SIC 3449

MISCELLANEOUS STRUCTURAL METAL WORK

This category includes establishments primarily engaged in manufacturing miscellaneous structural metal work, such as metal plaster bases, fabricated bar joists, and concrete reinforcing bars. Also included in this industry are establishments primarily engaged in custom roll-forming of metal.

NAICS Code(s)

332114 (Custom Roll Forming)

332312 (Fabricated Structural Metal Manufacturing)

332321 (Metal Window and Door Manufacturing)

332323 (Ornamental and Architectural Metal Work Manufacturing)

In 2001, Houston-based Suncoast Post-Tension LP led the industry with sales of $62 million on the work of 300 employees. Miami-based Glassalum International Corp. followed with sales of $61 million and 500 workers. Tamco rounded out the top three industry leaders with 2001 sales of $61 million and 400 workers.

Closely related to the construction and automobile industries, structural metal work manufacturers were heavily affected by the recession of the late 1980s and early 1990s, following a $1 billion boom in shipments between 1986 and 1988. Shipment values, after dropping sharply in the early 1990s, recovered and leveled out in 1993.

One reason for this stagnation was the industry trade deficit between the United States and its foreign competitors. Customers of steel firms were adversely affected by complaints filed by U.S. firms against foreign steel manufacturers concerning this trade deficit. The deficit continued into the mid-1990s, as imports of steel drastically increased in 1996 to the second-highest tonnage ever: 29 billion net tons of steel were imported, up an enormous 19.5 percent from 1995. The deficit, combined with U.S. steel producers' protests, diminished business at U.S. ports, increased prices for steel products, and left a shortage of specialty plate and sheet products previously supplied

by foreign suppliers. As a result, some U.S. steel-using firms were contemplating relocation to Canada, Mexico, and other Pacific Rim countries.

In the mid-1990s, the industry focused on cost reduction through process improvement and materials research. In 1993 CF&I Corporation invented a new process that produced rails continuously for a quarter of a mile, reducing the need for welding and reducing construction costs. Ford Motor Company, in partnership with Alcan Rolled Products Company, experimented with the effects of hybrid aluminum-steel sheet metal on an automobile's fuel economy, durability, service, and performance. A new rigid rod-polymer, developed in 1995, has the capability to replace structural metals, such as stainless steel and aluminum. The new polymer, which is four times stiffer than conventional plastics and can be injection molded, extruded, or compressed, posed a threat to the structural metal industry.

In the first three quarters of 1998, Japan "dumped" almost 5.5 million tons of steel, selling it below manufacturing costs into the United States; this represented a 157 percent increase over 1997 U.S. imports. Domestic prices fell in response, as did domestic production. Officials blamed imports for the loss of 10,000 steel industry jobs. The fabricating segment of the industry, however, did not suffer as much as production did, since fabrication took advantage of the low prices of its raw materials.

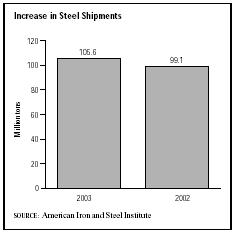

By 2003, however, the market was rebounding. According to the American Iron and Steel Institute, in this year American steel mills increased shipments by 6.5 percent over 2002. In fact, shipments increased more than 19 percent when comparing only December 2002 and December 2003. The employment outlook for the architectural and structural metals manufacturing industry was expected to grow steadily from 316,000 in 1992 to nearly 480,000 by 2012. With increased automation, reductions in production-related employment were expected, while job prospects for sales personnel, industrial production managers, and cost estimators were expected to increase. According to the Precision Metalforming Association, the industry was looking at an upswing going into 2004, with increasing orders and trade activity.

As with all manufacturing industries, challenges to the steel industry in the mid-to-late 2000s were expected to come from inequitable foreign market competition. Tax incentives on exports, offered through the Federal FSC/ETI bill, were strongly opposed by American manufacturers, as was the World Trade Organization's policy on taxes. According to the American Iron and Steel Institute, this policy basically was a "double tax" on U.S. products, contributing to the difficulty of competing in the global market and sustaining stable growth in the manufacturing sector.

Further Reading

"2003 Steel Shipments Increase 6.5 Percent from 2002." American Iron and Steel Institute , 13 February 2004. Available from http://www.steel.org/news/pr/2004/pr040213_ship.asp .

"AISI President Calls for Congress to Prevent Damaging EU Retaliation." American Iron and Steel Institute , 2 March 2004. Available from http://www.steel.org/news .

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

"Business Conditions Report Projects Bright Future." Precision Metal forming Association , 19 February 2004. Available from http://www.metalforming.com/PRESSRM/press_release.asp?id=1015 .

"Economic Forecast Spikes for Metal formers." Precision Metal-forming Association , 15 December 2003. Available from http://www.metalforming.com/PRESSRM/press_release.asp?id=951 .

"Suncoast Post-Tension, LP." Hoover's Online. . 2 March 2004. Available from http://www.hoovers.com .

Comment about this article, ask questions, or add new information about this topic: