SIC 5198

PAINT, VARNISHES, AND SUPPLIES: WHOLESALE DISTRIBUTION

This category covers businesses that distribute wholesale paints, varnishes, wallpaper, and supplies. Retail stores selling these items to the general public are classified in SIC 5231: Paint, Glass, and Wallpaper Stores. According to the Standard Industrial Classification, inventory handled by businesses in this category include calcimines, colors and pigments, enamels, lacquers, paint brushes, shellac, rollers, and sprayers.

NAICS Code(s)

422950 (Paint, Varnish and Supplies Wholesalers)

444120 (Paint and Wallpaper Stores)

The paint, varnish and supplies wholesale distribution industry is a relatively small one, with just 2,179 operators in 2001 according to the U. S. Census Bureau. The total number of employees was 20,619, and their annual payroll was about $810,233. The paints sector represented the largest segment in the industry. They numbered 1,506 and the combined sales totaled $1.76 billion, or 47 percent of the market. Paints, varnishes, and supplies numbered 899, with $821.1 million in sales, or 28 percent of the market. The 489 wall coverings businesses had combined sales of $789.9 million, or 15 percent of market share. States with the highest concentration were California, Texas, Florida, and New York. In 2003, the total number of establishments increased to 3,177, with total sales of $3.8 billion. The number of employees climbed to 22,384. The average establishment accounted for $1.8 million of the overall sales.

Like most sectors of the wholesale trade, this industry felt the ill effects of the early 1990s recession. Although sales were down between 1988 and 1992, there were signs of a recovery by 1993, and sales grew slowly during the rest of the nineties. The majority of paint, varnish, and supply wholesalers reported sales between $250,000 and $500,000 in 1993, according to Dun's Census of American Business; 1,278 establishments were in this net income range, compared with 1,138 in the previous year. One thousand and ninety-three wholesalers had a sales range of between $1 million and $5 million, compared with 1,119 in 1992. One thousand and two firms had sales between $500,000 and $1 million in 1993, 31 more than in 1992; 848 outfits had sales of from $100,000 to $249,000, just one more than the previous

year. Three hundred and six companies had sales of more than $5 million; 196 wholesalers earned less than $100,000; and 105 earned less than $50,000 in 1993.

Establishments were generally productive, even with small staffs: most had fewer than four employees but a high rate of staff turnover. According to 1997 County Business Patterns published by the U.S. Census Bureau, 1,394 companies had four or fewer employees. This represented a decrease of 2,040 in this category since 1994. There were 776 establishments that had between five and nine employees in 1997, compared with 1,827 in 1994. Four hundred and twenty-two outfits employed between 10 and 19 workers, 133 less than in 1994. Companies that employed between 20 and 49 in the industry in 1997 numbered 153, compared with 178 in this category in 1994. Of the remainder, 30 employed between 50 and 99 workers; 12 employed between 100 and 249; and only four had more than 250 workers.

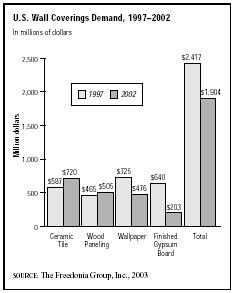

As consumers change, so will the wall covering industry overall. According to The Freedonia Group, wall covering demand was expected to climb to 5.7 percent, or $2.5 billion by 2007. Ceramic tile was also expected to grow to 3.2 percent during the same time period, while wallpaper demand was expected to grow 4.2 percent.

The industry's leaders in the mid-1990s included the following companies: Seabrook Wallcoverings Inc. of Memphis, Tennessee, with estimated sales of $100 million and 500 employees; Thompson PBE Inc. of Clearwater, Florida, with estimated sales of $65 million and 300 employees; and Masterchem Industries, Inc. of Barnhart, Missouri, with estimated sales of $50 million and 100 employees.

The employment rate—approximately 29,000 in 1997—was predicted to grow in the wholesale paint, varnishes, and supplies industry over the next 15 years due to a rise in wholesale exports. In particular, the passing of the North American Free Trade Agreement (NAFTA) in 1994 was expected to cause export demand to rise over the long term. The paint, varnish, and supply wholesale industry should benefit from NAFTA, in terms of both job creation and sales.

Further Reading

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .

"US Wall Coverings Demand." The Freedonia Group, September 2003. Available from http://www.the.infoshop.com/press/fd14202_en.shtml .

Comment about this article, ask questions, or add new information about this topic: