SIC 3586

MEASURING AND DISPENSING PUMPS

The measuring and dispensing pumps industry is comprised of establishments primarily engaged in manufacturing pumps used in service stations for dispensing gas, oil, and grease. This category also includes grease guns. Industrial pumps are classified in SIC 3561: Pumps and Pumping Equipment.

NAICS Code(s)

333913 (Measuring and Dispensing Pump Manufacturing)

In the 1990s, multi-pump units, which offer several grades of gasoline from the same pump, accounted for about 22 percent of industry sales. More traditional single-pump units still held a 19 percent share of the market. Lubricating oil pumps represented about 4 percent of output, and grease guns made up 3 percent of sales. Approximately 30 percent of industry revenues were made from the sale of parts and attachments, such as vapor recovery systems and replacement hoses.

Non-industrial gas, oil, and grease pumps were a corollary of the proliferation of cars and trucks during the early and mid-1900s. As American society became increasingly mobile, markets for service station pumps expanded rapidly. Indeed, by the late 1970s the service station pump industry was shipping more than $600 million worth of products per year and employing about 8,000 workers.

Despite an oil shortage in the United States in the late 1970s and a recession in the early 1980s, industry revenues climbed sporadically to $1.14 billion by 1988. Although growth of demand for new gas, oil, and grease pumps waned in comparison to growth in previous decades, other product segments prospered. Importantly, environmental regulations forced service stations in many states to equip their pumps with costly new vapor recovery systems and safety devices.

A U.S. economic recession that began in the late 1980s suppressed pump sales to about $1.03 billion per year by the early 1990s. As sales faltered, industry employment plummeted from a high of 9,400 in 1987 to about 8,000 by 1990. Figures for 1992 showed that employment levels were at 6,500 workers, 31 percent below 1987 levels, while the value of goods shipped slipped to $896.3 million. In 1993, however, the economy began to improve, and the industry responded. In 1997 the industry reported 6,824 employees and shipment of goods worth $1.3 billion.

By 2001, the industry had slipped again. Shipments were valued at about $1.1 billion, and employment had dropped by around 1,000. Projections from some analysts showed that employment would continue to decrease and sales would remain relatively stable, due to further automation of equipment.

In the mid-1990s, pump manufacturers scrambled to revive profits by introducing new gas pump systems, focusing on the multi-pump market, and incorporating computer technology into their machines. New pumps with point-of-sale credit card devices, for example, allowed customers to fill a vehicle with gas and pay without leaving their car, thus reducing labor costs. Likewise, to help service stations comply with federal "Stage II" vapor recovery guidelines, producers of vapor recovery pumps and attachments were introducing a variety of new systems and designs.

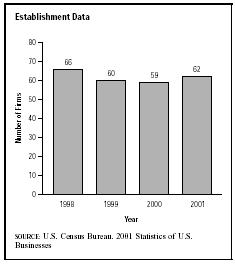

The largest U.S. company primarily engaged in the production of service station pumps and equipment in 2001 was Graco Inc. of Minneapolis, Minnesota. Graco boasted sales of $487 million and had 1,900 employees. The following year, Graco reported 200 fewer employees and sales again at $487 million. Second was Greenwich, Connecticut-based Valois of America Inc., with $252 million in 2001 sales and fewer than 100 employees. Shields Harper and Company of Oakland, California, placed third, with $206 million in sales and less than 100 employees. In all, about 62 firms were classified in the industry in 2001, the vast majority of which had fewer than 100 employees.

Industry participants were able to increase production yet keep a lid on employment growth during the 1980s—primarily through productivity gains. The movement of some manufacturing activities overseas also reduced workforce gains. The future of employment in this industry was uncertain during the early twenty-first century. However, the outlook for job growth in the overall general purpose machinery manufacturing sector was generally positive through 2012, according to the U.S. Bureau of Labor Statistics.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Darnay, Arsen J., ed. Manufacturing and Distribution USA. Detroit: Thomson Gale, 2003.

Hoover's Company Fact Sheet. "Graco Inc." 3 March 2004. Available from http://www.hoovers.com .

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Commerce. Annual Survey of Manufactures. Washington: GPO, 2002.

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

Comment about this article, ask questions, or add new information about this topic: