SIC 3499

FABRICATED METAL PRODUCTS, NOT ELSEWHERE CLASSIFIED

The fabricated metal products not elsewhere classified industry encompasses establishments that manufacture miscellaneous metal goods for both commercial and residential applications. Examples of industry output include metal ladders, ironing boards, steel safes, toilet fixtures, trophies, lawnmower wheels, chairs, barricades, ammunition boxes, and automobile seat frames. For more information about miscellaneous fabricated metal products, see other entries in this industry group.

NAICS Code(s)

337215 (Showcase, Partition, Shelving, and Locker Manufacturing)

332117 (Powder Metallurgy Part Manufacturing)

332439 (Other Metal Container Manufacturing)

332510 (Hardware Manufacturing)

332919 (Other Metal Valve and Pipe Fitting Manufacturing)

339914 (Costume Jewelry and Novelty Manufacturing)

332999 (All Other Miscellaneous Fabricated Metal Product Manufacturing)

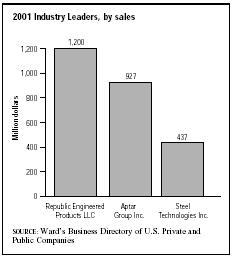

Republic Engineered Products LLC of Akron, Ohio, was the industry leader with 2001 sales of more than $1.2 billion and 4,500 employees. In second place was the Aptar Group Inc. of Crystal Lake, Illinois, with sales of $927 million and 6,600 employees. Rounding out the top three was Louisville, Kentucky-based Steel Technologies Inc., with $437 million in sales and 1,100 employees.

The background and development of the industry varies by product category. During the post-World War II U.S. economic expansion, the industry was characterized by a general surge in demand. Approaching the 1980s, industry participants were churning out about $4.4 billion worth of goods per year and employing a workforce of 65,000 people. Moreover, healthy economic growth during most of the 1980s boosted sales and profits. A surge in housing starts, for example, boosted shipments of metal furniture parts and ladders. Likewise, bank and vault manufacturers benefited from growth in the savings and loan industry.

By 1989, industry sales had reached more than $6.9 billion, representing average annual revenue growth of 7 percent since 1983. In contrast to many other manufacturing sectors, both the number of employees and companies in the industry grew during the decade, to 80,000 and 900, respectively. Unfortunately, an economic recession in the early 1990s stalled this expansion. Revenues actually declined about 1 percent in 1990 and remained flat

throughout 1991 and 1992. For example, shipments of metal containers dropped about 6 percent in 1992, and purchases by the ailing savings and loan industry remained depressed. An upturn in housing and automobile markets in the mid-1990s, however, renewed optimism in some segments.

In the late 1990s, California had the highest number of establishments with 380, but that state only produced 8 percent of total U.S. shipments. Pennsylvania's 211 establishments generated 11 percent of U.S. shipments. Overall, shipment values in the industry were expected to increase from about $8.4 billion in 1996 to $9.0 billion in 1998.

Because of its specialized nature, the industry is highly fragmented. The average industry participant grossed about 28 percent as much as the average U.S. manufacturer in the mid-1990s and employed about half as many workers.

Although the industry is fragmented, a few product segments stood out in the late 1990s. Fabricated metal safes and vaults accounted for about 3 percent of production, and metal ladders accounted for about 4 percent. Flat metal strapping accounted for about 5 percent, and powder metallurgy parts represented approximately 14 percent of production. The largest segment of production, at 50 percent, was for all other fabricated metal products, not elsewhere classified, which illustrates the industry's fragmentation.

According to the U.S. Department of Labor, Bureau of Labor Statistics' Economic and Employment Projections , employment for the other fabricated metal product manufacturing industries as a whole was expected to decline by 3 percent annually into 2012, even as ouput was expected to rise. Automation and the movement of manufacturing facilities to locations outside the United States were expected to curtail job growth. Openings for many positions declined by 3-29 percent between 1994 and 2005. Jobs for assemblers and fabricators, which made up a leading 11 percent of the workforce, increased in small numbers. The occupations with the highest projected growth were combination machine tool operators (51 percent) and metal and plastic machine tool cutting operators (42 percent).

Industry leader Republic Engineered Products, following on the heels of layoffs, was hard hit after the major power outage that struck the northeast United States in August of 2003. A fire during the blackout caused a blast furnace to explode, which stopped production for a month and a half, until a backup furnace began operating. Less than two weeks later, the company also lost the use of a rolling mill and new bar mill due to electrical problems. In October of 2003, Republic filed for Chapter 11 bankruptcy and was bought the following month by Perry Strategic Capital Inc. There were plans to impose surcharges on raw materials and scrap at the close of 2003. As of January 2004, five months after the blackout, the damaged furnace was still being repaired.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Hoover's Company Fact Sheet. "Republic Engineered Products LLC." 2 March 2004. Available from http://www.hoovers.com .

"Republic Back in Chapter 11." Steel Times International. November 2003.

Sacco, John E. "Bankruptcy Judge OKs Perry's Bid for Republic," American Metal Market. 18 December 2003.

——. "Republic Clearing Furnace to Probe Blast," American Metal Market. 7 January 2004.

——. "Republic Still Feels Power Outage 'Aftershock."' American Metal Market. 12 September 2003.

U.S. Census Bureau. 1997 Economic Census—Manufacturing. 12 February 2000. Available from http://www.census.gov/prod/ec97/97m3329m.pdf .

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

Comment about this article, ask questions, or add new information about this topic: