SIC 5049

PROFESSIONAL EQUIPMENT AND SUPPLIES, NOT ELSEWHERE CLASSIFIED

This industry classification covers establishments primarily engaged in the wholesale distribution of professional equipment and supplies that are not categorized elsewhere. It includes wholesale distributors of drafting instruments, laboratory equipment (other than medical and dental), and scientific instruments.

NAICS Code(s)

421490 (Other Professional Equipment and Supplies Wholesalers)

453210 (Office Supplies and Stationery Stores)

Wholesale distributors of medical and dental laboratory equipment are classified in SIC 5047: Medical, Dental, and Hospital Equipment and Supplies.

Industry Snapshot

The industry is divided into two general categories: wholesalers primarily engaged in the distribution of religious and school supplies, which represented 20 percent of the market, and wholesalers primarily engaged in the distribution of other professional equipment and supplies, which controlled about 75 percent of the market.

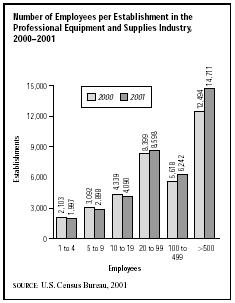

According to the U.S. Census Bureau, some 2,615 establishments composed this industry in the 2001, and employed an estimated 38,536 people in the United States. Their combined sales were estimated at approximately $15 million in 2003. The industry accounts for a small portion of the broader professional and commercial equipment category, which sold an estimated $85 million in products in 2003. In 2003, there were a total of approximately 5,291 establishments. Average sales per establishment were about $3.4 million. States with the largest number of establishments were California with 734, Florida with 407, Texas with 392, and New York with 372.

Background and Development

In the 1990s, one of the most promising product segments was laboratory equipment. Some industry analysts predicted that provisions of the Clean Air Act of 1990 would bring steady growth in U.S. sales of instruments and apparatus used to measure and control pollutants. Pollution abatement programs undertaken in other countries around the world were expected to create similar increases in other markets.

Sales of school equipment, however, were uncertain. One industry participant stated that the school market was "characterized by tight funding and restricted budgets." Typically, such conditions tend to stifle market growth.

This industry consisted of just over 7,000 establishments in 1997, according to Dun's Census of American Business. The largest group, comprising 2,076 units, reported sales between $250,000 and $499,000 in 1997. The next biggest category included slightly smaller operations with gross revenues between $100,000 and $249,000 in 1997: 1,143 wholesalers fell into this group. Interestingly, the next largest group was at the higher end of the scale, with gross revenues of $1 million to $5 million, with 1,104 establishments. More than 842 units had sales between $500,000 and $1 million; about 319 distributors had an annual sales volume between $50,000 and $99,000. Only 82 sold between $1,000 and $50,000 worth of stock in 1997, while 339 units reported more than $5 million in annual sales.

Almost half of the distributors in this category, for a total of 4,399 firms, employed fewer than five workers in 1997. 1,311 businesses had between five and nine employees; 517 staffed between 10 and 14 workers; and 214 employed from 15 to 19. A slightly larger number of establishments, 412, employed between 20 and 49 workers. There were 127 with between 50 and 99 employees, and just 82 with over 100.

Industry Leaders

One of the nation's leading distributors of professional equipment and supplies in the late 1990s was the VWR Scientific Products Corporation. Founded in 1852, VWR provided laboratory equipment, chemicals, and supplies to customers around the world. VWR also offered value-added services such as warehouse management systems, electronic order entry, electronic data interchange, and bar coding for more efficient inventory control. The company posted sales of $1.3 billion in 1998, nearly tripling its revenues within five years. VWR Scientific Products was acquired by Germany-based Merck Kga, in 1999. Merck Kga then changed the name to VWR International, and planned to sell the company to Clayton, Dubilier & Rice, a private equity investment firm based in New York. Both VWR and Dubilier & Rice were expecting final approvals in 2004. Walter W. Zywottek, CEO of VWR, would operate as an independent company, and also continue to distribute Merck's product line.

Other leaders were Carl Zeiss, Inc. of Thornwood, New York, Mitutoyo America Corp./MTI Corp. of Aurora, Illinois, and Crocker Fels Co. of Cincinnati, Ohio.

Further Reading

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

George, John. Philadelphia Business Journal, 16 February 2004. Available from http://bizjournals.com/nashville/stories/2004/02/16/daily2.html .

Sacramento Business Journal, 16 February 2004. Available from http://bizjournals.com/nashville/stories/2002/12/23/story3.html .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .

Comment about this article, ask questions, or add new information about this topic: