EURO

The euro is the world's newest and undoubtedly the world's most publicized unit of currency. Amidst much media coverage, the euro made its official debut for banking purposes on January 1,1999, although no one will be able to carry a euro around in pocket, wallet, or purse until January 1,2002. The euro is also the most anticipated unit of currency as its introduction has been planned and debated for decades. The euro will eventually make purchasing goods and services vastly easier for European consumers, businesspeople, and tourists. While bolstering the economies of its various member countries and serving as a unifying force, the euro is also expected to challenge the U.S. dollar's place as the world's dominant currency in global finance. In 2002, the euro will completely replace the national currencies of 11 of the countries belonging to the European Union. Finland, France, Belgium, Italy, Austria, the Netherlands, Luxembourg, Germany, Portugal, Spain, and Ireland have agreed to surrender their monetary sovereignty by that year. After July 1, 2002, national currencies will no longer be accepted in those countries. Britain, Denmark, Sweden, and Greece have yet to join "Euroland" for a variety of reasons, but their economies will nonetheless be affected in major ways by the new unit of currency.

The European Union—and the euro by default—can in a way trace their founding ideology to a speech made in 1949 by Paul G. Hoffman (1891 1974), then president of the Studebaker auto company and an administrator of the Organisation for European Economic Co-operation (OEEC). The OEEC (which later became the Organisation for Economic Co-operation and Development) was responsible for planning and implementing the Marshall Plan, which was put in place to aid the recovery of Western Europe following World War II. Hoffman set forth a plan that called for the "integration of the European economy." He told OEEC members that "the substance of integration would be the formation of a single large market within which quantitative restrictions on the movement of goods, monetary barriers to the flow of payments, and eventually all tariffs are permanently swept away."

The European Union, however, can trace its lineal beginnings to the 1951 signing of the Treaty of Paris by Belgium, France, Italy, Luxembourg, the Netherlands, and West Germany, which established the European Coal and Steel Community (ECSC). The ECSC was a single common market covering iron ore, coal, scrap metal, and steel. The success of the ECSC led to the signing of the Treaty of Rome, which established the European Atomic Energy Commission and the European Economic Community. In 1967 the governing agencies of these three organizations merged to form the European Community. In 1978 the European Council, which was the principal policymaking organ of the European Community, agreed to the establishment of the European Monetary System (EMS). The purpose of the EMS was to stabilize exchange rates between member countries, while being responsible for the stability of a common unit of artificial currency—known originally in 1974 as the European unit of account, but which soon came to be called the European currency unit (ECU). The ECU was backed by pooling specified amounts of member nations' currencies into a "basket." In 1995 the ECU became known as the euro. Although the term "ECU" made sense as an expression in English, it had no basis of meaning in any other European language. Germany proposed the term "euro" be combined with the name of each national currency as a suffix. In this case the new unit of currency would be known as "euro-mark," "euro-franc," "euro-lira," etc., but ultimately the simple "euro" won out.

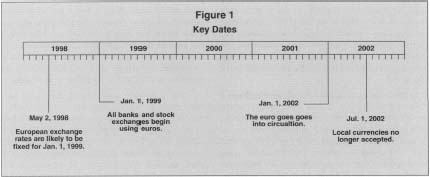

In 1992 the 12 members of the European Community signed the Treaty on European Union in Maastricht, the Netherlands. The Maastricht Treaty contained provisions to further the economic integration of its members and start them on a road toward political and social integration as well. The Maastricht accord also called for the establishment of a European Central Bank, which would oversee implementation of a single monetary policy for the European Union and implementation and stability of the euro. See Figure 1 for past and future key dates for the euro.

INTRODUCTION OF THE EURO

Euro trading began at 5 A.M. on January 4,1999, in Sydney, Australia. At the start of business it was being traded for about $1.17 American, close to what was expected. The euro hit a high of $ 1.1886 in Tokyo and dipped to $1.1820 in late trading in Europe and $1.1830 in New York. Although initial trading of the euro was without surprise, its introduction held profound implications for European consumers, tourists, businesspeople, and for the American dollar.

The advantage of the euro to tourists and businesspeople is quite obvious—there will be only one currency to deal with instead of 11 different national currencies. Although notes and coins will not be in circulation until 2002, prices of goods and services in much of Europe are already being quoted in both the respective national currency and the euro. Stock and bond prices are also being quoted in the euro, as are transactions between banks and the electronic transfer of funds for payment of personal monthly bills and other debts. The euro can also be used for credit card purchases; American Express will soon begin selling euro traveler's checks. The three-year transition period will allow people to become accustomed to the new currency. Many, however, have already accepted the euro.

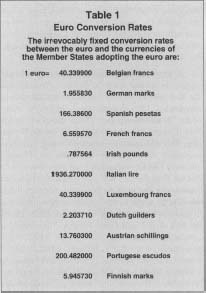

A buyer of fine wines and liqueurs, who purchases his favorite spirits in different countries, told the New York Times how the euro would simplify his transactions. "It will make things simpler for everybody," he told the reporter. "Some things are cheaper here [France] and others are cheaper on the German side. This will make the payments easier." A travel consultant for PricewaterhouseCooper's Financial Advisory Services concurred in an interview with the Detroit Free Press. "If a U.S. business traveler has meetings in two or more European countries during one trip, the single currency makes it easier than ever to compare hotel room rates across borders to choose the best deal," said Bjorn Hanson. "For example, comparing hypothetical room rates of 3,820.50 Belgian francs for a room in Brussels, 1,022.40 French francs for a room in Paris, 22,500 Spanish pesetas for a room in Madrid and 300,060 Italian lira for accommodations in Rome requires time and calculation. But a single currency reveals that—in this example and as of 9 A.M. EST on Jan. 4—the best rate among these is in Brussels at 94.71 euros, followed by Madrid at 135.22 euros, Rome at 154.97 euros, and Paris at 155.85 euros." See Table 1 for the fixed conversion rates between the euro and the currencies of the member states adopting the euro. According to the PricewaterhouseCoopers consultant, the euro will also have a tremendous unifying effect. "Whereas traditional currencies emphasized and reinforced national identities and histories, the euro provides a modem,

Key Dates

Euro Conversion

Rates

| The irrevocably fixed conversion rates between the euro and the currencies of the Member States adopting the euro are: | |

| 1 euro= 40.339900 | Belgian francs |

| 1.955830 | German marks |

| 166.38600 | Spanish pesetas |

| 6.559570 | French francs |

| .787564 | Irish pounds |

| 1936.270000 | Italian lire |

| 40.339900 | Luxembourg francs |

| 2.203710 | Dutch guilders |

| 13.760300 | Austrian schillings |

| 200.482000 | Portugese escudos |

| 5.945730 | Finnish marks |

EURO'S DESIGN

In 2002, when euro coins and currencies will be available, there will be seven euro notes and eight coins. The notes will be denominated in 500, 200, 100, 50, 20, 10, and 5 euros and each will be a different color and size. The design of each note will feature an allegorical image reflecting Europe's architectural heritage. The images will not be of any existing monuments or buildings. Windows and gateways will be prominently featured on the front of each banknote as a symbol of the European Union's openness and cooperation. The verso of each banknote will feature a bridge representative of a particular era. The bridge will symbolize communication between the peoples of Europe and between Europe and the rest of the world.

The eight coins will be denominated as 2 and I euros and 50, 20, 10, 5,2, and 1 cents. Every coin will have a common face showing a map of the European Union backed by transverse lines to which are attached the stars of the European flag. Each member state will design the obverse, which bears the main design of the coin, with their own motifs—such as an imprint of the king of Spain. Regardless of motif, the coins will be accepted throughout all European Union countries. The 1-, 2-, and 5-cent coins will also have a theme relating to Europe's place in the world. The 1- and 2-euro coins will depict Europe sans frontiers.

The graphic symbol for the euro is a curved "E" (looking very much like a "C") with two parallel lines crossing its center. The symbol is based on the Greek letter epsilon—chosen because Greece is the cradle of western civilization and "E" is the first letter in "Europe." The parallel lines symbolize the stability of the euro. EUR is the official abbreviation for the euro and has been so registered with the International Standards Organization.

CHALLENGE TO THE U.S. DOLLAR?

The big question looming in the minds of international currency traders, and those involved in international finance and international trade and commerce is: will the euro supplant the U.S. dollar as the world's dominant currency? Economists, such as former International Monetary Fund administrator George Tavlas, provide a circuitous route to the answer.

It is generally held by economists that within an economic system money has three functions. It functions as a medium of exchange—it is generally accepted as payment in return for goods and services. It functions as a unit of account—the value of a chair, for instance, is generally expressed in terms of money and not in bushels of wheat or haircuts. Money is also a storehouse of value—stocks, bonds, real estate, etc., usually retain a value over time that can be measured in money. In a single economy, such as a country, the government decides what currency can be used as legal tender and that is invariably its own national currency. In the United States, for instance, taxes cannot be paid in Mexican pesos. In the international arena, however, the choice of currency for any given transaction is market driven. As a result of various market forces, money as a medium of exchange and a unit of account is more important than money as a store of value. Because of this, a single international currency or at best a few international currencies come to dominate the global marketplace. Since World War II the dollar has been challenged by the yen and the deutsche mark, but despite ups and downs the dollar has remained dominant because of its medium of exchange and its unit of account characteristics—not because of its ability to store value.

The dollar has maintained its dominance for a number of reasons. Its value has remained stable as has the U.S. government. U.S. financial markets have been relatively free of political control. They also contain a wide variety of financial instruments and have well-developed secondary markets such as the stock market. The dominance of the dollar is also greatly aided by the size of the U.S. economy and its large share of world trade. The United States profits from the dollar's dominance in numerous ways, including seigniorage, the use of home financial institutions for the execution of international transactions, and an economy less influenced than others by currency fluctuations.

Given all of this, the U.S. dollar will nonetheless be challenged by the euro because the combined population, economy, and market force of the I1 countries that make up the European Monetary Union (EMU) is equivalent to the same factors in the United States. The population of the EMU is 290 million, that of the United States, 267 million. The International Monetary Fund provides the following comparative statistics: the 1997 gross domestic product (GDP) of the EMU in trillions of dollars was $6.28, that of the United States was $8.09; the per capita GDP of the EMU in 1997 was $21,600, that of the United States was $30,100; 1996 exports as a share of GDP were 11.7 percent (EMU) versus 8.5 percent (U.S.), and imports as a share of GDP were the same at 10.8 percent.

There are, however, a number of factors, as enumerated by a multitude of economists and other financial analysts, working against the euro and the EMU. The European Central Bank, which is responsible for maintaining the euro, is an unknown quantity as is its ability to control inflation, the number-one eroder of a currency. The dollar is issued by a single political entity while the euro is issued by a union made up of 11 sovereign countries—and many of these countries are undergoing internal conflict between social demands and economic competitiveness. There is also no "Euroland" equivalent to the U.S. Department of the Treasury, which has both monetary and to a certain degree political control over currency. Finally, the United States and the U.S. dollar are known quantities, the European Union and the euro are not. Nevertheless, the euro has the potential to be a strong challenger to the dollar's dominance.

[ Michael Knes ]

FURTHER READING:

Andrews, Edmund L. "Primer on the Euro: From Birth to Growth as Unifying Force." New York Times, 30 December 1998, IA.

Bartlett, Bruce. "Highly Touted Euro Faces Tough Challenges." Detroit News, II January 1999, 6A.

Cohen, Roger. "Shiny, Prosperous 'Euroland' Has Some Cracks in Facade." New York Times, 3 January 1999, IA.

"EMU: An Awfully Big Adventure" (special section). Economist, 11 April 1998.

"Euro May Be Boon for U.S. Travelers." Detroit Free Press, II January 1999, 12F.

European Commission. The Euro: One Currency for Europe." Brussels: European Commission, 1998. Available from europa.eu.int .

Hubbard, R. Glenn. Money, the Financial System, and the Economy. Reading, MA: Addison-Wesley, 1995.

McCauley, Robert N. The Euro and the Dollar. Princeton, NJ: Princeton University, Department of Economics, International Finance Section, 1997.

"Onslaught of the Mighty Euro." Euromoney, August 1998, 37-59.

Organisation for Economic Co-operation and Development. Implementation of the Euro: Key Considerations from the International Business Perspective. Paris: Organisation for Economic Co-operation and Development, 1998.

Tavlas, George. "The International Use of Currencies: The U.S. Dollar and the Euro." Finance and Development 35 (June 1998): 46-49.

Walker, Martin. "The Euro: Why It's Bad for the Dollar but Good for America." World Policy Journal 15, no. 3 (fall 1998): 1-13.

Comment about this article, ask questions, or add new information about this topic: