Real Estate Investment Company

BUSINESS PLAN

WOLFE PARTNERS

45001 Washington Blvd.

Jefferson City, MO 65101

This business plan emphasizes the entrepreneur's experience, knowledge, and savvy, as well as the symbiotic philosophy of the business. The requirements for successful real estate investing are clearly explored and a concise response to each concern gives the plan its authority. Notice how the cautious short-term goals are tempered with the ambi tious outlook.

- BUSINESS GOALS

- DEVELOPING KNOWLEDGE OF MARKETPLACE

- BUSINESS OPERATIONS

- TIMELINE

BUSINESS GOALS

Mission

Wolfe Partners has been a family-owned business for more than 10 years. Its principle, Ron Wolfe, is a licensed builder in the state of Missouri and has been working in the construction industry for more than 25 years. Wolfe Partners, L.L.C. is now being established to make the business a full-time venture and to include real property investing, primarily single-family homes, into our strategy. Mr. Wolfe also has over 20 years experience in corporate operations, ranging from a Mechanical Engineer, upon college graduation, to his most recent position as an executive in a Fortune 100 information technology company, managing a $13 million business unit with 120 employees.

Our mission is to create investment income through the purchasing and reselling of distressed homes. A targeted 100% profitability will be generated by performing cosmetic or functional improvements to single-family homes. These renovations will significantly increase the value of the property and make it available for sale to a focused customer marketplace.

Short-Term Goals

The first year of Wolfe Partners will be spent expanding our building opportunities. The company will strive to create and maintain an image and reputation in the industry as an honest, cooperative, and creative enterprise, characterized by ethics, fair play, and win-win results. Our operations will be noted for our high technology processes that will utilize state-of-theart information and management systems. In order to ensure success, Wolfe Partners will focus on the development of strong partnerships with key real property professionals, i.e., sales brokers/agents, financial institutions, law firms, building trade contractors, real estate service firms, and others.

During this period we will purchase, renovate, and sell approximately one home per month for a total of nine units in 1999. Also during this period one home will be selected, based on its financial performance quality, as a rental unit to be held. This will be the beginning of our long-term investment strategy around rental income properties, and the developing of our expertise in property management.

Long-Term Goals

During the year 2000, Wolfe Partners will become a full-time enterprise. During 2000 and each year thereafter, 2 homes per month will be purchased and renovated. This will allow for one house per month to be kept in the rental income property portfolio, while the second unit is sold to continue the cash income stream. Holding to this strategy over a seven-year period will yield a portfolio of 85 investment units each returning an average $2,000 positive cashflow per year for a total annual income of $170,000, and annual asset appreciation of 5%. Also during this seven-year period, more than 80 homes would have been sold for an average $15,000 profit each for a total of more than $1.3 million cash income. At an average investment of $10,000 per unit, a 100% to 150% profit margin is expected.

Ownership & Employees

Wolfe Partners, L.L.C. is intended to be a highly leveraged organization with only one employee, that being the principle and sole owner, Ron Wolfe. All tasks to be performed on behalf of the enterprise, that cannot be done by the employee, will be hired contract services.

DEVELOPING KNOWLEDGE OF THE MARKETPLACE

Target Neighborhoods

Wolfe Partners will operate in the southeast corridor of Mixci County. This area will include the communities of Birmingham, Jones, Royal, and Rickston. This area was chosen because of its significant population of homes in our target price range of $80,000 to $100,000 and because of the recent popularity of this area by our target customer base of young, first-time, or first-upgrade homebuyers. Also, we have significant familiarity with those neighborhoods after living in the area for more than 16 years.

Selecting Properties

Wolfe Partners has developed a strategy around the purchase of homes in the $80,000 to $100,000 price range. This price represents homes on the lower end of home values in the targeted neighborhoods. A price differential of at least $30,000 between our purchase price and typical sales prices is necessary for each purchase. This will allow us to absorb a renovation and acquisition expense of approximately $10,000 to $15,000 and still net $15,000 to $20,000 profit from each deal.

In order to appeal to the widest audience of homebuyers, these homes will be at least 3 bedrooms, located on side streets close to schools, and inclusive of certain amenities which are desired by young, professional families.

Locating Flexible/Desperate Sellers

The target neighborhoods are also well populated with sellers that are significantly motivated to be creative in the sale of their property. This "distressed" seller situation can be created for several reasons. The owner may be having trouble selling the property, or may be forced to move quickly to satisfy some pressing personal issue. We will attempt to locate sellers that fit one or more of the following profiles: divorce, estate sales, unemployment, property in disrepair, job transfer, property management problems, absentee ownership, investor washout, tenant problems, retirement, or any other emotional dissatisfaction with the property. It is anticipated that these homeowners will be willing to negotiate on price, terms, or possibly both.

Working with Real Estate Professionals

To be successful in real estate investing, a strong partnership must be built with many service providers that have an intimate knowledge of the neighborhoods we have selected. This list of business contacts includes but is not limited to real estate brokers/agents, chamber of commerce, local investment clubs, financial institutions, utility company repair personnel, title insurance companies, local government personnel, and others.

BUSINESS OPERATIONS

Target Customer

According to recent demographic studies, more than 30% of the U.S. population will be in the age group of 25-44 by the year 2000. In addition, work force studies indicate that the number of trained professionals for most industry categories is inadequate to meet business growth demands and attrition rates. Therefore not only is there a large population of homebuyers in this age bracket, but their long-term employability, and thus their ability to make house payments, is quite favorable. With these trends in mind, our target customer is a young, professional, dual-income family. These buyers will have good credit and income potential, but may not have significant cash reserves. Our approach to these buyers, therefore, will be to get them into our houses with creative solutions to their cash shortage problems.

Establishing a Buyer Profile

Several strategies will be employed to publicize the name of Wolfe Partners and its attempt to be a frequent buyer of distressed real estate. A professional public relations firm was hired to develop a corporate image and identity system which will be incorporated into every correspondence for the business, including business cards, stationery, flyers, postcards, signage, and all other advertising. Once a reputation has been built for the business, it is anticipated that much of the purchase volume will be a result of word-of-mouth advertising. It will be important to these types of transactions to have cash on hand to move quickly when opportunities present themselves.

To endear the business to the real estate broker community, a commitment was made to work with specific firms to conduct all transactions for their areas. In exchange for that commitment, a real estate investor account has been established and preferential commission rates negotiated with these firms.

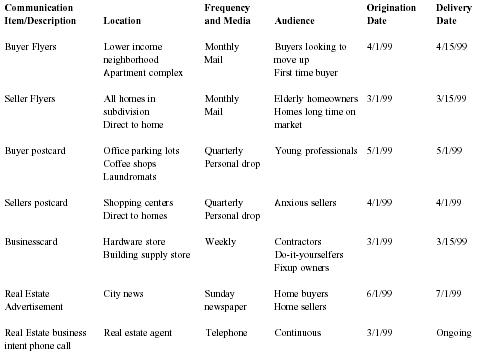

Communication Plan

To announce the newly established operations of Wolfe Partners, and to further our penetration into the real estate investment process, we will advertise our approach through several media. This includes newspaper advertisements for buying and selling homes, personal contact with real estate agents and building trade contractors, flyers placed on vehicles in parking lots and in mailboxes of homes needing improvement, and by driving through neighborhoods to talk to residents. We will also begin networking with people at businesses and functions involved in real estate investing, for example, county courthouses, bank real estate foreclosure offices, investment clubs, neighborhood association meetings, etc. The following communication plan outlines how Wolfe Partners will begin to inform the community of our business process.

Buying Properties

Working with Home Sellers

A significant amount of time and vehicle mileage can be spent in the pursuit of good home deals. In order to minimize this expense, a rigorous process has been developed to qualify properties for their investment potential, and sellers for their flexibility and compatibility. The process includes two components: a telephone screening script and a property analysis form.

It will be imperative during this process that we establish a rapport with the seller to create comfort with one another, a win-win environment, and an opportunity to drive to closure on the business transaction. The property analysis form is used throughout the process by first recording any information that is contained in the advertisement, so as not to waste the seller's time, except to clarify understanding. During the following phone screening, the form is used to record additional data that is pertinent to our investment strategy. Then, in the event a visit to the property is warranted, the form would be completed during the property inspection.

| Communication Item/Description | Location | Frequency and Media | Audience | Origination Date | Delivery Date |

| Buyer Flyers | Lower income neighborhood | Monthly | Buyers looking to move up | 4/1/99 | 4/15/99 |

| Apartment complex | First time buyer | ||||

| Seller Flyers | All homes in subdivision | Monthly | Elderly homeowners | 3/1/99 | 3/15/99 |

| Direct to home | Homes long time on market | ||||

| Buyer postcard | Office parking lots | Quarterly | Young professionals | 5/1/99 | 5/1/99 |

| Coffee shops | Personal drop | ||||

| Laundromats | |||||

| Sellers postcard | Shopping centers | Quarterly | Anxious sellers | 4/1/99 | 4/1/99 |

| Direct to homes | Personal drop | ||||

| Businesscard | Hardware store | Weekly | Contractors | 3/1/99 | 3/15/99 |

| Building supply store | Do-it-yourselfers | ||||

| Fixup owners | |||||

| Real Estate | City news | Sunday | Home buyers | 6/1/99 | 7/1/99 |

| Advertisement | newspaper | Home sellers | |||

| Real Estate business | Real estate agent | Telephone | Continuous | 3/1/99 | Ongoing |

| intent phone call |

The telephone screening script was developed to provide a consistent way to build this rapport, in a nonoffensive manner, to obtain the information needed to make our buying decisions. The phone screening is intended to be very conversational and informal. The conversation includes questions about the following topics:

- May I ask your name? Could you please tell me about your home?

- What is size, square footage, lot size, garage?

- How many rooms, what configuration, bathroom layouts?

- What special features or amenities, appliances?

- What is existing financing, mortgage type, terms, interest, payments, assumability?

- Are you current on all payments to banks, contractors, taxes (liens)?

- Are you willing to assist in the financing?

- How much cash is needed at close? Can the down payment be spread out?

- What is the asking price? How long on the market?

- How long have you been there? Why are you selling?

- What do you like most/least about the property?

- Are there any renters in the neighborhood and what are they paying for rent?

It is anticipated that in order to find a home that meets our investment criterion, we will have to call on approximately 25 advertised listings. Of these, only approximately 5 will justify a property visit, yielding 2 or 3 offers, and 1 purchase.

Performing Appraisals

A database is currently under construction to capture and report the sale price of all homes in our targeted neighborhoods for the past 12 months. The data for this appraisal tool is available from 3 sources and is being used to build a profile of potential market value and budget for renovation investments. The data sources include: property sold listing books available through real estate brokers that subscribe to the MLS (Multi Listing Service). This listing is created monthly and is only available to licensed real estate professionals (or people they choose to share it with). The second source is available on the Internet, online at the Detroit News web site of Sunday's "Real Estate Sold in Your Area" section of the newspaper. The listing from each Sunday paper is downloaded and scanned into our computer into the appropriate city section of our database. The third source of homes sold in the area is the county courthouse and/or Mixci County Legal News paper, under "property ownership transfers." This database is a critical tool in our efforts to properly estimate the value of a home and determine the up side and down side potential of our transactions.

Financial Analysis

Each property to be purchased will go through an extensive financial analysis in a spreadsheet that has been created for this purpose. This analysis will provide the decisionmaking data to determine the appraisal value, appropriate purchase price, detailed estimates of potential renovation, acquisition costs, and potential sale price as well as anticipated profitability.

Creative Financing Techniques

One of the most difficult and critical components of our purchase strategy is the elimination or minimizing of the down payment required to obtain the property. Quite often, the down payment represents a significant portion of the out-of-pocket investment, which is used to calculate the overall rate of return of the transaction. That is, the less money invested to turn the property, the higher the rate of return on the purchase. Several strategies will be employed to take advantage of money that is available from traditional, as well as slightly more obscure sources of funding.

The following sources represent opportunities to purchase property with lower initial costs:

- The seller—quite often a seller will finance some portion if not all of the purchase transactions, especially if the interest rate is attractive and the term is short

- Equity in other homes or vacant land can be used as down payments or collateral for future payments

- Land contracts or private mortgages on other properties can be discounted and sold for cash; Wolfe Partners professional skills and services could be used as "sweat equity"

- Real estate brokers will sometimes take their commissions on a note or as an account receivable

- Investors could be used when larger amounts or quick cash is needed

- Tenants of rental properties could be enticed to convert their lease to a lease with option and apply some money down at the time of lease creation

- Existing loans on the property can sometimes be cashed out or leveraged

- Conventional institutional lenders

Banks and savings and loan institutions will typically be considered as a last resort. This is due to their high closing costs and long delays in processing mortgages. When a seller is not in a hurry to close, and the property will carry the added costs, conventional mortgages might be an option, especially in the current low interest market.

Renovation Process

The investment strategy for Wolfe Partners includes a renovation for every property purchased. Obviously, homes that can be purchased well below market value with very little repair required are optimum investments, but difficult to find. It is anticipated that every home will require at least cosmetic improvements to bring the home up to maximum value and allow it to be sold quickly.

To perform these renovations, Wolfe Partners will enlist the help of building trade contractors to perform each of the tasks needed. Wolfe Partners will act as the general contractor and manage each rehab according to rigorous project management and timeline processes. Once we reach our goal of two houses per month, the volume of work should keep a consistent crew of quality contractors busy nearly full-time. Each project is expected to be completed over a 4-6 week period, depending on the complexity of the renovation.

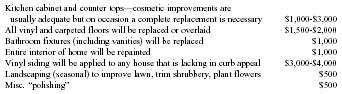

During the last several years, extensive research into home resale value and consumer buying habits has yielded six specific cosmetic home improvements that significantly increase the desirability of a home. These tasks can become more difficult and costly in homes of severe disrepair, but the costs are usually more than accounted for in a lower purchase price. The six tasks and corresponding estimated costs for a typical 1,200-1,400 square-foot home are:

| Kitchen cabinet and counter tops—cosmetic improvements are usually adequate but on occasion a complete replacement is necessary | $1,000-$3,000 |

| All vinyl and carpeted floors will be replaced or overlaid | $1,500-$2,000 |

| Bathroom fixtures (including vanities) will be replaced | $1,000 |

| Entire interior of home will be repainted | $1,000 |

| Vinyl siding will be applied to any house that is lacking in curb appeal | $3,000-$4,000 |

| Landscaping (seasonal) to improve lawn, trim shrubbery, plant flowers | $500 |

| Misc. "polishing" | $500 |

Again, each house will be evaluated on its own merits but the renovation costs are expected to range from $8,500-$12,000. Any property purchased at $25,000-$30,000 below the market value of the neighborhood, will provide sufficient differential to achieve our 100% return on investment in a 2-3 month period.

The Wolfe Partners renovation process model assumes that the above 6 tasks represent the entire work to be done on the property. This assumption will be validated prior to purchase, due to a thorough inspection of the home to ensure mechanical and structural integrity. On occasion, however, a home will be available that represents a larger purchase—resale differential opportunity, but requires structural or other major remodeling expenses. These could be homes that are in terrible disrepair, natural disaster damage, or simply a small ranch home that is surrounded by larger colonial style homes in an affluent neighborhood. These cases do not meet our typical investment strategy, but could be considered, depending on the money needed and the longer time that the money will be tied up during the completion of the project.

Selling Properties

Once the homes have been renovated, they will be placed back on the market through the traditional real estate sales process, with our chosen broker partner. The terms that will be offered to prospective buyers, however, will be equally as creative as our purchase techniques. Since our target market is young professionals that have good earning potential but probably not much of a down payment, we expect to offer assistance with portions of their closing costs, and/or down payment, in order to make it easier for them to get into the home. The actual sale price of the home could be negotiated up as well if the buyer wanted to add some amenity to the home to suit their lifestyle, for example, central air, garage, appliances, furniture, or any other capital expenditure that they wanted to roll into the loan. The sales contract itself could be structured any way that works best for the buyer, as long as we can obtain our initial cash investment back out of the property at close.

Cash Out

It is expected that with the current low interest rates, most buyers will choose conventional bank financing to purchase the home. This works out well for all parties and provides us the money to immediately reinvest in another property.

Wrap Around Financing

In the event we were able to obtain favorable financing at the time the property was purchased, and the buyer has enough down payment to return our initial cash investment, a wrap around financing plan may be possible. In this scenario, Wolfe Partners would have assumed an FHA, VA, private mortgage, or contract for deed (land contract) for the majority of the original purchase price. We could then write a private mortgage or contract for deed for the new equity basis above the old loan, for the buyer. The buyer makes payments to Wolfe Partners for a mortgage on the full market price (minus down payment), and we in turn make payments on the underlying loan. The underlying financing amortizes faster than the wrap around financing, creating an increasing equity position with each payment. When the underlying loan is paid in full, the entire monthly payment from the wrap financing is profit on the equity.

Lease with Option

If a buyer is a good credit risk, but just does not have enough cash or the desire to buy, we could sell the property to them on a lease with option contract. In this arrangement, we and the buyer would agree upon a sale price, usually 10%-15% higher than current market, at a date 2-3 years in the future. The buyer would put some money down as earnest money to ensure the contract will be met. They will also get a credit of some portion of the monthly rent, which is accumulated with the earnest money to be used as the purchase down payment at the end of the contract period. This situation also works out well for the seller if we don't have much cash invested in the property or don't need it right away. We will usually get a much higher quality renter that will take better care of the property, invest their own money in improvements, be more diligent in their monthly payments to avoid forfeit of the contract, as well as gain the tax benefits of rental properties during the option period.

Rental Properties

As previously mentioned, careful attention will be made during the purchase process to locate properties that could be entered into our long-term investment portfolio of rental homes. To meet our standards for inclusion in the rental portfolio the property must pass three performance measures. First, we must be able to buy and prepare the home with very little cash outlay. Second, the home must be located in a desirable area that will ensure better than average appreciation, which we define as twice the inflation rate. Thirdly, and most importantly, the loan structure, maintenance costs, operational expenses and income stream must be favorable to net a positive cash flow of at least $2,000 per year. Since our intention is to hold these houses in our portfolio for 7-8 years, the combination of appreciation and cash flow will yield an estimated 20% return on our investment over this period. In addition, all properties in the portfolio will be managed by a professional property management firm, which is included in the operational expense.

Building Speculation Homes

During the course of normal property buy/fixup/sell processes, it is expected that Wolfe Partners will occasionally obtain ownership of vacant land that is traded as part of a transaction or split off from a larger parcel. As a secondary source of income, and an opportunity to add diversity to our enterprise, we will use our expertise as a licensed builder to develop a piece of property from the ground up. Since these ventures are very capital intensive and time consuming, it is anticipated that we would only build approximately one house per year. Since the property will probably be held free and clear, and the construction crews would be the same contract labor companies that provide us with good rates on renovations, it is expected that a $150,000 property could be completed for under $100,000 and net a $50,000 profit on each deal.

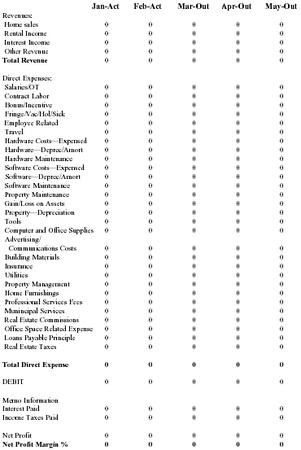

Managing the Business

As a hybrid home construction and real estate investing firm with a high technology flair, Wolfe Partners will be managed much differently than traditional construction or small investment companies. Utilizing our significant expertise in information systems, financial controls, and project management, Wolfe Partners will be a very tightly managed enterprise. In addition to the individual property financial analysis process mentioned earlier, a corporate financial control and reporting system has been developed for the business as a whole. Meticulous recordkeeping and continuous transaction monitoring will be accompanied each month by a profit and loss statement that would be used to track the performance of the company for all parties involved.

Quarterly revenue and expense outlooks will be performed and, each month, actual results will be compared to the outlooks to monitor performance and make adjustments as necessary in daily operations to achieve the desired corporate profit attainment. A sample of the profit and loss statement is contained on the following page.

Timeline

Wolfe Partners, L.L.C. was officially formed on March 5, 1999. The month of March has been, and will continue to be, a period of organization and preparation with our first "official" home purchase expected in April. Following the timeline identified throughout this document, we would expect to purchase another home in May and turn the first home during the later half of May or early June. Another home would be purchased in June and one each month thereafter through the end of 1999, at which time we will ramp up to our fully operational level of 2 houses per month.

FINANCIAL INFORMATION

Wolfe Partners, L.L.C. - Financial Information Monthly Profit & Loss Statement U.S. Dollars

| Prepared by: | Ron Wolfe |

| Date: | 12/25/98 |

| Report Sector: | Consolidated |

| Rate Tables: | Personal Income |

| Report Time: | 04:49 pm |

| Report Basis: | Calendar Year 1999 |

| Reporting Period: | Month 1 thru 12 |

| Jan-Act | Feb-Act | Mar-Out | Apr-Out | May-Out | |

| Revenues: | |||||

| Home sales | 0 | 0 | 0 | 0 | 0 |

| Rental Income | 0 | 0 | 0 | 0 | 0 |

| Interest Income | 0 | 0 | 0 | 0 | 0 |

| Other Revenue | 0 | 0 | 0 | 0 | 0 |

| Total Revenue | 0 | 0 | 0 | 0 | 0 |

| Direct Expenses: | |||||

| Salaries/OT | 0 | 0 | 0 | 0 | 0 |

| Contract Labor | 0 | 0 | 0 | 0 | 0 |

| Bonus/Incentive | 0 | 0 | 0 | 0 | 0 |

| Fringe/Vac/Hol/Sick | 0 | 0 | 0 | 0 | 0 |

| Employee Related | 0 | 0 | 0 | 0 | 0 |

| Travel | 0 | 0 | 0 | 0 | 0 |

| Hardware Costs—Expensed | 0 | 0 | 0 | 0 | 0 |

| Hardware—Deprec/Amort | 0 | 0 | 0 | 0 | 0 |

| Hardware Maintenance | 0 | 0 | 0 | 0 | 0 |

| Software Costs—Expensed | 0 | 0 | 0 | 0 | 0 |

| Software—Deprec/Amort | 0 | 0 | 0 | 0 | 0 |

| Software Maintenance | 0 | 0 | 0 | 0 | 0 |

| Property Maintenance | 0 | 0 | 0 | 0 | 0 |

| Gain/Loss on Assets | 0 | 0 | 0 | 0 | 0 |

| Property—Depreciation | 0 | 0 | 0 | 0 | 0 |

| Tools | 0 | 0 | 0 | 0 | 0 |

| Computer and Office Supplies | 0 | 0 | 0 | 0 | 0 |

| Advertising/Communications Costs | 0 | 0 | 0 | 0 | 0 |

| Building Materials | 0 | 0 | 0 | 0 | 0 |

| Insurance | 0 | 0 | 0 | 0 | 0 |

| Utilities | 0 | 0 | 0 | 0 | 0 |

| Property Management | 0 | 0 | 0 | 0 | 0 |

| Home Furnishings | 0 | 0 | 0 | 0 | 0 |

| Professional Services Fees | 0 | 0 | 0 | 0 | 0 |

| Munincipal Services | 0 | 0 | 0 | 0 | 0 |

| Real Estate Commissions | 0 | 0 | 0 | 0 | 0 |

| Office Space Related Expense | 0 | 0 | 0 | 0 | 0 |

| Loans Payable Principle | 0 | 0 | 0 | 0 | 0 |

| Real Estate Taxes | 0 | 0 | 0 | 0 | 0 |

| Total Direct Expense | 0 | 0 | 0 | 0 | 0 |

| DEBIT | 0 | 0 | 0 | 0 | 0 |

| Memo Information | |||||

| Interest Paid | 0 | 0 | 0 | 0 | 0 |

| Income Taxes Paid | 0 | 0 | 0 | 0 | 0 |

| Net Profit | 0 | 0 | 0 | 0 | 0 |

| Net Profit Margin % | 0 | 0 | 0 | 0 | 0 |

| Jun-Out | Jul-Out | Aug-Out | Sep-Out | Oct-Out | Nov-Out | Dec-Out | Total | Pct % |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0 |

Comment about this article, ask questions, or add new information about this topic: