Business Consulting

BUSINESS PLAN

KOSHU

2275 Timberview, Ste. 4

Tucson, AZ 49787

June 15, 1994

Koshu is a one-person management consulting firm serving companies of all sizes in all industries. The company plans to "productize" its methods and the results of its services as software packages and manuals. The following plan outlines the ways that additional funding will help Koshu continue to fulfill its aim of providing visionary and quality work at lower costs than its competitors .

- EXECUTIVE SUMMARY

- BUSINESS HISTORY

- COMPANY CONCEPT

- MARKETING PLAN

- MANAGEMENT PLAN

- FINANCIAL PLAN

- PRO FORMA

- BALANCE SHEET: BUSINESS & PERSONAL

- REASON FOR LOAN REQUEST

- FINANCING OPTIONS

EXECUTIVE SUMMARY

Koshu is a unique management consultancy incorporated in Tucson, Arizona. The company provides strategic planning and technology management services to companies of all sizes in all industries, and plans to "productize" the results of its work and its methodologies into mass marketable software packages and manuals.

Koshu employs one professional, Kevin Vaartinna, but maintains affiliations with other independent consultants and small firms around the world. These entities work together as a kind of virtual consulting firm, utilizing modern communications technologies such as fax machines and electronic mail to complete projects without ever meeting each other.

The business began as a sole proprietorship more than one year ago, and was profitable in its first year of existence. Management expects to double revenues and profits this year, and to expand the product line.

The market is limited only by the ability of the company to market itself to other businesses; capacity is constrained by the number of hours in the day and the number of employees. Koshu is in the unique position of its competitors often turning into its customers, and feels that this is a strategic advantage.

The company prides itself on its technical ability, its value-added services at unbeatable rates, its high standards of quality, its technologically superior equipment and its adaptability to changes in the market and in the methods of its practice.

The professionals who make up Koshu value this phrase more than any other: "I think."

BUSINESS HISTORY

Koshu was founded as a sole proprietorship in 1992 in the name of Kevin Vaartinna. Mr. Vaartinna had prior experience as a market specialist for the New York Port Authority in Tokyo, Japan, and as an Asia specialist with the firm of Braxton Associates, the strategic consulting division of Deloitte Touche Tohmatsu.

After an extended tour in Korea, Mr. Vaartinna left the firm and moved to New Mexico. Although Mr. Vaartinna had no plans to continue consulting, the managing partner of Braxton referred a local client requested Mr. Vaartinna's involvement on another team for four more months. Concurrently, a subsidiary of the client contracted Mr. Vaartinna for a brief engagement. Former associates called and inquired about availability. A national special interest group requested a competitive analysis. An acquaintance of a former colleague employed Mr. Vaartinna for two pieces of work for a major client in Arizona. By the end of 1993, at approximately 40% utilization, the unintentional business had grossed approximately the average annual salary of a "Big 6" analyst.

In the late 1993 Mr. Vaartinna worked with Terry Kackman, a consultant and entrepreneur in Tucson. Mr. Kackman offered to purchase 75% of Mr. Vaartinna's time for the next year if he would relocate to Arizona. The original client in New Mexico continued to requisition small engagements, and other companies were making inquiries. Mr. Vaartinna relocated to Tucson and incorporated in early January 1994 as an S corporation under the name of Koshu. At that time, the company issued 10,000 shares of its available one million shares to Mr. Vaartinna for $1,000 paid-in capital. Koshu rents workspace from and utilizes the personnel of the Kelsey group, a management consultancy owned and operated by Mr. Kackman.

(Less than two weeks after incorporating, the business made a successful loan presentation to Tri-Star Bank and obtained it's first financing. The funds from this loan purchased the current assets of the company, primarily a laptop computer and relevant business software. The loan is collateralized with Mr. Vaartinna's personal assets and Koshu's assets.)

COMPANY CONCEPT

Koshu provides management consulting services to companies in all industries. Clients range in size from $50,000 to $500 million in annual revenues. The company intends to "productize" the methodologies and results of its services as computer software and manuals that can be sold and distributed independently or in conjunction with the services offered.

Koshu's image is that of efficient, visionary, technologically advanced and quality work. The company will compete in a lower price range than its competitors, with professional rates of $75 to $125 per hour.

Koshu fills a market need that seeks temporary action-oriented white-collar staff with interdisciplinary backgrounds, highly creative thinking and superior analytical techniques. Koshu is unique in that it maintains a synergistic existence with its competitors, which are often its customers. The company is also unique in the low level of cost associated with its high level of service.

The actual services that Koshu provides include, but are not limited to:

- Financial performance assessment and improvement

- Competitive analysis

- Market and customer research and segmentation

- Best demonstrated practice reviews

- Joint venture analysis and due diligence

- Strategic planning at the corporate, business unit, and product line levels

- Macro and micro economic forecasting and scenario building

- Information search and retrieval

- Product conceptualization and development

- Training in planning and analysis techniques, and technology utilization

- Technology recommendations and computer network administration

- Ad hoc problem solving / solution building / catalysis and imple mentation

MARKETING PLAN

The General Market

The market for management consulting services is the entire business community. Any size firm in any industry can utilize good thinkers. Traditionally, companies in high-growth industries employ consultants to manage the growth and to compete most effectively. Companies in stagnant markets will often utilize consultants to improve performance or to discover new markets. The latter are more common than the former, although the fees commanded in servicing the high-growth industries are normally higher than those in low-growth to stagnant markets.

Client Geography

Currently, Koshu clients are primarily in the American southwest—California, Arizona, and New Mexico. The company intends to develop its Asia practice, due to the recent interest in the southwest in relationships with Pacific rim countries.

Client Industries

Koshu's current direct and indirect clients are involved in the industries of:

- Healthcare

- Health and Beauty Aids

- Management Consulting

- Publishing

Previous client industries include:

- Telecommunications

- Aerospace

- Petrochemicals

- Raw lumber and wood products

- Specialty Steel

A particular niche that the company intends to market to is that of the sole practitioner senior management consultant or small firm. Typically, a more senior consultant will leave his or her position at a large firm or will begin practicing directly after exiting an industry. These consultants often lack the analytical skills, current techniques, and basic technological "horsepower" that Koshu has at its disposal. Larger firms are a smaller target market; these consultancies tend to employ their own staff analysts. Occasionally, however, these firms sell above their capacity or are in need of particular skills, and will outsource work.

The Consulting Purchase Decision and Critical Service Characteristics

Normally, Koshu works with executive-level clients, and it is at this level that the purchasing decision is made. The company customarily works at the executive level with Presidents, and Vice Presidents of Strategy, Planning, Operations, Information Systems and Quality Control, and their respective staffs. The priority that these executives place on the purchase of consulting services usually depends on the exigency of the issues facing them at the moment, and their lack of adequate skills or staff to combat these issues. While bids and proposals are occasionally solicited, customers are more often obtained through personal relationships and referrals. A consultant's value is based on his experience, knowledge, availability, personal compatibility with the staff of the client, and price.

Seasonality

Companies are less likely to engage consultants in December or in April, due to the calendar and tax year closings. The summer months are traditionally slower for consultants; the primary seasons of engagement are spring, fall, and early winter. These observations apply to the securing of contracts; an appropriate strategy to combat seasonality is to secure long-term contracts during favorable engagement sales periods that will run through the less favorable ones. Absolute volume and growth, therefore, are constrained more by Koshu's own ability to network and promote itself by any external factors: the industry has been argued to be both cyclical and counter cyclical with the economy.

Compensation

The company currently receives monetary payment in exchange for the services it provides. The professional rates are between $75-$125 per hour, depending on the client. This price is 25-250% lower than most independent consultants charge for their services, primarily because the professionals of Koshu are between 25-30 years old, while most independent consultants are between 40-60 years old. The price is highly competitive with large firm rates: a consultant with commensurate experience would be billed out at 2-3 times Koshi's going rate. Because the professionals of Koshu were trained at these larger firms, customers receive the same level of quality and service at one third the price. Billing is performed on a monthly basis; payment is expected within ten working days of receipt of invoice.

Management intends in the future to provide its services for an equity stake in its clients, and and to eventually use the corporate identity to provide full-time executive management for developing companies with which it is involved.

Competition

Koshu's niche market of outsourced analytical work transforms its competitors into potential customers. There are tens of thousands of small and large firms in the national market. McKinsey & Company, the Boston Consulting Group, Bain & Company, Monitor, and Andersen Consulting are the prominent large national firms; each of the Big 6 accounting firms has one or more consulting practices as well. Research shows approximately one hundred small to medium-size potential customer/competitor firms in the local Tucson market.

The larger firms are successful due to several factors:

- Prestige image is aided by the employment of a young prestige-school MBA staff.

- Customer base provided by partners who are former industry executives with large contact bases.

- Efficient networking and communication is encouraged and provides a large and rapidly growing knowledge base.

- Publication of research findings and case studies enhance the company image.

Customers will choose Koshu over its competitors because they want the same quality work, but are price-sensitive. Competitors will engage Koshu because its quality matches their own, and they turn a profit even with the utilization of Koshu professionals.

Koshu does not expect to gain a large share in its current market of consulting services. As its methodology is productized, however, the packages will be unique enough to gain a large share of their particular niches.

Location Analysis

Arizona is the fourth fastest growing state by population. Consumer and commercial real estate sales are up, and Tucson's publicly traded companies yield a higher rate of return on investment than any other group of securities when judged by geographic area. Overall, the city is an ideal location.

The actual location of the offices is in premier real estate at the Tuscon Center. The company sub-leases space from and is provided office staff by The Kelsey group. The Kelsey group, have contracted almost 75% of Koshu's capacity for 1994, is the company's largest client, and the tenancy is therefore ideal for both parties. If Koshu takes on additional employees, it will be forced to find additional offices.

Marketing Approach

Because of the personal nature of the purchase decision in the engagement of consulting services, the company must utilize "high-touch" networking as its primary mode of customer acquisition. Channels most suitable for this purpose are:

-

High involvement in local professional activities and

- Chambers of Commerce

- World Trade Center

- Leads Clubs

- Entrepreneur's clubs and seminars

- Small Business Administration workshops

- Service organizations (Rotary, Lions)

- Asia-related clubs and activities

- Personal acquaintances

- Referrals by current and former clients

- Former Braxton colleagues

- Cornell/Kyoto alumnae

- Athletic and religious organizations

In addition, the company intends to promote its services through periodic mailers to potential clients that will be followed up with personal interviews. If these promotional attempts fail, they will be discontinued.

As the company develops hard products, it will utilize more standard channels of distribution for software packages and books.

MANAGEMENT PLAN

Management Team

The sole employee of Koshu is Kevin Vaartina, whose complete resume is available upon request. However, the company maintains affiliations with other independent consultants and small consulting firms in Boston, Bethesda, Minneapolis, Seattle, San Francisco, Tokuo, and Sydney. Most of these consultants have five to ten years experience and prestige-school backgrounds. Many are interconnected through commercial electronic mail services, whereby communication and work product flow in a "virtual office" environment.

Employees

Koshu currently has no plans to take on additional employees, and will instead outsource work to independent contractors as the need arises.

Operational Controls

Capacity is constrained by the number of qualified affiliates and by the billable hours in a day. Koshu bills on a ten hour day, although twelve to eighteen hour daily peaks are occasionally reached. The ability and willingness to put in almost double the normal working hours of a standard employee is an obvious operational advantage.

The optimization of utilization and efficiency are critical to success of Koshu. If Koshu can achieve 120% utilization, complete all the work and maintain its high standards of quality, the company will be deemed successful. Once the level is achieved, the company will be ready to raise its prices, add employees, or diversify.

FINANCIAL PLAN

Start Up Costs

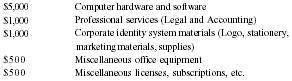

Start up costs are estimated to be approximately $8,000 dollars, as follows:

| $5,000 | Computer hardware and software |

| $1,000 | Professional services (Legal and Accounting) |

| $1,000 | Corporate identity system materials (Logo, stationery, marketing materials, supplies) |

| $500 | Miscellaneous office equipment |

| $500 | Miscellaneous licenses, subscriptions, etc. |

These expenses were paid in the following way:

| $1,000 | Kevin Vaartinna paid-in capital for 10,000 shares |

| $4,000 | Fees for services rendered (past due and current) |

| $3,000 | Loan from bank |

Less than two weeks after incorporating, the business made a successful loan presentation to Tri-Star Bank and obtained its first financing—a $10,000 six-month loan. $1,500 of this loan is payable in three months, and the balance is due at the end of another three. $7,000 of this loan was put into a certificate of deposit with the bank, and is therefore secured. The remaining $3,000 is collateralized with Mr. Vaartinna's personal assets and Koshu's assets. Excess funds were borrowed in order to establish a reasonable line of credit for the business. Funds were borrowed in order to obtain a lower rate of interest, and again, to establish a line of credit for the business.

Financial Projections Summary

Company financials are included in this report. In summary:

- The company earned $50,000 in revenues last year as a sole proprietorship, and netted 70% of this amount.

- On a worst case basis, the company will increase its revenues to $61,000 this year (a 22% increase), and will net approximately $40,000 (a 14% gain from the previous year).

- On a best case basis, the company will increase its revenues to $100,000 this year (a 100% increase), and will experience a corresponding rise in net profits.

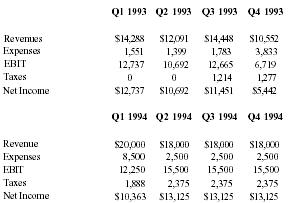

KOSHU PRO FORMA

|

Actual & Projected: Q1 1993 - Q4 1994

DBA Kevin Vaartinna |

||||

| Ql 1993 | Q2 1993 | Q3 1993 | Q4 1993 | |

| Revenues | $14,288 | $12,091 | $14,448 | $10,552 |

| Expenses | 1,551 | 1,399 | 1,783 | 3,833 |

| EBIT | 12,737 | 10,692 | 12,665 | 6,719 |

| Taxes | 0 | 0 | 1,214 | 1,277 |

| Net Income | $12,737 | $10,692 | $11,451 | $5,442 |

| Q1 1994 | Q2 1994 | Q3 1994 | Q4 1994 | |

| Revenue | $20,000 | $18,000 | $18,000 | $18,000 |

| Expenses | 8,500 | 2,500 | 2,500 | 2,500 |

| EBIT | 12,250 | 15,500 | 15,500 | 15,500 |

| Taxes | 1,888 | 2,375 | 2,375 | 2,375 |

| Net Income | $10,363 | $13,125 | $13,125 | $13,125 |

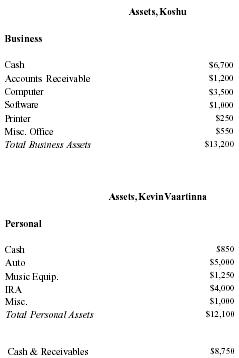

BALANCE SHEET: BUSINESS & PERSONAL

| Assets, Koshu | |

| Business | |

| Cash | $6,700 |

| Accounts Receivable | $1,200 |

| Computer | $3,500 |

| Software | $1,000 |

| Printer | $250 |

| Misc. Office | $550 |

| Total Business Assets | $13,200 |

| Assets, Kevin Vaartinna | |

| Personal | |

| Cash | $850 |

| Auto | $5,000 |

| Music Equip. | $1,250 |

| IRA | $4,000 |

| Misc. | $1,000 |

| Total Personal Assets | $12,100 |

| Cash & Receivables | $8,750 |

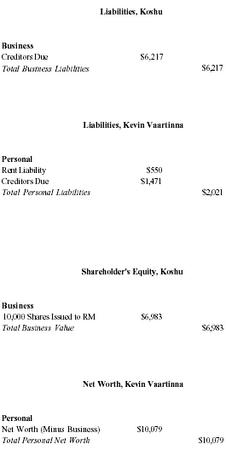

| Liabilities, Koshu | ||

| Business | ||

| Creditors Due | $6,217 | |

| Total Business Liabilities | $6,217 | |

| Liabilities, Kevin Vaartinna | ||

| Personal | ||

| Rent Liability | $550 | |

| Creditors Due | $1,471 | |

| Total Personal Liabilities | $2,021 | |

| Shareholder's Equity, Koshu | ||

| Business | ||

| 10,000 Shares Issued to RM | $6,983 | |

| Total Business Value | $6,983 | |

| Net Worth, Kevin Vaartinna | ||

| Personal | ||

| Net Worth (Minus Business) | $10,079 | |

| Total Personal Net Worth | $10,079 | |

REASON FOR LOAN REQUEST

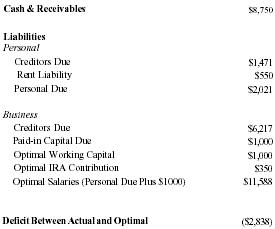

| Cash & Receivables | $8,750 |

| Liabilities | |

| Personal | |

| Creditors Due | $1,471 |

| Rent Liability | $550 |

| Personal Due | $2,021 |

| Business | |

| Creditors Due | $6,217 |

| Paid-in Capital Due | $1,000 |

| Optimal Working Capital | $1,000 |

| Optimal IRA Contribution | $350 |

| Optimal Salaries (Personal Due Plus $1000) | $11,588 |

| Deficit Between Actual and Optimal | ($2,838) |

FINANCING OPTIONS

-

Pay non-revolving credit with personal revolving credit and service

minimum required

- High interest

- Business obtains no credit

-

Obtain minimal loan for exact needs

- Lower Interest

- Business obtains some credit

-

Obtain excessive loan (deposit excess in CD)

- Lower interest

- Business obtains higher credit

- Better deal for bank (higher collected interest, same risk)

Comment about this article, ask questions, or add new information about this topic: