SIC 5044

OFFICE EQUIPMENT

This entry includes establishments primarily engaged in the wholesale distribution of office machines and related equipment, including photocopy and micro-film equipment; safes and vaults; accounting and adding machines; calculating machines; cash registers; duplicating machines; mailing machines; mimeograph equipment; typewriters; and addressing machines. These establishments also frequently sell office supplies, but establishments primarily engaged in wholesale distribution of office supplies are classified in SIC 5111: Printing and Writing Paper, SIC 5112: Stationary and Office Supplies, or SIC 5113: Industrial and Personal Service Paper. Establishments primarily engaged in wholesale distribution of office furniture are classified in SIC 5021: Furniture, and those involved primarily in wholesale distribution of computers and peripheral equipment are classified in SIC 5045: Computers and Computer Peripheral Equipment and Software.

NAICS Code(s)

421420 (Office Equipment Wholesalers)

Industry Snapshot

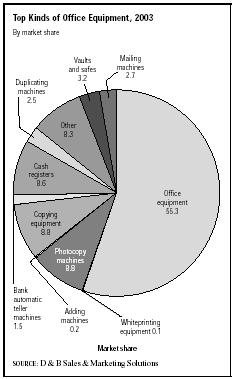

The office equipment industry is made up of establishments that distribute supplies and equipment from typewriters to safes to calculating machines. In 2003, photocopy machines, copying equipment, and cash registers dominated this industry, followed by vaults and safes, addressing and mailing machines, and duplicating machines.

The industry consisted of approximately 6,779 establishments in 2001, slightly down from 7,023 in 2000. By 2003, the number increased to 9,233 with more than $25 million in annual sales. The average number of employees per establishment was 15, and the average sales per establishment was almost $4 million. The majority of office equipment establishments were concentrated in California with 1,240 with sales of about $1 million. Florida followed with approximately 700 establishments and about $4 million in annual sales.

The wholesale distribution of office machines and related equipment employed about 147,160 people in 2001, up from 134,340 in 2000. The total number of employees continued to decline, and by 2003 the number dropped to 128,589.

Background and Development

Xerox Corporation, the inventor of the copier in 1949, led the office equipment industry until the 1970s when Japanese rivals entered the market. Xerox sales representatives found themselves competing against local distributors of Minolta Camera Co. Ltd., Toshiba Corporation, and other companies. At the premium-priced end, Eastman Kodak Co. had become a powerful competitor as well. Xerox's quality-improvement strategy, however, helped the company regain much of its market share (about 38 percent in 1991). Xerox sells and rents machines and provides special financing to its largest accounts. Because Xerox machines are usually high-end product sand small or new businesses do not qualify for Xerox's low interest financing, entrepreneurs often turn to the distributors of the lower-priced Japanese machines to buy or rent.

Wholesale distributors of office equipment have traditionally been part of a two-tier distribution system in which they bought merchandise from the manufacturers and sold it for profit to other retailers or industrial and commercial clients. They maintained deep inventories, often by taking loans against those inventories. To remain competitive, they needed to continually expand their services, expand geographically, and diversify their product markets.

The number of office equipment wholesalers decreased in the 1990s due to consolidation, forcing dealers to accept tighter profit margins. Like distributors in other industries, office equipment dealers found that the way to

maintain or increase their market share was to emphasize the service they provided that customers would not find in the superstores and other discount outlets. To broaden their appeal, many distributors also developed online catalogs for easy customer use.

The office machinery wholesale industry became intensely competitive as profit margins tightened. Many buyers of office equipment ordered through wholesale distributors rather than through retail outlets or direct from the manufacturer. Dealers selling low-end copiers and other equipment encountered tough competition from superstores and discounters, whose prices appeal to small and medium-sized businesses that do not qualify for the volume discounts given to large companies.

Distributors of office equipment, although not so vulnerable to the spending habits of individual consumers, had to contend with downsizing and layoffs at businesses across the country. Superstores have vied for the small to midsized business market and have been very successful in part because they offered smaller businesses discounts for which they had never qualified before. Smaller distributors, who could not profitably compete with the superstores for their customer base, had thus been endangered.

Dealers, however, stressed the value-added service that they could provide to business customers of the retail outlets they supplied. Value-added service was one advantage that wholesalers stressed in their competition with superstores. Value-added services included on-call technical expertise; special financing arrangements; assistance in customer materials management costs; product lines tailored to specific customers; specially designed, labeled, or customized products or catalogs; next-day delivery; after-market products and service; just-in-time inventory controls; online reporting; and usage reports. Intense competition, though, often prevented dealers from charging fees for these services, which adversely affected their already tight profit margins.

Long-standing dealers of office equipment were angered by the generous discounting some manufacturers extended to office supply superstores. According to the National Office Machine Dealers Association (NOMDA), manufacturers were selling to the discounters at a better price than they sold to dealers. They noted that the superstores did not have to bear the expense of supporting repair, training, and technical service networks that the dealers maintained.

Although manufacturers, through the large retailers, realized the benefits of reaching out to the small business and home-office market they might not have reached through traditional distributor channels, superstores were a mixed blessing to them. The superstores offered minimal service, and the manufacturers assumed increased responsibility for handling repair and warranty problems. Dealers, on the other hand, carried a large inventory of parts, provided training with the equipment they sold, and provided same-day, on-site repair of the equipment.

The remaining larger distributors competed for the corporate dollars of national companies. To be competitive, however, they offered a wide range of products and services since customers often look to deal with one supplier rather than many.

Fueled by the strong U.S. economy and by the advent of digital copiers, the office equipment industry experienced bounding growth throughout the 1990s. Industry Analysts Inc., of Rochester, New York, conducted a 1999 survey of 135 office equipment dealerships, which were experiencing increased sales of 8 to 10 percent that year. Another market research firm, Dataquest, of San Jose, California, had projected U.S. placements of 180,000 digital copiers in 1998; actual placements more than doubled this projection, with 377,710 digital copier placements that year. Combined 1998 placements of analog and digital copiers numbered 1,927,600 units, an increase of 9.9 percent compared to 1997 placements. Dataquest projections called for continued expansion of the total copier market over the three years after 1998 before decreasing to 2.1 million units by 2003. This would represent sales increases from $425.8 million in 1998 to a projected $36.1 billion in 2003.

Some industry analysts attributed the hot digital copier market to organizations replacing analog copiers with digital technology, which suggested finite growth once full digitalization was achieved. However, the trend toward digital networking encouraged the purchase of multiple copiers that could be interlinked, which could buoy sales once analog copiers are phased-out. Industry analysts also projected a shift in income for companies from hardware sales to technical support, as office equipment such as copiers were integrated into more complex systems requiring more sophisticated and knowledgeable users, and hence more support.

Current Conditions

According to 2003 data from D&B Sales & Marketing Solutions, photocopy machines, copying equipment, and cash registers dominated this industry, with 26 percent of the market. Combined, they accounted for more than $11 million in sales. Vaults and safes followed with about 3 percent; addressing and mailing machines accounted for over 3 percent; and 2 percent of the market was contributed to duplicating machines.

As technology grew at an accelerated pace, corporate leaders began to rent, or lease some of their office equipment. This had proven to be cost effective for businesses whose office equipment became obsolete as new technology was introduced. According to Equipment Leasing Association of America (ELA), of Arlington, Virginia, expected a 5 percent increase in leasing in 2004. Key Equipment Finance, of Superior, Colorado noted that approximately 90 percent of its sales are derived from office equipment dealers and manufacturers. Xerox Corp. also added that about 85 percent of their customers lease their office equipment, such as multi—function copiers and fax machines.

Industry Leaders

In the late 1990s, Alco Standard Corp. completed a long-contemplated consolidation by adopting IKON Office Solutions as its name for its office products division. IKON, which stands for I Know One Name, was previously one of the world's leading office machine companies. Alco spun off its paper distribution arm, Unisource Worldwide, the largest paper distributor in North America, to Alco's shareholders.

Another leading wholesale distributor was Lanier Worldwide Inc., a billion-dollar subsidiary of Harris Corporation. Lanier marketed copiers, fax machines and dictation equipment, telephones, integrated computer software and networking systems, and other office equipment.

Workforce

The wholesale distribution of office machines and related equipment employed about 147,160 people in 2001, up from 134,340 in 2000. The majority of companies in this industry were small—employing less than five persons. In 2001, 1,851 companies had less than 5 employees; 973 had between 5 and 9; 702 had between 10 and 19 employees; 652 had 20 to 49 employees; 84 had 50 to 99 employees; and about 63 establishments with 500 or more. The total number of employees continued to decline, and by 2003 the number dropped to 128,589.

Research and Technology

Wholesale distributors have applied computer technology to improve profit margins. This has improved the productivity of many functions, including purchasing, delivery, storage, and shipping. It also improved inventory, credit, and information management.

Further Reading

Avery, Susan. "Buyers Get Top Products by Leasing." Purchasing, 11 December 2003. Available from http://www.keepmedia.com/pubs/Purchasing/2003/12/11/338048 .

Business Technology Association, 2004. Available from http://www.bta.org .

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

IKON Office Solutions, 2004. Available from http://www.ikon.com .

Lanier Worldwide, Inc., 2004. Available from http://www.lanier.com .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/us/US421420.HTM .

Comment about this article, ask questions, or add new information about this topic: