 | 12/31/96 | 12/31/97 | 12/31/98 | |

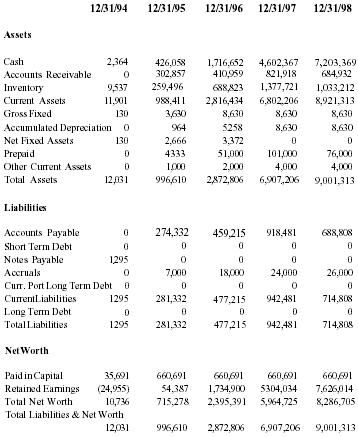

| Assets | |||||

| Cash | 2,364 | 426,058 | 1,716,652 | 4,602,567 | 7,203,369 |

| Accounts Receivable | 0 | 302,857 | 410,959 | 821,918 | 684,932 |

| Inventory | 9,537 | 259,496 | 688,823 | 1,377,721 | 1,033,212 |

| Current Assets | 11,901 | 988,411 | 2,816,434 | 6,802,206 | 8,921,513 |

| Gross Fixed | 130 | 3,630 | 8,630 | 8,630 | 8,630 |

| Accumulated Depreciation | 0 | 964 | 5,258 | 8,630 | 8,630 |

| Net Fixed Assets | 130 | 2,666 | 3,372 | 0 | 0 |

| Prepaid | 0 | 4,533 | 51,000 | 101,000 | 76,000 |

| Other Current Assets | 0 | 1,000 | 2,000 | 4,000 | 4,000 |

| Total Assets | 12,031 | 996,610 | 2,872,806 | 6,907,206 | 9,001,513 |

| Liabilities | |||||

| Accounts Payable | 0 | 274,332 | 459,215 | 918,481 | 688,808 |

| Short Term Debt | 0 | 0 | 0 | 0 | 0 |

| Notes Payable | 1,295 | 0 | 0 | 0 | 0 |

| Accruals | 0 | 7,000 | 18,000 | 24,000 | 26,000 |

| Curr. Port Long Term Debt | 0 | 0 | 0 | 0 | 0 |

| Current Liabilities | 1,295 | 281,332 | 477,215 | 942,481 | 714,808 |

| Long Term Debt | 0 | 0 | 0 | 0 | 0 |

| Total Liabilities | 1,295 | 281,332 | 477,215 | 942,481 | 714,808 |

| NetWorth | |||||

| Paid in Capital | 35,691 | 660,691 | 660,691 | 660,691 | 660,691 |

| Retained Earnings | (24,955) | 54,587 | 1,734,900 | 5,304,034 | 7,626,014 |

| Total Net Worth | 10,736 | 715,278 | 2,395,591 | 5,964,725 | 8,286,705 |

| Total Liabilities & Net Worth | 12,031 | 996,610 | 2,872,806 | 6,907,206 | 9,001,513 |

Annual Projections Cash Flow Analysis

| 12/31/94 | 12/31/95 | 12/31/96 | 12/31/97 | 12/31/98 | |

| Cash Flow From Operating Activities | |||||

| Net Income (Loss) | 24,955 | 79,541 | 1,681,189 | 3,569,134 | 2,321,980 |

| Depreciation | 0 | 964 | 4,294 | 3,372 | 0 |

| (Incr)/Decrease in Trade Receivables | 0 | (302,854) | (108,102) | (410,959) | 136,986 |

| (Incr)/Decrease in Inventory | (9,537) | (249,959) | (429,327) | (688,898) | 344,509 |

| Incr/(Decrease) in Accounts Payable | 0 | 274,332 | 184,833 | 459,266 | (229,673) |

| Incr/(Decrease) in Accruals | 0 | 7,000 | 11,000 | 6,000 | 2,000 |

| (Incr)/Decrease in other Assets | 0 | (5,533) | (47,467) | (52,000) | 25,000 |

| Net Cash Used in Operating Activities | (34,492) | (196,512) | 1,296,470 | 2,885,915 | 2,600,802 |

| Cash Flows from Investment Activities | |||||

| Purchase of Equipment | (130) | (3,500) | (5,000) | 0 | 0 |

| (Incr)/Decrease in other Assets | 0 | 0 | 0 | 0 | 0 |

| Net Cash Used in Investment Activities | (130) | (3,500) | (5,000) | 0 | 0 |

| Cash Flow from Financing Activities | |||||

| Incr/(Decrease) in Notes Payable | 1,295 | (1,295) | 0 | 0 | 0 |

| Increase-Paid in Capital | 35,691 | 625,000 | 0 | 0 | 0 |

| Net Cash Provided by Financing Activities | 36,986 | 623,705 | 0 | 0 | 0 |

| Net Change in Cash | 2,364 | 423,694 | 1,291,470 | 2,885,915 | 2,600,802 |

| Beginning Cash | 0 | 2,364 | 426,058 | 1,717,528 | 4,603,443 |

| Ending Cash | 2,364 | 426,058 | 1,717,528 | 4,603,443 | 7,204,245 |

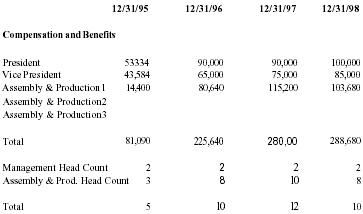

Annual Projections Salary Budget

| 12/31/95 | 12/31/96 | 12/31/97 | 12/31/98 | |

| Compensation and Benefits | ||||

| President | 53,334 | 90,000 | 90,000 | 100,000 |

| Vice-President | 43,584 | 65,000 | 75,000 | 85,000 |

| Assembly & Production 1 | 14,400 | 80,640 | 115,200 | 103,680 |

| Assembly & Production 2 | ||||

| Assembly & Production 3 | ||||

| Total | 81,090 | 225,640 | 280,200 | 288,680 |

| Management Head Count | 2 | 2 | 2 | 2 |

| Assembly & Prod. Head Count | 3 | 8 | 10 | 8 |

| Total | 5 | 10 | 12 | 10 |

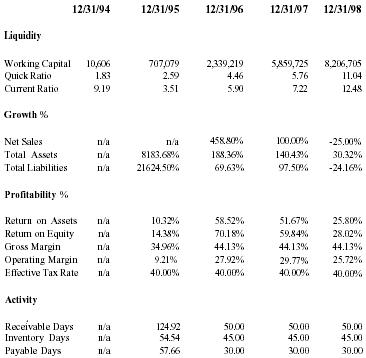

Annual Projections Ratios

| 12/31/94 | 12/31/95 | 12/31/96 | 12/31/97 | 12/31/98 | |

| Liquidity | |||||

| Working Capital | 10,606 | 707,079 | 2,339,219 | 5,859,725 | 8,206,705 |

| Quick Ratio | 1.83 | 2.59 | 4.46 | 5.76 | 11.04 |

| Current Ratio | 9.19 | 3.51 | 5.90 | 7.22 | 12.48 |

| Growth % | |||||

| Net Sales | n/a | n/a | 458.80% | 100.00% | −25.00% |

| Total Assets | n/a | 8183.68% | 188.36% | 140.43% | 30.32% |

| Total Liabilities | n/a | 21624.50% | 69.63% | 97.50% | −24.16% |

| Profitability % | |||||

| Return on Assets | n/a | 10.32% | 58.52% | 51.67% | 25.80% |

| Return on Equity | n/a | 14.38% | 70.18% | 59.84% | 28.02% |

| Gross Margin | n/a | 34.96% | 44.13% | 44.13% | 44.13% |

| Operating Margin | n/a | 9.21% | 27.92% | 29.77% | 25.72% |

| Effective Tax Rate | n/a | 40.00% | 40.00% | 40.00% | 40.00% |

| Activity | |||||

| Receivable Days | n/a | 124.92 | 50.00 | 50.00 | 50.00 |

| Inventory Days | n/a | 54.54 | 45.00 | 45.00 | 45.00 |

| Payable Days | n/a | 57.66 | 30.00 | 30.00 | 30.00 |

PATENTS, TRADEMARKS AND REGULATORY APPROVAL

The design and incorporation of the specific means and methods of incorporating intelligence into the base remote control design of the SafeViewing parental control system is the subject matter of a pending patent application filed with the U.S. Patent and Trademark Office on October 23, 1993. All materials issued with regard to the SafeViewing unit are clearly marked as U.S. Patent Pending indicative of the rights associated with a potential patent. Ownership of the patent will be in the name of Thomas P. Martin with exclusive licensing to Television for Kids, Inc. All contributory parties are subject to Confidentiality and Non Disclosure Agreements signed prior to all contractual agreements for both services and ownership of all designs, hardware and software associated with this project.

The components of the SafeViewing parental control system are derivatives of existing component parts which have been approved by both Underwriters Laboratories and the Federal Communications Commission. Modifications to the existing components for this product do not undermine the integrity of the basic designs and therefore do not require additional regulatory approvals. We are at this time investigating the requirement for an additional FCC approval for the addition of a video signaling switching network to be incorporated into a second generation of the base product. This switching network is being designed by Contec L.P. and will be incorporated within the FCC guidelines for the specific application. Regulatory approval will be acquired by Contec, L.P. on behalf of Television of Kids, Inc.

EXHIBIT

Safe Viewing Description and Operation

The Safeviewing control system is based on a standard microprocessor control system for both its remote control unit and baseband tuning converter. The remote control unit transmits a pulsed infrared beam to a receiver in the baseband converter whose microprocessor initiates a predetermined control sequence for the tuning of specific frequencies associated with broadband coaxial cable television transmission. The receiving converter box converts the broadband signal to a single frequency which is relayed to the television tuner for specific channel reception. The use of a baseband converter unit allows for regulating both the audio and video signal characteristics of the specified frequency. The advantage to utilizing the baseband control method over other standard cable signal control or tuning converters is that the signal control window is extremely narrow and as such does not allow for overlap of received signals. This control method and converter will not allow a television tuner to deviate from the baseband broadcast frequency as sent out by the converter box and any such deviation will result in an audio and video signal loss at the television set. This feature results in a secure method of regulating the signal or channel available at the television.

SafeViewing takes advantage of the narrow window signal control offered in base band converter design and further enhances its control method. Standard infrared remote control devices utilize application specific microprocessors, commonplace technology, to transmit a specific infrared signal which is interpreted by the microprocessor within the receiving converter boxes which in turn intiates a specific program sequence. The remote control unit which drives the SafeViewing parental control system has been upgraded to incorporate not only the basic remote control features of channel selection, channel memory and volume control but has the added feature of on-board nonvolatile memory. The addition of this memory to the basic remote control design enables the SafeViewing remote control to be programmed by the user to "lock out" specific transmission sequences. A user programmable Personal Identification Number (PIN) is utilized to provide access to the programming sequences.

The "lock out" feature of the SafeViewing operates by disabling the control keypad of the remote control unit. While in the locked mode only specific transmissions sequences are available to the operator. Those transmissions include: power on/off, channel memory scan, volume control, and sleep timer activation. The keypad of the SafeViewing remote control unit is enhanced to indicate to a child which functions are operable while locked. This allows for easily teaching a child how to use the device. Operation of the device is limited to selection of channels preporgrammed into memory by an adult user prior to locking of the unit. The unit is also preprogrammed to tune the television to a user programmed reference channel when it is turned on or off.

Comment about this article, ask questions, or add new information about this topic: