SIC 1752

FLOOR LAYING AND OTHER FLOOR WORK, NOT ELSEWHERE CLASSIFIED

This category includes special trade contractors primarily engaged in the installation of asphalt tile, carpeting, linoleum, and resilient flooring. The industry also includes special trade contractors engaged in laying, scraping, and finishing parquet and other hardwood flooring. Establishments primarily engaged in installing stone and ceramic floor tile are classified in the Masonry, Stonework, Tile Setting, and Plastering industries; those installing or finishing concrete floors are classified in SIC 1771: Concrete Work; and those installing artificial turf are classified in SIC 1799: Special Trade Contractors, Not Elsewhere Classified.

NAICS Code(s)

235520 (Floor Laying and Other Floor Contractors)

The U.S. floor-laying industry is characterized by a large number of special trade contractors who perform work for a general contractor or an architect. According

to the latest figures available from the U.S. Census Bureau, roughly 12,000 of these establishments operate in the United States. Carpet installers may also install other types of flooring, such as tile and/or vinyl and linoleum.

Much of the floor-laying industry works in the residential repair and remodeling (R&R) market. Renovation and repair had increased dramatically in the mid-1990s, reaching an all-time high of $69.5 billion in total revenue in 1995. New installations, however, were the key to industry growth in the late 1990s and early 2000s. Fueled by lower interest rates, the residential construction industry continued to boom well into the early 2000s, despite a weak economy. According to the National Association of Home Builders (NAHB), new housing starts reached a 25-year high of more than 1.8 million in 2003.

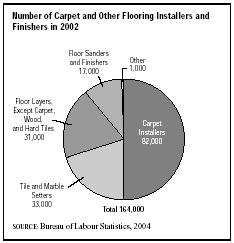

The health of the floor-laying industry is closely tied to that of the housing and construction industry; when housing starts increase, as they did in the early 2000s, floor layers see increased work. The rate of employment for carpet layers, however, generally remains stable, since so much of their work involves the replacement of carpet. By 2002, carpet, flooring, and tile installers numbered 164,000. Approximately 82,000 of those workers were employed in carpet installation, compared to 50,000 in the mid-1990s, according to the U.S. Bureau of Labor Statistics. Floor layers, except for carpet, wood, and hard tiles, accounted for 31,000 workers in 2002, while floor sanders and finishers numbered 17,000. While some flooring installers worked for flooring contractors or floor covering retailers, more than 40 percent were self-employed in 2002. Employment in this industry was expected to grow by nearly 17 percent between 2002 and 2012 due to the continued need to renovate and refurbish existing structures and a growing demand for carpet in new industrial plants, schools, hospitals, and other commercial buildings.

Carpet and other flooring installers may belong to either the United Brotherhood of Carpenters and Joiners of America or the International Brotherhood of Painters and Allied Trades.

Of all floor coverings, carpet continues to be the most popular product for both residential and commercial buildings. Carpet industry shipments reached 1.88 billion square yards in 2001, compared to 97 million square yards shipped in 1950. In the late 1990s and early 2000s, carpet accounted for the majority of the total flooring market (both residential and commercial). For houses built with plywood rather than hardwood floors, wall-to-wall carpet is a necessity. Commercial properties, such as offices and shopping centers, also use carpet to cover concrete floors. And, as previously stated, carpet continues to be used largely in renovation work. As new fibers are developed, particularly those that are stain and crush resistant, more durable, and in a wider range of colors, the demand for carpet will continue to grow. Over the past decade, however, hardwood floors have experienced a resurgence in popularity and usage. Laminate flooring, which looks and feels like hardwood but is typically less expensive and more resistant to scratching, also gained in popularity. Vinyl and linoleum manufacturers also continue to improve their products: the newer vinyls come with a glossed finish, requiring less maintenance to retain original appearance. Most are available without patterns (they may have a fleck or pebble-grain design), but more are becoming available with stylish patterns, in order to compete with the commercial carpet market.

Industry leaders in the early 2000s included Continental Flooring Company, based in Scottsdale, Arizona, which sold flooring mainly to government agencies, as well as Evergreen, Colorado-based Kalman Floor Company.

Further Reading

The Carpet and Rug Institute. "Carpet and Rug Institute." Dalton, GA: 2004. Available from http://www.carpet-rug.com .

National Association of Home Builders. Housing: 2004 Fact, Figures, Trends. Available from http://www.nahb.org/ .

U.S. Bureau of the Census. "Economic Census 1997." Washington, DC: 2000. Available from http://www.census.gov .

U.S. Department of Labor, Bureau of Labor Statistics. Occupational Outlook Handbook, 2004-05 Edition. Washington, DC:2004. Available from http://www.bls.gov/oco/print/ocos203.htm .

Comment about this article, ask questions, or add new information about this topic: