SIC 5064

ELECTRICAL APPLIANCES, TELEVISION, AND RADIO SETS

This industry is comprised of establishments engaged in the wholesale distribution of household electrical appliances (such as refrigerators, freezers, dishwashers, and laundry equipment), household and motor vehicle electronic sound or video equipment, and radio and television sets. The industry also includes establishments primarily engaged in the wholesale distribution of household nonelectric appliances (such as gas clothes dryers and gas refrigerators).

NAICS Code(s)

421620 (Electrical Appliance, Television, and Radio Set Wholesalers)

Industry Snapshot

Wholesale distributors of electrical appliances, televisions, and radio sets served an industry enjoying constant innovation and new product demand. By the 2000s, the market for these products was dominated by a major shift to digital technology. While this development clearly presented vast new market openings, it also posed tough challenges. Convincing a market highly saturated with its products to upgrade to the latest technology called for aggressive marketing strategies and value-added services. Wholesalers were expected to aid these strategies with services and technological sophistication of their own in order to most adeptly meet their manufacturers' and retailers' needs in the quick-paced marketplace.

About 4,900 establishments operated in this industry by the mid-2000s, generating revenues of $34.7 billion. The market remained relatively unconsolidated; according to estimates by Dun & Bradstreet, over half of all electrical appliance, television, and radio wholesale distributors employed fewer than five people, while the industry as a whole employed 56,500.

Current Conditions

The advent of digital television broadcasts on 1 November 1998 was good for the consumer electronics industry. The Consumer Electronics Association (CEA) estimated that 30 percent of American households would have digital television sets by 2006, an outcome that was expected to fuel sales in the consumer electronics industry. In 2003, sales of flat-panel televisions skyrocketed, registering triple-digit growth in the first half of that year. Liquid-crystal display (LCD) and plasma TVs emitted less radiation and reflected less glare than traditional cathode ray tube (CRT) TVs. By late 2003, flat-panel TVs represented 20 percent of all digital television sales.

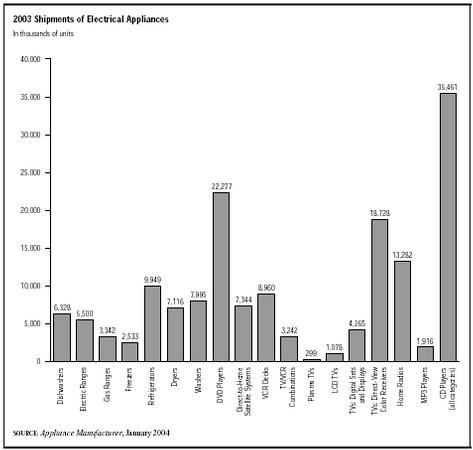

One of the trends that was expected to help the continued increase in television and related product sales was the growing interest in direct-to-home satellite systems. The early 2000s saw continued growth in this fast-emerging sector. According to Appliance Manufacturer, unit shipments of direct-to-home satellite systems grew from 6.9 million in 2002 to a predicted 7.8 million in 2004.

In fact, the transition to digital was even considered to be too important to relegate solely to market forces. The Federal Communications Commission (FCC) considered regulations requiring manufacturers of analog television sets to install tuners capable of receiving DTV signals, thereby making them digital-ready, in an effort to speed the digital conversion. The Council of Economic Advisors (CEA) sued the FCC, arguing that the cost to manufacturers and consumers outweighed the benefits of am across-the-board digital conversion. But clearly, by the mid-2000s, the writing for analog TV was on the wall. In 2002, the FCC ruled that half of all 36-inch analog televisions must be DTV-compatible by July 2004, and all such units must include DTV tuners a year later; smaller analog televisions must be DTV-ready by mid-2007.

Industry insiders worried that the advent of digital technology would adversely affect sales in categories that had not fully transformed from analog technology. While these fears were borne out in many cases, some analog industry categories were hanging on into the mid-2000s. The CEA reported combination television/video cassette recorder sales increased to 4.87 million units in 2002, up from 4.63 million units the year before, though falling prices led to a drop in total sales from $790 million to $737 million. Sales of projection televisions, on the other hand, continued to fall from their peak of 1.22 million units and $1.48 billion in sales in 2000 to 681 million units and $733 million in sales in 2002. Videocassette recorders registered one of the most severe declines, from 23.1 million units in 2001 to 13.57 million in 2002.

In the audio segment, overall unit shipments fell 19 percent in 2002, and an additional 4.3 percent in 2003. Industry observers attributed this slide to the lackluster economy and to the encroachment of new forms of audio consumption, particularly via the Internet and computerbased audio listening. The tide was stemmed somewhat by the rise of MP 3 players, which enjoyed double-digit growth in the early 2000s, but shipments of CD players fell from nearly 43 million in 2002 to a predicted 34 million in 2004.

Shipments of major household appliances such as refrigerators, ovens, and laundry equipment tend to track the performance of the overall U.S. economy. In particular, new housing starts were a key indicator for performance in this category. As such, growth was extremely modest in the early 2000s, but most major categories continued to grow slightly in the early 2000s. Between 2002 and 2004, according to Appliance Manufacturer, all the major categories in the major-appliance sector—dishwashers, disposers, electric and gas ranges, freezers, refrigerators, washers, and dryers—saw their shipments grow around 2 percent annually.

Further Reading

Delano, Daryl. "Onward & Upward." Appliance Manufacturer, January 2004.

Dun & Bradstreet. "Industry Reports." Waltham, MA: Dun & Bradstreet, 2004. Available from http://www.zapdata.com .

"Flats Flying High." Appliance Manufacturer, October 2003.

McConnell, Bill. "Court Tunes in Digital Debate." Broadcasting & Cable, 22 September 2003.

Comment about this article, ask questions, or add new information about this topic: