Wireless Systems Integrator

BUSINESS PLAN SPONGESHARK, LLC.

7100 Montcalm Avenue

Boulder, Colorado 80301

SpongeShark uses the new wireless Bluetooth technology to provide a superior self check-in solution to airlines. The SpongeShark solution will eliminate lines so that airline customer service personnel will be freed up to handle real problems for the customer, rather than just checking in passengers.

- EXECUTIVE SUMMARY

- COMPANY OVERVIEW

- PRODUCT & SERVICE

- INDUSTRY & MARKETPLACE ANALYSIS

- MARKETING PLAN

- OPERATIONS PLAN

- DEVELOPMENT PLAN

- MANAGEMENT

- FINANCIAL PLAN

- OFFERING

- APPENDIX

EXECUTIVE SUMMARY

Opportunity

SpongeShark is a systems integrator that provides wireless solutions for the airline industry. Airports are nearing capacity and air travel is expected to increase by 60 percent by 2010. In order to keep their most profitable frequent-flyer customers, airlines must develop new services to handle this traffic increase. Self check-in will be among the most important services airlines will offer their customers. SpongeShark's team, with its combination of airline industry contacts and technical and business expertise, is poised to provide these services to airlines.

Solution

"The passenger agent's role will be completely transformed from one of doing checkins and transactions to one of solving problems for our customers."

—Senior Director of Customer Service and Development, Air Canada

SpongeShark uses the new wireless Bluetooth technology to provide a superior self check-in solution to airlines. Our solution will include:

- Self check-in (with FAA approved security features)

- Access to flight information/status

- Access to first class upgrades and other offers

- Entertainment and other web-based information

The SpongeShark solution will eliminate lines so that airline customer service personnel will be freed up to handle real problems for the customer, not the mundane task of checking in passengers. Airlines are currently testing self check-in technologies, such as kiosks, but these do not have the capabilities of SpongeShark's Bluetooth-enabled solution.

Bluetooth is a short range, high bandwidth wireless technology that Nokia, Motorola, Ericsson, and personal digital assistant (PDA) manufacturers will be integrating into their devices beginning in 2001. Bluetooth's diffusion rate is expected to be high, reaching 600 million handheld devices by 2004. Due to the exploding growth of the number of Bluetoothenabled devices, airline passengers will be ready for and expecting the type of service that SpongeShark delivers. Customers will be able to use their own mobile phone or PDA, such as the Palm Pilot, to communicate with the airline information systems via the SpongeShark solution.

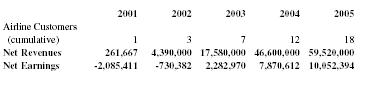

Financial Summary

We expect revenues of $60 million and net income of $10 million by 2005. Our software licenses and hardware support generate 30 percent of this revenue on a recurring basis. We are seeking an initial equity investment of $2.5 million to launch the business. This investment will have an ROI of 20 times at our exit event in 2005.

| 2001 | 2002 | 2003 | 2004 | 2005 | |

| Airline Customers (cumulative) | 1 | 3 | 7 | 12 | 18 |

| Net Revenues | 261,667 | 4,390,000 | 17,580,000 | 46,600,000 | 59,520,000 |

| Net Earnings | -2,085,411 | -730,382 | 2,282,970 | 7,870,612 | 10,052,394 |

COMPANY OVERVIEW

SpongeShark was created to provide wireless solutions for the airline industry. We are leveraging the new Bluetooth technology to enhance the customer service for users of Bluetooth-enabled handheld devices. The company was formed as an LLC in Colorado in 2000.

Mission Statement

SpongeShark delivers wireless solutions to the travel industry, enabling our customers to create and deliver innovative marketing programs to their best customers.

Current Status

SpongeShark is recruiting engineers and an international business development and sales team. We are beginning negotiations with several major international airlines that have expressed interest in our solution. The SpongeShark team has strong connections throughout the airline industry, and we will leverage these contacts to help refine our solution and provide a foundation for future sales. We are also in discussions with both hardware and software vendors that are developing their Bluetooth products.

Bluetooth

The SpongeShark solution uses Bluetooth technology to allow airlines to interact with their passengers in a way never before possible. Bluetooth will enable next-generation wireless devices (including cellular phones, personal digital assistants or PDAs and laptops) to communicate (both data and voice) with other Bluetooth-enabled devices within a range of 30-330 feet (approximately 10-100 meters). Bluetooth technology will be part of more than 100 million devices in the U.S. and almost 572 million devices worldwide by 2004, according to predictions of IDC and Dataquest. Bluetooth technology is currently at 721 kbps transfer rate, faster than wireless web, with a second version due with 10 Mbps transfer rate. This Ethernet-quality speed enables high-resolution graphics, audio, and video.

Objectives

SpongeShark aims to contract with major international airlines and become their systems integrator for wireless check-in and other enhanced services. Airlines are racing to implement self check-in services, however, none of the current solutions have the advantage of SpongeShark's proximity-based Bluetooth-enabled solution. Only SpongeShark's solution will use the devices that travelers already own, and allow for the airlines to use proximity-based marketing tools. Self check-in solutions are just beginning to come to market, and we intend to seize this window of opportunity and be the first company to offer a Bluetooth solution.

Our future vision is to expand our services to other areas of the travel ribbon. As travelers begin to expect Bluetooth wireless services at airports, they will also expect similar services at hotels, resorts, and other modes of transportation. By expanding further into the travel ribbon, SpongeShark will be able to continue its rapid growth beyond the first five years of operation. SpongeShark will be able to leverage the expertise it has gained from our airline integration and offer solutions to these new markets.

PRODUCT & SERVICE

SpongeShark will be responsible for installing and maintaining the hardware an airline will need in order to become "Bluetooth-enabled." In addition, SpongeShark will include proprietary software to enable airline content to be displayed on the airline passenger's mobile devices. SpongeShark will be able to provide these services by placing proximity-based Bluetooth servers in key areas of the airport, such as check-in areas, gates owned by the airline, and public areas designated by the airline. A typical airport setup will contain one main SpongeShark server along with several wireless access points in public areas. SpongeShark will develop the software to interact with the handheld devices, handle the software integration with the airline databases, arrange the placement of the wireless access points in the airport, enable Internet access to the access points, and perform maintenance and repairs.

SpongeShark will deliver a complete wireless solution, including user interface and database software, integration with legacy systems, network engineering, installation, maintenance, and help desk support.

Airline Passenger's Experience

"The check-in, once again, took forever; even though [the] check-in desks were fully staffed, only one passenger seemed to get through the line every 15 minutes."

—E-pinions.com User

SpongeShark will offer amazing convenience and entertainment to the airline's passengers through their own mobile devices. Mobile devices have seen great improvements to the screen size and clarity in the last few years, and due to the expected convergence of mobile phones with PDAs, the technology will only continue to get better.

Airline passenger's will be able to:

- Check-in: At either check-in areas or the gate, customers can register their arrival for a specific flight.

- Check flight info/status: The user can check the intended flight's departure time.

- Check seat arrangements: Using a graphical layout appropriate for the specific aircraft, a user can check and change if needed his/her seat arrangement.

- Be alerted to cancellations/delays: An audible sound and splash screen can alert users to changes in their flight status.

- Be alerted to time of boarding: Not only can the users mobile device alert to the correct time of boarding according to the user's status and seat arrangement, the device may also work as a boarding pass.

- Receive promotions and offers from the airline.

- Listen to streaming audio (news, music): As Bluetooth uses radio frequency, the technology is apt for streaming audio broadcasts.

- View news, city information, city maps, airport maps: Users will want assistance finding a connecting gate or determining where the rental agencies are located within the airport. Additionally, users will wish to have city specific information for their arriving city.

- Watch streaming video: With 721 kbps, Bluetooth can allow for streaming video.

- Play networked games: Users will have the ability to play games either against a computer opponent or against other passengers.

- Use instant chat: Passengers can instant message with other passengers, or airline personnel can instant message a passenger if necessary.

- Access the Internet: Users will also be able to check e-mail and browse web pages at a faster rate than WAP allows, and free of charge. (Some mobile providers charge air time for WAP use.)

SpongeShark gives airlines a unique competitive edge and therefore increased loyalty by providing these services to passengers.

INDUSTRY & MARKETPLACE ANALYSIS

Industry Analysis

SpongeShark falls within two industries: wireless communications and computer related services.

Wireless Communications: SpongeShark is part of the wireless communications industry (NAICS 51332). This is a very broad industry which includes wireless handset manufacturers to wireless service providers. The wireless communications industry grew 20.8 percent in 1999. By 2002, mobile devices will make up one half of all devices accessing the Internet worldwide. Currently, telecom companies such as Nokia and Ericsson are developing the next generation of mobile devices that will have greater functionality due to increased local processing power and larger, color displays. This will allow for the fusion of the cell phone, PDA, and electronic wallet into a single device.

Computer Related Services: SpongeShark can also be classified as a company which provides "computer related services" (SIC 7379) because we are involved with integrating a Bluetooth communications system with an airline's website or ticketing database.

Marketplace Analysis

SpongeShark will provide wireless technology to the airline industry. Our entry market will be major European airlines and major U.S. airlines that operate in Europe.

Air travelers in European and North American airports will be the first end-users of the SpongeShark service. More than two billion passengers pass through the world's airports each year. This number is projected to increase by 60 percent by 2010. Business travelers are likely to be the first to use the SpongeShark service, since they will be the early adopters of Bluetooth enabled phones.

Customer Analysis

"Airlines are in a race to provide technology-based check-in."

—CIO, ATA

Airlines are in a highly competitive market, and they are always looking for innovative services that will give them an edge over their competitors. The competition is particularly intense for business travelers, who are the most lucrative segment of air travelers. There is an opportunity to improve the experience for business travelers through wireless technology because so many business travelers use wireless handheld devices.

Routine Transactions: Airlines we have spoken with recognize that improvement in customers' air travel experiences can be a competitive advantage. Time spent waiting in line is one of the biggest obstacles that travelers experience. Since SpongeShark allows passengers to complete routine transactions with their mobile devices, there will be fewer people waiting in line for simple transactions with the agent. The shorter line benefits all of the passengers, not just those with a Bluetooth-enabled devices. One major U.S. carrier said that their goal is to automate all of the transactions that would make people wait in line: check-in, rebooking, upgrades, and frequent flyer account transactions.

Entertainment: SpongeShark also offers high-speed Internet access and entertainment to passengers while they wait in the gate area. Airlines can offer this benefit exclusively to customers in its frequent-flyer program, or to those who have membership in their executive service. Once mobile devices have adequate displays, airlines could show previews to all passengers of the pay-per-view entertainment options that will be on the flight. In-flight entertainment is becoming an important new revenue source for airlines. SpongeShark offers airlines a great opportunity to integrate wireless service with their customer relationship management (CRM) software. The m-Commerce Manager of a major U.S. airline told us that he expects wireless to transform customer relationship management. For example, a business traveler could receive an automatic notification of an upgrade after his flight had been cancelled during his previous trip. Integration with the airline's CRM system will give the airline more touch points with its best customers thereby creating more upselling and crosselling opportunities.

Airlines are using technology as a competitive weapon, and they are in a rush to implement new technology before it has been widely adopted. Icelandair implemented WAP services a year and a half before WAP-enabled phones were available on the market. Similarly, airlines will be in a race to implement Bluetooth services.

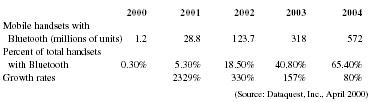

As an open standard with many applications, it is widely expected that almost all wireless devices being manufactured by mid to late 2004 will be Bluetooth-enabled. See the chart below for worldwide Bluetooth adoption estimates. Europe is destined to see the earliest growth, considering their dependency on mobile phones currently.

| 2000 | 2001 | 2002 | 2003 | 2004 | |

| (Source: Dataquest, Inc., April 2000) | |||||

| Mobile handsets with Bluetooth (millions of units) | 1.2 | 28.8 | 123.7 | 318 | 572 |

| Percent of total handsets with Bluetooth | 0.30% | 5.30% | 18.50% | 40.80% | 65.40% |

| Growth rates | 2329% | 330% | 157% | 80% | |

We also know that airlines readily copy each other's successful technological initiatives. The CIO of ATA told us that airlines have a herd mentality. If one airline announces a new service, others will be sure to follow. SpongeShark needs to be successfully implemented with one key airline, and then our service will be attractive to many other airlines.

"If you wait another two years to start planning your wireless strategy and initiatives, you may have lost your opportunity."

—e-Commerce Specialist, Delta Airlines

Competitor Analysis

There are several alternative check-in technologies that are being tested and implemented in the airline industry.

Barcode Readers. Customers print out barcoded airline tickets when they purchase online using their home PC. In tests the technology didn't work very well and it caused longer lines than the standard system where a flight attendant takes boarding passes.

Handheld Wireless Computers. Northwest Airlines now has handheld computers and printers for its gate agents to take into a long line to check passengers in and print out their boarding passes. Unlike SpongeShark, this does not allow for self-service. Even if these handheld computers reduce waiting time, agents will still be busy dealing with all of the same routine transactions.

Smart Cards. Some airlines are considering embedding frequent flyer cards with a chip or a small antenna which will contain all of the information that they need to check-in for their flight. The cards with the antennas are able to automatically detect a customer's presence and check them in as soon as they walk into the airport. A major U.S. airline rejected this idea because they felt that U.S. travelers would consider the smart card an invasion of their privacy. In contrast, SpongeShark gives the traveler control of the check-in process: they know when the transaction is complete because the boarding pass is visible on the screen of their handheld device. SpongeShark also offers travelers a wider range of transactions. The SpongeShark system can be implemented to offer simple services at the beginning but can be expanded as the airlines' needs expand. The three technologies above cannot expand beyond the functionality that they currently provide.

Kiosks. Kiosk solutions are being tested by several U.S. and international airlines for self-serve check-in. Unlike SpongeShark, kiosks do not significantly reduce lines at the gate because only one customer can use the kiosk at a time. Where there used to be a line for the desk, there is now a line for the kiosk. Also, kiosks are more expensive to install and maintain than SpongeShark servers and they do not offer Internet access and entertainment options to passengers who are waiting at the gate. Finally, kiosk users have to deal with an unfamiliar user interface whereas SpongeShark users are working with their own mobile device.

Wireless Internet. Those who have subscriptions to wireless Internet services can access the Internet through their WAP-enabled cell phone or PDA. Swissair began testing self-service check-in through the wireless Internet in October 1999. This technology is seriously flawed, however, because passengers can check in while they are still miles away from the airport.

SpongeShark avoids this security problem because our Bluetooth network is a "proximitybased" solution that operates at a maximum range of 330 feet. SpongeShark is superior to the wireless Internet because of the much higher bandwidth. Anybody who has tried to surf the Internet on a mobile phone can tell you that it is very frustrating to wait for the very slow connection. SpongeShark's 721 kbps transfer rate provides a much better experience. Airlines can offer their best customers access to free news and entertainment to encourage participation in their loyalty programs.

Wireless LAN/Internet Kiosks. SpongeShark also competes with companies that are focused on providing Internet access in airports. Travelers can log on at numerous kiosks, plug their laptops into data ports on many pay phones, or visit Internet cafes or business centers which provide access. Wireless LAN's are a new and growing trend in airports. Users can rent or buy an 802.11 card and connect to a wireless network that is accessible through the entire airport.

SpongeShark is a superior service because our service is designed for handheld devices, which are much more convenient to bring on a trip than a laptop computer. In the next few years handheld devices will outsell PCs by a factor of three-to-one.

MARKETING PLAN

SpongeShark's goal is to facilitate wireless check-in and provide entertainment to passengers of all of the major airlines in the world. We will start by signing a contract with one major airline. We will give our first airline customer a tremendous competitive advantage because their gate agents will be freed from routine transactions and will be able to offer more complete customer service to their passengers. Our target market is the 111 major international airlines in Europe, North America, and Asia. Our entry market will be those airlines who are part of an international alliance with other airlines. We will raise our profile in airline technology circles with our presence at major trade shows and advertisements in key trade publications. We will use personal relationships and highly skilled personal sales staff to develop relationships with airlines and acquire the contracts. Our niche is major airlines which are competing on the basis of customer service and the latest technology. Airline executives we have spoken with have indicated that now is the time to begin implementing the technology that SpongeShark offers. Our identity is as wireless experts who can implement the most cutting edge technology for the travel industry.

Target Market Strategy

Our target market is major airlines that fly in Europe, North America, and Asia. There are 111 airlines with over 30 planes which fly in these regions. Our sales assumptions project that we will capture 18 percent of the 86 airlines in the European and North American markets in five years. Representative airlines in this group have the following characteristics:

- 32 major European destinations

- 21 major U.S. destinations

- 400 total gates needing SpongeShark access points

- 56 million passengers per year

Our entry market will be airlines which fly in Europe as part of an international alliance. Passengers who fly with alliance partners often change from one airline to another in major European hubs, which is where SpongeShark's check-in technology would be most useful in the near term based on the fact that Bluetooth adoption will be much faster in Europe. Currently, mobile device penetration is up to 70 percent in some European countries versus under 30 percent in the United States. Many Europeans will be comfortable using their Bluetooth enabled phones to make purchases and access information, and they will expect airlines to provide similar services. One alliance partner who implements the SpongeShark system will encourage their alliance partners to do so as well so that air travelers can enjoy a seamless travel experience. There are currently five major airline alliances with 26 airlines which fly in Europe and North America.

Product and Service Strategy

SpongeShark will be positioned as a tool for airlines to stay in communication with their best customers while they wait in the gate area. Ours is the best solution for airlines because:

SpongeShark frees airline gate agents. Passengers with Bluetooth-enabled devices will be able to perform a wide range of transactions on their own, from simple check in, to rebooking, to changing their seat, to upgrading to first class, to making sure their miles have been credited towards their frequent flyer account. Instead of dealing with lines of customers who need these simple transactions, airline gate agents will spend their time solving real problems for passengers. Airlines will be able to provide a much higher level of service to their passengers as a result.

SpongeShark allows for push marketing. SpongeShark uses Bluetooth, which only works when passengers are near the access point and allows for information to be "pushed" to mobile devices even if the information was not requested by the end user. Airlines have a captive audience with their passengers who are waiting in the gate area. Passengers have the option of "pulling" information from an airline's wireless Internet site, but they may not choose to do so. With SpongeShark, airlines can push promotions and offers to the passengers through their mobile devices. This can build the customer relationship and encourage purchases of additional services.

SpongeShark allows airlines constant contact with passengers at critical moments. Airlines decide at the last minute which passengers will get upgrades to first class based on variables in their CRM system such as number of miles traveled or amount paid for the ticket. Once this is decided, passengers then have to get back in line to claim their upgrade. When flights are rebooked, passengers also have to get back in line to find out that the flight has been cancelled, and again to check in for another flight. SpongeShark allows airlines to push messages directly to the passengers, such as "To thank you for flying with United, we have upgraded you to first class for this flight. Your new seat is 3A." Other self check-in technologies such as kiosks do not offer the constant contact with passengers.

SpongeShark provides the infrastructure to support a wide range of entertainment options. The high bandwidth transmission of Bluetooth gives waiting passengers much faster access to the Internet as well as music and video entertainment. The airlines can control the content that is offered to their passengers, so passengers will know that all of the entertainment they are enjoying has been brought to them by the airline. In the future, when mobile device screens are able to support video, the airline can present previews of pay-per-view options that will be available on the flight. None of the other self check-in technologies can offer this range of entertainment options.

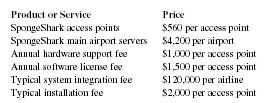

Pricing Strategy

Our pricing assumptions are as follows:

| Product or Service | Price |

| SpongeShark access points | $560 per access point |

| SpongeShark main airport servers | $4,200 per airport |

| Annual hardware support fee | $1,000 per access point |

| Annual software license fee | $1,500 per access point |

| Typical system integration fee | $120,000 per airline |

| Typical installation fee | $2,000 per access point |

Airlines spend an average of 2.5 percent of their revenues on Information Technology. Twenty-nine percent of airlines spend over 3 percent of their revenues on information technology. Together, the 26 airlines in our entry market had 1999 revenue of $132 billion, which translates to an information technology investment of $3.3 billion in our entry market alone. This year, IT budgets allocated to e-business will increase by 40 percent as airlines shift the focus of their spending from Y2K problems. Ten percent of their e-business investment will be in self-service ticketing and check-in systems such as ours.

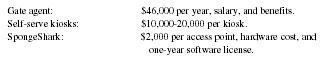

A SpongeShark access point can provide service for eight passengers at a time, whereas a customer service agent or a kiosk can only provide service for one passenger at a time. These alternatives are also much more expensive than SpongeShark. This is what airlines are willing to spend on alternatives to SpongeShark technology:

| Gate agent: | $46,000 per year, salary, and benefits. |

| Self-serve kiosks: | $10,000-20,000 per kiosk. |

| SpongeShark: | $2,000 per access point, hardware cost, and one-year software license. |

SpongeShark not only minimizes airlines' expenses, but it also boosts revenue by encouraging more passengers to become loyal customers. Loyal airline passengers outspend other air travelers by a factor of twelve to one.

Distribution Strategy

Our discussions with airline executives have indicated that major airlines do not buy their technology through resellers and consultants, but buy directly from providers after they have figured out what it is that they need through internal processes. Therefore, SpongeShark will be distributed primarily through in-house personal sales. In order to get an introduction to the important decision-makers in the airlines, we will also work through companies that have established strong relationships with them. Our connection with major systems integrators and tour package companies will enhance our credibility in the eyes of airlines.

Major systems integrators like Sabre, Amadeus, and Galileo work closely with Information Technology Directors at many airlines. These are the types of companies who have won contracts to modernize airlines' legacy systems, build websites, and set up online transactions. Information Technology Directors will turn to them for suggestions for self-service check-in. SpongeShark will work to build relationships with these companies, so that they will recommend our solution.

Tour package companies like the Mark Travel Corporation develop tours for airlines to sell under their own brand name such as American Airlines Vacations. These companies have relationships with several airlines as well as resorts, hotels, and car rental companies. It is important for tour package customers to have a seamless travel experience, checking in with no hassles at their flight, car rental, and resort. SpongeShark will make this a reality once all of the companies implement our solution. Therefore, tour package companies have an interest in introducing SpongeShark to all of the companies it works with, starting with the airlines.

Advertising and Promotion Strategy

The goal of SpongeShark's communications efforts is to position ourselves as the company with the most cutting-edge technology, which is strong enough to be the dominant player in this niche for many decades. We will use a mix of trade shows, advertising, and public relations to spread this message.

SpongeShark will attend all of the major trade shows on the subject of technology in the travel industry. These include IATA Passenger Services 2001, Travel Technology Odyssey, and E-commerce for Travel 2001. Executives who purchase technology for their airlines attend these trade shows to learn about the latest technological trends. Wireless technology is becoming a hot topic at these conferences. Presence at trade shows will establish us as a strong and enduring company.

Print advertising and public relations will also be very important for getting our name out and positioning ourself as a technological leader. We will also devote substantial resources towards getting our product reviewed by influential trade publications such as Airline InfoTech . Finally, SpongeShark will publicize any new partnerships with system integrators and our first contract with an airline so that the industry is aware of us and so that the public knows that they can use the service.

SpongeShark will promote our brand within the travel industry so that we are well known as a wireless solutions company. We will not be branded for the airline passengers. The look and feel of our service will be tailored to the specifications of the airlines so that passengers know that the services have been brought to them by their airline.

Sales Strategy

Our product and service will be sold by an internal direct sales force that works with the executives at the headquarter offices of airlines who are responsible for airport technology. Some titles of these executives are Manager of Airport Automation Development, General Manager-Wireless Programs, Director Systems Integration, VP Network Strategy and Profitability, and Director Technical Services. We will make the initial contact through personal relationships that we have within the airline industry.

During our surveys of airline industry executives, we have found that airlines do not buy their technology through consultants or resellers. Instead, they decide internally what they need and who could provide it to them. They generally work through an RFP (request for proposal) system, whereby they solicit multiple bids for a given project. Our sales efforts will focus on convincing these decision makers that our Bluetooth-enabled check-in will be their best solution even before they write the RFP.

After the RFP process is finished, the sale will be closed with a contract between SpongeShark and the airline. At that point, we will begin installing the access points in airports. Integration happens at this time too. We are planning to waive the installation fee for our first airline customer to encourage them to implement the SpongeShark system.

OPERATIONS PLAN

Airlines are constantly struggling to stay competitive. Customer service and entertainment are critical to attract new passengers and to maintain their loyalty. SpongeShark will deliver a complete wireless solution that enhances customer service, improves customer retention, and lowers operating costs to boost airline profits.

Operations Strategy

SpongeShark will focus on the design and installation of wireless networks that leverages Bluetooth's proximity-based features to drive customer loyalty programs. Our key strengths are:

- Design of Bluetooth-based networks that enable 1-to-1 marketing

- Integration of our networks with legacy information systems

We are not a manufacturing company. Numerous companies are better positioned to build and sell Bluetooth hardware. We will partner with these companies, purchase their components, and build networks to deliver our service.

We are not a content aggregator. Our airline customers will select the news, entertainment, and travel information that they want to deliver to their passengers. The airlines will use our network to deliver this value-added service to their best customers.

We are a wireless solution provider. SpongeShark customers will benefit from our expertise in installation and maintenance of wireless access points.

SpongeShark has a competitive advantage because our Bluetooth network is low cost, flexible, and scalable. These features allow our clients to install and modify the network quickly and easily. Our specific focus on the travel industry gives us an expertise to provide wireless solutions that address the needs of this sector.

Very high reliability and hardware support are key to achieving high transaction usage and positive passenger feedback, especially since our service will be deployed in volume across a wide geography.

Scope of Operations

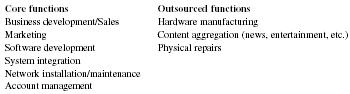

In-house staff will perform the majority of our operations. Our internal focus will be on the design and delivery of value-added services on behalf of our customers. Functions that do not directly focus on this task will be outsourced to vendors or strategic partners as follows:

| Core functions | Outsourced functions |

| Business development/Sales | Hardware manufacturing |

| Marketing | Content aggregation (news, entertainment, etc.) |

| Software development | Physical repairs |

| System integration | |

| Network installation/maintenance | |

| Account management |

We will round out our current management team with marketers and sales people who possess international experience in the IT and/or travel sectors. In addition, we will seek out software developers and network engineers to perform the system integration functions.

Ongoing Operations

The SpongeShark solution offers four services to our airline customers: integration, hardware support, software licensing, and security.

Integration

From our interviews, we know the majority of airlines use a Sabre database for flight information and an Oracle database for customer service. This allows SpongeShark to predevelop most of the software that will be used in communicating information from the airline's databases to our equipment. The SpongeShark main server will do all of the data translation from the airline databases and build an interface layer to communicate to the wireless access points. Most airlines have already experienced integration due to their development of their e-commerce websites. We can leverage off of the airlines' past experience, combined with our own experience, to create a smooth and quick integration for our customers.

Our goal is to achieve consistency and accuracy of information. System integration costs will be bundled with the costs for the servers that are sold to each airline.

Hardware Support & Software Licensing

A per-seat licensing agreement with SpongeShark will ensure the airlines for:

- server diagnostics

- network diagnostics

- hardware repairs

- software bug fixes/patches

- software upgrades

- software updates

The SpongeShark main server for each airport will use a software solution to operate as a router/firewall. Not only does this provide security for wireless access points against hack attempts, but it can facilitate in diagnostics and software upgrades. Main servers can report network and server information in a variety of secure manners to both SpongeShark and to the client. Additionally, software patches, bug fixes, and updates can be sent through the main servers. As mobile devices' displays and memory upgrade, users will expect more dynamic content. SpongeShark can continually update our software, so that the airlines can quickly benefit. Pretested firmware upgrades sent over the network will eliminate the need for SpongeShark to send support staff in the field, allow clients to receive updates quicker and more efficiently, and eliminate the need for clients to install any software themselves. While most on-site repair will be outsourced, SpongeShark will bind quality-service agreements with our support/service partners to ensure a positive experience for our clients if repairs are necessary.

Network Security

Since SpongeShark uses a wireless radio frequency, passengers may be apprehensive that their personal data could be "heard" by a third-party device. Embedded in the Bluetooth protocol are authentication and encryption schemes. Bluetooth authentication ensures that information can only be read by the intended device. Additionally, encryption disallows any promiscuous or malicious devices from reading information.

SpongeShark main servers will also act as firewalls, to prevent any intrusions from the Internet interfering with the SpongeShark internal networks created by the wireless access points and the passenger's mobile devices.

Check-in Security

The Federal Aviation Association (FAA) has recently approved self-serve technology for both passenger and baggage check-in. In fact, asking security questions through a digital form allows for better record keeping of the transaction. A description of the check-in process is presented in Appendix A.

DEVELOPMENT PLAN

We will target European airports as our first marketplace to take advantage of the high adoption rates for handheld devices. In many European countries the adoption rate exceeds 70 percent. We will deploy our service in Asia and North America when the perceived demand is at a sufficient level.

Development Strategy

Numerous elements are required to launch this company successfully. Our primary need is for people and partnerships that can drive the company forward. We will seek out strategic partnerships that will accelerate the design, testing, implementation, and expansion of our service such as:

- System integrators (e.g., Sabre): To aid in the development of relationships with airline IT management.

- Handheld device manufacturers (e.g., Ericsson): To accelerate the adoption of Bluetooth devices with promotion and education.

- Wireless access server manufacturers (e.g., Red-M): To facilitate disbursement and price point of our solution.

The first year of operations will focus on two distinct functions: business development and engineering. The key steps in our initial development plan are as follows:

- Milestone 1: Obtain Series A funding

-

Hire key staff with specific expertise

o Senior level management with experience in an international technology rollout

o International sales and marketing

o Engineering (network design, database programming, interface design, system integration) -

Milestone 2:

Build a demonstration prototype

o Database server (back-end hardware and software)

o Network (from airline to Bluetooth server)

o Bluetooth server (hardware and application)

o End-user interface (front-end application) - Expand on our current relationships with airlines and airports

- Build the service through engineering while building the market through business development

- Obtain letters of intent from potential customers

- Seek out investors for Series B funding

- Set up agreements with service and equipment vendors

- Negotiate outsourced manufacturing agreements

- Identify European partners for network maintenance

- Milestone 3: Sign first sales contract

- Complete first network installation and system integration

- Milestone 4: Obtain Series B funding

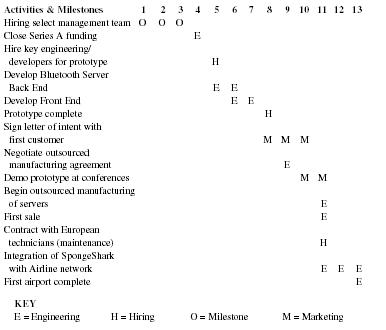

The development timeline for the first 13 months of operation is shown in below.

| Activities & Milestones | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| KEY | |||||||||||||

| E = Engineering H = Hiring O = Milestone M = Marketing | |||||||||||||

| Hiring select management team | O | O | O | ||||||||||

| Close Series A funding | E | ||||||||||||

| Hire key engineering/developers for prototype | H | ||||||||||||

| Develop Bluetooth Server Back End | E | E | |||||||||||

| Develop Front End | E | E | |||||||||||

| Prototype complete | H | ||||||||||||

| Sign letter of intent with first customer | M | M | M | ||||||||||

| Negotiate outsourced manufacturing agreement | E | ||||||||||||

| Demo prototype at conferences | M | M | |||||||||||

| Begin outsourced manufacturing of servers | E | ||||||||||||

| First sale | E | ||||||||||||

| Contract with European technicians (maintenance) | H | ||||||||||||

| Integration of SpongeShark with Airline network | E | E | E | ||||||||||

| First airport complete | E | ||||||||||||

MANAGEMENT

Company Organization

SpongeShark is a licensed LLC in the state of Colorado, headed by a dynamic team of five University of Colorado M.B.A.s. Specializing in management, finance, business development, technology, and operations, each member brings a unique set of business skills that construct an energetic driven team. Ownership will be equally divided among the five members.

As SpongeShark expands we will bring on several experienced members. The key requirements to round out the team are business development and sales professionals. SpongeShark's clear vision and growth prospects will allow it to attract top people. Additionally all members of the management team have developed many key relationships and networks that will enable rapid growth.

Management Team

Kaj Gronholm—CEO

Kaj Gronholm has an extensive background in leadership and management. As president of the UC M.B.A. class of 2001, he has helped lead and develop UC's relationship with the business community, M.B.A. class culture, and program direction. Prior to coming to UC, Kaj grew a retail store at an annual growth rate of 50 percent and boosted net profit by over 200 percent. As an entrepreneur, SpongeShark is Kaj's second start-up. The first is a still growing company in the pet industry. Kaj's undergraduate degree is in Physics, awarded by the University of Texas at Austin. While at UT, Kaj developed an extensive knowledge of computers and technology.

Derek Kumm—COO

Derek Kumm bring 5 years of technical project management to SpongeShark. As a project manager for Carnot Technical Services, Derek managed a staff of five technicians and one analyst while being responsible for sales, marketing, planning, budgeting, staffing, and control of field projects. Derek has shown strong leadership at the UC as President of the Graduate Entrepreneurs Association. Additionally, Derek was a managing member of Entrepreneurial Solutions, LLC, an M.B.A. consulting firm.

Seth Goldhammer—CTO

Seth Goldhammer has been building and deploying computer networks and solutions since 1995. Combining management and technical skills, Seth is a key component of SpongeShark's team. Most recently Seth was CEO of Entrepreneurial Solutions, LLC, an M.B.A. consulting firm. Seth is proficient with SQL, Perl, Javascript, VBScript, and HTML, as well as Win2K, NT 4.0 Server, FreeBSD, Linux, Solaris 2.6, MacOS 9.0, and network administration. Seth will be able to leverage these skills to build the SpongeShark technology.

Chris Gray—CFO

Chris Gray, a UC M.B.A., will take on the duties of Chief Financial Officer. Before SpongeShark, Chris managed inside sales and engineering responsibilities for Microminiature Technology, Inc., a manufacturing company in the microelectronics industry. After Microminiature, Chris worked at CDM Optics, Inc., as a Product Development Manager. At CDM Optics, Chris was responsible for marketing of medical products as intern for a start-up company that designs and manufactures digital imaging systems. Chris's experience and training as a UC M.B.A. will enable him to build the network of partnerships needed to build SpongeShark into a leader in the wireless world.

Kate Tallman—CMO

Kate Tallman brings a wealth of experience to SpongeShark. Kate spent time as a research analyst from 1996-1999 analyzing marketing positions and business strategies of healthcare companies. After this, Kate worked in the marketing department of Ecrix Corporation, a data storage company, evaluating e-commerce strategies. Kate is near the top of the UC M.B.A. class, and is specializing in marketing and entrepreneurship.

Advisory Board

Juan Rodriguez

A cofounder of StorageTek, Juan brings tremendous experience in both technology and management to the SpongeShark team. Juan has founded 3 companies since StorageTek, including Exabyte and Ecrix. Juan serves on the board of directors of several start-up companies.

Urs von Euw

Urs is the CIO of Swiss Air Group, the technology arm of Swiss Air. Swiss Air is the leader in wireless check-in services for the airline industry, however, they do not have a Bluetooth solution. Urs is advising SpongeShark on airline needs and current solutions.

Lex Aludeman

Lex was the system administrator for ITN.net, a web development company for the airline industry. Lex brings industry contacts and experience to SpongeShark's team. His knowledge of airline databases and e-commerce systems are being leveraged in building the SpongeShark solution.

FINANCIAL PLAN

Summary

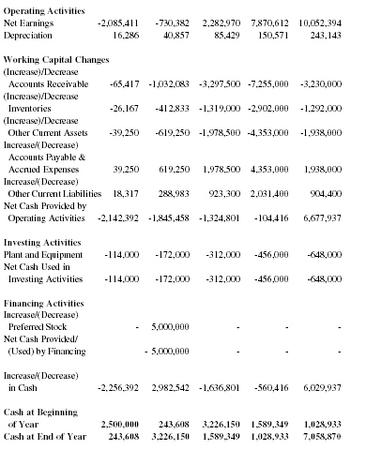

A summary of the financial outlook for SpongeShark is outlined below. Please see Appendix B for a complete set of financial projections, including annual income statements, balance sheets and cash flow statements for 2001 through 2005, as well as monthly income statements and cash flow statements for 2001. An analysis of key financial, profitability, and return ratios is also included in Appendix B.

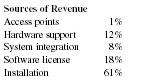

Sources of Revenue

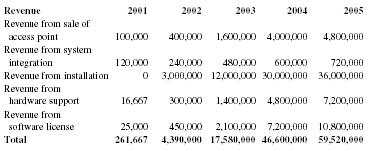

SpongeShark will generate revenue from five elements of each airline contract. These revenue streams include the sale of access point hardware, fees for system integration with the airline databases and reservation system, installation of the main server and access points, annual hardware support contracts, and annual software license contracts. The breakdown of the revenue streams can be seen in the chart below representing our total revenues of $60 million in our fifth year of operation.

| Sources of Revenue | |

| Access points | 1% |

| Hardware support | 12% |

| System integration | 8% |

| Software license | 18% |

| Installation | 61% |

The hardware support and software license contracts will be sold on a per access point basis and will generate monthly cash flows for SpongeShark. Therefore, 30 percent of our revenues will be recurring on a monthly basis throughout the entire duration of our relationship with an airline.

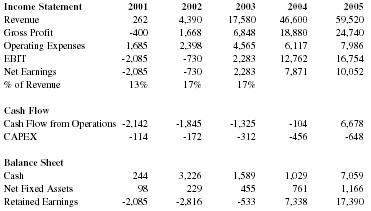

Financial Projections

SpongeShark expects to acquire our first airline client in Q4 2001. This initial customer will test our system in a major European hub airport and several smaller airports with approximately 50 total access points. We are anticipating break-even to occur in 2002 after acquiring our fourth airline client. Roughly at this same time we expect a substantial increase in revenues due to an increase in customer acquisition, larger contracts with additional access points, and the reoccurring revenues generated from the hardware support and software license contracts. In our fifth year of operations we are anticipating revenues of $60 million while generating net income of $10 million.

A summary of our financial projections can be seen below:

| Income Statement | 2001 | 2002 | 2003 | 2004 | 2005 |

| Revenue | 262 | 4,390 | 17,580 | 46,600 | 59,520 |

| Gross Profit | -400 | 1,668 | 6,848 | 18,880 | 24,740 |

| Operating Expenses | 1,685 | 2,398 | 4,565 | 6,117 | 7,986 |

| EBIT | -2,085 | -730 | 2,283 | 12,762 | 16,754 |

| Net Earnings | -2,085 | -730 | 2,283 | 7,871 | 10,052 |

| % of Revenue | 13% | 17% | 17% | ||

| Cash Flow | |||||

| Cash Flow from Operations | -2,142 | -1,845 | -1,325 | -104 | 6,678 |

| CAPEX | -114 | -172 | -312 | -456 | -648 |

| Balance Sheet | |||||

| Cash | 244 | 3,226 | 1,589 | 1,029 | 7,059 |

| Net Fixed Assets | 98 | 229 | 455 | 761 | 1,166 |

| Retained Earnings | -2,085 | -2,816 | -533 | 7,338 | 17,390 |

| Growth | ||||

| Revenue Annual Growth | 1,578% | 300% | 165% | 28% |

| Net Earnings Annual Growth | 245% | 28% |

Financial Assumptions

The number of clients acquired annually after the initial test market can be seen below:

| 2001 | 2002 | 2003 | 2004 | 2005 | |

| New airline clients | 1 | 2 | 4 | 5 | 6 |

| Cumulative clients | 1 | 3 | 7 | 12 | 18 |

In our fifth year of operation we will have a total of 18 airline clients representing approximately 400 access points per airline. The number of access points increases from the initial number of 50 due to the fact that at this time our clients will be using our service in both European and North American airports.

SpongeShark will be purchasing the servers and access points from outside vendors and will not be designing or assembling these products in-house. In addition, the company will be outsourcing the installation and maintenance of the access points in the airports. Working capital requirements have been estimated using an analysis of comparable firms in the communication services and information technology industries. Please see Appendix B for additional financial assumptions used in constructing these projections.

Capital Required

An initial equity investment of $2,500,000 is required to launch the business and provide funds for research and development, marketing expenses, working capital requirements, and to finance our first installation. We will require an additional round of funding in twelve months of $5,000,000 to fund the rapid growth of the company expected at this time.

SpongeShark is seeking these funds from a variety of sources. Specifically, the company is seeking venture capital or angel investors who are familiar with the wireless communication or airline industries. In addition, other nontraditional sources of funding are being considered. Airlines are currently in a technological race to see who can offer the best customer service using a variety of technologies and they are not interested in developing these services inhouse. Therefore, customer advances or customer participation in the development of the company are seen as additional sources of financing.

Business Risks

Technology

Currently it is still unknown whether Bluetooth will be the wireless technology of choice in the future. However, the SpongeShark concept is not technology specific and can be delivered using other wireless technologies. In addition, the adoption rate of Bluetooth-enabled handheld devices could potentially delay the introduction of the SpongeShark wireless service. However, airlines are interested in rolling out these services before widespread adoption of these devices has taken place.

Operations

SpongeShark is currently in the development stage of operations. Therefore, it is possible for the service to take longer to launch than anticipated, delaying the timeline for acquiring our first customer. In addition, an inability to control the costs involved with supplying the service could potentially decrease our net income projections. Since the hardware that we will be utilizing to deliver our service already exists, we hope to minimize any technological hurdles that could potentially delay the introduction of our service.

Competition

There are companies in the marketplace interested in delivering a variety of wireless services to the airline traveler. However, SpongeShark is uniquely focused on delivering services to the airlines to further enhance their customer service. Information technology companies, systems integrators, or communication service companies could move in on the wireless space that SpongeShark will be operating in. However, we expect to develop a niche expertise in delivering customer service solutions via a Bluetooth network. Currently, the focus of many of the companies interested in developing Bluetooth technology are working on building hardware and not services around the technology.

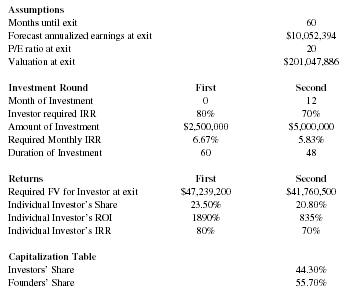

OFFERING

In return for an investment of $2.5 million, SpongeShark is offering a 24 percent share of the company to the investor. We expect that this investment will grow by 80 percent annually over our five-year planning horizon. Details of the valuation and returns to the investor calculations can be found in Appendix B.

Funding Required

SpongeShark is seeking an initial equity investment of $2.5 million to fund research and development, marketing expenses, working capital requirements, and to finance our first installation. A second round investment of $5 million will be required 12 months after the initial round to support additional customer acquisitions and subsequent rapid growth of the company.

Valuation and Offering

SpongeShark's valuation at the time of the anticipated exit event in 2005 is approximately $200 million. The initial $2.5 million investment will acquire 24 percent of the company in preferred Series "A" stock. The investor is expected to gain an internal rate of return of 80 percent and a 20X return on investment at the exit event in five years.

The second round investment of $5 million will acquire an additional 21 percent of the company in preferred Series "B" stock. The second round investor is expected to achieve an internal rate of return of 70 percent and a 8X return on investment at the exit event in four years.

Exit Strategies

The preferred exit strategy in 2005 for SpongeShark investors will be acquisition after the company has proved the business model and has begun to stabilize operations and revenue growth. By the fifth year of operation, SpongeShark will have substantial revenues and a valuable knowledge base regarding delivering wireless technologies to the travel industry. Larger information technology, systems integrators, or wireless communications companies that have not developed a Bluetooth expertise in-house will find SpongeShark to be an attractive acquisition target. An additional liquidity event for our investors will be an initial public offering in 2005. This strategy will depend largely on the market for initial public offerings at the time of exit.

APPENDIX

Appendix A: Check-In Procedures

Premise 1: End user purchases e-ticket prior to departure. The airline reservation system records the transaction.

Premise 2: Handheld device is used as an e-wallet for many other transactions.

- Enter check-in "zones" for Bluetooth handheld device users

-

Connect to check-in system using handheld device

User is identified via e-wallet technology.

User confirms ID with log-in and password. -

Accept or change ticketing information

To accept your seat or review any special requests you may have made when booking, touch the relevant buttons on your handheld device. -

Change your seat with ease

If you want to amend your seat allocation, you will be linked to this screen. To change your seat, just touch an available seat and it's yours. -

Check-in your baggage

If you have baggage to check in, just hand it to the airline customer service officer at the adjacent baggage drop-off counter. -

Collect your boarding pass instantly

Once you finish check-in, your boarding pass is activated on your handheld device.

Proceed to the gate to board the plane.

Appendix B: Financial Statements and Assumptions

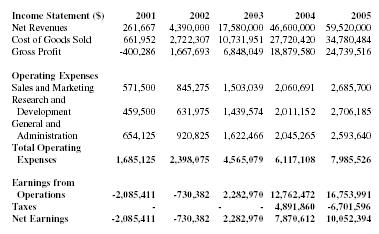

Income Statement

| Income Statement ($) | 2001 | 2002 | 2003 | 2004 | 2005 |

| Net Revenues | 261,667 | 4,390,000 | 17,580,000 | 46,600,000 | 59,520,000 |

| Cost of Goods Sold | 661,952 | 2,722,307 | 10,731,951 | 27,720,420 | 34,780,484 |

| Gross Profit | -400,286 | 1,667,693 | 6,848,049 | 18,879,580 | 24,739,516 |

| Operating Expenses | |||||

| Sales and Marketing | 571,500 | 845,275 | 1,503,039 | 2,060,691 | 2,685,700 |

| Research and Development | 459,500 | 631,975 | 1,439,574 | 2,011,152 | 2,706,185 |

| General and Administration | 654,125 | 920,825 | 1,622,466 | 2,045,265 | 2,593,640 |

| Total Operating Expenses | 1,685,125 | 2,398,075 | 4,565,079 | 6,117,108 | 7,985,526 |

| Earnings from Operations | -2,085,411 | -730,382 | 2,282,970 | 12,762,472 | 16,753,991 |

| Taxes | - | - | - | 4,891,860 | -6,701,596 |

| Net Earnings | -2,085,411 | -730,382 | 2,282,970 | 7,870,612 | 10,052,394 |

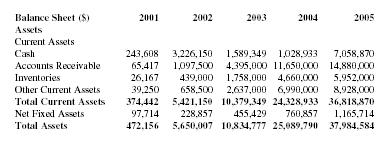

Balance Sheet

| Balance Sheet ($) | 2001 | 2002 | 2003 | 2004 | 2005 |

| Assets | |||||

| Current Assets | |||||

| Cash | 243,608 | 3,226,150 | 1,589,349 | 1,028,933 | 7,058,870 |

| Accounts Receivable | 65,417 | 1,097,500 | 4,395,000 | 11,650,000 | 14,880,000 |

| Inventories | 26,167 | 439,000 | 1,758,000 | 4,660,000 | 5,952,000 |

| Other Current Assets | 39,250 | 658,500 | 2,637,000 | 6,990,000 | 8,928,000 |

| Total Current Assets | 374,442 | 5,421,150 | 10,379,349 | 24,328,933 | 36,818,870 |

| Net Fixed Assets | 97,714 | 228,857 | 455,429 | 760,857 | 1,165,714 |

| Total Assets | 472,156 | 5,650,007 | 10,834,777 | 25,089,790 | 37,984,584 |

| Liabilities and Shareholders' Equity | ||||||

| Current Liabilities | ||||||

| Accounts Payable and Accrued Expenses | 39,250 | 658,500 | 2,637,000 | 6,990,000 | 8,928,000 | |

| Other Current Liabilities | 18,317 | 307,300 | 1,230,600 | 3,262,000 | 4,166,400 | |

| Total Current Liabilities | 57,567 | 965,800 | 3,867,600 | 10,252,000 | 13,094,400 | |

| Stockholders' Equity | ||||||

| Preferred Stock | 2,500,000 | 7,500,000 | 7,500,000 | 7,500,000 | 7,500,000 | |

| Retained Earnings | -2,085,411 | -2,815,793 | -532,823 | 7,337,790 | 17,390,184 | |

| Total Equity | 414,589 | 4,684,207 | 6,967,177 | 14,837,790 | 24,890,184 | |

| Total Liabilities and Equity | 472,156 | 5,650,007 | 10,834,777 | 25,089,790 | 37,984,584 | |

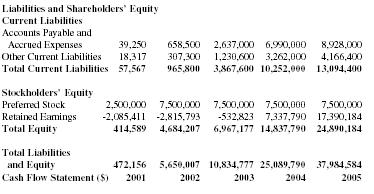

| Cash Flow Statement ($) | 2001 | 2002 | 2003 | 2004 | 2005 |

Cash Flow Statement

| Operating Activities | |||||

| Net Earnings | -2,085,411 | -730,382 | 2,282,970 | 7,870,612 | 10,052,394 |

| Depreciation | 16,286 | 40,857 | 85,429 | 150,571 | 243,143 |

| Working Capital Changes | |||||

| (Increase)/Decrease Accounts Receivable | -65,417 | -1,032,083 | -3,297,500 | -7,255,000 | -3,230,000 |

| (Increase)/Decrease Inventories | -26,167 | -412,833 | -1,319,000 | -2,902,000 | -1,292,000 |

| (Increase)/Decrease Other Current Assets | -39,250 | -619,250 | -1,978,500 | -4,353,000 | -1,938,000 |

| Increase/(Decrease) Accounts Payable & Accrued Expenses | 39,250 | 619,250 | 1,978,500 | 4,353,000 | 1,938,000 |

| Increase/(Decrease) Other Current Liabilities | 18,317 | 288,983 | 923,300 | 2,031,400 | 904,400 |

| Net Cash Provided by Operating Activities | -2,142,392 | -1,845,458 | -1,324,801 | -104,416 | 6,677,937 |

| Investing Activities | |||||

| Plant and Equipment | -114,000 | -172,000 | -312,000 | -456,000 | -648,000 |

| Net Cash Used in Investing Activities | -114,000 | -172,000 | -312,000 | -456,000 | -648,000 |

| Financing Activities | |||||

| Increase/(Decrease) Preferred Stock | - | 5,000,000 | - | - | - |

| Net Cash Provided/(Used) by Financing | - | 5,000,000 | - | - | - |

| Increase/(Decrease) in Cash | -2,256,392 | 2,982,542 | -1,636,801 | -560,416 | 6,029,937 |

| Cash at Beginning of Year | 2,500,000 | 243,608 | 3,226,150 | 1,589,349 | 1,028,933 |

| Cash at End of Year | 243,608 | 3,226,150 | 1,589,349 | 1,028,933 | 7,058,870 |

This page left intentionally blank to accommodate tabular matter following.

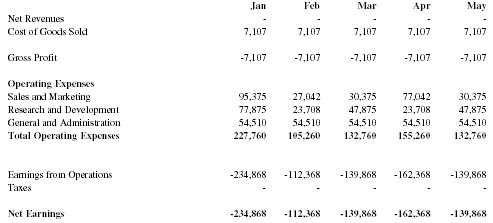

Income Statement ($)

| Jan | Feb | Mar | Apr | May | |

| Net Revenues | - | - | - | - | - |

| Cost of Goods Sold | 7,107 | 7,107 | 7,107 | 7,107 | 7,107 |

| Gross Profit | -7,107 | -7,107 | -7,107 | -7,107 | -7,107 |

| Operating Expenses | |||||

| Sales and Marketing | 95,375 | 27,042 | 30,375 | 77,042 | 30,375 |

| Research and Development | 77,875 | 23,708 | 47,875 | 23,708 | 47,875 |

| General and Administration | 54,510 | 54,510 | 54,510 | 54,510 | 54,510 |

| Total Operating Expenses | 227,760 | 105,260 | 132,760 | 155,260 | 132,760 |

| Earnings from Operations | -234,868 | -112,368 | -139,868 | -162,368 | -139,868 |

| Taxes | - | - | - | - | - |

| Net Earnings | -234,868 | -112,368 | -139,868 | -162,368 | -139,868 |

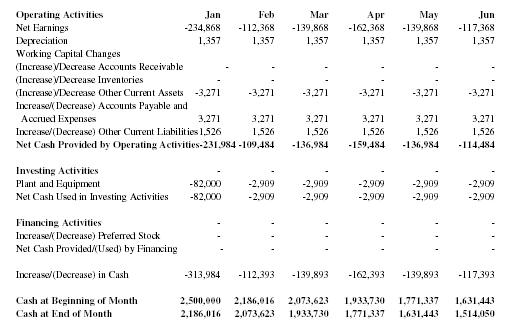

Cash Flow Statement ($)

| Operating Activities | Jan | Feb | Mar | Apr | May | Jun |

| Net Earnings | -234,868 | -112,368 | -139,868 | -162,368 | -139,868 | -117,368 |

| Depreciation | 1,357 | 1,357 | 1,357 | 1,357 | 1,357 | 1,357 |

| Working Capital Changes | ||||||

| (Increase)/Decrease Accounts Receivable | - | - | - | - | - | - |

| (Increase)/Decrease Inventories | - | - | - | - | - | - |

| (Increase)/Decrease Other Current Assets | -3,271 | -3,271 | -3,271 | -3,271 | -3,271 | -3,271 |

| Increase/(Decrease) Accounts Payable and Accrued Expenses | 3,271 | 3,271 | 3,271 | 3,271 | 3,271 | 3,271 |

| Increase/(Decrease) Other Current Liabilities | 1,526 | 1,526 | 1,526 | 1,526 | 1,526 | 1,526 |

| Net Cash Provided by Operating Activities | -231,984 | -109,484 | -136,984 | -159,484 | -136,984 | -114,484 |

| Investing Activities | - | - | - | - | - | - |

| Plant and Equipment | -82,000 | -2,909 | -2,909 | -2,909 | -2,909 | -2,909 |

| Net Cash Used in Investing Activities | -82,000 | -2,909 | -2,909 | -2,909 | -2,909 | -2,909 |

| Financing Activities | - | - | - | - | - | - |

| Increase/(Decrease) Preferred Stock | - | - | - | - | - | - |

| Net Cash Provided/(Used) by Financing | - | - | - | - | - | - |

| Increase/(Decrease) in Cash | -313,984 | -112,393 | -139,893 | -162,393 | -139,893 | -117,393 |

| Cash at Beginning of Month | 2,500,000 | 2,186,016 | 2,073,623 | 1,933,730 | 1,771,337 | 1,631,443 |

| Cash at End of Month | 2,186,016 | 2,073,623 | 1,933,730 | 1,771,337 | 1,631,443 | 1,514,050 |

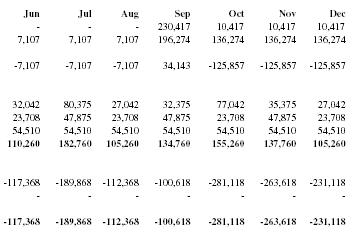

| Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| - | - | - | 230,417 | 10,417 | 10,417 | 10,417 |

| 7,107 | 7,107 | 7,107 | 196,274 | 136,274 | 136,274 | 136,274 |

| -7,107 | -7,107 | -7,107 | 34,143 | -125,857 | -125,857 | -125,857 |

| 32,042 | 80,375 | 27,042 | 32,375 | 77,042 | 35,375 | 27,042 |

| 23,708 | 47,875 | 23,708 | 47,875 | 23,708 | 47,875 | 23,708 |

| 54,510 | 54,510 | 54,510 | 54,510 | 54,510 | 54,510 | 54,510 |

| 110,260 | 182,760 | 105,260 | 134,760 | 155,260 | 137,760 | 105,260 |

| -117,368 | -189,868 | -112,368 | -100,618 | -281,118 | -263,618 | -231,118 |

| - | - | - | - | - | - | - |

| -117,368 | -189,868 | -112,368 | -100,618 | -281,118 | -263,618 | -231,118 |

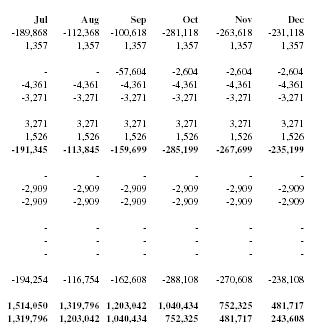

| Jul | Aug | Sep | Oct | Nov | Dec |

| -189,868 | -112,368 | -100,618 | -281,118 | -263,618 | -231,118 |

| 1,357 | 1,357 | 1,357 | 1,357 | 1,357 | 1,357 |

| - | - | -57,604 | -2,604 | -2,604 | -2,604 |

| -4,361 | -4,361 | -4,361 | -4,361 | -4,361 | -4,361 |

| -3,271 | -3,271 | -3,271 | -3,271 | -3,271 | -3,271 |

| 3,271 | 3,271 | 3,271 | 3,271 | 3,271 | 3,271 |

| 1,526 | 1,526 | 1,526 | 1,526 | 1,526 | 1,526 |

| -191,345 | -113,845 | -159,699 | -285,199 | -267,699 | -235,199 |

| - | - | - | - | - | - |

| -2,909 | -2,909 | -2,909 | -2,909 | -2,909 | -2,909 |

| -2,909 | -2,909 | -2,909 | -2,909 | -2,909 | -2,909 |

| - | - | - | - | - | - |

| - | - | - | - | - | - |

| - | - | - | - | - | - |

| -194,254 | -116,754 | -162,608 | -288,108 | -270,608 | -238,108 |

| 1,514,050 | 1,319,796 | 1,203,042 | 1,040,434 | 752,325 | 481,717 |

| 1,319,796 | 1,203,042 | 1,040,434 | 752,325 | 481,717 | 243,608 |

Financial Assumptions

Revenue

Revenue projections assume that the first airline contract will include the sale of 50 access points. This number will increase to 100 access points per airline in 2002, 200 access points per airline in 2003, and 400 access points per airline in 2004 and 2005. The number of access points steadily increases as our clients move from using our service in European airports to both European and North American airports. The number of access points per airline is based on the average number of gates and major airports served by several of our target airline customers. A breakdown of our revenue projections can be seen below:

| Revenue | 2001 | 2002 | 2003 | 2004 | 2005 |

| Revenue from sale of access point | 100,000 | 400,000 | 1,600,000 | 4,000,000 | 4,800,000 |

| Revenue from system integration | 120,000 | 240,000 | 480,000 | 600,000 | 720,000 |

| Revenue from installation | 0 | 3,000,000 | 12,000,000 | 30,000,000 | 36,000,000 |

| Revenue from hardware support | 16,667 | 300,000 | 1,400,000 | 4,800,000 | 7,200,000 |

| Revenue from software license | 25,000 | 450,000 | 2,100,000 | 7,200,000 | 10,800,000 |

| Total | 261,667 | 4,390,000 | 17,580,000 | 46,600,000 | 59,520,000 |

2001 revenue projections assume that we will not be receiving revenue from the installation of the 50 access points for our first client. SpongeShark will be funding this initial installation to lower the financial barriers for an airline testing our service. In addition, we will only be receiving revenue from the hardware support and software license contracts for four months since we will be acquiring this customer at the beginning of Q4. Our pricing structure can be found in the Marketing Plan.

Cost of Goods Sold

The cost of system integration and the software license contracts is assumed to include the salaries of the software engineers working on these projects. We are assuming that the cost per access point will be $1,200, which includes the cost of one server for every fifty access points. The cost of installation will average $10,000 per access point based on the assumption of approximately $200 per hour labor charge and 50 hours of labor. The cost of hardware support is $1,000 per access point based on a $100 per hour labor charge and 10 hours of labor.

Operating Expenses

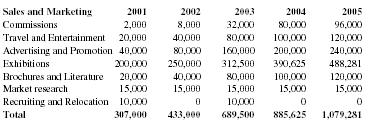

Sales and marketing expenses can be seen in the chart below:

| Sales and Marketing | 2001 | 2002 | 2003 | 2004 | 2005 |

| Commissions | 2,000 | 8,000 | 32,000 | 80,000 | 96,000 |

| Travel and Entertainment | 20,000 | 40,000 | 80,000 | 100,000 | 120,000 |

| Advertising and Promotion | 40,000 | 80,000 | 160,000 | 200,000 | 240,000 |

| Exhibitions | 200,000 | 250,000 | 312,500 | 390,625 | 488,281 |

| Brochures and Literature | 20,000 | 40,000 | 80,000 | 100,000 | 120,000 |

| Market research | 15,000 | 15,000 | 15,000 | 15,000 | 15,000 |

| Recruiting and Relocation | 10,000 | 0 | 10,000 | 0 | 0 |

| Total | 307,000 | 433,000 | 689,500 | 885,625 | 1,079,281 |

Commissions are assumed to be 2 percent of the sale of access points. Travel and entertainment expenses are $20,000 per new airline client. Advertising and promotion expenses are $40,000 per new airline client. Exhibition and trade show expenses are $200,000 in 2001 and grow at 25 percent per year. Brochures and literature are $20,000 per new airline client. Recruiting and relocation includes $10,000 per relocated executive employee.

Sales and marketing salaries, benefits, and headcount for this department can be seen below:

| Sales and Marketing | |||||

| Salaries | 2001 | 2002 | 2003 | 2004 | 2005 |

| Total Salaries | 230,000 | 358,500 | 707,425 | 1,021,796 | 1,396,886 |

| Benefits (15% of salary) | 34,500 | 53,775 | 106,114 | 153,269 | 209,533 |

| Headcount | 3 | 5 | 10 | 15 | 21 |

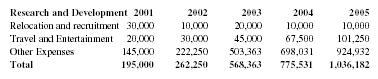

Research and development expenses can be seen in the chart below:

| Research and Development | 2001 | 2002 | 2003 | 2004 | 2005 |

| Relocation and recruitment | 30,000 | 10,000 | 20,000 | 10,000 | 10,000 |

| Travel and Entertainment | 20,000 | 30,000 | 45,000 | 67,500 | 101,250 |

| Other Expenses | 145,000 | 222,250 | 503,363 | 698,031 | 924,932 |

| Total | 195,000 | 262,250 | 568,363 | 775,531 | 1,036,182 |

Relocation and recruitment includes $10,000 per relocated executive employee. Travel and entertainment is assumed to be $20,000 in 2001 with a 50 percent annual growth. Other expenses were assumed to be 50 percent of the research and development salary budget.

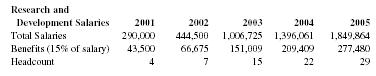

Research and Development salaries, benefits, and headcount for this department can be seen below. These totals include the salaries of the software engineers that are figured as cost of goods sold.

| Research and Development Salaries | 2001 | 2002 | 2003 | 2004 | 2005 |

| Total Salaries | 290,000 | 444,500 | 1,006,725 | 1,396,061 | 1,849,864 |

| Benefits (15% of salary) | 43,500 | 66,675 | 151,009 | 209,409 | 277,480 |

| Headcount | 4 | 7 | 15 | 22 | 29 |

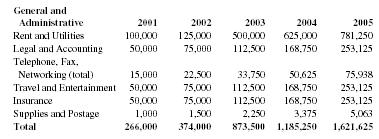

General and administrative expenses can be seen in the chart below:

| General and Administrative | 2001 | 2002 | 2003 | 2004 | 2005 |

| Rent and Utilities | 100,000 | 125,000 | 500,000 | 625,000 | 781,250 |

| Legal and Accounting | 50,000 | 75,000 | 112,500 | 168,750 | 253,125 |

| Telephone, Fax, Networking (total) | 15,000 | 22,500 | 33,750 | 50,625 | 75,938 |

| Travel and Entertainment | 50,000 | 75,000 | 112,500 | 168,750 | 253,125 |

| Insurance | 50,000 | 75,000 | 112,500 | 168,750 | 253,125 |

| Supplies and Postage | 1,000 | 1,500 | 2,250 | 3,375 | 5,063 |

| Total | 266,000 | 374,000 | 873,500 | 1,185,250 | 1,621,625 |

The increase in rent and utilities in 2003 is based on the assumption that SpongeShark will move into a larger facility in this year. All other general administrative expenses grow at an annual rate of 50 percent.

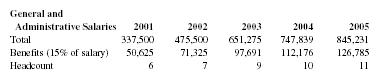

General and administrative salaries, benefits, and headcount for this department can be seen below:

| General and Administrative Salaries | 2001 | 2002 | 2003 | 2004 | 2005 |

| Total | 337,500 | 475,500 | 651,275 | 747,839 | 845,231 |

| Benefits (15% of salary) | 50,625 | 71,325 | 97,691 | 112,176 | 126,785 |

| Headcount | 6 | 7 | 9 | 10 | 11 |

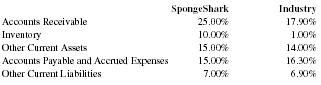

Balance Sheet

Balance sheet assumptions were based on an analysis of comparable companies and industry data from the computer-related services and wireless communication industries. SpongeShark's cash account is inflated in 2005 because we intend to use this cash to fund development and deployment of our service in other areas of the travel ribbon. In addition, our accounts receivables are above average based on the assumption that our installations will take roughly three months to complete at which time we will receive payment from our clients. Also, our inventory requirements are above average as we will require an inventory of access points to satisfy our customer's expansion plans and to realize economies of scale when purchasing the access points from outside vendors. The balance sheet accounts as a percent of revenues can be seen in the chart below:

| SpongeShark | Industry | |

| Accounts Receivable | 25.00% | 17.90% |

| Inventory | 10.00% | 1.00% |

| Other Current Assets | 15.00% | 14.00% |

| Accounts Payable and Accrued Expenses | 15.00% | 16.30% |

| Other Current Liabilities | 7.00% | 6.90% |

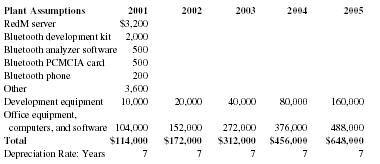

Property, plant, and equipment assumptions can be seen below:

| Plant Assumptions | 2001 | 2002 | 2003 | 2004 | 2005 |

| RedM server | $3,200 | ||||

| Bluetooth development kit | 2,000 | ||||

| Bluetooth analyzer software | 500 | ||||

| Bluetooth PCMCIA card | 500 | ||||

| Bluetooth phone | 200 | ||||

| Other | 3,600 | ||||

| Development equipment | 10,000 | 20,000 | 40,000 | 80,000 | 160,000 |

| Office equipment, computers, and software | 104,000 | 152,000 | 272,000 | 376,000 | 488,000 |

| Total | $114,000 | $172,000 | $312,000 | $456,000 | $648,000 |

| Depreciation Rate: Years | 7 | 7 | 7 | 7 | 7 |

Development equipment requirements will grow 100 percent per year from the initial amount of $10,000. Office equipment, computers, and software are assumed to be $8,000 per person.

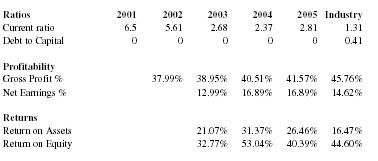

Ratio Analysis

A summary of the key financial ratios and profitability and return percentages can be seen below. The industry numbers are constructed from a compilation of ratios from comparable companies and industry averages from the computer-related services (SIC 7379) and the communication services (SIC 4899) industries.

| Ratios | 2001 | 2002 | 2003 | 2004 | 2005 | Industry |

| Current ratio | 6.5 | 5.61 | 2.68 | 2.37 | 2.81 | 1.31 |

| Debt to Capital | 0 | 0 | 0 | 0 | 0 | 0.41 |

| Profitability | ||||||

| Gross Profit % | 37.99% | 38.95% | 40.51% | 41.57% | 45.76% | |

| Net Earnings % | 12.99% | 16.89% | 16.89% | 14.62% | ||

| Returns | ||||||

| Return on Assets | 21.07% | 31.37% | 26.46% | 16.47% | ||

| Return on Equity | 32.77% | 53.04% | 40.39% | 44.60% |

Our current ratio is larger than the industry average because we are anticipating above average accounts receivables. This is a result of the assumption that our installation process will take approximately three months at which time we will receive payment from our airline client. SpongeShark expects to have an all equity capital structure throughout the five-year period.

SpongeShark's return on assets is above the industry average based on the assumption that we will be outsourcing the manufacturing aspects of the business and will not be an asset intensive company. The average gross profit, net earnings, and return on equity for 2003 through 2005 is near the industry average for each figure.

Valuation Calculation

The assumptions and calculations utilized to determine the returns to the investor and capitalization structure can be seen below:

| Assumptions | ||

| Months until exit | 60 | |

| Forecast annualized earnings at exit | $10,052,394 | |

| P/E ratio at exit | 20 | |

| Valuation at exit | $201,047,886 | |

| Investment Round | First | Second |

| Month of Investment | 0 | 12 |

| Investor required IRR | 80% | 70% |

| Amount of Investment | $2,500,000 | $5,000,000 |

| Required Monthly IRR | 6.67% | 5.83% |

| Duration of Investment | 60 | 48 |

| Returns | First | Second |

| Required FV for Investor at exit | $47,239,200 | $41,760,500 |

| Individual Investor's Share | 23.50% | 20.80% |

| Individual Investor's ROI | 1890% | 835% |

| Individual Investor's IRR | 80% | 70% |

| Capitalization Table | ||

| Investors' Share | 44.30% | |

| Founders' Share | 55.70% |

Appendix C: Detailed Description of Product and Service

Handset Technology

Mobile phones and PDAs do have limitations. Wireless Internet currently receives negative reviews due to the difficulty in typing words. To type, mobile phones force a user to use the number pad, which often means pressing multiple buttons just to type a single letter. Prototype phones have attempted to eliminate this problem by including a keyboard, but the small buttons are often difficult to use. Understanding this limitation, SpongeShark will offer an easy to use menu-like interface to reduce the amount of keystrokes necessary for an end-user.

Menu and icon driven pages will be the most effective on mobile phone displays. The resolution of the screens will allow for creativity similar to current web design, which is also designed for point-and-click navigation. As a result, airlines have the ability to use their preexisting e-commerce site templates. Not only can this expedite integration, but it can work in tangent with the airline's e-commerce site to build brand recognition for their online services.

Legacy Integration

Converting the travel information into the appropriate format for this new service will require a "transcoding" process which involves filtering and adapting content developed in standard markup languages (which enable browser applications to interpret and display data) to be better suited to end-user devices.

SpongeShark will write a JAVA application to translate the airline's travel-related information into the Wireless Markup Language (WML): a format that can be presented on Wireless Application Protocol (WAP) enabled devices. The resulting WML content will then pass through our wireless access points via Bluetooth to phones and PDA's supporting WAP. The WAP browser has become the standard for mobile Internet use and therefore will not require any pre-installation or purchase by the passenger.

Following is a graphical representation of how SpongeShark's software application translates data into a presentable form for the passenger:

CRS Database SpongeShark GUI Bluetooth (Sabre, Oracle, etc.) (JAVA, WML, WAP) PDA, Phone, Notebook

Authentication

To ensure a user's identity, SpongeShark plans to provide a two-level security system. Currently, self-serve kiosks ask for a credit card swipe of the credit card used to make the initial ticket purchase. This is an example of single level security. Every mobile phone and PDA, regardless of manufacturer, carries a unique identification string. SpongeShark will associate this ID with the user for a primary security. Additionally, SpongeShark will ask each user to create a unique username and password for login purposes. An airline using SpongeShark as part of their customer loyalty program could have the username be the frequent flyer membership number of that passenger. Future options in security include biometrics such as voice recognition or digital signatures.