SIC 3565

PACKAGING MACHINERY

Firms in this industry manufacture machinery used in packaging, wrapping, and bottling. In 1987 the classification code was changed to combine two 1972 categories, SIC 35514: Food Packaging and Bottling Machinery and SIC 35691: Non-food Packaging and Bottling, along with parts of the two general categories: SIC 3551: Food Products Machinery and SIC 3569: General Industry Machinery. The 1972 category numbered SIC 3565: Industrial Patterns was renumbered as SIC 3543.

NAICS Code(s)

333993 (Packaging Machinery Manufacturing)

According to the Annual Survey of Manufactures , this industry employed 27,923 workers in 2001, with a payroll of $1.2 billion. Nearly 15,000 employees worked in production, earning more than $508 million. Shipments for the industry were valued at $4.2 billion.

The industry found itself challenged to change and innovate in the late 1980s and early 1990s, as industry shifted to leaner production methods requiring just-in-time (JIT) inventory management and as consumers rebelled against excessive and expensive product packaging. This meant new technology to manufacture smaller, more flexible machinery, and more packaging options for manufacturers.

To meet the demand, the industry introduced programmable logic controllers, robotics, self-diagnostic systems, microprocessor controls, automated testing, vision inspection systems, and built-in fault correction devices. Hydraulic and pneumatic actuators reduced clamping time and sped line changeover rates. Modern lines could shift from producing one part to an entirely different component in minutes instead of the previously common hours.

In 2001, Riverwood International Corp. of Atlanta outpaced all other companies in this industry, with sales of $1.3 billion and 4,100 employees. In 2003, the company bought Graphic Packaging International, and the resulting company was known as Graphic Packaging Corp. In distant second place was Cincinnati, Ohio-based RA Jones and Company Inc., with $74 million in 2001 sales and 500 employees. Angelus Sanitary Can Machine Co. of Los Angeles rounded out the top three with 500 employees and $56 million in sales. The following year, Better Packages held 75 percent of the market share in this industry. According to the US Industry and Trade Outlook , there were just under 700 companies in the industry at the start of the new century, and most of them were located in California, Illinois, Minnesota, Ohio, and Wisconsin.

Although most of the market demand was domestic, exports formed an important part of the industry's market. In the late 1990s, products were shipped to about 140 foreign countries. The largest purchaser of American equipment was Canada, followed by Europe, the Asia-Pacific region, and Central and South America. At the close of the century, due to the falling Asian economy and undervaluation of Asian currency, the exports to this market decreased. But the economy was recovering in the early 2000s, and going along with an increase in exports from other industries to Asian countries, exports from the packaging machinery industry were also expected to increase. The increasing use of the Internet and e-commerce was also expected to keep demand high.

In both the United States and foreign countries, the industry faced major challenges by environmental and energy concerns. This especially was true in Europe. The demands for recyclable and reusable materials and containers prompted more than 500 legislative proposals in 50 states to control solid waste. Other countries instituted their own measures. Concerns over conflicting regulations prompted interest in such measures as the ISO 9000 international machinery standard, which define the rules of manufacture and prevent such national or state standards from becoming non-tariff barriers to trade.

At the same time, industry was demanding lighter materials—both in the actual packaging and the machinery—to reduce transportation-related energy costs. Responding to the JIT philosophies, packaging equipment companies were beginning to use air freight to speed delivery time.

The manufacturing focus in the early-to-mid-2000s was on new and diverse products to meet the individual needs and desires of the market. According to the Packaging Machinery Manufacturers Institute (PMMI), companies in 2003 wanted "quick changeover capabilities, flexibility, and fast speeds" more than any other features. Consequently, the industry was expecting continued growth to meet demands for newer and better packaging machinery, replacing older equipment with newer, faster, more efficient, and more automated machines. Trends toward lightweight, individually designed, flexible, and reusable packaging increased demand for the design of machines that could manufacture such packaging.

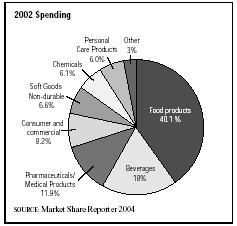

In 2002, there was just shy of $5 billion spent on this industry. Food products accounted for 40 percent, followed by beverage products (18 percent), medical and pharmaceutical products (12 percent), and consumer products (8 percent). Nondurable goods, chemicals, and personal care products were all around 6 percent of the total, with the rest going to miscellaneous sectors. In 2003 the industry was still quite healthy, and only consumer products and nondurable goods were expected to decrease demand. The largest jump in demand was forecast for medical and pharmaceutical products. Overall demand, and therefore industry shipments, were expected to continue in a steady annual increase of 2-3 percent. According to a study done by PMMI, industry shipments were expected to reach nearly $5.4 billion by 2005.

Further Reading

"About Us." Graphic Packaging International, Inc. 5 March 2004. Available from http://www.graphicpkg.com/products/paperboard/paperboard.html .

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Calamusa, Dennis, "At Pack Expo International, Flexible Packaging Technology Steals the Show." Flexible Packaging , February 2003.

Darnay, Arsen J., ed. Manufacturing and Distribution USA. Detroit: Thomson Gale, 2003.

"February Business Conditions Remain Strong." Frozen Food Digest , April-May 2003.

Hoover's Company Fact Sheet. "Graphic Packaging Corporation." 5 March 2004. Available from http://www.hoovers.com .

Lazich, Robert S., ed. Market Share Reporter. Detroit, MI: Thomson Gale, 2004.

"Machinery Demand Continues." Beverage Industry , May 2003.

"New Machinery Trends Unveiled." Official Board Markets , 8 February 2003.

"Packaging Machinery Shipments to Recover in 2004." Converting , January 2004.

"Packaging Machinery Spending to Increase." Official Board Markets , 17 May 2003.

"Packaging Machinery Spending to Level Off." Converting , July 2001.

"PMMI: Machinery Market Is a Mixed Bag." Food & Drug Packaging , May 2003.

"Summary of 2003 Forecast Growth/Decline in Packaging Machinery Expenditures by Principal Market Segment." Frozen Food Digest , July 2003.

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Commerce. Annual Survey of Manufactures. Washington: GPO, 2002.

US Industry and Trade Outlook. New York: McGraw Hill, 2000.

Comment about this article, ask questions, or add new information about this topic: