Hardware Store

FICTIONAL BUSINESS PLAN

OSHKOSH HARDWARE, INC

123 Main St.

Oshkosh, WI 54901

June 1994

The following plan outlines how a small hardware store can survive competition from large discount chains by offering products and providing expert advice in the use of any product it sells. This plan is fictional and has not used to gain funding from a bank or other lending institution.

- EXECUTIVE SUMMARY

- THE BUSINESS

- THE MARKET

- SALES

- MANAGEMENT

- GOALS IMPLEMENTATION

- FINANCE

- JOB DESCRIPTION-GENERAL MANAGER

- QUARTERLY FORECASTED BALANCE SHEETS

- QUARTERLY FORECASTED STATEMENTS OF EARNINGS AND RETAINED EARNINGS

- QUARTERLY FORECASTED STATEMENTS OF CHANGES IN FINANCIAL POSITION

- FINANCIAL RATIO ANALYSIS

- DETAILS FOR QUARTERLY STATEMENTS OF EARNINGS

EXECUTIVE SUMMARY

Oshkosh Hardware, Inc. is a new corporation which is going to establish a retail hardware store in a strip mall in Oshkosh, Wisconsin. The store will sell hardware of all kinds, quality tools, paint and housewares. The business will make revenue and a profit by servicing its customers not only with needed hardware but also with expert advice in the use of any product it sells.

Oshkosh Hardware, Inc. will be operated by its sole shareholder, James Smith. The company will have a total of four employees. It will sell its products in the local market. Customers will buy our products because we will provide free advice on the use of all of our products and will also furnish a full refund warranty.

Oshkosh Hardware, Inc. will sell its products in the Oshkosh store staffed by three sales representatives. No additional employees will be needed to achieve its short and long range goals. The primary short range goal is to open the store by October 1, 1994. In order to achieve this goal a lease must be signed by July 1, 1994 and the complete inventory ordered by August 1, 1994.

Mr. James Smith will invest $30,000 in the business. In addition the company will have to borrow $150,000 during the first year to cover the investment in inventory, accounts receivable, and furniture and equipment. The company will be profitable after six months of operation and should be able to start repayment of the loan in the second year.

THE BUSINESS

The business will sell hardware of all kinds, quality tools, paint, and housewares. We will purchase our products from three large wholesale buying groups.

In general our customers are homeowners who do their own repair and maintenance, hobbyists, and housewives. Our business is unique in that we will have a complete line of all hardware items and will be able to get special orders by overnight delivery. The business makes revenue and profits by servicing our customers not only with needed hardware but also with expert advice in the use of any product we sell. Our major costs for bringing our products to market are cost of merchandise of 36%, salaries of $45,000, and occupancy costs of $60,000.

Oshkosh Hardware, Inc.'s retail outlet will be located at 1524 Frontage Road, which is in a newly developed retail center of Oshkosh. Our location helps facilitate accessibility from all parts of town and reduces our delivery costs. The store will occupy 7500 square feet of space. The major equipment involved in our business is counters and shelving, a computer, a paint mixing machine, and a truck.

THE MARKET

Oshkosh Hardware, Inc. will operate in the local market. There are 15,000 potential customers in this market area. We have three competitors who control approximately 98% of the market at present. We feel we can capture 25% of the market within the next four years. Our major reason for believing this is that our staff is technically competent to advise our customers in the correct use of all products we sell.

After a careful market analysis we have determined that approximately 60% of our customers are men and 40% are women. The percentage of customers that fall into the following age categories are:

Under 16-0%

17-21-5%

22-30-30%

31-40-30%

41-50-20%

51-60-10%

61-70-5%

Over 70-0%

The reasons our customers prefer our products is our complete knowledge of their use and our full refund warranty.

We get our information about what products our customers want by talking to existing customers. There seems to be an increasing demand for our product. The demand for our product is increasing in size based on the change in population characteristics.

SALES

At Oshkosh Hardware, Inc. we will employ 3 sales people and will not need any additional personnel to achieve our sales goals. These salespeople will need several years experience in home repair and power tool usage. We expect to attract 30% of our customers from newspaper ads, 5% of our customers from local directories, 5% of our customers from the yellow pages, 10% of our customers from family and friends and 50% of our customers from current customers. The most cost effect source will be current customers. In general our industry is growing.

MANAGEMENT

We would evaluate the quality of our management staff as being excellent. Our manager is experienced and very motivated to achieve the various sales and quality assurance objectives we have set. We will use a management information system which produces key inventory, quality assurance and sales data on a weekly basis. All data is compared to previously established goals for that week and deviations are the primary focus of the management staff.

GOALS IMPLEMENTATION

The short term goals of our business are:

- Open the store by October 1, 1994

- Reach our breakeven point in two months

- Have sales of $100,000 in the first six months

In order to achieve our first short term goal we must:

- Sign the lease by July 1, 1994

- Order a complete inventory by August 1, 1994

In order to achieve our second short term goal we must:

- Advertise extensively in Sept. and Oct.

- Keep expenses to a minimum

In order to achieve our third short term goal we must:

- Promote power tool sales for the Christmas season

- Keep good customer traffic in Jan. and Feb.

The long term goals for our business are:

- Obtain sales volume of $600,000 in three years

- Become the largest hardware dealer in the city

- Open a second store in Fond du Lac

The most important thing we must do in order to achieve the long term goals for our business is to develop a highly profitable business with excellent cash flow.

FINANCE

Oshkosh Hardware, Inc. Faces some potential threats or risks to our business. They are discount house competition. We believe we can avoid or compensate for this by providing quality products complimented by quality advice on the use of every product we sell. The financial projections we have prepared are located at the end of this document.

JOB DESCRIPTION-GENERAL MANAGER

The General Manager of the business of the corporation will be the president of the corporation. He will be responsible for the complete operation of the retail hardware store which is owned by the corporation. A detailed description of his duties and responsibilities is as follows:

Sales

Train and supervise the three sales people. Develop programs to motivate and compensate these employees. Coordinate advertising and sales promotion effects to achieve sales totals as outlined in budget. Oversee purchasing function and inventory control procedures to insure adequate merchandise at all times at a reasonable cost.

Finance

Prepare monthly and annual budgets. Secure adequate line of credit from local banks. Supervise office personnel to insure timely preparation of records, statements, all government reports, control of receivables and payables and monthly financial statements.

Administration

Perform duties as required in the areas of personnel, building leasing and maintenance, licenses and permits and public relations.

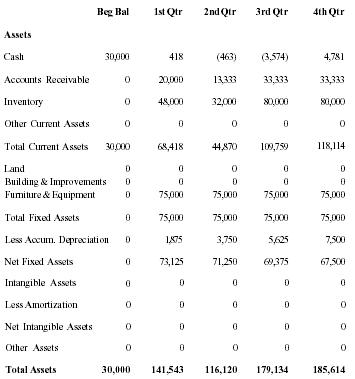

QUARTERLY FORECASTED BALANCE SHEETS

| Beg Bal | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | |

| Assets | |||||

| Cash | 30,000 | 418 | (463) | (3,574) | 4,781 |

| Accounts Receivable | 0 | 20,000 | 13,333 | 33,333 | 33,333 |

| Inventory | 0 | 48,000 | 32,000 | 80,000 | 80,000 |

| Other Current Assets | 0 | 0 | 0 | 0 | 0 |

| Total Current Assets | 30,000 | 68,418 | 44,870 | 109,759 | 118,114 |

| Land | 0 | 0 | 0 | 0 | 0 |

| Building & Improvements | 0 | 0 | 0 | 0 | 0 |

| Furniture & Equipment | 0 | 75,000 | 75,000 | 75,000 | 75,000 |

| Total Fixed Assets | 0 | 75,000 | 75,000 | 75,000 | 75,000 |

| Less Accum. Depreciation | 0 | 1,875 | 3,750 | 5,625 | 7,500 |

| Net Fixed Assets | 0 | 73,125 | 71,250 | 69,375 | 67,500 |

| Intangible Assets | 0 | 0 | 0 | 0 | 0 |

| Less Amortization | 0 | 0 | 0 | 0 | 0 |

| Net Intangible Assets | 0 | 0 | 0 | 0 | 0 |

| Other Assets | 0 | 0 | 0 | 0 | 0 |

| Total Assets | 30,000 | 141,543 | 116,120 | 179,134 | 185,614 |

| Liabilities and Shareholders' Equity | |||||

| Short-Term Debt | 0 | 0 | 0 | 0 | 0 |

| Accounts Payable | 0 | 12,721 | 10,543 | 17,077 | 17,077 |

| Dividends Payable | 0 | 0 | 0 | 0 | 0 |

| Income Taxes Payable | 0 | (1,031) | (2,867) | (2,355) | (1,843) |

| Accured Compensation | 0 | 1,867 | 1,867 | 1,867 | 1,867 |

| Other Current Liabilities | 0 | 0 | 0 | 0 | 0 |

| Total Current Liabilities | 0 | 13,557 | 9,543 | 16,589 | 17,101 |

| Long-Term Debt | 0 | 110,000 | 110,000 | 160,000 | 160,000 |

| Other Non-Current Liabilities | 0 | 0 | 0 | 0 | 0 |

| Total Liabilities | 0 | 123,557 | 119,543 | 176,589 | 177,101 |

| Common Stock | 30,000 | 30,000 | 30,000 | 30,000 | 30,000 |

| Retained Earnings | 0 | (12,014) | (33,423) | (27,455) | (21,487) |

| Shareholders' Equity | 30,000 | 17,986 | (3,423) | 2,545 | 8,513 |

| Total Liabilities & Shareholders' Equity | 30,000 | 141,543 | 116,120 | 179,134 | 185,614 |

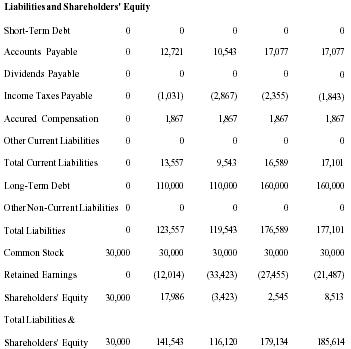

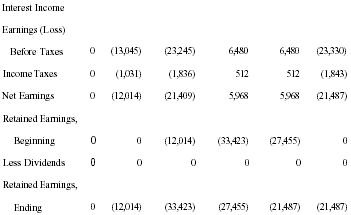

QUARTERLY FORECASTED STATEMENTS OF EARNINGS AND RETAINED EARNINGS

| Beg Actual | lst Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Total | |

| Total Sales | 0 | 60,000 | 40,000 | 100,000 | 100,000 | 300,000 |

| Goods/Services | 0 | 21,600 | 14,400 | 36,000 | 36,000 | 108,000 |

| Gross Profit | 0 | 38,400 | 25,600 | 64,000 | 64,000 | 192,000 |

| Operating Expenses | 0 | 47,645 | 45,045 | 52,845 | 52,845 | 198,380 |

| Fixed Expenses | ||||||

| Interest | 0 | 1,925 | 1,925 | 2,800 | 2,800 | 9,450 |

| Depreciation | 0 | 1,875 | 1,875 | 1,875 | 1,875 | 7,500 |

| Amortization | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Fixed Expenses | 0 | 3,800 | 4,675 | 4,675 | 16,950 | |

| Operating Profit (Loss) | 0 | (13,045) | (23,245) | 6,480 | 6,480 | (23,330) |

| Other Income (Expense) | 0 | 0 | 0 | 0 | 0 | 0 |

| Interest Income | ||||||

| Earnings (Loss) | ||||||

| Before Taxes | 0 | (13,045) | (23,245) | 6,480 | 6,480 | (23,330) |

| Income Taxes | 0 | (1,031) | (1,836) | 512 | 512 | (1,843) |

| Net Earnings | 0 | (12,014) | (21,409) | 5,968 | 5,968 | (21,487) |

| Retained Earnings, Beginning | 0 | 0 | (12,014) | (33,423) | (27,455) | 0 |

| Less Dividends | 0 | 0 | 0 | 0 | 0 | 0 |

| Retained Earnings, Ending | 0 | (12,014) | (33,423) | (27,455) | (21,487) | (21,487) |

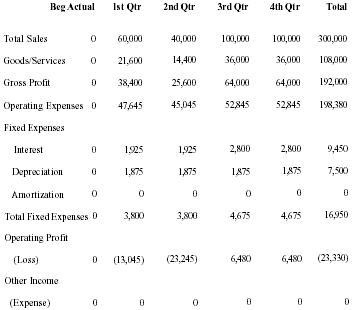

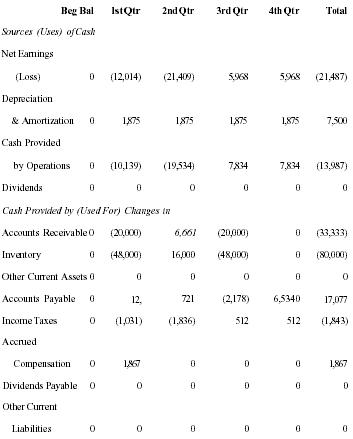

QUARTERLY FORECASTED STATEMENTS OF CHANGES IN FINANCIAL POSITION

| Beg Bal | lst Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Total | |

| Sources (Uses) of Cash | ||||||

| Net Earnings (Loss) | 0 | (12,014) | (21,409) | 5,968 | 5,968 | (21,487) |

| Depreciation & Amortization | 0 | 1,875 | 1,875 | 1,875 | 1,875 | 7,500 |

| Cash Provided by Operations | 0 | (10,139) | (19,534) | 7,834 | 7,834 | (13,987) |

| Dividends | 0 | 0 | 0 | 0 | 0 | 0 |

| Cash Provided by (Used For) Changes in | ||||||

| Accounts Receivable | 0 | (20,000) | 6,667 | (20,000) | 0 | (33,333) |

| Inventory | 0 | (48,000) | 16,000 | (48,000) | 0 | (80,000) |

| Other Current Assets | 0 | 0 | 0 | 0 | 0 | 0 |

| Accounts Payable | 0 | 12, | 721 | (2,178) | 65,340 | 17,077 |

| Income Taxes | 0 | (1,031) | (1,836) | 512 | 512 | (1,843) |

| Accrued Compensation | 0 | 1,867 | 0 | 0 | 0 | 1,867 |

| Dividends Payable | 0 | 0 | 0 | 0 | 0 | 0 |

| Other Current Liabilities | 0 | 0 | 0 | 0 | 0 | 0 |

| Other Assests | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Cash Provided by (Used For) | ||||||

| Operating Activities | 0 | (54,443) | 18,653 | (60,954) | 512 | (96,233) |

| Investment Transactions | ||||||

| Furniture & Equipment | 0 | (75,000) | 0 | 0 | 0 | (75,000) |

| Land | 0 | 0 | 0 | 0 | 0 | 0 |

| Building & Improvements | 0 | 0 | 0 | 0 | 0 | 0 |

| Intangible Assets | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Cash From | ||||||

| Investment Transactions | 0 | (75,000) | 0 | 0 | 0 | (75,000) |

| Financing Transactions | ||||||

| Short-Term Debt | 0 | 0 | 0 | 0 | 0 | 0 |

| Long-Term Debt | 0 | 110,000 | 0 | 50,000 | 0 | 160,000 |

| Other Non-Current Liabilities | 0 | 0 | 0 | 0 | 0 | 0 |

| Sale of Common Stock | 30,000 | 0 | 0 | 0 | 0 | 0 |

| Net Cash from Financing Transactions | 30,000 | 110,000 | 0 | 50,000 | 0 | 160,000 |

| Net Increase (Decrease) in Cash | 30,000 | (29,582) | (881) | (3,111) | 8,355 | (25,219) |

| Cash-Beginning of Period | 0 | 30,000 | 418 | (463) | (3,574) | 30,000 |

| Cash-End of Period | 30,000 | 418 | (463) | (3,574) | 4,781 | 4,781 |

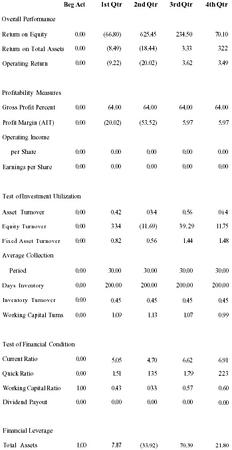

FINANCIAL RATIO ANALYSIS

| Beg Act | lst Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | |

| Overall Performance | |||||

| Return on Equity | 0.00 | (66.80) | 625.45 | 234.50 | 70.10 |

| Return on Total Assets | 0.00 | (8.49) | (18.44) | 3.33 | 3.22 |

| Operating Return | 0.00 | (9.22) | (20.02) | 3.62 | 3.49 |

| Profitability Measures | |||||

| Gross Profit Percent | 0.00 | 64.00 | 64.00 | 64.00 | 64.00 |

| Profit Margin (AIT) | 0.00 | (20.02) | (53.52) | 5.97 | 5.97 |

| Operating Income per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Earnings per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Test of Investment Utilization | |||||

| Asset Turnover | 0.00 | 0.42 | 0.34 | 0.56 | 0.54 |

| Equity Turnover | 0.00 | 334 | (11.69) | 39.29 | 11.75 |

| Fixed Asset Turnover | 0.00 | 0.82 | 0.56 | 1.44 | 1.48 |

| Average Collection Period | 0.00 | 30.00 | 30.00 | 30.00 | 30.00 |

| Days Inventory | 0.00 | 200.00 | 200.00 | 200.00 | 200.00 |

| Inventory Turnover | 0.00 | 0.45 | 0.45 | 0.45 | 0.45 |

| Working Capital Turns | 0.00 | 1.09 | 1.13 | 1.07 | 0.99 |

| Test of Financial Condition | |||||

| Current Ratio | 0.00 | 5.05 | 4.70 | 6.62 | 6.91 |

| Quick Ratio | 0.00 | 1.51 | 1.35 | 1.79 | 2.23 |

| Working Capital Ratio | 1.00 | 0.43 | 0.33 | 0.57 | 0.60 |

| Dividend Payout | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Financial Leverage | |||||

| Total Assets | 1.00 | 7.87 | (33.92) | 70.39 | 21.80 |

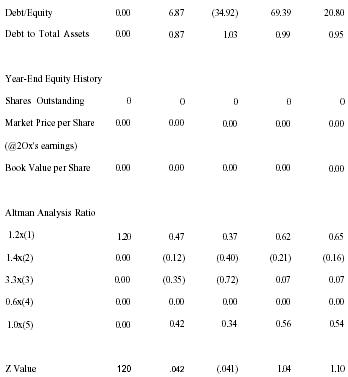

| Debt/Equity | 0.00 | 6.87 | (34.92) | 69.39 | 20.80 |

| Debt to Total Assets | 0.00 | 0.87 | 1.03 | 0.99 | 0.95 |

| Year-End Equity History | |||||

| Shares Outstanding | 0 | 0 | 0 | 0 | 0 |

| Market Price per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| (@20x's earnings) | |||||

| Book Value per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Altman Analysis Ratio | |||||

| 1.2x (1) | 1.20 | 0.47 | 0.37 | 0.62 | 0.65 |

| 1.4x (2) | 0.00 | (0.12) | (0.40) | (0.21) | (0.16) |

| 3.3x (3) | 0.00 | (0.35) | (0.72) | 0.07 | 0.07 |

| 0.6x (4) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 1.0x (5) | 0.00 | 0.42 | 0.34 | 0.56 | 0.54 |

| Z Value | 1.20 | .042 | (.041) | 1.04 | 1.10 |

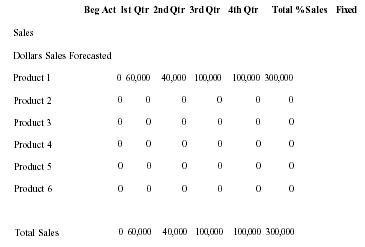

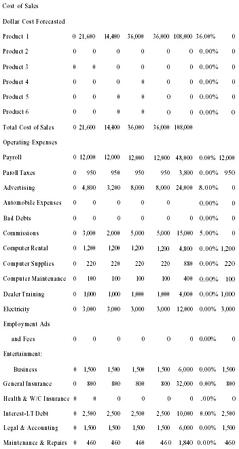

DETAILS FOR QUARTERLY STATEMENTS OF EARNINGS

| Beg Act | lst Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Total | % Sales | Fixed | |

| Sales | ||||||||

| Dollars Sales Forecasted | ||||||||

| Product 1 | 0 | 60,000 | 40,000 | 100,000 | 100,000 | 300,000 | ||

| Product 2 | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Product 3 | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Product 4 | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Product 5 | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Product 6 | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Total Sales | 0 | 60,000 | 40,000 | 100,000 | 100,000 | 300,000 |

| Cost of Sales | ||||||||

| Dollar Cost Forecasted | ||||||||

| Product 1 | 0 | 21,600 | 14,400 | 36,000 | 36,000 | 108,000 | 36.00% | 0 |

| Product 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Product 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Product 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Product 5 | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Product 6 | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Total Cost of Sales | 0 | 21,600 | 14,400 | 36,000 | 36,000 | 108,000 | ||

| Operating Expenses | ||||||||

| Payroll | 0 | 12,000 | 12,000 | 12,000 | 12,000 | 48,000 | 0.00% | 12,000 |

| Paroll Taxes | 0 | 950 | 950 | 950 | 950 | 3,800 | 0.00% | 950 |

| Advertising | 0 | 4,800 | 3,200 | 8,000 | 8,000 | 24,000 | 8.00% | 0 |

| Automobile Expenses | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 | |

| Bad Debts | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Commissions | 0 | 3,000 | 2,000 | 5,000 | 5,000 | 15,000 | 5.00% | 0 |

| Computer Rental | 0 | 1,200 | 1,200 | 1,200 | 1,200 | 4,800 | 0.00% | 1,200 |

| Computer Supplies | 0 | 220 | 220 | 220 | 220 | 880 | 0.00% | 220 |

| Computer Maintenance | 0 | 100 | 100 | 100 | 100 | 400 | 0.00% | 100 |

| Dealer Training | 0 | 1,000 | 1,000 | 1,000 | 1,000 | 4,000 | 0.00% | 1,000 |

| Electricity | 0 | 3,000 | 3,000 | 3,000 | 3,000 | 12,000 | 0.00% | 3,000 |

| Employment Ads and Fees | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Entertainment: Business | 0 | 1,500 | 1,500 | 1,500 | 1,500 | 6,000 | 0.00% | 1,500 |

| General Insurance | 0 | 800 | 800 | 800 | 800 | 32,000 | 0.00% | 800 |

| Health & W/C Insurance | 0 | 0 | 0 | 0 | 0 | 0 | .00% | 0 |

| Interest-LT Debt | 0 | 2,500 | 2,500 | 2,500 | 2,500 | 10,000 | 0.00% | 2,500 |

| Legal & Accounting | 0 | 1,500 | 1,500 | 1,500 | 1,500 | 6,000 | 0.00% | 1,500 |

| Maintenance & Repairs | 0 | 460 | 460 | 460 | 460 | 1,840 | 0.00% | 460 |

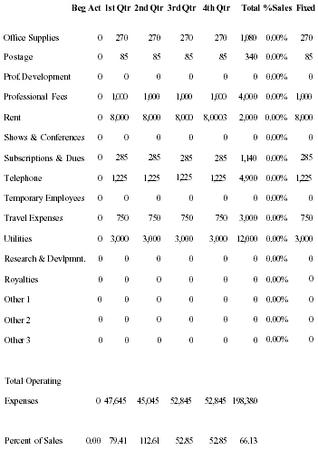

| Beg Act | lst Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | Total | % Sales | Fixed | |

| Office Supplies | 0 | 270 | 270 | 270 | 270 | 1,080 | 0.00% | 270 |

| Postage | 0 | 85 | 85 | 85 | 85 | 340 | 0.00% | 85 |

| Prof. Development | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Professional Fees | 0 | 1,000 | 1,000 | 1,000 | 1,000 | 4,000 | 0.00% | 1,000 |

| Rent | 0 | 8,000 | 8,000 | 8,000 | 8,0003 | 2,000 | 0.00% | 8,000 |

| Shows & Conferences | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Subscriptions & Dues | 0 | 285 | 285 | 285 | 285 | 1,140 | 0.00% | 285 |

| Telephone | 0 | 1,225 | 1,225 | 1,225 | 1,225 | 4,900 | 0.00% | 1,225 |

| Temporary Employees | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Travel Expenses | 0 | 750 | 750 | 750 | 750 | 3,000 | 0.00% | 750 |

| Utilities | 0 | 3,000 | 3,000 | 3,000 | 3,000 | 12,000 | 0.00% | 3,000 |

| Research & Devlpmnt. | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Royalties | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Other 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Other 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Other 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0.00% | 0 |

| Total Operating | ||||||||

| Expenses | 0 | 47,645 | 45,045 | 52,845 | 52,845 | 198,380 | ||

| Percent of Sales | 0.00 | 79.41 | 112.61 | 52.85 | 52.85 | 66.13 |

Comment about this article, ask questions, or add new information about this topic: