SIC 3639

HOUSEHOLD APPLIANCES, NOT ELSEWHERE CLASSIFIED

This industry includes establishments primarily engaged in manufacturing household appliances, not elsewhere classified, such as water heaters, dishwashers, food waste disposal units, and household sewing machines. Major product groups include water heaters, dishwashers, food disposers, trash compactors, floor waxers, and sewing machines. Laundry equipment, refrigerators, and other major household goods are classified separately, as are commercial appliances.

NAICS Code(s)

335212 (Household Vacuum Cleaner Manufacturing)

333298 (All Other Industrial Machinery Manufacturing)

335228 (Other Household Appliance Manufacturing)

Industry Snapshot

A uniquely American innovation, electric and gas household appliances became commonplace in U.S. homes during the postwar economic expansion of the 1950s, 1960s, and 1970s. By the early 1980s, miscellaneous appliance makers in the United States were shipping about $1.5 billion worth of goods each year and employing a workforce of more than 14,000. Continued rapid growth in the 1980s pushed industry sales past $3.2 billion by the early 1990s. In the late 1990s, industry shipments were valued at $3.7 billion. In 1997, combined sales were approximately $2.9 billion for just the water heater, dishwashing machine, floor-care machine, food waste disposal, and household trash compactor industry segments. Industry projections expected growth in the total shipment value of this industry to continue at about 3 percent annually through 2012.

Although limited due to manufacturing consolidation, intense competition, and market maturity, growth in this industry seems assured as the economy stays strong and demographics change.

Organization and Structure

The largest segment of this household appliances category is water heater manufacturing, which accounts for roughly 40 percent of industry sales. Dishwashers, the second largest product category, are trailed by trash compactors, disposers, floor waxers, sewing machines, and related supplies and attachments.

Appliance sales are driven primarily by three factors: replacement sales; product market penetration, particularly in the case of completely new appliances; and new construction, which generates demand by builders that perform first-time installations. Because most product categories have achieved almost full market penetration, miscellaneous appliance sales are highly dependent upon replacement sales and new construction, and are closely linked to housing starts and economic growth.

Pricing is very competitive. According to Standard & Poor's, "To gain or simply maintain market share, domestic appliance manufacturers have endeavored over the past few years to offer consumers more product at a lower price, to improve relationships with the strongest distributors, and to keep operating costs down." Manufacturers attempt to keep costs down by more efficient manufacturing and through restructurings, and work to build brand loyalty, especially in the replacement market.

The appliance industry can be differentiated from other manufacturing sectors by its production characteristics. Appliance manufacturing is essentially an assembly-line process whereby ready-made components are assembled. Because it has low fixed costs and is labor intensive, appliance production offers abundant opportunities for manufacturing efficiency gains. This characteristic contributes to a high weight-to-value ratio that limits overseas appliance imports into the United States, and caused prices to remain effectively fixed during the 1980s and into the 2000s.

Appliances are mainly sold through retail outlets, which have trained workers. Manufacturers usually ship products to warehouses from which they are distributed to retailers. However, some large retailers, such as Sears, Roebuck & Co., establish agreements with manufacturers for shipments directly to their warehouses. While manufacturers generally used the Internet only for providing product information to consumers, with the rise of e-commerce in the 2000s, retailers like Sears were using the Internet to offer products for sale online.

Products. The two main types of water heaters are electric- and gas-powered. Gasheaters made up over half of all residential water heater sales in 2002. Although electric heaters are often priced lower, gas heaters usually operate less expensively. Most water heaters consist of a tank that is made of galvanized iron or aluminum alloys and holds between 20 and 140 gallons. A glass or plastic liner is used to reduce corrosioninside the tank. Water temperature can be adjusted between 100 and 200 degrees Fahrenheit. In 2002 U.S. producers sold about 4.99 million gas water heaters and $4.39 electric water heaters.

The two main categories of household dishwashers are portable and built-in. Built-ins were by far the major type. Manufacturers shipped a total of 6.2 million dishwashers in 2002. Most dishwashers use pumps and impellers to throw the same water against dishes over and over to clean them. Fresh rinse water is then used. The cycle is typically completed by heat-drying the dishes. About 50 percent of all U.S. homes had a dishwasher in the early 1990s, up from 45 percent in 1980. However, in the late 1990s dishwashers still were not considered a must-have appliance by homeowners, and they had a low market saturation in comparison to other major appliances. Shipments continued to show steady annual growth in the early 2000s.

Garbage disposal units are motor-operated grinders that are installed in kitchen sinks. These devices allow food to be washed down the drain. Approximately 50 percent of all U.S. homes were equipped with a disposal

unit in the early 1990s, and nearly 4.0 million units were sold in 1993. In 1998, 4.9 million units were shipped, and in 2002 that number had increased to 5.8 million. Trash compactors represent a negligible share of the appliance market. In 1989 manufacturers shipped 207,000 compactors. Except for a spike of 130,000 units in 1994, the category slipped to just 97,000 units in 1995 and 1996 before increasing to 103,000 in 1997, reaching 106,000 in 1998, and then 115,000 in 2002.

In the 1990s, floor polishers and sewing machines accounted for a meager share of U.S. miscellaneous appliance output. Manufacturers exported 49,000 floor polishers in 1997, while 13,200 units were imported. Most sewing machines are manufactured in Japan. In 1997,1.56 million household sewing machines, with a value of $232 million, were imported; 50,000 machines, with a value of $14 million, were exported.

Background and Development

Many of the appliances classified in this industry have existed for centuries. Not until the twentieth century, however, did self-contained electric- and gas-powered household appliances appear. A primary impetus for the development of such tools was the almost total disappearance of full-time domestic servants.

Appliances available in the early 1900s included electric clothes washers, water heaters, refrigerators, and sewing machines. In the second half of the century, during rapid postwar U.S. economic growth, a demand emerged for dishwashers, clothes dryers, food disposers, floor polishers, and similar devices of convenience. A rise in discretionary income, growth in the number of U.S. households, and a desire for more recreational time were major factors contributing to the rise of the miscellaneous appliance industry from the 1950s to the 1970s.

By the early 1980s, miscellaneous appliance manufacturers were shipping about $1.5 billion worth of goods each year, and employing more than 14,000 workers. Strong industry growth continued during the 1980s as housing starts surged and growing home renovation markets spurred replacement sales. In addition, an increase in the number of working women boosted market penetration by some products.

Although industry revenues shot up more than 100 percent between 1982 and 1990, reaching approximately $3.3 billion, unit shipments grew at an even faster rate and industry profits climbed. Manufacturers were able to achieve such growth through economies of scale and productivity gains. Indeed, as revenues and shipments more than doubled during the 1980s, industry employment remained steady. Hefty investments in automation and information systems permitted these efficiency gains.

Economies of scale were attained primarily through mergers and acquisitions, which characterized almost all appliance sectors throughout the 1980s and early 1990s. As manufacturers joined forces to increase investment capital and reduce research and production expenditures, the number of competitors in the miscellaneous appliances industry lessened. Antitrust legislation enacted during the 1980s slowed the rate of consolidation by the early 1990s.

Sluggish economic conditions, which suppressed housing starts and replacement sales, battered manufacturers of miscellaneous appliances in 1990. Home building and consumer expenditures picked up in 1992, though, prodded by low interest rates and pent-up demand. After plunging to $3.1 billion in 1990, industry revenues climbed to $3.3 billion in 1991 and grew about 4 percent annually during 1992 and 1993. Unit sales volume climbed even faster. Dishwasher shipments, for example, jumped almost 8 percent in 1993, and water heater orders increased by about 6 percent. Export growth augmented the domestic recovery and promised to provide an avenue for long-term expansion.

About 26 percent of industry revenues in the early 1990s was garnered from individual consumer purchases. Residential builders consumed approximately 20 percent of aggregate output, while commercial and institutional developers made up approximately 24 percent of the market. Roughly 5 percent of production was exported. The remaining 25 percent of sales were made to the armed forces, state and local governments, mobile home builders, and other sectors.

Although appliance makers lacked major new product offerings that could broaden their industry, they were having some success enticing new buyers to the market by adding new features to established products. Manufacturers also were benefiting from generally positive demographic trends. For instance, aging baby-boomers were investing an increasing proportion of their income into their homes, reflecting a desire for products that make the lives of two-income families more convenient and more comfortable. In addition, large numbers of appliances sold in the early 1980s were rapidly approaching replacement age. In an effort to exceed forecasts of modest growth, producers in the mid-1990s strove to accelerate replacement sales by developing more energy-efficient, convenient, and versatile machines.

While opportunities prevailed in rapidly unfurling Asian markets, U.S. producers were largely avoiding that region in the early 1990s. Three successful Japanese conglomerates—Hitachi, Toshiba, and Matsushita—had established a strong grip on much of the Asian market and posed formidable entry barriers to even the most savvy American competitors. Likewise, Japanese producers were avoiding North American markets for fear of their U.S. counterparts, which maintained a lead in production efficiency, distribution, and marketing know-how—U.S. producers supplied more than 75 percent of domestic demand for all types of appliances in 1993. Japanese companies had succeeded in penetrating the sewing machine market, though, and were supplying more than 70 percent of global demand going into 1994.

U.S. appliance exports jumped 16 percent in 1992. Canada and Mexico consumed about 46 percent of those shipments, while the European Community purchased about 15 percent. East Asian and South American consumers accounted for 12 percent and 6 percent of U.S. exports, respectively. In the short term, Canada and Mexico will continue to offer strong growth opportunities, particularly in the wake of the North American Free Trade Agreement (NAFTA) that Congress passed in 1994. Exports to Mexico jumped 18 percent in 1993, while shipments to Canada ballooned 20 percent following a 1992 reduction in tariffs.

As domestic appliance makers continued to boost exports, imports surged. Imports increased by an uncharacteristically high 28 percent in 1992, despite a weak U.S. dollar, and imports rose steadily during the 1990s and early 2000s. The main reason for import growth was the proliferation of U.S.-owned manufacturing plants in foreign countries. U.S. producers were shifting production to low-cost countries, such as Mexico and China, which offered cheap labor and materials. Imports from Mexico, for example, grew by 40 percent in 1993 and were expected to expand further with the passage of NAFTA.

Several trends were contributing to favorable conditions for the industry at the close of the twentieth century. The pool of likely buyers was increasing as a large segment of the population was reaching its peak spending years. Because employment was high, more consumers had disposable income. In addition, available credit and lower interest rates spurred housing activity and remodeling, and thus, appliance sales. Home ownership reached a record level of 66 percent. Homeowners purchased appliances to furnish new houses, to replace those in houses new to their buyers, to replace worn-out appliances, and to renovate their kitchens with modern appliances. Four or five appliance units are bought for each new housing start. Replacement sales were expected to be strong in the next decade as appliances bought in the 1980s come to the end of their 10-to-15-year life spans. Approximately three-quarters of all appliance sales are to replace broken or worn-out appliances.

The appliance industry was globalizing as many countries lowered their tariffs, thus enabling appliance imports and exports to increase about 6 percent between 1996 and 1997. Also, appliance companies invested in foreign companies through acquisitions and joint ventures, particularly in the former communist countries and in industrializing countries in Asia and Latin America. China, Mexico, Canada, Taiwan, and South Korea accounted for 66 percent of imports in 1997. Mexico and Canada were benefiting from NAFTA and the U.S.-Canada Free Trade Agreement; China was benefiting from low labor costs. In 1998, imports caused U.S. appliance producer prices to decline. Fifty-three percent of U.S. appliance exports went to Canada, Mexico, the United Kingdom, Japan, and South Korea.

Current Conditions

The steel tariffs imposed in the early 2000s hurt many U.S. manufacturers, and the appliance manufacturing industry was no exception. The industry annually consumes more than 3 million tons of steel, and the increase in price, as well as the sharp drop in employment, hurt appliance manufacturers by association. The tariffs were repealed in 2003, and the manufacturing market was expected to stabilize again.

Government environmental regulations continued to be one of the greatest hurdles facing appliance makers. The Department of Energy's (DOE) National Appliance Energy Conservation Act of 1987 had set new standards that limited energy consumption by new appliances. The act required manufacturers to cut product energy consumption by 25 percent every five years. More recent regulations were aimed at reducing harmful gas emissions.

While most industry participants achieved compliance with all regulations on schedule, and some manufacturers had boost sales with environmentally friendly products, some appliance makers resented the new regulations, citing the capital investments required to meet the stipulations of such legislation, as well as the small amount of energy consumed by appliances—only 4 percent, according to the Association of Home Appliance Manufacturers. As of 2003, manufacturers had more than doubled the energy efficiency of their appliances over those of 30 years prior, but at great cost to the industry in both dollars and employment, particularly for smaller firms.

Industry Leaders

The appliance industry remains highly consolidated; five major firms supply more than 98 percent of all U.S. appliances. The biggest players in the miscellaneous appliance market are Whirlpool, General Electric (GE) Appliances, and Maytag. Whirlpool, the number one major home appliance producer in the United States and number two in the world, markets its products under the Kenmore, KitchenAid, Whirlpool, and other brand names. Products include dishwashers and compactors. GE is the number two producer of major household appliances. Its products include dishwashers, disposals, and compactors. Number three Maytag sells Maytag, Jenn-Air, Performa, and Magic Chef dishwashers, and Hoover floor polishers.

Some smaller product segments, however, are dominated by niche firms. In-Sink-Erator is the largest food waste disposer manufacturer in the world, with 75 percent of the market, followed by Anaheim Manufacturing Co. Anaheim's brands include Waste King, Sinkmaster, and Whirlaway. The Singer Company, founded in the United States and now headquartered in Netherlands Antilles, is the world's leading producer of sewing machines. Its brands are Singer and Pfaff. Water heater manufacturers include State Industries Inc., which produces more than 2.3 million units per year, including the Maytag brand, and A.O. Smith Corp.

Kenmore held the largest share of the dishwasher market, with 26 percent, followed by Maytag and General Electric with about 17 percent each. Whirlpool commanded 88 percent of the compactor market, with Broan nuTone holding at 11 percent.

According to Ward's Business Directory of US Private and Public Companies, three of the top firms in this industry in 2001 were Nortek, Inc. of Providence, Rhode Island, with sales of $1.8 billion; State Industries Inc. of Ashland City, Tennessee, with sales of $538 million; and Rheem Manufacturing Co. of Montgomery, Alabama, with sales of $347 million.

America and the World

The United States is the largest consumer and producer of appliances in the world. It maintains the highest level of market saturation in virtually every major line of appliance. Generally low penetration of major appliances in comparison to the United States reflects the higher energy costs, less space, and lower living standards characteristic of other countries.

Because manufacturers have achieved close to maximum market penetration with most miscellaneous appliances in the United States, they increasingly focused their expansion efforts in the 1990s on foreign markets that offered a greater potential for growth. Europe posed the greatest prospect for profits. Appliance industries on that continent were still fragmented, leaving the market open for massive U.S. conglomerates to take market share or make company acquisitions. The Latin American market also was fragmented, with about 65 manufacturers. However, by 1998 Whirlpool and its affiliates already had garnered a 25 percent share.

Asia promised to be the world's largest market in the twenty-first century. According to Standard & Poor's, "it could consume as many appliances as North America and Western Europe combined." Whirlpool had entered this market through joint ventures in China and as a major distributor to India, Pakistan, and other nations. Maytag also entered into a partnership in China. According to the Association of Home Appliance Manufacturers, trade with China, the fastest growing export market for many manufacturing industries, was particularly important to cultivate in the 2000s, since growth would be assured "not from selling to saturated, developed markets, but instead from trading with emerging markets and developing countries."

Although imports have risen, exports were expected to increase at a higher rate.

Research and Technology

Technological advancements in the mid-1990s centered around compliance with environmental regulations and the development of more efficient appliances. Producers were striving to retain the cleansing power of dishwashers, for example, while reducing water usage. Meanwhile, water heater manufacturers continued to search for more efficient heating, insulation, and distribution technology.

European manufacturers were involved in producing a noise-free dishwasher in the early 1990s. Although the cleansing power of such machines was not yet acceptable to U.S. consumers, manufacturers from all continents were trying to develop a soundless machine. Frigidaire, for example, was offering three sound-blanketing packages with its dishwashers that incorporated vinyl-backed fiberglass, quilted foil-backed fiberglass, and asphaltic sound-damping materials. Manufacturers also were experimenting with quieter motors and noise-cancellation frequency generators.

Advances related to all types of appliances were being achieved through the increased use of plastics. New thermoplastics, for example, were being used to reduce heat loss that occurs in appliances encased in metal. Other plastics were helping manufacturers reduce shipping weight and increase the strength and durability of their products. Waste King, for example, switched from a stainless steel housing on a garbage disposal to one made of an engineered polymer compound. This reduced the unit's weight by five ounces, made it smaller, and decreased its noise level by five decibels.

Further Reading

"Appliance Industry Applauds Steel Tariff Reversal." Association of Home Appliance Manufacturers, 4 December 2003. Available from http://www.aham.org/News/newsitem.cfm?Item_ID=175 .

"Background Information and AHAM Position on DOE's Energy Standard Program." Association of Home Appliance Manufacturers. 7 March 2004. Available from http://www.aham.org/issues/doe.cfm .

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

"China Most Favored Nation Status." Association of Home Appliance Manufacturers. 7 March 2004. Available from http://www.aham.org/issues/chinamfn.cfm .

"Global Climate Change." Association of Home Appliance Manufacturers. 7 March 2004. Available from http://www.aham.org/issues/climatechange.cfm .

Hoover's Company Fact Sheet. "Nortek Holdings, Inc." 3 March 2004. Available from http://www.hoovers.com .

Hoover's Company Fact Sheet. "Whirlpool Corporation." 7 March 2004. Available from http://www.hoovers.com .

"Household Durables." Standard & Poor's Industry Surveys, October 1999.

Lazich, Robert S., ed. Market Share Reporter. Detroit, MI: Thomson Gale, 2004.

"Major Appliance Exports." Association of Home Appliance Manufacturers, August 2003. Available from http://www.aham.org .

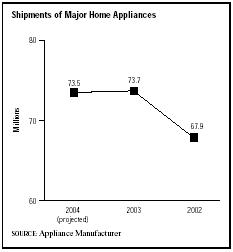

"Shipments and Forecasts." Appliance Manufacturer, March 2004.

"Statistical Highlights Ten Year Summary." Gas Appliance Manufacturers Association, 2003. Available from http://www.gamanet.org .

"Study Shows Efficient Appliances Yield Dramatic Energy and Water Savings." 1 August 2001. Available from http://www.energy.gov .

"Trends and Forecasts." Association of Home Appliance Manufacturers, 2003. Available from http://www.aham.org/report/files/TRENDS.htm .

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

US Industry and Trade Outlook. New York: McGraw Hill, 2000.

Comment about this article, ask questions, or add new information about this topic: