SIC 3829

MEASURING AND CONTROLLING DEVICES, NOT ELSEWHERE CLASSIFIED

This industry is comprised of companies primarily engaged in manufacturing a multitude of miscellaneous monitoring instruments. Major industry product segments include aircraft engine instruments; nuclear radiation detection and monitoring instruments; commercial, geophysical, meteorological, and general-purpose instruments and equipment; and physical properties testing and inspection equipment. This industry also encompasses companies that produce selected surveying and drafting supplies, such as transits, slide rules, and T-squares, as well as other measuring and controlling devices. For more information on the history of measuring devices, see other entries in SIC group 382.

NAICS Code(s)

339112 (Surgical and Medical Instrument Manufacturing)

334519 (Other Measuring and Controlling Device Manufacturing)

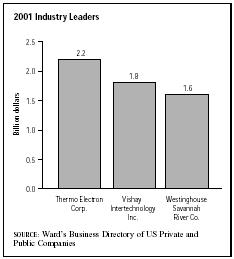

This industry was fragmented in comparison to other U.S. manufacturing sectors, with a large variety of product specializations. The overall industry leader in 2001 was Thermo Electron Corp. of Waltham, Massachusetts, with sales of $2.2 billion and 12,000 employees. Despite a small decline, the company was stable, with 2003 sales of $2.1 billion and 10,800 employees. In second place was Vishay Intertechnology Inc. of Malvern, Pennsylvania, with 2001 sales of $1.8 billion and 21,400 employees. Rounding out the top three was Westinghouse Savannah River Co. of Aiken, South Carolina, with $1.6 billion in sales and 12,400 employees. In the trace detection segment of the industry, Ion Track commanded a full 50 percent of the market share.

The main customers of the aircraft engine instruments segment were General Electric (GE), United Technologies, Rolls Royce, and other aircraft manufacturers. The sector shipped temperature, pressure, vacuum, fuel and oil flow-rate sensors, and other measuring devices. Growth in this market is linked to aircraft production.

Most of the products shipped by the nuclear radiation detection and monitoring segment were shipped to the U.S. Department of Energy, U.S. Department of Defense, and nuclear power plants. These products included radiation detection instruments, radiation dosage monitoring instruments, pulse analyzers, and nuclear spectrometers. The segment's growth hinges on defense research and development (R&D) spending.

Commercial, geophysical, meteorological, and general-purpose instruments and equipment is a large segment in the measuring and controlling devices industry. Product shipments include weather forecasting and other meteorological instruments, seismic detection, petroleum exploration, and other geophysical instruments. This segment's growth is affected by the nation's economy.

Physical properties testing and inspection equipment was another large segment of this industry. R&D investment by durable goods manufacturers spurs demand for the physical properties testing instruments, physical properties inspection equipment, and kinematic testing equipment produced by this segment.

Construction activity affects growth in the surveying and drafting instruments and apparatus segment. Surveying equipment comprises the majority of product shipments.

After 1950, rising demand for measuring and controlling devices by aerospace, nuclear, and petroleum industries pushed industry revenues to about $2 billion by the end of the 1970s. Likewise, increased defense spending and general U.S. economic growth, combined with steady export gains, almost doubled revenues during the 1980s. Indeed, as aerospace and nuclear device sales proliferated, overall industry sales grew at an average rate of 7 percent between 1982 and 1990, to more than $4 billion. Exports represented 40 percent of total shipments.

Although industry employment remained steady during the 1980s—at about 37,000 workers—increased automation and the movement of some manufacturing activities overseas resulted in workforce cutbacks during the 1990s. In fact, by 1996 the workforce as a whole had dropped 17 percent from 1990, and production workers fell 11 percent since 1992.

Sharp cutbacks in defense spending and the virtual cessation of new nuclear facility construction in the United States rattled industry participants in the early 1990s. Despite some domestic setbacks, the demand for meteorological measuring devices continued to grow, and exports surged. Sales in physical properties testing took up the rest of the slack in the industry, passing up meteorological measuring in 1995 as the biggest division within the industry in terms of sales dollars. Total value of shipments in 1995 was $4.6 billion, with physical properties accounting for $1.5 billion of that total, and meteorological measuring devices accounting for $1.4 billion. Although imports increased, exports still held a commanding 40 percent of sales, thus bringing the trade surplus down to $1.1 billion.

As with many manufacturing industries, the miscellaneous measuring and controlling device sector was changing rapidly due to increased computer, electronic, and digital innovations. Automation and efficiency, in conjunction with cost-effectiveness, was expected in products in the 2000s. According to the U.S. Industry and Trade Outlook , "the increased use of 'intelligent' products is allowing the end user—a manufacturing facility or power plant—to predict problems in advance of costly failures."

Through the mid-2000s, the miscellaneous measuring and controlling devices industry was projected to grow at an annual rate of 3 percent. Aircraft engine instruments was predicted to be one of the industry's faster growing segments. Furthermore, the addition of software and services will contribute to overall industry growth, as will further expansion into overseas markets. The top five export markets in the late 1990s were Canada, Mexico, Japan, United Kingdom, and Germany; these five countries also were the top import countries. Looking into the 2000s, estimates indicated that 33 percent of measuring and controlling instruments product shipments would be exported, while 25 percent of U.S. production would be imported.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Hoover's Company Fact Sheet. "Thermo Electron Corporation." 3 March 2004. Available from http://www.hoovers.com .

"Latest GC/MS Delivery." R&D , February 2004.

Lazich, Robert S., ed. Market Share Reporter. Detroit, MI: Thomson Gale, 2004.

"Thermo Signs Sales Pact." Analytic Separations News , January 2004.

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

US Industry and Trade Outlook. New York: McGraw Hill, 2000.

Comment about this article, ask questions, or add new information about this topic: