SIC 1796

INSTALLATION OR ERECTION OF BUILDING EQUIPMENT, NOT ELSEWHERE CLASSIFIED

Special trade contractors primarily engaged in the installation, erection, or dismantling of miscellaneous building equipment make up this industry, which encompasses numerous firms that offer a wide range of services. Common activities include the installation, repair, and dismantling of conveyor systems, dumbwaiters, dust collecting equipment, elevators, incinerators, industrial machinery, power generation devices, revolving doors, and vacuum cleaning systems.

NAICS Code(s)

235950 (Building Equipment and other Machinery Installation Contracts)

Businesses classified in this industry include more than 4,400 establishments, according to the latest figures available from the U.S. Census Bureau. The installation or erection of building equipment industry produces nearly $10 billion in total revenues.

Most contractors in this industry rely heavily on new commercial, industrial, and institutional construction. Industrial buildings account for nearly one-third of the value of construction work done by this industry, followed by office buildings and other commercial buildings.

When building markets boomed during the mid-1980s, most specialty contractors realized healthy growth in billings and profits, and demand for items such as industrial machinery, elevators, and revolving doors increased. Contractors in this business, however, have to cope with the extremely cyclical nature of the nonresidential construction market, and this fluctuating cycle was most clearly evident during the late 1980s and early to mid-1990s. For example, industrial building construction expenditures in the United States advanced from $15 billion in 1987 to $23.8 billion in 1990. In 1991, however, construction in this category fell to $22.3 billion and continued falling to $20.7 billion in 1992 and to $19.5 billion in 1993. Nonetheless, the industrial building market bounced back in 1994, to $21.1 billion and $24.1 billion in 1995.

The cycle in office building construction, the second largest market for contractors in SIC 1796, has been even more pronounced. Construction in this category peaked in 1989 at $31.5 billion. By 1993, however, construction expenditures in this category had dropped by half, to just $15.4 billion, before recovering slightly to $17.0 billion in 1994 and $19.4 billion in 1995.

This cycle has a profound impact on contractors in this industry category. During good times, specialty contractors enjoy healthy profit margins, expanding business, and steady demand for their services. In bad times, many contractors manage to stay afloat only by taking on installation and repair jobs at very low profit margins. In the early to mid-1990s, for example, elevator contractors were emphasizing elevator retrofits that integrated advanced technology. They were also striving to increase their share of the airport and health care elevator markets.

The long-term outlook for this industry appears to be mixed. While commercial construction benefited from the extended economic expansion of the late-1990s, over-building in many regions dampened the industry's performance in the early 2000s when the economy weakened considerably. While residential construction was boosted by interest rates that dipped to rates not seen since the 1950s, nonresidential construction experienced no such cushion. Businesses of all kinds began to curb spending on new and existing construction projects. Particularly hard hit was office construction. Spending on office building construction slowed considerably, from $47.5 billion in 1999 to roughly $43 billion in 2002 and

to $39 billion in 2003. Between 1999 and 2003, office vacancy rates jumped from 8.9 percent to 16.5 percent.

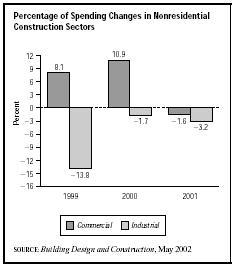

One bright spot in this downturn was institutional construction, fueled in large part by healthcare facility construction, which didn't begin to wane until 2003. Compared to industrial construction spending, which declined by 3.2 percent in 2001, and to commercial construction spending, which dipped 1.6 percent that year, spending on institutional construction grew 10 percent. In 2003, however, total nonresidential construction spending dropped by 6 percent, as even the strongest sectors, such as healthcare construction, began to see previously rapid growth rates slow.

Privately owned companies dominate this diverse industry. The largest companies in the industry tend to be diversified contractors that have interests in many different areas. As a result, their activities in this industry category are just a small part of their overall business. Industry leaders include Millar Elevator Service Company, of Holland, Ohio, which was acquired by Morristown, New Jersey-based Schindler Elevator Corp. in 2002, and Harco Technologies Corp. of Medina, Ohio.

Further Reading

Delano, Daryl. "Clouds Over Industrial Sector Won't Break Until '03." Building Design and Construction. May 2002.

"Home Building Strong, But Commercial Construction Falters." Indianapolis Business Journal. 17 February 2003.

U.S. Bureau of the Census. 1997 Economic Census, 20 March 2000. Available from http://www.census.gov .

Comment about this article, ask questions, or add new information about this topic: