SIC 3543

INDUSTRIAL PATTERNS

This category covers establishments primarily engaged in manufacturing industrial patterns.

NAICS Code(s)

332997 (Industrial Pattern Manufacturing)

Industrial patternmaking companies make patterns for forming and molding metal. These patterns are used by other companies to produce metal ornaments, tools, automobile parts, cutlery, and other goods. The largest consumer of industrial patterns was the architectural metalworking industry, which consumed more than 20 percent of industry output in the early 1990s. Producers of pipes, valves, and fittings represented roughly 12 percent of the market. Miscellaneous repair shops purchased 27 percent of output. Other specialized industries purchased patterns to make engineering and scientific apparatus, prefabricated structural metal, car parts, railroad equipment, and other metal products.

Industrial patterns are often used in foundries to create molds and dies for iron, steel, and other metals. Foundries typically melt scrap in an electric furnace. The liquid is then poured into a mold, which is usually formed from sand, metal, or ceramic material. The metal cools and solidifies into any number of complicated shapes, such as an engine block, a turbine blade, or a surgical instrument.

According to the Annual Survey of Manufactures , there were more than 7,000 employees in this industry in 2001, nearly 6,000 of whom were in production jobs. The payroll for that year was about $275 million, and the total value of shipments was about $636 million. Other estimates projected a drop to 6,700 employees by 2004, with an increase to $683 million in total shipments.

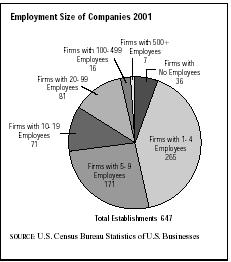

Companies in this industry tended to be small in size, with more than 80 percent of companies in the industry employing fewer than 20 workers. Aarowcast Inc., of Shawano, Wisconsin, led the industry with 2001 sales of $27 million and 400 employees. In second place was tied Cascade Pattern Company of Elyria, Ohio, and Unique Model Inc. of Grand Rapids, Michigan, each with $20 million in sales and 100 employees.

Copper was the first material that metallurgists learned to melt and form. By 4000 B.C. smiths had developed sophisticated smelting (melting and molding) techniques. Iron ore was first smelted in 1500 B.C. to make utensils and weapons. The advancement of the blast furnace, which was invented in 1323, was hastened by the industrial revolution in eighteenth century England. Advanced metallurgical and patternmaking techniques evolved during the 1800s and particularly during the 1900s, in the wake of both world wars.

U.S. industrial patternmaking emerged as a separate industry from the 1950s through the 1970s. Pattern-makers continued to enjoy relatively healthy growth during most of the 1980s as the demand for metal products, such as architectural metalwork and automotive parts, swelled. By 1988, the industry was generating revenues of about $719 million per year and employing a workforce of 10,500. A real estate depression in the late 1980s that reduced demand for architectural metals, coupled with a general nationwide recession, hurt competitors in the late 1980s and early 1990s. Sales slipped to about $530 million in 1990 and employment decreased to 8,100.

Despite an economic boost going into the mid-1990s, the long-term employment outlook for the overall metalworking industry was dismal. Jobs for most laborers are expected to decline 20-30 percent between 1990 and 2005, according to the U.S. Department of Labor, Bureau of Labor Statistics. For example, the demand for machine tool cutting operators was expected to plummet about 27 percent by 2005. Jobs for machine tool cutting and forming workers were expected to fall by about 19 percent. Positions for engineers and sales professionals, in contrast, should rise 10-20 percent.

Those in metal manufacturing will stay competitive through the development of product technology and innovation, in order to be ready to meet the future needs of a demanding marketplace. Industry leader Aarowcast was upgrading and replacing equipment to improve molding quality, which ultimately would improve casting quality. In the 2000s, enhanced control systems for molding improved control and performance, as well as reduced broken molds and inefficient processes.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Darnay, Arsen J., ed. Manufacturing and Distribution USA. Detroit: Thomson Gale, 2003.

"Investing in Molding's Future." Foundry Management and Technology , October 2001.

U.S. Census Bureau. 1997 Economic Census—Manufacturing. 14 February 2000. Available from http://www.census.gov/prod/ec97/97m3329k.pdf .

——. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Commerce. Annual Survey of Manufactures. Washington: GPO, 2002.

Comment about this article, ask questions, or add new information about this topic: