Car Wash

BUSINESS PLAN

J&J VENTURES, INC.,

T/A EAST CHINA AUTO WASH

100 Elizabeth Road

Trenton, NJ 19030

J&J Ventures, Inc. seeks financing to build and operate a state-of-the-art car wash in a small, but growing, community outlying several urban areas as well as a major metropolitan area. The car wash is expected to attract the increasing local population in addition to commuter traffic. The company plans to offer self serve car washing and an automatic wash facility, plus numerous additional products and services, such as vending machines and carpet shampooing.

- EXECUTIVE SUMMARY

- NATURE OF VENTURE

- MARKET DESCRIPTION AND ANALYSIS

- DESCRIPTION OF PRODUCTS AND SERVICES

- BUILDING AND EQUIPMENT

- MANAGEMENT TEAM AND OWNERSHIP

- BUSINESS STRATEGIES

- FINANCIAL DATA

- EXHIBITS

EXECUTIVE SUMMARY

Company

: J&J Ventures, Inc., T/A East China Auto Wash

100 Elizabeth Road

Trenton, NJ 19030

Tel: (610) 698-4000

Fax: (610) 698-4001

Contacts

: Scott Jones, Co-Owner

Larry Jones, Co-Owner

Business Type : Self Serve Car Wash

Company Summary : J&J Ventures, Inc. (J&J) was formed to own and operate a self service car wash consisting of five self service bays and one automatic bay. The business will be located on King Road in East China Township, Delaware County, NJ. Delaware County is the tenth-largest county in the state and East China Township is the fastest growing township in the county. J&J will develop a well equipped, attractive, low maintenance, customer friendly car wash facility. The car wash will service the local community in an effort to develop a loyal base of repeat customers as well as draw new customers from the surrounding communities and attract the area's growing local and commuter traffic.

Management

Scott Jones, Co-Owner

Scott Jones will be responsible for operational and financial management, sales, marketing and promotion. Mr. Jones has been a corporate lender for Citicorp serving as Vice President in the middle market lending area for the past 11 years. He brings extensive knowledge and experience in the field of banking, finance, sales and marketing. Mr. Jones graduated from New York University in 1983 with a B.S. in Business Administration—Marketing. In May, 1994, he received a Masters of Business Administration—Finance from Georgetown University.

Larry Jones, Co-Owner

Larry Jones will be responsible for mechanical and electrical operations and materials procurement. After receiving his B.S. in Mechanical Engineering from Boston University, Mr. Jones accepted a position as Project Manager for Blackwell and Meldrum, Inc., a premier national engineering and construction firm. Mr. Jones later formed Jones Works, Inc., a commercial/industrial electrical construction firm, which grew to $1.2 million in sales with a workforce of 17 employees. Mr. Jones later joined Stelton, Inc. as a Project Manager. Mr. Jones was project manager for the $20 million electrical construction project at the New Jersey Convention Center. More recently he has been assigned as project manager of the $15 million electrical construction project at the new Civic Arena. As a result, Mr. Jones brings extensive knowledge and experience in the areas of project/program management, electrical and mechanical engineering and construction, contract administration, materials procurement and labor management.

Market : The company's target market will consist primarily of local residential customers. Research indicates that 90% of self serve business comes from a three-mile radius. The population of East China Township is approximately 4,791 (estimated 1995) and has grown 92% since 1990, making it Delaware County's fastest growing township. The population demographics consist of a mix of newer single-family homes and townhouse developments, older residential areas, scattered mobile home parks and apartment dwellings.

J&J will also target local businesses and will attract customers from surrounding communities and commuter traffic. According to a 1993 New Jersey Department of Transportation traffic survey, the traffic count on King Road west toward Bella Rd. averaged 9,673 vehicles and 8,533 vehicles east toward Wainledge Rd.

Product and Services : The company will provide state-of-the-art, reliable, customer friendly products and services, including a seven-selection wash control station in each self service bay, seven vacuums, two fragrance machines and several accessory product and food/drink vending machines. For the customers' convenience, the automatic bay will provide a complete, detailed wash and wax.

Competition : J&J's competition within a ten-mile radius consists primarily of several local, established, self serve washes. The Simcoe Car Wash is located within the town of Simcoe on Wainledge Rd., south approximately 2.5 miles from the J&J location. The Downtown Tillion Car Wash is located in the town of Tillion on Wainledge Rd., north approximately 8 miles from the J&J location. Both competitors maintain only four-bay self service washes with no automatic tunnel. The Simcoe facility is a well-maintained corrugated steel structure, but has no front access and is on a small lot with only two vacuums. The Downtown Tillion wash is well maintained and has good front access, but has limited vending facilities and only three vacuums.

Uniqueness : Several factors will make the J&J car wash unique. The company will offer a modern, easily accessible, high quality car wash facility featuring a variety of income producing services, including vacuums, fragrance machines, carpet shampooers and vending machines. Management will actively promote the company's service through local advertisements, cross-couponing with local merchants, direct mail promotions and promotional giveaways (coffee mugs, key chains, golf balls, etc.).

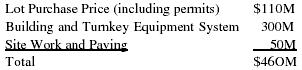

Project Cost : The total project cost is estimated to be $460M. A breakdown of these costs is as follows:

| Lot Purchase Price (including permits) | $110M |

| Building and Turnkey Equipment System | 300M |

| Site Work and Paving | 50M |

| Total | $46OM |

Funds Sought : J&J is seeking to finance $332M, or 70% of the $46OM proposed project cost, through a local financial institution. The company will seek to obtain either conventional mortgage/equipment financing or an SBA guaranteed mortgage loan at a fixed rate amortizing over 15 to 20 years, and a fixed rate equipment loan amortizing over five to seven years. The remaining balance of the required funds will be provided through a $60M seller note and from J&J's equity contribution of approximately $78M for project costs and $73M for start-up costs and working capital.

Use of Proceeds : The company intends to use the proceeds of the bank loans to finance building construction, equipment purchases and installation and site development costs.

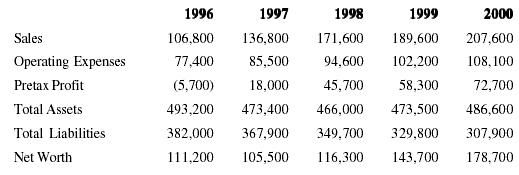

Summary of Financial Projections

| 1996 | 1997 | 1998 | 1999 | 2000 | |

| Sales | 106,800 | 136,800 | 171,600 | 189,600 | 207,600 |

| Operating Expenses | 77,400 | 85,500 | 94,600 | 102,200 | 108,100 |

| Pretax Profit | (5,700) | 18,000 | 45,700 | 58,300 | 72,700 |

| Total Assets | 493,200 | 473,400 | 466,000 | 473,500 | 486,600 |

| Total Liabilities | 382,000 | 367,900 | 349,700 | 329,800 | 307,900 |

| Net Worth | 111,200 | 105,500 | 116,300 | 143,700 | 178,700 |

NATURE OF VENTURE

Background

The self serve car wash industry is an established industry although it continues to grow within the Northeast at a rate of 5-8% annually. Engineering and design improvements have contributed to the industry's growth and have enhanced profit potential.

Products and Services

J&J will develop an attractive, low maintenance, fully equipped and customer friendly car wash designed to draw a wide customer base. The car wash will feature state-of-the-art equipment designed for quality, reliability and easy usage. Each self service bay will contain an eight-selection wash control system featuring wheel and tire shampoos, pre-soap wash, foam brush, spot-free rinse, wax and final rinse, with an LED money and time countdown display and a last minute horn-alert function. Face plate instructions and function descriptions will make the system customer friendly. Each short barrel trigger gun will provide a high pressure wash, enabling customers to get to hard-to-reach places easily and quickly. Conveniently located within each self serve bay will be a soft, but durable, foaming brush for quick, easy and thorough cleaning. Surrounding the wash bay area will be seven coin operated, high powered vacuums with conveniently located floor mat hangers. In addition, there will be a centrally located carpet shampoo machine, two fragrance machines and bill changers, along with a vending area that will feature accessory items such as drying towels, tire cleaner and food and drink items.

Location of Venture

East China Auto Wash will be located on King Road in the borough of Simcoe, East China Township, Delaware County, NJ. The site is approximately two miles west of the town of Simcoe (Wainledge Rd.) and five miles east of the town of Bedford (Bella Rd.). The City of Trenton is approximately 10 miles from the site.

The site is zoned for commercial development and has been approved by the East China Planning Commission for the development of a self serve car wash. The subject property is adjoined by seven additional land parcels that are zoned for commercial development. This includes a proposed convenience store and 40-unit storage facility scheduled to open in Spring, 1996. The remaining lots are expected to be developed within the next year and include a small retail shopping area.

According to East China Township authorities, the surrounding area is expected to continue to grow in conjunction with the construction of a 100-unit apartment complex within a quarter-mile of the site, as well as additional townhouse, single-family and semi-detached housing developments.

According to the New Jersey Department of Transportation, a 1995 traffic survey for King Road, Wainledge Rd. and Bella Rd. determined the average daily traffic counts to be as follows:

King Road

Eastbound = 9,673 vehicles

Westbound = 8,533 vehicles

Bella Rd. and King Road

Eastbound = 8,321 vehicles

Westbound = 6,500 vehicles

Wainledge Rd. and King Road

Northbound = 10,848 vehicles

Southbound = 8,735 vehicles

MARKET DESCRIPTION AND ANALYSIS

J&J will target the local residents and businesses of East China and Plymouth Townships in order to develop a loyal base of repeat customers as well as draw new customers from the surrounding communities. In addition, the company will seek to attract the area's growing commuter traffic.

Market Trends

J&J's target market will consist of local residential customers, local businesses and commuter traffic. Research indicates that up to 90% of self serve business comes from within a three-mile radius. Consequently, the company will focus on attracting and developing a loyal customer base from the surrounding community. The business will be situated on the main thoroughfare between Simcoe and Bedford and intersects both Wainledge Rd. to the east and Bella Rd. to the west. J&J expects to capture commuter traffic traveling to Camden, Passaic and Trenton.

Demographic and Economic Trends

Delaware County is an urban county of 343,130 persons (estimate 1992) situated in western New Jersey. The county seat, the City of Trenton, is near Philadelphia and is one of the leading industrial and trade complexes in the nation.

Delaware County is one of the leading agricultural counties within the state, with approximately 50 percent of its land area devoted to agricultural uses. Delaware is also an important industrial area, with emphasis in the production of textiles, metals and food products. The City of Trenton is the county's most populous municipality and its center of industry and commerce.

East China Township is located approximately 10 miles northeast of Trenton, and Plymouth Township is several miles closer. East China is Delaware County's fastest growing township, growing by 41.0% from 1990 to 1995. The township consists of 13.2 square miles of land with a population of 4,791 (1995 estimate) of which 59.1% of the population is between the ages of 18 and 59. Approximately 93.8% are married couples with a median household income of $39,550. Approximately 82.1% of housing units in the township are owner-occupied.

Plymouth Township consists of 8.6 square miles of land and borders East China Township to the south. The 1995 population is estimated at 1,370, of which 61.4% of the population is between the ages of 18 and 59. Approximately 87.4% are married couples with a median household income of $35,670. Approximately 68.6% of housing units within the township are owner-occupied.

A change in economic conditions can influence the area demographics and consumer spending habits. The region continues to expand modestly due to increased capital investment, productivity gains and low labor costs resulting in a relatively low inflation rate of 2.3%. This low inflation rate and interest rate environment has spurred the region's manufacturing, finance, insurance, real estate and service industries. The health of the local economy is important since many of the local East China and Plymouth Township residents commute to work in Trenton, Passaic and Camden.

Current Competitors and Competitive Products and Services

J&J's principal competition will come from two local, self serve washes within a ten-mile radius.

Simcoe Car Wash is located in the town of Simcoe, approximately two and one-half miles east on Wainledge Rd., and is well established in the area. However, the facility is outdated, maintaining only four self serve bays with no automatic tunnel. The wash area is small with no front access. In addition, there are only two vacuum stations and minimal vending facilities.

The Downtown Tillion Car Wash is located within the town of Tillion on Wainledge Rd., approximately eight miles southeast of the J&J location. The business is well established with good visibility from the highway and good access. However, the facility has not been modernized and maintains only four self serve bays with no automatic tunnel. There are only three vacuums and minimal vending facilities.

DESCRIPTION OF PRODUCTS AND SERVICES

Uniqueness of the Products and Services

The East China Auto Wash will be unlike any of its surrounding competitors due to several factors. The company will offer a modern, easily accessible, high quality car wash system featuring a variety of convenient, income producing services, such as vacuums, fragrance machines, carpet shampooer and vending machines. J&J will have a modern and professional look and will feature an automatic bay, which will provide a complete, detailed wash and wax.

Management will actively promote the company's services through local advertisements, cross couponing with local merchants, direct mail promotions and through promotional giveaways.

Advantages Over Competition

J&J's principal competitive advantages will stem from its ability to offer a modern, professional car wash utilizing a state-of-the-art, self serve car washing system, including a convenient automatic wash. Moreover, J&J will utilize cost effective and targeted advertising and promotion to become the preferred car wash in the area.

BUILDING AND EQUIPMENT

The building will consist of five self service bays, one automatic bay, an equipment room and office/storage area containing approximately 4,025 square feet. The building will be constructed of 8" concrete block, except exterior walls, which will be split face block and brick veneer atop a 5" concrete floor and concrete foundation. All interior walls in the bays and equipment room are to be covered with "Kalite white textured fiberglass paneling .090" in thickness. The roof will consist of 2 x 4 pre-engineered steel beams with a pre-finished ribbed metal roof.

Vacuums will be mounted on 30" x 4" concrete pads, each containing a 10' light pole and 4' fluorescent fixture.

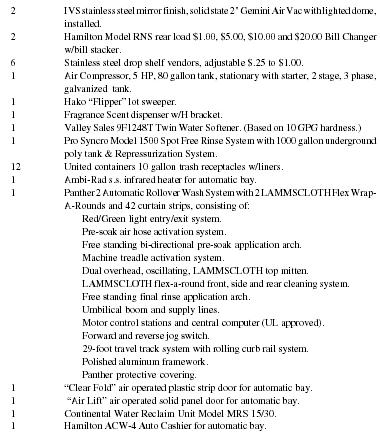

A breakdown of equipment needs is as follows:

| Quantity | Description |

| 1 | 5-bay High Pressure system, 5 HP, 3 phase motors and starters, dual belt drive, "CAT" 310 ceramic plunger pumps, 100 VA rated 24 volt transformers, solid state timers, trigger controls w/US paraplate unloader/regulator valves, glycerin filled pressure gauges, Master menu sign package plus 4 additional signs per bay, booms with rebuildable swivels. Deluxe System includes stainless steel equipment chassis, stainless steel tanks w/lids, hour meters and function indicator lights, momentary push button test features, hot/cold rinse selector switch, coin boxes w/8 position rotary switch, meter heater, countdown timers with last coin alert, Slugbuster II coin and token accepter and 1 D-5 vault per bay with medico locks, all stainless steel wand holders and one pair mat hangers per bay. |

| 1 | 5-bay Low Pressure, all stainless steel Foaming Brush and antifreeze Combination Super System, with stainless steel 180 degree booms. |

| 1 | 5-bay Low Pressure, all stainless steel Foaming White Wall Cleaning System. |

| 1 | 5-bay Low Pressure all stainless steel Presoak System. |

| 1 | 5-bay RayPak Floor Heat System, -10 degree, with 403,000 BTU gas fired heater, manifolds, manifold boxes, tubing, fittings & wire ties, plus engineering layout. Includes installation of tubing to Customers prepared slab. (Does not include copper plumbing, materials or labor.) |

| 1 | 5-bay RayPak 514,000 BTU Wash Water Heater with circulating pump and motor, pressure and temperature relief valves, thermostat and flow wash. |

| 4 | IVS stainless steel mirror finish, solid state 2" Vac with lighted domes, installed. |

| 2 | IVS stainless steel mirror finish, solid state 2" Gemini Air Vac with lighted dome, installed. |

| 2 | Hamilton Model RNS rear load $1.00, $5.00, $10.00 and $20.00 Bill Changer w/bill stacker. |

| 6 | Stainless steel drop shelf vendors, adjustable $.25 to $1.00. |

| 1 | Air Compressor, 5 HP, 80 gallon tank, stationary with starter, 2 stage, 3 phase, galvanized tank. |

| 1 | Hako "Flipper" lot sweeper. |

| 1 | Fragrance Scent dispenser w/H bracket. |

| 1 | Valley Sales 9F1248T Twin Water Softener. (Based on 10 GPG hardness.) |

| 1 | Pro Syncro Model 1500 Spot Free Rinse System with 1000 gallon underground poly tank & Repressurization System. |

| 12 | United containers 10 gallon trash receptacles w/liners. |

| 1 | Ambi-Rad s.s. infrared heater for automatic bay. |

| 1 | Panther 2 Automatic Rollover Wash System with 2 LAMMSCLOTH Flex Wrap-A-Rounds and 42 curtain strips, consisting of: |

|

|

| 1 | "Clear Fold" air operated plastic strip door for automatic bay. |

| 1 | "Air Lift" air operated solid panel door for automatic bay. |

| 1 | Continental Water Reclaim Unit Model MRS 15/30. |

| 1 | Hamilton ACW-4 Auto Cashier for automatic bay. |

MANAGEMENT TEAM AND OWNERSHIP

J&J's management team will consist of Scott Jones and Larry Jones, who together will be coowners maintaining a majority ownership interest in the company. Scott and Larry are highly focused, hard working, energetic and broadly experienced individuals whose combined talents provide a strong and qualified management team. Scott Jones provides the needed experience in the areas of business administration, finance, sales and marketing. His extensive business background and academic credentials compliment the strengths and talents of Larry Jones. Larry Jones provides strong technical and engineering expertise and will be responsible for mechanical and electrical operations and materials procurement. Resumes on the management team are included in the Exhibits section.

BUSINESS STRATEGIES

J&J will employ a differentiation strategy that will create value for the customer beyond that available from existing competition. The company will focus on providing a modern, professional, high quality car washing environment that features state-of-the-art, reliable, customer friendly products and services.

Marketing Plan Supporting Strategies

J&J will support its differentiation strategy by effective execution of its marketing plan, which contains several integral supporting strategies, including product/service, promotional/sales and pricing.

J&J's product/service strategy will be to provide state-of-the-art, reliable, high quality and customer friendly products and services. Each self service bay will feature an eight-selection wash control system with an LED money and time countdown display and a last minute horn-alert function. Face plate instructions and function descriptions will make the system customer friendly. Surrounding the wash bay area will be eight conveniently located, high powered vacuums and one carpet shampooer. In addition, there will be two centrally located fragrance machines and bill changers, along with a vending area that will feature accessory items, such as drying towels, tire cleaners and food/drink items. The vacuums, carpet shampooer and accessory items will be in constant demand and provide a strong source of additional income.

J&J will utilize multiple, constant, but limited advertising and promotional sources. These sources will be selected to maximize the return on allocated advertising/promotional dollars. The local community residents and businesses will be attracted through the Yellow Pages, local newspaper advertisements, flyers, coupons and periodic direct mail programs. J&J will highlight its modern and professional facilities and specific products and services, such as its automatic bay, carpet shampooer and car accessory items.

J&J will offer certain promotional giveaway items, such as car window shades, key chains, calendars and coffee mugs, which will all include the distinctive East China logo. In addition, special offers will include free vacuuming and carpet shampooing on certain weekdays.

The company will also join certain industry associations, such as the International Carwash Association (ICA) and the local chamber of commerce. These associations provide valuable business tips, allow the business owner to develop industry contacts and build community relations.

J&J will utilize a combination of competitor based and prestige pricing. This will ensure pricing is in line with local competitors for products and services where little value can be added, such as in the case of vending machine products. However, prestige pricing will be employed in areas such as the automatic bay and self serve bays, where J&J can offer higher quality, reliability and convenience. The company's strategy will be to position itself among the leading competitors and compete on quality, reliability, convenience, customer service and, lastly, on price. By developing a high quality image and reputation J&J can maintain premium pricing and still become the preferred car wash in the area.

The average customer is expected to spend between $1.75 and $5.00 per visit. The industry standard for a four-minute self serve wash is between $1.50 to $2.00 per cycle, and for an automatic wash, $5.00 to $5.50 per cycle. The industry average for vacuums is $0.75 to $1.00 per four-minute cycle. J&J will charge $1.75 per cycle for self serve, $5.00 per automatic wash and $1.00 per cycle for vacuum.

Financial Strategy

J&J will be owned and operated by Scott and Larry Jones, who will retain financial and managerial control. The principals will together own 100% of the company's capital stock.

J&J will seek to finance $322M of the total project cost of $460M through a local financial institution. The company will seek to obtain either conventional mortgage/equipment financing or an SBA guaranteed mortgage loan at a fixed rate amortizing over 15 to 20 years, and a fixed rate equipment loan amortizing over five to seven years. The remaining balance of the required funding will be provided through a $60M seller note to be repaid over 15 years, bearing interest at 8 1/4% fixed per annum. J&J's cash contribution will be approximately $151M, of which $78M will be for project costs and the remainder for start-up costs and working capital purposes.

Overall Growth Strategy

J&J expects to realize strong consistent sales and earnings growth in year one, which will increase significantly by year five. This growth will be principally attributable to the increase in local population as a result of continued expansion of residential housing developments and from the establishment of local businesses within the immediate area. A 100-unit residential apartment complex, as well as a new office building complex, is planned to be constructed along King Road. J&J expects the other surrounding land parcels will be sold for commercial development, including a storage facility and possibly a convenience store by Spring, 1996. The company expects to develop additional loyal customers through execution of its advertising/promotional programs. In addition, J&J expects to grow sales as a result of the area's growing commuter traffic. Sales will also be favorably impacted from the sale of high-margin accessory products and services. Through the five-year period, management will effectively control purchases and overhead to maximize operating efficiency and profitability. In addition, operating expenditures will be carefully managed to ensure incremental revenue growth, resulting in increased bottom-line profitability.

FINANCIAL DATA

Financial Statements

For the purposes of this projection it is assumed the company began operations on 12/31/95. A brief analysis of the 1995 financial statement is as follows:

1995 Income Statement

Sales

Since 12/31/95 is assumed to be the company's start date, no sales were recorded in 1995.

Operating Expenses

Includes primarily start-up expenditures consisting of EDU fees, utility connection/permit expenses, legal costs, bank loan costs and initial advertising/promotional expenses.

1995 Balance Sheet

Paid-In-Capital

There will be approximately $151M in equity investments as of the company's inception date.

Cash

This figure represents management's desired minimum cash balance available for working capital purposes.

Fixed Assets

This will include real estate and equipment. Real estate will be depreciated over 20 years and equipment over seven years, assuming straight line depreciation.

Long-Term Debt

This represents the long-term portion of an original $195M bank mortgage loan at 10% fixed amortizing over 20 years and a $127M equipment loan at 9% fixed amortizing over 7 years. Also included is the long-term portion of a $60M seller note at 8.25% fixed amortizing over 15 years.

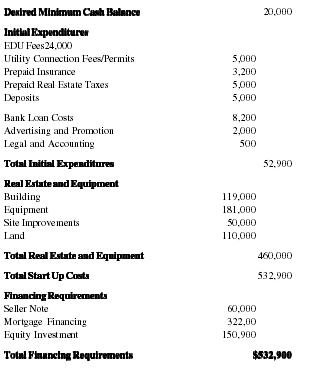

Estimated Start-Up Costs

| Desired Minimum Cash Balance | 20,000 | |

| Initial Expenditures | ||

| EDU Fees24,000 | ||

| Utility Connection Fees/Permits | 5,000 | |

| Prepaid Insurance | 3,200 | |

| Prepaid Real Estate Taxes | 5,000 | |

| Deposits | 5,000 | |

| Bank Loan Costs | 8,200 | |

| Advertising and Promotion | 2,000 | |

| Legal and Accounting | 500 | |

| Total Initial Expenditures | 52,900 | |

| Real Estate and Equipment | ||

| Building | 119,000 | |

| Equipment | 181,000 | |

| Site Improvements | 50,000 | |

| Land | 110,000 | |

| Total Real Estate and Equipment | 460,000 | |

| Total Start Up Costs | 532,900 | |

| Financing Requirements | ||

| Seller Note | 60,000 | |

| Mortgage Financing | 322,00 | |

| Equity Investment | 150,900 | |

| Total Financing Requirements | $532,900 | |

Annual Projections: Balance Sheet

| 12/31/95 | 12/31/96 | 12/31/97 | 12/31/98 | 12/31/99 | 12/31/00 | |

| ASSETS | ||||||

| Cash | 20,000 | 38,600 | 69,400 | 115,700 | 167,600 | 225,900 |

| Accounts Receivable | ||||||

| Inventory | ||||||

| Current Assets | 20,000 | 38,600 | 69,400 | 115,700 | 167,600 | 225,900 |

| Gross Fixed | 460,000 | 460,000 | 460,000 | 460,000 | 460,000 | 460,000 |

| Accumulated Depreciation | 0 | 39,800 | 79,600 | 119,400 | 159,200 | 199,000 |

| Net Fixed Assets | 460,000 | 420,200 | 380,400 | 340,600 | 300,800 | 261,000 |

| Prepaid | 8,200 | 9,600 | 11,200 | 12,200 | 13,200 | 14,200 |

| Other Current Assets/Deposits | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 |

| Total Assets | 493,200 | 473,400 | 466,000 | 473,500 | 486,600 | 506,100 |

| LIABILITIES | ||||||

| Accounts Payable | 0 | 3,100 | 3,700 | 4,500 | 5,200 | 5,600 |

| Current Long Term Debt - Bank | 16,900 | 18,500 | 20,300 | 22,200 | 24,300 | 26,700 |

| Curr. Port Long Term Debt - Seller | 2,100 | 2,300 | 2,500 | 2,700 | 2,900 | 3,200 |

| Current Liabilities | ||||||

| Long Term Debt - Bank | 305,100 | 288,200 | 269,700 | 249,400 | 227,200 | 202,900 |

| Long Term Debt - Seller | 57,900 | 55,800 | 53,500 | 51,000 | 48,300 | 45,400 |

| Total Liabilities | 382,000 | 367,900 | 349,700 | 329,800 | 307,900 | 283,800 |

| NET WORTH | ||||||

| Paid in Capital | 150,900 | 150,900 | 150,900 | 150,900 | 150,900 | 150,900 |

| Retained Earnings | (39,700) | (45,400) | (34,600) | (7,200) | 27,800 | 71,400 |

| Total Net Worth | 111,200 | 105,500 | 116,300 | 143,700 | 178,700 | 222,300 |

| Total Liabilities & Net Worth | 493,200 | 473,400 | 466,100 | 473,560 | 486,600 | 506,100 |

Annual Projections: Income Statement

| 12/31/95 | 12/31/96 | 12/31/97 | 12/31/98 | 12/31/99 | 12/31/00 | |

| SALES | ||||||

| 5 Self Service Bays | 0 | 72,000 | 96,000 | 108,000 | 120,000 | 132,000 |

| 1 Automatic Bay | 0 | 18,000 | 24,000 | 30,000 | 36,000 | 42,000 |

| 7 Vacuums | 0 | 16,800 | 25,200 | 33,600 | 33,600 | 33,600 |

| Total Annual Revenue | 0 | 106,800 | 136,800 | 171,600 | 189,600 | 206,700 |

| OPERATING EXPENSES | ||||||

| Chemical and Vending | 0 | 5,300 | 6,800 | 8,600 | 9,500 | 10,400 |

| Gas and Electric | 0 | 6,400 | 8,200 | 10,300 | 11,400 | 12,500 |

| EDU Fees | 24,000 | 0 | 0 | 0 | 0 | 0 |

| Water & Sewer | 0 | 3,200 | 4,100 | 5,200 | 5,700 | 6,300 |

| Utility Connections/Permits | 5,000 | 0 | 0 | 0 | 0 | 0 |

| Telephone | 0 | 250 | 250 | 300 | 350 | 400 |

| Trash Removal | 0 | 1,100 | 1,400 | 1,700 | 1,900 | 2,100 |

| Insurance | 0 | 3,200 | 4,100 | 5,200 | 5,700 | 6,200 |

| Real Estate Taxes | 0 | 5,000 | 5,500 | 6,000 | 6,500 | 7,000 |

| Accounting & Legal | 500 | 300 | 500 | 600 | 700 | 800 |

| Repairs & Maintenance | 0 | 2,100 | 2,700 | 3,400 | 5,700 | 6,200 |

| Labor | 0 | 8,000 | 9,400 | 10,700 | 12,100 | 13,500 |

| Depreciation | 0 | 39,800 | 39,800 | 39,800 | 39,800 | 39,800 |

| Bank Charges | 0 | 250 | 250 | 300 | 350 | 400 |

| Bank Loan Costs | 8,200 | 0 | 0 | 0 | 0 | 0 |

| Advertising and Promotion | 2,000 | 2,300 | 2,500 | 2,500 | 2,500 | 2,500 |

| Total Operating Expenses | 39,700 | 72,400 | 85,500 | 94,600 | 102,200 | 108,100 |

| Operating Profit/Loss | (39,700) | 29,400 | 51,300 | 77,000 | 87,400 | 99,500 |

| Interest Expense | 0 | 35,100 | 33,300 | 31,300 | 29,100 | 26,800 |

| Pre-Tax Loss/Income | (39,700) | (5,700) | 18,000 | 45,700 | 58,300 | 72,700 |

| Taxes | 0 | 0 | 7,200 | 18,300 | 23,300 | 29,100 |

| NET INCOME(LOSS) | (39,700) | (5,700) | 10,800 | 27,400 | 35,000 | 43,600 |

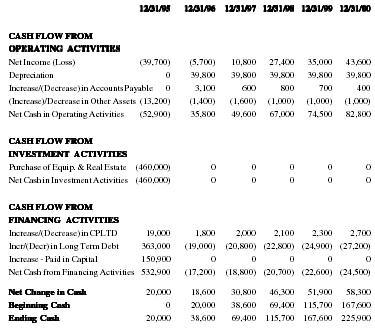

Annual Projections: Cash Flow Analysis

| 12/31/95 | 12/31/96 | 12/31/97 | 12/31/98 | 12/31/99 | 12/31/00 | |

| CASH FLOW FROM | ||||||

| OPERATING ACTIVITIES | ||||||

| Net Income (Loss) | (39,700) | (5,700) | 10,800 | 27,400 | 35,000 | 43,600 |

| Depreciation | 0 | 39,800 | 39,800 | 39,800 | 39,800 | 39,800 |

| Increase/(Decrease) in Accounts Payable | 0 | 3,100 | 600 | 800 | 700 | 400 |

| (Increase)/Decrease in Other Assets | (13,200) | (1,400) | (1,600) | (1,000) | (1,000) | (1,000) |

| Net Cash in Operating Activities | (52,900) | 35,800 | 49,600 | 67,000 | 74,500 | 82,800 |

| CASH FLOW FROM | ||||||

| INVESTMENT ACTIVITIES | ||||||

| Purchase of Equip. & Real Estate | (460,000) | 0 | 0 | 0 | 0 | 0 |

| Net Cash in Investment Activities | (460,000) | 0 | 0 | 0 | 0 | 0 |

| CASH FLOW FROM | ||||||

| FINANCING ACTIVITIES | ||||||

| Increase/(Decrease) in CPLTD | 19,000 | 1,800 | 2,000 | 2,100 | 2,300 | 2,700 |

| Incr/(Decr) in Long Term Debt | 363,000 | (19,000) | (20,800) | (22,800) | (24,900) | (27,200) |

| Increase - Paid in Capital | 150,900 | 0 | 0 | 0 | 0 | 0 |

| Net Cash from Financing Activities | 532,900 | (17,200) | (18,800) | (20,700) | (22,600) | (24,500) |

| Net Change in Cash | 20,000 | 18,600 | 30,800 | 46,300 | 51,900 | 58,300 |

| Beginning Cash | 0 | 20,000 | 38,600 | 69,400 | 115,700 | 167,600 |

| Ending Cash | 20,000 | 38,600 | 69,400 | 115,700 | 167,600 | 225,900 |

Five-Year Financial Projections and Assumptions

These Financial Projections are based on estimates and assumptions set forth therein, and have been delivered for the information and convenience of persons who wish to evaluate the feasibility of the company's strategy and goals. Each such person who has received them realizes that financial projections are inherently speculative. The Financial Projections are based upon the company's assumptions, reflecting conditions it expects to exist or the course of action it expects to take. As the company is in the start-up stage, these projections are based on estimates and not on the company's historical results. Because events and circumstances do not occur as anticipated, there will be differences between the Financial Projections and actual results, and those differences may be material. The Financial Projections are based upon detailed underlying assumptions. Interested parties should consult their own professional advisors regarding the validity and reasonableness of the assumptions contained herein.

Income Statement

Sales

Sales are projected to reach $106,800 in 1996 and increase by 28% in 1997, 25% in 1998, 10% in 1999 and 9% in 2000. Sales through the projection period will be fueled by the increase in local population as a result of continued expansion of residential housing developments and from the establishment of new local businesses within the immediate area. J&J will attract and develop these new customers through execution of its advertising/promotional programs.

J&J's principal sources of income will be generated through the self serve bays, automatic bay and from vacuum sales. Self serve bay revenue will comprise between 63% and 70% of total annual revenue throughout the projection period. Monthly sales per self serve bay will increase from $1200 to $2200 through the projection period. Automatic bay revenue is expected to be the fastest growing sales category, increasing from $1,200 per month in 1996 to $2,800 per month in 2000. Income generated through vacuum sales is projected to increase substantially from 1996 to 1998, remaining relatively stable thereafter. The aforementioned sales figures are based on industry averages and assume average daily traffic of 8000 to 10,000 vehicles.

Operating Expenses

Due to significant sales growth through the projection period, expenses are forecasted to increase yet decline as a percentage of sales while remaining within industry averages. Operating expenses are projected to decline from 72% in 1996 to 52% in 2000 as a result of effective management and control of expenses.

Taxes

The effective tax rate is projected to be 40%. For the purposes of this projection, available tax losses are not carried forward, but are available to be used in future periods to reduce taxable income.

Balance Sheet

Fixed Assets

Fixed assets include principally real estate and equipment to be depreciated over 20 years and 7 years respectively, assuming straight line depreciation.

Accounts Payable

The majority of suppliers are expected to extend 30-day terms and J&J will pay within those terms.

Long-Term Debt

Long-term debt will consist of the remaining principal balance of bank real estate and equipment loans. Also included will be the remaining principal balance of the seller note.

Net Worth

J&J expects to achieve profitability in 1997 and thereafter. The company plans to finance growth through cash flow from operations. No additional equity will be required after 1995. Net worth is expected to improve from 1996 and thereafter, comprising a greater percentage of total capitalization.

EXHIBITS

The resumes of the owners are included as Exhibits. Several other Exhibits are available upon request:

• Site Overview showing the layout of roads and land parcels in the immediate area.

• Map of housing developments in East China Township.

• Table listing the numbers of occupied and available single-family homes, semi-detached homes, townhouses and apartments in East China and Plymouth Townships. Also lists proposed housing developments.

Resume of Scott Jones

SCOTT JONES

478 Parker

Lemuel, NJ 19307

(610) 578-7405

OBJECTIVE

The opportunity to perform as an Executive Bank Manager with a long-range goal of becoming a Senior Manager.

PROFILE

Seasoned financial executive with over ten years of experience in financial management, financial analysis, consultative sales negotiation, cash management and business development. Recognized as an effective problem-solver and decision-maker; a self-directed and motivated individual with sound judgment; a strong sense of teamwork and a proven leader.

EDUCATION

Georgetown University

Master of Business Administration—May 1994

Finance—GPA 3.6/4.0

New York University

Bachelor of Science Degree—May 1983

Business Administration/Marketing

PROFESSIONAL EXPERIENCE

Citicorp, Camden, NJ—March 1987 to Present Vice President/Team Leader/Relationship Manager

Responsibilities include corporate lending, portfolio management, cash management sales and business development for regional middle market companies in two counties.

- Manage all facets of banking relations for 45 clients with aggregate commitments of $40 million and aggregate outstandings of $25 million.

- Developed $5 million in new loan outstandings and loan fees of $60,000 in 1994, including five new client relationships.

- Surpassed performance goals and objectives each year as evidenced by performance rating of quality to exceptional since 1987. Qualified for corporate bonus program each year since the program's inception in 1990.

- Expertise in arranging financing for six corporations involved in the federal government contracting industry.

- Developed corporate direct mail program including promotional brochure, database management and telemarketing program.

- Team leader for two relationship managers, four credit analysts and one administrative staff member. Responsible for performance evaluations, salary and bonus recommendations, in-house training and mentoring.

- Due diligence analysis as part of the Citicorp Due Diligence Team in connection with potential bank acquisition/merger candidates.

- Sponsor and mentor for a trainee in the Wholesale Bank Training Program.

Citicorp, Camden, NJ

Senior Credit Analyst—March 1985 to 1987

Wholesale Bank Training Program Graduate: Supported relationship managers through financial analysis, administrative support, sales presentations and preparation of loan documentation and approval reports in the following divisions: Regional Middle Market, Northeast Corporate, Cash Management and Real Estate Finance.

Eastman Kodak Chemicals Div., Hartford, CT—October 1983 to March 1985

Sales Representative

Responsibilities included locating and developing new accounts; development and servicing of existing accounts in three counties.

CONTINUING EDUCATION/PROFESSIONAL COURSE WORK

Richardson Group Consultative Negotiation Skills Course

Richardson Group Consultative Selling: Prospecting and Retention Frank Ward Relationship Management Course

Phoenix-Hecht Professional Sales Course

Graduate Financial Accounting and Corporate Finance (Wharton Business School)

Proficient in Quattro-Pro, Lotus, Wordperfect, FAMAS and FAST

AFFILIATIONS

New Jersey Business Network—Board Member

Adult Volleyball Management Committee

ACTIVITIES

Football referee, softball, golf, weight lifting.

REFERENCES

Available upon request.

Resume of Larry Jones

LARRY JONES

45612 Winchester

Snelling, New Jersey 19096

(610) 623-0912

EDUCATION

Boston University

Bachelor of Science Degree, May, 1982

Field of Concentration—Mechanical Engineering

BACKGROUND

Thirteen years of comprehensive general management and project/program leadership experience...Problem solving, results oriented leader who exercised full P & L and operational responsibility...Designed, estimated, negotiated and administered diverse contracts...Decisive manager with a record of completing projects on time, generating strong profit margins and earning customer/contractor respect.

EXPERIENCE

February 1991 to Present

Stelton, Inc., Passaic, New Jersey

Project Manager—Civic Arena

Management of $15 million electrical construction project. Project is GMP fee based stadium construction project. Responsibilities include contract administration, labor management, materials procurement, engineering, contractor interface and overall P & L responsibility.

Project Manager-New Jersey Convention Center

Management of $20 million electrical construction project including base electrical construction, fire and security systems as well as building automation system. Supervised foreman, scheduled subcontractors, initiated change orders and negotiated through settlement, established and incorporated extensive computerized cost and labor tracking system. Generated change orders in excess of 25% of base contract value. Assisted in development of project claim. Project was completed on time and generated revenues far in excess of projected goals.

March 1984 to February 1991

Jones Works, Inc., Snelling, New Jersey

President/General Manager

Established and built commercial/industrial electrical construction firm from inception to $1.2 million in sales with a workforce of up to 17 employees in five years. Exercised complete operational and P & L responsibility including design, estimating, budgeting and project management.

June 1982 to March 1984

Blackwell and Meldrum, Inc., Barton, New Jersey

Project Engineer—Corrosion Engineer

Designed and installed cathodic protection system for a nuclear plant cooling tower. Managed $1.2 million project, supervised 33 union personnel, generated 14% profit margin and completed job ahead of schedule.

Assisted in design of and subsequently installed a cathodic protection system at an aquarium at Seaworld. Supervised construction, administered contract, materials procurement and subsequent testing.

Conducted corrosion studies on gas and oil pipelines as well as fossil fuel storage tank facilities throughout the United States.

REFERENCES

Will be furnished upon request.

Thank you.