TERM STRUCTURE OF INTEREST

RATES

The term structure of interest rates describes the differing yields to maturity (YTM) on similar debt securities, with yields typically being higher the longer the period until maturity. For instance, a U.S. Treasury bill with a 6-month maturity might carry a 4.5 percent yield, while a 30-year Treasury bond bought at the same time may yield a 5.5 percent return. When such a difference exists, it is known as a term premium. In the United States, Treasury securities are generally used to map the term structure of interest rates (i.e., the yield curve) because they are virtually free of default risk. However, term structures may be computed and analyzed for any number of interest bearing instruments.

Economists and financial analysts employ term structure analysis, which frequently involves creating or using mathematical models, for a variety of applications. Some of the most common include

- forecasting future interest rates

- estimating the cost of capital for discounting future cash flows

- building predictive models of general economic growth (e.g., to project gross domestic product)

- formulating monetary policy

- estimating future inflation

- understanding dynamics in financial markets

- constructing a portfolio or hedging strategy

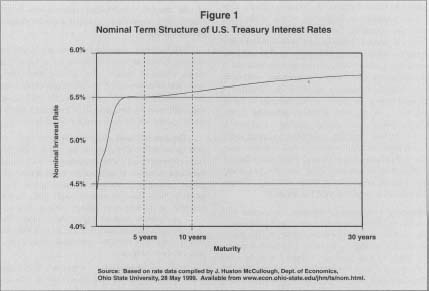

The shape of the term structure may change from period to period, being either upward sloping (i.e., long-term rates higher than short-term rates), downward sloping (i.e., long-term rates lower than short-term rates), or flat (long-term rates equal to short-term rates). Most frequently, however, the term structure is upward sloping. In addition to the direction of the slope, term structure analysis is concerned with the steepness of the slope at any particular time, where a greater slope signifies a larger disparity between interest rates over some period of time. The yield curve in Figure I illustrates the nominal term structure (that is, using the current face value and not adjusting for future inflation) for U.S. Treasury securities based on current rates as of mid-1999.

NOMINAL VERSUS REAL RATES

For many detailed analyses of term structure, the nominal or observed interest rates (e.g., those shown in the figure) are only a starting point, and may not be very meaningful if they cannot be adjusted for inflation

Nominal Term Structure of U.S. Treasury Interest Rates

where R = the nominal interest rate,

r = the real interest rate net of inflation, and

ft = the inflation rate

For example, if the nominal rate on a bond is 4.5 percent, and a reliable

estimate suggests that inflation over the term will average 2.7 percent,

the real rate could be estimated as follows:

Thus, the real rate of return in this case is just 1.75 percent.

TERM STRUCTURE THEORIES

Several theories have been developed to explain the shape and behavior of term structures. While there is no general consensus on these theories among economists, the general trend has been toward more complex theories that address issues like volatility in bond prices. Three main perspectives on term structure are the expectations theory, the liquidity preference theory, and the market segmentation theory.

EXPECTATIONS THEORY.

Expectations theory, also termed expectations hypothesis, is one of the most common economic theories of term structure. It comes in several variations, the most widely known being the unbiased expectations theory. The unbiased expectations theory contends that the long-term rate is the geometric mean of the intervening short-term rates. Further, it suggests that if the term structure is upward sloping, inflation rates are expected to rise in the future. A flat term structure, according to the theory, indicates little change in inflation is expected, and if the term structure is downward sloping, inflation is expected to fall over the period. Another variation is local expectations theory, which posits that the expected rate of return on future maturities is actually equal to the short-term risk-free rate (e.g., current Treasury bill yield) adjusted for inflation.

LIQUIDITY PREFERENCE THEORY.

Concerned with risk-aversion investment behaviors, the liquidity preference theory asserts that lenders anticipate the potential need to liquidate an investment earlier than expected. Since for a given change in interest rates, the price volatility of a short-term investment is lower than the price volatility of a long-term investment, investors prefer to lend short term. Therefore, they must be offered a risk premium to induce them to lend long-term. Borrowers, on the other hand, often prefer long-term bonds because they eliminate the risk of having to refinance at higher interest rates in future periods. Furthermore, the fixed costs of frequent refinancing can be quite high. Therefore, borrowers are willing to pay the premium necessary to attract long-tern financing.

The liquidity preference theory, in conjunction with the unbiased expectations theory, suggests that an upward sloping term structure would be expected to occur more often than a downward sloping term structure. In fact, as stated earlier, this is the most common situation.

MARKET SEGMENTATION THEORY.

Market segmentation theory (MST) is also known as institutional hedging or habitat theory. This theory sees two separate maturity habitats or segments—one long and the other short. Each segment has a schedule of supply (lenders) and demand (borrowers) for loanable funds. The point at which the demand and supply intersect determines the prevailing rate for that sector.

MST recognizes that there are institutional restrictions on the asset side and hedging pressures on the liability side which allow for very little substitutability between bonds of different maturities. Some of these restrictions result from government regulation, company policy, Securities and Exchange Commission regulations, goals and objectives, and fiscal and operational considerations.

Commercial banks and nonfinancial corporations generally supply loans in the short-term segment of the market. Nonfinancial corporations invest (hedge) their excess liquidity until it is needed to meet cash distributions.

Life insurance companies, pension funds, and the like supply the long term segment in anticipation of a steady stream of income over the long haul. Their goals and objectives seem to differ completely from the short-term suppliers except that, for each to be successful over the long-term, they each must consistently operate within their predetermined habitat.

The flow of funds into these institutions, however, is not static. Customers make withdrawals, receive payments, and reallocate resources. As a result, the supply schedule in each market shifts among different institutions. Pensioners may place their monthly funds into commercial banks. The supply decreases in the long-term segment, thus putting upward pressure on rates to attract more funds. The increase of capital in commercial banks increases the supply in the short-term, thus putting downward pressure on short-term rates.

The demand schedules for loanable funds also shifts with changes in the economic cycles. The demand for long-term funds increases when an upturn in the economy is perceived, putting upward pressure on rates. As a business cycle matures, the need to expand inventories creates upward pressures on short-term rates, thus attracting additional supply to the short segment.

The market segmentation model proposes that the spread between long and short-term rates depends largely on the relative supply and demand for these instruments by transactors in their preferred habitats.

[ Roger J. AbiNader ]

FURTHER READING:

Brown, Roger. "Mastering Management: Term Structure of Interest Rates." Financial Times, 3 May 1996.

Dodds, J.C., and J.L. Ford. Expectations, Uncertainty, and the Term Structure of Interest Rates. Reprint ed. New York: Gregg International Publishers, 1993.

Russell, Steven. "Understanding the Term Structure of Interest Rates." Federal Reserve Bank of St. Louis Review, July-August 1992.

Van Deventer, Donald R., and Kenji Imai. Financial Risk Analytics: A Term Structure Model Approach for Banking, Insurance, and Investment Management. Chicago: Irwin Professional Publishing, 1996.

Comment about this article, ask questions, or add new information about this topic: