Manufacturing Business

BUSINESS PLAN

FIBER OPTIC AUTOMATION, INC.

141 S. Main St.

Boston, MA 02120

The authors of this plan have developed an innovative monitoring system for underground cables, wires, and storage tanks. They are seeking financing to expand their reach into consumer markets, while increasing their industrial market.

- EXECUTIVE SUMMARY

- DESCRIPTION OF BUSINESS

- SALES AND MARKETING

- COMPETITION

- MANAGEMENT

- FUNDING REQUIREMENTS

- FINANCIAL PROJECTIONS

EXECUTIVE SUMMARY

Overview

Fiber Optic Automation, Inc. ("FOA" or the "Company") was founded in 1986 and is based in Boston, Massachusetts. In September 1995, FOA was merged into Optech Inc. The Company has obtained the exclusive rightto manufacture and market apatented monitoring and fault locating technology. The primary focus of the Company is in the telecommunications industry, telephone operating companies, ("Telco's"), Cable TV (CATV) and Local Area Network (LAN) fiber optic markets.

To date, the Company has raised approximately $6.0 million to support research and development, product introduction to the Telco market and initial sales. The Company seeks to raise an additional $5.0 million to fund its growth. The funds will be used for general corporate purposes, including working capital and expansion of the sales and marketing efforts. FOA's business plan projects that annual sales will reach the $34.0 million level by the fifth year with net after-tax profits of approximately $10.8 million.

The Company's monitoring system, Cablewatch, facilitates the continuous monitoring of fiber optic and copper cables. By providing "early warning" and by identifying and locating faults before an outage can occur, the system can save telephone companies as much as $1.0 million per minute in lost revenue and repair costs. This system can also extend the useful life of telephone cable network (outside plant) significantly. The outdoor telephone cable, splices, and repeater sites are generally known as outside plant. Management believes there is no other product currently available which can directly monitor and locate long-range faults on fiber optic cable. Most other competing technologies and products in this regard are more complementary to the Company's products than competitive.

The Company's technology was originally developed in Canada and has been in operation on the Canadian fiber optic network since 1988. Since the acquisition of the basic technology and a basic patent in late 1986, the Company has developed several important products and been awarded several new patents. In addition, several more patent disclosures are being processed for the Company's latest innovations dealing with automated monitoring and fault locating of both optical fiber copper cable and for solving one of the industry's major obstacles in bringing fiber to the home or fiber to the curb.

Customers for Cablewatch and related Telco telephone products include telephone companies worldwide. Product development has been completed and many of the products have already been approved and are now awaiting standardization. Product improvements, however, are an ongoing activity in the ever-changing market, as well as modifications in order to meet customer-specific requirements. The company has been developing sales of its products over the years since the business was established. Sales have fluctuated from year-to-year, from a low of $233,000 to a high of $700,000 during the period from 1990 to 1995. This was due to minimal sales and marketing efforts put forth during the early years, when we concentrated our efforts on development of products and partnership agreements. Cutbacks in customer's capital budgets and changes/cuts in personnel have partly contributed to the delays in Company growth and sales goal achievement. The Company has experienced a continued shortage of capital, and therefore has been unable to take itself to the next step of its growth cycle. The Company has been focusing its efforts on the fiber optic segment of the telephone market, which is growing rapidly (in excess of 20% a year) on a worldwide basis. The total market for Cablewatch application on fiber optic cables is estimated by management to grow from $156 million annually in 1993 to approximately $363 million by 1997. This has been limited due to manufacturing limitations. These numbers are based on the market size for fiber optic cables as projected by Kimbrough Marketing Inc. ("KMI") as shown in the accompanying charts and graphs that follow. That we have only addressed the fiber cable market in our plan, and that these products can also be utilized for copper cable, reduces cost justification for the Telco.

The same technology used in the Telco market has been applied to the industrial market for the development of a continuous monitoring system to detect spills and leaks of hazardous substances for use at factories, industrial storage facilities, high rise condominium complexes, and gasoline storage tanks, either above or below ground. FOA has sold an initial system to a major ammunition plant in Texas and is in the process of implementing an upgrade for automation of the monitoring system. Management estimates the market potential for products in this market to be hundreds of millions of dollars per year. However, limited resources preclude FOA from marketing this product line at this time.

FOA has also developed inexpensive monitoring devices to detect water or gas leaks, as well as basement flooding, in the home. Primary customers include mass merchandisers of all kinds. The current size of this market is estimated to be in excess of $100 million. Again, due to limited resources, marketing of these consumer products may be done through royalty arrangements.

It is possible that the non-fiber optic related market could be funded as separate business segments. Each product offers the potential to be the industry leader in its respective market. Management believes it has distinct competitive advantages in all three products. Additionally, the monitoring technology can be applied to other markets such as building security and secured communications, among others applications.

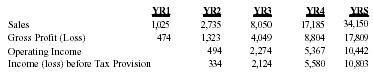

Selected Financial Projection

| Telco Products Only ($000's) | |||||

| YR1 | YR2 | YR3 | YR4 | YRS | |

| Sales | 1,025 | 2,735 | 8,050 | 17,185 | 34,150 |

| Gross Profit (Loss) | 474 | 1,323 | 4,049 | 8,804 | 17,809 |

| Operating Income | 494 | 2,274 | 5,367 | 10,442 | |

| Income (loss) before Tax Provision | 334 | 2,124 | 5,580 | 10,803 | |

MANAGEMENT

Officers/Directors

Lyle Kasdan, 49 years old is Chairman of Optech, the parent, and President, CEO & Director and co-founder of FOA. At FOA, he was responsible for developing the Company's business strategy and raising approximately $5.0 million in equity financing through private & institutional sources. He oversaw the development of several new products & patents for application in the telecommunication, industrial & consumer markets.

Mr. Kasdan was also a co-founder of a leading publicly traded optical fiber manufacturer. He served as a Director, Treasurer and Executive Vice-President of Manufacturing & Engineering. He was responsible for all engineering and manufacturing including equipment technology, process technology, product development, quality assurance, plant engineering, plant automation and purchasing. He supervised the growth of manufacturing and engineering capabilities to become the third-largest manufacturer of optical fiber in the U.S. through installation of stateof-the-art manufacturing facilities and factory automation systems.

Dr. Aslami received his B.S. degree in Chemical Engineering, and his Ph.D. in Chemical Engineering. He has published several articles, taught at several universities, and has patented a unique vapor delivery system for fiber preform manufacture that increased productivity, reproducibility and yields of high-performance communication optical fiber.

Investment Merits

Proven Management Team

The principals of FOA, Lyle Kasdan and Roger Knight, have collectively over forty years of experience in the fiber optic field. Both executives were co-founders of Optech Inc., a leading optical fiber manufacturer.

Mr. Kasdan has developed and managed three different fiber optic manufacturing operations in addition to Optech. He is also the coauthor of several industry patents. Mr. Knight's management experience includes executive marketing roles in addition to his Optech experience.

Patented Technology

The Company has acquired exclusive rights to the initial electronic monitoring technology; all patents, products and know-how to manufacture and market Cablewatch worldwide (except Canada). Patent protection extends from the U.S. and Canada to the European Common Market countries and the Far East. The Company has also conducted patent searches, including a detailed infringement search, with positive results.

This proven technology was originally developed to meet the needs of the Canadian telephone system. It has been in operation on the Canadian fiber optic network since 1988 and is now used across that country. Penetration and acceptance in the U.S. Telco market has been slow over the last three years due to the Company's lack of capital. The company has received several new patents, with others in the process of being issued.

Management believes there is no similar competing technology which can monitor and locate long range faults on fiber optic cable and jel-filled copper cables. However, there are systems in place for the monitoring of old pressurized copper cables. Pressurization, however, is not practical for use on fiber optic and modern jel-filled copper cables.

Compatible Technologies

Although there is no direct competitive product in the market today, there are, however, several alternative technologies available:

Line Walker

This product has been around for over 30 years and works on the principle of sending an audio signal on the cable sheath and monitoring the leakage of this signal from the damaged site via a portable receiver. In order to do this, however, one must "walk the line," since the receiver has to be near the damaged site. Management believes this technology is more complementary than competitive. Several large companies are manufacturing this product.

Pressurization

This technology was developed and used on copper telephone cable for over 30 years. It is simply not practical and/or economical on small fiber optic cable.

ORD (Optical Reflectometer Device)

This instrument has also been used for approximately 10 years. It works on the principle of sending an optical signal on the individual fiber and measuring the elapsed reflection time of the signal from the damaged or broken fiber. This is a delicate and expensive instrument that is manufactured by several large and small companies. Again, because of the fact that this instrument works on the individual fiber and not the entire cable, it can be considered a complementary technology. This instrument is not capable of identifying the cable sheath damage that will in most cases result in fiber damage. There may be as many as 144 fibers in a fiber optic cable. FOA's instruments, on the other hand, provide early warning, identify and locate damage to the entire cable, and more importantly, prior to the fiber(s) being damaged. In most cases such sheath damage can be repaired through preventive maintenance before the full degradation and/or outage can occur. FOA's 1996 plan, once funded, is to build this instrument into our Long Range Cablewatch and thus provide the most powerful, useful, versatile, and economical instrument that is available to the industry.

Fiber Monitoring

In those cases where the fiber optic cable does not have a metallic armor to allow the company's Cablewatch to be implemented, an ORD monitoring approach must be used. This technique is costly and dependent on the number of fibers that must be monitored. There are a number of companies that offer ORD types for non-active fibers (dark fibers) monitoring. This is a "hit or miss" type of random monitoring. The Company has signed an agreement to offer its product, which is an active approach to 100% of the fibers being monitored. The Company believes that its product and that of their agreement partner makes for the offering of a unique package. It is working on a number of opportunities using both types of technology.

Large Potential Market

The total worldwide market for FOA's products has grown from approximately $156 million in 1993, and is expected to grow to $363 million annually by 1997. This growth in the fiber optic market is partially due to the development of the "Information Super Highway and The New Telecommunication Bill". The Company is in discussions with certain developers to consider the use of FOA's cable monitoring systems on these networks.

Customers for Cablewatch and related Telco products include telephone companies worldwide. The Cable TV (CATV) industry has recently started deploying large amounts of fiber optic cables from the distribution office to the end-user distribution panels in an attempt to meet tougher transmission quality standards as well as participate in the growing multi media market. These C ATV networks, as well, will require the Company's products to maintain their network integrity. The company has sold a trial system for use on one cable company's fiber optic network in the California Area.

Wide Application of Technology

The Company's monitoring technology may have significant applications in other fields such as security, secured communications, building management/environmental control, and rail-road tankcar monitoring. Although there are no official market size estimates for these fields and no current FOA products, management is continually evaluating applications beyond the core telecommunications market.

Management believes there will be a multi-million dollar market for its hazardous chemical leak detection system. Growth in this market will be spurred by recently passed federal legislation mandating chemical leak monitoring for gasoline storage tanks and other chemical storage facilities. The management, however, is not actively marketing in this area due to limited resources.

Current estimates for the consumer market for FOA's home flood detection equipment are approximately $100 million.

Due to limited resources, the primary focus of the company is the fiber optic portion of the telecommunication market and not the hazardous chemical leak detection or the consumer market.

Fiber Optic Trend

The telephone commercial and industrial marketplaces worldwide have made a commitment to fiber optic technology. A significant portion of their capital expenditures are dedicated to fiber optic installation. Fiber optic lines have supplanted copper line as the optimal cable medium, due to its higher transmission capacity, quality and greater price/performance characteristics. Telecommunications providers worldwide continue to invest heavily in fiber optic technology as most carriers plan to fully adopt optical transmission networks in the next century. The Clinton administration strongly supports the "Information Super Highway". The Company's patented technology is the only passive monitoring system available to support the integrity of the outside plant network. FOA is well positioned to profit from this trend by offering patented products that provide increased reliability, easier maintenance and lower systems maintenance costs for these industries.

FOA Financial Characteristics

As a marketing and light assembly operation, FOA believes it will operate as a high-margin, lowoverhead firm with minimal needs for heavy capital investment. Accordingly, the greatest use of funds will be directed toward corporate purposes, including working capital, sales and marketing, and new product development and product improvements.

Fortune 1000 Customer Base

FOA's monitoring technology is directed toward Fortune 1000 customers that are reliable payers with ample resources and high profiles. Major current and potential customers for the Company's product lines include the long distance carriers the RBOCs (Regional Bell Operating Companies) and major independent utilities. Customers for the industrial product lines include chemical, petroleum and industrial companies, as well as nuclear contractors. Consumer products would be sold through mass merchandisers and hardware/home center stores.

DESCRIPTION OF BUSINESS

Corporate Overview

The Company was formed in September 1986, was merged into Optech in September 1995, and is engaged in the design, manufacturing and marketing of cable monitoring and automated long-range fault locating systems. These systems are used primarily for monitoring and fault locating of communication cables. By using the Company's patented electronic monitoring technology, the user has an early warning monitoring system which facilitates preventive maintenance, provides system integrity and long life, and offers substantial cost savings.

While the initial technology was designed for the detection of moisture and/or sheath penetration in fiber optic and/or electrical (copper) cables for the telecommunications industry, the Company has expanded the scope of applications by adapting the technology to meet all utility company needs (e.g. water, electric, gas, and telecommunication) such as automated fault locating, as well as to serve the industrial and consumer marketplace. In that regard, a hazardous leak and spill detection system, including leak monitoring of underground storage tanks (i.e. gas stations) was pioneered for the industrial market, and a home water leak detection alarm was developed for the consumer market.

The Company acquired the exclusive rights to the initial technology, patents, products and knowhow to manufacture and market cablewatch worldwide (except Canada).

Since the issuance of the basic patents in 1984, several successful patent searches have been conducted by outside counsel, including a detailed infringement search. To further protect and enhance the Company's position, four new patents have been received with respect to concept upgrade and several new products and applications.

Cablewatch

Given the almost universal acceptance (anticipated market penetration of 80%) of the Cablewatch technology throughout the Canadian telecommunications industry where it was first introduced, the Company, since its inception, has concentrated its energies and resources primarily on marketing Cablewatch to the telecommunications industry, both in the United States and in certain overseas markets. Product development has essentially been completed and many of the products have already been approved and are now awaiting standardization. As such, the size of the sales orders have increased. In addition to the fiber optic installations, the system can also be used on copper cables. The Company expects that the application of Cablewatch technology to new and existing copper cable installations, given the size of these markets, represents a significant growth opportunity.

To date, Cablewatch and ancillary products have been sold primarily by the Company's sales force and independent sales representatives. To a lesser extent, distributors are also involved in sales of the product line. The distributor sales effort is expected to grow as the company supports these accounts in the future. The Company has entered into several distributor agreements, covering the U.S. and foreign markets.

Other Markets

Due to limited resources, the primary focus of the company is the fiber optic portion of the telecommunications market. With respect to the marketing of the home water leak detection system, the Company's consumer product, the Company previously marketed this product primarily through sales representative organizations.

For the hazardous chemical leak detection system, the Company has done most of the initial development activities and will begin marketing efforts through a licensing and/or marketing joint venture with an appropriate party.

No efforts are being made in either of the above market areas due to the Company's limited resources and focus.

Manufacturing

The Company's Cablewatch and related products are manufactured by subcontracting through outside vendors. Final assembly and testing are done at FOA prior to shipment. Manufacturing and packaging of the home water leak detection system were conducted in Mainland China, but no further manufacturing has occurred for this product since its initial run due to the Company's decision to focus on the Telco market.

Facilities

FOA is located in Optech's shared 20,000 sq ft. leased facility in Boston, MA. It is ideally suited for light manufacturing and assembly.

Employees

The Company presently has a limited number of full time employees. Candidates for various positions have been identified. Upon completion of this financing, additional employees will be hired to support the Company's efforts in sales, marketing, and product development to meet market needs.

Markets and Opportunities

Numerous applications for automated long-range fault locating and cable monitoring technologies exist today. The Company's annualized estimates of the market size for these technologies are as follows:

|

Market Size

(in $ millions/yr.) |

|||

| 1993 | 1994 | 1997 | |

| Telco - Fiber Optic Applications | 156 | 191 | 363 |

Industrial - Hazardous Chemical Leak Detection

$1,000+/Year

Consumer - Water Leak Alarm, Gas Leak Alarm

$100+/Year

Source: (1) Kimbrough Marketing Inc. (2) EPA; (3) Management assumptions and interpretation of the data.

The foregoing is an estimate of market size and is not a prediction of sales. The Company does not have the capital or other resources to service more than a small fraction of the estimated market size. It should be noted that the fiber optic cable for the independent cable TV market sector is not included. The Company is focusing its efforts, due to limited resources, on the Telco market sector only.

Telco

Prior to the advent of petroleum jel-filled copper cables in the 1970's and, more recently, fiber optic cables in the early 1980's, pressurization was the telephone companies' standard approach for monitoring conventional (air-filled) copper cable. This was the case, despite the fact that for a small central office, the cost of installing and maintaining a pressurization system over the cable life is a multi-million dollar commitment.

However, with the introduction of smaller jel-filled (a water blocking agent) copper and fiber optic cables, pressurization is no longer feasible. The concept of monitoring via air pressure, given the high resistance levels associated with the smaller cables, proved to be no longer a viable approach.

As a result, an immediate demand was created for an approach that would provide an effective preventive maintenance program for the smaller (newer) cable designs. Without such amonitoring system, the telephone companies face significant cost exposure. Depending upon the extent of trunkline damage, major telephone companies have estimated downtime to run between $78,000 and $1,000,000 in loss of revenues per minute, excluding the labor cost associated with maintenance and repair.

A redundant system with a 100% alternate route backup allows for traffic to be rerouted in minutes. However, there are several major trunk routes across the U. S. which either have no back-up or only limited alternate rerouting capability. Therefore, until the line is repaired, the affected telephone companies must redirect traffic to either another in-house line or piggy-back onto the line of another telephone company under pre-existing arrangements. Restoration time is usually 4 to 8 hours at a cost of $50,000 to $100,000, excluding the significant loss of revenue discussed above. With the utilization of the Company's early warning system, the telephone companies are warned at the onset of cable deterioration, and thereby have adequate time to locate and repair the damage long before the cable system degrades to a state whereby a catastrophic outage may occur. As a result, the telephone companies avoid loss of revenues by way of downtime and/or sharing arrangements, as well as costly emergency repairs.

The Company believes that its products represent a proven solution for the monitoring of both fiber optic and conventional copper cables. Not only does the Company's product provide for early warning, positive feedback and continuous cable monitoring, but it also can locate the fault to within 0.5% of the line distance or a few hundred feet, by way of the Long Range Fault Locator. The company is able to provide monitoring of all (100%) of the fibers in an optical cable and cable monitoring system. Other providers of this type of equipment only provide 1-2 optical fibers, thereby providing only limited monitoring capability to the network.

Telephone Outages

One of the first major telephone outages occurred in the fall of 1991 in the New York and New Jersey areas. It was not clear at that time how frequently telephone outages occur and whether or not the situation is getting worse. The general feelings were that the outages were getting worse and more frequent due to greater penetration of fiber cable in FTTC, FTTH, and FTTL (Fiber to the Curb, Home, Loop). In order to determine the scope of this problem, the U.S. General Accounting Office (GAO) was directed by Congress to determine the frequency and causes of telephone outages. Data was received from 15 holding companies controlling over 83% of the local telephone service and 3 major long distance companies representing 89% of the long distance market. Outages that affected at least 10,000 customers and lasted 15 minutes or longer were reported in the GAO report that was published in March 1993.

An outline of the GAO results have been prepared from the GAO/RCED-93-79FS Telecommunication document. This report highlights cable cuts as the number one problem for telephone outages for the long distance carriers as shown in the accompanying charts and graphs. It also points out that cable failure nearly doubled during the one-year time frame.

From the results of the data, it can be concluded that a cable monitoring system could be useful in providing early warning of cable damage. This early warning can provide the time in certain cases to reduce the impact of an outage, and in certain other cases prevent a potential outage altogether.

In the case of local telephone companies, cable cuts were cited as one of the top four problems, and the only one in the top four that nearly doubled from 1990 to 1991. Since the local telephone companies are behind the long distance carriers in the deployment of fiber optic cables, this situation can get a lot worse for the local telephone companies in the future as they deploy more and more fiber optic cables, unless of course they choose to reduce such risks of cable related problems through utilizing FOA's cable monitoring system.

Industrial

The Company's hazardous chemical leak detection system helps solve a problem faced by businesses ranging from gas stations to major chemical complexes: the unintentional leakage and spilling of hazardous material. FOA offers an added measure of dependable protection and early warning at a cost which is slight in comparison with the potential liability of the user if the leaks and spills go undetected. Recently, additional regulatory authority was granted to the U.S. Environmental Protection Agency (EPA) in the area of managing and monitoring underground hazardous material stored in these tanks. The new requirements establish guidelines for underground tank monitoring and leak detection, and impose financial responsibility standards for tank owners. These standards will most likely include the posting of a bond or obtaining insurance coverage for an amount sufficient to provide for estimated tank replacement and cleanup costs. The EPA estimates that there are approximately 1.4 million underground tanks, and that the costs associated with decontamination and disposal can range from $30,000 to more than $250,000 for a cleanup of contaminated groundwater. Given the advantages of the Company's system, implementation of the new EPA regulations would place the Company in a strong position to compete in this market. In addition, a series of expensive cleanups in recent years relating to leakage from underground gasoline tanks has caused insurance premiums to rise sharply and has forced owners of such tanks to seek out detection systems. While the Company's initial product strategy was being directed toward the owners of petroleum storage tanks, the product has widespread applications beyond this market, including nuclear power plants, chemical plants and containment vaults. No marketing effort, however, has been applied to this area. The primary focus, as mentioned earlier, has been in the Telco application.

Consumer

The Company's consumer products provide homeowners with inexpensive, easily installed early warning system devices that greatly reduce the extent of water damage, fire, and asphyxiation. An enhanced version of the home water leak protection alarm contains a shut-off feature which is especially valuable for unattended homes. Again, no marketing effort, because of the Company's primary focus in the Telco market.

Technology and Patents

Telco-Cablewatch

Telecommunications companies face considerable cost from failures and disruptions of their cable installations. For both copper and fiber optic cable, the most common cause of disruption is moisture infiltration. Moisture entry can be caused by damage to the outside sheath during installation or by subsequent activity around the cable or at splice points. For fiber optic cable, contact of the optical fiber with water can change the chemical and surface characteristics of the fiber and thereby reduce transmission because of increased microbending sensitivity of the fiber. In addition, cable life can be reduced significantly by accelerating the deterioration rate caused by stress within the splice closure in the presence of water.

Historically, pressurization systems have been used on copper cables to detect and prevent water penetration inside of the copper cable that causes disruption of service. However, pressurization does not directly detect water, is costly to implement and maintain, and is ineffective for fiber optic cable. Moreover, if water penetration occurs, a pressurization system cannot pinpoint the location of the fault.

Cablewatch was designed for use with fiber optic cable installations, but also can be used with other metallic telephone cable and electric power lines. Cablewatch employs remote moisture sensors placed in splice closures, repeater housing, and other locations along the cable. When moisture activates a sensor, it triggers a digitally encoded alarm system to a terminal located in a central monitoring office. The terminal equipment intercepts, decodes and displays the exact location of the moisture penetration in the splice closure. In addition, the Company's automated Long Range Cablewatch can locate the fault within the cable from the central office to within 0.5% of the line distance or a few hundred feet.

Cablewatch operates by continuously monitoring a DC line current along the metallic sheath of a fiber optic cable. A decrease, increase or pulsating in the detection line current from set limits will activate an alarm. The detection current can flow through any conductor. Typically, the protective metallic cable outer and/or inner armor or sheath is used as the detection line. With this configuration, the metallic sheath forms a sensor in the system and is continuously monitored for physical damage. Thus, early detection of cable deterioration is provided allowing the crucial time to locate and repair the damage before costly cable failure occurs.

A cable monitoring system can monitor up to 99 sensors at splice closures, repeater sites, or control equipment vaults (CEV's). One system is capable of servicing approximately 100 kilometers of installed cable. However, because of boundary and jurisdictional limitations, users will typically employ one system to cover approximately thirty kilometers.

Industrial-Hazardous Leak Detection

The Company's hazardous chemical leak detection system uses the same patented technology as the Company's Cablewatch. Sensors are located at the most likely sources of leaks or spills. When a leak occurs, an alarm signal as well as a digital code are sent to a central monitoring station. The alarm and code not only signal that a leak has occurred, but also locate the source, a capability not available with any other competing system or monitoring approach known to exist. The system offers continuous monitoring, a high degree of reliability, and low maintenance.

Consumer-Water/Gas Detection

The home water leak detection device is based on the patented telecommunication cable monitoring technology previously described. Any water coming in contact with the detection leads or extended sensors is immediately sensed and alarmed by the solid state circuits.

Further enhancements and modifications of the device for marine applications and unattended homes (with auto shut-off feature) have been developed. This product will be marketed through licensing or an appropriate marketing joint venture.

The home gas detection device is designed to sound an alarm if a natural gas and/or propane gas leak occurs at home from either a gas heating system, a gas stove or similar gas appliances. A production prototype has been made for demonstration; however, manufacturing and marketing are awaiting financing and identification of a marketing partner or licensee.

Patents

The Company has acquired an exclusive right (except in Canada) to the technology, patents, products and know-how to manufacture and market the cable monitoring system. U.S. Patent #4480251 (issued October 30, 1984); Canadian Patent #1168707 (issued June 5, 1984); and United Kingdom Patent #2082406B (issued June 13, 1984) permit the Company to market and manufacture the product worldwide (except Canada).

New Patents

Since the acquisition of the basic technology, the Company has developed several new products and has filed for patent applications in the U.S., Canada and twelve countries in the European Common Market.

Two new US patents have been issued, which protect FOA's Long Range Cablewatch products.

A new patent recently issued has to do with solving one of the industry's major problems of how to power a telephone at the home using a fiber optic cable in power shutdown emergencies. This problem does not exist with copper cables, since copper lines carry 48 VDC from the telephone office. Fiber optic cables do not typically have copper lines, thus the problem.

The European patent filings have been approved and are in the process of being issued.

Products

At present, the Company is engaged in the manufacturing and marketing of products to three distinct customer markets: telecommunications, datacommunications and CATV. These products are derived from the same patented technology. In view of the fact that the Company's patent position is strongest in the Telco market, with practically no competition, and that the products are customer-driven and are receiving wide acceptance in the industry, the Company's primary focus has been in the these markets. The Company's other products for the industrial and consumer markets are well-positioned but, to date, because of a lack of resources, marketing has been limited.

Products for the Telecommunications Industry

The Company's telecommunications products ("Telco products") for use by telephone companies are based on patented concepts using the protective metal "armor or sheath" of both fiber optic and copper cables to provide a number of very useful functions.

Telco products ensure more reliable cable installation and provide continuous monitoring and protection of outdoor cables, splice points and other vital components of the communication circuits. Telco products provide for a more secure and easily maintained communications network.

The design of these products makes them unique to the Telco industry. The reliability and wide acceptance of the several of the Company's systems has been proven during years of "in service" use covering thousands of miles of fiber optic cables with several major telephone companies in North America. In the event of trouble, a patented concept is used to locate the faults quickly and effectively.

The following product descriptions provide a brief summary of the Company's current Telco products.

Fault Locating Products

FOA's Long Range Cablewatch is a unique instrument for the outside plant engineer. Based on patented technology, the Long Range Cablewatch can locate damage to the cable sheath from a distance of up to 60 miles. This can be done without walking the line with an A frame or other locating device. The unit is simply connected to each end of the cable being analyzed. The Long Range Fault Locator will display the results of the analysis, which includes, the location and size of any fault damage, in a matter of minutes.

The Long Range Cablewatch works in pairs. One unit is placed at one end of the cable being analyzed, and the second unit is then placed at the other end. The operator only has to provide the distance between the two units. The Long Range Fault Locator does the rest.

Cable Monitoring Products

The cables that are installed by telephone companies are called their "outside plant".

Outside plant cable is subjected to many forms of mechanical abuse and damage as well as normal wear and tear. Damage can occur during initial installation, subsequent rock settlement, or by digging or plowing and sabotage. Additionally, chewing rodents, gophers, termites, and the like cause serious damage to cables left to the environment. The FOA Cablewatch with reliable, low-cost, solid state circuitry, is designed to continuously monitor the integrity of outside cable plant and provide protection against these intrusions from end to end.

Using a central office terminal and remote sensors, Cablewatch continuously monitors the integrity of cables, splice closures, repeater sites and other critical locations for the presence of moisture and other mechanical intrusions. Operating over any metal circuit or a single conductor, such as metal "armor or sheath," and ground return, the system will sense and signal the damage of the cable sheath and the location of any water ingress allowing the crucial time for repair, before outages occur. In the alarm mode, the system provides cathodic protection of the sheath damage site, thus inhibiting corrosion of the protective "armor or sheath" until a repair can be carried out.

Communications Products

FOA's Hands-Off TalkSets are unique in the area of field communications. All units have the ability to operate on either the fiber, protective metal "armor or sheath" or other available conductor. They offer extremely long range and high power. All units allow for hands-free communication.

These talk sets are designed for outside plant maintenance personnel who need a reliable, rugged, long range communications tool when installing, splicing or restoring fiber optic cables under adverse conditions. The ability to communicate on the sheath as well as the fiber is unique, and provides a level of flexibility that is extremely important in restoration situations. The unit is packaged in a durable, watertight case and operates off of long-life rechargeable batteries. It can also be used as an optical or electrical repeater device to achieve even greater range of operation.

FOA has recently upgraded the design of the talk sets to allow the user to be able to "dial out" on a network called the "order wire." This is a unique and desirable feature in an outage/crisis situation. The user can dial out to advise alarm center personnel the status at the cable cut or damage site. A cut cable, depending on the number of fibers, could cost from $100,000 to $1 million per minute, so down time is expensive. The dial out can be done over the cable metallic sheath, twisted pair or over an optical fiber.

Cable Protection Devices

Cable protection devices are attached to the cable sheath at splices and regens to provide lightning and voltage protection. The units are designed to allow the sheath to be used for locating, fault locating, and communications, without entering splice closures. If a dangerous voltage appears on the sheath, the protection devices immediately provide a low impedance path to ground. Once the voltage has passed, the sheath is restored to its original state. If a power-cross or other condition results in an excess current flow for an extended period, a thermal fail-safe system grounds the line safely and permanently. The impact resistant polycarbonate enclosure is watertight and dust-tight. Other potential areas of use exist at the customer premise for CATV and datacomm users.

Products for the Industrial Market

Hazardous Chemical Leak Detection System

The system is used for the detection of hazardous chemicals, liquid waste leaks, and spills. The liquids detected by this system may be either organic or inorganic, and either acidic, basic, or neutral.

The hazardous chemical leak detection system uses the same patented technology as the Company's Cablewatch. This system is intended to be used for monitoring multiple points or zones within a factory, chemical plant or storage site. The sensors are strategically located at the most likely sources of leaks and spills of hazardous and toxic materials. Should aleak occur, an instant alarm signal as well as a digital code indicating the exact location are sent back to the central monitoring station alerting the security officer or alarm center that a spill or leak has occurred. Through such early detection of leaks and spills, expensive clean-up, repairs, injuries, and related liabilities could be reduced.

A smaller system has been developed for gas station use to monitor leaks in underground storage tanks. The system can also be adapted to monitor water leaks in unattended apartment and condominium complexes. Further engineering work is required to complete this package for marketing.

Products for the Consumer Market

Currently, the Company is engaged in the marketing and manufacturing of a home water detection device, and is ready to manufacture and market a home gas detection device. A device sensor for use with sump pumps and marine applications is also ready for product introduction.

Manufacturing

The Company uses several U.S. subcontractors to manufacture various components, PC boards, PC board assemblies, sheet metal work and the like. The final assembly and testing of these components are being done at the Company's facility.

The Company currently shares office and assembly space at Optech's leased building in Boston, MA.

Employees

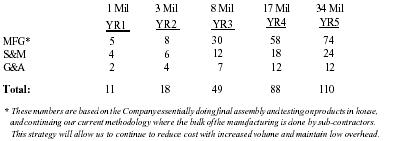

The projected number of employees in the manufacturing, sales and marketing, and general and administrative areas is expected to increase over the next five years as follows:

|

1 Mils

YR1 |

3 Mil

YR2 |

8 Mil

YR3 |

17 Mil

YR4 |

34 Mil

YR5 |

|

| * These numbers are based on the Company essentially doing final assembly and testing on products in house, and continuing our current methodology where the bulk of the manufacturing is done by sub-contractors. This strategy will allow us to continue to reduce cost with increased volume and maintain low overhead. | |||||

| MFG* | 5 | 8 | 30 | 58 | 74 |

| S&M | 4 | 6 | 12 | 18 | 24 |

| G&A | 2 | 4 | 7 | 12 | 12 |

| Total: | 11 | 18 | 49 | 88 | 110 |

SALES AND MARKETING

Telecommunication

Direct Sales

Cablewatch is a relatively new technology, and as such, requires that the market be developed. A direct sales approach is not a cost-effective means for this product line. However, due to the technical nature of the products, a direct customer contact needs to be made through the stages of product evaluation, qualification and field trials. The associated cost of direct sales will limit our sales efforts to targeted key accounts. Direct sales will be used increasingly to support agents and representatives in each respective territory.

Sales Representatives

The Company plans to continue to use independent sales representatives. The firms we are presently using sell products from other manufacturers to the same customer base. They are located in strategic areas across the country. While most of the individuals have some technical knowledge, factory support is required.

Distributors

Because of the number and location of the potential customer base, sales and marketing can be more effective on certain of FOA's products with the use of distributors. The distributor typically has direct salespeople calling on accounts selling many different items, thereby reducing their overall selling cost. Typically, these sales people are not technically knowledgeable about the products they sell. It is a challenge to find organizations that could promote the sale of the FOA system. As the products become qualified with more customers, the use of distributors becomes more appropriate.

Distributors can provide access to certain U.S. and foreign business opportunities. The distributor has qualified mailing lists and contacts which can be used to provide information about the company's products. These channels of distribution reach various telephone companies and contractors in the growing fiber optic telecommunications and data communications market place. Field sales people that the distributor uses are competent in outside plant practices to address field personnel needs. Inside sales personnel of the distributor handle the administrative functions required to support the field's efforts.

Advertising, Promotion & Trade Shows

As with any new product or technology, the user must be made aware of its existence. A continuous advertising program is used in trade journals to make potential users aware of the product and its ability to provide solutions to existing problems. This advertising helps achieve brand name recognition by management personnel. In addition, the ads generate "Bingo" leads for sale representatives to follow up on.

Promotional literature is provided to describe the system's operation. Application notes are provided upon request. A no-cost "postage pre-paid" card is available for the potential customer to use.

Trade shows are attended for industry visibility. A booth and equipment demonstration is used to promote the system.

International Sales and Marketing

The international market is no longer a "dumping grounds" for used telephone equipment and technology. They are focusing on the deployment of optical fiber. Even the Third World countries are looking to deployment of state-of-the-art fiber optic technology.

The international Telecom market is 1 to 1.5 times the size of the United States market. Because of the size, distance and politics involved, a totally direct sales approach is not effective; however, due to the technical nature of the product, a certain level of direct customer contact will be required. Local representatives/agents who are approved to sell to the governmentowned telephone companies will be used to start the selling process. Direct contact will be made at appropriate stages of product evaluation, qualification and field trials.

Industrial - Hazardous Chemical Leak Detection Systems

Sales & Marketing Strategy

With mandated EPA regulations, as well as OSHA and corporate awareness as to liability costs associated with hazardous leaks, a heightened need to use monitoring systems for leak detection has been developed. At this time, however, the Company is not focusing on selling to this market. An appropriate marketing and distribution partner may be the best way to enter into this market.

Consumer Products

Sales and Marketing Strategy

There are 88 million single-family dwellings in the U.S. A viable market exists for water and gas leak detection in multiple family/condominium structures. At this time, however, the Company does not anticipate selling to the consumer market. An appropriate marketing, joint venture partner or licensing may be the best way to market these products.

COMPETITION

Telco

Non-Direct Competitors

Trojan Meter Industries and Notch Products offer air pressurized cable monitoring systems (not suited for fiber optic or other filled cable). Water or moisture penetration into any outside cable plant can cause communication circuits to fail. In copper cables, water causes short circuits, conductor corrosion and immediate loss of communication circuits. In fiber optic cables, water causes swelling and degradation of the protective coatings, stress corrosion of the glass fiber and deterioration of surrounding cable and splice components. These problems often cause outages which result in interrupted service, loss of revenue, added cost to locate and repair, and significant reduction in useful life of the outside plant.

A wide range of materials and methods have been tried, with varying degrees of success, in the battle to maintain outside plant. Pressurization, a common means to monitor and protect large air core copper cables, is difficult to place and maintain on small compact cables and cannot be used at all on modern filled designs (e.g., fiber optic cables). In an attempt to protect fiber optic splice closures, encapsulated double closure systems are sometimes used.

Fiber optic cables currently are not monitored for damage. Optical Reflectometer Devices (ORD's) are used to measure optical fibers for degradation. ORD's are used when a fiber break or cable has been cut. Manufacturers are: Bend Corporation, Yamagi Ltd., Faser, Laser Optics Corp., Cove Corp., and Amsterdam Technology.

Prior to the FOA products, cable faults could only be found by placing a tone signal on the cable's metallic sheath. An operator must then walk over the entire length of the cable to determine the location of the fault. There are four major manufacturers of this type of device: Faser, Fibertech, Cableco, and Applied Detection Inc. This product and technique does not directly complete with FOA's product. In fact it is considered more complementary than competitive.

All of the above methods have been used in an attempt to maintain the integrity of outside cable plant. While providing a degree of protection, these methods nevertheless all suffer from the same deficiency. None of the previous methods provide early detection and warning of developing cable trouble. The first signs are often outages. In addition, none of the above methods can locate long range faults.

Industrial

Mandated EPA regulations, OSHA requirements and environmental groups have exerted pressure on corporations to be environmentally responsive.

There are currently several companies with different types of products and techniques for use in the monitoring of leaks. It is also expected that many more will enter into this market. A few of the companies that are presently offering products include: Chemtech, Applied Detection, and Chemical Instruments.

The FOA device is derived from its patented technology. It allows for leak detection over great distance using a single or pair of copper conductors. The underground storage tank monitor provides three methods to monitor for leaks. These methods provide for the detection of gasoline vapor and liquid outside the tanks and gasoline liquid between the walls of a double wall tank. All three detection methods are expected to be required to meet final EPA regulations. The system could provide the owner with reduced cost for insurance coverage and payback in as little as one year. It is believed that FOA's approach, could compete effectively in this multi-billion dollar marketplace. The Company is not considering dilution of its effort in this area.

Consumer

There are several lower-priced, but lower quality, products on the market.

FOA's advantages are:

- Product quality

- Low level battery alarm

- Warranty

- Attractive design, packaging & POP display

- Remote sensor

- Interchangeable sensor

The Company is not considering dilution of its effort in this area.

MANAGEMENT

Roger Knight, 57 years old, is a Vice-President and Director of Optech Inc. and is Executive Vice-President of Sales & Marketing, Director and co-founder of FOA. Mr. Knight has assisted in the development of FOA's business plan & fund raising. He has been primarily responsible for the market & customer development activities for FOA's products. Mr. Knight successfully completed several product evaluation programs with major Telcos & has set up sales representative organizations in the US and abroad.

Mr. Knight has an excellent knowledge of the product scope proposed for the Company and its potential customer base. Mr. Knight has a B.S. in Economics, an M.B.A. in Management and Marketing, and has co-published several articles.

Harvey Winslow, 47 years old, is a Director of and Financial Advisor to FOA. Mr. Winslow is President of Financial Services Incorporated, a registered investment advisor, which is engaged in a diversity of financial activities, including establishing and/or managing security-related trading partnerships and other investment vehicles, and locating, structuring, and negotiating investment opportunities for business entities and financially sophisticated individuals. As a result, Mr. Winslow has become a director and/or officer of several of the companies associated with these activities. Prior to 1985, he spent seventeen years on Wall Street, fifteen of which were spent as Chief Financial Officer of a government and money market securities firm and two of which were spent as operations manager of a New York Stock Exchange Member Firm.

James Sullivan, 36 years old, is Manager of Product Development and Engineering, with extensive analog, digital and fiber optic communication system design expertise. Mr. Lavallee joined FOA in July 1988. He has been the principal developer of both the Long Range Cablewatch and Hands Off TalkSet which operate on the outer armor of fiber optic cables.

From 1976 to 1988, Mr. Sullivan held various positions with other fiber optic systems companies in product development and design.

He is licensed by the Federal Communications Commission and is a member of both the Society of Motion Picture and Television Engineers (SMPTE) and the Audio Engineering Society (AES).

William Fenkell, Director, is 51 years old, and from October 1969 to December 1987 held various positions at the Union Bank. In his latest position, he served as a Senior Loan Officer for South Asia programs. His responsibilities have included design and administration of the Bank's assistance to the countries for which he was responsible. He has conducted economic policy and operational discussions with senior foreign government officials and has led the Bank's team to negotiate loans and credits with client governments for projects costing in excess of four billion dollars. He has also helped arrange financing packages for a number of these projects.

Hugh McDonald, is 49 years old. He has been retained by FOA as an independent telecommunication consultant and will assume the position of Vice President of Sales and Marketing upon completion of funding.

Mr. McDonald has an extremely broad background in Sales, Marketing, and Operation, with over twenty years of experience in telephony and cable industry. He was most recently employed by Fiber Cable Co. to develop a new sales and marketing organization for the telecommunications industry. He completed his task recently, where in less than twenty-four months the department was in place and generated more than $23 million in revenue with extremely handsome gross margins. Mr. McDonald has a B.A. in Business. He is a member of numerous industry organizations and associations.

FUNDING REQUIREMENT

Funding to Date

The Company has raised approximately $6 million to date in the form of equity and debt as outlined below. These funds have been invested toward the development of a unique and patented technology that has widespread application possibilities. The Company's main emphasis, however, has been in the Telco market. It plans on entering the datacommunications and CATV markets as well. Most of the funds have been used to finance R&D, patents, product development, field trials and market development for the telecommunications market place.

| Funding to Date ($000) | |

| Equity ( 1 ) | $ 5,371 |

| Secured Debt | $ 600 |

| Total | $ 5,971 |

| (1) Includes equity from: | |

| Officers/Directors | $ 957 |

| Outside Directors | $ 857 |

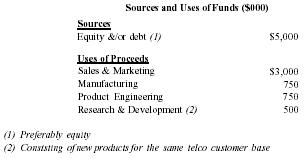

Current Requirement

The Company seeks to raise $5 million to finance its anticipated growth over the next two years. The bulk of the new funds will be used to expand sales and marketing efforts worldwide.

Once the funds are raised, the Company would invest $500,000 to continue developing certain new products that can be marketed to the same Telco customer base. A breakdown of the uses for all the funds raised are outlined below.

| Sources and Uses of Funds ($000) | |

| (1) Preferably equity | |

| (2) Consisting of new products for the same telco customer base | |

| Sources | |

| Equity &/or debt ( 1 ) | $5,000 |

| Uses of Proceeds | |

| Sales & Marketing | $3,000 |

| Manufacturing | 750 |

| Product Engineering | 750 |

| Research & Development (2) | 500 |

ASSUMPTIONS TO FINANCIAL PROJECTIONS

Income Statement

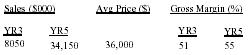

Sales, average price and margins by existing product line for specific years are as follows:

| Sales ($000) | Avg Price ($) | Gross Margin (%) | ||

| YR3 | YR5 | YR3 | YR5 | |

| 8050 | 34,150 | 36,000 | 51 | 55 |

Represents a market share of approximately 10.0% for fiber optic applications. Average prices shown represent initial pricing for purposes of market penetration and approximately 3% of the total network cost for a new fiber optic installation. Thereafter, it is anticipated that product pricing will bear a closer relationship to customer savings. This price is also subject to change, depending on the number of splices and number of cables monitored.

Sales are net of selling commission, estimated at between 5 - 7.5%

Cablewatch sales are attributable to new fiber optic installations and fiber optic retrofit markets. No sale amounts have been projected for the copper, fiber to home markets, C ATV and security markets.

Industrial sales are derived from hazardous chemical leak detection system for underground gasoline station tanks only. These monitoring systems are estimated at $5,000 each. No sale amounts have been projected for aboveground and other underground applications.

The provision for income taxes reflects application of net operating loss carry forwards and an effective federal, state, and local tax rate of 38%.

Pro-Forma Balance Sheet

The Company is currently negotiating with its creditors to convert most of the outstanding loans and accompanying warrants to stock. It is hoped to occur as of March 31, 1994. It is expected, however, the actual conversion may take place in the June quarter as opposed to March, and therefore the numbers may change slightly. For this reason, balance sheets are not included in this plan.

Stockholders' Ownership

The Company is authorized to issue 10,000,000 shares of common stock, par value $.01. As of December 31, 1993, the Company had 3,839,236 shares outstanding, allocated as follows:

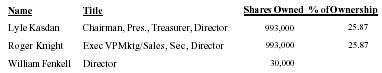

| Name | Title | Shares Owned | % of Ownership |

| Lyle Kasdan | Chairman, Pres., Treasurer, Director | 993,000 | 25.87 |

| Roger Knight | Exec VPMktg/Sales, Sec, Director | 993,000 | 25.87 |

| William Fenkell | Director | 30,000 |

Comment about this article, ask questions, or add new information about this topic: