Refrigerant Recovery

BUSINESS PLAN

ROAD RUNNER REFRIGERANT RECOVERY SYSTEM

757 N. 22nd Dr.

Tucson, AZ 85028

Road Runner is an ecological manufacturing firm dedicated to providing refrigerant recovery systems to enterprises specializing in refrigeration. Refrigerant recovery systems are designed to retain refrigerants from refrigeration systems to avoid its illegal and dangerous release into the atmosphere.

- MISSION STATEMENT

- INDUSTRY BACKGROUND

- PRODUCT OFFERING

- MARKETING PLAN

- OPERATIONS

- MANAGEMENT TEAM

- FINANCIAL PLAN

- RISK AND CONTINGENCY

- SUMMARY

MISSION STATEMENT

ROAD RUNNER. We are an environmental manufacturing firm committed to providing product, service, and support of the highest quality. We will provide refrigerant recovery systems to the refrigeration industry, currently regulated by government law. Our product, designed for refrigeration service technicians, will be distributed throughout the entire United States. By creating a business environment built upon integrity, honesty, and ambition, ROAD RUNNER will help to revitalize the manufacturing industry and return it to the infrastructure of America. As we seek future challenges, we will continually embrace the passion of goodwill for our employees, our customers, our environment and our country.

Core Philosophies

- Ensure our continuing existence by satisfying the customer.

- Strive to manufacture products and provide service that maximizes value and minimizes cost.

- Create a corporate culture that emphasizes teamwork, integrity, honesty, and leadership.

INDUSTRY BACKGROUND

Technology has changed our lives in many ways. It has enhanced nearly every activity that we undertake. Although technology has played a tremendous role in making our lives better, more efficient, and easier, it has played a role in endangering the safety of our earth. One such technology is refrigeration. Refrigeration uses gasses (such as freon) which contain chloroflourocarbons (CFCs) and hydrochloroflourocarbons (HCFCs). CFCs and HCFCs have been determined to deplete the ozone layer of our atmosphere, creating a large problem for our environment. In response to this, the United States government passed the Clean Air Act, regulating the handling and use of refrigerants.

On July 1, 1992, the United States Government and the Environmental Protection Agency established the Clean Air Act. Section 608 of the Act contains the following prohibition.

" Effective July 1, 1992, it shall be unlawful for any person, in the course of maintaining, servicing, and repairing, or disposing of any appliance or industrial process refrigerant, to knowingly vent or otherwise knowingly release or dispose of any class I or class II substance used as a refrigerant in such appliance (or industrial process refrigeration) in a manner which permits such substance to enter the environment. De minimis releases associated with good faith attempts to recapture and recycle or safely dispose of any such substance shall not be subject to the prohibition set forth."

The penalty for those technicians caught venting refrigerant into the atmosphere is as follows:

" With respect to enforcement, civil penalties of not more than $25,000 per day for each violation may be assessed. Criminal penalties for persons knowingly violating (after having been notified by the Administrator) a requirement or prohibition shall, upon conviction, be punished by a fine pursuant to Title 18 of the United States Code or by imprisonment not to exceed five years, or both "

This new law, along with the increasing pressure to uphold environmental standards, has created a dynamic market for refrigerant recovery systems. As the rules and regulations took effect in July of 1992, orders for refrigerant recovery systems greatly outnumbered available supply. Service technicians purchased approximately 132,000 recovery systems (research estimates that 18-20% of service technicians purchased units). This accounts for approximately $206 million in sales. However, many service technicians attempted to comply with the law, but could not do so. Manufacturers granted these individuals "rain checks" since they could not meet the demand. At the same time, a large percentage of technicians felt reluctant to purchase a system.

To further compound the arduous start for this industry, service technicians were not satisfied with the refrigerant recovery systems on the market. These systems: operated slowly due to inferior compressors, could not operate efficiently during extreme summer temperatures, and were too heavy. (These problems are explained further in the Product Offering.) Furthermore, manufacturers failed to provide adequate service and attention to the problems that occurred in the field.

Economic Incentives Propel Industry

In addition to the Clean Air Act and the penalty, two additional forces will propel the sales and popularity of refrigerant recovery systems. The Clean Air Act served as the initial catalyst by creating immense public interest and publicity. However, the economic aspects of this situation will begin to outweigh the regulatory. First, since the inception of the Clean Air Act, prices of all varieties of refrigerant (R12, R22, R500, R502, Rl 14, R60/40) have increased approximately 130% (as of March 1993), due to heavy government taxes. Taxes are currently $1.67/lb., and over the next six years will increase to $4.90/lb. Furthermore, refrigeration wholesalers are forecasting an increase in the manufacturers' price, which drive the retail prices even higher.

Second, environmentally safe refrigerant currently costs $17/lb. and is referred to in the industry as "liquid gold." At this exorbitant cost, twice the amount of non-environmental refrigerant technicians have a financial incentive to save as much of this "liquid gold" as possible. Thus, this creates an on-going market for the refrigerant recovery industry into the 21st century.

The Refrigerant Recovery Process

In order to understand the logic behind ROAD RUNNER'S design strategy, it is essential to understand the process of capturing refrigerants. Before an air-conditioning system can be serviced, the refrigerant inside the system must be removed. Before the Clean Air Act passed, service technicians would generally detach a hose and allow the refrigerant to release into the atmosphere. As explained, current refrigerants contain chloroflourocarbons (CFCs) and hydrochloroflourocarbons (HCFCs). These refrigerants can no longer by legally vented into the atmosphere. ROAD RUNNER assures rapid recovery of all types of refrigerants (in both liquid and gaseous states) from refrigeration systems containing refrigerant (refrigerators, walk-in coolers, air conditioners, automobiles, etc.).

Liquid Recovery

Liquid recovery occurs faster than any other type of refrigerant recovery possible. During this process, liquid refrigerant gets extracted from the air conditioning unit, and moves directly into the storage tank. It does not pass through the recovery unit, as compressors are only designed to pump vapor. The ROAD RUNNER will recover liquid refrigerant by utilizing a push-pull method. A vacuum is drawn on the storage tank to assist the liquid flow from the higher pressure area of the A/C unit into the low pressure area established in the storage tank. After the liquid refrigerant has been recovered, vapor recovery can commence.

Vapor Recovery

During vapor recovery, an additional hose must be attached between the storage tank and the recovery unit. Vapor is drawn from the A/C unit into the recovery system. It passes through the compressor to the condenser, where cooling occurs. Once cooled to a sufficient temperature, the gas turns to liquid and proceeds into the storage tank. Refrigerant recovery systems operate on a temperature pressure relationship. A lower temperature facilitates a lower pressure, therefore allowing for faster and more efficient operation.

PRODUCT OFFERING

Technicians faced many design and performance problems with the recovery systems they purchased to fulfill the requirements of the Clean Air Act. Therefore, ROAD RUNNER faced a great opportunity to design a recovery system that would completely fulfill the needs of the refrigeration service technicians. ROAD RUNNER'S product strategy centers around a second mover position and the ability to design a recovery system based upon the difficulties technicians encountered with competitors' systems.

ROAD RUNNER – Designing Archetype 2000

ROAD RUNNER's triple benefit positioning strategy (detailed explanation in the Marketing section) centers around the results of primary market research. This research indicated that the service technicians have a great need for a recovery unit with powerful and durable compression, rapid operation, and light weight. Taking this into consideration, the design engineer carefully chose components and system design in an effort to completely satisfy the needs of the service technician. Technicians faced big problems when it came to refrigerant recovery, but ROAD RUNNER solves them all.

Problems faced by technicians

- Damage to compressors caused by liquid

- Inadequate compressor strength

- Poor recovery rate in extreme temperatures

- Excessive weight for portable use

ROAD RUNNER provides solutions

• ROAD RUNNER contains a rotary compressor.

The first of several complaints focused on the situation of accidentally pulling liquid into the compressor. If liquid gets pulled into the compression chamber of a reciprocating piston compressor (similar to the piston and chamber in an automobile engine), the compressor will lock up and render the system useless. If the service technician works haphazardly, this can easily happen. Rotary compressors are much more durable and less vulnerable to damage if liquid is encountered.

• ROAD RUNNER utilizes a high capacity, one (1) horsepower compressor.

Secondly, service technicians complained that the recovery systems did not work quickly enough. What should have taken them minutes took several hours to capture the refrigerant from an A/C unit. This compressor nearly doubles the power of most competitors.

• ROAD RUNNER contains a tank cool down system.

Refrigerant recovery systems operate based on a direct temperature/pressure relationship. In order for a recovery system to work quickly and efficiently, it is crucial to minimize both temperature and pressure. Many of the current systems are unable to do this, thus slowing the refrigerant recovery process greatly. This became such a big problem during the summer of 1992, that service technicians were forced to submerge the refrigerant storage tank in ice in order to keep the temperature to a minimum. ROAD RUNNER's oversized condenser (300 cfm, three times the cooling capacity of competitors) coupled with a tank cool down system will enable the service technicians to recover refrigerants quickly and efficiently.

• ROAD RUNNER weighs only 41 lbs. and comes complete with a shoulder harness.

Finally, service technicians found that recovery systems weighed too much for portable use. Most commercial systems with the same recovery capabilities as ROAD RUNNER range from 60-100 lbs. Imagine climbing up a ladder onto a roof carrying a 100 pound machine. Itis nearly impossible unless one has unbelievable balance and incredible strength. Technicians said they actually had to use pulley systems and ropes to bring their refrigerant recovery systems onto the roof!

ROAD RUNNER Archetype 2000 includes:

- ROAD RUNNER refrigerant recovery system

- Connection hoses (3)

- Float valve (controls automatic shut-off function)

- Inlet vapor filter (O52 dryer, liquid filter)

- ROAD RUNNER utility bag (to carry hoses and filter), shoulder harness, and 2 ROAD RUNNER baseball caps

ROAD RUNNER Builds for the Future

Once Archetype 2000 becomes established in the marketplace, Archetype 250 will be introduced. This refrigerant recovery system will have orientation toward the more price-conscious service technician. Initial market research indicates that a unit with a smaller compressor and condenser and a lower price will serve the needs of this portion of the refrigeration industry much more adequately.

Additionally, ROAD RUNNER Archetype 3000 is currently under development. This system will have dual uses. It will serve as a recovery system (just like Archetype 2000) and a refrigerant recycler. Archetype 3000 will re-charge and clean old refrigerant on location. This will save the service technician time and the consumer money.

MARKETING PLAN

Goals and Objectives

-

Createproduct awareness and a positive reputation for ROAD RUNNER

Archetype 2000, ensuring a successful market introduction for future

ROAD RUNNER products.

- Establish feedback channels that will allow ROAD RUNNER to determine purchaser satisfaction and opinions.

- Use creative advertising (baseball caps, T-shirts, bumper stickers)

-

Utilize promotional activities to persuade our customers

(wholesalers) to purchase ROAD RUNNER. Determine market demand for

further ROAD RUNNER products.

- Institute a three phase promotional strategy consisting of sales promotion, education, and advertising.

- Survey the market and determine potential demand for a smaller, less expensive recovery system, and a refrigerant recycling system.

- Provide demonstration and educational seminars with wholesalers and technicians.

ROAD RUNNER's marketing strategy is based upon in-depth interviews, surveys and information provided by the company's sales representatives. This provided ROAD RUNNER with concise knowledge of the refrigeration industry. Each of these sources was extremely helpful as the information was used as validation for the product design and concept. This continual validation prompted ROAD RUNNER to switch from prototype production to full scale operations late in the winter of 1992.

Experts Provide Information

The initial phase of our research consisted of a series often (10) in-depth interviews with wholesalers and service technicians. As the first phase of the research effort, ROAD RUNNER gathered information on trends in the industry, current manufacturers of refrigerant recovery systems, and consumer product preference. Both the wholesalers and technicians concurred that recovery systems on the market at that time were of poor quality. Another frequent complaint centered around the lack of service and assistance provided by the manufacturers. Additionally, wholesalers indicated that many technicians planned on postponing a recovery system purchase until the Environmental Protection Agency began stringent enforcement of the law, and the quality standards of the recovery systems increased to acceptable levels. The information from these interviews served as the foundation for the marketing strategy and product development for ROAD RUNNER. Although the government drives the demand for refrigerant recovery systems, the consumer must also demand the unit in order to ensure product sales and success. The service technician must purchase a recovery system, but has several product options. Hence, by incorporating several useful product features, service technicians will choose the ROAD RUNNER over existing competitors.

Service Technician Survey Shows Viability

A survey of 114 residential and commercial air conditioning service technicians took place. The results of this survey provided an abundance of information that served as an integral tool in the product design of the ROAD RUNNER. This information helped to determine the wants and needs of service technicians in refrigerant recovery. Additionally, the survey provided an outlook on industry market share and extent of demand within the recovery industry.

Key Competitors and Market Share

The survey of 114 technicians also provided ROAD RUNNER with and estimate of the market share each of our competitors has captured. These numbers were validated at the International Refrigeration Industry Trade Show (Evanston, IL) in June 1994. Although minor discrepancies occurred as to the exact percentage captured by each competitor, ROAD RUNNER survey results were fairly accurate. The discrepancies are due mainly as a result of fluctuating sales intensity of different refrigerant recovery systems in different regions of the country.

ROAD RUNNER Targets Enormous Market

ROAD RUNNER's overall target market focuses on residential and commercial air conditioning service technicians governed by the Clean Air Act. More specifically, ROAD RUNNER targets residential and commercial technicians in need of a portable recovery system. Secondary research estimates this target to be $724,000,000. Within this target, ROAD RUNNER directs its efforts at the informed purchaser. This includes technicians who have learned about refrigerant recovery systems through trade shows, product literature, personal use, and the "grapevine." The largest portion of this segment, seventy percent, consists of technicians who have not purchased a refrigerant recovery system. The smaller portion of this segment, ten percent (10%), centers around technicians who purchased an inferior refrigerant recovery system that malfunctioned in the field. Victims of product failure, these individuals know exactly what features they require in a recovery system for optimal field performance. The remaining twenty percent (20%) of the informed segment is composed of technicians who purchased a competitor's system and technicians who will avoid the requirements of the Clean Air Act.

ROAD RUNNER's target market and segmentation scheme were selected based on several factors. The impact of the Clean Air Act focuses its attention at commercial and residential technicians. Before the legislation, the presence of refrigerant recovery systems in the field appeared scarce. According to sources within the industry (trade magazines, wholesalers, and manufacturers) it is estimated that approximately 132,311 registered refrigeration service contractors operate in the United States. Each of these individuals employs between 3-7 service technicians, on average. This presents ROAD RUNNER with an opportunity to initially sell 661,500 units to our specific target market. Additional sales opportunities will be available in the replacement market (exact numbers will depend on product breakdown and obsolescence).

ROAD RUNNER: The High Quality System

The ROAD RUNNER will be sold to service technicians through refrigeration supply wholesalers. Wholesalers, as an industry standard, act as intermediaries between manufacturers and technicians. ROAD RUNNER will position itself as the highest quality and performance system in the light-weight niche of the market. ROAD RUNNER'S positioning strategy also places great emphasis on a comprehensive service and support program that will solidify the ROAD RUNNER as the premiere refrigerant recovery system.

ROAD RUNNER'S triple benefit positioning strategy centers around the results of market research. This research indicated that service technicians need a recovery unit with powerful and durable compression, rapid operation, and light weight. Taking this into consideration, the components and system design were carefully chosen and assembled in an effort to satisfy the needs of the service technician.

ROAD RUNNER Utilizes National Distribution Strategy

There are thirteen thousand (13,000) wholesaler/distributor (w/d) outlets in the United States which sell a variety of refrigeration related products in their stores. The geographic distribution area for ROAD RUNNER will encompass the entire United States. The ROAD RUNNER is designed to fit the demanding needs of the Southwest technician who will operate the machine in extreme temperatures. Because of this durable design structure, the ROAD RUNNER will, without question, serve technicians in other parts of the country with cooler climates.

The composition of the w/d portion of the refrigeration industry consists of four tiers:

National Wholesalers - This tier is composed of large companies who have outlet stores located all around the country. Because they have such immense size they enjoy economy of scale advantage. They account for over sixty percent (60%) of w/d sales. A few major players on this level include: Palmetto Air (270 stores), Rhinestone Supply, Ashby, and Burton.

Regional Wholesalers - These businesses typically consist of five (5) to fifteen (15) stores in two or three different states within the same geographic region. This portion of the industry has fifteen percent (15%) to twenty percent (20%) of the sales. Companies such as Frozen Stock Distributors (FSD), Williams Engineering and Nevada Refrigeration Company are regional wholesalers that operate in the Southwest.

Statewide - This tier is composed of companies that operate two (2) to five (5) stores within the same state. Wholesalers such as this account for eight percent (8%) to thirteen percent (13%) of sales. Faulkner Refrigeration Supply, McAdoo, and Moultrie's act as examples of w/ds who operate on the third tier.

Sole Proprietorships - Sole Proprietorships account for approximately four percent (4%) to eight percent (8%) of industry sales. Often times they find it difficult to compete as their larger competitors dominate the market and have more bargaining power with suppliers. Consequently they can obtain inventory at a lower cost.

Because of the highly concentrated (national w/d) make-up of the w/d structure, ROAD RUNNER's distribution strategy will place an emphasis on national and regional wholesalers. The majority of these companies have an established purchasing department that makes the inventory selection for all of its stores. A sale to the purchasing team will directly translate into a sale to each of the company stores nationwide. It has been determined that over seventy-five percent (75%) of ROAD RUNNER's recovery system sales will involve national and regional w/ds.

ROAD RUNNER Attracts Experienced Sales Reps

The Production Workers National Association (PWNA) will represent ROAD RUNNER. John Caleb, Vice President of Marketing, selected sales agents who are specialized in the air conditioning industry and have established rapport with key members in distribution channels. Because of this, ROAD RUNNER will gain tremendous exposure. The sales representatives were selected on a basis of:

- Knowledge of the refrigerant recovery industry

- Number of products currently represented

- Past sales record

- Access to distribution channels

Currently ROAD RUNNER has twenty (20) sales representatives working for the company. These individuals are strategically placed in specific geographic regions across the entire United States. PWNA representatives will receive seven percent (7%) commission of ROAD RUNNER sales. These sales representatives handle a large portion of promotion, as they provide direct contact to the wholesalers. Furthermore, they will educate and attract the wholesalers who will, in turn, pass information on to service technicians. This develops an efficient "push through" marketing and promotion strategy for ROAD RUNNER.

Promotion Strategy Creates Awareness

The promotion strategy for ROAD RUNNER has two main goals. The first goal focuses on building consumer awareness for the ROAD RUNNER Archetype 2000. The second orients itself on creating extensive awareness and recognition for the company throughout the industry.

ROAD RUNNER's promotional strategy utilizes three phases: personal selling, product emonstrations, and advertisements.

The first phase of our promotional strategy centers around personal selling. Our sales representatives will make an appointment to meet with the wholesaler's purchasing agent. The first sales call lasts approximately an hour and includes a product demonstration. The second phase, advertising, will take the form of brochures, point-of-sale advertisements and wholesaler initiated mailers to technicians. All promotional activities will be implemented and monitored by John Caleb, Vice-President of Marketing. The third phase, product demonstrations and sales seminars, occurs after the wholesaler has purchased the ROAD RUNNER. Atthis point, ROAD RUNNER's service and support team will hold all-day demonstrations of the system in the wholesaler's showroom. The service and support team will consist of Real Manufacturing staff, along with the sales representative responsible for the sale. The support team will teach the wholesaler's sales staff how to use and sell the ROAD RUNNER. This adds value, as ROAD RUNNER's competitors do not offer this service.

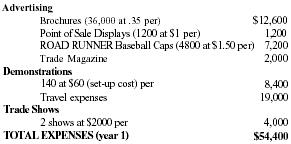

Promotional Budget (Year 1)

| Advertising | |

| Brochures (36,000 at .35 per) | $12,600 |

| Point of Sale Displays (1200 at $1 per) | 1,200 |

| ROAD RUNNER Baseball Caps (4800 at $1.50 per) | 7,200 |

| Trade Magazine | 2,000 |

| Demonstrations | |

| 140 at $60 (set-up cost) per | 8,400 |

| Travel expenses | 19,000 |

| Trade Shows | |

| 2 shows at $2000 per | 4,000 |

| TOTAL EXPENSES (year 1) | $54,400 |

OPERATIONS

Goals and Objectives

-

Produce and sell the premier refrigerant recovery system at a

competitive price.

- Determine the operational and design problems with recovery systems currently on the market and design a unit based on suggestions and input from service technicians and wholesalers/distributors.

- Utilize a forty six (46) point quality control system during manufacturing which will rigorously test each completed unit and ensure the highest quality and performance.

-

Establish an open channel of feedback between customers and the

company.

- Establish a customer "hot-line" to provide on-the-spot assistance and information.

- Send out follow-up questionnaires and conduct in-depth interviews with ROAD RUNNER users.

-

Keep employees enthusiastic, productive, and informed.

- Provide job enrichment and job enlargement programs for employees (including cross-training, rotation, shift leadership, and educational seminars).

- Encourage a healthy social climate in the workplace (social outings, contests, theme days).

ROAD RUNNER's operations strategy is designed to efficiently manufacture the premier refrigerant recovery system. This will be achieved through the use of quality control checklists, time motion studies, and employee training. Furthermore, an ongoing research and development department along with established relations with suppliers, will enable ROAD RUNNER to stay at the forefront of its industry.

Efficient and High Quality Production

The operations of ROAD RUNNER will initially take place at the Real Manufacturing Co. plant in Phoenix, Arizona. This facility encompasses 12,000 square feet and has ample resources available for ROAD RUNNER's use. As sales and the distribution network grow, production of the ROAD RUNNER will expand to RMC's plant in Dallas, Texas (15,000 square feet). This facility will provide ROAD RUNNER extra manufacturing space and will serve as distribution center to the Midwest and east coast.

The assembly process includes eleven (11) different production stations. Through time motion studies, data pertaining to time-per-station was gathered and calculated. This resulted in an a highly efficient and organized operation flow. Moreover, ROAD RUNNER employees work as a team and are trained to participate in all phases of the manufacturing process. Through job enrichment and job enlargement practices, the cohesiveness and flexibility of the team have resulted in rapid and high quality production. Through the following manufacturing analysis, maximum production with current resources has been estimated at 13,360 units per year.

Assumptions:

- Two 7.5 hour shifts per day (8.5 hour shift less .5 hour lunch and two 15 minute breaks)

- 14 line employees per shift

- 37.5 hours per week per employee (7.5 hours × 5 days)

- 1050 production hours per week (2 shifts × 14 employees × 7.5 hours × 5 days)

- 4 hours to complete each unit

- 1050 production-hours/4 hours per unit = 262 per week

- 262 per week × 51 manufacturing weeks = 13,360 units/year

To ensure a defect free product, ROAD RUNNER utilizes a forty six (46) point quality control checklist. This checklist concentrates on such areas as structural integrity, pressure tests, electrical tests and packaging requirements. Through the first six months of production this system has ensured a virtually defect free product (less than 1%).

R&D Provides Quality Products

All product design and technical writing are completed by ROAD RUNNER's design engineer, Antoine Walker. The R&D period for the ROAD RUNNER elapsed over a four month period, by which ample in-depth research of all aspects of refrigerant recovery systems and the refrigeration industry took place. A thorough investigation of technician's needs, competitor's systems, and the components that comprise the ROAD RUNNER, has resulted in a recovery system that surpasses all others in quality and performance.

Perhaps the most noteworthy portion of the research and development of the ROAD RUNNER occurred upon the system's designing, building, and implementation. Through follow up interviews and customer surveys, an evaluation of the ROAD RUNNER's performance in the field took place. This provided the engineer with technician's opinions and actual field data, which have proven extremely valuable in making minor adjustments and in the design phase for future products.

ROAD RUNNER Carefully Selects Suppliers

To maintain control over cost and schedule, ROAD RUNNER will manage the purchasing of components, scheduling, and inventory control. Special order arrangements were negotiated with suppliers, allow ROAD RUNNER the advantage of purchasing assembly parts and components within one month of production. This will assist ROAD RUNNER in managing cash flow as well as storage concerns. Inventory will be purchased from a variety of suppliers. The suppliers were chosen based on a criterion composed of: quality, shipment flexibility, parts availability, location, payment terms, and price. Choosing suppliers became a critical function of our initial operations as ROAD RUNNER views its suppliers as an integral part of the team.

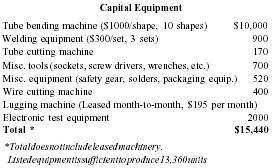

Only Minimal Capital Equipment Required

Although the assembly and production of the ROAD RUNNER will occur in-house, the capital equipment requirements are not immense. The manufacturing procedure is not "high-tech" since its composition consists mainly of a series of labor intensive tasks including: brazing, soldering, and fastening. As sales grow, further equipment investment will take place. A list of necessary capital equipment is provided below:

| Capital Equipment | |

|

*Total does not include leased machinery.

Listed equipment is sufficient to produce 13,360 units |

|

| Tube bending machine ($1000/shape, 10 shapes) | $10,000 |

| Welding equipment ($300/set, 3 sets) | 900 |

| Tube cutting machine | 170 |

| Misc. tools (sockets, screw drivers, wrenches, etc.) | 700 |

| Misc. equipment (safety gear, solders, packaging equip.) | 520 |

| Wire cutting machine | 400 |

|

Lugging machine (Leased month-to-month, $195 per month)

Electronic test equipment |

2000 |

| Total * | $15,440 |

MANAGEMENT TEAM

Goals and Objectives

-

Attract individuals who are experienced and will be capable of

interacting with the other key personnel.

- Implement a well-rounded interviewing process including both personal and group interviews.

- Hire only those individuals the entire ROAD RUNNER team feels they can work with.

-

Obtain skilled individuals at all levels of the organization.

- Hire personnel who understand organizational relationships.

- Hire personnel who have skills necessary to make informed decisions.

The management team of ROAD RUNNER is healthy, energetic, and very excited about the company. The strength of ROAD RUNNER'S management team is derived from the blend of much needed experience and youthful ideas. Companies do not become profitable without successful employees. ROAD RUNNER is no different.

Key Personnel Provide Experience and Energy

Mr. Joseph Purdue currently serves as President and Chief Executive Officer of Real Manufacturing Company, Inc. He has held this position since he founded the company in 1987. As president and CEO, Mr. Purdue is responsible for strategic and financial planning. Furthermore, he oversees the personnel responsible for operating both of the company's divisions.

Previous to his current position, Mr. Purdue served as Executive Vice President of U.S. Chair Company, Inc. In his capacity as Vice President, he was directly responsible for returning his company to profitability one year after Chapter 11 proceedings. Mr. J. Purdue gained his twenty five years (25) of manufacturing background while being employed as Director of Materials with Computerized Supplies Inc.

Mr. Roger Burton was born in Denver, Colorado in 1971. He has been a resident of Arizona for the past twelve (12) years, having lived in Tucson and Phoenix. He is currently a senior at Arizona State University, pursuing dual degrees in Entrepreneurship and Accounting. Mr. Burton will be the Vice President of Operations for Road Runner. This position entails management of daily operations and research and development. Additionally, Mr. Burton will be responsible for the accounting function of ROAD RUNNER'S operation. Mr. R. Burton is qualified for these responsibilities as he played a crucial role in the operations of a drycleaning franchise. Through this experience, Mr. Burton honed his skills in such areas as personnel management, operations management, customer satisfaction and franchise sales. Most importantly however, Mr. Burton has developed a great understanding of the intangibles necessary to operate a business.

Mr. Gary Purdue was born in San Francisco, California, in 1971. He has lived throughout the United States including Colorado, Pennsylvania, and Arizona. He is currently a senior at Arizona State University, pursuing dual degrees in Entrepreneurship and Finance.

Mr. Purdue will operate in the capacity of Vice President of Marketing for ROAD RUNNER. His main responsibility includes management of sales representatives. However, Mr. G. Purdue will also be responsible for the ROAD RUNNER's marketing and customer service programs. As the executive assistant for Real Manufacturing Co. for the past three years, Mr. Purdue has acquired a considerable amount of managerial and communication skills necessary to be successful in the world of business.

Mr. James Watson, ROAD RUNNER's design engineer, is a graduate of Northwestern University, with a B.S. in Manufacturing Engineering and Operations Management. Since his graduation in 1980, Mr. Watson has accumulated over 10 years experience in product design as he served a Chief Design Engineer with such companies as MRIP Inc. and Richard Spas. Mr. Watson is responsible for all research and development of future products. Furthermore, his responsibilities include designing the manufacturing process as well as conducting time motion studies.

FINANCIAL PLAN

Goals and Objectives

-

Achieve positive cash flow by the end of year 1.

- Obtain needed financing ($230,000).

- Accurately forecast sales with the help of wholesalers and sales representatives.

-

Maintain at least a 40% gross margin throughout years 1, 2, and 5.

- Keep raw material waste to .05%

- Maintain excellent relationships with suppliers.

- Continuously improve production efficiency.

-

Provide a 250% return on investment (ROI) by December 1994.

- Pay back half of shareholders investment in December, 1996, and double the investment in December, 1997.

ROAD RUNNER is a division of Real Manufacturing Company, Inc. RMC has been in business for the past six years, and a historical record of actual expense amounts is available. Many of the forecasted general and administration expenses in ROAD RUNNER'S business plan are approximations based on amounts that RMC incurred. However, the ROAD RUNNER division is of a different nature than RMC's other interests, and the expense structure will be different. Furthermore, in constructing the financials for ROAD RUNNER, the conservative principle was utilized.

Financial Rationale

- Direct Materials $450 per unit

- Administrative Salaries - During the inception of the ROAD RUNNER division, RMC instituted a "pool system" to manage salaries. Administrators will be responsible for overall operations at Real Manufacturing. Therefore, salaries are distributed equally between Real Manufacturing overhead and ROAD RUNNER overhead.

- Commissions - Based on the existing commission structure in the refrigeration industry, ROAD RUNNER is forecasting 7% commission for all sales representatives of ROAD RUNNER.

- Payroll Taxes Estimated to be 14% of salaries.

- Employee Fringe Benefits - Employee fringe benefits include such items as contests, employee social functions, and employee bonuses. Fringe Benefits will average at $500 per employee per year.

- Trade Shows $2000 per show (Includes booth rental and freight.)

-

Travel

Airfare: $550 avg./trip

Lodging: $70/day avg.

Meals: $75/day avg.

Car Rental: $50/day avg. - Rent .44/square foot per month

- Utilities .16/square foot per month

- General Business Insurance $850 per month

- Telephone $450 per month

- Freight $3450 per month

- Office Expense $590 per month

- Dues and Subscriptions $25 per month

- Legal and Accounting $3200 per year

- Licensees and Fees $108 per month

- Bad Debt Expense 2% of sales

- Returns and Allowances 2% of sales

-

Selling Price

- All prices are based on an average from a regressive cost structure

Year 1: $950 average per unit

Year 2: $910 average per unit

Year 3: $870 average per unit -

Unit Sales

Year 1:2,471 units

Year 2: 11,950 units

Year 3: 27,850 units - Product Warranties 1% of overall sales per year

- Accounts Receivable Collection terms - 2/10, net 30

-

Inventory Purchases

31-60 days prior to sale: 50% of materials

Month of sale: 50% of materials -

Research & Development

Year 1:2% of sales

Year 2:4% of sales

Year 3:5% of sales

Established Financing Structure

Due to the fact that ROAD RUNNER is a division of Real Manufacturing Company (RMC), a closely held corporation, maintaining a substantial equity position has proven an important consideration. In the initial stages of the formation of ROAD RUNNER, the company secured both debt and equity financing.

Debt - Loans from Family Bank in Tucson, Arizona ($ 15,000) and the Bank of Dallas, Texas, ($15,000) were obtained. These moneys proved to be critical in maintaining adequate cash flow for the first few months of research and development and production. Furthermore, ROAD RUNNER received a $100,000 line-of-credit from Marble Industries. Interest on the line-of- credit will be three (3) points above the prime interest rate. Marble Industries currently stands as the primary customer of RMC.

Equity -100,000 shares (common stock, par $ 1) have been distributed. Shareholders include: Real Manufacturing Corporation, 65,000 shares, Spring Inc. (outside investor), 35,000 shares.

Exit Strategies Protect Shareholders

ROAD RUNNER will utilize a "front-loaded" dividend structure to provide quick return on investment for shareholders. Shareholders will obtain dividends at the end of fiscal year 1996. Planned dividend payment structure is as follows. In December of 1996, shareholders will receive one-half of their original investment. In the subsequent year (1997) shareholders will obtain dividends in the amount of twice the original investment, bringing the total return on investment to 250%, after two years.

Shareholders have the option of holding onto their shares or selling them back to the company any time after 1997. A sell-back price for outstanding shares will be negotiated with the shareholders when the issue arises.

If an unforeseeable reason should force ROAD RUNNER to cease ongoing operations, very little risk will be encountered. ROAD RUNNER is a labor intensive operation that does not require large costs of capital equipment. Furthermore, at most, two months of inventory will remain in stock at all times. In the case of ROAD RUNNER liquidation, unused inventory would be sold back to the original suppliers, capital equipment (approximately $13,000) and other business assets will be sold. The proceeds of the liquidation will be distributed in the order of priority: debt holders, outside shareholders, Real Manufacturing Company, Inc. Furthermore, Real Manufacturing Company has agreed to provide financial protection for outside shareholders, in this situation.

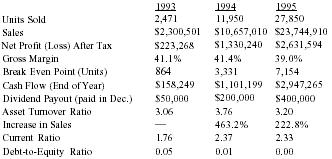

Key Financial Data

| 1993 | 1994 | 1995 | |

| Units Sold | 2,471 | 11,950 | 27,850 |

| Sales | $2,300,501 | $10,657,010 | $23,744,910 |

| Net Profit (Loss) After Tax | $223,268 | $1,330,240 | $2,631,594 |

| Gross Margin | 41.1% | 41.4% | 39.0% |

| Break Even Point (Units) | 864 | 3,331 | 7,154 |

| Cash Flow (End of Year) | $158,249 | $1,101,199 | $2,947,265 |

| Dividend Payout (paid in Dec.) | $50,000 | $200,000 | $400,000 |

| Asset Turnover Ratio | 3.06 | 3.76 | 3.20 |

| Increase in Sales | — | 463.2% | 222.8% |

| Current Ratio | 1.76 | 2.37 | 2.33 |

| Debt-to-Equity Ratio | 0.05 | 0.01 | 0.00 |

THIS PAGE INTENTIONALLY LEFT BLANK SEE NEXT PAGE FOR PROJECTED BALANCE SHEET

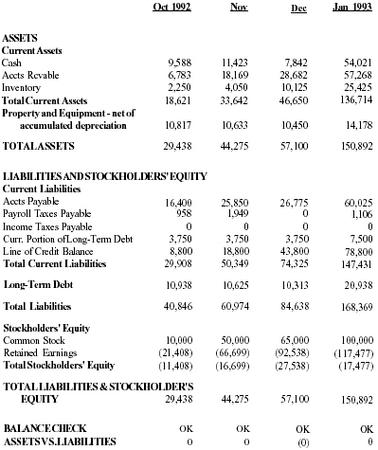

Projected Balance Sheet: Year 1

| Oct 1992 | Nov | Dec | Jan 1993 | |

| ASSETS | ||||

| Current Assets | ||||

| Cash | 9,588 | 11,423 | 7,842 | 54,021 |

| Accts Rcvable | 6,783 | 18,169 | 28,682 | 57,268 |

| Inventory | 2,250 | 4,050 | 10,125 | 25,425 |

| Total Current Assets | 18,621 | 33,642 | 46,650 | 136,714 |

| Property and Equipment - net of accumulated depreciation | 10,817 | 10,633 | 10,450 | 14,178 |

| TOTAL ASSETS | 29,438 | 44,275 | 57,100 | 150,892 |

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

| Current Liabilities | ||||

| Accts Payable | 16,400 | 25,850 | 26,775 | 60,025 |

| Payroll Taxes Payable | 958 | 1,949 | 0 | 1,106 |

| Income Taxes Payable | 0 | 0 | 0 | 0 |

| Curr. Portion of Long-Term Debt | 3,750 | 3,750 | 3,750 | 7,500 |

| Line of Credit Balance | 8,800 | 18,800 | 43,800 | 78,800 |

| Total Current Liabilities | 29,908 | 50,349 | 74,325 | 147,431 |

| Long-Term Debt | 10,938 | 10,625 | 10,313 | 20,938 |

| Total Liabilities | 40,846 | 60,974 | 84,638 | 168,369 |

| Stockholders' Equity | ||||

| Common Stock | 10,000 | 50,000 | 65,000 | 100,000 |

| Retained Earnings | (21,408) | (66,699) | (92,538) | (117,477) |

| Total Stockholders' Equity | (11,408) | (16,699) | (27,538) | (17,477) |

| TOTAL LIABILITIES & STOCKHOLDER'S EQUITY | 29,438 | 44,275 | 57,100 | 150,892 |

| BALANCE CHECK | OK | OK | OK | OK |

| ASSETS VS. LIABILITIES | 0 | 0 | (0) | 0 |

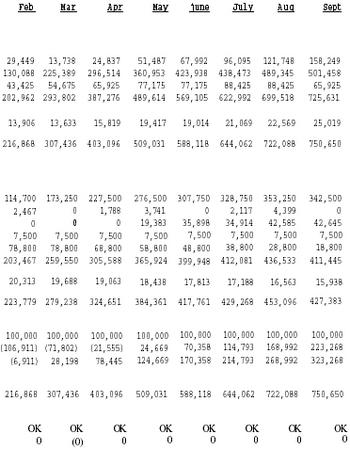

| Feb | Mar | Apr | May | June | July | Aug | Sept |

| 29,449 | 13,738 | 24,837 | 51,487 | 67,992 | 96,095 | 121,748 | 158,249 |

| 130,088 | 225,389 | 296,514 | 360,953 | 423,938 | 438,473 | 489,345 | 501,458 |

| 43,425 | 54,675 | 65,925 | 77,175 | 77,175 | 88,425 | 88,425 | 65,925 |

| 202,962 | 293,802 | 387,276 | 489,614 | 569,105 | 622,992 | 699,518 | 725,631 |

| 13,906 | 13,633 | 15,819 | 19,417 | 19,014 | 21,069 | 22,569 | 25,019 |

| 216,868 | 307,436 | 403,096 | 509,031 | 588,118 | 644,062 | 722,088 | 750,650 |

| 114,700 | 173,250 | 227,500 | 276,500 | 307,750 | 328,750 | 353,250 | 342,500 |

| 2,467 | 0 | 1,788 | 3,741 | 0 | 2,117 | 4,399 | 0 |

| 0 | 0 | 0 | 19,383 | 35,898 | 34,914 | 42,585 | 42,645 |

| 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 |

| 78,800 | 78,800 | 68,800 | 58,800 | 48,800 | 38,800 | 28,800 | 18,800 |

| 203,467 | 259,550 | 305,588 | 365,924 | 399,948 | 412,081 | 436,533 | 411,445 |

| 20,313 | 19,688 | 19,063 | 18,438 | 17,813 | 17,188 | 16,563 | 15,938 |

| 223,779 | 279,238 | 324,651 | 384,361 | 417,761 | 429,268 | 453,096 | 427,383 |

| 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 |

| (106,911) | (71,802) | (21,555) | 24,669 | 70,358 | 114,793 | 168,992 | 223,268 |

| (6,911) | 28,198 | 78,445 | 124,669 | 170,358 | 214,793 | 268,992 | 323,268 |

| 216,868 | 307,436 | 403,096 | 509,031 | 588,118 | 644,062 | 722,088 | 750,650 |

| OK | OK | OK | OK | OK | OK | OK | OK |

| 0 | (0) | 0 | 0 | 0 | 0 | 0 | 0 |

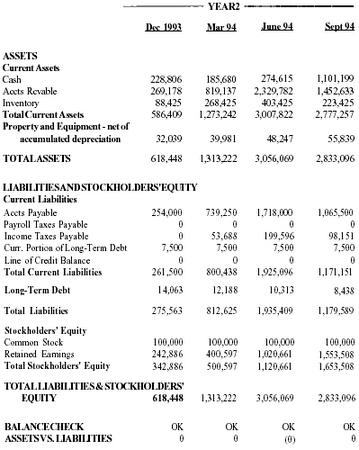

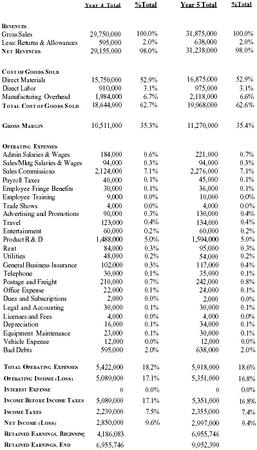

Projected Balance Sheet: Years 2-5

| YEAR 2 | ||||

| Dec 1993 | Mar 94 | June 94 | Sept 94 | |

| ASSETS | ||||

| Current Assets | ||||

| Cash | 228,806 | 185,680 | 274,615 | 1,101,199 |

| Accts Rcvable | 269,178 | 819,137 | 2,329,782 | 1,452,633 |

| Inventory | 88,425 | 268,425 | 403,425 | 223,425 |

| Total Current Assets | 586,409 | 1,273,242 | 3,007,822 | 2,777,257 |

| Property and Equipment - net of accumulated depreciation | 32,039 | 39,981 | 48,247 | 55,839 |

| TOTAL ASSETS | 618,448 | 1,313,222 | 3,056,069 | 2,833,096 |

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

| Current Liabilities | ||||

| Accts Payable | 254,000 | 739,250 | 1,718,000 | 1,065,500 |

| Payroll Taxes Payable | 0 | 0 | 0 | 0 |

| Income Taxes Payable | 0 | 53,688 | 199,596 | 98,151 |

| Curr. Portion of Long-Term Debt | 7,500 | 7,500 | 7,500 | 7,500 |

| Line of Credit Balance | 0 | 0 | 0 | 0 |

| Total Current Liabilities | 261,500 | 800,438 | 1,925,096 | 1,171,151 |

| Long-Term Debt | 14,063 | 12,188 | 10,313 | 8,438 |

| Total Liabilities | 275,563 | 812,625 | 1,935,409 | 1,179,589 |

| Stockholders' Equity | ||||

| Common Stock | 100,000 | 100,000 | 100,000 | 100,000 |

| Retained Earnings | 242,886 | 400,597 | 1,020,661 | 1,553,508 |

| Total Stockholders' Equity | 342,886 | 500,597 | 1,120,661 | 1,653,508 |

|

TOTAL LIABILITIES & STOCKHOLDERS'

EQUITY |

618,448 | 1,313,222 | 3,056,069 | 2,833,096 |

| BALANCE CHECK | OK | OK | OK | OK |

| ASSETS VS. LIABILITIES | 0 | 0 | (0) | 0 |

| YEAR3 | YEAR 4 | YEAR 5 | ||||

| Dec 1994 | Mar 95 | June 95 | Sept 95 | Sept 1996 | Sept 1997 | |

| 1,441,193 | 1,330,034 | 1,472,878 | 2,947,265 | 5,695,546 | 8,544,868 | |

| 798,660 | 1,899,036 | 4,623,354 | 3,700,458 | 3,294,860 | 3,522,188 | |

| 178,425 | 605,925 | 988,425 | 673,425 | 720,450 | 720,450 | |

| 2,418,278 | 3,834,995 | 7,084,657 | 7,321,148 | 9,710,856 | 12,084,381 | |

| 66,158 | 75,639 | 85,203 | 107,289 | 193,689 | 236,511 | |

| 2,484,437 | 3,910,634 | 7,169,860 | 7,428,436 | 9,904,545 | 12,320,892 | |

| 664,000 | 1,699,000 | 3,680,000 | 2,901,000 | 2,698,475 | 2,125,375 | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

| 19,502 | 124,237 | 344,889 | 233,897 | 150,324 | 143,127 | |

| 7,500 | 7,500 | 7,500 | 7,500 | 0 | 0 | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

| 691,002 | 1,830,737 | 4,032,389 | 3,142,397 | 2,848,799 | 2,268,502 | |

| 6,563 | 4,688 | 2,813 | 938 | 0 | 0 | |

| 697,564 | 1,835,425 | 4,035,201 | 3,143,335 | 2,848,799 | 2,268,502 | |

| 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | |

| 1,686,872 | 1,975,209 | 3,034,658 | 4,185,102 | 6,955,746 | 9,952,390 | |

| 1,786,872 | 2,075,209 | 3,134,658 | 4,285,102 | 7,055,746 | 10,052,390 | |

| 2,484,437 | 3,910,634 | 7,169,860 | 7,428,436 | 9,904,545 | 12,320,892 | |

| OK | OK | OK | OK | OK | OK | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

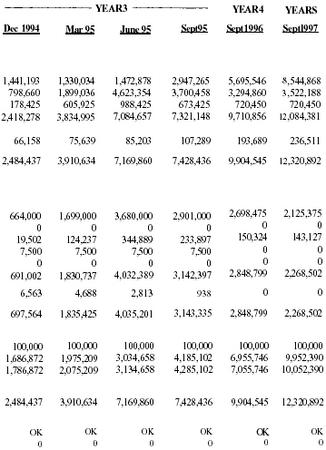

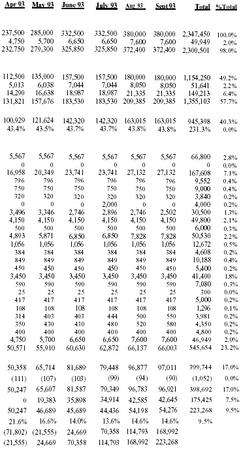

Projected Statement of Profit and Loss: Year 1

| Oct 1992 | Nov 92 | Dec 92 | Jan 1993 | Feb 93 | Mar 93 | |

| R EVENUES | ||||||

| Gross Sales | 6,650 | 16,150 | 23,750 | 49,400 | 114,000 | 190,000 |

| Less: Returns and Allowances | 133 | 323 | 475 | 988 | 2,280 | 3,800 |

| N ET R EVENUES | 6,517 | 15,827 | 23,275 | 48,412 | 111,720 | 186,200 |

| C OST OF G OODS S OLD | ||||||

| Direct Materials | 3,150 | 30,600 | 19,800 | 34,200 | 54,000 | 90,000 |

| Direct Labor | 161 | 1,369 | 886 | 1,530 | 2,415 | 4,025 |

| Manufacturing Overhead | 2,440 | 5,276 | 4,149 | 5,652 | 8,183 | 11,941 |

| T OTAL C OST OF G OODS S OLD | 5,751 | 37,245 | 24,835 | 41,382 | 64,598 | 105,966 |

| G ROSS M ARGIN | 766 | (21,418) | (1,560) | 7,030 | 47,122 | 80,234 |

| G ROSS M ARGIN% | 11.8% | −135.3% | −6.7% | 14.5% | 42.2% | 43.1% |

| O PERATING E XPENSES | ||||||

| Admin Salaries & Wages | 5,567 | 5,567 | 5,567 | 5,567 | 5,567 | 5,567 |

| Sales/Mktg Salaries & Wages | 0 | 0 | 0 | 0 | 0 | 0 |

| Sales Commissions | 475 | 1,153 | 1,696 | 3,527 | 8,140 | 13,566 |

| Payroll Taxes | 796 | 796 | 796 | 796 | 796 | 796 |

| Employee Fringe Benefits | 750 | 750 | 750 | 750 | 750 | 750 |

| Employee Training | 320 | 320 | 320 | 320 | 320 | 320 |

| Trade Shows | 0 | 0 | 0 | 2,000 | 0 | 0 |

| Advertising | 850 | 822 | 1,005 | 3,460 | 3,285 | 3,346 |

| Travel | 4,150 | 4,150 | 4,150 | 4,150 | 4,150 | 4,150 |

| Entertainment | 500 | 500 | 500 | 500 | 500 | 500 |

| Product R and D | 470 | 1,331 | 861 | 1,487 | 2,348 | 3,914 |

| Rent | 1,056 | 1,056 | 1,056 | 1,056 | 1,056 | 1,056 |

| Utilities | 384 | 384 | 384 | 384 | 384 | 384 |

| General Business Insurance | 849 | 849 | 849 | 849 | 849 | 849 |

| Telephone | 450 | 450 | 450 | 450 | 450 | 450 |

| Postage and Freight | 3,450 | 3,450 | 3,450 | 3,450 | 3,450 | 3,450 |

| Office Expense | 590 | 590 | 590 | 590 | 590 | 590 |

| Dues and Subscriptions | 25 | 25 | 25 | 25 | 25 | 25 |

| Legal and Accounting | 417 | 417 | 417 | 417 | 417 | 417 |

| Licenses and Fees | 108 | 108 | 108 | 108 | 108 | 108 |

| Depreciation | 183 | 183 | 183 | 272 | 272 | 272 |

| Equipment Maintenance | 220 | 220 | 220 | 300 | 300 | 300 |

| Vehicle Expense | 400 | 400 | 400 | 400 | 400 | 400 |

| Bad Debts | 133 | 323 | 475 | 988 | 2,280 | 3,800 |

| T OTAL O PERATING E XPENSES | 22,142 | 23,844 | 24,252 | 31,846 | 36,437 | 45,010 |

| O PERATING I NCOME (L OSS ) | (21,376) | (45,261) | (25,811) | (24,816) | 10,685 | 35,224 |

| I NTEREST E XPENSE | (32) | (30) | (28) | (124) | (119) | (115) |

| I NCOME B EFORE I NCOME T AXES | (21,408) | (45,291) | (25,839) | (24,939) | 10,566 | 35,109 |

| I NCOME T AXES | 0 | 0 | 0 | 0 | 0 | 0 |

| N ET I NCOME (L OSS ) | (21,408) | (45,291) | (25,839) | (24,939) | 10,566 | 35,109 |

| N ET I NCOME (L OSS )% | −328.5% | −286.2% | −111.0% | −51.5% | 9.5% | 18.9% |

| R ETAINED E ARNINGS , B EGINNING | 0 | (21,408) | (66,699) | (92,538) | (117,477) | (106,911) |

| R ETAINED E ARNINGS , E ND | (21,408) | (66,699) | (92,538) | (117,477) | (106,911) | (71,802) |

| Apr 93 | May 93 | June 93 | July 93 | Aug 93 | Sept 93 | Total | %Total |

| 237,500 | 285,000 | 332,500 | 332,500 | 380,000 | 380,000 | 2,347,450 | 100.0% |

| 4,750 | 5,700 | 6,650 | 6,650 | 7,600 | 7,600 | 49,949 | 2.0% |

| 232,750 | 279,300 | 325,850 | 325,850 | 372,400 | 372,400 | 2,300,501 | 98.0% |

| 112,500 | 135,000 | 157,500 | 157,500 | 180,000 | 180,000 | 1,154,250 | 49.2% |

| 5,013 | 6,038 | 7,044 | 7,044 | 8,050 | 8,050 | 51,641 | 2.2% |

| 14,290 | 16,638 | 18,987 | 18,987 | 21,335 | 21,335 | 149,213 | 6.4% |

| 131,821 | 157,676 | 183,530 | 183,530 | 209,385 | 209,385 | 1,355,103 | 57.7% |

| 100,929 | 121,624 | 142,320 | 142,320 | 163,015 | 163,015 | 945,398 | 40.3% |

| 43.4% | 43.5% | 43.7% | 43.7% | 43.8% | 43.8% | 231.3% | 0.0% |

| 5,567 | 5,567 | 5,567 | 5,567 | 5,567 | 5,567 | 66,800 | 2.8% |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0% |

| 16,958 | 20,349 | 23,741 | 23,741 | 27,132 | 27,132 | 167,608 | 7.1% |

| 796 | 796 | 796 | 796 | 796 | 796 | 9,552 | 0.4% |

| 750 | 750 | 750 | 750 | 750 | 750 | 9,000 | 0.4% |

| 320 | 320 | 320 | 320 | 320 | 320 | 3,840 | 0.2% |

| 0 | 0 | 0 | 2,000 | 0 | 0 | 4,000 | 0.2% |

| 3,496 | 3,346 | 2,746 | 2,896 | 2,746 | 2,502 | 30,500 | 1.3% |

| 4,150 | 4,150 | 4,150 | 4,150 | 4,150 | 4,150 | 49,800 | 2.1% |

| 500 | 500 | 500 | 500 | 500 | 500 | 6,000 | 0.3% |

| 4,893 | 5,871 | 6,850 | 6,850 | 7,828 | 7,828 | 50,530 | 2.2% |

| 1,056 | 1,056 | 1,056 | 1,056 | 1,056 | 1,056 | 12,672 | 0.5% |

| 384 | 384 | 384 | 384 | 384 | 384 | 4,608 | 0.2% |

| 849 | 849 | 849 | 849 | 849 | 849 | 10,188 | 0.4% |

| 450 | 450 | 450 | 450 | 450 | 450 | 5,400 | 0.2% |

| 3,450 | 3,450 | 3,450 | 3,450 | 3,450 | 3,450 | 41,400 | 1.8% |

| 590 | 590 | 590 | 590 | 590 | 590 | 7,080 | 0.3% |

| 25 | 25 | 25 | 25 | 25 | 25 | 300 | 0.0% |

| 417 | 417 | 417 | 417 | 417 | 417 | 5,000 | 0.2% |

| 108 | 108 | 108 | 108 | 108 | 108 | 1,296 | 0.1% |

| 314 | 403 | 403 | 444 | 500 | 550 | 3,981 | 0.2% |

| 350 | 430 | 430 | 480 | 520 | 580 | 4,350 | 0.2% |

| 400 | 400 | 400 | 400 | 400 | 400 | 4,800 | 0.2% |

| 4,750 | 5,700 | 6,650 | 6,650 | 7,600 | 7,600 | 46,949 | 2.0% |

| 50,571 | 55,910 | 60,630 | 62,872 | 66,137 | 66,003 | 545,654 | 23.2% |

| 50,358 | 65,714 | 81,689 | 79,448 | 96,877 | 97,011 | 399,744 | 17.0% |

| (111) | (107) | (103) | (99) | (94) | (90) | (1,052) | 0.0% |

| 50,247 | 65,607 | 81,587 | 79,349 | 96,783 | 96,921 | 398,692 | 17.0% |

| 0 | 19,383 | 35,898 | 34,914 | 42,585 | 42,645 | 175,425 | 7.5% |

| 50,247 | 46,689 | 45,689 | 44,436 | 54,198 | 54,276 | 223,268 | 9.5% |

| 21.6% | 16.6% | 14.0% | 13.6% | 14.6% | 14.6% | 9.5% | |

| (71,802) | (21,555) | 24,669 | 70,358 | 114,793 | 168,992 | ||

| (21,555) | 24,669 | 70,358 | 114,793 | 168,992 | 223,268 |

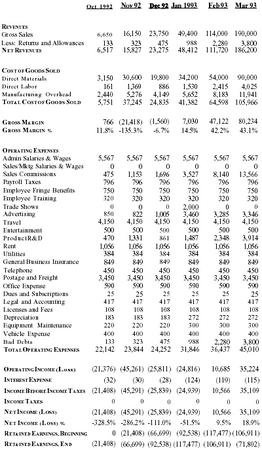

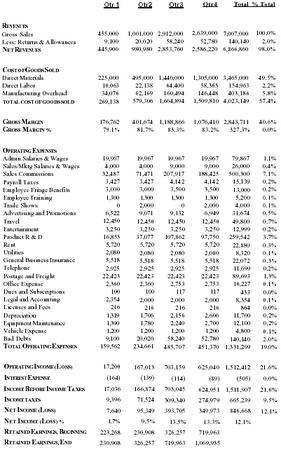

Projected Statement of Profit and Loss: Year 2

| Qtr 1 | Qtr 2 | Qtr 3 | Qtr 4 | Total | % Total | |

| R EVENUES | ||||||

| Gross Sales | 455,000 | 1,001,000 | 2,912,000 | 2,639,000 | 7,007,000 | 100.0% |

| Less: Returns & Allowances | 9,100 | 20,020 | 58,240 | 52,780 | 140,140 | 2.0% |

| N ET R EVENUES | 445,900 | 980,980 | 2,853,760 | 2,586,220 | 6,866,860 | 98.0% |

| C OST OF G OODS S OLD | ||||||

| Direct Materials | 225,000 | 495,000 | 1,440,000 | 1,305,000 | 3,465,000 | 49.5% |

| Direct Labor | 10,063 | 22,138 | 64,400 | 58,363 | 154,963 | 2.2% |

| Manufacturing Overhead | 34,076 | 62,169 | 160,494 | 146,448 | 403,186 | 5.8% |

| T OTAL C OST OF G OODS SOLD | 269,138 | 579,306 | 1,664,894 | 1,509,810 | 4,023,149 | 57.4% |

| G ROSS M ARGIN | 176,762 | 401,674 | 1,188,866 | 1,076,410 | 2,843,711 | 40.6% |

| G ROSS M ARGIN % | 79.1% | 81.7% | 83.3% | 83.2% | 327.3% | 0.0% |

| O PERATING E XPENSES | ||||||

| Admin Salaries & Wages | 19,967 | 19,967 | 19,967 | 19,967 | 79,867 | 1.1% |

| Sales/Mktg Salaries & Wages | 4,000 | 4,000 | 9,000 | 9,000 | 26,000 | 0.4% |

| Sales Commissions | 32,487 | 71,471 | 207,917 | 188,425 | 500,300 | 7.1% |

| Payroll Taxes | 3,427 | 3,427 | 4,142 | 4,142 | 15,139 | 0.2% |

| Employee Fringe Benefits | 3,000 | 3,000 | 3,500 | 3,500 | 13,000 | 0.2% |

| Employee Training | 1,300 | 1,300 | 1,300 | 1,300 | 5,200 | 0.1% |

| Trade Shows | 0 | 2,000 | 0 | 2,000 | 4,000 | 0.1% |

| Advertising and Promotions | 6,522 | 9,071 | 9,132 | 6,949 | 31,674 | 0.5% |

| Travel | 12,450 | 12,450 | 12,450 | 12,450 | 49,800 | 0.7% |

| Entertainment | 3,250 | 3,250 | 3,250 | 3,250 | 12,999 | 0.2% |

| Product R and D | 16,853 | 37,077 | 107,862 | 97,750 | 259,542 | 3.7% |

| Rent | 5,720 | 5,720 | 5,720 | 5,720 | 22,880 | 0.3% |

| Utilities | 2,080 | 2,080 | 2,080 | 2,080 | 8,320 | 0.1% |

| General Business Insurance | 5,518 | 5,518 | 5,518 | 5,518 | 22,072 | 0.3% |

| Telephone | 2,925 | 2,925 | 2,925 | 2,925 | 11,699 | 0.2% |

| Postage and Freight | 22,423 | 22,423 | 22,423 | 22,423 | 89,693 | 1.3% |

| Office Expense | 2,360 | 2,360 | 2,753 | 2,753 | 10,227 | 0.1% |

| Dues and Subscriptions | 100 | 100 | 117 | 117 | 433 | 0.0% |

| Legal and Accounting | 2,354 | 2,000 | 2,000 | 2,000 | 8,354 | 0.1% |

| Licenses and Fees | 216 | 216 | 216 | 216 | 864 | 0.0% |

| Depreciation | 1,319 | 1,706 | 2,156 | 2,606 | 11,700 | 0.2% |

| Equipment Maintenance | 1,390 | 1,780 | 2,240 | 2,700 | 12,100 | 0.2% |

| Vehicle Expense | 1,200 | 1,200 | 1,200 | 1,200 | 4,800 | 0.1% |

| Bad Debts | 9,100 | 20,020 | 58,240 | 52,780 | 140,140 | 2.0% |

| T OTAL O PERATING E XPENSES | 159,562 | 234,661 | 485,707 | 451,370 | 1,331,299 | 19.0% |

| O PERATING I NCOME (L OSS ) | 17,200 | 167,013 | 703,159 | 625,040 | 1,512,412 | 21.6% |

| I NTEREST E XPENSE | (164) | (139) | (114) | (89) | (505) | 0.0% |

| I NCOME B EFORE I NCOME T AXES | 17,036 | 166,874 | 703,045 | 624,951 | 1,511,907 | 21.6% |

| I NCOME T AXES | 9,396 | 71,524 | 309,340 | 274,979 | 665,239 | 9.5% |

| N ET I NCOME (L OSS ) | 7,640 | 95,349 | 393,705 | 349,973 | 846,668 | 12.1% |

| N ET I NCOME (L OSS )% | 1.7% | 9.5% | 13.5% | 13.3% | 12.1% | |

| R ETAINED E ARNINGS , B EGINNING | 223,268 | 230,908 | 326,257 | 719,963 | ||

| R ETAINED E ARNINGS , E ND | 230,908 | 326,257 | 719,963 | 1,069,935 | ||

Projected Statement of Profit and Loss: Year 3

| Qtr 1 | Qtr 2 | Qtr 3 | Qtr 4 | Total | %Total | |

| R EVENUES | ||||||

| Gross Sales | 1,435,500 | 2,262,000 | 6,003,000 | 6,438,000 | 16,138,500 | 100.0% |

| Less: Returns & Allowances | 28,710 | 45,240 | 120,060 | 128,760 | 322,770 | 2.0% |

| N ET R EVENUES | 1,406,790 | 2,216,760 | 5,882,940 | 6,309,240 | 15,815,730 | 98.0% |

| C OST OF G OODS S OLD | ||||||

| Direct Materials | 742,500 | 1,170,000 | 3,105,000 | 3,330,000 | 8,347,500 | 51.7% |

| Direct Labor | 33,206 | 52,325 | 138,863 | 148,925 | 373,319 | 2.3% |

| Manufacturing Overhead | 91,755 | 136,046 | 336,519 | 359,830 | 924,149 | 5.7% |

| T OTAL C OST OF G OODS S OLD | 867,461 | 1,358,371 | 3,580,381 | 3,838,755 | 9,644,968 | 59.8% |

| G ROSS M ARGIN | 539,329 | 858,389 | 2,302,559 | 2,470,485 | 6,170,762 | 38.2% |

| G ROSS M ARGIN % | 76.6% | 77.2% | 78.3% | 78.3% | 310.3% | 0.0% |

| O PERATING E XPENSES | ||||||

| Admin Salaries & Wages | 22,175 | 22,175 | 22,175 | 22,175 | 88,700 | 0.5% |

| Sales/Mktg Salaries & Wages | 13,593 | 13,593 | 13,593 | 13,593 | 54,373 | 0.3% |

| Sales Commissions | 102,495 | 161,507 | 428,614 | 459,673 | 1,152,289 | 7.1% |

| Payroll Taxes | 5,115 | 5,115 | 5,115 | 5,115 | 20,459 | 0.1% |

| Employee Fringe Benefits | 4,500 | 4,500 | 4,500 | 4,500 | 18,000 | 0.1% |

| Employee Training | 1,500 | 1,500 | 1,500 | 1,500 | 6,000 | 0.0% |

| Trade Shows | 0 | 2,000 | 0 | 2,000 | 4,000 | 0.0% |

| Advertising and Promotions | 7,610 | 9,610 | 11,610 | 11,610 | 40,440 | 0.3% |

| Travel | 19,090 | 19,090 | 19,090 | 19,090 | 76,360 | 0.5% |

| Entertainment | 9,086 | 9,086 | 9,086 | 9,086 | 36,346 | 0.2% |

| Product R and D | 77,752 | 122,519 | 325,145 | 348,707 | 874,122 | 5.4% |

| Rent | 11,000 | 11,000 | 11,000 | 11,000 | 44,000 | 0.3% |

| Utilities | 4,000 | 4,000 | 4,000 | 4,000 | 16,000 | 0.1% |

| General Business Insurance | 15,429 | 15,429 | 15,429 | 15,429 | 61,715 | 0.4% |

| Telephone | 4,400 | 4,400 | 4,400 | 4,400 | 17,600 | 0.1% |

| Postage and Freight | 32,000 | 32,000 | 32,000 | 32,000 | 128,000 | 0.8% |

| Office Expense | 3,540 | 3,540 | 3,540 | 3,540 | 14,160 | 0.1% |

| Dues and Subscriptions | 150 | 150 | 150 | 150 | 600 | 0.0% |

| Legal and Accounting | 7,572 | 7,572 | 7,572 | 7,572 | 30,288 | 0.2% |

| Licenses and Fees | 216 | 216 | 216 | 216 | 864 | 0.0% |

| Depreciation | 3,125 | 3,692 | 4,286 | 5,367 | 16,469 | 0.1% |

| Equipment Maintenance | 3,230 | 3,830 | 4,450 | 5,480 | 16,990 | 0.1% |

| Vehicle Expense | 1,200 | 1,200 | 1,200 | 1,200 | 4,800 | 0.0% |

| Bad Debts | 28,710 | 45,240 | 120,060 | 128,760 | – | 0.0% |

| T OTAL O PERATING E XPENSES | 377,088 | 502,563 | 1,048,332 | 1,115,763 | 3,043,746 | 18.9% |

| O PERATING I NCOME (L OSS ) | 162,240 | 355,826 | 1,254,227 | 1,354,723 | 3,127,016 | 19.4% |

| I NTEREST E XPENSE | (64) | (39) | (14) | 11 | (105) | 0.0% |

| I NCOME B EFORE I NCOME T AXES | 162,177 | 355,787 | 1,254,213 | 1,354,734 | 3,126,911 | 19.4% |

| I NCOME T AXES | 71,358 | 156,546 | 551,854 | 596,083 | 1,375,841 | 8.5% |

| N ET I NCOME (L OSS ) | 90,819 | 199,241 | 702,359 | 758,651 | 1,751,070 | 10.9% |

| N ET I NCOME (L OSS ) % | 6.3% | 8.8% | 11.7% | 11.8% | 10.9% | |

| R ETAINED E ARNINGS , B EGINNING | 1,069,935 | 1,160,754 | 1,359,995 | 2,062,354 | ||

| R ETAINED E ARNINGS , E ND | 1,160,754 | 1,359,995 | 2,062,354 | 2,821,005 | ||

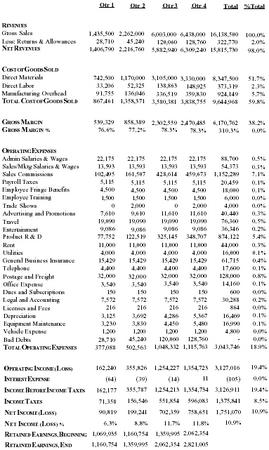

Projected Statement of Profit and Loss: Years 4 & 5

| Year 4 Total | %Total | Year 5 Total | %Total | |

| R EVENUES | ||||

| Gross Sales | 29,750,000 | 100.0% | 31,875,000 | 100.0% |

| Less: Returns & Allowances | 595,000 | 2.0% | 638,000 | 2.0% |

| N ET R EVENUES | 29,155,000 | 98.0% | 31,238,000 | 98.0% |

| C OST OF G OODS S OLD | ||||

| Direct Materials | 15,750,000 | 52.9% | 16,875,000 | 52.9% |

| Direct Labor | 910,000 | 3.1% | 975,000 | 3.1% |

| Manufacturing Overhead | 1,984,000 | 6.7% | 2,118,000 | 6.6% |

| T OTAL C OST OF G OODS S OLD | 18,644,000 | 62.7% | 19,968,000 | 62.6% |

| G ROSS M ARGIN | 10,511,000 | 35.3% | 11,270,000 | 35.4% |

| O PERATING E XPENSES | ||||

| Admin Salaries & Wages | 184,000 | 0.6% | 221,000 | 0.7% |

| Sales/Mktg Salaries & Wages | 94,000 | 0.3% | 94,000 | 0.3% |

| Sales Commissions | 2,124,000 | 7.1% | 2,276,000 | 7.1% |

| Payroll Taxes | 40,000 | 0.1% | 45,000 | 0.1% |

| Employee Fringe Benefits | 30,000 | 0.1% | 36,000 | 0.1% |

| Employee Training | 9,000 | 0.0% | 10,000 | 0.0% |

| Trade Shows | 4,000 | 0.0% | 4,000 | 0.0% |

| Advertising and Promotions | 90,000 | 0.3% | 130,000 | 0.4% |

| Travel | 123,000 | 0.4% | 134,000 | 0.4% |

| Entertainment | 60,000 | 0.2% | 60,000 | 0.2% |

| Product R and D | 1,488,000 | 5.0% | 1,594,000 | 5.0% |

| Rent | 84,000 | 0.3% | 95,000 | 0.3% |

| Utilities | 48,000 | 0.2% | 54,000 | 0.2% |

| General Business Insurance | 102,000 | 0.3% | 117,000 | 0.4% |

| Telephone | 30,000 | 0.1% | 35,000 | 0.1% |

| Postage and Freight | 210,000 | 0.7% | 242,000 | 0.8% |

| Office Expense | 22,000 | 0.1% | 24,000 | 0.1% |

| Dues and Subscriptions | 2,000 | 0.0% | 2,000 | 0.0% |

| Legal and Accounting | 30,000 | 0.1% | 30,000 | 0.1% |

| Licenses and Fees | 4,000 | 0.0% | 4,000 | 0.0% |

| Depreciation | 16,000 | 0.1% | 34,000 | 0.1% |

| Equipment Maintenance | 23,000 | 0.1% | 30,000 | 0.1% |

| Vehicle Expense | 12,000 | 0.0% | 12,000 | 0.0% |

| Bad Debts | 595,000 | 2.0% | 638,000 | 2.0% |

| T OTAL O PERATING E XPENSES | 5,422,000 | 18.2% | 5,918,000 | 18.6% |

| O PERATING I NCOME (L OSS ) | 5,089,000 | 17.1% | 5,351,000 | 16.8% |

| I NTEREST E XPENSE | 0 | 0.0% | 0 | 0.0% |

| I NCOME B EFORE I NCOME T AXES | 5,089,000 | 17.1% | 5,351,000 | 16.8% |

| I NCOME T AXES | 2,239,000 | 7.5% | 2,355,000 | 7.4% |

| N ET I NCOME (L OSS ) | 2,850,000 | 9.6% | 2,997,000 | 9.4% |

| R ETAINED E ARNINGS , B EGINNINC | 4,186,083 | 6,955,746 | ||

| R ETAINED E ARNINGS , E ND | 6,955,746 | 9,952,390 | ||

THIS PAGE INTENTIONALLY LEFT BLANK SEE NEXT PAGE FOR PROJECTED CASH FLOWS

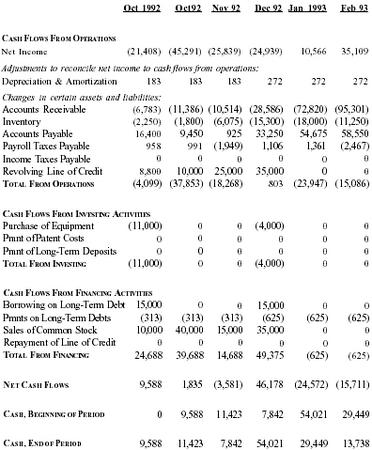

Projected Statement of Cash Flows: Part 1

| Oct 1992 | Oct 92 | Nov 92 | Dec 92 | Jan 92 | Feb 93 | |

| C ASH F LOWS F ROM O PERATIONS | ||||||

| Net Income | (21,408) | (45,291) | (25,839) | (24,939) | 10,566 | 35,109 |

| Adjustments to reconcile net income to cash flows from operations: | ||||||

| Depreciation & Amortization | 183 | 183 | 183 | 272 | 272 | 272 |

| Changes in certain assets and liabilities: | ||||||

| Accounts Receivable | (6,783) | (11,386) | (10,514) | (28,586) | (72,820) | (95,301) |

| Inventory | (2,250) | (1,800) | (6,075) | (15,300) | (18,000) | (11,250) |

| Accounts Payable | 16,400 | 9,450 | 925 | 33,250 | 54,675 | 58,550 |

| Payroll Taxes Payable | 958 | 991 | (1,949) | 1,106 | 1,361 | (2,467) |

| Income Taxes Payable | 0 | 0 | 0 | 0 | 0 | 0 |

| Revolving Line of Credit | 8,800 | 10,000 | 25,000 | 35,000 | 0 | 0 |

| T OTAL F ROM O PERATIONS | (4,099) | (37,853) | (18,268) | 803 | (23,947) | (15,086) |

| C ASH F LOWS F ROM I NVESTING A CTIVITIES | ||||||

| Purchase of Equipment | (11,000) | 0 | 0 | (4,000) | 0 | 0 |

| Pmnt of Patent Costs | 0 | 0 | 0 | 0 | 0 | 0 |

| Pmnt of Long-Term Deposits | 0 | 0 | 0 | 0 | 0 | 0 |

| T OTAL F ROM I NVESTING | (11,000) | 0 | 0 | (4,000) | 0 | 0 |

| C ASH F LOWS F ROM F INANCING A CTIVITIES | ||||||

| Borrowing on Long-Term Debt | 15,000 | 0 | 0 | 15,000 | 0 | 0 |

| Pmnts on Long-Term Debts | (313) | (313) | (313) | (625) | (625) | (625) |

| Sales of Common Stock | 10,000 | 40,000 | 15,000 | 35,000 | 0 | 0 |

| Repayment of Line of Credit | 0 | 0 | 0 | 0 | 0 | 0 |

| T OTAL F ROM F INANCING | 24,688 | 39,688 | 14,688 | 49,375 | (625) | (625) |

| N ET C ASH F LOWS | 9,588 | 1,835 | (3,581) | 46,178 | (24,572) | (15,711) |

| C ASH , B EGINNING OF P ERIOD | 0 | 9,588 | 11,423 | 7,842 | 54,021 | 29,449 |

| C ASH , E ND OF P ERIOD | 9,588 | 11,423 | 7,842 | 54,021 | 29,449 | 13,738 |

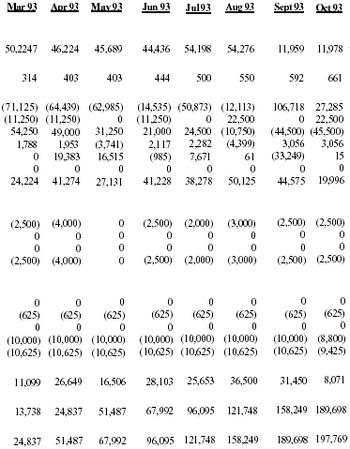

| Mar 93 | Apr 93 | May 93 | Jun 93 | Jul 93 | Aug 93 | Sept 93 | Oct 93 |

| 50,2247 | 46,224 | 45,689 | 44,436 | 54,198 | 54,276 | 11,959 | 11,978 |

| 314 | 403 | 403 | 444 | 500 | 550 | 592 | 661 |

| (71,125) | (64,439) | (62,985) | (14,535) | (50,873) | (12,113) | 106,718 | 27,285 |

| (11,250) | (11,250) | 0 | (11,250) | 0 | 22,500 | 0 | 22,500 |

| 54,250 | 49,000 | 31,250 | 21,000 | 24,500 | (10,750) | (44,500) | 45,500) |

| 1,788 | 1,953 | (3,741) | 2,117 | 2,282 | (4,399) | 3,056 | 3,056 |

| 0 | 19,383 | 16,515 | (985) | 7,671 | 61 | (33,249) | 15 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 24,224 | 41,274 | 27,131 | 41,228 | 38,278 | 50,125 | 44,575 | 19,996 |

| (2,500) | (4,000) | 0 | (2,500) | (2,000) | (3,000) | (2,500) | (2,500) |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| (2,500) | (4,000) | 0 | (2,500) | (2,000) | (3,000) | (2,500) | (2,500) |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| (625) | (625) | (625) | (625) | (625) | (625) | (625) | (625) |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| (10,000) | (10,000) | (10,000) | (10,000) | (10,000) | (10,000) | (10,000) | (8,800) |

| (10,625) | (10,625) | (10,625) | (10,625) | (10,625) | (10,625) | (10,625) | (9,425) |

| 11,099 | 26,649 | 16,506 | 28,103 | 25,653 | 36,500 | 31,450 | 8,071 |

| 13,738 | 24,837 | 51,487 | 67,992 | 96,095 | 121,748 | 158,249 | 189,698 |

| 24,837 | 51,487 | 67,992 | 96,095 | 121,748 | 158,249 | 189,698 | 197,769 |

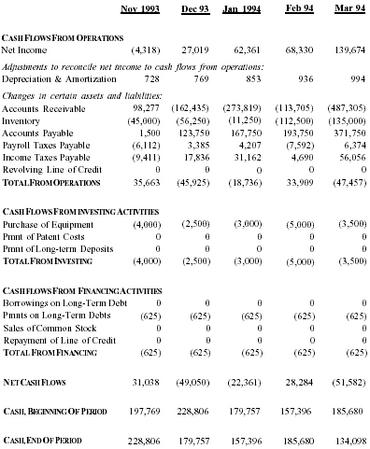

Projected Statement of Cash Flows: Part 2

| Nov 1993 | Dec 93 | Jan 1994 | Feb 94 | Mar 94 | |

| C ASH F LOWS F ROM O PERATIONS | |||||

| Net Income | (4,318) | 27,019 | 62,361 | 68,330 | 139,674 |

| Adjustments to reconcile net income to cash flows from operations: | |||||

| Depreciation & Amortization | 728 | 769 | 853 | 936 | 994 |

| Changes in certain assets and liabilities: | |||||

| Accounts Receivable | 98,277 | (162,435) | (273,819) | (113,705) | (487,305) |

| Inventory | (45,000) | (56,250) | (11,250) | (112,500) | (135,000) |

| Accounts Payable | 1,500 | 123,750 | 167,750 | 193,750 | 371,750 |

| Payroll Taxes Payable | (6,112) | 3,385 | 4,207 | (7,592) | 6,374 |

| Income Taxes Payable | (9,411) | 17,836 | 31,162 | 4,690 | 56,056 |

| Revolving Line of Credit | 0 | 0 | 0 | 0 | 0 |

| T OTAL F ROM O PERATIONS | 35,663 | (45,925) | (18,736) | 33,909 | (47,457) |

| C ASH F LOWS F ROM I NVESTING A CTIVITIES | |||||

| Purchase of Equipment | (4,000) | (2,500) | (3,000) | (5,000) | (3,500) |

| Pmnt of Patent Costs | 0 | 0 | 0 | 0 | 0 |

| Pmnt of Long-term Deposits | 0 | 0 | 0 | 0 | 0 |

| T OTAL F ROM I NVESTING | (4,000) | (2,500) | (3,000) | (5,000) | (3,500) |

| C ASH F LOWS F ROM F INANCING A CTIVITIES | |||||

| Borrowings on Long-Term Debt | 0 | 0 | 0 | 0 | 0 |

| Pmnts on Long-Term Debts | (625) | (625) | (625) | (625) | (625) |

| Sales of Common Stock | 0 | 0 | 0 | 0 | 0 |

| Repayment of Line of Credit | 0 | 0 | 0 | 0 | 0 |

| T OTAL F ROM F INANCING | (625) | (625) | (625) | (625) | (625) |

| N ET C ASH F LOWS | 31,038 | (49,050) | (22,361) | 28,284 | (51,582) |

| C ASH , B EGINNING OF P ERIOD | 197,769 | 228,806 | 179,757 | 157,396 | 185,680 |

| C ASH , E ND OF P ERIOD | 228,806 | 179,757 | 157,396 | 185,680 | 134,098 |

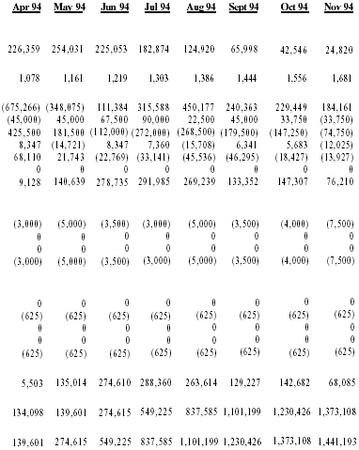

| Apr 94 | May 94 | Jun 94 | Jul 94 | Aug 94 | Sept 94 | Oct 94 | Nov 94 |

| 226,359 | 254,031 | 225,053 | 182,874 | 124,920 | 65,998 | 42,546 | 24,820 |

| 1,078 | 1,161 | 1,219 | 1,303 | 1,386 | 1,444 | 1,556 | 1,681 |

| (675,266) | (348,075) | 111,384 | 315,588 | 450,177 | 240,363 | 229,449 | 184,161 |

| (45,000) | 45,000 | 67,500 | 90,000 | 22,500 | 45,000 | 33,750 | (33,750) |

| 425,500 | 181,500 | (112,000) | (272,000) | (268,500) | (179,500) | (147,250) | (74,750) |

| 8,347 | (14,721) | 8,347 | 7,360 | (15,708) | 6,341 | 5,683 | (12,025) |

| 68,110 | 21,743 | (22,769) | (33,141) | (45,536) | (46,295) | (18,427) | (13,927) |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 9,128 | 140,639 | 278,735 | 291,985 | 269,239 | 133,352 | 147,307 | 76,210 |

| (3,000) | (5,000) | (3,500) | (3,000) | (5,000) | (3,500) | (4,000) | (7,500) |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| (3,000) | (5,000) | (3,500) | (3,000) | (5,000) | (3,500) | (4,000) | (7,500) |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| (625) | (625) | (625) | (625) | (625) | (625) | (625) | (625) |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| (625) | (625) | (625) | (625) | (625) | (625) | (625) | (625) |

| 5,503 | 135,014 | 274,610 | 288,360 | 263,614 | 129,227 | 142,682 | 68,085 |

| 134,098 | 139,601 | 274,615 | 549,225 | 837,585 | 1,101,199 | 1,230,426 | 1,373,108 |

| 139,601 | 274,615 | 549,225 | 837,585 | 1,101,199 | 1,230,426 | 1,373,108 | 1,441,193 |

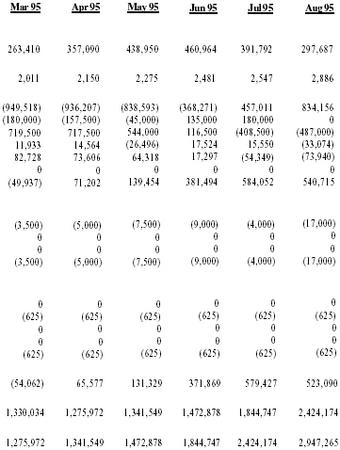

Projected Statement of Cash Flows: Part 3

| Dec 1994 | Jan 1995 | Feb 95 | |

| C ASH F LOWS F ROM O PERATIONS | |||

| Net Income | 41,121 | 89,096 | 158,120 |

| Adjustments to reconcile net income to cash flows from operations: | |||

| Depreciation & Amortization | 1,739 | 1,828 | 1,953 |

| Changes in certain assets and liabilities: | |||

| Accounts Receivable | (90,959) | (381,582) | (627,836) |

| Inventory | (90,000) | (135,000) | (202,500) |

| Accounts Payable | 123,250 | 354,250 | 566,500 |

| Payroll Taxes Payable | 5,683 | 6,999 | (12,682) |

| Income Taxes Payable | 12,807 | 37,695 | 54,233 |

| Revolving Line of Credit | 0 | 0 | 0 |

| T OTAL F ROM O PERATIONS | 3,642 | (35,714) | (62,212) |

| C ASH F LOWS F ROM I NVESTING A CTIVITIES | |||

| Purchase of Equipment | (3,500) | (4,000) | (7,500) |

| Purchase of Patent Costs | 0 | 0 | 0 |

| Pmnt of Long-Term Deposits | 0 | 0 | 0 |

| T OTAL F ROM I NVESTING | (3,500) | (4,000) | (7,500) |

| C ASH F LOWS F ROM F INANCING A CTIVITIES | |||

| Borrowings on Long-Term Debt | 0 | 0 | 0 |

| Pmnts on Long-Term Debt | (625) | (625) | (625) |

| Sales of Common Stock | 0 | 0 | 0 |

| Repayment of Line of Credit | 0 | 0 | 0 |

| T OTAL F ROM F INANCING | (625) | (625) | (625) |

| N ET C ASH F LOWS | (483) | (40,339) | (70,337) |

| C ASH , B EGINNING OF P ERIOD | 1,441,193 | 1,440,710 | 1,400,371 |

| C ASH , E ND OF P ERIOD | 1,440,710 | 1,400,371 | 1,330,034 |

| Mar 95 | Apr 95 | May 95 | Jun 95 | Jul 95 | Aug 95 | |

| 263,410 | 357,090 | 438,950 | 460,964 | 391,792 | 297,687 | |

| 2,011 | 2,150 | 2,275 | 2,481 | 2,547 | 2,886 | |

| (949,518) | (936,207) | (838,593) | (368,271) | 457,011 | 834,156 | |

| (180,000) | (157,500) | (45,000) | 135,000 | 180,000 | 0 | |

| 719,500 | 717,500 | 544,000 | 116,500 | (408,500) | (487,000) | |

| 11,933 | 14,564 | (26,496) | 17,524 | 15,550 | (33,074) | |

| 82,728 | 73,606 | 64,318 | 17,297 | (54,349) | (73,940) | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

| (49,937) | 71,202 | 139,454 | 381,494 | 584,052 | 540,715 | |

| (3,500) | (5,000) | (7,500) | (9,000) | (4,000) | (17,000) | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

| (3,500) | (5,000) | (7,500) | (9,000) | (4,000) | (17,000) | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

| (625) | (625) | (625) | (625) | (625) | (625) | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

| 0 | 0 | 0 | 0 | 0 | 0 | |

| (625) | (625) | (625) | (625) | (625) | (625) | |

| (54,062) | 65,577 | 131,329 | 371,869 | 579,427 | 523,090 | |

| 1,330,034 | 1,275,972 | 1,341,549 | 1,472,878 | 1,844,747 | 2,424,174 | |

| 1,275,972 | 1,341,549 | 1,472,878 | 1,844,747 | 2,424,174 | 2,947,265 |

RISK AND CONTINGENCY

ROAD RUNNER Refrigerant Recovery Systems will undoubtedly face many obstacles within the first months of operations. ROAD RUNNER has attempted to forecast these potential problems in an effort to ensure the minimization of potential detrimental surprises. Several of these potential risks and ROAD RUNNER's solution have been provided below.

Sales Representatives

Arisk that faces ROAD RUNNER focuses reliability on its sales representatives. ROAD RUNNER does not solely employ these agents. By this, they also sell other company's products simultaneously (although no other recovery systems). Because sales rely heavily on these agents, the amount of sales drive they give to ROAD RUNNER will help to determine the amount of success in the marketplace. This problem will be circumvented by educating the sales representatives and making them part of the ROAD RUNNER team. The education process will include: step-by-step analysis of the product design, a detailed explanation of the forces that drive the industry, and formation of strategy and methods that will be effective in selling the ROAD RUNNER.

Barriers to Entry: Distribution Channels

A formidable risk facing entrants into the refrigeration industry stems from possible barriers to entry. One such barrier concerns accessibility to the established distribution network. Service technicians purchase equipment through wholesalers. Therefore, a manufacturer wishing to sell his product to the industry, must do it through the wholesalers. In order to penetrate these distribution channels, a manufacturer must have a quality system and properly timed entry, in accordance with industry "norms." For example, wholesalers make inventory and purchasing decisions during the winter (the off season for the industry). A manufacturer trying to sell his product during the summer will not have much success. This risk has been greatly minimized as ROAD RUNNER has attracted twenty (20) experienced sales representatives. Many of these individuals have represented other refrigerant recovery systems, thus providing access to distribution channels across the entire United States.

Political Environment

Due to the previous experience of key personnel many of the operational risks typically associated with a manufacturing firm have been circumvented. Despite past experience, possible risks in this area of the business still remain. The probable risk that faces ROAD RUNNER centers around the Environmental Protection Agency. This government organization has wavered from time to time in regards to its policy decisions. As a prime example, the EPA lacked stringent enforcement of the Clean Air Act during the summer of 1992. Furthermore, the EPA recently announced its decision to require the use of electronic testing equipment during the production of refrigerant recovery systems. This forced ROAD RUNNER to purchase this machinery at a cost of $2000. The uncertainty of the Environmental Protection Agency does not threaten the existence of ROAD RUNNER. It merely has created an inconvenience. ROAD RUNNER will deal with the Environmental Protection Agency by maintaining regular contact with a representative from the agency.

SUMMARY

Many new industries have been created as the result of government regulations over the past thirty years. In the early 1970's, "automobile safety" legislation was the hot topic. Soon thereafter, many new firms began manufacturing seat belts and automobile safety equipment. Today, this industry is larger than ever and moving ahead with new and safer equipment. The government's effect on the refrigeration industry will be just as profound. This industry is presented with an opportunity not often encountered in the business world. Service technicians are required by law to purchase a refrigerant recovery system. Therefore, presenting the refrigeration industry with an incredible need for a recovery system that will stand up to the everyday rigors of refrigeration recovery. ROAD RUNNER will satisfy this need with Archetype 2000. A complete recovery system, designed from the input of service technicians for service technicians, this system surpasses its competition as the most complete refrigerant recovery system on the market.

However, ROAD RUNNER's product offering is not the only strength of the company. Great companies are built by great people. ROAD RUNNER will thrive in the future on a management team possessing much needed business experience and youthful excitement.