SIC 4222

REFRIGERATED WAREHOUSING AND STORAGE

This category includes establishments primarily engaged in the warehousing and storage of perishable goods under refrigeration. The establishments may also rent locker space for the storage of food products for individual households and provide incidental services for processing, preparing, or packaging such food for storage. Establishments primarily selling frozen foods for home freezers (freezer and locker meat provisioners) are classified in SIC 5421: Meat and Fish (Seafood) Markets, Including Freezer Provisioners.

NAICS Code(s)

493120 (Refrigerated Storage Facilities)

In 2001, a total of 607 firms operated 942 refrigerated warehousing and storage establishments. There were 28,231 employees receiving a total payroll of $853.7 million. Total revenue for the year was $2.3 billion, which increased to nearly $2.5 billion in 2002.

According to the International Association of Refrigerated Warehouses (IARW), there was a record total of 2.1 billion cubic feet of refrigerated/frozen storage in North America in 1999. The USDA estimated slightly more than 2.7 billion cubic feet, but this figure included both private and public storage space. The five states containing the largest gross general warehouse capacity were California, Florida, Washington, Texas, and Wisconsin. According to the USDA, there has been a 59 percent increase in capacity in the past 10 years. While refrigerated storage is generally used for food products, it also serves the pharmaceutical, chemical, medical, and scientific industries.

Cold storage operators have historically acted as middlemen between the manufacturers and the grocery or convenience store retailers. They provide storage and distribution services for domestic and international clients. These operators have been able to meet the needs of their clients by offering, through the latest technology, an efficient and inexpensive way to store their goods.

Many cold storage warehouses are at seaports where volumes of perishables are imported and exported. Berkshire Foods Inc. operates the cold storage facility at the Port of Savannah, Georgia, which is owned by the Georgia Ports Authority. Berkshire also operates four warehouse facilities, which include more than 4 million cubic feet of freezer space at -5 to -30 degrees Fahrenheit.

Companies, including seaports, that otherwise would have to operate large warehouses and spend considerable resources on computerized tracking systems are able to avail themselves of services from the cold storage operators. Throughout the second half of the twentieth century, cold storage operators developed expertise through experimentation and the application of new technology that food manufacturers were anxious to use. With the passage of time, the production of this expertise became costly and time-consuming for food manufacturers. Therefore, food manufacturers elected to outsource their food storage needs to refrigerated storage experts.

Since the 1970s, moreover, the use of artificial preservatives as a means of keeping food fresh has come under increasing scrutiny from health-conscious consumers. As a result, the demand for frozen foods, which do not contain as many preservatives, has increased. Cold storage providers were indirect beneficiaries of this evolving market trend.

As of 2003, the industry was growing slowly. Some 37.8 percent of warehouses reported increased turnover,

down from 51.0 percent in 2002, and 57.1 percent reported steady inventories, up from 41.7 in 2002.

In terms of revenue, Americold Logistics LLC of Atlanta, Georgia, was the industry leader in 2001 with $700 million in revenue and 6,200 employees. In 2004, the company had 541 million cubic feet of space and 100 locations. Burris Refrigerated Logistics of Milford, Delaware, had $186 million in 2001 revenue and 1,000 employees. Cherry Hill, New Jersey-based United States Cold Storage Inc. was next, with $144 million in revenue and 800 employees. Rounding out the top four was Hal's Warehouse Corp. of South Plainfield, New Jersey, with $93 million in revenue and 200 employees.

In terms of storage space, Atlas Cold Storage was the industry leader with 277.8 million cubic feet of storage space throughout North America in 2003. Atlas was followed by P & O Cold Logistics, which had operations in Australia, New Zealand, and Argentina in addition to the United States. Other leaders included John Swire & Sons Ltd., which had operations in Australia and Vietnam, as well as the United States, and Versacold, which had operations throughout North America.

Along with the IARW, the industry also is promoted by an organization known as the World Group, which celebrated its twentieth anniversary in 1998. World Group is a consortium of eight public refrigerator warehouse companies in the United States and Canada. Their common interests are to promote state-of-the-art technology and to simplify manufacturers' distribution processes.

Further Reading

"Atlas No. 1 Titan of Global PRW Business." Quick Frozen Foods International, January 2003.

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Hoover's Company Fact Sheet. "Americold Logistics, LLC." 3 March 2004. Available from http://www.hoovers.com .

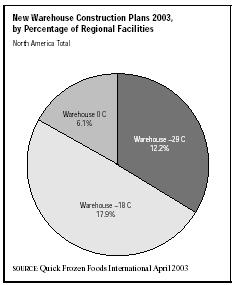

Pierce, J.J. "PRWs May Grow at a Lesser Pace, But Slow and Steady Wins the Race." Quick Frozen Foods International, April 2003.

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

——. Transportation Annual Survey. 8 March 2004. Available from http://www.census.gov .

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

Comment about this article, ask questions, or add new information about this topic: