Limited Liability Company

BUSINESS PLAN NORTHERN INVESTMENTS, LLC

3500 North Plaza Dr.

Portland, Oregon 97204

Northern Investments is a forward-thinking limited liability company that is planning to expand its financial services to a specialized audience—Cultural Creatives. Using the values of this selected group, Northern Investments will build Networks that will focus on socially aware, environmentally responsible, and values-driven investors.

- COMPANY HISTORY

- MANAGEMENT & STAFF

- THE MARKET FOR SOCIALLY RESPONSIBLE INVESTMENTS

- MARKETING AND SALES STRATEGY

- DISTRIBUTION

- COMPETITION

- PRODUCTS AND SERVICES

- INVESTMENT COMMITTEE

- ADVISORY BOARD

- REVENUES

- MISSION

- FUNDAMENTAL GUIDING BELIEFS

- A CORPORATE CULTURE OF RESPECT

- SHARED OWNERSHIP - EXPAND DISTRIBUTION

- KEY PEOPLE

COMPANY HISTORY

Northern Investments, LLC is an Oregon limited liability company that on June 30, 1999 acquired the name, the investment advisory business, and certain other assets of Northern Investments, formerly a division of Plum Tree Advisors.

Northern has been a significant national provider of financial services through investment professionals and a leading voice for the concept of socially responsible investing since 1988. In January 1990, Northern Investments became a branch of Plum Tree Securities, Inc., Member NASD & SIPC. In 1992, the company began developing fee-based investment advisory services to augment its traditional brokerage business. In May 1995, Northern Investments's brokerage and investment advisory businesses were acquired and became a wholly owned subsidiary of Plum Tree. With the purchase transaction completed on June 30, 1999, Northern is once again an independent, owner-managed financial services firm.

Northern is an investment advisory firm registered with the SEC (Securities and Exchange Commission) based in Portland, Oregon. At present, Northern Investments has 52 licensed representatives with offices in 20 states and clients in 46 states. All representatives focus their business in the area of socially and environmentally responsible investing.

Northern Investments currently manages or administers approximately $175,000 in fee-based assets for these representatives. In addition, the company will continue to receive a supervisory override on revenues generated by the brokerage business (roughly $300,000,000) that these representatives have placed with Plum Tree Securities for about six months as the necessary transitions are completed. The revenues from this part of the "old" Northern Investments, as well as all related operations, potential liabilities, and compliance requirements, will be fully Plum Tree's responsibility by December 31, 1999.

All representatives of Northern Investments are independent contractors and business owners in their own right. All are currently associated with Plum Tree Securities and registered with the NASD (National Association of Securities Dealers). Depending on each individual's business strategy, s/he may choose to remain with Plum Tree, to move their brokerage strategy to another broker-dealer firm, and/or to drop their NASD registration entirely. Management strongly believes and expects that these representatives will remain associated with Northern Investments in the conduct of their fee-based advisory business.

Since developing fee-based advisory services in 1992, Northern Investments's Registered Investment Advisor (RIA) business has grown dramatically. The company is focusing the vast majority of future product and service development on meeting the needs of investment professionals who choose to work with clients in a fee-based advisory relationship. Management believes this is where Northern Investments can add significant value, providing needed investment programs and information services designed to help representatives grow their business by tapping into and serving socially aware/values oriented investors.

Management believes this market is large and largely untapped. Most investors who fit the profile of socially aware/concerned individuals, and who are currently working with a professional advisor, are being rather poorly served. The "new" Northern Investments is being designed to facilitate this process—to provide investment professionals with the information, products, services, and tools to dramatically improve service to this market. It is believed that this market will be best served by advisors who focus on managing the relationship they have with these clients, and handing off most money management responsibilities to others.

MANAGEMENT & STAFF

Northern Investments is led by a senior management team with substantial prior experience in the securities, financial services, and social investment industry.

John Craig CFP is Chief Executive Officer and Manager of Northern Investments, LLC. He has managed the operations of the company and its predecessor entitles since 1989. He has served on the board of directors of the Social Investment Forum for seven years.

Walter Smith is President, Chief Marketing Officer and Manager of Northern Investments, LLC. For over a decade he has been a nationally recognized authority, consultant, and resource to the social investment industry. He serves as Chair and President of the Social Investment Forum and as Co-Chair of the Oregon Network of Businesses for Social Responsibility.

Jennifer Frame is Vice President and Director of Operations for Northern Investments, LLC. She has twelve years of experience in the financial services/securities industry, having worked for Northern Investments since 1990.

Wendell Letterman CFP is co-designer and primary manager of the Efficiencies program and serves on Northern Investments's Investment Committee. He is a 20-year veteran of the financial services industry, having spent the majority of his career focused on the field of retirement planning.

Robert Sloan is Director of Research, primary manager of the Fair Ways program and serves on Northern Investments's Investment Committee. Currently CFA level II candidate, he is an affiliate member of both the Denver Society of Security Analysts and the Association for Investment Management and Research (AIMR).

Susan Williams is Director of Nonprofit Support Services for Northern Investments. Her intimate involvement with various nonprofit organizations spans a 15-year period. Her service has run the full spectrum of participation, from hands-on volunteering, to leadership positions such as board presidencies and executive directorships.

THE MARKET FOR SOCIALLY RESPONSIBLE INVESTMENTS

Many independent studies in recent years have established that between 20 and 30 percent of adult Americans exhibit the characteristics of being "social responsibility oriented," "socially aware," or "values-based" investors. The most pointed and detailed of these studies is entitled The Integral Culture Survey: A Study of the Emergence of Transformational Values in America. This decade-long research effort found that nearly one in four American adults lives by a "new" set of values. They are affluent, well educated, and on the cutting edge of social change.

As predicted by futurists Alvin Toffler, John Naisbitt, and Marilyn Ferguson in the early 1980s, study author and sociologist Gerald Jones has identified an emerging culture whose adherents tend to be more altruistic and powerfully attuned to global issues and whole systems. They are relationship oriented, interested in spirituality and ecological sustainability, and actively involved in their local communities. Jones calls the 24 percent of Americans who hold this emerging world view "Cultural Creatives." Traditional age-specific demographic categories such as "Baby Boomer" or "Generation X" do not apply. Cultural Creatives are found in all age groups. In fact, the only strikingly significant conventional demographic that distinguishes them is that six in ten are women.

Cultural Creatives tend to believe that few other people share their values. While they are avid readers and gatherers of news and information, little of what Cultural Creatives read provides evidence of their huge numbers and growing clout. This is partly because the views of these 44 million adult Americans are rarely represented in the conventional media. The press is substantially owned and operated according to a very different world view - that of the Modernists, according to Jones. For the most part, Modernists also own and/or control the financial services industry in the United States. As a result, sensitivity to the goals, needs, and aspirations of investors with a Cultural Creative world view is seriously lacking.

Jones's Cultural Creatives match the profile of American social investors almost perfectly. Indeed, over the past two decades, social investing in the U.S. has evolved into a $1.2 trillion industry (1997 Report on Responsible Investing in the United States, Social Investment Forum). To tens of thousands of socially aware investors, the term "investing for the future" has a double meaning, and their investment approach often has a dual objective. The investment analysis process they employ is both quantitative and qualitative. The "double bottom line" approach they employ aims at competitive returns while seeking to put money to work in ways which are consistent with their personal, oral, and ethical values. They are most satisfied with investment programs that go beyond purely financial goals to address their need to "make a difference." They are most comfortable with investments that align with their highest aspirations for the world they see themselves passing on to future generations.

Contrary to what some might believe, Jones's study has underscored the fact that Cultural Creatives have incomes and investment resources comparable, on average, to the "mainstream" market targeted by most conventional financial services organizations. And yet this is a market that most investment professionals ignore, or try to serve in traditional ways that simply don't fit the needs and/or styles of investors with a Cultural Creative world view.

MARKETING AND SALES STRATEGY

Serving the more progressive investor market of Cultural Creatives with traditional financial products is difficult and often uncomfortable. This discomfort is felt by both investors and their professional advisors, as well as by conventional investment product providers. Understanding how to help them meet their special needs is a challenge for financial professionals. Cultural Creatives' penchant for relationships and community, their desire to know and feel good about where a product comes from, how it was designed, and who the company is behind the product, makes them a very different market for financial services.

Exciting business opportunities for Northern lie in providing social investment products and services delivered in ways that resonate with the mostly untapped market of Cultural Creatives in the United States. The company intends to develop win-win relationships with 20-30 broker/dealer firms within the first 18 months of operations by offering an attractive package of unique services focused on the socially aware investor. The Company will focus on serving Cultural Creatives nationwide primarily through the investment practitioners scattered across the country who know this market. This strategy will effectively leverage our resources and create new distribution capabilities through hundreds of professionals who work directly with thousands of individual and institutional clients fitting the profile of socially aware/Cultural Creative investors.

Northern Investments, as its name suggests, is building a Network of investment professionals who have a need for information, products, and fee-based investment services unavailable through their current broker/dealer relationships. The attraction will be a well capitalized firm whose leadership, vision, mission, culture, commitment, and services are focused on socially aware, environmentally responsible, values-driven investors. The Network will be connected through e-mail and Internet services, through conferences and educational gatherings, and through dynamic personal relationships that will develop between Network members over time. Management envisions growing its Network of representatives from 50 to over 200 in the first 18 months of operations.

The Company is building a marketing and sales capability to promote the concept of socially responsible investing, as well as provide information, education and fee-based products and services to investment advisors nationwide. Northern Investments will develop both "push" and "pull" strategies, aimed at growing the social investment industry and the businesses of investment professionals who join the Network.

DISTRIBUTION

Initially, the primary distribution of Northern Investments products and services is expected to be through the existing group of Northern representatives. While the company will cease to receive revenues generated by the brokerage activities of these representatives at the end of 1999, management expects the current trends toward greater reliance on fee-based, rather than commission-based client relationships to continue to grow.

The next key distribution group for the company's services is another existing but larger group of investment professionals who are actively working in the social investment marketplace. All of these representatives are associated with other broker-dealer firms (outside of Plum Tree). Most of them do not have access to either the breadth of quality of social investment services and programs offered by Northern Investments. Many of these representatives have exposure to the company through participation in the annual SRI in Portland conference. Management estimates that this group numbers about 250 practitioners, associated with 20 to 30 broker-dealer firms. The company will quickly focus its attention on signing selling agreements with these firms. Management expects to add approximately 20 new representatives to its Network within 18 months.

Longer term, the company will work to sign additional selling agreements and to position itself as the preferred provider of socially responsible portfolio management and related services. These efforts will be focused on broker-dealer firms and investment professionals who are relatively unfamiliar with the social investment field and whose clients may, on occasion, ask for or be appropriate for Northern Investments's services.

COMPETITION

Although there is substantial competition within the overall securities industry, competition between financial services firms and among investment professionals within the socially responsible investment field is virtually nonexistent. Approximately 250 brokers and financial planners nationwide focus on serving socially aware investors as their primary business, and 20 percent of them are already associated with Northern. Most of the rest are familiar with Northern Investments, but have not done business with the company to date because they have elected to maintain their existing broker-dealer relationships.

Northern Investments's new business model, as an independent investment advisory firm, will allow representatives who currently serve, or seek to serve, socially aware/Cultural Creative investors to work with the company without changing their existing broker-dealer relationships. Management believes that hundreds of additional representatives work with Cultural Creative investors. However, the vast majority of these professionals have neither access to the types of services which will be offered by Northern nor the support of an organization focused on helping products and services designed to serve the needs of socially aware/Cultural Creative investors to hundreds of additional brokers, planners, and advisors through selling agreements with their parent broker-dealer firms. This was not possible while Northern Investments was part of Plum Tree, a competitor.

The target market for socially responsible investment products and services has only recently been identified and defined and most conventional competitors within the financial services industry are unaware of it, or have no affinity for it. The historic slow growth of socially responsive investment alternatives is, in management's opinion, most directly attributable to conventional competition's indifference or even skepticism toward the concept. There is only one other broker-dealer firm, outside of Plum Tree Securities, that has made a significant commitment to this market, and it is expected this firm will be one of the first to sign a selling agreement with Northern Investments. There are virtually no managed investment products that utilize socially screened mutual funds or SRI capable money managers. There is no other central research or resource for SRI practitioners, other than the nonprofit Social Investment Forum. Various major firms, most notably, Salomon Smith Barney, have made minor moves into the SRI marketplace. To date, however, no major firm has achieved results that are material to their overall business.

Management strongly believes that there is a major opportunity to deliver Northern Investments's services to its target market through investment professionals affiliated with dozens, even hundreds of broker-dealer firms throughout the U.S. with little or no competition. In fact, the company's business model capitalizes on the belief that more competitors can be expected to consider contracting for Northern Investments's services rather than developing their own.

PRODUCTS AND SERVICES

The following core investment programs are "packaged" products which are proprietary to Northern Investments and will be marketed to broker-dealer firms and investment professionals nationwide:

Dynamics is a tactical asset allocation managed mutual fund program utilizing socially screened funds. This program has been operating successfully for nearly three years and will be managed under contract to Northern Investments by its creators.

Efficiencies is a managed mutual fund program using socially screened funds. This program is designed to emulate the strategic asset allocation model produced by Nobel Prize-winning research, and implemented by some of the industry's leading consultants. This approach emphasizes efficient diversification by blending multiple asset classes, investment styles, and money managers. Efficiencies will be managed and administered in-house.

Fair Ways is an investment management consulting program utilizing third party money managers who have internal social screening and/or shareholder activism capabilities. These managers work with Northern Investments on a separate account basis. This program will be managed and administered in-house.

In addition to the above packaged products, the company will offer a number of services designed to support investment professionals who are members of the Network:

Direct Services: Northern Investments will continue to administer fee-based accounts managed by representatives. This service is available only to representatives associated with Plum Tree Securities, and is a continuation of services provided prior to the acquisition of Northern Investments's advisory business from Plum Tree. Over time, this business is expected to represent a smaller and smaller portion of Northern Investments's overall business.

Partnerships with Network Members: The company anticipates generating asset management business in partnership with certain of its associated representatives. For example, one Northern Investments representative was formerly a municipal bond manager for a major insurance company. Management expects to offer socially screened municipal bond fund management in partnership with this representative.

Financial Planning, Hourly Consulting and Coaching: The company expects its representatives to continue developing services and alternative pricing mechanisms within the scope of Northern Investments's umbrella national Registered Investment Advisory status. Management intends to provide the flexibility, training, and service necessary to support a wide range of advisor/client relationships, including financial planning, hourly consultations and personal/professional program coaching. The company intends to develop a "Life Planning" program that will be designed to provide the skills and tools for representatives to expand and deepen the value-added services they will provide clients in the years ahead.

Research and Information Services: Numerous services of specific interest to investment professionals serving socially aware/Cultural Creative clients will be aggregated and offered for a modest annual fee to Network members. These research and information services, when purchased separately, are either not currently accessible or are simply not available at economically viable prices for most individual practitioners. The company has completed tentative negotiations with several providers, based on the buying power of the Network, which will allow it to offer these services at a very attractive price to Network members.

Consulting Services: Both Walter Smith and John Craig have substantial experience in product design, marketing, public relations, and practice management relative to businesses focusing on the company's target market of socially aware/Cultural Creative investors. Management anticipates consulting service revenues to be a small, yet material part of company operations.

SRI in Portland: The company created, produces, and hosts the SRI in Portland conference each year. This conference is recognized as the annual industry conference for investment professionals and practitioners whose businesses focus on the socially responsible investment field. Approximately 400 participants are expected to attend the 2000 conference, which will be the tenth anniversary of this highly successful event. Sponsorship and registration revenues are sufficient to generate a modest profit each year, while providing an outstanding platform to inform the market of SRI investment professionals about the company's services.

Institutional Investor Initiatives: Management intends to invest some of the capital raised through a successful $1 million offering in creating an in-house capability to develop a direct asset management business with large institutional investors. This will entail hiring and supporting at least one, possibly two, highly qualified people to build relationships and generate institutional business directly to the company. This will be a long lead time process, which may not begin to pay off for 12 to 18 months. Such a direct institutional capability will not compete with Network members, and in many cases may be positioned to augment Network member efforts.

Internet Strategy: Northern Investments is developing an Internet strategy aimed at serving the needs of socially aware/Culture Creative investors whose investment resources and needs may be considered too small to work with a professional advisor. This strategy may also serve investors who simply choose to make their own investment decisions without the assistance of an investment professional. The company's Internet strategy, while designed to serve smaller investors, will continuously encourage them to consider working with a professional advisor, and connect them with members of the Network. An aggressive Internet strategy will only be possible if the company is successful in achieving its goal of raising $1 million in investor capital.

INVESTMENT COMMITTEE

An Investment Committee will be responsible for all due diligence and monitoring of the socially responsible mutual funds, and separate account managers who are involved in managing money for Northern Investments representatives and clients. The Committee will review all pertinent economic, market, fund and manager specific information and make decisions accordingly affecting all assets under management in Northern Investments investment programs. The Committee is composed of John Craig CFP, CEO; Wendell Letterman CFP, co-designer and primary manager of the Efficiencies program; and Robert Sloan CFA level II candidate, Director of Research, and primary manager of the Fair Ways program.

ADVISORY BOARD

Management intends to appoint a board of advisors representing investment professionals who are members of the Northern Investments. Management envisions this Advisory Board meeting formally on a quarterly basis, with informal communications occurring as needed. This Board will be expected to advise management on strategic as well as tactical issues facing the company, with a focus on improving service to the investment professionals who choose to join the Network. Four advisors will be appointed from the initial group of 52 Northern Investments representatives. An additional two or three practitioners will be added to the Advisory Board as is warranted by the addition of new representatives from broker-dealer firms other than Plum Tree. No appointments have been made as of this time.

REVENUES

The company's financial projections assume normal market conditions over the next five years, with annual market growth of well-diversified portfolios averaging 9 percent. Regardless of whether the general industry trend toward fee-based business continues, it is assumed that socially aware/Cultural Creative investors will be more receptive to this type of relationship with a financial professional. In fact, Northern Investments will be seeking to establish relationships with investment professionals who recognize that the most effective way to leverage their time and grow their businesses will be through a fee-based client relationship with professional management provided by a firm such as Northern Investments.

Projections reflect the fact that Northern Investments will terminate its AOSJ/Branch Office relationship with Plum Tree Securities by December 31, 1999, thus eliminating brokerage related revenues the company has historically received. Revenue projections are based on a gradual reduction in the share of representative-managed assets (Plum Tree associated representatives only) and aggressive increases in program-managed assets. For the first several quarters, fee-based assets are likely to generate sufficient revenues to create a profitable operation. As such, it will be important to quickly grow advisory assets and revenues to generate positive cash flow.

The company's program-managed products, which are expected to become the most significant source of revenues within the first 18 months of operations, are priced to generate the following approximate revenues (annualized) to Northern Investments after selling costs (compensation paid to representatives):

Dynamics - 45 basis points

Efficiencies - 40 basis points

Fair Ways - 20 basis points

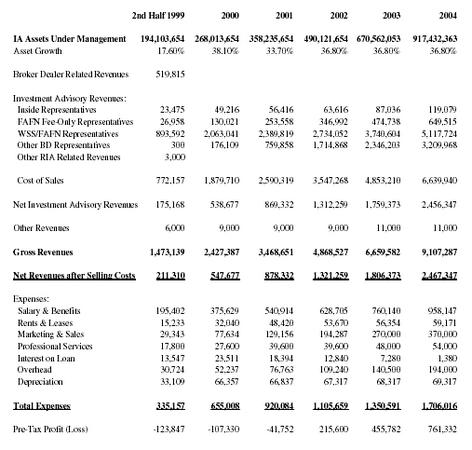

Minimum Offering - Core Business Projections

CHART 1 shows revenue and expense projections based on raising a minimum of $400,000 in investor capital to support Northern Investments's "core" business. This chart reflects all of the above described fundamental assumptions. It projects growth in revenues from new business through adding 2 to 4 new representatives per month to the initial core group of 52 Northern Investments representatives. New representatives will be allowed to join the Network as the company is successful in signing selling agreements with their broker-dealer firms. Management expects to sign at least one new selling agreement per month over the first 18 to 24 months of operations. While expected to build slowly based on minimum capitalization, over time, this process will allow Northern Investments services to be offered through hundreds of representatives associated with firms outside of Plum Tree.

Expenses are projected based on the past five years' operating history, adjusting for brokerdealer support services that will be phasing out over the second half of 1999, and for new products, services, and business initiatives as reflected in this summary business plan. Revenues associated with Internet initiatives are not specifically identified in CHART 1 and no revenue assumptions have been developed. Similarly, CHART 1 does not incorporate revenues associated with Northern Investments direct institutional sales. This is a "slow and steady growth" scenario, one which management is very comfortable and confident of achieving.

CHART 1 - "CORE" BUSINESS PLAN PROJECTIONS

| 2nd Half 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | |

| IA Assets Under Management | 194,103,654 | 268,013,654 | 358,235,654 | 490,121,654 | 670,562,053 | 917,432,363 |

| Asset Growth | 17.60% | 38.10% | 33.70% | 36.80% | 36.80% | 36.80% |

| Broker Dealer Related Revenues | 519,815 | |||||

| Investment Advisory Revenues: | ||||||

| Inside Representatives | 23,475 | 49,216 | 56,416 | 63,616 | 87,036 | 119,079 |

| FAFN Fee-Only Representatives | 26,958 | 130,021 | 253,558 | 346,992 | 474,738 | 649,515 |

| WSS/FAFN Representatives | 893,592 | 2,063,041 | 2,389,819 | 2,734,052 | 3,740,604 | 5,117,724 |

| Other BD Representatives | 300 | 176,109 | 759,858 | 1,714,868 | 2,346,203 | 3,209,968 |

| Other RIA Related Revenues | 3,000 | |||||

| Cost of Sales | 772,157 | 1,879,710 | 2,590,319 | 3,547,268 | 4,853,210 | 6,639,940 |

| Net Investment Advisory Revenues | 175,168 | 538,677 | 869,332 | 1,312,259 | 1,759,373 | 2,456,347 |

| Other Revenues | 6,000 | 9,000 | 9,000 | 9,000 | 11,000 | 11,000 |

| Gross Revenues | 1,473,139 | 2,427,387 | 3,468,651 | 4,868,527 | 6,659,582 | 9,107,287 |

| Net Revenues after Selling Costs | 211,310 | 547,677 | 878,332 | 1,321,259 | 1,806,373 | 2,467,347 |

| Expenses: | ||||||

| Salary & Benefits | 195,402 | 375,629 | 540,914 | 628,705 | 760,140 | 958,147 |

| Rents & Leases | 15,233 | 32,040 | 48,420 | 53,670 | 56,354 | 59,171 |

| Marketing & Sales | 29,343 | 77,634 | 129,156 | 194,287 | 270,000 | 370,000 |

| Professional Services | 17,800 | 27,600 | 39,600 | 39,600 | 48,000 | 54,000 |

| Interest on Loan | 13,547 | 23,511 | 18,394 | 12,840 | 7,280 | 1,380 |

| Overhead | 30,724 | 52,237 | 76,763 | 109,240 | 140,500 | 194,000 |

| Depreciation | 33,109 | 66,357 | 66,837 | 67,317 | 68,317 | 69,317 |

| Total Expenses | 335,157 | 655,008 | 920,084 | 1,105,659 | 1,350,591 | 1,706,016 |

| Pre-Tax Profit (Loss) | -123,847 | -107,330 | -41,752 | 215,600 | 455,782 | 761,332 |

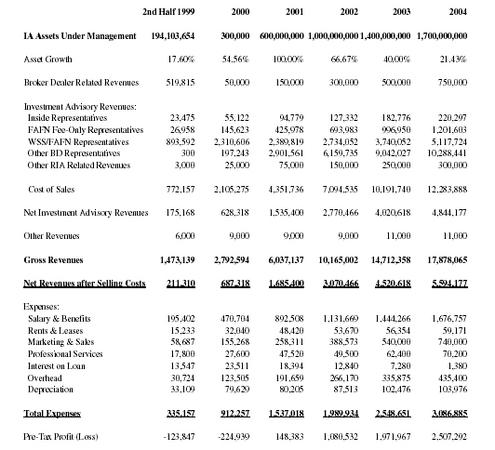

Maximum Offering Fully Funded Projections

CHART 2 shows projected revenues and expenses based on successfully raising $1,000,000 of investor capital and putting it to work over the first 21-24 months of operations to aggressively grow the company's business and revenues.

Under the company's "fully funded" plan, additional working capital will be invested in ways management believes will result in faster growth of the Network, of investment advisory assets under management, and of profitability in future years. While no assurances can be made that the aggressive growth shown in CHART 2 will be achieved, management believes it is both possible and probable given the market potential, the strategy, and the resources the company will have to focus on this exciting effort.

With full funding, the company will hire an additional qualified person to market Northern Investments services to investment professionals seeking to serve socially aware/Cultural Creative clients across the land. This talented and experienced individual will be responsible for arranging selling agreements between Northern Investments and broker-dealer firms, for selling the concept of social investing and Northern's unique ability to serve that market, and for cultivating relationships with representatives who work with or wish to work with socially responsible investment programs.

Full funding will allow the company to hire a qualified person to develop direct institutional business from religious organizations, foundations, retirement plan sponsors, and others. This individual will focus on those larger investors who choose to work directly with a management company, and will not compete with investment professionals in the Network. On occasion, this person may be in a position to help Network members land large accounts.

Full funding will provide the capital necessary for the company to develop a significant presence on the Internet. The technology exists to create most of the connectivity and services management envisions provided via the Internet avoiding virtually any custom development. However, a process of adapting the "off the shelf" software and services to Northern Investments's needs will require a certain amount of proprietary programming. It is expected that the planned Research and Information Services will be made available to Network members primarily via the Internet.

In addition, management believes that the smaller end of the social investment marketplace can be effectively served via the Internet. Currently shunned by many investment professionals, investors with limited resources often have difficulty in accessing information and making socially responsible investments. There is currently no vehicle designed to make it easy for the socially aware/Cultural Creative investor with a small amount of investment capital to facilitate the purchase of socially screened mutual funds, other than by going directly to the fund company. When "shopping," these investors are more likely to get lost inside of Schwab.com or E-Trade, rather than finding their way to a socially screened mutual fund. Northern Investments believes that a focused web-based facility can be developed relatively quickly to provide investors with $2,000 to $10,000, and possibly more. An easy way to become socially responsible investors will be through the dozens of mutual funds whose products will be available through this service (some of which are currently not available through the larger fund supermarkets).

Management will seek a strategic partner to implement such an Internet initiative. It will require a simple broker-dealer able to facilitate trading of mutual funds. The simple brokerdealer envisioned would be set up to trade mutual funds only and would have minimal compliance requirements and virtually no staff, except web technicians. The oversight necessary to fulfill NASD and SEC requirements would be available through the principles of the company. Capital requirements to establish the broker-dealer and register it in all states is estimated at $100,000. An additional, undetermined investment will be required in developing this web capability. Revenues will flow from trailing compensation the company will realize from the assets under management in funded accounts.

The company sees its planned Internet initiative having substantial long-term potential for referring business to investment professionals within the Network. It is clear from industry research that the majority of investors seek investment advice once their assets reach a certain size, or when they achieve a certain level of success in their professional endeavors, or are at the point where they realize the complexity of their financial affairs has outgrown their ability to manage them. Northern Investments will seek to build relationships with these initially small and/or do-it-yourself social investors, gently encouraging them to seek the assistance of Network members over the course of time. Management envisions this process becoming a major source of leads to Network professionals in the years to come.

CHART 2 - "FULLY FUNDED" PLAN PROJECTIONS

| 2nd Half 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | |

| IA Assets Under Management | 194,103,654 | 300,000 | 600,000,000 | 1,000,000,000 | 1,400,000,000 | 1,700,000,000 |

| Asset Growth | 17.60% | 54.56% | 100.00% | 66.67% | 40.00% | 21.43% |

| Broker Dealer Related Revenues | 519,815 | 50,000 | 150,000 | 300,000 | 500,000 | 750,000 |

| Investment Advisory Revenues: | ||||||

| Inside Representatives | 23,475 | 55,122 | 94,779 | 127,332 | 182,776 | 220,297 |

| FAFN Fee-Only Representatives | 26,958 | 145,623 | 425,978 | 693,983 | 996,950 | 1,201,603 |

| WSS/FAFN Representatives | 893,592 | 2,310,606 | 2,389,819 | 2,734,052 | 3,740,052 | 5,117,724 |

| Other BD Representatives | 300 | 197,243 | 2,901,561 | 6,159,735 | 9,042,027 | 10,288,441 |

| Other RIA Related Revenues | 3,000 | 25,000 | 75,000 | 150,000 | 250,000 | 300,000 |

| Cost of Sales | 772,157 | 2,105,275 | 4,351,736 | 7,094,535 | 10,191,740 | 12,283,888 |

| Net Investment Advisory Revenues | 175,168 | 628,318 | 1,535,400 | 2,770,466 | 4,020,618 | 4,844,177 |

| Other Revenues | 6,000 | 9,000 | 9,000 | 9,000 | 11,000 | 11,000 |

| Gross Revenues | 1,473,139 | 2,792,594 | 6,037,137 | 10,165,002 | 14,712,358 | 17,878,065 |

| Net Revenues after Selling Costs | 211,310 | 687,318 | 1,685,400 | 3,070,466 | 4,520,618 | 5,594,177 |

| Expenses: | ||||||

| Salary & Benefits | 195,402 | 470,704 | 892,508 | 1,131,669 | 1,444,266 | 1,676,757 |

| Rents & Leases | 15,233 | 32,040 | 48,420 | 53,670 | 56,354 | 59,171 |

| Marketing & Sales | 58,687 | 155,268 | 258,311 | 388,573 | 540,000 | 740,000 |

| Professional Services | 17,800 | 27,600 | 47,520 | 49,500 | 62,400 | 70,200 |

| Interest on Loan | 13,547 | 23,511 | 18,394 | 12,840 | 7,280 | 1,380 |

| Overhead | 30,724 | 123,505 | 191,659 | 266,170 | 335,875 | 435,400 |

| Depreciation | 33,109 | 79,629 | 80,205 | 87,513 | 102,476 | 103,976 |

| Total Expenses | 335,157 | 912,257 | 1,537,018 | 1,989,934 | 2,548,651 | 3,086,885 |

| Pre-Tax Profit (Loss) | -123,847 | -224,939 | 148,383 | 1,080,532 | 1,971,967 | 2,507,292 |

MISSION

Northern Investments, LLC's mission is to be the premier provider of investment products and services designed to serve socially aware/Cultural Creative investors.

The company will use its unique position in the industry to significantly expand distribution of socially responsible investment programs nationwide, primarily through investment advisory relationships.

FUNDAMENTAL GUIDING BELIEFS

The following fundamentals guide our efforts.

We believe:

- Every person has a core set of values which govern his/her actions.

- People rarely have identical sets of values, but for most there is a wide expanse of common ground. Indeed, most people's shared beliefs transcend their differences.

- Fair-minded people can agree to disagree and can remain tolerant and respectful of the values and priorities of others, even when in disagreement.

- It is both prudent and proper to reflect personal values in financial and investment decisions.

- Many thoughtful people are unwilling to profit from behavior in others that they find unacceptable in themselves and will choose an alternative course of action when they know they have one.

- Consciously bringing personal values and financial decision making into alignment is a powerful way to influence others and to encourage behavior which enhances quality of life for all.

A CORPORATE CULTURE OF RESPECT

Northern Investments is intentionally creating a corporate culture based on respect. The values, beliefs, and styles of the company's owners, managers, employees, and representatives are intended to reflect the best and most common characteristics of our target market of socially aware/Cultural Creative investors.

Businesses rise and fall based on their corporate culture. It's at the level of corporate culture that the purpose and vision of Northern Investments becomes real for employees, customers, and everyone else who feels the touch of the organization. The company's culture is the invisible hand that shapes its literature, management decisions, investor commitments, client relations, back office support effectiveness, profitability, community perceptions, and responses to unforeseen events.

Northern Investments's corporate culture is rooted in the broad social impulse to honor diversity and reclaim respect within the human community. It's an impulse that draws understanding from nature. This is not the type of respect that is given to one person but held back from the next. It's a respect that is unconditional. In essence, unconditional respect is, at its core, what socially responsible investing is really all about.

A culture of respect will be felt by every client. It will be known by every investor who owns a membership interest in the company. It will be a motivation for every investment professional who joins the Network. It will be the cause for service, the reason for diligence, the cohesion for teamwork, a key criteria for recruitment, and the foundation for expansion. Respect will underpin every aspect of the relationships between the company, investors, staff, product providers, and the hundreds of investment professionals who will become members of the Network.

Respect for customers is not a unique business concept. However, unconditional respect for every person one encounters is unique. Unconditional respect is an understanding set forth in the teachings of historic masters and sages, but one that has become all but extinct in modern times. Northern Investments holds the intention to be a catalyst in the creation of a new social culture based on respect. Management believes that aligning Northern Investments with respect and creating a culture that acknowledges the magnificence of all who enter its sphere of influence, will lead to business and financial success.

SHARED OWNERSHIP - EXPAND DISTRIBUTION

The company seeks to attract investors in Northern Investments LLC from all ranks of the social investment industry. Management hopes that investment professionals who are members of the Network, mutual fund companies, and investment management firms whose products and services are offered through the firm may want to own interests in the "new" Northern. The company seeks to encourage this process and to attract as many investors as possible from within the social investment community to share in the success and profits of the "new" Northern Investments.

Northern will promote the concept and practice of socially and environmentally responsible investing broadly, introduce the vast and virtually untapped market of socially aware/Cultural Creative investors to professional advisors across the country, and develop new business initiatives aimed at expanding demand for social investment programs. Management sees these efforts quickly creating a powerful new distribution channel for socially responsible product and service providers.

KEY PEOPLE

John Craig CFP is Chief Executive Officer of Northern Investments, LLC. He has served on the board of directors of the Social Investment Forum since 1993 and has produced and hosted the annual SRI in Portland conference since 1990. He was the recipient of the industry's 1997 "SRI Service Award."

John joined the company that was to become Northern Investments as a financial planner in November 1986. He assumed the position of Chief Operating Officer of Northern Investments in 1989 and managed the sale of Northern Investments to Plum Tree Securities, Inc., in 1995. John served as President of the Northern Investments division of Plum Tree Advisors and as Vice President of Plum Tree Advisors from May 1, 1995 through June 30, 1999.

Born January 5, 1951 in Cincinnati, Ohio, John is a 1975 graduate of the United States Military Academy at West Point. He served on active duty for nine years in various command, staff and faculty assignments as an Armor officer. His final assignment on active duty, and for three more years as a civilian, was in the Resource Management Division, Directorate of Personnel and Community Activities at Fort Carson, Oregon. As chief of this division, John was responsible for the financial management of most business operations on the installation, ranging from the Golf Course and Bowling Center, to the Club Systems and Child Care operations. Upon his departure, John received the Department of the Army "Commander's Award for Civilian Service."

John earned his Certified Financial Planner (CFP) designation in June 1984, and in short order completed a range of securities examinations covering both the practice and supervision of the securities business.

Walter Smith is President and Chief Marketing Officer of Northern Investments, LLC. For over a decade he has been a nationally recognized authority, consultant and resource to the social investment industry. He serves as Chair and President of the Social Investment Forum, the industry's national trade association, as a director of the Colloquium on Socially Responsible investing, and as Co-Chair of the Oregon Network of Business for Social Responsibility (BSR). He received the industry's "SRI Service Award" in 1998.

Prior to starting his own consulting practice in 1997, Walter worked for nearly eight years as a senior executive of Calvert Group. He specialized in promoting the concept and practice of social investing with the public and the press. His efforts significantly enhanced Calvert's reputation as a leader in the field, while the firm's assets under management in socially screened mutual funds more than tripled. He led a small product development group which created the first global socially screened mutual fund in the U.S., and was involved in launching four other new Calvert funds designed for socially aware investors.

Walter managed Calvert's national sales organization from 1994 to 1997. As President of Calvert Distributions, Inc., he was responsible for the company's relationship with over 2,000 broker/dealer firms and growing the assets of Calvert's 35 money market, bond and equity mutual funds. He directed a staff of 30 and recorded NAV fund sales of over $500 million annually during this time period. His accomplishments were complemented by his team-oriented management style and a path-breaking initiative which reoriented the sales group into customer-focused teams working with a values-based selling process.

Previously, Walter served for three years as a major gifts officer and Director of Development at the Billings School, University of Montana. He also spent five years as Vice President of Prescott Realty Services, a real estate securities firm, and was responsible for all due diligence, marketing, and sales of real estate related investments sold through Prescott Ball & Turben, Inc. (now part of Everen Securities).

Born July 16, 1953 and raised in Atlanta, Georgia, his father owned a hardware store where Walter worked meeting the needs of retail customers from the age of ten. He is a graduate of the University of Tennessee with a degree in Journalism/Communications, and holds NASD Series 24 (Registered Principal) and Series 7 (Registered Representative), and Series 63 licenses.

Jennifer Frame is Vice President and Director of Operations of Northern Investments Network, LLC. She obtained her NASD Series 7 license (Registered Representative) and her NASD Series 24 license (Registered Principal) in 1989 while associated with Portland brokerage firm, First Eagle, Inc., where she worked from 1987 through 1990.

Jennifer joined Northern Investments in 1990 as an administrative assistant to the main office and two of its Portland-based representatives. Combining administrative skills and knowledge of the business, she quickly assumed a much larger role and broader responsibilities, first becoming Operations Manager, and then Assistant Branch Manager of the Plum Tree Securities, Inc. branch office. Jennifer managed the conversion of accounts from Northern Investments, to the Northern Investments division of Plum Tree Advisors, Inc. following the sale of Northern Investments to Plum Tree Securities, Inc. in 1995. As Assistant Branch Manager, Jennifer has assumed a majority of the compliance supervision responsibilities for the Northern Investments field force of 52 representatives around the country.

Born February 4, 1960 in Detroit, Michigan, her father is a retired United Methodist Minister and her mother is a psychologist. Jennifer graduated from the University of Michigan in 1983 with a Bachelor of Arts degree in English, specializing in Medieval Literature.

Wendell Letterman CFP is Primary Manager of the Efficiencies program and serves on Northern Investments's Investment Committee. He holds NASD Series 7, Series 63, and Series 65 licenses, and is a member of the Investment Management Consultants Association.

Wendell has been a registered representative with Plum Tree Securities and investment advisor representative with Northern since 1991. In 1997, he joined Reber/Russell Company, an investment advisory firm affiliated with Frank Russell Investment Management Company, well known in the institutional investment world, and highly regarded for their expertise in asset allocation, rigorous manager evaluation, and consulting services to some of the world's largest pools of capital. Wendell's two years with Reber/Russell taught him how institutions construct and manage portfolios of mutual funds. He was responsible for servicing several dozen clients whose aggregate assets exceeded $100 million. He also taught inexperienced investors how to become good consumers of financial services, and developed a multimedia CD-ROM designed to walk a novice investor through the entire process.

While at Reber/Russell Company, he continued his relationship with Northern and continued to service his Northern clients. Upon leaving Reber/Russell Company in early 1999, Wendell expanded his role at Northern Investments. In collaboration with John Craig, he developed a strategic asset allocation program based on the investment management principles used by Russell, and designed to meet the needs of the SRI market. He named his program Efficiencies, in recognition of its fundamental strengths: efficient use of risk in pursuit of investment returns, cost efficiency, and tax efficiency.

Wendell was born October 3, 1954 in Cleveland, Ohio. He graduated from Bowling Green University in 1977 with a degree in Psychology, and went on to complete his master's degree in Counseling Psychology there in 1979. He worked for EF Hutton specializing in retirement planning throughout the 1980s.

Robert Sloan is the Director of Research and Primary Manager of the Fair Ways program for Northern Investments, LLC. He also serves on the Northern Investments Investment Committee. He is an affiliate member of both the Denver Society of Security Analysts and the Association for Investment Management and Research (AIMR), and is currently at CFA level II candidate (Chartered Financial Analyst program).

Robert earned an MBA in Finance and Accounting with honors from the University of Arizona in 1995 while working for American Century Mutual Funds. Robert earned his undergraduate Bachelor of Science degree in Civil Engineering from the University of Missouri in 1986. He went on to earn his Professional Engineering designation while working for the Texas Department of Transportation in Dallas. There he designed highways, bridges, and drainage systems that resulted in minimal environmental impact to the surroundings, but yet provided safe, innovative, and aesthetically pleasing structures. Later he worked as an Environmental Engineer for the Texas Water Commission where he reviewed plans for hazardous waste facilities to ensure they complied with complex state and federal hazardous waste regulations. After moving to Oregon, Robert headed the Pollution Prevention Program at Space Command Headquarters of the U.S. Air Force.

Robert has volunteered his time with active environmental groups such as the Southern Rockies Ecosystem Project and the Volunteers for Outdoor Oregon.

Susan Williams is Director of Nonprofit Support Services for Northern Investments, LLC. For over 15 years she has been regarded as an invaluable asset to the nonprofit community. Her service has run the full spectrum of participation, from hands-on volunteering on projects, to leadership positions such as board presidencies and executive directorships.

Her most recent service, prior to Northern, was the Executive Director of the Environmental Fund of Illinois and the Chair of the National Coalition of Environmental Federations where, through her leadership, donations, and gifts more than doubled during her two-year tenure. She currently serves as Chair of the Portland Chapter of Community Shares of Oregon and received their 1999 Volunteer of the Year award.

Susan was born June 3, 1960 in Wilmington, Delaware and graduated from the University of Virginia in 1982 with a Bachelors of Science degree in Actuarial Science. She holds Society of Actuary exams 100, 110, 120, 130, 135, and 140, and NASD Series 7 and 63 licenses.

Comment about this article, ask questions, or add new information about this topic: