Restaurant/Microbrewerwery

BUSINESS PLAN

HOMESTEADERS' PUB & GRUB

5297 Kingswood

Marble River, WA 98922

This business plan is exemplary in it's thoroughness and consideration of every detail. It's clear vision and enthusiasm underscore the owners' qualifications for the undertaking. Note the complementary nature of the business and it's environment. Their suitedness for each other lends uniqueness to the venture and ambience to the establishment.

- CONFIDENTIALITY STATEMENT

- EXECUTIVE SUMMARY

- CURRENT POSITION AND FUTURE OUTLOOK

- MANAGEMENT AND OWNERSHIP

- UNIQUENESS OF THE ESTABLISHMENT

- FUNDS SOUGHT AND USAGE

- BUSINESS DESCRIPTION

- SITUATION ANALYSIS

- VISION AND MISSION STATEMENT

- OBJECTIVES

- STRATEGIES

- MANAGEMENT/OWNERSHIP

- THE UNFILLED NEED/UNIQUENESS OF THE ESTABLISHMENT

- PRICING AND VALUE

- MARKET RESEARCH AND ASSUMPTIONS/MARKET OVERVIEW

- MARKET SEGMENTS/COMPETITION

- CUSTOMER PROFILE/MARKET SHARE

- GEOGRAPHIC MARKET FACTORS

- MARKET STRATEGIES

- SALES FORECASTS

- THEME, MENU, SERVICE AND DELIVERY

- ADVERTISING AND PROMOTIONS

- CUSTOMER CONTACT/EMPLOYMENT AND PERSONNEL PLANS

- BUYING AND STOCKING PLANS

- FACILITY PLANS

- RISK ANALYSIS

- BUSINESS PROJECTED FINANCIAL STATEMENTS

- PERSONAL PROJECTED FINANCIAL STATEMENTS

CONFIDENTIALITY STATEMENT

The information, data, and drawings embodied in this business plan are strictlyconfidential and are supplied on the understanding that they will be held confidentially and not disclosed to third parties without the prior written consent of the authors of this document.

EXECUTIVE SUMMARY

Homesteaders' Pub & Grub will be a people friendly restaurant and tavern. It will provide comfortable surroundings for people to bring family and friends to enjoy a reasonably priced meal and a wide variety of American microbrewed beers and American wines. The business will be established at the current site of Howie's, located on the riverfront in Marble River, Washington. With some remodeling, and the use of most of the existing equipment, we will turn what was once a drive-in, into a gathering spot for people who have an appreciation for the natural environment. It will not matter whether our guests are local people or visitors to our town. All will be made to feel comfortable. Customers will find a love of the outdoors portrayed, friendliness, warmth and a special appreciation for the mountains and all the activities relating to this area.

CURRENT POSITION AND FUTURE OUTLOOK

The strength of our business will be in the quality of the products we serve; the food, beer, wine, the environment and most of all the service we provide our guests. Within 2-3 years we plan to add a microbrewery onsite. This addition will give us even a more unique draw for customers. National statistics show micro/restaurant openings increasing markedly and the failure rate in the US is a low 1 out of 7.

Marble River Washington is one of the gateways to North Cascades National Park. The northeast entrance (at the top of the "Sawtooth Highway" above Marble River) logged over 190,000 visitors last year. With the current 10 year, 21 million dollar development plan for the ski area, and the fine 18 hole championship golf course, the community and it's present leadership are demonstrating their commitment to the future growth of the area. Marble River is on its' way to becoming a competitor with Big Sky, Montana, Jackson Hole, Wyoming and Sun Valley, Idaho as a destination year round recreation center in the west.

MANAGEMENT AND OWNERSHIP

Gary and Diane Danforth are husband and wife and will be joint owners. Gary Danforth (41) has been an educator/coach for 20 years in both Michigan and Wyoming. He has received awards as both a teacher and a coach. Gary has also served an internship in a microbrewery/restaurant in northern Michigan. He has recently received extensive training to become a brew master at a The Siebel Institute this summer.

Diane Danforth (34) has spent her career in the business sector. Diane started in public accounting after college then moved to the private sector. She currently works for three separate corporations (all the same owners) and holds the positions of General Manager/CFO/Controller.

UNIQUENESS OF THE ESTABLISHMENT

Our company will differentiate itself from others in Marble River because of three factors. Foremost will be the "personal touch" provided by the owners. Gary and Diane have ample experience in serving and dealing with people. Gary brings people skills from education and Diane brings her skills from the public and private business sector. We will have a unique atmosphere. Presently there is no restaurant/pub that brings nature and the offerings of the North Cascades ecosystem inside. Finally, we will offer food and drink quality that will be hard to match. By serving fresh food, American beer and wine in wonderful atmosphere, people will come.

FUNDS SOUGHT AND USAGE

The business is seeking $350,000 in long term debt financing secured by a combination of business assets and personal assets. These funds combined with the $40,000 of our personal money will give us a total of $390,000. $265,000 will be used to purchase the property and building presently called Howie's in Marble River. $60,000 will be used in remodeling & additional furnishings. $25,000 will be used to purchase inventory for the restaurant. $40,000 will be used as working capital. All of the funds to purchase the property, building, fixtures, etc. will be loaned to Gary & Diane personally, with the reasoning to follow.

Homesteaders' Pub & Grub will operate as a corporation with Diane owning 51% of the stock and Gary owning 49%. This ratio is used so that the corporation may receive some future benefits of a woman owner (in some instances classified as a minority). The building will be owned by Gary & Diane personally, and rented to the corporation. This will be done for tax purposes.

Homesteaders' Pub & Grub will be a restaurant/pub, specializing in good food, and American beer and wines. We feel that the rebirth of the brewing industry in this country and the many fine wineries throughout the United States will allow us to serve top quality American fare without the need to import beer and wine. Eventually we will open a microbrewery on premise to complete the total package. The microbrewing industry is expanding throughout this country. There are over 300 such places in this country. We will begin however, as a restaurant/pub specializing in specialty American brews and wines.

The current facilities will be remodeled to accommodate an actual sit down bar area and a sit down dining room with table service. We would like to open the room up so the appearance will be more appealing and more practical from a serving stand point. Our projected seating capacity will be over 60 dining seats and 10 bar seats

SITUATION ANALYSIS

The restaurant/pub market is described as a risky venture. It will take much time and work. Presently the building we are seeking serves the community as a seasonal drive-in type restaurant. We will remodel the facility and make it into an attractive sit down restaurant/pub. Diane and Gary bring a wealth of people, management and motivational skills to the business. Gary also brings a knowledge of the brewing industry and Diane brings hands on management, business and accounting knowledge. We are both recognized as outstanding cooks and are gifted in the art of entertaining people. We will make this work. Our ideas, energy and people skills willmake this happen. When the brewing operation comes online there will be added benefits of local and regional distribution of the products.

VISION AND MISSION STATEMENT

The microbrewery/pub experience is expanding all over the United States. The failure rate is 1 in 7 start ups. That is quite good. Basically that means if you won't work, you won't make it. The Danforths will work.

We envision a thriving restaurant/pub operation for the first two to three years. We intend to then begin a microbrewing operation. At that point, we will have the ability to market our beer product locally and regionally. The advantage of an on site brewery attached to the restaurant will only make our position in the dining market of Marble River stronger. The uniqueness of having an operating brewing operation in full view of dining customers will add even more ambience to our friendly establishment. The ability to enjoy fresh, high quality beer with a top notch meal will be hard to beat.

The company's mission is to provide the people of Marble River, Washington and the visitors to the area, the highest quality service, food and drink at a reasonable cost. We further plan to provide an environment that brings a touch of the natural wonders of the North Cascades ecosystem inside to the patrons. We will target all residents of Miner County as well as all visitors to the area.

OBJECTIVES

- To be "the" premier restaurant/pub in Marble River

- To expand our business with the addition of a microbrewery on site within two to three years.

- To realize a 10% increase in sales over the next three years and a 15% increase when the microbrewery is open.

- To become an integral part of the city of Marble River and it's future.

STRATEGIES

- To secure financing for the purchase of the established building, remodeling costs, inventory, and operating capital.

- To provide service to the customer that is second to none.

- To provide an atmosphere for dining and drinking that truly reflects the greater North Cascades ecosystem and it's history.

- To provide a stimulating menu that crosses a variety of food styles.

- The food served will be of the highest quality and best value for the money spent.

- Seek out and find the highest quality American microbrewed beers to serve to our customers.

- Seek out and find the highest quality American wines to serve to our customers.

MANAGEMENT/OWNERSHIP

The management team will be Gary and Diane Danforth. Gary & Diane decided to go into business for themselves seven years ago. They evaluated their life styles and decided they were ready for a change. They began to focus on long term planning to make this plan a reality. They knew they wanted to return to the west and most of all to the mountains. They became familiar with the microbrewery industry when they helped a friend open one in northern Michigan. Their dream then became to have a restaurant microbrewery in the west. In the spring of 1996 they put their lakefront home up for sale and began to expedite their plan. They focussed their planned move to the city of Marble River. They were familiar with this town because both used to live in Freemont, Washington before moving east. Marble River had always been a favorite spot. Their house sold in December of 1996. They liquidated their other debts with their profits and put the rest in the bank . They began a serious search for a piece of property to fit their needs. In February of 1997 they came across the Howie's site. With some imagination they decided this would be the place to recognize their dreams.

Both Gary and Diane have a lot of experience in the people and service business. The intention is to run the business with the owners as primary employees, adding staff as the need arises. The Danforths will manage all operations and employees will report to them.

The Homesteaders' Pub & Grub will be operated as a corporation. Diane Danforth will own 51% of the corporation and Gary Danforth will own 49%. The land, building and fixtures will be owned by Gary and Diane personally and leased to the corporation. This ownership structure may have to change once the brewery is brought on line. The corporation will register it's trade name to ensure that promotional activities, articles, and decor are protected. Management believes that the unique combination of marketing and products can only be protected in this manner.

THE UNFILLED NEED/UNIQUENESS OF THE ESTABLISHMENT

Marble River needs a restaurant and pub that highlights the North Cascades environment and Miner County's history. The town needs a place where people can meet over a cold brew, good food, and enjoy the special ambience of the establishment. There needs to be a spot in town that stimulates the urge in all of us to get out and enjoy the natural surroundings (the Sawtooth Wilderness and the Cascade Range). We also need a spot where those of us that are interested in these out of door activities can meet to plan future adventures.

The restaurant will cater to the largely unfilled need for a spot to view North Cascades and thesurrounding wilderness areas through pictures, photographs, and detailed maps. The mineral history of Miner County, mainly coal, will also be highlighted. The history of the area's famous mountain men will be on display. The image of the restaurant will be designed to provoke a desire to explore the area by car, walking the trails, or backpacking in the high country. The owners want their customers to see and explore the amazing country that surrounds them.

We will target both tourists and local residents to frequent the establishment. The restaurant will be located near many of the local motels. Parking will be "outside the door" and ample.

The beer and wine selections will attract a variety of customers from the outdoor enthusiast, to the professional, to families, to older established connoisseurs of these beverages. Pricing on the menu will be moderate. The menu will be a cross section of food styles. Portions will be generous and of top quality The service will be friendly and prompt.

PRICING AND VALUE

The menu pricing structure was established based on competition locally and throughout the industry for similar menus. With our competitors in mind we also looked at labor and ingredient costs to arrive at a pricing scheme. We used what is known in the industry as "combination pricing" to arrive at our final figures. Combination pricing is a combination of the factor method, gross margin pricing, prime cost method and competition pricing.

In designing our menu we looked at the customers we are trying to attract. We tried to design a menu that would appeal to this audience. Our menu has a wide range of prices and selections.

MARKET RESEARCH AND ASSUMPTIONS/MARKET OVERVIEW AND SIZE

The restaurant and pub industry are well established in the Miner County area. In fact Marble River boasts itself as having "more restaurants per capita than any other community in Washington." The careful reader can understand this statement when you examine Marble River's major industry: tourism. To support the large visiting population (190,000 used the north entrance to North Cascades last year) the current food service industry in this area doesn't seem so large.

Marble River currently offers a variety of food choices. We feel our establishment will fit nicely into this market. We will be unique in our menu, service and decor. We will also provide easy parking and access to the main road. Visitors to our establishment will enjoy a great view of the city, the mountains, and the creek.

Being one of many good restaurants in the area can only help this community. With so many people coming through this area every year, a good meal in several locations will make them speak fondly of the area, return to the area, and encourage others to visit.

MARKET SEGMENTS/COMPETITION

One of every 3 meals eaten in this country is eaten away from the home. This equates to42% of the consumers food budget being spent at restaurants. We will capture our share of these national statistics. More importantly though, our restaurant's growth potential is tied directly to the growth of the community of Marble River. While census data shows Miner County realizing about a 5% annual growth rate, Marble River has been seeing close to 15% growth during the same recent intervals. Our food menu, beer and wine selections will be able to keep up with this growth. The owners feel that this establishment will exceed the areas projected growth rate because it will become known for it's quality of food, selection of beer and wines, superior service, location, and atmosphere.

We expect with the addition of a microbrewery we will see a growth in sales by as much as 20% due to the uniqueness and the addition of off site sales and distribution.

The restaurant and pub competition in Marble River is varied and intense. Each existing establishments holds a unique place in the market. Because Marble River has this variety though, people from the surrounding areas come and enjoy! Our addition to this market will attract even more people.

We look at competition as a positive. Competition can only make us better. The owner both strive to be the best in all they do. That intrinsic motivation both owners have will not go away. It will only grow with competition.

CUSTOMER PROFILE/MARKET SHARE

Our customer base will be large and varied. We intend to attract local people, vacationers to the North Cascades area, skiers who come for the skiing, "car campers" who are on road tours, golfers, and backcountry enthusiasts who enjoy the area and all it has to offer. We do not intend to forget the weekenders who come from surrounding communities just to enjoy this special town at all times of year.

We will welcome all ages, from infants to senior citizens. We will provide an environment that makes them all feel welcome.

It is hard to determine what share we will have of the market because we are combining two areas. Combining quality food with a pub atmosphere and potential microbrewery is new to this area. The previous owner operated this piece of property as a drive-in, which is very different from our perception of how we'll operate it.

GEOGRAPHIC MARKET FACTORS

This piece of property is usually the last place you see (convenient for take out sales) when leaving Marble River towards the mountains or the first place you see when entering town from the mountains. It has 200' of creek frontage and it has it's own parking lot making it convenient for motorhomes, travel trailers and snow mobile trailers. The outside of the building will attract interest as people pass by, making them say "Lets go back to that first place we saw" or "Lets stop here, this looks perfect." Being first and last does have its advantages.

We believe in the growth of the area. This town is one of the best kept secrets in the United States. It is sixty miles from Bellingham, Washington and all that city has to offer. It is the gateway to some of the most spectacular wilderness left in the world. The majority of the community seems to want slow, planned, well-thought-out growth and we very much agree in this approach.

Marble River has location, recreation (golf, skiing, camping, fishing, hunting, back packing, etc.), and most importantly, great people from many cultural backgrounds.

This is a great place to be and a great time to be here. We will work hard to be a positive part of the community and it's future.

MARKET STRATEGIES

The restaurant and pub will attract locals with monthly promotional events; like an English pint club, daily food specials, a changing variety of microbrewed beers and American wines. We will cater to local businesses by providing a fax order system far lunches. We will advertise in the local and regional newspapers and hotel fliers to attract out of town guests. We will make the building appealing and intriguing both inside and out so people will want to stop.

The owners will pride themselves in being present (one or the other or both) during most working hours. We will let the customer know we are here and that we value their business and we are always there for them. We hope to meet most all the customers and help them enjoy themselves. We will provide that extra service that everyone appreciates.

The restaurant & pubs' strategy for service will include a well-trained staff that will offer any type of service to the customer when asked (i.e. special orders, special seating, special dietary needs, information about the area and directions). Thus our unconditional guarantee: If you are not satisfied, we will make it right.

SALES FORECASTS

The receipts for Homesteaders' Pub & Grub are forecasted to remain steady in 1998 and increase by 10% in 1999, to $277,860 in 1999. We assume the average ticket will be $15.00 in 1997 and 1998. A combination of increased customers as well as an increase in the average ticket will account for this growth. This will be achieved by targeting our local customer base and visitors to Marble River

The projected sales breakdown by customer in 1998 is as follows:

| % of Sales | |

| Under 30 Young adults | 10 |

| Over 50 couples | 20 |

| Other families | 30 |

| Others | 10 |

THEME, MENU SERVICE AND DELIVERY

Homesteaders' Pub & Grub will serve a variety of dishes. This variety is based on the fact that we are attempting to attract a variety of customers for both lunch and dinner. We will offer vegetarian items, traditional restaurant and pub fare, and a children's menu. Salads and fresh bread will compliment the service. The addition of the microbrewery in a few years will add a unique image and aroma to the facilities relaxing, natural, and subdued ambience. The pricing on the menu is moderate and compares favorably to other menus in town. Dinner service is forecast to be our highest revenue generator with more than 60% of the sales. The hours from 3:00 p.m. to 10:00 p.m. will be key for our establishment as this is the time that travelers and recreationalists are settling in for the evening and looking for a great spot to eat and enjoy a beverage.

Once a patron walks in the door, customer service begins. Customers will be shown to a seat or allowed to choose a seat if that is their preference. A member of the staff will then offer a menu and ask if they have a drink preference. Once the meal is ordered, the ticket will be taken to the kitchen and the order prepared in an expedient manner. Food will be delivered in a timely manner. Wait staff will be available and pleasant at all times during a customer's meal. Once the meal is completed, busing will bedone as unobtrusively as possible. The wait staff will ask if anything else is desired. If the patron requires something else it will be provided, if not, the customer will receive his/her ticket (bill). We will accept cash and major credit cards as a method of payment.

ADVERTISING AND PROMOTIONS

Promotional activities for Homesteaders' Pub & Grub will focus on the unique theme and image Of the establishment. The primary advertising will be in the local newspapers and local radio. We will also advertise in promotional publications and flyers that are directed to the local tourist industry. The establishment's logo will be prominent in all advertising. This logo will also be displayed on several types of apparel that will be worn by the staff and for sale in the restaurant. We also intend to help sponsor local events in the community that will allow our name or logo to be displayed.

The owners plan to be active in the community. This may be the single biggest promotional tool for the business. By building goodwill we feel we will be building a strong community base that will support our business.

More advertising may be explored as the business is established and funds permit.

CUSTOMER CONTACT/EMPLOYMENT AND PERSONNEL PLANS

The Homesteaders' Pub & Grub will look for outgoing, intelligent, and fun-loving employees. Eating out is fun if we are entertained and coddled. Going to a restaurant is similar to going to the theater. The "action" around you is for your benefit, to satisfy your wants and needs. Our staff will be trained to unconditionally guarantee satisfaction to all patrons. Once ourcustomers arrive they will be made to feel at all times as if, individually and collectively, they are at center stage. The decor, menu and the wait staff will help to make this a reality.

In addition to the two owners, the plan is to hire two part time employees to keep throughout the year. These employees will be utilized in the kitchen and compensated at $8.00 per hour. In July and August the forecast is to employ two additional part time people to serve as wait staff for $4.00 per hour plus tips.

The owners will share the cooking and management duties unless a competent cook can be found. the shortage of motivated personnel and higher than average employee turnover is predicted. That seems to be a fact of life in the restaurant business. The owners will employ a motivational plan, as well as various incentives to keep employees committed to "their" pub and restaurant. Training and performance evaluations will be an integral part of employee motivation. Moving employees towards "taking ownership" of their job, their responsibilities, and the business operation will be the primary goal.

BUYING AND STOCKING PLANS

Bellingham, Washington which is 60 miles west of Marble River has a number of restaurant equipment and supply companies. Items such as detergents, kitchen supplies, specialty food equipment, fresh produce, and food can be purchased there. Whenever possible we will purchase items locally. A large food service company called Sysco Food Services of Washington will be a primary supplier. They will come "right to the room." That company will be hard to beat price wise. They offer most everything that we will need. Repair items and specialty goods will be available in Bellingham.

We will search out local sources for our meats. Beef especially, is raised right in our area and we can't imagine the need to look elsewhere.

Our beer and wine products will be purchased from distributors in Bellingham. Franklin Beverage, Digby Distributing, Greely Brewing, Inc., and Mountainside Distributing Co. each will be evaluated as to price, selection, and quality.

Because we will be starting as a small operation we see our stocking inventory as easily manageable. We will inventory our goods at least twice monthly. This will help to discipline us, so that we can monitor our purchases carefully. This will reveal which items are used most frequently and which are slow moving. This info will also tell us about our customers tastes, seasonal changes, and other fluctuations that may lead to menu selection improvement or change. Accurate inventory control will also help us monitor our cost of sales.

Finally keeping a close accounting of our stock will allow us to order proper quantities at the most opportune times. This we feel will cut down on spoilage as well as tying up funds in excess inventory that is not needed.

FACILITY PLANS

The internal structure of the restaurant will be gutted when the building if first purchased. The remodeling will emphasize a personal relaxed atmosphere, rather than the current dining hall/drive-in effect. A bar will be installed that seats up to 12 people. The interior design coordination will be handled by the owners. Kitchen facilities will be substantially improved by changing the preparation, cooking and storage areas. Replacement of older and broken equipment, within cost constraints, will be undertaken. The remodeling will improve security and reduce maintenance. The process will be completed within six weeks. Parking will be evaluated once the restaurant is up and running. To keep costs manageable the owners will start out using the present parking facilities.

RISK ANALYSIS

The two major issues to be dealt with the first year or two in the life of Homesteaders' Pub & Grub are seasonal slowdowns and making ourselves known. Marketing, advertising, getting involved in the community, and time in the market will be the keys to both. The first problem will be the most difficult. Time in our location will be the key we feel. If we become very profitable during the busy season, we feel we'll be able to weather the slower times. If we can maintain a minimum level of profitability during the first two years as we build relationships with local clients, we will become a very successful year around operation. We will do very well during the busy season and well during the slower times. The experiences the owners have had with people during their lives have truly been, "build it, they will come." If you provide a "total package" that people want and enjoy you will be successful! We intend to be successful!

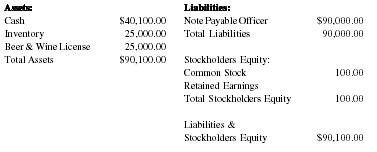

Projected Balance Sheet for Homesteaders' as of 9/30/97

| Assets: | Liabilities: | ||

| Cash | $40,100.00 | Note Payable Officer | $90,000.00 |

| Inventory | 25,000.00 | Total Liabilities | 90,000.00 |

| Beer & Wine License | 25,000.00 | ||

| Total Assets | $90,100.00 | Stockholders Equity: | |

| Common Stock | 100.00 | ||

| Retained Earnings | |||

| Total Stockholders Equity | 100.00 | ||

| Liabilities & Stockholders Equity | $90,100.00 |

Projected Balance Sheet for Homesteaders as of 12/31/97

| Assets: | Liabilities: | ||

| Cash | $37,796.47 | Note Payable Officer | $90,000.00 |

| Inventory | 25,000.00 | Total Liabilities | 90,000.00 |

| Beer & Wine License | 25,000.00 | ||

| Less Amortization | -125.00 | ||

| Total Assets | $87,671.47 | Stockholders Equity: | |

| Common Stock | 100.00 | ||

| Retained Earnings | -2428.53 | ||

| Total Stockholders Equity | -2328.53 | ||

| Liabilities & Stockholders Equity | $87,671.47 |

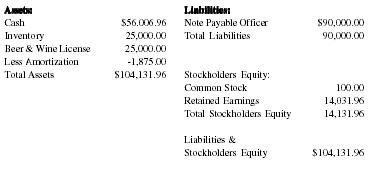

Projected Balance Sheet for Homesteaders' as of 12/31/98

| Assets: | Liabilities: | ||

| Cash | $56.006.96 | Note Payable Officer | $90,000.00 |

| Inventory | 25,000.00 | Total Liabilities | 90,000.00 |

| Beer & Wine License | 25,000.00 | ||

| Less Amortization | -1,875.00 | ||

| Total Assets | $104,131.96 | Stockholders Equity: | |

| Common Stock | 100.00 | ||

| Retained Earnings | 14,031.96 | ||

| Total Stockholders Equity | 14,131.96 | ||

| Liabilities & Stockholders Equity | $104,131.96 |

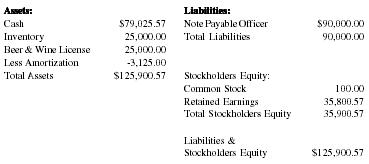

Projected Balance Sheet for Homesteaders' as of 12/31/99

| Assets: | Liabilities: | ||

| Cash | $79,025.57 | Note Payable Officer | $90,000.00 |

| Inventory | 25,000.00 | Total Liabilities | 90,000.00 |

| Beer & Wine License | 25,000.00 | ||

| Less Amortization | -3,125.00 | ||

| Total Assets | $125,900.57 | Stockholders Equity: | |

| Common Stock | 100.00 | ||

| Retained Earnings | 35,800.57 | ||

| Total Stockholders Equity | 35,900.57 | ||

| Liabilities & Stockholders Equity | $125,900.57 |

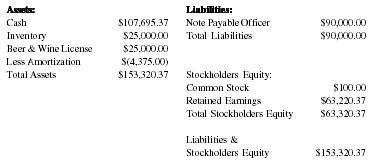

Projected Balance Sheet for Homesteaders' as of 12/31/2000

| Assets: | Liabilities: | ||

| Cash | $107,695.37 | Note Payable Officer | $90,000.00 |

| Inventory | $25,000.00 | Total Liabilities | $90,000.00 |

| Beer & Wine License | $25,000.00 | ||

| Less Amortization | $(4,375.00) | ||

| Total Assets | $153,320.37 | Stockholders Equity: | |

| Common Stock | $100.00 | ||

| Retained Earnings | $63,220.37 | ||

| Total Stockholders Equity | $63,320.37 | ||

| Liabilities & Stockholders Equity | $153,320.37 |

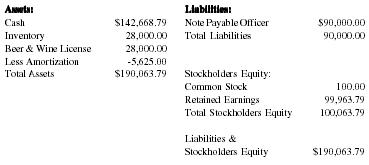

Projected Balance Sheet for Homesteaders' as of 12/31/2000

| Assets: | Liabilities: | ||

| Cash | $142,668.79 | Note Payable Officer | $90,000.00 |

| Inventory | 28,000.00 | Total Liabilities | 90,000.00 |

| Beer & Wine License | 28,000.00 | ||

| Less Amortization | -5,625.00 | ||

| Total Assets | $190,063.79 | Stockholders Equity: | |

| Common Stock | 100.00 | ||

| Retained Earnings | 99,963.79 | ||

| Total Stockholders Equity | 100,063.79 | ||

| Liabilities & Stockholders Equity | $190,063.79 |

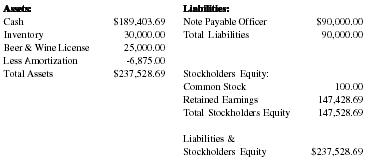

Projected Balance Sheet for Homesteaders' as of 12/31/2002

| Assets: | Liabilities: | ||

| Cash | $189,403.69 | Note Payable Officer | $90,000.00 |

| Inventory | 30,000.00 | Total Liabilities | 90,000.00 |

| Beer & Wine License | 25,000.00 | ||

| Less Amortization | -6,875.00 | ||

| Total Assets | $237,528.69 | Stockholders Equity: | |

| Common Stock | 100.00 | ||

| Retained Earnings | 147,428.69 | ||

| Total Stockholders Equity | 147,528.69 | ||

| Liabilities & Stockholders Equity | $237,528.69 |

Personal Balance Sheet as of 8/31/97

| Assets: | Liabilities: | ||

| Cash | $40,000.00 | Notes Payable: | |

| Vehicles | 13,000.00 | Insurance | $16,543.45 |

| Life Insurance | 12,951.00 | Vehicles | 10,461.88 |

| TSA'S | 100,386.00 | Other | 3,000.00 |

| Total Assets | $166,337.00 | Total Liabilities | $30,005.33 |

| Net Worth | 136331.67 | ||

| Total Liabilities & Net Worth | $166,337.00 |

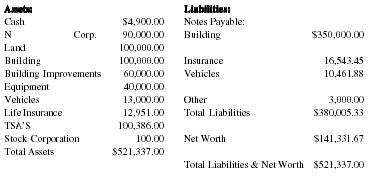

Projected Personal Balance Sheet as of 9/30/97

| Assets: | Liabilities: | ||

| Cash | $4,900.00 | Notes Payable: | |

| N Corp. | 90,000.00 | Building | $350,000.00 |

| Land | 100,000.00 | ||

| Building | 100,000.00 | Insurance | 16,543.45 |

| Building Improvements | 60,000.00 | Vehicles | 10,461.88 |

| Equipment | 40,000.00 | ||

| Vehicles | 13,000.00 | Other | 3,000.00 |

| Life Insurance | 12,951.00 | Total Liabilities | $380,005.33 |

| TSA'S | 100,386.00 | ||

| Stock Corporation | 100.00 | Net Worth | $141,331.67 |

| Total Assets | $521,337.00 | ||

| Total Liabilities & Net Worth | $521,337.00 |

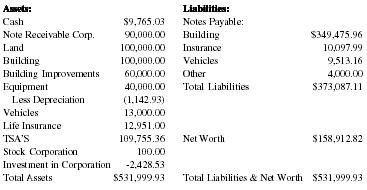

Projected Personal Balance Sheet as of 12/31/97

| Assets: | Liabilities: | ||

| Cash | $9,765.03 | Notes Payable: | |

| Note Receivable Corp. | 90,000.00 | Building | $349,475.96 |

| Land | 100,000.00 | Insurance | 10,097.99 |

| Building | 100,000.00 | Vehicles | 9,513.16 |

| Building Improvements | 60,000.00 | Other | 4,000.00 |

| Equipment | 40,000.00 | Total Liabilities | $373,087.11 |

| Less Depreciation | (1,142.93) | ||

| Vehicles | 13,000.00 | ||

| Life Insurance | 12,951.00 | ||

| TSA'S | 109,755.36 | Net Worth | $158,912.82 |

| Stock Corporation | 100.00 | ||

| Investment in Corporation | -2,428.53 | ||

| Total Assets | $531,999.93 | Total Liabilities & Net Worth | $531,999.93 |

Projected Personal Income Statement as of 12/31/97

| Income: | |

| Wages Corporation | 7,714.00 |

| Rent Income | 3,414.67 |

| Interest Payment | 666.67 |

| Total Income | 11,795.34 |

| Expenses: | |

| Interest Expense | |

| Building Loan | 2,625.00 |

| Insurance Loan | 0.00 |

| Vehicle | 948.71 |

| Depreciation | 1,142.83 |

| Total Expenses Before Taxes | 4,716.54 |

| Income (Loss) Before Taxes | 7,078.80 |

| Taxes | 2123.64 |

| Income (Loss) After Taxes | $4,955.16 |

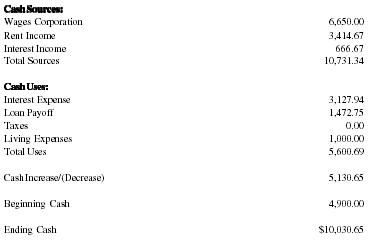

Projected Personal Cash Flow Statement 12/31/97

| Cash Sources: | |

| Wages Corporation | 6,650.00 |

| Rent Income | 3,414.67 |

| Interest Income | 666.67 |

| Total Sources | 10,731.34 |

| Cash Uses: | |

| Interest Expense | 3,127.94 |

| Loan Payoff | 1,472.75 |

| Taxes | 0.00 |

| Living Expenses | 1,000.00 |

| Total Uses | 5,600.69 |

| Cash Increase/(Decrease) | 5,130.65 |

| Beginning Cash | 4,900.00 |

| Ending Cash | $10,030.65 |

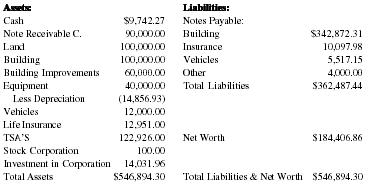

Projected Personal Balance Sheet as of 12/31/98

| Assets: | Liabilities: | ||

| Cash | $9,742.27 | Notes Payable: | |

| Note Receivable C. | 90,000.00 | Building | $342,872.31 |

| Land | 100,000.00 | Insurance | 10,097.98 |

| Building | 100,000.00 | Vehicles | 5,517.15 |

| Building Improvements | 60,000.00 | Other | 4,000.00 |

| Equipment | 40,000.00 | Total Liabilities | $362,487.44 |

| Less Depreciation | (14,856.93) | ||

| Vehicles | 12,000.00 | ||

| Life Insurance | 12,951.00 | ||

| TSA'S | 122,926.00 | Net Worth | $184,406.86 |

| Stock Corporation | 100.00 | ||

| Investment in Corporation | 14,031.96 | ||

| Total Assets | $546,894.30 | Total Liabilities & Net Worth | $546,894.30 |

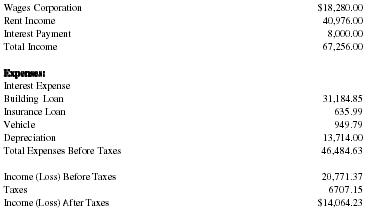

Projected Personal Income Statement as of 12/31/98

| Wages Corporation | $18,280.00 |

| Rent Income | 40,976.00 |

| Interest Payment | 8,000.00 |

| Total Income | 67,256.00 |

| Expenses: | |

| Interest Expense | |

| Building Loan | 31,184.85 |

| Insurance Loan | 635.99 |

| Vehicle | 949.79 |

| Depreciation | 13,714.00 |

| Total Expenses Before Taxes | 46,484.63 |

| Income (Loss) Before Taxes | 20,771.37 |

| Taxes | 6707.15 |

| Income (Loss) After Taxes | $14,064.23 |

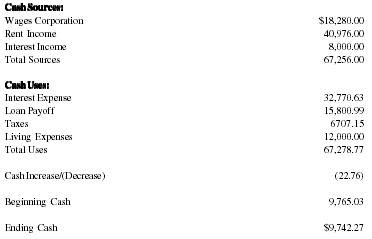

Projected Personal Cash Flow Statement as of 12/31/99

| Cash Sources: | |

| Wages Corporation | $18,280.00 |

| Rent Income | 40,976.00 |

| Interest Income | 8,000.00 |

| Total Sources | 67,256.00 |

| Cash Uses: | |

| Interest Expense | 32,770.63 |

| Loan Payoff | 15,800.99 |

| Taxes | 6707.15 |

| Living Expenses | 12,000.00 |

| Total Uses | 67,278.77 |

| Cash Increase/(Decrease) | (22.76) |

| Beginning Cash | 9,765.03 |

| Ending Cash | $9,742.27 |

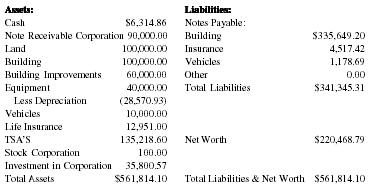

Projected Personal Balance Sheet as of 12/31/99

| Assets: | Liabilities: | ||

| Cash | $6,314.86 | Notes Payable: | |

| Note Receivable Corporation 90,000.00 | Building | $335,649.20 | |

| Land | 100,000.00 | Insurance | 4,517.42 |

| Building | 100,000.00 | Vehicles | 1,178.69 |

| Building Improvements | 60,000.00 | Other | 0.00 |

| Equipment | 40,000.00 | Total Liabilities | $341,345.31 |

| Less Depreciation | (28,570.93) | ||

| Vehicles | 10,000.00 | ||

| Life Insurance | 12,951.00 | ||

| TSA'S | 135,218.60 | Net Worth | $220,468.79 |

| Stock Corporation | 100.00 | ||

| Investment in Corporation | 35,800.57 | ||

| Total Assets | $561,814.10 | Total Liabilities & Net Worth | $561,814.10 |

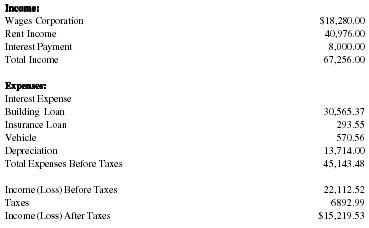

Projected Personal Income Statement as of 12/31/99

| Income: | |

| Wages Corporation | $18,280.00 |

| Rent Income | 40,976.00 |

| Interest Payment | 8,000.00 |

| Total Income | 67,256.00 |

| Expenses: | |

| Interest Expense | |

| Building Loan | 30,565.37 |

| Insurance Loan | 293.55 |

| Vehicle | 570.56 |

| Depreciation | 13,714.00 |

| Total Expenses Before Taxes | 45,143.48 |

| Income (Loss) Before Taxes | 22,112.52 |

| Taxes | 6892.99 |

| Income (Loss) After Taxes | $15,219.53 |

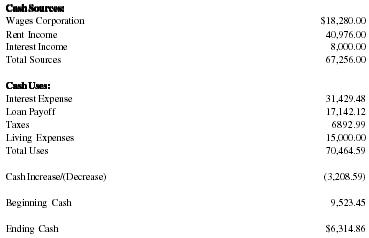

Projected Personal Cash Flow Statement as of 12/31/99

| Cash Sources: | |

| Wages Corporation | $18,280.00 |

| Rent Income | 40,976.00 |

| Interest Income | 8,000.00 |

| Total Sources | 67,256.00 |

| Cash Uses: | |

| Interest Expense | 31,429.48 |

| Loan Payoff | 17,142.12 |

| Taxes | 6892.99 |

| Living Expenses | 15,000.00 |

| Total Uses | 70,464.59 |

| Cash Increase/(Decrease) | (3,208.59) |

| Beginning Cash | 9,523.45 |

| Ending Cash | $6,314.86 |

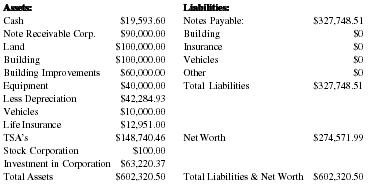

Personal Balance Sheet as of 12/31/2000

| Assets: | Liabilities: | ||

| Cash | $19,593.60 | Notes Payable: | $327,748.51 |

| Note Receivable Corp. | $90,000.00 | Building | $0 |

| Land | $100,000.00 | Insurance | $0 |

| Building | $100,000.00 | Vehicles | $0 |

| Building Improvements | $60,000.00 | Other | $0 |

| Equipment | $40,000.00 | Total Liabilities | $327,748.51 |

| Less Depreciation | $42,284.93 | ||

| Vehicles | $10,000.00 | ||

| Life Insurance | $12,951.00 | ||

| TSA's | $148,740.46 | Net Worth | $274,571.99 |

| Stock Corporation | $100.00 | ||

| Investment in Corporation | $63,220.37 | ||

| Total Assets | $602,320.50 | Total Liabilities & Net Worth | $602,320.50 |

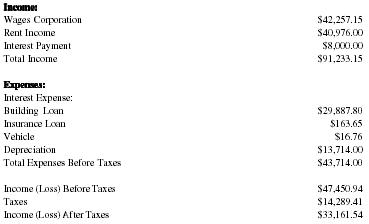

Projected Personal Income Statement as of 12/31/2000

| Income: | |

| Wages Corporation | $42,257.15 |

| Rent Income | $40,976.00 |

| Interest Payment | $8,000.00 |

| Total Income | $91,233.15 |

| Expenses: | |

| Interest Expense: | |

| Building Loan | $29,887.80 |

| Insurance Loan | $163.65 |

| Vehicle | $16.76 |

| Depreciation | $13,714.00 |

| Total Expenses Before Taxes | $43,714.00 |

| Income (Loss) Before Taxes | $47,450.94 |

| Taxes | $14,289.41 |

| Income (Loss) After Taxes | $33,161.54 |

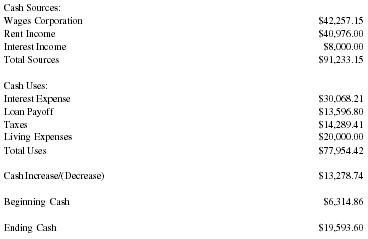

Projected Personal Cash Flow Statement as of 12/31/2000

| Cash Sources: | |

| Wages Corporation | $42,257.15 |

| Rent Income | $40,976.00 |

| Interest Income | $8,000.00 |

| Total Sources | $91,233.15 |

| Cash Uses: | |

| Interest Expense | $30,068.21 |

| Loan Payoff | $13,596.80 |

| Taxes | $14,289.41 |

| Living Expenses | $20,000.00 |

| Total Uses | $77,954.42 |

| Cash Increase/(Decrease) | $13,278.74 |

| Beginning Cash | $6,314.86 |

| Ending Cash | $19,593.60 |

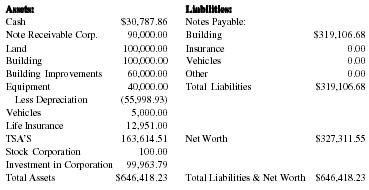

Projected Personal Balance Sheet as of 12/31/2001

| Assets: | Liabilities: | ||

| Cash | $30,787.86 | Notes Payable: | |

| Note Receivable Corp. | 90,000.00 | Building | $319,106.68 |

| Land | 100,000.00 | Insurance | 0.00 |

| Building | 100,000.00 | Vehicles | 0.00 |

| Building Improvements | 60,000.00 | Other | 0.00 |

| Equipment | 40,000.00 | Total Liabilities | $319,106.68 |

| Less Depreciation | (55,998.93) | ||

| Vehicles | 5,000.00 | ||

| Life Insurance | 12,951.00 | ||

| TSA'S | 163,614.51 | Net Worth | $327,311.55 |

| Stock Corporation | 100.00 | ||

| Investment in Corporation | 99,963.79 | ||

| Total Assets | $646,418.23 | Total Liabilities & Net Worth | $646,418.23 |

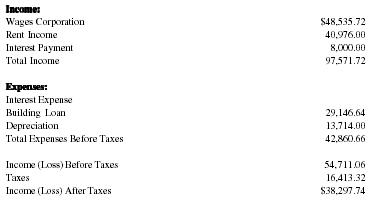

Projected Personal Income Statement as of 12/31/2001

| Income: | |

| Wages Corporation | $48,535.72 |

| Rent Income | 40,976.00 |

| Interest Payment | 8,000.00 |

| Total Income | 97,571.72 |

| Expenses: | |

| Interest Expense | |

| Building Loan | 29,146.64 |

| Depreciation | 13,714.00 |

| Total Expenses Before Taxes | 42,860.66 |

| Income (Loss) Before Taxes | 54,711.06 |

| Taxes | 16,413.32 |

| Income (Loss) After Taxes | $38,297.74 |

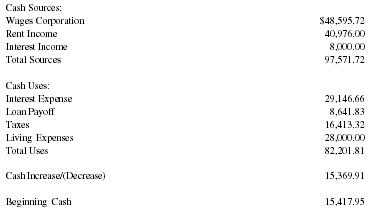

Projected Personal Cash Flow Statement as of 12/31/2001

| Cash Sources: | |

| Wages Corporation | $48,595.72 |

| Rent Income | 40,976.00 |

| Interest Income | 8,000.00 |

| Total Sources | 97,571.72 |

| Cash Uses: | |

| Interest Expense | 29,146.66 |

| Loan Payoff | 8,641.83 |

| Taxes | 16,413.32 |

| Living Expenses | 28,000.00 |

| Total Uses | 82,201.81 |

| Cash Increase/(Decrease) | 15,369.91 |

| Beginning Cash | 15,417.95 |

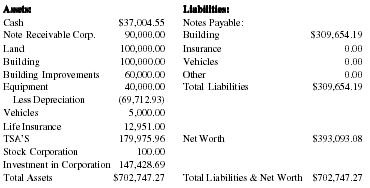

Projected Personal Balance Sheet as of 12/31/2002

| Assets: | Liabilities: | ||

| Cash | $37,004.55 | Notes Payable: | |

| Note Receivable Corp. | 90,000.00 | Building | $309,654.19 |

| Land | 100,000.00 | Insurance | 0.00 |

| Building | 100,000.00 | Vehicles | 0.00 |

| Building Improvements | 60,000.00 | Other | 0.00 |

| Equipment | 40,000.00 | Total Liabilities | $309,654.19 |

| Less Depreciation | (69,712.93) | ||

| Vehicles | 5,000.00 | ||

| Life Insurance | 12,951.00 | ||

| TSA'S | 179,975.96 | Net Worth | $393,093.08 |

| Stock Corporation | 100.00 | ||

| Investment in Corporation | 147,428.69 | ||

| Total Assets | $702,747.27 | Total Liabilities & Net Worth | $702,747.27 |

Projected Personal Income Statement as of 12/31/2000

| Income: | |

| Wages Corporation | $55,885.08 |

| Rent Income | 40,976.00 |

| Interest Payment | 8,000.00 |

| Total Income | 104,861.08 |

| Expenses: | |

| Interest Expense | |

| Building Loan | 28,336.00 |

| Depreciation | 13,714.00 |

| Total Expenses Before Taxes | 42,050.00 |

| Income (Loss) Before Taxes | 62,811.08 |

| Taxes | 18,843.32 |

| Income (Loss) After Taxes | $43,967.75 |

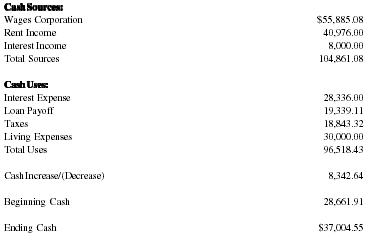

Projected Personal Cash Flow Statement as of 12/31/2002

| Cash Sources: | |

| Wages Corporation | $55,885.08 |

| Rent Income | 40,976.00 |

| Interest Income | 8,000.00 |

| Total Sources | 104,861.08 |

| Cash Uses: | |

| Interest Expense | 28,336.00 |

| Loan Payoff | 19,339.11 |

| Taxes | 18,843.32 |

| Living Expenses | 30,000.00 |

| Total Uses | 96,518.43 |

| Cash Increase/(Decrease) | 8,342.64 |

| Beginning Cash | 28,661.91 |

| Ending Cash | $37,004.55 |

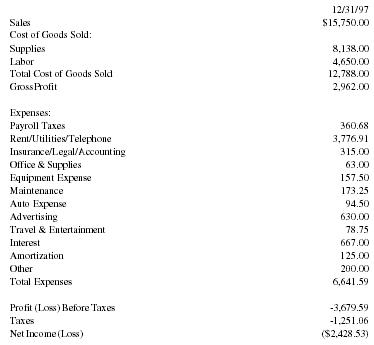

Projected Monthly Income Statement as of 12/31/97

| 12/31/97 | |

| Sales | $15,750.00 |

| Cost of Goods Sold: | |

| Supplies | 8,138.00 |

| Labor | 4,650.00 |

| Total Cost of Goods Sold | 12,788.00 |

| Gross Profit | 2,962.00 |

| Expenses: | |

| Payroll Taxes | 360.68 |

| Rent/Utilities/Telephone | 3,776.91 |

| Insurance/Legal/Accounting | 315.00 |

| Office & Supplies | 63.00 |

| Equipment Expense | 157.50 |

| Maintenance | 173.25 |

| Auto Expense | 94.50 |

| Advertising | 630.00 |

| Travel & Entertainment | 78.75 |

| Interest | 667.00 |

| Amortization | 125.00 |

| Other | 200.00 |

| Total Expenses | 6,641.59 |

| Profit (Loss) Before Taxes | -3,679.59 |

| Taxes | -1,251.06 |

| Net Income (Loss) | ($2,428.53) |

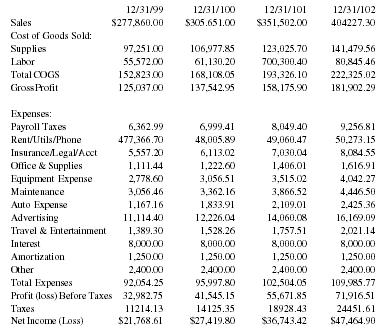

Projected Income Statements for Homesteaders' for Years' Ending...

| 12/31/99 | 12/31/100 | 12/31/101 | 12/31/102 | |

| Sales | $277,860.00 | $305.651.00 | $351,502.00 | 404227.30 |

| Cost of Goods Sold: | ||||

| Supplies | 97,251.00 | 106,977.85 | 123,025.70 | 141,479.56 |

| Labor | 55,572.00 | 61,130.20 | 700,300.40 | 80,845.46 |

| Total COGS | 152,823.00 | 168,108.05 | 193,326.10 | 222,325.02 |

| Gross Profit | 125,037.00 | 137,542.95 | 158,175.90 | 181,902.29 |

| Expenses: | ||||

| Payroll Taxes | 6,362.99 | 6,999.41 | 8,049.40 | 9,256.81 |

| Rent/Utils/Phone | 477,366.70 | 48,005.89 | 49,060.47 | 50,273.15 |

| Insurance/Legal/Acct | 5,557.20 | 6,113.02 | 7,030.04 | 8,084.55 |

| Office & Supplies | 1,111.44 | 1,222.60 | 1,406.01 | 1,616.91 |

| Equipment Expense | 2,778.60 | 3,056.51 | 3,515.02 | 4,042.27 |

| Maintenance | 3,056.46 | 3,362.16 | 3,866.52 | 4,446.50 |

| Auto Expense | 1,167.16 | 1,833.91 | 2,109.01 | 2,425.36 |

| Advertising | 11,114.40 | 12,226.04 | 14,060.08 | 16,169.09 |

| Travel & Entertainment | 1,389.30 | 1,528.26 | 1,757.51 | 2,021.14 |

| Interest | 8,000.00 | 8,000.00 | 8,000.00 | 8,000.00 |

| Amortization | 1,250.00 | 1,250.00 | 1,250.00 | 1,250.00 |

| Other | 2,400.00 | 2,400.00 | 2,400.00 | 2,400.00 |

| Total Expenses | 92,054.25 | 95,997.80 | 102,504.05 | 109,985.77 |

| Profit (loss) Before Taxes | 32,982.75 | 41,545.15 | 55,671.85 | 71,916.51 |

| Taxes | 11214.13 | 14125.35 | 18928.43 | 24451.61 |

| Net Income (Loss) | $21,768.61 | $27,419.80 | $36,743.42 | $47,464.90 |

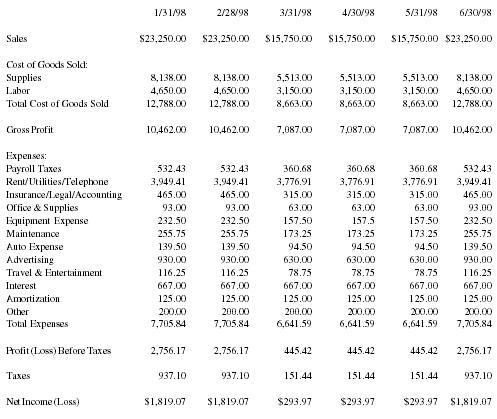

Projected Monthly Income Statements for Homesteaders' for Twelve Months Ending 12/31/98

| 1/31/98 | 2/28/98 | 3/31/98 | 4/30/98 | 5/31/98 | 6/30/98 | |

| Sales | $23,250.00 | $23,250.00 | $15,750.00 | $15,750.00 | $15,750.00 | $23,250.00 |

| Cost of Goods Sold: | ||||||

| Supplies | 8,138.00 | 8,138.00 | 5,513.00 | 5,513.00 | 5,513.00 | 8,138.00 |

| Labor | 4,650.00 | 4,650.00 | 3,150.00 | 3,150.00 | 3,150.00 | 4,650.00 |

| Total Cost of Goods Sold | 12,788.00 | 12,788.00 | 8,663.00 | 8,663.00 | 8,663.00 | 12,788.00 |

| Gross Profit | 10,462.00 | 10,462.00 | 7,087.00 | 7,087.00 | 7,087.00 | 10,462.00 |

| Expenses: | ||||||

| Payroll Taxes | 532.43 | 532.43 | 360.68 | 360.68 | 360.68 | 532.43 |

| Rent/Utilities/Telephone | 3,949.41 | 3,949.41 | 3,776.91 | 3,776.91 | 3,776.91 | 3,949.41 |

| Insurance/Legal/Accounting | 465.00 | 465.00 | 315.00 | 315.00 | 315.00 | 465.00 |

| Office & Supplies | 93.00 | 93.00 | 63.00 | 63.00 | 63.00 | 93.00 |

| Equipment Expense | 232.50 | 232.50 | 157.50 | 157.5 | 157.50 | 232.50 |

| Maintenance | 255.75 | 255.75 | 173.25 | 173.25 | 173.25 | 255.75 |

| Auto Expense | 139.50 | 139.50 | 94.50 | 94.50 | 94.50 | 139.50 |

| Advertising | 930.00 | 930.00 | 630.00 | 630.00 | 630.00 | 930.00 |

| Travel & Entertainment | 116.25 | 116.25 | 78.75 | 78.75 | 78.75 | 116.25 |

| Interest | 667.00 | 667.00 | 667.00 | 667.00 | 667.00 | 667.00 |

| Amortization | 125.00 | 125.00 | 125.00 | 125.00 | 125.00 | 125.00 |

| Other | 200.00 | 200.00 | 200.00 | 200.00 | 200.00 | 200.00 |

| Total Expenses | 7,705.84 | 7,705.84 | 6,641.59 | 6,641.59 | 6,641.59 | 7,705.84 |

| Profit (Loss) Before Taxes | 2,756.17 | 2,756.17 | 445.42 | 445.42 | 445.42 | 2,756.17 |

| Taxes | 937.10 | 937.10 | 151.44 | 151.44 | 151.44 | 937.10 |

| Net Income (Loss) | $1,819.07 | $1,819.07 | $293.97 | $293.97 | $293.97 | $1,819.07 |

| 7/31/98 | 8/31/98 | 9/30/98 | 10/31/98 | 11/30/98 | 12/31/98 | TOTAL |

| $32,550.00 | $32,550.00 | $15,750.00 | $15,750.00 | $15,750.00 | $23,250.00 | $252,600.00 |

| 11,393.00 | 11,393.00 | 5,513.00 | 5,513.00 | 5,513.00 | 8,138.00 | 88,416.00 |

| 6,510.00 | 6,510.00 | 3,150.00 | 3,150.00 | 3,150.00 | 4,650.00 | 50,520.00 |

| 17,903.00 | 17,903.00 | 8663 | 8,663.00 | 8,663.00 | 12,788.00 | 138,936.00 |

| 14,647.00 | 14,647.00 | 7,087.00 | 7,087.00 | 7,087.00 | 10,462.00 | 113,664.00 |

| 745.40 | 745.40 | 360.68 | 360.68 | 360.68 | 532.43 | 5,784.54 |

| 4,163.31 | 4,163.31 | 3,776.91 | 3,776.91 | 3,776.91 | 3,949.41 | 46,785.72 |

| 651.00 | 651.00 | 315.00 | 315.00 | 315.00 | 465.00 | 5,052.00 |

| 130.20 | 130.20 | 63.00 | 63.00 | 63.00 | 93.00 | 1,010.40 |

| 325.50 | 325.50 | 157.50 | 157.50 | 157.50 | 232.50 | 2,526.00 |

| 358.05 | 358.05 | 173.25 | 173.25 | 173.25 | 255.75 | 2,778.60 |

| 195.30 | 195.30 | 94.50 | 94.50 | 94.50 | 139.50 | 1,515.60 |

| 1,302.00 | 1,302.00 | 630.00 | 630.00 | 630.00 | 930.00 | 10,104.00 |

| 162.75 | 162.75 | 78.75 | 78.75 | 78.75 | 116.25 | 1,263.00 |

| 667.00 | 667.00 | 667.00 | 667.00 | 667.00 | 667.00 | 8,004.00 |

| 125.00 | 125.00 | 125.00 | 125.00 | 125.00 | 125.00 | 1,500.00 |

| 200.00 | 200.00 | 200.00 | 200.00 | 200.00 | 200.00 | 2,400.00 |

| 9,025.51 | 9,025.51 | 6,641.59 | 6,641.59 | 6,641.59 | 7,705.84 | 88,723.86 |

| 5,621.50 | 5,621.50 | 445.42 | 445.42 | 445.42 | 8,156.17 | 24,940.14 |

| 1,911.31 | 1,911.31 | 151.44 | 151.44 | 151.44 | 937.10 | 8,479.65 |

| $3,710.19 | $293.97 | $293.97 | $293.97 | $293.97 | $1,819.07 | $16,460.49 |

Comment about this article, ask questions, or add new information about this topic: