SIC 3769

SPACE VEHICLE EQUIPMENT, NOT ELSEWHERE CLASSIFIED

This category covers establishments primarily engaged in manufacturing guided missile and space vehicle parts and auxiliary equipment, not elsewhere classified. This industry also includes establishments owned by manufacturers of guided missile and space vehicle parts and auxiliary equipment, not elsewhere classified, and primarily engaged in research and development on such products, whether from enterprise funds or on a contract or fee basis. Establishments primarily engaged in manufacturing navigational and guidance systems are classified in SIC 3812: Search, Detection, Navigation, Guidance, Aeronautical, and Nautical Systems and Instruments. Research and development on guided missile and space vehicle parts, on a contract or fee basis by establishments not owned by manufacturers of such products, are classified in SIC 8731: Commercial Physical and Biological Research.

NAICS Code(s)

336419 (Other Guided Missile and Space Vehicle Parts and Auxiliary Equipment Manufacturing)

Products manufactured by this industry are mostly airframe assemblies for guided missiles, castings for missiles and missile components, nose cones for guided missiles, and space capsules for space vehicles.

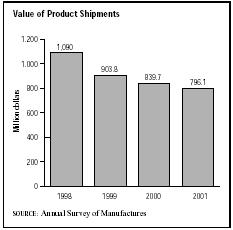

According to the Annual Survey of Manufactures, the value of product shipments for guided missile and space vehicle parts and auxiliary equipment was decreasing every year. Shipments for 1998 were valued at $1.09 billion, shipments for 1999 were valued at $903.8 million, shipments for 2000 were valued at $839.7 million, and in 2001 shipments were valued at $796.1 million.

According to the 1997 Economic Census, the value of product shipments for guided missile and space vehicle parts and auxiliary equipment fell by approximately 48 percent between 1992 and 1997. The sector of the industry showing the biggest decline was production for U.S. government military customers—not including manufacture of airframes and space capsules. Shipment values in 1997 were just 33 percent higher than 1992 levels. Nonetheless, the industry saw slight gains in shipments to nonmilitary government customers and commercial

customers—between 1992 and 1997, those sectors combined jumped 36 percent.

In 2001, there were 38 firms operating 41 establishments in the industry. This number also had been decreasing each year. Nearly all of the companies were quite small, with more than 84 percent employing fewer than 100 workers.

The number of workers in this industry has fallen dramatically since a high in 1985 of 33,700. Smaller peaks occurred in 1988 and 1992, when the number of workers was 19,400 and 17,200, respectively. Employment totaled 6,755 in 1998; 6,068 in 1999; 6,044 in 2000; and was still very low in 2001 when the number of workers totaled 5,512. Employment figures were projected to continue the annual downward spiral into 2012.

Jobs most affected by the decline in employment have included precision assemblers, inspectors, secretarial and clerical workers, and machinists. Other areas were expected to increase through the first decade of the twenty-first century, particularly electrical engineers and systems analysts. By contrast, jobs for aeronautical and astronautical engineers, which made up 8.4 percent of the industry workforce in 1996, were expected to decline by more than 11 percent by 2006.

Like other sectors of the aerospace industry, U. S. space vehicle equipment exports far exceed imports. In 1997, this industry exported more than $690 million in equipment, compared to $109 million in imports. The value of imports has held fairly steady since 1992 ($103 million), while the value of exports has decreased overall. Although forecasts for 1999 exports were as high as $730 million, that was nonetheless a 5 percent decline from 1992 levels.

Industry leaders in 2001 included Rockwell Collins Inc. of Cedar Rapids, Iowa, with sales of $2.5 billion and 14,500 employees; Ball Aerospace and Technologies Corp. of Boulder, Colorado, with $383 million in sales and 2,200 employees; and Lockheed Martin Michoud Operations of New Orleans, with sales of $355 million and 2,000 employees.

Sales for individual companies continued to plummet during the late 1990s as government contracts continued to shrink. Combined with the constant dismantling of missiles and reduced spending on space missions, this has been detrimental for the health of the industry. Unlike many companies in the industry, leader Rockwell Collins was able to grow into 2004 due to its focus on researching and developing products and applications for both the defense and commercial markets. While the economy was unstable after the September 11, 2001 terrorist attacks on the World Trade Center, the defense sector grew both domestically and abroad.

The growth and stability of this industry are dependent on manufacturers of complete guided missiles and space vehicles, SIC 3761: Manufacturers of Guided Missiles and Space Vehicles, who act as primary contractors in the manufacturing of these products. Both industries rely largely on the world political situation that dictates military needs, and on the competitiveness of the world market for space exploration and commercial space ventures, mainly in launching communications satellites.

Positive indicators for the industry include a thriving market in satellite services that was expected to continue at least until 2005. Developments in the U.S. Space Program have less certain consequences for the industry. Well-publicized failures with the Mars space probes in 1999 brought increased attention to NASA spending habits. Since 1993, NASA had adopted a policy of "faster, better, cheaper" spacecraft, but in 1999 NASA administrators questioned whether the low spending levels could remain viable.

Research and development for guided missile and space vehicle equipment and auxiliary parts followed the trend of the aerospace industry as a whole in its focus on reduced-cost reusable products. In the 2000s, there was research focus on global positioning systems (GPS) and the possible application for improvement of weapons systems. The United States continued to dominate the missile industry in the 2000s. In particular, there was almost no competition for the Advanced Medium-Range Air-to-Air Missile (AMRAAM), according to U.S. Industry and Trade Outlook.

Further Reading

"Avionics, Communications Supplier Rockwell Collins Sees Sales Rising." Knight Ridder/Tribune News, 11 February 2004.

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Darnay, Arsen J., ed. Manufacturing and Distribution USA. Detroit: Thomson Gale, 2003.

Hoover's Company Fact Sheet. "Rockwell Collins, Inc." 3 March 2004. Available from http://www.hoovers.com .

Nelson, Brett, "Aerospace & Defense." Forbes, 12 January 2004.

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Commerce. 1997 Economic Census, Washington: GPO, 1999.

——. Annual Survey of Manufactures. Washington: GPO, 2002.

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

US Industry and Trade Outlook. New York: McGraw Hill, 2000.

Comment about this article, ask questions, or add new information about this topic: