SIC 2782

BLANKBOOKS, LOOSELEAF BINDERS AND DEVICES

This industry consists of establishments primarily engaged in manufacturing blankbooks, including checkbooks and books with ruling paper, and looseleaf binders. Other items included in this industry are albums, ruled chart and graph paper, and record albums.

NAICS Code(s)

323110 (Commercial Lithographic Printing)

323111 (Commercial Gravure Printing)

323112 (Commercial Flexographic Printing)

323113 (Commercial Screen Printing)

323119 (Other Commercial Printing)

323118 (Blankbook, Loose-leaf Binder and Device Manufacturing)

While blankbooks have been produced since the advent of the first printing presses, the modern day concept of the looseleaf binder is less than 50 years old in the United States. The production of blankbooks, which includes checkbooks, ledger sheets, accounting books, and diaries, has changed little in its U.S. history, until recently. Modernization has replaced letterpress with offset printing for the small amount of actual printing involved in blankbook manufacturing.

The largest checkbook producers looked to product diversification for increased profits in the early 1990s, but mid-size checkbook companies in the late 1990s were reportedly focusing on improving existing check printing systems to meet the ever-growing volume of checks written in the United States each year. One report stated that 61 billion checks were written in 1995, a figure that was increasing in the late 1990s by about 2 percent per year. However, according to the Federal Reserve System, the number of checks written had reached its height in the mid-1990s. According to a survey completed in 2002, the

number of checks in 2000 written totaled 42.5 billion, valued at roughly $39.3 trillion.

The looseleaf binder manufacturers have seen growth through innovation and diversification within their product lines. One of the most significant developments in this sector of the industry in recent years has been the use of four-color lithograph on vinyl. This has greatly eased the majority of the industry's manufacturing, which entails the production of custom-designed binders with company logos and other artwork.

Another major development for looseleaf binder manufacturers was the introduction of new flexible vinyls for binder covers. These vinyls are more durable and tighter fitting than their predecessors. However, these new vinyls have posed problems for the industry because they are harmful to the environment; the vinyl does not decompose in landfills and releases a hazardous chemical when incinerated.

Competition among manufacturers is generally concentrated in the area of accessories, such as supplementary pockets and slots designed to carry additional awkward items. From the mid-1980s, binders with accessories have remained in strong demand with the advent of organizers—looseleaf date books with inserts, such as foldout maps and charts. For looseleaf binder manufacturers involved in the production of organizers, diversification has also been realized with profits derived from the sale of a large variety of insert refills.

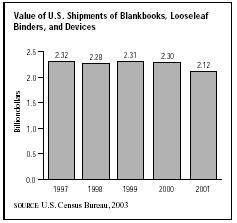

Recurring predictions that blankbooks and looseleaf binder manufacturers would suffer as a result of the emergence of the computer and Internet technology finally caught up with the industry in the late 1990s. Shipments of blankbooks and looseleaf binders and devices declined from $2.32 billion in 1997 to $2.12 billion in 2001. Looseleaf binders, devices, and forms, including those used for time planners-organizers, appointment books, photo albums, scrapbooks, etc. accounted for $1.61 billion (76.2 percent) of industry shipments in 2001. Blankbook making, except checkbooks, accounted for $348 million (16.4 percent) of shipments in 2001. Blankbooks and looseleaf binders and devices, not separated by kind, accounted for $158 million (7.4 percent). Each of these segments had seen the value of its shipments decline in the late 1990s and early 2000s.

In 2004 the largest company, nationally and internationally, for blankbooks and looseleaf binders was ACCO World Corp., with $1.1 billion in sales and 5,839 employees. In 2002, sales for the firm had declined 12 percent and the number of employees had fallen 16.2 percent. Another industry leader, Safeguard Business Systems, Inc., operated as a subsidiary of New England Business Service, Inc., which posted 2003 sales of $551 million. Burnes of Boston, Inc, formerly known as Holson Burnes Group, Inc., operated as a subsidiary of Newell Rubbermaid Inc.

In 2000, nearly 15,700 people worked in this industry. The 10,385 production workers earned an average of $10.66 hourly for an average workweek of 39.2 hours with 2.9 overtime hours.

Further Reading

"Revision Suggests Check Use Peaked in Mid-1990s." Cardline, 16 August 2002.

U.S. Census Bureau. "Statistics for Industry Groups and Industries: 2000." February 2002. Available from http://www.census.gov/prod/2002pubs/m00as-1.pdf .

——. "Value of Shipment for Product Classes: 2001 and Earlier Years." December 2002. Available from http://www.census.gov/prod/2003pubs/m01as-2.pdf .

Comment about this article, ask questions, or add new information about this topic: