Electronic Document Security Company

BUSINESS PLAN GOLDTRUSTMARK.COM

445 Lockheed Avenue

Overland Park, Kansas 66213

GoldTrustMark.com provides Internet-enabled electronic document security. By providing an integrated bundle of technological tools, GoldTrustMark.com aims to position itself as the market leader in providing electronic document watermarking security solutions to the financial services industry and other knowledge-intensive industries.

- COMPANY SNAPSHOT

- THE OPPORTUNITY

- THE SOLUTION

- MARKET ANALYSIS

- COMPETITIVE ANALYSIS

- MARKETING STRATEGY

- MANAGEMENT TEAM

- FINANCIAL OVERVIEW

- APPENDIX A: MARKET RESEARCH FINDINGS

- APPENDIX B: FINANCIAL PROJECTIONS

COMPANY SNAPSHOT

Management:

Bill Piller,

Founder

Edward Reins, CTO

Jonathan Kosow, Director, Sales/Marketing

Maxine Stein, Esq, Director, Sales

Board of Advisors:

Frank Letterman, Co-Chairman—Letterman Capital

Jimmy Douglas, CIO—Manhattan Solutions, Inc.

Robert Timperton, Director, Kingston Mist Fund—Rising Sun Fruits

Henry Gonzalez, President—Gonzalez Enterprises

Mark Rubin, Managing Director—Whitehall & Rubin Co.

Edward Gargant, President—Gargant Technologies, Inc.

Industry: Electronic Document Security

Web Design: Luminary Studios

Database Management: InforPen

Nonprofit Partner: Habitat for Humanity

PR Agency: Bowdent Communications

Bank: Imperial Bank

Law Firms: Davis, Smith & Flounder; White & Trent

Use of Funds: Product development, technology development, marketing/sales, and distribution

Current Investors: ($150,000)

Business Description

GoldTrustMark.com provides Internet-enabled electronic document security. The company's mission is to enable any document or contract intensive industries to take full advantage of the opportunities presented by the Electronic Signatures Act and Global and National Commerce Act, and Revised Article 9 of the Uniform Commercial Code. The GoldTrustMark.com solution contains processes for document watermarking and security, and aims to move these industries from the traditional paper-based system into the realm of electronic content management and security. GoldTrustMark.com's solution is a proprietary watermarking technology that, unlike any technologies on the market today, ensures the integrity of text and image documents in both digital and analog formats.

The company will deliver its solution using a software-based product, meaning that clients will not have to make significant investments in information technology hardware or infrastructure in order to take advantage of it. Instead, GoldTrustMark.com functionality will be accessible via a standard software package, accessible by any permissioned user. State-of-the-art security and encryption technology will guarantee the safety of all information transferred across the network, and advanced watermarking functionality will secure the documents prior to transmission and upon receipt.

Finally, the solution's wireless accessibility will ensure that users can watermark their documents from their laptop or personal digital assistant (PDA). By providing this integrated bundle of technological tools, GoldTrustMark.com aims to position itself as the market leader in providing electronic document watermarking security solutions to the financial services and other knowledge-intensive industries.

Market Needs

Businesses currently have several document security needs, which are not being met:

- Improved document security

- Technology that doesn't allow for the manipulation of text

- Improved document integrity verification

- Document authenticity

Service Features

GoldTrustMark.com will directly address the needs of clients by delivering a comprehensive, software-based, document watermarking and security solution for the financial services profession. Service features will include:

- Document watermarking functionality

- Comprehensive document security package

- Secure online transactions

- Wireless access

Security Features

The company has developed a proprietary watermarking technology that, unlike most digital watermarking programs, protects both text and images before, during, and after their electronic transmission. Furthermore this technology is unique in that it enables a document to be watermarked in both digital and analog formats.

Market Opportunity

On October 1, 2000, the United States took a substantial step toward bringing the business world up to speed with the rapidly evolving landscape of e-commerce when the "Electronic Signatures in Global and National Commerce Act" (E-Sign) came into effect. This legislation is designed to bridge the gap between business transactions and online technology. Its fundamental purpose is to remove the existing legal impediments to the use of electronic contracts in order to facilitate the growth of e-commerce. The goal of E-Sign is to permit contracting parties to take advantage of the efficiencies that only the digital world can offer. Instantaneous exchange of documents between contracting parties eliminates the time loss to traditional carriers such as mail or the quality degradation that results from repeated faxing.

Such increased efficiencies are also the goal of Revised Article 9 of the Uniform Commercial Code—a regulation that requires all transactions related to the creation of a security interest in "goods, documents, instruments, general intangibles, chattel paper or accounts" as well as the sale of the latter two items, to be registered with the Secretary of State in the state(s) where these transactions take place. Given the wide scope of transactions covered (the definition above covers security sales of nearly every type), to date, this has been a paper-and time-intensive process. But with the passing of a Revised Article 9 (effective July 1, 2001), all of these filings will be handled electronically—a move that will result in increased efficiencies, as well as an anticipated elimination of "dual filing" which still exists in approximately 20 percent of states.

As required by law for E-Sign and Revised Article 9 to work, there must be protocols in place to ensure that issues such as authenticity, integrity, and security are adequately addressed. It is critical when facilitating an electronic transaction to maintain the integrity of the data being transmitted. The document being sent must be the same as the one received, with no unauthorized or accidental alterations during or after delivery. The need to establish authenticity and maintain data integrity naturally leads to the enforceability of an electronic transaction. If neither authenticity nor data integrity can be preserved during the course of a transaction, then the underlying deal may be subject to repudiation.

One of the pitfalls of E-Sign is the lack of guidance in prescribing the type of technology that must be used for an electronic record to meet the functional equivalence standard. E-Sign has left it to the contracting parties to determine for themselves the best method to ensure authentication and data integrity.

GoldTrustMark.com has developed a proprietary document watermarking system that safeguards the integrity of both electronic and hard-copy documents. The company's watermarking method is unique in that it functions in—and is automatically transferred between—digital and analog versions of the same document. This unique technological facet positions GoldTrustMark.com to be able to take advantage of the increased demand for electronic document security. It is anticipated that the passing of this Act will cause contract-intensive industries to rely increasingly on electronic documents, and the resultant increased need for security and authentication technologies by these firms signifies a considerable market opportunity for the company's watermarking technology.

COMPETITIVE ADVANTAGE

While there are providers of digital document security solutions, GoldTrustMark.com's proprietary technology is the only one that functions in both digital and analog environments. GoldTrustMark.com technology will reduce costs for clients, for it will not require them to invest in IT hardware. Furthermore, the company's value-added wireless interface—a feature that is not offered by any competitors—will allow client firms to watermark their records regardless of their location. These facts will enable the company to deliver a highly flexible solution that is specifically tailored to the document security needs of the financial services profession, and which allows firms to take advantage of the Electronic Signatures in Global and National Commerce Act. As a result, the company will enjoy a number of sustainable competitive advantages: proprietary technology, incumbent advantages, and learning curve advantages.

Market Entry

In entering the market and positioning itself in front of potential clients, GoldTrustMark.com will utilize a dual-track approach. First off, the company will forge a series of strategic alliances with world-class products and service providers, whose offerings complement its own: manufacturers and distributors of computer hardware, such as scanners and PCs, as well as with document storage providers. These alliances will not only provide GoldTrustMark.com with strong client referral channels, but will also provide it with increased visibility and credibility. In addition, the company will employ a more traditional marketing approach by engaging in selective target marketing and direct advertising to target financial services firms.

As an initial step in its marketing efforts, GoldTrustMark.com will launch an operational website, focused on the needs of financial services professionals in its first tier target markets. This version of the site will be accessible only to a select number of users, most notably some of the local attorneys who have signed letters of intent to subscribe to the company's service. The site's functionality will be limited, but will include links to alliance partners and a working demo of GoldTrustMark.com functionality.

Financial Projections

GoldTrustMark.com will derive its revenues from two primary revenue streams:

- Software licensing fees

- Partnership fees

THE OPPORTUNITY

As information technology has taken an increasingly pivotal role in organizations and enterprises from all industries and economic sectors, the exchange of data and conclusion of agreements in the electronic medium has taken on crucial importance as a means of increasing operational efficiency and effectiveness. Organizations in both the private and public sectors recognize that switching from paper-based to electronically based transactional and archival systems will result in both speedier transactions, as well as substantial cost savings in the areas of transactional processing, approval, communications, and archiving. Federal and state governments have also recognized the important role of electronically enabling transactions—a situation, which has recently resulted in two key pieces of legislation and regulation in this area.

Electronic Signatures in Global and National Commerce Act

The Electronic Signatures in Global and National Commerce Act, known as E-Sign, was signed by President Clinton last summer and went into effect on October 1, 2000. In short, it gives electronic signatures the same standing as their paper and pen counterparts. While many have viewed the effects of this piece of legislation to be solely upon electronic signatures, they are indeed much wider. More broadly, E-Sign directly addresses the legitimacy and legality of all electronic records and notices, establishing them as satisfying the same requirements as their hard-copy counterparts. Furthermore, it makes the use of electronic records in place of hard-copy records acceptable in a broad range of instances where record retention is required. Thus, overall, the purpose of the Act is to establish that electronic records and signatures can replace paper in most transactions.

However, one thing the Act does not do is specify how these records and signatures will be secured and verified. In fact, the Act does not even outline what an electronic signature specifically is, other than to describe it as an "electronic sound, symbol, or process, attached to or logically associated with a contract or other record and executed or adopted by a person with the intent to sign the record."

In this regard, E-Sign may in fact at first appear more confusing than it is helpful. While many have touted it as a piece of legislation that is designed to revolutionize the manner in which transactions are conducted, its direct effects are nowhere near as far reaching. Instead of mandating a change in the way that business is transacted, the Act merely gives rise to the possibility of a new way of conducting business by recognizing the legitimacy of the electronic medium. It leaves the decision as to what shape these new types of legally valid electronic transactions will take up to the market.

Uniform Commercial Code, Revised Article 9

Article 9 of the Uniform Commercial Code requires that all transactions related to the creation of a security interest in "goods, documents, instruments, general intangibles, chattel paper, or accounts" as well as the sale of the latter two items, must be registered with the Secretary of State in the state(s) where these transactions take place. Given the wide scope of transactions covered (the definition above covers security sales of nearly every type), to date, this has been a paper-and time-intensive process. But with the passing of Revised Article 9 (effective July 1, 2001), all of these filings will be handled electronically—a move that will result in increased efficiencies, as well as an anticipated elimination of "dual filing," which still exists in approximately 20 percent of states. Revised Article 9, therefore, essentially applies the principles set forth in E-Sign and applies them specifically to the realm of securities sales and trades. Naturally, it sets forth concrete guidelines for the length of time for which these electronic records must be maintained, when they must be filed, etc. However, much like E-Sign, it is technologically neutral, meaning that it does not prescribe any particular technologies for use in these new electronic transactions.

Putting These New Regulations into Practice

Whatever shape they do take, in order to be truly viable for business purposes, electronic records and signatures will have to satisfy the same two key criteria as their analog counterparts:

Authentication

It must be known that the record or signature was indeed generated by the person(s) who claim to have generated it. In short, it must be established that it is not a forgery. Off-line, this is most often done by signing documents in person, but the more impersonal nature of electronic communication renders this impossible in the vast majority of cases.

Integrity

Once generated or signed by the author(s), it must be known that the record or signature is not altered in transit or during storage. In the analog realm, this fact is most often ensured by signing multiple copies of an identical document, for each of the transacting parties to retain in their records. Once again, however, this is not easily replicated in the digital realm.

In order to reap the full benefits of these new government regulations, document integrity and authentication must not only be established at the time of the electronic transaction (i.e., when the "electronic signing" takes place), but must be maintained for the life of the electronic record (for archival purposes and future reference). Furthermore, in the case of some government regulations, uniqueness of a given electronic file will need to be proven. In other words, in cases where possession of an electronic document signifies ownership or control of the particular agreement it contains, the uniqueness of the original version of an electronic file will need to be proven, as opposed to any copies that may have been made of it.

The Market Response

The key nature of these criteria for the success of electronic records and signatures as a transactional medium signals a clear opportunity for providers of electronic signatures and certificates, as well as companies that provide digital security (to ensure integrity). This situation has the potential to open a Pandora's box of incompatible, ineffective, or outright insecure document security technology development and several years of struggle before second-generation systems emerge, which will provide ease of use with effective multi-tier security mechanisms.

Currently, companies like Wappa Technologies, Bet-Net, NetLine Certification, PenLore, NNQ, and others are offering technologies ranging from RSA encryption to digital signatures and digital certificates.

Each of the above technologies relies on some form of encryption, and as such exhibits the associated vulnerability to hacking. Encryption-based security mechanisms in general are designed to provide security during document transmission, but not before and after. Digital signatures do provide a document authentication capability before and after receipt but have a number of shortcomings aside from hackability. One is that currently, they are designed to work on text only. Graphics, pictures, or images are unprotected. Another is the technique's inherent design for use in the digital domain only, limiting the naturally occurring nondigital transmission of documents by hand, mail, Xerox™ or fax.

Thus, while these technologies will enable businesses to take advantage of the electronic exchange of records and signatures, they will not ensure their integrity if they are transferred to hard copy—a conversion that will doubtless be necessary in any number of industries and situations.

Identifying Market Needs

President Clinton's signing of the Digital Signature Act opened a new category of document management possibilities for broad range of companies in information industries. The law recognizes all electronic documents as legal and binding, rendering the distinction between hard-copy documents and their digital versions obsolete in legal terms. Instead of relying on hard-copy document management, businesses are now able to store their archives in electronic form. However, there are currently no document security companies which specifically address these needs in this new electronically enabled context. As a result, businesses currently have numerous document security needs which are not being met:

- Improved document security

- Improved document integrity verification

- Document authentication

THE SOLUTION

GoldTrustMark.com Security

GoldTrustMark.com recognizes that high levels of security are crucial for companies who produce, share, transmit, and store extremely confidential documents. These documents and information are one of the foundations of any business's competitive advantage. Consequently, the company is taking great steps to ensure that its clients have access to the most rigorous, state-of-the-art security features. User confidence is of the paramount concern to GoldTrustMark.com, and that's why the company has developed one of the most sophisticated and advanced maximum security systems available online.

Watermarking Functionality

GoldTrustMark.com is developing a one-of-a-kind, proprietary watermarking technology which will securely watermark either hard copy and/or electronic documents, and render those documents tamperproof. This technology will allow GoldTrustMark.com users to add an extra layer of protection to their business-critical documents, and enable them to keep track of any time their documents have been changed.

Secure GoldTrustMark.com IDs

All users will be required to register a password and user identification number with GoldTrustMark.com. Users will individually create and control these access numbers, allowing them to change their log-in details to ensure maximum sustained security. Subscribing firms will, of course, have the ability to cut off the accessibility of terminated employees. Finally, as an added security feature, GoldTrustMark.com will maintain a user log for client firms to review.

Wireless Access

GoldTrustMark.com will provide its subscribers with wireless access to all of their archived documents. By doing so, users will be able to access any of their documents using a wireless modem or personal digital assistant (PDA).

GoldTrustMark.com Technology Compatibility

In designing its technology, GoldTrustMark.com has been careful to ensure that it affords its clients maximum flexibility in applying its watermarking and security solution. As a result, GoldTrustMark.com's watermarking technology is equally applicable to both analog (hard copy) and digital documents and, within the digital realm, with all leading programming languages and applications. The company's intent is to ensure that its solution evolves to support technological advances, ensuring that its clients have continued access to the most flexible and effective watermarking and security solution.

For example, given the increasing profile of Extensible Markup Language (XML) as a web formatting specification, GoldTrustMark.com has ensured that its solution is fully XML compatible and complies with all XML specifications. Moving forward, the company will ensure such compatibility and compliance for all major technology standards.

In short, GoldTrustMark.com's technology will render documents completely tamperproof— not only at the time of their creation, but throughout their life span. Therefore, the company's technology will be critical both in transactional and archival environments. This fact, alongside the solution's flexibility and technological compatibility, will ensure that it is applicable to a wide range of document and transaction types:

Application Example 1: Financial Services Industry

Through the application of GoldTrustMark.com's technology, financial services firms will be able to realize increased efficiencies through converting their existing paper records into electronic format. Given the relative flexibility of E-Sign, financial services firms will be able to scan their existing hard-copy records into the digital realm and watermark them with GoldTrustMark.com's technology, thereby authenticating them and ensuring their integrity for the life of the document. Similarly, financial services firms will be able to conclude any new legal documents or agreements solely in the electronic realm. In both cases, the authenticity and integrity of documents will be ensured in both electronic and hard-copy formats, given the attributes of GoldTrustMark.com's technology.

Application Example 2: Major Retail Service Providers

Firms in the retail industry will benefit from GoldTrustMark.com's technology by applying it to any and all online agreements concluded with partners and customers. For example, numerous credit card issuers currently afford new customers the ability to sign up for a new credit card online. However, current security and encryption technology does not allow authenticated, unalterable copies of these new cardmember agreements to be distributed to both contracting parties at the time the agreement is concluded. GoldTrustMark.com's technology will do just that, providing each contracting party with an authenticated legal copy of the cardmember agreement, which cannot be altered in either digital or hardcopy format.

Application Example 3: Online Transactions

Parties to online transactions—whether they be purchases at such leading consumer sites as Amazon.com or Priceline.com, or auction agreements between individuals on sites such as eBay—will enjoy benefits similar to those described in the example above. Both parties to a transaction will be provided with an authenticated copy of their agreement, which will preserve its integrity in both digital and analog formats.

Application Example 4: Academic Records

Academic institutions will benefit from GoldTrustMark.com's solution by utilizing it to authenticate and ensure the integrity of students' transcript records. Application of GoldTrustMark.com technology will ensure that student records cannot be tampered with once entered, and will facilitate the electronic transmission of transcripts between academic institutions and other interested parties—a process, which is currently limited to the hard-copy realm, given the need for thorough watermarking.

Value Proposition

The previous examples illustrate just a few of the myriad potential applications for GoldTrustMark.com's watermarking technology. As they illustrate, the company's technology is applicable to any number of functional and industry contexts and, in each case, provides a thorough solution to the unique watermarking and security needs of each situation.

In other words, GoldTrustMark.com delivers value to the client by rendering a more efficient and effective solution to existing document security—one which not only bolsters security in existing transactions and archives, but which enables new types of transactions that are not currently possible because of the inadequacy of existing security and watermarking solutions.

Specifically, GoldTrustMark.com's technology solution delivers value to its clients by addressing their three most pressing current market needs:

- Improved document security

- Improved document integrity verification

- Document authentication

MARKET ANALYSIS

Target Market Segmentation

While GoldTrustMark.com recognizes the vast opportunity for document security and management in all knowledge industries, given the management team's experience and the need for a focused market entry approach, the company will initially beta test in one of the most document-intensive industries in the U.S.—the financial services profession. A large number of the millions of documents produced for this industry are being transmitted across the Internet, with no level of security, either pre- or post-transmission.

As the second largest revenue-generating service in the U.S., the financial industry is inundated with documents, both hard copy and electronic. And perhaps, no other industry wastes as many resources creating, filing, searching, and retrieving documents. Upon successful completion of testing in this industry, GoldTrustMark.com will quickly expand into other vertical markets.

Primary Market Research Findings

In order to add depth to the understanding of the target market, GoldTrustMark.com conducted extensive market research with financial services professionals across the United States. The primary research initiative was intended to probe financial services professionals' need for the increased security effectiveness in document transmission and management, as well as the increased online visibility, which the company's services afford. The results indicate a market fertile for the development of the GoldTrustMark.com concept, and are included in Appendix A of this document.

COMPETITIVE ANALYSIS

Overview of Competition

There are only a handful of companies that compete in the watermarking arena. There are two that have emerged as the market leaders. These two companies are Javelin and Globe Marking. Both companies have a digital watermarking process and engage in various forms of watermark protection:

Javelin

Javelin is a developer of patented digital watermarking technologies for multimedia content distribution. Their technology can only survive in electronic format.

Globe Marking

Globe Marking is the leading developer of digital watermarking technologies. Their technologies can allow digital data to be imperceptibly embedded in digital visual content, including movies, photographic, or artistic images. These technologies are used in a wide variety of applications, including solutions that deter counterfeiting, piracy, and other unauthorized uses. Their system enables communications capabilities within electronic content only.

GoldTrustMark.com's Competitive Advantage

GoldTrustMark.com differentiates itself from all of the above competitors by being the only industry player to focus specifically upon the electronic security of documents. The GoldTrustMark.com solution will reduce costs for clients, for it will not require them to invest in IT hardware or infrastructure. Furthermore, the company's value-added wireless interface—a feature that is not offered by any of the competitors—will allow client firms and financial services professionals to watermark and transmit their records regardless of their location.

These facts will enable the company to deliver a highly flexible solution that is specifically tailored to document security needs of the financial services profession. GoldTrustMark.com's sustainable competitive advantages will be a result of its product/service offerings and market entry position.

Proprietary Technology

The GoldTrustMark.com record management solution will be based upon the company's proprietary watermarking technology, which significantly improves on existing technologies in the market. The GoldTrustMark.com watermark is the only one that will survive in both digital and analog environments. This will pose an obstacle to other market players who wish to develop similarly rich functionality in their technology solutions.

Incumbent Advantages

By being the first player in its market niche, GoldTrustMark.com will be offering a unique value proposition to financial professionals, and will therefore be able to garner a substantial share of the legal document security market. For these clients, the cost of switching to an alternate solution will exceed the cost of retaining GoldTrustMark.com as their record management provider, providing the company with significant incumbent advantages.

Learning-Curve Advantages

By working longer and more extensively with clients in the legal profession than any other company, GoldTrustMark.com will be able to evolve its product and service offerings to meet the changing needs of its clients. This will afford the company significant learning-curve advantages.

MARKETING STRATEGY

Overall Strategy

In entering the market and positioning itself in front of potential clients, GoldTrustMark.com will utilize a dual-track approach. First off, the company will forge a series of strategic alliances with world-class product and service providers, whose offerings complement its own. These alliances will not only provide GoldTrustMark.com with strong client referral channels, but will also provide it with increased visibility and credibility. In addition, the company will employ a more traditional marketing approach by engaging in selective target marketing and direct advertising to target financial services firms.

Strategic Alliances

GoldTrustMark.com aims to forge a series of strategic alliance partnerships with leading providers of web and technology products and services. The company's web partners will play a crucial role in the development and launch of the GoldTrustMark.com online service, and will be retained as service providers following the launch. Affiliated partners, on the other hand, will serve as a referral channel, spreading brand knowledge of the GoldTrustMark.com solution to their existing clients in the legal profession. In return, GoldTrustMark.com will refer its clients to affiliated partners for services that are complementary to the company's solution.

Affiliated Partners

GoldTrustMark.com intends to conclude agreements with key strategic alliance partners, whose product and service offerings complement its own. These types of partners will help provide the company with a steady stream of client referrals and will enable it to offer its subscribers a complete document security solution. Keeping these goals in mind, the following types of partners are currently being given priority by GoldTrustMark.com:

Computer Hardware

The company recognizes that certain clients will wish to invest in technology hardware, which will enhance their ability to internally manage their documents and knowledge in tandem with the GoldTrustMark.com service. Consequently, GoldTrustMark.com will form alliance partnerships with world-class manufacturers of hardware such as PCs, scanners, and document shredders. The company has already approached and is in negotiation with several leading hardware manufacturers and distributors.

Document Management Services

GoldTrustMark.com realizes that there are a number of service providers, whose offerings will complement its own. For example, client companies may wish to archive selected documents in both electronic and hard-copy form. Similarly, some client companies may wish to outsource the destruction of hard-copy documents, which have been stored electronically. Consequently, GoldTrustMark.com aims to form alliance partnerships with leading providers of services in areas such as traditional hard-copy document storage and document destruction, among others. The company is currently in discussion with a number of leading traditional document management service providers.

Internet Security Companies

There are numerous companies that are offering technologies ranging from RSA encryption to digital signatures and digital certificates. Through partnerships with companies such as Atlanta Bright Solutions, Kippers, LPW, and a host of other companies, we will leverage off their existing sales and marketing platforms.

Direct Marketing Channels

In addition to approaching potential clients through affiliate partner referrals, GoldTrustMark.com will also employ more traditional direct marketing mechanisms to target prospective client financial services firms:

Selective target marketing

GoldTrustMark.com will initially concentrate its services on financial services firms located in its primary target markets: New York, Miami, and Atlanta. The company selected these targets as a result of focus groups and a broad primary research study to identify financial services firms most interested in the service.

Direct advertising

The company will focus its advertising campaign on trade journals and newspapers, taking out full-page ads in trade journals for the legal community. GoldTrustMark.com is also negotiating with many different annual legal conferences to be the electronic document and knowledge management speaker for the legal profession. GoldTrustMark.com will also obtain trade booths at many trade shows and legal seminars.

Branding

With the aid of Luminary Studios, GoldTrustMark.com has developed an eye-catching logo which embodies the company's intended image. In developing this logo, GoldTrustMark.com conducted an extensive branding exercise and identified some core values that it felt will be critical to the success of its service. The color blue was chosen as a symbol of the stability and reliability of the company's service. Gold was chosen to reference the speed of the GoldTrustMark.com document watermarking functionality. Finally, the box around the word "gold" symbolizes the safety and security, which the company's solution affords its clients.

Site Launch

As an initial step in its marketing efforts, GoldTrustMark.com will launch an operational site, focused on the needs of financial services professionals in its first-tier target markets. This version of the site will be accessible only to a select number of users, most notably some of the local attorneys who have signed letters of intent to subscribe to the company's service. Although the site's functionality will be limited, it will include a working demo of the document watermarking functionality

GoldTrustMark.com believes that this will serve as a constructive first step, as it will allow the company to fine-tune the features and content of the site prior to its full, nationwide launch, which will follow in a few months' time.

THE MANAGEMENT TEAM

GoldTrustMark.com is currently conducting a nationwide search for a Chief Executive Officer to add to its management team. The company's existing management team is in the process of interviewing numerous executive search firms, with the aim of retaining one to assist in filling this vacant position.

Bill Piller, President and Founder

Mr. Piller founded GoldTrustMark.com in February 2000 and is currently responsible for all aspects of the company's management and administration. Prior to founding GoldTrustMark.com, he was a Senior Consultant with Zocari Strategies, a boutique management-consulting firm located in downtown New York. Mr. Piller worked in the emerging technology practice at Zocari, specializing in business plan development, strategy, and market research. He has also been an angel investor and board member for several start-up businesses over the past five years. Mr. Piller holds a B.A . from Yale, and is presently pursuing a master's degree in New Media and Technology.

Edward Reins, Chief Technology Officer

Mr. Reins founded Monumental M Technologies, a Miami-based audio and multimedia copyright protection company which developed a watermarking and copyright protection system recognized by the worldwide media protection industry. During the development phase, Mr. Reins was granted several patents in media copyright protection technologies. Monumental M has since merged with NuKoppe Research to become WKO Corp. Mr. Reins holds a BSEE from Texas A&M and is a Ph.D. candidate at the Massachusetts Institute of Technology.

Jonathan Kosow, Director of Marketing

Mr. Kosow is in charge of developing, managing, and coordinating the initial sales and marketing efforts for GoldTrustMark.com. He is currently Vice President of Sales and Marketing at Second Century Group of Minneapolis. Mr. Kosow has specialized in building national sales forces in financial services industries for the past five years. Prior to joining Second Century, he opened the retail division of a national subprime mortgage lender and was directly responsible for the marketing efforts of its 10 offices in five states. Mr. Kosow holds a B.A. in English from Christendom College.

Maxine Stein, Director of Sales

Ms. Stein is the president and founder of Advanced Career Strategies, an agency providing consulting to professionals in career and networking services. Prior to founding Advanced Career Strategies, she worked as a legal recruiter for both Fortune 500 companies and niche financial services firms. Ms. Stein has spent her entire professional career selling services to the financial services community. She has a B.S. in Human Resources from the University of Dallas and an M.B.A. from the University of South Carolina.

FINANCIAL OVERVIEW

Revenue Streams

GoldTrustMark.com will derive its revenues from two primary revenue streams:

Software Licensing Fees

GoldTrustMark.com subscribers will be charged a monthly software licensing fee for the use of the company's knowledge management software functionality. The company will implement a tiered pricing model, charging client companies a licensing fee based on the number of potential end users they employ.

Partnership Fees

GoldTrustMark.com will receive a partnership or referral fee from partners, to which the company has referred its customers for service or product purchase. These fees will apply to partners who provide hardware, scanning, and document destruction services, among others.

For a summary of management's financial projections, please refer to Appendix B.

GoldTrustMark.com Roll-Out Timeline

Phase I—Strategic Positioning

January-March 2001

- Complete phase one-product development

- File patent application

- Forge alliances with strategic partners

- Begin key staff hiring

- Fund additional operating expenses

- Security Audit

Phase I Benchmarks:

- Successful initial product launch

- Completion of senior management team by hiring highly experienced CEO

- Completion of core product development for initial site software

Phase II—Soft Launch

April-August 2001

- Hire staff for key company functions

- Enhance product features beyond initial version

- Develop marketing strategies, messages, and sales team

- Complete Board of Directors and Advisors; fund additional operating expenses

Phase II Benchmarks:

- Complete partnerships necessary to launch fully functional site

- Complete initial success tests with trial companies

- Develop marketing material and tactics

- Complete hiring of "launch" staff

Phase III—Full Launch

September-December 2001

- Hire full team for product launch

- Launch national business-to-business marketing campaign

- Fund additional operating expenses

- Obtain additional venture financing

Phase III Benchmarks:

- Achieve profitability

APPENDIX A: MARKET RESEARCH FINDINGS

In order to add depth to the understanding of the target market, GoldTrustMark.com conducted extensive market research with financial services firms across the United States. The primary research initiative was intended to probe financial service professionals' need for the increased efficiency and effectiveness in document and knowledge management, as well as the increased online visibility, which the company's services afford. The results indicate a market fertile for the development of the GoldTrustMark.com concept.

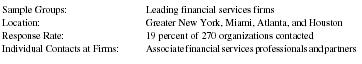

Profile of Survey Participants

| Sample Groups: | Leading financial services firms |

| Location: | Greater New York, Miami, Atlanta, and Houston |

| Response Rate: | 19 percent of 270 organizations contacted |

| Individual Contacts at Firms: | Associate financial services professionals and partners |

Survey Findings and Analysis

Survey participants were asked to respond to three fundamental questions regarding their firms' current and intended use of the Internet, which gave a broad indication of the market acceptance of the GoldTrustMark.com concept.

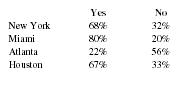

Does your firm currently utilize the Internet as a business tool?

- 62 percent of total respondents said their firm maintained a website and significantly utilized the Internet as a business tool.

- Results varied widely by geographic dispersion. 56 percent of respondents in Atlanta do not have a website or significantly utilize the Internet as a business tool. In contrast, only 20 percent of Miami respondents did not have a website or significantly utilize the Internet.

| Yes | No | |

| New York | 68% | 32% |

| Miami | 80% | 20% |

| Atlanta | 22% | 56% |

| Houston | 67% | 33% |

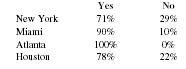

Does your firm see the Internet as a viable tool to support your regional or statewide expansion?

- Most respondents believed that the Internet is a viable tool for supporting the regional or statewide expansion of their financial services firm. This finding remained consistent across regions.

| Yes | No | |

| New York | 71% | 29% |

| Miami | 90% | 10% |

| Atlanta | 100% | 0% |

| Houston | 78% | 22% |

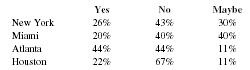

Would your firm be interested in participating in a service like GoldTrustMark.com?

- 54 percent of respondents stated they would be interested or might be interested in participating in a service like GoldTrustMark.com, while 41 percent stated they would not be interested in participating at this time.

- Respondents in Atlanta and New York were most interested in GoldTrustMark.com, while those in Miami were the least interested.

| Yes | No | Maybe | |

| New York | 26% | 43% | 30% |

| Miami | 20% | 40% | 40% |

| Atlanta | 44% | 44% | 11% |

| Houston | 22% | 67% | 11% |

Given the survey findings, GoldTrustMark.com has narrowed its first-tier target market to include those cities, in which a substantial number of financial services firms have already embraced Internet technologies as a business tool. The company's second-tier target market will include cities whose strategic Internet adoption among financial services firms is not currently as high, but where financial services firms realize the value of the Internet as a strategic business tool and are highly-interested in adopting new, web-based ways of working.

APPENDIX B: FINANCIAL PROJECTIONS

Assumptions

Software Revenue

The Software Revenue is based on the assumption of the following income source:

a. Yearly software charge that will average $7,500/firm per year. This fee is based on conversations with other software companies who charge fees on a per seat basis.

The company is projecting to sign-up the following number of new clients to use its service.

| Year 1: | 112 |

| Year 2: | 515 |

| Year 3: | 640 |

| Total: | 1,267 |

The software and general maintenance fees are the same for every client.

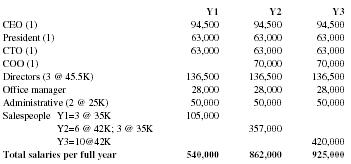

Salary Expenses

The company anticipates the following salaries:

| Y1 | Y2 | Y3 | |

| CEO (1) | 94,500 | 94,500 | 94,500 |

| President (1) | 63,000 | 63,000 | 63,000 |

| CTO (1) | 63,000 | 63,000 | 63,000 |

| COO (1) | 70,000 | 70,000 | |

| Directors (3 @ 45.5K) | 136,500 | 136,500 | 136,500 |

| Office manager | 28,000 | 28,000 | 28,000 |

| Administrative (2 @ 25K) | 50,000 | 50,000 | 50,000 |

| Salespeople Y1=3 @ 35K | 105,000 | ||

| Y2=6 @ 42K; 3 @ 35K | 357,000 | ||

| Y3=10@42K | 420,000 | ||

| Total salaries per full year | 540,000 | 862,000 | 925,000 |

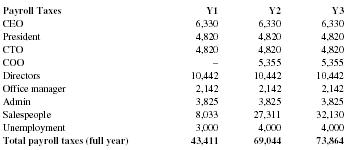

| Payroll Taxes | Y1 | Y2 | Y3 |

| CEO | 6,330 | 6,330 | 6,330 |

| President | 4,820 | 4,820 | 4,820 |

| CTO | 4,820 | 4,820 | 4,820 |

| COO | – | 5,355 | 5,355 |

| Directors | 10,442 | 10,442 | 10,442 |

| Office manager | 2,142 | 2,142 | 2,142 |

| Admin | 3,825 | 3,825 | 3,825 |

| Salespeople | 8,033 | 27,311 | 32,130 |

| Unemployment | 3,000 | 4,000 | 4,000 |

| Total payroll taxes (full year) | 43,411 | 69,044 | 73,864 |

Employee Benefits

Projected to be 10 percent of total salaries:

| Y1 | Y2 | Y3 | |

| 54,000 | 86,200 | 92,500 |

Other Expences

Other expense were estimates per client.

This page left intentionally blank to accommodate tabular matter following.

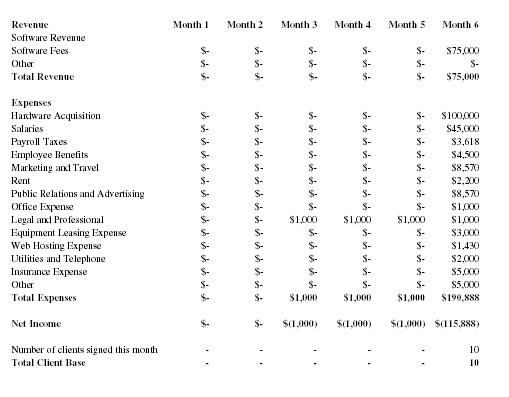

Projected Income Statement for the Year Ended December 31, 2001

| Revenue | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 |

| Software Revenue | ||||||

| Software Fees | $- | $- | $- | $- | $- | $75,000 |

| Other | $- | $- | $- | $- | $- | $- |

| Total Revenue | $- | $- | $- | $- | $- | $75,000 |

| Expenses | ||||||

| Hardware Acquisition | $- | $- | $- | $- | $- | $100,000 |

| Salaries | $- | $- | $- | $- | $- | $45,000 |

| Payroll Taxes | $- | $- | $- | $- | $- | $3,618 |

| Employee Benefits | $- | $- | $- | $- | $- | $4,500 |

| Marketing and Travel | $- | $- | $- | $- | $- | $8,570 |

| Rent | $- | $- | $- | $- | $- | $2,200 |

| Public Relations and Advertising | $- | $- | $- | $- | $- | $8,570 |

| Office Expense | $- | $- | $- | $- | $- | $1,000 |

| Legal and Professional | $- | $- | $1,000 | $1,000 | $1,000 | $1,000 |

| Equipment Leasing Expense | $- | $- | $- | $- | $- | $3,000 |

| Web Hosting Expense | $- | $- | $- | $- | $- | $1,430 |

| Utilities and Telephone | $- | $- | $- | $- | $- | $2,000 |

| Insurance Expense | $- | $- | $- | $- | $- | $5,000 |

| Other | $- | $- | $- | $- | $- | $5,000 |

| Total Expenses | $- | $- | $1,000 | $1,000 | $1,000 | $190,888 |

| Net Income | $- | $- | $(1,000) | $(1,000) | $(1,000) | $(115,888) |

| Number of clients signed this month | - | - | - | - | - | 10 |

| Total Client Base | - | - | - | - | - | 10 |

| Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| $90,000 | $105,000 | $120,000 | $135,000 | $150,000 | $165,000 |

| $- | $- | $- | $- | $- | $- |

| $90,000 | $105,000 | $120,000 | $135,000 | $150,000 | $165,000 |

| $- | $- | $- | $- | $- | $- |

| $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 |

| $3,618 | $3,618 | $3,618 | $3,618 | $3,618 | $3,618 |

| $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 |

| $8,570 | $8,570 | $8,570 | $8,570 | $8,570 | $8,570 |

| $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 |

| $8,570 | $8,570 | $8,570 | $8,570 | $8,570 | $8,570 |

| $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| $1,430 | $1,430 | $1,430 | $1,430 | $1,430 | $1,430 |

| $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| $90,888 | $90,888 | $90,888 | $90,888 | $90,888 | $90,888 |

| $(888) | $14,112 | $29,112 | $44,112 | $59,112 | $74,112 |

| 12 | 14 | 16 | 18 | 20 | 22 |

| 22 | 36 | 52 | 70 | 90 | 112 |

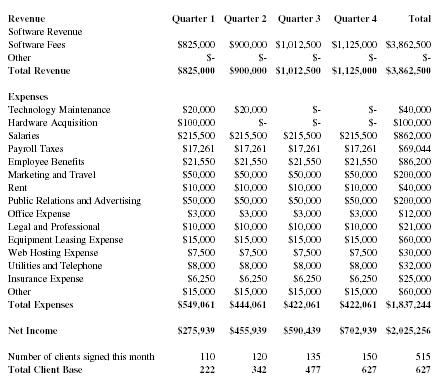

Projected Income Statement for the Year Ended December 31, 2002

| Revenue | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Total |

| Software Revenue | |||||

| Software Fees | $825,000 | $900,000 | $1,012,500 | $1,125,000 | $3,862,500 |

| Other | $- | $- | $- | $- | $- |

| Total Revenue | $825,000 | $900,000 | $1,012,500 | $1,125,000 | $3,862,500 |

| Expenses | |||||

| Technology Maintenance | $20,000 | $20,000 | $- | $- | $40,000 |

| Hardware Acquisition | $100,000 | $- | $- | $- | $100,000 |

| Salaries | $215,500 | $215,500 | $215,500 | $215,500 | $862,000 |

| Payroll Taxes | $17,261 | $17,261 | $17,261 | $17,261 | $69,044 |

| Employee Benefits | $21,550 | $21,550 | $21,550 | $21,550 | $86,200 |

| Marketing and Travel | $50,000 | $50,000 | $50,000 | $50,000 | $200,000 |

| Rent | $10,000 | $10,000 | $10,000 | $10,000 | $40,000 |

| Public Relations and Advertising | $50,000 | $50,000 | $50,000 | $50,000 | $200,000 |

| Office Expense | $3,000 | $3,000 | $3,000 | $3,000 | $12,000 |

| Legal and Professional | $10,000 | $10,000 | $10,000 | $10,000 | $21,000 |

| Equipment Leasing Expense | $15,000 | $15,000 | $15,000 | $15,000 | $60,000 |

| Web Hosting Expense | $7,500 | $7,500 | $7,500 | $7,500 | $30,000 |

| Utilities and Telephone | $8,000 | $8,000 | $8,000 | $8,000 | $32,000 |

| Insurance Expense | $6,250 | $6,250 | $6,250 | $6,250 | $25,000 |

| Other | $15,000 | $15,000 | $15,000 | $15,000 | $60,000 |

| Total Expenses | $549,061 | $444,061 | $422,061 | $422,061 | $1,837,244 |

| Net Income | $275,939 | $455,939 | $590,439 | $702,939 | $2,025,256 |

| Number of clients signed this month | 110 | 120 | 135 | 150 | 515 |

| Total Client Base | 222 | 342 | 477 | 627 | 627 |

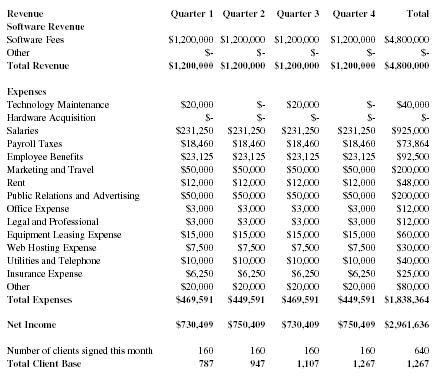

Projected Income Statement for the Year Ended December 31, 2003

| Revenue | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Total |

| Software Revenue | |||||

| Software Fees | $1,200,000 | $1,200,000 | $1,200,000 | $1,200,000 | $4,800,000 |

| Other | $- | $- | $- | $- | $- |

| Total Revenue | $1,200,000 | $1,200,000 | $1,200,000 | $1,200,000 | $4,800,000 |

| Expenses | |||||

| Technology Maintenance | $20,000 | $- | $20,000 | $- | $40,000 |

| Hardware Acquisition | $- | $- | $- | $- | $- |

| Salaries | $231,250 | $231,250 | $231,250 | $231,250 | $925,000 |

| Payroll Taxes | $18,460 | $18,460 | $18,460 | $18,460 | $73,864 |

| Employee Benefits | $23,125 | $23,125 | $23,125 | $23,125 | $92,500 |

| Marketing and Travel | $50,000 | $50,000 | $50,000 | $50,000 | $200,000 |

| Rent | $12,000 | $12,000 | $12,000 | $12,000 | $48,000 |

| Public Relations and Advertising | $50,000 | $50,000 | $50,000 | $50,000 | $200,000 |

| Office Expense | $3,000 | $3,000 | $3,000 | $3,000 | $12,000 |

| Legal and Professional | $3,000 | $3,000 | $3,000 | $3,000 | $12,000 |

| Equipment Leasing Expense | $15,000 | $15,000 | $15,000 | $15,000 | $60,000 |

| Web Hosting Expense | $7,500 | $7,500 | $7,500 | $7,500 | $30,000 |

| Utilities and Telephone | $10,000 | $10,000 | $10,000 | $10,000 | $40,000 |

| Insurance Expense | $6,250 | $6,250 | $6,250 | $6,250 | $25,000 |

| Other | $20,000 | $20,000 | $20,000 | $20,000 | $80,000 |

| Total Expenses | $469,591 | $449,591 | $469,591 | $449,591 | $1,838,364 |

| Net Income | $730,409 | $750,409 | $730,409 | $750,409 | $2,961,636 |

| Number of clients signed this month | 160 | 160 | 160 | 160 | 640 |

| Total Client Base | 787 | 947 | 1,107 | 1,267 | 1,267 |

Comment about this article, ask questions, or add new information about this topic: