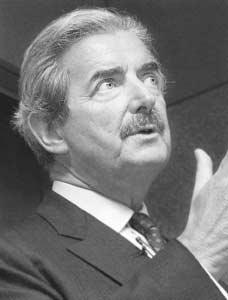

Matthew William Barrett

1944–

Chief executive officer, Barclays Bank

Nationality: Irish.

Born: September 20, 1944, in County Kerry, Ireland.

Education: Attended Harvard Business School.

Family: Married Irene Korsak, c. 1967 (divorced, 1995); married Anne-Marie Sten, 1997 (separated); children (first marriage): four.

Career: Bank of Montreal, 1962–1967, clerk; 1967, management trainee; 1967–1987, held various management positions; 1987–1989, chief operating officer; 1989, CEO; 1990–1998, chairman and CEO; Barclays Bank, 1999–, CEO.

Awards: Canadian Catalyst prize; Officer of the Order of Canada, 1994; Canada's Outstanding CEO of the Year, 1995; Communicator of the Year Award, British Association of Communicators in Business, 2001.

Address: Barclays Bank, 54 Lombard Street, London, EC3P 3AH, England; http://www.barclays.com.

■ Matthew William Barrett worked for the Bank of Montreal for more than 30 years, serving as CEO for the final 10 years. He retired in 1998 but was persuaded to join the troubled Barclays Bank in London as CEO in 1999. Within three years he improved the bank's performance to the point that Barclays shares outperformed the FTSE All-Share Index (which includes approximately eight hundred companies) by more than 39 percent. Industry analysts say that Barrett believed strongly in value-based management analysis and was able to get the most out of his staff thanks in part to his charm and wit.

A DEFINING CHANGE

Barrett was born and raised in County Kerry, Ireland, where his father struggled to make a living as a musician playing in local dance halls in the 1950s. Since the family was relatively poor, Barrett was encouraged by his father to enter the banking business; in 1962, at the age of 18, he became a clerk

at the London headquarters of the Bank of Montreal. Shortly afterward Barrett's father died of a heart attack, and Barrett was left as the sole supporter of his mother and sister. In an interview with Ruki Sayid for the Mirror , Barrett recalled, "It aged me overnight. I was the man of the family; it changed me from being a young man having a good time into a serious career banker" (October 18, 2003).

With his newfound focus, Barrett impressed his employers enough to win a promotion to management trainee at the Bank of Montreal's main office in Canada in 1967. As part of his training he attended Harvard Business School, eventually becoming an expert in retail banking. Barrett steadily rose through the ranks at the Bank of Montreal and was appointed president in 1987. In 1989 Barrett took over as chief executive officer.

Barrett paid close attention to the bank's diversification strategy, in terms of both line of business and geography. He oversaw nine years of record profits, and by the time he left the bank, more than half its earnings came from outside Canada. He was also credited with guiding the company into the realm of Internet banking. Overall, during Barrett's 10-year tenure as chief executive, the Bank of Montreal's market cap quadrupled.

MERGER FAILURE LEADS TO NEW JOB

Although he had been extremely successful in turning around the weak Bank of Montreal, Barrett's plans for continued expansion finally met a roadblock. He planned for the bank to merge with the Royal Bank of Canada; his goal was to form a North American behemoth that could compete head to head with any bank in the world and would reinvigorate Canada's role in global financial services. The Canadian government eventually ruled against the merger, and shortly afterward Barrett decided to retire, a decision many analysts credited to the failed merger.

Barrett's retirement did not last long. In October 1999, at the age of 55, he decided to accept an offer to become the CEO of Barclays Bank in England. Many saw Barrett's appointment as a new start for what banking insiders described as a stuffy 300-year-old British institution. Succeeding the previous "blue-blood" bosses, Barrett was a rare non-British leader of the bank.

EXPANDS BUSINESS AND REDUCES OVERHEAD

Barrett took over the reins of Barclays during a period of upheaval. The company had been Britain's largest bank in 1982, with assets that ranked fifth in the world. In 1988 it had 4,200 branches in 83 countries and $190 billion in assets. However, the British banking industry faced turbulent times in the late 1980s and 1990s, and many competitors from both within and without Britain were successful in luring customers away from Barclays. Many blamed the bank's demise on its "inbred culture," and according to John H. Christy, writing in Forbes , "Barrett was a blast of fresh air" (July 23, 2001).

One of the first areas Barrett focused on as CEO was that of the Internet. He used his Web savvy to establish a number of online banking services, including free Internet access for life for new Barclays customers and online share dealing. In 2000 he oversaw the launch of the company's business-to-business Web site.

Barrett proceeded to attack what many analysts saw as Barclays' swollen overhead. Setting a target of $1.4 billion in cut costs by 2003, Barrett ordered the shutting down of 171 Barclays branches, mostly in rural areas, and the laying off of numerous staff. At the same time, he focused on widening the bank's product range, as he had done at the Bank of Montreal. In August 2000 he negotiated Barclays' $7.6 billion purchase of Woolwich, Great Britain's leading mortgage banker. The move also added Woolwich's Internet operation, making Barclays the biggest Internet bank in Great Britain, with 1.4 million online customers.

Barrett further bolstered Barclays' business by forming a distribution alliance with Legal & General, one of Great Britain's leading suppliers of pension plans and life and health insurance, a move which gave Barclays customers a wider range of savings options. Banking analysts saw the Woolwich takeover and the relationship with Legal & General as over-coming two of Barclays' biggest challenges, namely, its weaknesses in Great Britain's mortgage business and in long-term savings.

THE PR WARS

While Barrett was making headway in quickly turning Barclays around, he committed a few missteps, especially in terms of public relations. His closure of many Barclays branches in rural areas resulted in a massive public outcry. Many complained that the closings left rural communities with no banking options. Customers demonstrated, and Barrett and Barclays apologized for the way the closings had been handled; the bank then forged a deal with post offices so customers could cash and pay in checks.

Barrett took additional criticism when it was learned that he received £1.3 million for just three months' work at a time when the bank was drastically cutting costs that directly affected customers. Barrett further raised the ire of many in the public when he commanded the closure of one hundred Woolwich branches by the end of 2000, a move which resulted in the losses of one thousand jobs.

In spite of bad publicity, many analysts saw Barrett's tenure at Barclays as successful. By the end of 2002 Barclays had experienced a steady rise in profits. The bank's 2003 pretax profit increased 15 percent over the previous year, surpassing analysts' estimates. The bank's private-client, corporate, and investment banking units all grew stronger in 2003, while credit quality improved.

VALUE-BASED MANAGEMENT

According to industry analysts, Barrett based much of his business strategy on value-based management. The approach focuses on creating value for all stakeholders in an organization, including customers, shareholders, employees, and vendors. Essentially, value is created as long as the return on a business or an investment is higher than the cost of capital invested in the business. Barrett's adherence to this approach was evident when he led Barclays out of the car-leasing business because the cost of capital was not keeping up with economic earnings. He then invested the realized capital from the sale elsewhere. Writing in Forbes , the analyst John H. Christy noted, "By tying many of Barclay's incentive schemes to economic—not reported—profit, Barrett sets higher hurdles for his managers to clear" (July 23, 2001).

Barrett, who preferred to be called "Matt" over the more formal "Matthew," was long seen as an employer who stressed communication with his employees and the importance of ethics in the banking industry. Within his first two years at Barclays, he spoke with more than 14,000 employees at events in the United Kingdom, Paris, New York, Madrid, and Lisbon. In accepting the Communicator of the Year Award, Barrett was quoted in the CiB enews as saying, "It's through communications that strong leaders have an ability to add value to colleagues. There needs to be a conscious value take-out by the recipient—knowledge should be shared, not hoarded" (November 2001). Barrett's belief in the sharing of knowledge was evident at the Bank of Montreal as well. In 1994 he created the bank's Institute of Learning in order to create an atmosphere of continued intellectual engagement, so that the bank and its employees could maintain a competitive advantage in the rapidly and constantly changing environment of the banking world.

Barrett was known for his efforts to ensure employee diversification, including through the hiring of women and minorities. He received the Canadian Catalyst prize for fostering the advancement of women in the banking industry. In his 10 years as chairman of the Bank of Montreal he constantly updated the bank's mode of operation, actively encouraging the employment of women and members of minority groups in senior positions and bringing in social scientists to advise senior executives. He continued to use this approach at Barclays.

Another aspect of Barrett's management approach was his willingness to lead banking into new areas of operation. He initiated computerization at the Bank of Montreal long before any of his competitors did so; he similarly strengthened the Internet-banking component at Barclays. A proponent of a leader's ability to think laterally, Barrett commented in the CiB enews that company leaders "need to catch the waves of change early, and be prepared to take ideas and input from a variety of different sources" (November 2001).

MOVING ON

In late 2003 Barclays announced that Barrett would be leaving his post as CEO of Barclays to become chairman of the board by the end of 2004. The appointment came under criticism by some industry insiders, who noted that Barrett did little to assuage the public's perception of him as a "fat cat." He committed another public-relations gaff when he stated that he would not use bank credit cards because the interest rates were too high. However, the communications management consultant George Pitcher wrote in Marketing Week that Barrett's comment was to be commended, calling it "a simple point. But not one you would expect MPs, with their tax-free allowances, their wives as secretaries and credit from any number of organizations in the form of freebies, readily to understand" (October 23, 2003).

See also entries on Bank of Montreal and Barclays PLC in International Directory of Company Histories .

sources for further information

"Canada Dry at Barclays," Observer , February 17, 2002, http://observer.guardian.co.uk/business/story/0,6903,651338,00.html .

Christy, John H., "Phoenix Rising," Forbes.com , July 23, 2001, http://www.forbes.com/global/2001/0723/032.html .

Jones, Neil, "Making the Light Bulbs Go On," CiB enews , November 2001, http://www.abraca.net/cib_enews/cib_archives/barrett_profile.html .

Pitcher, George, "Barclays Boss Should Be Credited for Card Claims," Marketing Week , October 23, 2003, p. 29.

Sayid, Ruki, "Secret Life of Barclays Plank Barrett," Mirror , October 18, 2003, http://www.mirror.co.uk/news/allnews .

—David Petechuk

Comment about this article, ask questions, or add new information about this topic: