SIC 5111

PRINTING AND WRITING PAPER

This industry classification includes wholesale distributors of printing and writing paper. Products of the industry include fine paper, envelope paper, and ground wood paper. Wholesale distributors of computer paper and stationery are classified in SIC 5112: Stationery and Office Supplies.

NAICS Code(s)

422110 (Printing and Writing Paper Wholesalers)

Industry Snapshot

In 2003, there were about 1,860 printing and writing paper wholesale distributors in the United States, generating revenues in excess of $7.8 billion. The industry employed almost 29,000 workers, the vast majority of whom worked in firms employing fewer than ten people overall. But this trend was changing by the mid-2000s as a result of difficult industry conditions. As the industry fell on hard times in the late 1990s and the early 2000s, paper producers and paper wholesalers alike underwent a wave of consolidation.

Resource Information Systems Inc. (RISI), in its 2003 North American Graphic Paper Forecast, reported that printing and writing paper was falling behind the pace of the U.S. economy. Notoriously chained to the performance of the overall economy, the paper industry as a whole tended to patiently weather downturns as a lapse in the broader market. In the early 2000s, however, that connection was beginning to slip, as demand for printing and writing paper lagged behind even the sluggish U.S. economy.

Overcapacity through the late 1990s and early 2000s was largely to blame for the decline in prices the plagued the industry. But the American Forest & Paper Association (AF&PA) found that the sustained downturn that marked the paper industry through the late 1990s and early 2000s had begun to level off by 2003. As the industry stabilized, prices were expected to creep upwards again. Still, while demand and prices were expected to rebound with the improving economy through the mid-2000s, analysts expected the pace to lag a bit behind the overall economy. To make matters worse, the U.S. industry also faced fierce foreign competition, as overseas firms delivered quality improvements at a brisk pace and sold them at aggressive prices, helping exacerbate the downturn in U.S. paper prices.

Organization and Structure

Printing and writing paper is grouped in four large categories: uncoated groundwood, coated groundwood, uncoated freesheet, and coated freesheet. "Groundwood" refers to paper made from mechanical pulp, and "freesheet" refers to paper made from chemical pulp (see SIC 2611: Pulp Mills ). "Coated" refers to paper that has been treated to improve printability and/or appearance. Printing and writing papers range from the lower-quality paper used to print advertising circulars to the high-quality coated paper used to print upscale magazines. These categories do not include newsprint, which is considered to be a low-quality paper.

Through the 1990s, distributors and wholesalers of printing and writing paper focused on forming strategic alliances with major commercial printers and with other high-volume end users. In some cases, distributors became sole suppliers to certain printers. On the "imaging" side of the business, the growth of desktop computers, software graphics programs, and new output devices challenged paper distributors to more closely match paper requirements to their customers' imaging needs. To do this, distributors had to provide more technical assistance to customers.

Background and Development

In the 1980s and 1990s, printing and writing paper distributors had to deal with wide price swings brought about by the volatile market for paper products. For example, after several years of below average pricing in the early to mid-1990s, the average price for all pulp, paper, and paperboard products rose 34 percent in 1995, with some printing and writing grades rising as much as 75 percent. However, the next year prices dropped as much as 30 percent in some grades. This volatility was brought about by a complex cycle of mill capacity additions, changes in inventory, and paper usage. For example, as the cost of printing and writing paper soared in 1995, publishers and printers increased their inventories dramatically in anticipation of future price increases. When publishers and printers began using this inventory, they stopped buying new supplies and prices for printing and writing paper tumbled.

For distributors and wholesalers, this pattern made business planning difficult. When demand and prices were high, they could make incremental profits, but down cycles were difficult since they were carrying the double burden of excess inventory and low unit prices.

The growing popularity of electronic modes of communication such as the Internet, electronic mail, and voice mail certainly contributed to the slowdown in demand for printing and writing paper in the late 1990s. These means of communication were still in their infantile phases in the early and mid-1990s and did not impact the industry. In fact, wholesalers of printing and writing paper showed consistent sales growth in the early to mid-1990s, moving from $32.3 billion in 1990 to $37.9 billion in 1993 and $43.2 billion in 1996, sustaining average growth of 5.6 percent, well ahead of inflation.

Current Conditions

While the sluggish U.S. economy certainly played its part, many analysts attributed a share of the paper industry's woes to the accumulated effects of the shift toward electronic media. While these effects were predicted—often to dramatic extremes—in the 1980s and 1990s, only around 2000 did the combined shift to electronic media play out across fields and sectors—from electronic plane tickets to online advertising, for example—to rear up and create a major and lasting dent throughout the paper industry. However, optimists had something to cheer about in the mid-2000s, as advertisers, many of them licking wounds from the disappointments of Web-based banner advertising, slowly returned to the printing fold.

The early 2000s represented a period of recovery from the chronic aggregate paper production overcapacity in the United States and of adjustment to rising foreign competition and to continued weak demand. After capacity growth leveled off in the late 1990s, paper production capacity fell 1.9 percent in 2001 and an additional 1.3 percent in 2002 to reach a total of 100.5 million tons, down from 101.3 million in 1999, according to the forty-third annual capacity survey conducted in 2002 by American Forest & Paper Association (AF&PA). Projections for aggregate production capacity remained very slow, predicting increases of 1.1 percent in 2000, 0.7 percent in 2001, and 0.4 percent in 2002. The AF&PA estimated that capacity declined about 0.5 percent in 2003, with projections of modest increases of 0.8 percent in 2004 and 0.4 percent in 2005.

After experiencing annual capacity growth of 2.2 percent in the 1990s, printing and writing paper capacity dropped dramatically beginning in 1999. This trend continued into the 2000s, falling by 2.1 million tons between 2000 and 2002 to reach 27.3 million. While holding steady in 2003, capacity was expected to begin rising again in the mid-2000s, by 1.6 percent in 2004 and 0.5 percent in 2005 as prices rose and the industry shook off the effects of its late 1990s overcapacity.

The growth rate for uncoated groundwood capacity reached an astonishing 10.3 percent in 2002, with estimates of another 5.4 percent in 2003 and 3.4 percent in 2004 as total capacity inched back towards its 1996 peak of 2.3 million tons. Uncoated groundwood, meanwhile, achieved capacity growth of 2 percent in 2003 to reach 5.04 million tons. With an estimated decline of 2.4 percent in 2003, capacity for coated freesheet had fallen about 12.6 percent below its 2000 peak, due primarily to a string of mill closings, according to AF&PA. Uncoated freesheet capacity fell to its 10-year low of 13.6 million

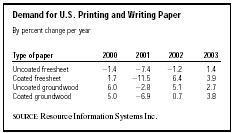

| Demand for U.S. Printing and Writing Paper | ||||

| By percent change per year | ||||

| Type of paper | 2000 | 2001 | 2002 | 2003 |

| SOURCE : Resource Information Systems Inc. | ||||

| Uncoated freesheet | −1.4 | −7.4 | −1.2 | 1.4 |

| Coated freesheet | 1.7 | −11.5 | 6.4 | 3.9 |

| Uncoated groundwood | 6.0 | −2.8 | 5.1 | 2.7 |

| Coated groundwood | 5.0 | −6.9 | 0.7 | 3.8 |

tons in 2002, though it was expected to rise and level off at 14 million in the mid-2000s.

Industry Leaders

As in other industries, diversification, acquisitions, and mergers dominated the business plans of the leading companies. In 1999 market leader Unisource was acquired by Georgia-Pacific Corporation, the world's second-largest forest products company, but Georgia-Pacific sold 60 percent of its share of Unisource's distribution segment in 2002 to Bain Capital.

Unisource Worldwide Inc. of Berwyn, Pennsylvania, was the largest independent marketer and distributor of printing and imaging paper in North America, though it thinned its workforce in the early 2000s from 13,400 in 1998 to 11,800 in 2003. Sales took a similar dip over that period, from $7.42 billion to $4.76 billion. The firm operated about 100 distribution centers throughout North America and claimed Xerox among its clients.

Georgia-Pacific Corporation, based in Atlanta, Georgia, was a paper-industry behemoth, with 61,000 employees spread across its diverse operations. Georgia-Pacific's distribution operations raked in revenues of $4.8 billion in 2002.

International Paper Co. of Purchase, New York, the other major player in this industry, relied on diversification to balance its business. The firm, which employed 72,500 workers in 2002, spent the early 2000s selling off many of its fringe operations to concentrate on its core paper and forest-product businesses. In 1998 International Paper purchased industry giant Mead's distribution business. Distribution revenues amounted to $6.52 billion in 2002, though that accounted for the distribution of all its diversified products, from printing and writing paper to industrial and consumer packaging.

Further Reading

Ambroz, Jillian. "Paper Prophecies." Folio, October 2003.

American Forest & Paper Association. "Paper Industry Survey Shows Capacity Falloff." Washington, DC: American Forest & Paper Association, 14 February 2003. Available from http://www.afandpa.org/Content/NavigationMenu/Pulp_and_Paper/Statistics_Publications1/43rd_Capacity_Survey_Press_Release1.htm .

Lontz, Denise. "Paper Prices on the Rise." In-Plant Printer, May/June 2003.

Miller, Caroline. "Waiting for the Rebound." Printing Impressions, June 2002.

Mishina, Mayu. "Paper-Market Outlook." American Printer, October 2002.

Rudder, Grege, Noel Deking, Will Mies, Bryan Smith, et al. "Paper Industry Recovery Pushed Back; Elements for Market Upswing in Place." Pulp & Paper, August 2003.

Comment about this article, ask questions, or add new information about this topic: