SIC 2493

RECONSTITUTED WOOD PRODUCTS

The reconstituted wood products industry is comprised of establishments primarily engaged in manufacturing hardboard, particleboard, insulation board, medium-density fiberboard (MDF), waferboard, oriented strand board (OSB), and other panelized products made from wood chips and particles.

NAICS Code(s)

321219 (Reconstituted Wood Product Manufacturing)

Background and Development

Particleboard is created from wood flakes, shavings, or splinters that are discharged when wood products are processed. The particles are bonded together under pressurized heat using resin and adhesives to make an inexpensive, durable wooden panel. Approximately 80 percent of all particleboard is used to make furniture, cabinets, and doors. A hardboard, or fiberboard, panel is made from wood fibers that are steamed, rubbed apart, and then compacted under pressurized heat. Unlike particleboard, only a small amount of resin or adhesive is used to bond the fibers. Hardboard has a smooth finish and is used primarily for exterior house siding, indoor cabinets, and fixtures.

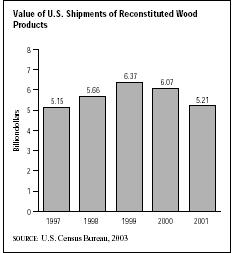

Commercially useful wood particle panels resulted from the chemical industry's development of high-tech synthetic resins and adhesives, particularly during the 1960s, 1970s, and 1980s. The value of reconstituted panel shipments increased steadily during the 1980s and 1990s to an estimated $5.1 billion by 1996. Shipments grew by about 3 percent to nearly $5.3 billion in 1997.

After reaching a high of $6.37 billion in 1999, shipments fell to $6.07 in 2000 and to $5.21 in 2001, according to the U.S. Department of Commerce.

Current Conditions

Although the economic recession in the early 1980s caused industry revenues to drop slightly, improved economic conditions in the 1990s saw a surge in shipments of particleboard and medium-density fiberboard (MDF) from U.S. mills. The Composite Panel Association estimated that U.S. particleboard and MDF shipments increased by 18 and 45 percent to almost 5 billion and 1.4 billion square feet, respectively, from 1993 to 1998. Particleboard shipments from Canadian mills increased by almost 14 percent in 1998 to 1.24 billion square feet.

However, growth in this industry began to slow when the U.S. economy hit the skids. Particleboard shipments declined from $1.37 billion in 2000 to $1.09 billion in 2001. Over the same time period, MDF shipments fell from $530.4 million to $481.2 million; waferboard and oriented strandboard shipments, fell from $2.21 billion to $1.86 billion; cellulosic fiberboard shipments, dropped from $131.4 million to $129.6 million; hardboard shipments, fell from $1.37 billion to $1.09 billion; and prefinished particleboard and MDF shipments, dropped from $667 million to $601.2 million.

Throughout the late 1990s, MDF shipments grew steadily, increasing from $454.3 million in 1997 to $530.4 million in 2000. Despite a decline in 2001 to $530.4 million, applications like high-detail moldings and edge-detailed furniture continue to hold promise as MDF's share of the molding market, which grew from 20 percent in 1997 to 26 percent in 1998, was expected to grow dramatically through the early 2000s. Some analysts expected its share of the molding market to reach 85 by the year 2005.

Wood panel manufacturers were starting to market their products with the Forest Stewardship Council's label, which certifies companies that are responsibly managing their timber lands. With the greening trend continuing, panels made of waste and alternative materials were also in demand. In 1999 CanFiber's Riverside, California, facility announced that it had produced the world's first MDF made from 100 percent post-consumer wastewood. Other companies were making boards composed of rice straw, barley straw, or other agricultural fibers. Iowa State University researchers had developed a process to turn cow manure into MDF.

Industry Leaders

The largest U.S. producers included Louisiana-Pacific Corporation (L-P), with 2003 total sales of $2.3 billion (60 percent in wood products), and Masonite Corporation of Illinois, which had operated as a subsidiary of International Paper until Ontario, Canada-based Premdor Inc. acquired the firm in 2002.

Workforce

Despite overall growth, opportunities in most occupations in the industry are expected to decline significantly between 1990 and 2005, according to the U.S. Bureau of Labor Statistics. Jobs for assemblers and fabricators, which accounted for 14 percent of the work force in the 1990s, are predicted to fall by more than 25 percent. Most positions, in fact, are expected to decline 5 to 20 percent by 2005. The industry employed 25,180 workers in 2000, down from 24,517 in 1997. The 20,057 production workers in the industry earned an average wage of $21.86 per hour.

America and the World

By the early 2000s, the Asian furniture market had become a primary target for North American exports of particleboard. Total U.S. exports of particleboard increased 1.9 percent in the first half of 2001. Imports of particleboard decreased 1.2 percent.

Global demand for MDF was expected to increase 25 percent between 2000 and 2010. A worldwide survey by Wood Technology showed that 28 new MDF installations occurred in 1999, with 24 planned into the early 2000s; half of these 52 projects were in Europe. U.S. imports of MDF increased 22 percent during the first six months of 2001, while U.S. exports of MDF declined 12.5 percent.

Waferboard and oriented strand board (OSB) made up about 35 percent of industry sales in the early 2000s. Waferboard is similar to particleboard, but only square three-inch wood flakes are used. OSB is a type of waferboard, but its flakes are layered and oriented in a way that makes it much stronger than waferboard, yet still less expensive than plywood. Global capacity of OSB is predicted to increase 50 percent by 2010. Globally, 23 new plants were planned from 1999 through 2005, with 15 of these plants in North America.

North American OSB production grew from 7.65 billion square feet in 1990 to 19.45 billion square feet in 1999. OSB consumption in 2001 was 17.2 million cubic meters. OSB accounts for 53 percent of total structural panel production in 2001, up from 28 percent of the market in 1994 and 31 percent in 1995. U.S. imports of OSB in 2000 grew 3.4 percent and exports increased 6.7 percent.

Hardboard production declined 16 percent in 2000 to 11.2 million cubic meters. A 1 percent decline in U.S. hardboard imports that year was offset by a 29 percent jump in imports during the first six months of 2001. Conversely, exports increased 2.8 percent in 2000, but declined 16.8 percent in the first half of 2001.

Further Reading

Haddox, Katherine. "Strong Economy Supports Panel Growth, Stabilization." Wood Technology, October 1999. Available from http://www.woodwideweb.com/db_area/archives/1999/9910/panel.html .

U.S. Census Bureau. "Statistics for Industry Groups and Industries: 2000." February 2002. Available from http://www.census.gov/prod/2002pubs/m00as-1.pdf .

——. "Value of Shipment for Product Classes: 2001 and Earlier Years." December 2002. Available from http://www.census.gov/prod/2003pubs/m01as-2.pdf .

U.S. Department of Agriculture. "U.S. Forest Products Annual Market Review and Prospects, 1999-2002." Available from http://www.fpl.fs.fed.us/documnts/fplrn/fplrn282.pdf

Comment about this article, ask questions, or add new information about this topic: