SIC 2671

COATED AND LAMINATED PACKAGING PAPER AND PLASTICS FILM

This classification covers establishments primarily engaged in manufacturing coated or laminated flexible materials made of combinations of paper, plastics film, metal foil, and similar materials (excluding textiles) for packaging purposes. These are made from purchased sheet materials or plastics resins and may be printed in the same establishment. Establishments primarily engaged in manufacturing coated or laminated paper for other purposes are classified in SIC 2672: Coated and Laminated Paper, Not Elsewhere Classified, including establishments manufacturing all gummed or pressure sensitive tape. Those establishments that manufacture unsupported plastics film are classified in SIC 3081: Unsupported Plastics Film and Sheet. Establishments manufacturing aluminum foil are classified in SIC 3497: Metal Foil and Leaf, while those manufacturing paper from pulp are classified in SIC 2621: Paper Mills.

NAICS Code(s)

322221 (Coated and Laminated Packaging Paper and Plastics Film Manufacturing)

326112 (Unsupported Plastics Packaging Film and Sheet Manufacturing)

Note: The U.S. Economic Census now reports industrial information under the North American Industry Classification System (NAICS) instead of the Standard Industrial Classification (SIC) system. As a result, the data reported below is for NAICS 322221 (the replacement

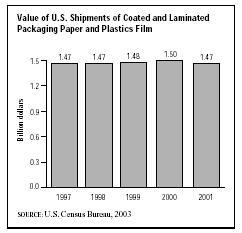

for SIC 2671 ), and includes only a small portion of what used to be reported for SIC 2671. For example, the 1995 value of shipments for SIC 2671 was estimated at $4.14 billion; in 1997, the value of shipments for NAICS 322221 was reported at $1.58 billion.

The coated and laminated packaging paper and plastics film industry is one of the smallest segments within the paper industry group, totaling just $1.48 billion in 2001. It makes the raw materials used to make specialized packages, such as those used for razor blades and other "carded" products, as well as other packaging products. The industry is more fragmented than most other paper industries, with a number of small players competing either in highly specialized product niches or regions. A company might, for example, have a leading position in one segment but have no products in any of the other segments. A distinguishing feature of the industry is the fact that an inordinately high percentage (approximately 20 percent) of potential clients such as manufacturers package their own goods, which means that firms within the industry often compete with potential clients.

This industry was made up of roughly 90 establishments at the turn of the twenty-first century. The industry employed a total of 5,897 people in 2000, including 4,680 production workers. Those production workers had total wages of $142 million and logged 10.1 million hours, for an average hourly wage of $14.03.

Three product categories make up most of this industry's shipments. Single-web paper, coated rolls and sheets, including waxed, for flexible packaging uses, accounted for $884.1 million of the value of product shipments in 2001. Multiweb laminated rolls and sheets, except foil and film, for flexible packaging uses accounted for another $539.1 million. Coated and laminated packaging paper and plastics film, not specified by kind, represented $64.1 million.

Companies in this industry were located primarily east of the Mississippi River, and five states dominated the industry. Massachusetts was the leading producer, followed by Tennessee, Wisconsin, Missouri, and Michigan. Other leading states included Illinois, New York, Ohio, and Texas.

The paper, coated, and laminated packaging industry, while small, has been resilient for much of the 1980s and 1990s, producing a gain in the value of shipments even during recessions. Since 1987, the value of shipments for this industry increased every year; this growth continued through the late 1990s. A stronger national economy in the late 1990s, more emphasis on research and development, and the expansion of niche markets appeared to be driving this industry toward increased sales and new markets. The value of industry shipments between 1997 and 1999 increased from $1.47 billion to $1.48 billion. After climbing to $1.5 billion in 2000, however, the value of industry shipments began to decline, falling to $1.48 billion in 2001, as the U.S. economy weakened considerably.

Bemis Company Inc. of Minneapolis, Minnesota, primarily active in flexible film packaging, was one of the leading companies in this industry with sales of $2.6 billion in 2003. Consolidated Papers Incorporated, a major paper manufacturer of paper and converted paper products, sold its coated and laminated packaging operations to St. Laurent Paperboard, a Canadian company, in 1999. Other leading companies in the industry included Printpack Incorporated of Atlanta, Georgia, with 2003 sales of one billion dollars and Minnesota Mining & Manufacturing (3M) of St. Paul, Minnesota, with 2003 sales of $18.2 billion.

Some of the more notable changes the industry has experienced include new materials, environmentally conscious products, specialization, and technological innovation. The industry experimented with new materials as customers demanded lighter weight, stronger materials for packaging. Some of the new materials include lighter, high-tech plastics and reinforced paper. The increased popularity of the microwave, for example, has produced a growing need for a wider range of uses for existing and new materials.

Biodegradable, recyclable, and recycled materials have become essential in the packaging industry. Packaging accounted for more than 30 percent of U.S. solid waste in the late 1990s and early 2000s. In response to environmental pressures as well as to higher prices for landfill usage, producers have incorporated "green" products and recycled raw materials into their packaging. However, there was some doubt about whether or not "green" products were commercially viable. While in surveys consumers often say that they want to buy more environmentally friendly products, when asked to pay more for them, they usually decline.

With manufacturers demanding more from packaging, producers have needed to incorporate new skills and materials into producing packages. This has led to specialization and technological innovation. An example of such innovation is razor packaging, which has been made to simulate the look of a mirror.

Further Reading

U.S. Census Bureau. "Statistics for Industry Groups and Industries: 2000." February 2002. Available from http://www.census.gov/prod/2002pubs/m00as-1.pdf .

——. "Value of Shipment for Product Classes: 2001 and Earlier Years." December 2002. Available from http://www.census.gov/prod/2003pubs/m01as-2.pdf .

Comment about this article, ask questions, or add new information about this topic: