SIC 5084

INDUSTRIAL MACHINERY AND EQUIPMENT

This industry is comprised of establishments involved in the wholesale distribution of industrial machinery and equipment, not elsewhere classified. Products of the industry include chainsaws, citrus processing machinery, conveyor systems, industrial cranes, derricks, industrial diesel engines, elevators, ladders, lift trucks, machine and machinists' tools, oil refining machines, packing machinery, industrial paint spray equipment, wood pulp manufacturing machinery, industrial pumps and pumping equipment, industrial sewing machines, shoe manufacturing and repairing machinery, smelting machinery, welding machinery, and winches.

NAICS Code(s)

421830 (Industrial Machinery and Equipment Wholesalers)

According to the U.S. Census Bureau, there were nearly 34,000 establishments employing approximately 352,561 people in the industrial machinery and equipment industry in 2001. These were subdivided into six groupings: food-processing machinery, equipment, and parts made up approximately 2 percent of sales; general-purpose industrial machinery, equipment, and parts accounted for about 33 percent; metalworking machinery, equipment, and parts accounted for 12 percent; materials handling equipment and parts accounted for 15 percent; oil well, oil refinery, and pipeline machinery, equipment, and supplies garnered 4 percent; and other industrial machinery and equipment made up the remaining 34 percent. Industry payroll in 2001 exceeded $16.4 million. Sales were expected to only increase slightly during the late 2000s, while employment was expected to remain relatively flat.

The top states, based on number of establishments and sales volume, largely mirrored the concentration of the U.S. population. These were California, Texas, Florida, Illinois, Ohio, New York, Pennsylvania, and Michigan. Together, these eight states generated more than half of all industry sales. North Carolina, Indiana, and New Jersey were also leaders in number of establishments.

Industrial equipment sales suffered downturns during the early 1990s as lean fiscal performances stalled new plant investment in many sectors served by this industry. Recovery began in 1993, and the industry posted healthy sales' growth and modest profits in the mid-1990s. The wholesale distribution of all machinery, equipment and supplies—which includes this category—made up 15 percent of the durable goods market for 1997, which totaled $193 billion. Trying to post higher returns, many in the industry reconfigured the way their companies distributed industrial machinery. Other industry strategies aimed at further increasing market strength included reducing costs, outsourcing distribution-related services, and seeking out new business, especially through the exploration of foreign markets. Strong prospects for export growth included Canada, Mexico, South America, the United Kingdom, France, Germany, Australia, Japan, China, and Africa.

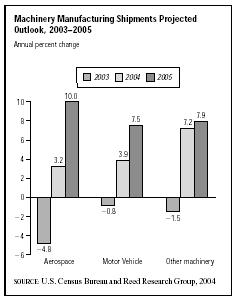

Reed Research Group, in conjunction with the U.S. Census Bureau, predicted the machinery and components manufacturing market was positioned for growth in 2004

that would continue into 2005. Fueled with an overall 8.5 percent increase in sales, the industry had emerged from its downturn trend of more than three years. The value of machinery shipments was projected to climb to about $72,000 in the first quarter of 2004, and reach almost $76,000 by the year's end, up from $70,000 at the end of 2003.

The industrial distribution industry underwent extensive consolidation, but merger and acquisition activity was down 41 percent in 2002. The pace picked back up in 2003 with a number of mergers and acquisitions. A leader in the industry, Airgass Inc., acquired a total of 14 branches of Union Gas Group.

One of the leading industrial distribution firms in the United States was Dresser Industries Inc. of Dallas, Texas, with annual sales of more than $7.4 billion and 31,000 employees. Other top companies included Unisource Worldwide Inc. of Berwyn, Pennsylvania, with sales of $4.76 billion and 10,000 employees; Applied Industrial Technologies, Inc. of Cleveland, Ohio, with sales of $1.46 billion and 4,355 employees; and W.W. Grainger Inc. of Lincolnshire, Illinois, with sales of $4.66 billion and 14,701 employees. Following the integrated supply trend in the wholesaling industry, W.W. Grainger established an alliance with VWR Scientific Products in 1997 to service consolidated customer orders. By 2002, W.W. Grainger announced its plans for a huge expansion over the course of five years.

Other leading companies include WESCO Distribution Inc. of Pittsburgh, Pennyslvania; Duferco Energy Group, Inc. of Houston, Texas; Stewart and Stevenson Services of Houston, Texas; Airgas Inc. of Radnor, Pennsylvania; and National-Oilwell Inc. of Houston, Texas.

The manufacturing sector shed two million jobs throughout the downturn, and unfortunately many of these jobs were expected to be moved overseas. Some companies were relocating their facilities to China, the Pacific Rim, and some are even looking into Africa, where labor costs are lower.

Further Reading

"Analysts Expect Mergers to Resume." Industrial Distribution, 1 January 2002. Available from http://www.keepmedia.com/pubs/IndustrialDistribution/2002/01/01/244839 .

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

Haughey, Jim. "Machinery and Components Manufacturing Market Outlook." Industrial Distribution, 6 April 2004. Available from http://www.manufacturing.net/ind/article/CA408444?text=machinery+and+components+manufacturing+components+market+outlook .

Keough, Jack. "M&A activity to rise in 2003." Industrial Distribution, 1 February 2003. Available from http://www.keepmedia.com/pubs/IndustrialDistribution/2003/02/01/117817 .

Keough, Jack. "Economic Rebound Ahead? Looking Ahead." Industrial Distribution, 1 January 2003. Available from http://www.keepmedia.com/pubs/IndustrialDistribution/2003/01/01/117794 .

——. "Here's to a Successful 2004." Industrial Distribution, 12 December 2003. Available from http://www.keepmedia.com/pubs/IndustrialDistribution/2003/12/01/330062 .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .