COST CONTROL

Cost control, also known as cost management or cost containment, is a broad set of cost accounting methods and management techniques with the common goal of improving business cost-efficiency by reducing costs, or at least restricting their rate of growth. Businesses use cost control methods to monitor, evaluate, and ultimately enhance the efficiency of specific areas, such as departments, divisions, or product lines, within their operations.

During the 1990s cost control initiatives received paramount attention from corporate America. Often taking the form of corporate restructuring, divestment of peripheral activities, mass layoffs, or outsourcing, cost control strategies were seen as necessary to preserve—or boost—corporate profits and to maintain—or gain—a competitive advantage. The objective was often to be the low-cost producer in a given industry, which would typically allow the company to take a greater profit per unit of sales than its competitors at a given price level.

Some cost control proponents believe that such strategic cost-cutting must be planned carefully, as not all cost reduction techniques yield the same benefits. In a notable late 1990s example, chief executive Albert J. Dunlap, nicknamed "Chainsaw Al" because of his penchant for deep cost cutting at the companies he headed, failed to restore the ailing small appliance maker Sunbeam Corporation to profitability despite his drastic cost reduction tactics. Dunlap laid off thousands of workers and sold off business units, but made little contribution to Sunbeam's competitive position or share price in his two years as CEO. Consequently, in 1998 Sunbeam's board fired Dunlap, having lost confidence in his "one-trick" approach to management.

COST CONTROL APPLICATIONS

A complex business requires frequent information about operations in order to plan for the future, to control present activities, and to evaluate the past performance of managers, employees, and related business segments. To be successful, management guides the activities of its people in the operations of the business according to pre-established goals and objectives. Management's guidance takes two forms of control: (1) the management and supervision of behavior, and (2) the evaluation of performance.

Behavioral management deals with the attitudes and actions of employees. While employee behavior ultimately impacts on success, behavioral management involves certain issues and assumptions not applicable to accounting's control function. On the other hand, performance evaluation measures outcomes of employee's actions by comparing the actual results of business outcomes to predetermined standards of success. In this way management identifies the strengths it needs to maximize, and the weaknesses it seeks to rectify. This process of evaluation and remedy is called cost control.

Cost control is a continuous process that begins with the proposed annual budget. The budget helps: (1) to organize and coordinate production, and the selling, distribution, service, and administrative functions; and (2) to take maximum advantage of available opportunities. As the fiscal year progresses, management compares actual results with those projected in the budget and incorporates into the new plan the lessons learned from its evaluation of current operations.

Control refers to management's effort to influence the actions of individuals who are responsible for performing tasks, incurring costs, and generating revenues. Management is a two-phased process: planning refers to the way that management plans and wants people to perform, while control refers to the procedures employed to determine whether actual performance complies with these plans. Through the budget process and accounting control, management establishes overall company objectives, defines the centers of responsibility, determines specific objectives for each responsibility center, and designs procedures and standards for reporting and evaluation.

A budget segments the business into its components or centers where the responsible party initiates and controls action. Responsibility centers represent applicable organizational units, functions, departments, and divisions. Generally a single individual heads the responsibility center exercising substantial, if not complete, control over the activities of people or processes within the center and controlling the results of their activity. Cost centers are accountable only for expenses, that is, they do not generate revenue. Examples include accounting departments, human resources departments, and similar areas of the business that provide internal services. Profit centers accept responsibility for both revenue and expenses. For example, a product line or an autonomous business unit might be considered profit centers. If the profit center has its own assets, it may also be considered an investment center, for which returns on investment can be determined. The use of responsibility centers allows management to design control reports to pinpoint accountability, thus aiding in profit planning.

A budget also sets standards to indicate the level of activity expected from each responsible person or decision unit, and the amount of resources that a responsible party should use in achieving that level of activity. A budget establishes the responsibility center, delegates the concomitant responsibilities, and determines the decision points within an organization.

The planning process provides for two types of control mechanisms:

- Feedforward: providing a basis for control at the point of action (the decision point); and

- Feedback: providing a basis for measuring the effectiveness of control after implementation.

Management's role is to feedforward a futuristic vision of where the company is going and how it is to get there, and to make clear decisions coordinating and directing employee activities. Management also oversees the development of procedures to collect, record, and evaluate feedback. Therefore, effective management controls results from leading people by force of personality and through persuasion; providing and maintaining proper training, planning, and resources; and improving quality and results through evaluation and feedback.

CONTROL REPORTS

Control reports are informational reports that tell management about an entity's activities. Management requests control reports only for internal use, and, therefore, directs the accounting department to develop tailor-made reporting formats. Accounting provides management with a format designed to detect variations that need investigating. In addition, management also refers to conventional reports such as the income statement and funds statement, and external reports on the general economy and the specific industry.

Control reports, then, need to provide an adequate amount of information so that management may determine the reasons for any cost variances from the original budget. A good control report highlights significant information by focusing management's attention on those items in which actual performance significantly differs from the standard.

Because key success factors shift in type and number, accounting revises control reports when necessary. Accounting also varies the control period covered by the control report to encompass a period in which management can take useful remedial action. In addition, accounting disseminates control reports in a timely fashion to give management adequate time to act before the issuance of the next report.

Managers perform effectively when they attain the goals and objectives set

by the budget. With respect to profits, managers succeed by the degree to

which revenues continually exceed expenses. In applying the following

simple formula, managers, especially those in operations, realize that

they exercise more control over expenses than they do over revenue.

While they cannot predict the timing and volume of actual sales, they can determine the utilization rate of most of their resources, that is, they can influence the cost side. Hence, the evaluation of management's performance and its operations is cost control.

STANDARDS

For cost control purposes, a budget provides standard costs. As management constructs budgets, it lays out a road map to guide its efforts. It states a number of assumptions about the relationships and interaction among the economy, market dynamics, the abilities of its sales force, and its capacity to provide the proper quantity and quality of products demanded.

An examination of the details of the budget calculations and assumptions indicates that management expects the sales force to spend only so much in pursuit of the sales forecast. The details also reveal that management expects operations to produce the required amount of units within a certain cost range. Management bases its expectations and projections on the best historical and current information, as well as its best business judgment.

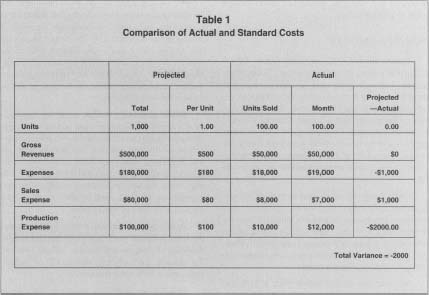

When calculating budget expenses, management's review of the historic and current data might strongly suggest that the production of 1,000 units of a certain luxury item will cost $100,000, or $100 per unit. In addition, management also determines that the sales force will expend about $80,000 to sell the 1,000 units. This is a sales expenditure of $80. With total expenditures of $180, management sets the selling price of $500 for this luxury item.

At the close of a month, management compares the actual results of that month to the standard costs to determine the degree and direction of any variance. The purpose for analyzing variances is to identify areas where costs need containment.

In the above illustration, accounting indicates to management that the sales force sold 100 units for a gross revenue of $50,000. Accounting data also shows that the sales force spent $7,000 that month, and that production incurred $12,000 in expenses. Table 1 summarizes the data that management reviews to identify variances. While revenue was on target, actual sales expense came in less than projected, with a per unit cost of $70. This is a favorable variance. Production expenses registered an unfavorable variance since actual expenditures exceeded the projected. The company produced units at $120 per item, $20 more than projected. This variance of 20 percent significantly differs from the standard costs of $100 and would call management to action if the variance exceeded acceptable levels (levels that were established before manufacturing began).

THE ROLE OF ACCOUNTING

Accounting plays a key role in all planning and control. It does this in four key areas: (1) data collection, (2) data analysis, (3) budget control and administration, and (4) consolidation and review.

DATA COLLECTION.

Accurate and timely information is the foundation of any accounting system, and thus detailed cost data are essential to any cost control endeavor. Management must understand—in great detail—how funds have been spent in the past and how they are being spent currently. As a result, companies invest large sums into sophisticated and error-resistant accounting systems in order to gain a nuanced understanding of their finances.

Comparison of Actual and Standard Costs

Table 1

Comparison of Actual and Standard Costs

| Projected | Actual | ||||

| Total | Per Unit | Units Sold | Month | Projected—Actual | |

| Units | 1,000 | 1.00 | 100.00 | 100.00 | 0.00 |

| Gross Revenues | $500,000 | $500 | $50,000 | $50,000 | $0 |

| Expenses | $180,000 | $180 | $18,000 | $19,000 | -$1,000 |

| Sales Expense | $80,000 | $80 | $8,000 | $7,000 | $1,000 |

| Production Expense | $100,000 | $100 | $10,000 | $12,000 | -$2000.00 |

| Total Variance = -2000 | |||||

DATA ANALYSIS.

Accounting's specialty is in the control function, yet its analysis is indispensable to the planning process. Accounting adjusts and interprets the data to allow for changes in company specific, industry specific, and economy-wide conditions.

BUDGET AND CONTROL ADMINISTRATION.

The accountants play a key role in designing and securing support for the procedural aspects of the planning process. In addition, they design and distribute forms for the collection and booking of detailed data on all aspects of the business.

CONSOLIDATION AND REVIEW.

Although operating managers have the main responsibility of planning, accounting compiles and coordinates the elements. Accountants subject proposed budgets to feasibility and profitability analyses to determine conformity to accepted standards and practices.

STRATEGIC COST CONTROL

Management relies on such accounting data and analysis to choose from several cost control alternatives, or management may direct accounting to prepare reports specifically for evaluating such options. As the Chainsaw Al episode indicated, all costs may not be viable targets for cost-cutting measures. For instance, in mass layoffs, the company may lose a significant share of its human capital by releasing veteran employees who are experts in their fields, not to mention by creating a decline in morale among those who remain. Thus management must identify which costs have strategic significance and which do not.

To determine the strategic impact of cost-cutting, management has to weigh the net effects of the proposed change on all areas of the business. For example, reducing variable costs related directly to manufacturing a product, such as materials and transportation costs, could be the key to greater incremental profits. However, management must also consider whether saving money on production is jeopardizing other strategic interests like quality or time to market. If a cheaper material or transportation system negatively impacts other strategic variables, the nominal cost savings may not benefit the company in the bigger picture, e.g., it may lose sales. In such scenarios, managers require the discipline not to place short-term savings over long-term interests.

One trend in cost control has been toward narrowing the focus of corporate responsibility centers, and thereby shifting some of the cost control function to day-to-day managers who have the most knowledge of and influence over how their areas spend money. This practice is intended to promote bottom-up cost control measures and encourage a widespread consensus over cost management strategies.

SUMMARY

Control of the business entity, then, is essentially a managerial and supervisory function. Control consists of those actions necessary to assure that the entity's resources and operations are focused on attaining established objectives, goals and plans. Control, exercised continuously, flags potential problems so that crises may be prevented. It also standardizes the quality and quantity of output, and provides managers with objective information about employee performance. Management compares actual performance to predetermined standards and takes action when necessary to correct variances from the standards.

SEE ALSO : Cost Accounting ; Costs ; Managerial Accounting

[ Roger J. AbiNader ]

FURTHER READING:

Anthony, Robert N., and Vijay Govindarajan. Management Control Systems. Chicago: Irwin, 1997.

Cooper, Robin, and Robert S. Kaplan. The Design of Cost Management Systems. Upper Saddle River, NJ: Prentice Hall, 1998.

Cooper, Robin, and Regine Slagmulder. "Micro-Profit Centers." Management Accounting, June 1998.

Hamilton, Martha M. "Who's Chainsawed Now? Dunlap Out as Sunbeam's Losses Mount." Washington Post, 16 June 1998. Rotch, William, et al. Cases in Management Accounting and Control Systems. 3rd ed. Englewood Cliffs, NJ: Prentice Hall, 1995.

Shank, John K., and Vijay Govindarajan. Strategic Cost Management. New York: Free Press, 1993.

I feel that the article is good but it would have been much better if current morden trends on costing were brouht into discussion in the same document. The impact of environment costs is such an important one. If you are not careful cost for the environment might come as a huge liability for exampl BP surprisingly caugt un aware!!!