SIC 2063

BEET SUGAR

This entry includes establishments primarily engaged in manufacturing sugar from sugar beets.

NAICS Code(s)

311313 (Beet Sugar Manufacturing)

Sugar beets are one of the world's main sugar sources and an important source of sugar for the United States—more than 1.3 million acres of sugar beets are grown in 12 states. Reduced raw cane sugar imports hurt U.S. refiners in the 1980s, and the sugar industry turned to sugar beets to make up the difference. The United States processes more sugar from domestically-grown sugar beets than from domestically-grown sugar cane. Many cane refiners also invested in sugar beet processing firms in the 1980s as the sugar beet market share (including imports) climbed from 30 percent in the 1970s to 40 percent in 1988.

However, the sugar beet market felt the effects of plummeting per capita sugar consumption (both beet and cane) from 1970, when it stood at roughly 102 pounds, to 1980, when it stood at about 60 pounds. By 2002 it had fallen to 45 pounds. The corn sweetener market has claimed much of sugar's old market share. The value of refined beet sugar shipments declined from $2.61 billion in 1997 to $2.49 billion in 2001.

Falling domestic consumption cost the U.S. sugar industry approximately $250 billion in 2001 alone. Between 1999 and 2003, domestic sugar sales fell from 10.11 million short tons in 1999 to 9.67 million short tons. As a result, production began to wane as well. Sugar beet acres planted fell from 1.42 million in 2001 to 1.36 million in 2002; acres harvested declined from 1.36 million to 1.33 million over the same time period.

The beet sugar industry traces its origins to ancient Babylon, Egypt, and Greece, where sugar beets were grown. In 1744, a German chemist discovered that sugar from sugar beets was the same as sugar from sugar cane. About 50 years later, another German chemist developed a method for extracting sugar from the beets. Sugar mills were soon built in Europe and Russia. In 1838, sugar beets were being processed in the United States as well. The first successful commercial beet sugar mill was built in Alvarado, California, by American businessman E.H. Dyer.

Unlike sugarcane, which is processed into raw sugar (see SIC 2061: Cane Sugar, except Refining ) tobe marketed to cane refiners (see SIC 2062: Cane Sugar Refining ), beets are processed directly into refined sugar. Beet sugar is produced from the root of the sugar beet plant, which is shipped to factories to be washed and cut into thin slices called cossettes. These cossettes are soaked in diffusers to remove the sugar. The resulting pulp is dried and mixed with molasses to make cattle feed. The sugar-water mixture goes through a series of purification processes in which lime, carbon dioxide, and filtration are used to remove impurities. Finally, the liquid is reheated until evaporation leaves a crystallized sugar product. Sugar products manufactured from sugar beets include dried beet pulp, beet sugar, molasses, granulated sugar, liquid sugar, invert sugar, powdered sugar, and syrup.

The federal government has provided price supports to the U.S. sugar industry for almost 200 years. Many consumer groups and commentators are critical of the U.S. program that protects the sugar industry. According to some analysts, these price supports for sugar keep American sugar prices at double or triple the rate of world prices and prevent the importation of less expensive sugar. When market conditions became bad in 1993 and 1994—reportedly the second time in history—industry leaders asked the U.S. Department of Agriculture (USDA) to help stimulate prices by imposing an allotment system, to balance beet sugar supply and demand.

Eventually, beet farmers themselves upset the balance "by bringing refined sugar directly to market through huge 'beet factories' that are often owned by nonprofit cooperatives. The government spent $468 million last year trying to keep prices at a target of 22.5 cents a pound, but the flood of beet sugar has driven prices as low as 21 cents," stated a May 2001 issue of Forbes. As a result, cane sugar companies like Imperial Sugar, which are not allowed to import less expensive raw sugar from foreign companies and thus must pay the government supported price of 22.5 cents per pound, were left struggling to make a profit. Beet sugar refiners themselves also faced unprecedented competition as beet sugar continued to flood the market.

California's sugar beet industry best exemplifies the results of the problems of the 1990s and early 2000s. Plagued by drought, disease and other problems, the state's once vibrant sugar beet industry, for the most part, never recovered. Crop yields in 1993 were down significantly. Between 1990 and 1996, the land devoted to sugar beet cultivation was cut by about 50 percent to about 90,000 acres. Two of California's eight sugar beet processing plants closed between the 1993 and 1994 harvests. In the 1994 season, growers for Spreckels Sugar Co.—founded in 1898, once California's leading beet refiner—began reporting yields more than 20 percent lower than the previous year. Coupled with rock bottom prices and an over-abundance of beets in other states for the second year running, lower production proved to be a disaster for Spreckels, which didn't survive; its assets and debts were purchased in 1996 by Imperial Holly. By 2002, California was planting only 50,000 acres of sugar beets.

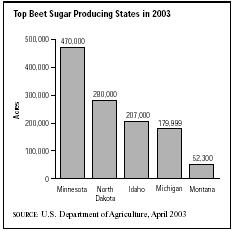

The main producers of sugar beets worldwide are Canada, France, Germany, Poland, Russia, Ukraine, and the United States. Minnesota, Idaho, North Dakota, California, and Michigan led in U.S. sugar beet production in 2003. Leading beet sugar producing companies include American Crystal Sugar Company, Imperial Sugar Company, and Domino Sugar, formerly known as Tate & Lyle North American Sugars Inc. In 2001, Tate & Lyle sold the Domino sugar brand to the Sugar Cane Growers Cooperative of Florida and the Florida Crystals Corp. for $180 million. American Crystal is owned by more than 3000 growers in North Dakota and Minnesota. The company,

formed in 1899 and converted to a co-op in 1973, saw sales of $829 million in 2003. Imperial (formerly Imperial Holly Corp.) is the largest refined sugar supplier in the United States. Imperial Sugar filed for Chapter 11 bankruptcy protection in 2001 while it paid down its mounting debt by divesting certain assets. Sales in 2003 declined 14 percent to $1.1 billion, although earnings increased 367 percent to $77 million.

Further Reading

Fisher, Daniel. "Sticky Situation." Forbes, 14 May 2001.

U.S. Department of Agriculture. "Sugar and Sweeteners." Washington, DC: 12 January 2004. Available from http://usda.mannlib.cornell.edu/reports/nassr/field/pcp-bba/acrg0603.txt .

U.S. Department of Agriculture. Track Records of U.S. Crop Production. Washington, DC: 2003. Available from http://usda.mannlib.cornell.edu/data-sets/crops/96120/track03d.htm .

Comment about this article, ask questions, or add new information about this topic: