SIC 4214

LOCAL TRUCKING WITH STORAGE

This category covers establishments primarily engaged in furnishing both trucking and storage services, including household goods, within a single municipality, contiguous municipalities, or a municipality and its suburban areas. Establishments primarily engaged in furnishing warehousing and storage of household goods when not combined with trucking are classified in SIC 4226: Special Warehousing and Storage, Not Elsewhere Classified. Establishments primarily engaged in furnishing local courier services for letters, parcels, and packages weighing less than 100 pounds are classified in SIC 4215: Courier Services Except Air.

NAICS Code(s)

484110 (Local General Freight Trucking, Local)

484210 (Used Household and Office Goods Moving)

484220 (Specialized Freight (except Used Goods) Trucking, Local)

The local trucking and storage industry consists of firms that provide storage, warehousing, and other services in addition to transport within an operating radius of 50 miles, which usually includes an urban area and its suburbs. The industry is divided between firms that transport and store furniture and household goods locally and firms that transport and store other goods locally.

In 1994, three-quarters of the industry's revenues were derived from motor carrier work (including the leasing of trucks with drivers). A total of 63 percent of these revenues came from local trucking and the remainder from long-distance trucking. The industry's nonmotor carrier derived revenues from such activities as parking and storing vehicles, snow plowing, repair work and truck terminal leasing for other carriers, and the lease and rental of vehicles without drivers. Industry firms generally are classified as "specialty freight" carriers, because the materials they transport—typically household goods—require special equipment for loading, unloading, or transport.

Local firms that both moved and stored household goods comprised roughly 20 percent of the total U.S. household goods moving industry in 1987, with the remainder divided between non-local household goods movers and local truckers that did not offer storage. Typically, most residential moves occur in the summer, and industry revenues often drop by as much as 50 percent during the winter months. As a result of such revenue fluctuations, many local moving and storage firms have supplemented their core moving business with other services, including off-season commercial and business office relocation, less-than-truckload (i.e., less than 10,000 pounds of goods per truckload) freight transport, third-party logistics, and warehousing.

A growing trend in American industry in the 1980s and 1990s was the "just-in-time" production management system, in which manufacturers lowered their inventory costs by maintaining only a short-term stock of manufacturing materials. Shippers of manufacturing materials responded to this trend by warehousing goods in the same locality as their customers, enabling them to respond more quickly to continual changes in their customer's orders while also lowering shipping expenses. Local trucking and storage companies participated in this trend by providing transport, warehousing, and logistics services to shippers and their customers. In third-party logistics arrangements, local trucking and storage firms provided storage, inventory control services, packing or crating of goods, or pickup and delivery of shipments. Goods were stored in the customer's warehouse, the trucking firm's warehouse, or in "dedicated" warehouses owned by the trucking firm but maintained exclusively for the customer. Inventory management could be handled by the customer in the trucker's storage facility or by the local trucking firm itself. Some firms maintained small warehouses called "parts banks" where important components were kept ready for immediate (1-4 hour) delivery to customers.

Many of the same firms that dominated the national intercity moving industry in the late 1990s—Bekins, Mayflower, Allied, North American, and U-Haul, for example—also operated in the local trucking and storage industry and were among the leaders in developing the nontraditional less-than-truckload and logistics services markets. Far more common, however, were smaller firms such as Kane Is Able Inc., Nice Jewish Boy Moving and Storage, Frozen Food Express, and Beverly Hills Transfer and Storage Inc.

In 2001, the industry leader was Bekins Van Lines LLC of Hillside, Illinois, with $207 million in revenue and 400 employees. In second place was Paul Arpin Van Lines of East Greenwich, Rhode Island, with $116 million in revenue and 500 employees. Next was Jacksonville, Florida-based Arnold Transportation Service Inc., with $93 million in revenue and 700 employees. Rounding out the top five in the industry were Cord Moving and Storage Co., of Earth City, Missouri, with $70 million in revenue and 300 employees, and McClendon Transportation Group of Lafayette, Alabama, with $64 million in revenue and 300 employees.

In addition to national moving companies and smaller trucking and storage firms, the local trucking and storage industry includes a variety of specialized carriers, such as merchants' goods delivery services, refrigerated meat transporters, data transport and storage firms, liquid tank truckers, container and inter-modal companies, cement hauling firms, bus companies, farm goods transporters, crane and excavation companies, as well as the local trucking and storage divisions of such national rail carriers as CSX and Norfolk Southern.

In the mid-1990s, important trends in the local-trucking-with-storage industry included continued diversification into new areas of business: some companies, for example, would offer to pack up a company's computers, move them to a new office location, and reinstall them so employees could begin work immediately.

Overall, the local general freight trucking industry reported revenues of $14.96 billion in 2001, down from $15.15 billion in 2000, but up from $14.27 billion in 1999. The local specialized freight trucking industry reported revenues of $25.36 billion in 2001, a slight gain over $25.33 billion in 2000 and $24.09 billion in 1999. In general, employment in this industry is tied to the general health of the economy. According to the Occupational Outlook Handbook, there were a total of 3.2 million truck drivers employed in 2002. The overall employment expectation was for steady growth into 2012, with better opportunities for heavy and light truck drivers.

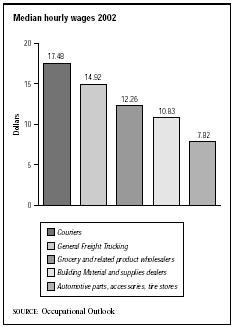

In 2002, the median salary for delivery and light duty truck drivers was $11.48 per hour. Intense competition in the industry has driven up truckers' wages. At the same time, industry firms also concentrated on developing ways to retain drivers, such as only hiring drivers from within the company or offering generous benefits and profit-sharing plans. There was virtually no unemployment in the truck driving industry, and the labor shortage was expected to worsen into the mid-2000s.

The highest costs in the industry were labor-related. Other costs were associated with retrofitting trucks to meet new diesel emissions standards. Diesel emissions were to be cut by up to 90 percent by 2007. In the 2000s, the Transportation Security Administration was looking into the viability of requiring locks on all truck cargo areas.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

"Bekins Worldwide Solutions." Bekins Van Lines LLC, 2002. Available from http://www.bekinssolutions.com .

General Statistics . GaleNet, 2000. The Gale Group. Available from http://www.galenet.com .

Hoover's Company Fact Sheet. "The Bekins Co." 3 March 2004. Available from http://www.hoovers.com .

"Lock It Up." Fleet Owner, 1 January 2003.

U.S. Census Bureau. Transportation Annual Survey. 8 March 2004. Available from http://www.census.gov .

U.S. Department of Labor, Bureau of Labor Statistics. 2000 National Industry-Specific Occupational Employment and Wage Estimates. 15 November 2001. Available from http://www.bls.gov/oes/2000/oesi3_414.htm .

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

U.S. Department of Labor, Bureau of Labor Statistics. Occupational Outlook Handbook 2004-05 Edition. Available from http://www.bls.gov .

US Industry and Trade Outlook. New York: McGraw Hill, 2000.

Comment about this article, ask questions, or add new information about this topic: