SIC 1099

MISCELLANEOUS METAL ORES, NOT ELSEWHERE CLASSIFIED

This category covers establishments that are primarily engaged in mining, milling, and preparing miscellaneous metal ores. Production of metallic mercury by furnacing or retorting at the mine site is also included.

NAICS Code(s)

212299 (Other Metal Ore Mining)

Industry Snapshot

Metal ores included in this category include: aluminum, antimony, bastnasite, bauxite, beryl, beryllium, cerium, cinnabar, ilmenite, iridium, mercury, microlite, monazite, osmium, palladium, platinum, quicksilver, the rare-earth metals, rhodium, ruthenium, rutile, thorium, tin, titaniferous-magnetite (chiefly for titanium content), titanium, and zirconium. The actual mining of these ores declined for two decades beginning in the 1970s. Production fell by 10.7 percent through the mid-1990s. In addition, environmental pressure for stricter regulation on mining and recycling strained the mining of ores. In the early 2000s metals mining increased slightly, from 53.8 million short tons in 2001 to 57.6 million short tons in 2002, although the value of the mined ore failed to register an increase when adjusted for inflation. In fact, the value of mined metals fell from $6.51 billion to $6.38 billion between 2001 and 2002.

United States consumption of the miscellaneous metals overall exceeds production, especially for the platinum-group metals and tin. However, consumption of metals declined steadily throughout the late 1990s and early 2000s, from 93.9 million short tons in 1997 to 72.2 million short tons in 2002. U.S. industry relies on imported product to satisfy its needs, and a trade deficit exists in these areas. Additionally, the U.S. government maintains a strategic stockpile of product, especially of import-dependent metals, that is crucial to the military and to the national security. The stockpile serves to sustain military reserves at adequate levels and creates a small, insulated metals market with limited fluctuation for certain producers. Specific metals in the U.S. government stockpiles include bauxite, titanium, platinum, and tin.

Organization and Structure

The production of miscellaneous metals is segregated into mining and metal refining according to respective metal product. Individual metal production is subdivided further into primary and secondary production. In the 2000s approximately 14 percent of mining firms in the industry additionally operated preparation plants. Virtually all of the total product output (99 percent) was from primary products. The industry's market structure grew more concentrated during the final decades of the twentieth century, and the number of metal mining establishments fell to under 125 by 2002, after achieving a dramatic peak of 236 in 1982.

In terms of geographic concentration, the largest number of firms mining miscellaneous metal ores is located in the Pacific region of the United States (California, Washington, and Oregon). The second greatest concentration was in the mountainous western region (Montana, Nevada, and Utah). California ranked first among the United States, with ten sites, followed by Montana with five, Arkansas with four, and Florida and Utah with two each.

The principal economic sectors or industries responsible for the purchase of miscellaneous metal ores are manufacturers of intermediate products for industrial use.

Background and Development

The mining of the miscellaneous metals is very much intertwined because multiple products are frequently extracted from the same ores; separation of the individual metal products occurs in the smelting process whereby reduction of the ores takes place.

Aluminum. Aluminum is the second most abundant metallic element in the earth's crust after silicon. The use of aluminum exceeds that of any other metal except iron, and it is important in nearly all segments of the world economy. The United States is the leading producer of primary aluminum. Aluminum's prime use is in packaging, aerospace, and increasingly in construction. In addition, aluminum competes with other metals and plastics for an increased share of the automobile market. Aluminum experienced a boom in world demand in the early 1980s, then dropped suddenly on the world market until 1986. The industry rebounded after 1986, buoyed by increased applications of aluminum products, and grew by more than 32 percent from 1986 to 1992.

Antimony. Most production of antimony in the United States is the result of a byproduct or is a co-product of mining, smelting, and refining other metals and ores that contain small quantities of antimony. Foreign deposits far outweigh domestic deposits, and U.S. users of antimony depend on suppliers in Bolivia, China, Mexico, and South Africa. Antimony has a variety of manufacturing applications, but is mainly used in batteries.

Beryllium. Beryllium is important in industrial and defense applications and is known for its high strength, light weight, and high thermal conductivity. It is used in components for aircraft, satellites, electronics, oil drilling equipment, and consumer goods. The U. S. beryllium industry is the largest in the western world.

Bismuth. Bismuth has been replacing lead (which is highly toxic) in many applications. For example, a bismuth and brass alloy was developed to replace leaded brass in some plumbing applications. In the United States, only ASARCO, Incorporated produces primary bismuth, while a number of smaller firms produce secondary bismuth product mainly from scrap.

Mercury. U.S. production of this key metal was a very small percentage of a declining world market. Manufacturers sought substitutes for mercury, especially for its primary use in batteries. New technology enabled reduction of the mercury content of some batteries by as much as 98 percent. A temporary suspension of mercury sales from the National Defense Stockpile in 1994 resulted in dramatically increased quantities of imported mercury in 1995. Sales were prohibited, not to resume until the U.S. Environmental Protection Agency and the Defense Logistics Agency might determine a safe method of selling the mercury to ensure against environmental damage. Consumption as a percentage of supply remained largely unchanged because of the ongoing elimination of mercury from many products and processes, and because of accelerated efforts to recycle product.

Platinum-Group Metals. Six closely related metals comprise the platinum-group metals: platinum, palladium, rhodium, ruthenium, iridium, and osmium. These are among the scarcest of all metal elements and are used in mostly commercial applications. Platinum and palladium (a platinum substitute) dominate this product grouping. These metals are used as emission catalysts for automobiles and in electronics and glass applications. Platinum is highly valued for its corrosion resistance and catalytic activity.

South Africa is the world's largest producer of platinum, furnishing 75 percent of the metal. Russia is also a critical producer in the world market for this metal group. Production of the platinum ores—platinum and palladium—increased in the early 1990s. Platinum production rose from 1,430 kilograms in 1989 to 2,000 kilograms in 1991, while palladium rose from 4,850 kilograms to a high of 6,780 kilograms in 1992, but fell again to 6,000 kilograms by 1994. In terms of revenue, U.S. mine production of platinum and palladium topped $60 million in 1994, and remained essentially unchanged in 1995.

Rare-Earth Ores: Lanthanides, Yttrium, and Scandium. This group of metals includes 17 elements. In 1995 more than 50 percent of the world total (28,700 metric tons) came from one company in California. The United States was a leading producer and processor of rare-earth ores and continued to be a major exporter and consumer of these products. Domestic ore production was valued at $82 million in 1995. Three companies refined these ores with plants in Arizona, California, and Tennessee, reaching an estimated value of more than $500 million. The uses of these metals range from catalysts in petroleum, chemical, and pollution control to metallurgical uses as iron and steel additives, and as alloys to ceramics and glass additives.

Thorium. Thorium is a naturally radioactive element and is extremely expensive to mine—environmental regulations and waste disposal mandate costly extraction and transport procedures. Domestic production of monazite ceased in 1994 as a result of decreased demand for thorium-bearing minerals. Only a small portion of the mined thorium is for consumption, while most is disposed of as waste. Its uses include refractory applications, lamp mantles and lighting, and welding electrodes.

Tin. One of the earliest metals known to humankind, tin is used in a variety of applications. Most known for tin cans, tin is also a component of solder used to weld electronic circuitry. Tin is highly valued for national security purposes by the U.S. military, and is the most collected of all metals in the National Defense Stockpile. Tin production occurs in many countries throughout the world, but U.S. production supplies only a very small percentage of the world market. Domestic consumption of tin exceeds production, and the deficit justifies the high level of defense stockpile.

Titanium. Two firms in Nevada and Oregon produce titanium, most known as a metal alloy used to lighten aircraft and spacecraft. Two titanium sponge producers and nine other firms in seven states produced the total U.S. output in 1995. About 30 companies also produce titanium forgings, mill products, and castings. In 1995 an estimated 65 percent of the titanium metal produced in the United States was used in aerospace applications. The remaining 35 percent was used in the chemical processing industry, mostly as a white pigment in paints, paper, and plastics. It is also used in ceramics, chemicals, welding rod coatings, heavy aggregate, and steel furnace flux. E.I. du Pont de Nemours & Co., Inc. (Du Pont) is the largest integrated producer of titanium products. According to the U.S. Bureau of Mines, U.S. companies own or control almost one-half of the world's productive capacity for titanium pigments. In 1995 titanium dioxide pigment was valued at $2.6 billion and was produced by five companies in 11 plants in nine states.

Zirconium. U.S. mining interests produced about one-seventh of the total tonnage of zirconium in 1992. Its ore, zircon, is generally recovered from operations in Florida and New Jersey. Zircon is used in refractories, foundry sands, and ceramic opacities. Its ore contains both zirconium and hafnium, two of the mainstay nuclear metals used in reactor cores.

Current Conditions

The actual mining of many of these ores has been in decline since the 1980s. Indeed, U.S. consumption became almost entirely import-dependent in some of these metals categories. Between 1999 and 2002, foreign producers supplied approximately 95 percent of U.S. platinum, along with 100 percent of U.S. bauxite, and 91 percent of U.S. tin.

Aluminum. Aluminum production is a major industry among the miscellaneous metals. Atypical of this industry, the United States was the largest producer of aluminum worldwide at the turn of the twenty-first century. However, aluminum production in the United States declined 28.1 percent in 2001 to 2.63 million tons. That year, global industry leader Alcoa Inc., based in Pittsburgh, Pennsylvania, reported its first quarterly loss since 1994. By the end of 2002, Canada had surpassed the United States in aluminum production due mainly to smelter shutdowns in the Pacific Northwest. Production in Canada was lead by Alcan Inc., the second largest aluminum producer in the world with 2003 sales of $13.6 billion and a 13 percent share of world aluminum production. Alcoa, which had acquired rival Reynolds Metals Co. in a $4.4 billion deal in 2000, posted sales of $21.5 billion in 2003 and accounted for 20 percent of world aluminum production.

Per capita consumption of aluminum in the United States totaled 65 pounds in 2002. To meet demand, the United States imported 41 percent of total aluminum consumed from countries such as Canada, Russia, Venezuela, and Mexico.

Rare Ores. Demand for platinum jewelry consumed approximately one-half of the world market for this precious metal at the onset of the twenty-first century, while the car industry—historically a key consumer of platinum—turned increasingly to palladium catalysts as a substitute. Nevertheless a chronic slump in the production of platinum persisted throughout the 1990s. Russian shipments had declined by more than one-third in 1999, thus aggravating the shortage and curtailing supplies of platinum everywhere through the early 2000s. Record deficits persisted despite unusually high levels of production in South Africa, which produced a record 4.65 million ounces in 2003. Despite the demand growth rate falling to its lowest point in ten years, a platinum shortfall continued to exist. Between 1999 and 2002, the United States relied almost exclusively on platinum from South Africa, the United Kingdom, Germany, and Canada, importing 96 percent of total consumption.

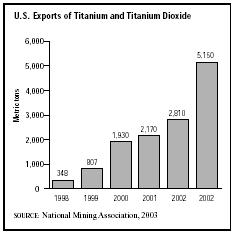

Other Metals. Titanium was described as a roller coaster industry by Myra Pinkham in American Metal Market. Volatile fluctuations in demand for the metal are attributed to fashion whims brought about by "designer" sports equipment made from titanium. Emerging industrial markets in gas and oil exploration, combined with traditional aerospace applications maintain the stability of the industry. At the turn of the twenty-first century, more than one-half of product distribution went to the commercial airline industry. Other leading markets were the military, industrial applications, and consumer markets. Exports grew from 348 metric tons to 5,150 metrics tons between 1998 and 2003. To meet consumption demands, the United States imported 73 percent of its titanium between 1999 and 2002 from Japan, Kazakhastan, and Russia.

Environmental Considerations. The momentum toward greater environmental consciousness continued to exert downward pressure on metals demand, especially toxic metals such as mercury. Increasing regulatory controls on mining activities resulted in escalated costs for producers. Incentives abounded for scientists to develop synthetic substitutes for many of the toxic primary metals. Additionally, use of these products was discouraged.

Mercury mining interests, long under scrutiny because of the toxicity of the metal, remained under strict operational guidelines from most governments. The mercury industry not only began to embrace recycling, but also introduced new technology in 1994 to replace mercury battery cells with a new type of membrane cell. U.S. mine production of mercury declined dramatically, by one-third from 1980 to the mid-1990s. Production of the metal virtually collapsed from a level of 1,057 metric tons in 1980 to just 58 metric tons in 1991. Production rose slightly to 64 metric tons in 1994, but political pressure to eliminate the metal from the environment altogether continued through the turn of the century.

Most of the mercury produced in the United States in the early 2000s was from secondary (recovered) product, from such items as obsolete batteries and electrical appliances, and from used fluorescent tubes. The combination of all sources, including the mercury obtained as a byproduct of gold mining, brought the total value of U.S. mercury to under $4 million. The Universal Waste Law of 1995 was amended on July 9, 1999, and became effective on January 6, 2000. The amendment specified proper disposal procedures for fluorescent light bulbs to prevent the mercury-coated tubes from ending up in landfills, and to recycle more product in the process.

Industry Leaders

It is difficult to identify precise market shares for individual companies, since nearly all of the leading companies engage in activities classified within other industries. These include SIC 1041, Gold Ores; SIC 1455, Kaolin and Ball Clay; SIC 1459, Clay, Ceramic, and Refractory Minerals, Not Elsewhere Classified; SIC 3312, Steel Works, Blast Furnaces (Including Coke Ovens), and Rolling Mills; and SIC 3339, Primary Smelting and Refining of Nonferrous Metals, Except Copper and Aluminum. As of 2003, among the leading companies with interests in the miscellaneous metal ores was the U.S. Steel Group of Pittsburgh, Pennsylvania, with nearly $9.3 billion total sales in all arenas including production of the miscellaneous metals. The leading company devoted primarily to production of miscellaneous metals ores was Teck Cominco Ltd., formed by the C$1.5 billion merger between Canada-based Teck Corp. and Cominco Ltd. in 2001. Prior to the merger, Cominco had total sales of $400 million. As of 2003, Teck Cominco was the leading zinc producer in the world. Other leading firms in the industry included Stillwater Mining Company of Columbus, Montana, with 2002 sales of $275.4 million.

Workforce

The mining of primary metals is considered to be the most dangerous type of mining. The average occupational injury incident rate per 100 full-time employees for total primary metal production was 16.5 incidents. Over-all employment in the industry followed a downward trend through the late 1990s and early 2000s, with metal mining employees declining from 42,202 in 1997 to 27,230 in 2002. The average wage for U.S. miners in 2002 was $48,609. Alaska was the highest paying state, offering an average annual salary of $86,000, followed by Louisiana, which paid its miners an average of $60,308, and Nevada, Wyoming, and Colorado, all of which paid an average of roughly $59,000.

America and the World

While virtually all of these metals have vital industrial applications in the world economy, the largest reserves, in most cases, are found outside the United States. According to the U.S. Bureau of Mines, the United States only serves as a net exporter of aluminum, beryllium, and rare-earth ores.

The small share and relative descent in U.S. production in this industry has been attributed to several economic pressures. First in most cases, the most productive mines for many of these metals are not located in the United States. Also, the downward pressure on prices and a great degree of uncertainty among producers has led to a U.S. decline in production. Aluminum, platinum, and titanium, for example, experienced severe losses in the face of worldwide competition and a major imbalance in supply and demand. Finally, the demand for many of these metals is directly connected to the world's industrial activity.

In 1999 Russia announced the discovery of a major titanium/zirconium deposit, anticipated to be the largest in the world and totaling seven billion tons of ore. The deposit is anticipated to produce 106 million tons of titanium and 26 million tons of zirconium in the early 2000s. Prior to the discovery, Russia produced no titanium and a maximum of 5,000 tons of zirconium concentrate annually.

Further Reading

National Mining Association. "Annual Mining Wages Vs. All Industries." Washington, DC: 2002. Available from http://www.nma.org .

National Mining Association. "Mineral Exports of Selected Commodities." Washington, DC: 2002. Available from http://www.nma.org .

National Mining Association. "Per Capita Consumption of Minerals." Washington, DC: 2002. Available from http://www.nma.org .

National Mining Association. "U.S. Mineral Materials Ranked By Net Import Reliance." Washington, DC: 2002. Available from http://www.nma.org .

"Platinum Production on a High." Africa News Service, 20 November 2003.

Regan, Bob. "Aluminum at 28-Month High." American Metal Market, 10 January 2000.

"U.S. Aluminum Output Near Two-Year High." American Metal Market, 13 February 2003.

"U.S. Aluminum Output Drops 28.1%." American Metal Market, 16 January 2002.

Comment about this article, ask questions, or add new information about this topic: