Online Customer Service Support

BUSINESS PLAN

LIVE E-CARE, INC.

801 North Main Street

Ann Arbor, Michigan 48104

live e-care is an outsource provider of online customer service support. We guarantee personalized e-mail management and live text chat response at a cost 30 to 50 percent lower than our customers' cost for an in-house alternative. The company plans to add revenue streams from ancillary services, including enhanced knowledge management and consulting services. Our goal is to become the leading outsourcer of web-based customer service support in the United States.

- EXECUTIVE SUMMARY

- BACKGROUND

- MANAGEMENT TEAM & ORGANIZATION

- MARKET ANALYSIS

- MARKETING PLAN

- SALES STRATEGY

- OPERATIONS

- HUMAN RESOURCES STRATEGY

- FINANCIAL PLAN

EXECUTIVE SUMMARY

The Company

live e-care is an outsource provider of online customer service support, one of the critical customer-retention services for e-business. We guarantee personalized e-mail management and live text chat response at a cost 30 to 50 percent lower than our customers' cost for an in-house alternative. As we amass customer and company information, live e-care will add revenue streams from ancillary services, including enhanced knowledge management and consulting services. Our goal is to become the leading outsourcer of web-based customer service support in the United States.

Operations will be located in the Philippines to draw on an educated, highly skilled, English-fluent workforce with labor costs substantially lower than in the U.S. Sales, marketing, client contact, and billing will be handled through U.S. offices.

The Opportunity

The Internet technologies which created the opportunity for e-business have also destroyed the traditional switching costs on which businesses relied for customer retention. With switching costs for online customers nearly negligible—the competitor's site is just one click away—customer service is becoming the key to developing and maintaining online customer loyalty and to managing online customer repurchase, recommendation, and retention.

Although e-businesses are becoming aware of this critical need, few have developed a plan, much less an infrastructure, to respond adequately to the volume or the specificity of customer service requests. Online requests for customer service come, overwhelmingly, via e-mail: IT consultants the Gartner Group predict that 25 percent of all customer communications will be via e-mail and web form by 2001. In surveying 125 major websites, however, marketing communications firm Jupiter Communications found that 42 percent either took too long to respond, or entirely failed to respond to customer inquiries. The business outcomes are tangible: Andersen Consulting found that over the 1999 holiday season, 88 percent of online customers left behind their virtual shopping carts without completing a purchase.

Meanwhile, total revenues flowing through online retailing channels continue to grow about 53 percent annually—1999's total of $36 billion is expected to stretch to $84 billion by 2001—increasing the pressure on online retailers to sharpen their core competencies in the manufacture and supply of retail goods. Retailers who have turned the responsibility for online customer service over to automated, immediate solutions, such as auto reply applications, have found these applications do not truly address the specifics of customer inquiries, and are therefore of little help in building customer loyalty.

The core competence of live e-care is bridging this gap. We guarantee a personalized response to each online customer service request our clients receive; we guarantee response time of less than twelve hours; we make the online shopping experience pleasant and personal for our clients' customers; and we allow our clients to refocus all their energies on their own core competitive competencies.

Key Success Factors

Because the market for our services is still so young, the key success factors for developing market share involve the ability to deliver service quickly and reliably, and to scale operations quickly without loss of quality. live e-care will succeed by delivering:

- Quality, consistent, and timely service to our clients' customers

- Rapid implementation of customized web-based support solutions

- Timely and insightful analysis (trends, etc.) of customer service transactions

- Accurate and reliable customer service at costs 30 to 50 percent lower than the costs our clients would bear in supporting these capabilities in-house.

Sustainable Competitive Advantages

There is no clear dominant provider of outsourced online customer service support. What is clear is that there are not enough providers in the market to handle the increasing demand. Competitors, correspondingly, have focused on grabbing early market share, rather than developing a long-term strategy for maintaining share as the market matures.

live e-care's operational competencies are built around two long-term competitive advantages:

- A labor cost advantage of 30 percent or greater, without compromising quality. By basing operations in the Philippines, we have access to an educated, literate, English-speaking workforce of 35 million people which commands salaries 80 to 90 percent lower than their counterparts in the U.S. Because the Philippines and the U.S. have strong historical ties, moreover, this workforce is more culturally attuned to U.S. jargon, brands, and attitudes than workforces in other low-labor-cost locations.

- A 4- to 8-year tax holiday, followed by a 5 percent income tax rate. The nature of the services we offer qualify us as a Philippine Export Zone Association (PEZA) company. In addition to the tax incentives, we are granted duty-free import of capital equipment.

Management Team

These structural advantages are bolstered by a management team which brings together practical experience in all aspects of live e-care's operations, as well as business training and experience in the U.S. and the Philippines.

Board of Advisors

live e-care has assembled a Board of Advisors with background in the business cultures of both the U.S. and the Philippines, and with functional experience in sales, marketing, finance, and private equity.

Marketing Strategy

live e-care will position itself as a highly-reliable, competitively-priced outsource provider of online customer service, and target:

- the new breed of successful e-tailers

- the traditional brick-and-mortar retailers rushing to go online

Our target clients will have estimated e-mail volume of at least 250 e-mails per day. Our marketing efforts will be a combination of direct sales force outreach and strategic advertising.

Sales Strategy

Our sales strategy relies on a direct sales force building relationships with U.S.-based businesses. We will recruit strong, experienced salespeople with backgrounds in industries reliant on customer relationships. A substantial portion (30-40%) of total cash compensation will be commission keyed to measures of customer satisfaction.

To allow our salespeople to focus on new business, and to help drive our projected increase in closing rates, account managers will service clients after the sale and will be responsible for generating prospective client lists. To ensure seamless, high-quality service we will assign a Client Relationship Team, composed of a salesperson, a sales account assistant, and dedicated customer service representatives in the Philippines, to each client account.

Pricing Strategy

E-mail management services will be billed at a fixed monthly rate of $5,000, with a variable fee of $1 for each e-mail transaction beyond the standard account quota of 5,000/month. Chat support services will be billed $10,000 per month for one 24/7 operator.

Human Resource Strategy

The ability to recruit high-quality customer service representatives in the Philippines will be critical to our success. Our recruiting will focus primarily on top Philippine universities and on identifying and hiring experienced talent. We will also work to reduce turnover, promote creativity, and attract quality talent through design of the physical and social work environments.

Operations Strategy

Operations will be located in the Philippines' Subic Bay Freeport, the former site of the largest U.S. Naval Base outside the United States. The infrastructure, of unusually high quality, includes office buildings, redundant electrical power, and access to high-speed data/telecommunications lines managed through a joint venture of AT&T.

Our IT operations will use current software to manage customer inquiry flow, skills-based routing of e-mails, chat sessions, and (eventually) voice calls. Strict quality assurance procedures and statistically valid sampling will ensure accurate and timely responses to inquiries. As we further develop expertise in the business needs and data of our clients, we will develop proprietary, state-of-the-art customer inquiry management software. We anticipate this software will become a sustainable advantage over our competitors.

Financial Forecasts

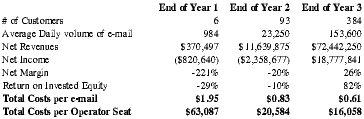

live e-care anticipates that revenues will grow from $370,497 in Year 1 to $72,442,250 by Year 3, with a Net Loss in Year 1 of $820,640 and Net Income reaching $18,777,841 by Year 3. Our ability to convert clients at a rate of 5 percent in Year 1, 7 percent in Year 2, and 10 percent in Year 3 and beyond, as well as an 80 percent adoption rate for our live chat and telephony service, will drive this revenue growth. Less certain revenues, such as those for consulting or FAQ database management, are not expected until late in Year 2 or 3 and are not included in these projections.

Return on Invested Equity (ROE)—based on projected capital needs of $350,000 at the start of operations, $2,500,000 in Q3 of Year 1, and $20,000,000 in Q2 of Year 2—will be 82 percent at the end of Year 3. The ROE will further increase in future years as Net Income grows.

live e-care will realize economies of both scale and scope as the number of clients increases. This is reflected in projections of annual costs per operator seat. Chat operator per-seat costs will drop from $63,087 in Year 1 to $16,058 in Year 3, and e-mail operator per-seat costs will decrease from $1.95 in Year 1 to $0.61 in Year 3. As these costs decrease, the Net Income margin will increase to 40 percent at the end of Year 3.

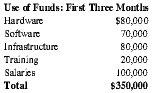

Use of Funds

The company has summarized a series of detailed pro-forma financial statements outlining the capital needs of the company over its first three years. The company intends to seek $350,000 for working capital needs at the start of the business. The majority of this capital will be needed to fund the purchase/licensing of hardware and software, as well as human resource needs. An additional $2,500,000 of capital will be needed approximately 6 to 9 months later in the project and $20,000,000 approximately 18 months after start-up. These funds will primarily be used for expansion of the sales force, infrastructure, and marketing.

BACKGROUND

The Opportunity—A Large and Growing Market

The market for outsourced, web-based customer support service is currently estimated at $18.4 million, out of a total teleservices market of $101 million, and is expected to grow to $1 billion in 3 years. Online buyers overwhelmingly rely on e-mail for customer service support: Forrester Research reports that 71 percent turn to e-mail to resolve their issues, and 51 percent use the telephone.

As online retailing activity increases, the need for web-based customer support, especially interactive online service providers, will continue to grow. Jae Kim of Paul Kagen Associates, an Internet consulting firm, estimates that less than 5 percent of retail websites now offer immediate customer assistance, but that 90 percent will offer the service within 3 years.

...which is turning toward an outsourcing solution. Yet the infrastructure of online customer service support is not, and will never become, the core competence of most retail firms. This is especially true of middle-market firms, for whom the resources required to develop and manage an effective, efficient online support center are a comparatively large and uncertain investment. Since online retailing eliminates many traditional switching costs for retail consumers, moreover, large and small firms alike must increasingly build their strategies for customer retention around tactics for customer satisfaction. As information technologies available for these purposes improve, these firms face an ongoing and expensive commitment to continuous improvement of infrastructure to support their continuous improvements in customer retention.

While online customer service support is both increasingly costly and necessary to these firms, it is unlikely to be a sustainable competitive advantage for any of them.

Outsourcing provides an ideal solution, especially for middle-market companies which will never achieve the economies of scale necessary to make an effective in-house operation cost competitive. Outsourcing allows these firms to maintain a substantial online competitive presence with minimal fixed investment in overhead and physical infrastructure.

...in which demand already outstrips the supply of quality service. Although outsourcing is increasing, web-based customer support is still often inadequate. Many companies have turned to autoreply software to meet the deluge of e-mail inquiries. These responses may prove worse than ignoring an e-mail: Business 2.0 found that 40 percent of automated responses did not even answer the customer's question. Surveying 125 sites supported by autoreply, in-house or outsourced customer response systems, Jupiter Communications found that 42 percent either ignored e-mail inquiries entirely or took longer than 5 days to respond.

Service Offerings

Focusing on providing a high level of service, exceptional reliability, and competitive pricing, live e-care will initially offer clients three support services:

1. E-mail management

E-mail support will be the heart of the live e-care system. State-of-the-art hardware and skills-based software routing will direct e-mails to appropriate customer service representatives (CSRs) who will review every reply to customer inquiries prior to sending a response. This will ensure a reply that answers the customer's question, and increases the probability of issue resolution at the first point of contact. Leveraging our knowledge and resources across multiple clients, moreover, we will achieve operational efficiencies, allowing us to provide the latest technologies as well as personalized, superior customer support to our clients.

2. Real-Time Text Chat Support

A newer customer support tool, chat support provides a pop-up text window on the customer's monitor through which the customer and the CSR "chat" about the customer's questions or concerns. Like e-mail, live chat allows a CSR to answer the customer's actual question directly; it also allows the CSR to act as a virtual salesperson, driving customer sales.

Chat support is currently being used, in fact, primarily as a sales tool. The majority of online customers end their purchasing efforts partway through the process: Jupiter Communications reports that 27 percent of web shoppers give up on their purchases when faced with online forms. Live chat services allow CSRs to walk the customer through the buying process, increasing the likelihood of an online sale.

3. Customer Information Analysis and Reporting

Using data gathered through these e-mail and chat transactions, live e-care can also analyze, summarize, and develop timely reports on customer trends which our clients can use to better adapt their businesses to the changing marketplace. This ability to develop, mine, and analyze customer databases has powered the growth of Amazon.com, among others. live e-care will offer our clients this ability to develop meaningful, real-time customer insights without the substantial expense of developing that ability in-house.

Future Offerings

As Internet and telecommunications technologies continue to converge, the blurring of their distinctions will present new opportunities to improve customer satisfaction and retention. live e-care will develop two additional service offerings to take advantage of these opportunities.

Voiceover I/P (VoIP)

VoIP allows a consumer to speak with a website representative directly over the Internet connection, without disconnecting from the website or purchasing a second phone line. Used effectively, VoIP can be even more valuable than live chat in helping firms close an online sale. Our CSRs will be well positioned to migrate to this new technology. The strong Americanization of Filipinos, combined with their excellent English speaking skills, make them ideal knowledge workers for this emerging medium.

Teleservices

live e-care will begin offering telephone and fax communications, a natural extension of our product line and a strong fit with our highly-skilled English speaking Filipino workforce, by the third quarter of Year 1.

MANAGEMENT TEAM & ORGANIZATION

The Management Team brings together practical experience in all aspects of live e-care's operations, as well as business training and experience in the U.S. and the Philippines:

Jeff Russell, CEO, managed technical infrastructure upgrades for call centers and telecommunications switching facilities in the U.S. and the Philippines. He has also worked as a quality assurance consultant to U.S. companies which outsource their data entry operations to overseas contractors. He holds an M.B.A. from the University of Michigan Business School.

Dax Almendras, COO, created and managed his own firm to resell long distance communication services to small and medium-sized Philippine businesses. He was previously a financial auditor for Arthur Andersen in the Philippines and is a member of the Philippine Institute of Certified Public Accountants. He holds an M.B.A. from the University of Michigan Business School.

Ken Hung, Director of Information Technology, holds three master's degrees (Industrial and Operations Engineering, Systems Science and Engineering, and Financial Engineering) and a bachelor's degree (Electrical Engineering and Computer Science) from the University of Michigan. He has worked extensively as a Web Master, Systems Administrator, and Web Programmer.

Board of Advisors

live e-care has assembled a Board of Advisors with background in the business cultures of both the U.S. and the Philippines, and with functional experience in sales, marketing, finance, and private equity:

John Siverling has worked with Frank Russell Capital, a private equity firm, and currently consults with Sloan Ventures, a venture development company, on venture market potential and financial projection sensitivities. His previous experience includes a variety of sales and customer service management positions with General Motors' Cadillac Motor Car Division. He holds an M.B.A. from the University of Michigan Business School.

Timothy Renn, who is based in Manila, is actively involved in the development of the Subic Bay Economic Development Center. He was previously the marketing communications executive for Nike in Southeast Asia, and has served as Associate Dean at Northwestern University's Kellogg School of Management.

Marshall Kiev is a founding partner of Colt Capital Group. Prior to that, he spent 13 years at FH Capital, a $500 million asset management firm, most recently as a Managing Director. He brings to live e-care extensive knowledge of the private equity industry. Marshall received his B.A. from New York University and his M.B.A. from NYU's Stern School of Business.

Board of Directors

Initially the Board of Directors will also serve as the management team of the company. However, the founders recognize that the Board of Directors will need to be developed into a separate body (although one or two management team members will have seats on the board). The founders plan to recruit directors and executives in the customer care industry who can aid the team in attracting large clients in the future.

Job Descriptions and Qualifications

live e-care will fill several additional positions within the first few months of operations:

Regional Sales Managers

Sales Managers will identify and acquire customers for the company, represent live e-care and its services to prospective clients, and cultivate business relationships with current and prospective customers.

Sales Account Assistants

The Sales Account Assistants will provide after-sales support to the sales managers. He or she will work closely with U.S. clients to determine their online customer service needs. The sales account assistant will also work closely with the Customer Sales Representative Manager in the Philippines to provide performance feedback to the CSRs.

Chief Technology Officer (CTO)

The CTO will oversee the growth and development of the company's IT department. In addition, the CTO will develop the company's internal technological capabilities to augment third party vendors' existing customer service software.

Chief Financial Officer (CFO)

The CFO will provide the financial leadership necessary to manage the rapid growth of the company. In addition, the CFO shall be responsible for the implementation of formal accounting control policies within the organization and manage the sources and uses of company funds.

Philippine Operations Manager

The Philippine Operations Manager will report directly to the COO and will oversee the execution of customer service operations in the Philippines.

Information Technology Manager (Philippines)

The Philippine IT Manager will assist the Philippine Operations Manager in the maintenance of the software and web-based systems of the Philippine operations. In addition, the IT manager will continuously update Philippine activities in order to help the CTO develop the company's internal technological capabilities in order to augment the use of third party vendors' existing customer service software.

CSR Manager (Philippines)

The CSR Manager will oversee the hiring, training, and retention strategies of CSRs and personally handle complex customer inquiry transactions.

CSR (Philippines)

The CSR will handle the processing and editing of customer e-mail and provide live chat support for client customers.

MARKET ANALYSIS

Definition and Size

The market for outsourced customer service support can be categorized into several sub-markets or industries. One way of segmenting this market is by dividing it into the web-based outsourcing industry, the customer support outsourcing industry, and the teleservices industry. Many of these segments overlap due to the current convergence of technologies. live e-care has further segmented our market within the web-based outsourcing industry into the web-based customer support e-mail and the live chat market.

E-tailing has legs and is running quickly. Online sales are expected to reach $36 billion this year, up from $15 billion in 1998, according to the Boston Consulting Group. It is estimated that e-commerce will grow to $84 billion by 2004. Lehman Brothers reports that Internet sales will eventually equal 5 to10 percent of retail sales.

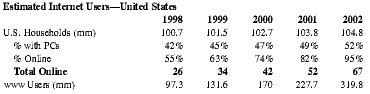

As previously mentioned, the online customer service market is predicted to be $1 billion in 3 years. The table below indicates that the number of web users is expected to increase by 143 percent in the next three years.

| 1998 | 1999 | 2000 | 2001 | 2002 | |

| U.S. Households (mm) | 100.7 | 101.5 | 102.7 | 103.8 | 104.8 |

| % with PCs | 42% | 45% | 47% | 49% | 52% |

| % Online | 55% | 63% | 74% | 82% | 95% |

| Total Online | 26 | 34 | 42 | 52 | 67 |

| www Users (mm) | 97.3 | 131.6 | 170 | 227.7 | 319.8 |

Target Markets

Segmentation and Critical Trends

Most of the Internet's estimated 650,000 existing sites (63 percent are dot coms) currently provide some means for visitors to contact a web manager by e-mail for further support. However, given our existing capabilities and resources, we plan to direct our efforts at two specific industries. We have chosen to focus on (1) currently successful e-tailers and (2) traditional brick-and-mortar retailers who are rushing to go online.

Successful e-tailers. A critical trend in this industry is the rapid rate of e-commerce growth. Internet-based retailers have gotten a head start over their bricks-and-mortar competitors and the traditional retailers are attempting to catch up. Amazon.com became a behemoth in the book world in a few short years, selling over $1 billion in books and other merchandise over the Internet in 1999. Barnes and Noble ($3.8 billion 1999 sales), the market leader of traditional book sales, has since scrambled to compete in the retail online business with Barnesandnoble.com. Of the top ten Internet revenue earners, nine are dot coms. As these revenues are predicted to increase, Lehman Brothers reports that the e-commerce movement will affect established brick-and-mortar retailers. To remain competitive, most broadline retailers have launched websites or revamped existing ones.

| 1. | Amazon.com | $1,000 |

| 2. | Onsale | $266 |

| 3. | Priceline.com | $189 |

| 4. | eBay | $125 |

| 5. | uBid | $119 |

| 6. | Barnesandnoble.com | $113 |

| 7. | Cyberian Outpost | $106 |

| 8. | Value America | $98 |

| 9. | CDnow | $92 |

| 10. | Beyond.com | $68 |

Traditional bricks-and-mortar retailers rushing to go online. Traditional retailers are speeding to compete on the Internet but web-based customer support services will be critical to their online success. In a survey conducted by PRTM management consulting, 97 percent of sales and marketing executives plan to offer online service support by 2000, and another 88 percent believe customer service will be the most important long-term e-business objective. Given these Internet customer care predictions, live e-care is well positioned to target traditional retailers in addition to the fast-growing e-tail companies. Our ideal client will receive a minimum of 4,500 messages per month but will be generally ill equipped to handle the rapid surge of e-mail inquiries to their site.

Based on initial market analysis involving calls to target clients who have recently launched websites, many new sites are receiving an average of 500 e-mails a day, yet have only 1 to 5 people responding to customers (Nordstrom's, Williams-Sonoma, Crate and Barrel, Pottery Barn, and furniture.com). In fact, a recent survey of 91 companies on the Internet showed that:

- 38 percent did not have a dedicated customer support mechanism

- 16 percent never bothered to answer e-mails

- 12 percent took more than 48 hours to respond and their replies were rated "poor"

- 18 percent answered within 48 hours, but their responses were still rated "poor"

Of the 91 companies, only 16 percent responded with a satisfactory and prompt reply. live e-care's goal is to ensure that our clients are viewed by their customers as exceptionally proactive, responsive e-companies.

Target Customers

We have identified an initial list of target customers within our two target market segments. All target retailers, whether traditional brick-and-mortar companies or modern e-tailers, have websites, receive a high volume of e-mail, and need to maintain a strong positive relationship with their customers. Our target client will have an average of 250-350 e-mails per day; our minimum acceptable number will be 150 e-mails a day. live e-care will initially focus on mid-sized companies to help establish our reputation.

Having secured a number of mid-sized, satisfied clients to testify to our quality and effectiveness, live e-care will focus on attracting larger and more established clients. Serving a few large clients instead of many smaller clients will allow for greater efficiencies and higher quality customer service (based on the assumption that it will be easier to answer 500 e-mails for one client than 50 e-mails for 10 clients). Our target customers either have poor e-mail support—they did not respond to test e-mails sent—or have indicated that they are overwhelmed and unprepared to handle the volume of e-mail they are receiving. These companies currently do not outsource their e-mail nor do they provide an online chat service to their customers.

Critical Needs

The retailers within live e-care's initial target market need swift implementation of customer support solutions. Our target market defines online quality customer service as the ability to answer inquiries in a timely and accurate manner at a low cost. These clients need to get their websites up and running quickly and often need third party vendors to assist them. However, only 1 percent of cybershops currently provide live chat customer support, and 5 percent or less outsource their customer support.

E-mail management is not a core competency of these companies. Our target companies would rather devote their efforts to developing company brand equity and selling merchandise. live e-care allows them to focus their attention on their core business functions by handling, and responding effectively, to their e-mail, engaging their customers in online chat sessions to support sales initiatives, and providing them with concise reports on customer trends and preferences. In addition, live e-care CSRs will be exceptional and of direct benefit to our clients, yet we will deliver our clients from the burden of recruitment and training. From our initial search on Monster.com, there are a number of companies frantically searching for people to fill positions as Internet CSRs. Retention is also an issue—the average annual industry turnover in the U.S. can be high as 100 percent. With live e-care our clients can be assured of continuity in customer relations personnel and service, without undue distraction from their core business functions.

Marketing Challenges

One of the main challenges to live e-care will be convincing retailers, especially traditional brick-and-mortar businesses trying to quickly ramp up their online presence, of the benefits and advantages of outsourcing their customer support. In a survey of companies that currently outsource, the top three reasons for deciding to outsource were to:

- reduce and control operating costs

- improve company focus

- gain access to world-class capabilities

The top three factors for vendor selection were:

- commitment to quality

- price

- references/reputation

Competitors

The primary competition will be the client's own internal customer support departments and a few existing niche market players. PriceWaterhouseCoopers reports that 80 to 90 percent of call centers are still in-house. Our target customers will be those companies who are unsuccessfully handling their e-mail support in-house.

There are five important oursource competitors in the e-mail customer support industry:

E-mail and Chat Support Providers

Brigade Solutions

Brigade is live e-care's most direct competitor. They have a similar business model in that they offer e-mail customer support using third party software vendors and focus solely on web-based customer support. They were founded in late 1997 as an Internet customer support company and have received their first round of venture capital funding early this year. They have not gone public to date. They, too, employ "cyberreps" who respond to 95 percent of e-mail queries within 24 hours. Their corporate headquarters in San Francisco has about 80 people (including reps). They also have a center in Madras, India, where 80 more cyberreps are located. At each location there are two shifts providing round-the-clock coverage. Brigade has focused on Fortune 500 clients and currently provides service to clients such as Excite, Compaq, and GTE.

PeopleSupport

PeopleSupport is based in Los Angeles, California, and currently employs 360 customer reps. They offer outsourced Internet customer care through e-mail response services, knowledge management reporting, and recently, voiceover IP. However, they specialize in live chat support. They believe that they provide superior quality customer care. Their customer focus is e-commerce companies—both traditional and Internet. Customers include Nokia, MGM, CarParts.com, and GE Capital.

Live Chat Support Only

LiveAssistance

LiveAssistance is owned by International Business Systems, Inc., and is based in Chantilly, Virginia. Founded in 1986 as a traditional customer call center, it currently focuses its Internet initiatives on providing live chat assistance. Its customers include 3buddies.com, HomeAuction.com, Department of Veteran Affairs, Bureau of Census, and HomeGain. Their site seems to be one of the most professional of the live chat competitors. The site provides a live demo chat and does not require any information from the site visitor. There was no waiting time for a chat operator, and the demo effectively illustrated the value of their service.

Finali.com

Finali.com is a new entrant in the live chat market, based in Broomfield, Colorado. They have focused on three market sectors: retail, financial services, and business-to-business chat. Their website live demo requires more visitor information than the LiveAssistance website, and requires a wait to get to an operator.

e-Assist.net

e-Assist.net is also a new entrant to the live chat Internet industry. They are based out of San Diego, California, and have the least impressive website of all competitors. They provide live chat, customer support management, and reports on customer data. The wait for an operator was over 7 minutes during their demo. These findings exemplify the critical need to provide potential clients access to a live demo with minimal wait time without having to divulge significant personal information.

MARKETING PLAN

Overview

In the Philippines, which posted an unemployment rate greater than 10 percent in 1998 and an underemployment rate double that, we have the ability to attract higher level CSRs than our customers or competitors in the United States. live e-care's customer service agents, recruited from the top universities in the Philippines, will provide superior care for our clients' customers. Additionally, the low cost of doing business in the Philippines will enable us to support various pricing levels without compromising our quality.

Although the retail customer operations will be located in the Philippines, live e-care will establish a physical sales and marketing presence in the U.S., whose direct sales efforts will be supplemented by print and other media advertising. live e-care will attend six to eight trade shows a year; each sales representative will contact an average of 20 new potential customers a month.

live e-care will also maintain an interactive website, through which potential customers will be able to demo our e-mail and live chat services and learn more about the company and its product offerings.

Value to Our Clients

Greater customer loyalty through better customer service

Websites currently spend an average of $40 apiece to attract customers, but they dedicate few resources to ensuring customer satisfaction and return visits. live e-care will provide the exceptional customer service to online retailer consumers that will help our clients build stronger customer relationships and generate bankable customer loyalty. Because attracting a new customer is 10 times more costly than retaining an existing one, live e-care's services will both save our clients money and give them a means to increase future revenues.

Competent, dedicated CSRs

Our customer service agents will be recruited from the top universities in the Philippines and encouraged to bring their considerable initiative and creativity to bear in solving customer dilemmas. Every CSR will have excellent written and spoken English skills. We will supplement an initial, comprehensive training with regular sessions keeping them abreast of the latest trends and developments of our business. Our human resources strategy includes retention incentives to ensure that our CSR teams enjoy continuity and satisfaction.

Intimate understanding of retail customers needs and concerns

live e-care will help clients better understand their customers' needs by providing trend-summarized information of customer feedback and comments. These reports will allow them to scale their website capabilities, adjust their merchandise offerings, and improve their appeal to potential customers on numerous indices.

Increased online revenues

As many as 62 percent of online shoppers give up on a purchase because of the difficulty they encounter navigating the website. As many as 20 percent of potential online shoppers report they would purchase online if the site had a live chat CSR to talk them through the process. HomeTownStores.com, a home improvement site, increased online sales 30 percent in four weeks by introducing a live chat service. live e-care's services will help our clients leap from a static website to a live, friendly, interactive, customer-oriented site which encourages browsers to become buyers.

Allow clients to focus on their retailing operations

live e-care helps free up clients' managerial and financial resources by intercepting the flood of e-mail messages and undertaking all service rep training sessions.

Improved cycle time for implementation

live e-care will enable its clients to handle dramatic increases in customer inquiry volume more quickly and more efficiently than they could be managed in-house. This capability is especially valuable to companies that experience high volatility in online sales, such as retailers in the Christmas season. The flexibility of live e-care's operations will also give clients the option of adding or subtracting live chat services and operators as necessary.

Cost savings through outsourcing

PriceWaterhouseCoopers estimates that the average company will save up to 30 percent by outsourcing customer service centers. live e-care's low cost structure and pricing strategy allow us to match or beat that savings benchmark.

Pricing Strategy

Competitors' strategies. Most e-mail outsourcing firms price per transaction, either in a multi-tiered pricing structure or by desired turnaround time. Pricing strategies for live chat services range from a fixed monthly fee based on the number of dedicated operators to a variable rate based on some metric of productivity, such as number of transactions handled or minutes spent chatting to a live operator.

Our e-mail pricing. live e-care clients will pay $5,000 per month for a monthly quota of 5,000 e-mails, and $1 apiece for e-mail in excess of that quota. Our quality assurance program will ensure that 95 percent of all client e-mails will be serviced within 24 hours. This fixed fee is based on the expected minimum number of e-mail inquiries we expect an average client to receive in a month, and the labor and training costs that client would incur to create this service in-house. This fixed fee is competitive with, or lower than, what competitors charge. Our inherent labor cost advantage allows live e-care to discount this price by as much as 35 percent and still meet profit margin goals.

Our live-chat pricing. live e-care will pay a fixed monthly fee of $10,000 per operator seat, which will guarantee them one chat operator 24/7. Because each operator seat requires a team of four CSRs on four shift cycles, this pricing strategy will be difficult for competitors to match using the U.S. labor market for their CSRs.

Long- and short-term quotes. Traditional call center contracts, which extend for one year or more, are unrealistic for a web-based business model. live e-care will initially offer six-month to one-year contracts, along with a free, one-month, "live" trial period beginning at service implementation. Payment terms will include an initial deposit covering one month's services, to be paid before the consultation process begins. The payment will be immediately applied to the first month of the actual customer service operations. Upon completion of the consultation and testing process, the client will pay the next two months' fees before the operation goes live. Thereafter, client payments will be made at the start of every quarter of the service period covered. The contract will also provide live e-care and its clients the flexibility to add other value-added services, such as competitive intelligence research and Internet marketing.

It is expected that as live e-care continues to understand and serve clients more effectively, it will become easier to cross-sell a variety of services, and that—after gaining the necessary expertise in serving clients on the Internet—it will be possible to negotiate longer contract terms, ensuring a more stable cash flow stream for the company.

Market Positioning: Unequaled Quality, Competitive Prices

live e-care will guarantee response rates of 95 percent within 24 hours or less. Our CSRs will be fully trained in e-customer service as well as cognizant of the issues most important to our clients and their customers. live e-care will be able to offer these services at competitive prices because of lower labor rates in the Philippines, lower costs due to lower rates of employee training and turnover, and special tax and legal advantages enjoyed as a PEZA-registered company. Price is one of the critical decision points in determining an outsourcing vendor: live e-care will clearly be able to offer customers cost savings in comparison to their in-house customer care centers and other outsourcing competitors.

Advertising

While our marketing strategy does not focus on advertising promotion, resources are earmarked for the second and third year's advertising expenses. Advertisement is planned on the Wall Street Journal national edition twice a year in the first year (half page) and three times a year in the third year (also half page). This may be supplemented with trade journal print ads. The goal for advertising is reach rather than frequency, to broaden the awareness of our company in our target market.

Alliance Strategy

Participation in alliances is a key industry trend. Brigade Communications, which handles just e-mail support, is partnered with both Egain and Kana for software. New companies entering the market, such as PeopleSupport, provide more alliance possibilities.

As a provider of strategic outsourcing services to clients, live e-care will focus on alliances which can offer as seamless a relationship with the client as possible. We are currently in discussions with several e-mail management software providers as well as newer chat room management software developers. The most attractive operating and software systems would be browser-based, and will also use products that run on Unix, Linux, or Windows NT. live e-care will seriously consider the use of newer start-up companies as partners, since most established firms already have developed numerous alliances that may not serve the best interests of the company.

SALES STRATEGY

Tactics

Sales force effectiveness. Our sales strategy is based on a direct model, utilizing experienced salespeople to make sales calls and build client relationships. Because of the importance of the client relationship, live e-care will have a secondary layer of account support personnel working in conjunction with the sales force. Finally, live e-care will coordinate specific client sales teams with their corresponding CSR teams in the Philippines in order to maintain a cohesive, consistent client interface.

Geographic organization. Initially, live e-care will have three salespeople, each one having geographic responsibilities. One will be responsible for the Eastern part of the U.S., one the Midwest, and one the West. They will work out of home offices, allowing them the flexibility to develop their markets.

Management, compensation, and recruitment. The Vice President-Marketing and Sales will oversee the performance of the sales force but the keys to success will be the selection and compensation structure. First, the selection of experienced salespeople is important. Their experience need not be, specifically, in customer support sales, but should be in a service sector and heavily focused on customer relationships. Successful individuals could be recruited from the likes of Xerox or IBM, where they have learned about business-to-business sales calls and customer focus. The attraction of live e-care will be the opportunity to run their own region, potentially greater compensation, and involvement with a growing start-up.

Compensation will be a key driver of the success of the sales force and, ultimately, the company. Consequently, live e-care will focus on a complete compensation package with competitive salary and commission, averaging about $60 thousand in total cash compensation. At the same time, live e-care will offer the upside potential of any start-up, stock options.

Compensation will be tied to sales and the retention of customers as well as individual goals. Naturally, each salesperson will be allocated a car allowance, travel and entertainment budget, and home office equipment. The VP-Marketing and Sales will be responsible for developing the overall training and review process, but will also help each salesperson develop an individual sales strategy.

Account support assistants for each salesperson. While we are planning to ramp up additional sales personnel as we gain clients, it is critical that the sales force has the time to seek new clients without live e-care losing the key relationship proximity to current clients. Therefore, each salesperson will have an account support individual working in tandem with him or her. The account support position will be a junior position to the salesperson but will report directly to the VP-Marketing and Sales rather than to the salesperson in order to ensure company-wide continuity. This position can also be used as a tool to develop future sales managers. Account support personnel will be compensated similarly to the salespeople, but on a somewhat lower scale, averaging $40,000 in total cash compensation. Their job description will not contain the same level of prerequisites of the salespeople. Their compensation will rely more heavily on client retention than attraction.

Developing client relationship teams. Finally, live e-care will develop client relationship teams within the organization. These teams will include the original salesperson and the related account support person, as well as the team of customer representatives in the Philippines. As a team, they will be responsible for a seamless, high quality relationship with the client. The salesperson and account support person will be able to keep the Philippine team informed of key issues with the client and product or service updates. Likewise, the Philippine team will be able to provide critical information and reports to the account support person and the salesperson.

Developing leads. live e-care will take a number of routes to develop leads for the sales force that will be managed by the VP-Marketing and Sales. Among the approaches will be trade show displays, reviews of trade journals and industry events, advertising, and Internet searches. All members of the team will be recruited to develop all leads whenever they notice an opportunity, such as a website without e-mail support, or sites with poor responses to e-mail. In addition, account support assistants and staff in the Philippines will be tasked with surfing the net, searching for retail sites with e-mail support facility. He or she will test the reliability of the e-mail support facility by sending numerous e-mails and checking the speed and quality of responses. Sites with poor response speed or quality will be marked as leads.

Identifying client's key decision-makers. Determining the key decision-makers at each potential client is critical to sales success. live e-care will use industry networks and expertise to find the right person within each organization. live e-care will also utilize a companywide customer contact database, so that anyone can add information to a client record as they come across information.

OPERATIONS

Strategy

live e-care will utilize the best of available technology and human resources to provide clients with seamless, prompt, and accurate web-based customer support. Locating the bulk of the operations in the Philippines will allow live e-care to offer these services at lower costs.

U.S. Operations

U.S. operations will consist mainly of regional sales and account management staff who will initially work out of home offices. Customer billing will be outsourced and overseen by the accounting staff in the Philippines, as well as account management staff in the U.S., until regional offices are established. Sales coverage will be maintained by staff located in the Eastern mid-Atlantic, Midwest, and West Coast regions.

Philippines Operations

The bulk of operations will be located in the Subic Bay Freeport (SBF), an Economic Zone managed by the Subic Bay Metropolitan Authority. Subic Bay was formerly a U.S. Naval base, the largest outside the U.S. When the U.S. vacated the base in 1992, most of the infrastructure was left relatively intact. Over the years it has been upgraded and further developed to suit commercial and business purposes. This area is near several technical universities and is known for the progressive mindset of its inhabitants.

Office space will be leased within Subic Bay which provides:

Dedicated, reliable, high speed T-1 and T-3 series data communications lines

Telecommunications are managed by Subic Telecom—a joint venture between AT&T and the Philippine Long Distance Telephone company, the largest telephone company in the Philippines. State-of-the-art 5ESS digital switches provide seamless connections to international telecommunications networks.

Reliable power supply (in-house redundancy will be installed—Uninterrupted Power Supply units will back up computer systems)

Power infrastructure was left behind by the U.S. Navy. The generating capacity far exceeds current as well as expected future demand. Power generation is managed by Enron and the Subic Power Corporation.

24 hours/day 7 days/week access

Nearly 2,000 residential homes were left behind by U.S. Navy personnel in the surrounding residential areas.

Access to transportation

Natural deep water ports, a newly renovated international airport, and a newly completed highway provide easy access to SBF.

Provisions for accommodating rapid growth

Sufficient capacity exists to accommodate our projected growth for the first 5 years of operation and well beyond.

Web-based Customer Support Systems

A general description of the systems needed to offer e-mail management, live text chat, or VoIP services follows.

With each type of service there are generally two options available. Option 1: Pay the application provider a fee to host the application and client data on in-house servers. This option usually requires a per client fee as well as a monthly fee based on the number of CSRs servicing that particular client. Option 2: Purchase the application and the necessary servers to host the application in-house. This entails a much higher fee up front for the purchase of the application software and a set number of "seat licenses." Usually the minimum fee includes 5-10 seat licenses. The seat license entitles a client to one CSR, 24 hours a day, 7 days a week. Option 1 is preferable until we have grown sufficiently to warrant the purchase of the application.

E-mail Management System

Currently, e-mail is the most common form of online customer service. Nearly 100 percent of businesses active on the Internet offer customer service via e-mail. E-mail message management applications manage customer e-mails generated from these client websites. They allow businesses to prioritize, categorize, route, track, respond to, and learn from their customer inquiries.

The following explains the online e-mail process:

- An e-mail message is received from a customer via an address given on the client's website.

- The e-mail is routed through the e-mail response management server.

- An automated response is sent to the customer acknowledging the receipt of the e-mail and possibly providing an estimated response time.

- The e-mail management server decides how to handle the e-mail based on categories designated by the client. The server will search for key phrases and then determine the appropriate action for the e-mail.

- If the e-mail falls into a predetermined category, the server will search the response database for an appropriate response and automatically respond to the customer. If it does not match the e-mail message with an existing category, the message is routed to the next available CSR.

- The CSR can then look up the customer's history and/or browse the response library for the appropriate response. Depending on the nature of the e-mail, the CSR may need to consult a client representative.

- Once a response is generated, either automatically or by a CSR, the response is routed to the e-mail response server which archives the message, and sends it back to the mail server to be forwarded to the customer.

Live Text Chat

This form of online customer service is becoming more popular as customers demand human contact from e-businesses. Text Chat generally takes the form of a button on the client's website. When the customer activates this button, a chat box is opened and a signal is sent to the CSR notifying him or her of the customer's request for assistance. CSRs can then respond using preformatted responses or customized responses, depending on the nature of the inquiry.

Most text chat applications provide the ability to transfer the chat to a more knowledgeable CSR or supervisor as necessary. They also provide tracking of CSR performance and customer profiling and survey capabilities.

Voiceover Internet Protocal (VoIP)

VoIP is similar to live text chat except that the exchange occurs using voice data. When the service request button is activated on the client's website, a call is initiated to an available CSR. Instead of a chat box, an actual voice call is made using the Internet as the medium. Because very few customers have the technology required to initiate these types of calls, and because the quality of the voice transmission is not high, developments surrounding VoIP technology will be monitored in order to best integrate this, at the right time, into the existing line of web-based customer support services being offered.

Quality Assurance (QA)

QA will be performed using the administrative features included in the various customer service application packages. In addition, the QA process will be designed to randomly sample and analyze responses to customer inquiries. These responses will be checked for accuracy, clarity, and timeliness. Automatic and categorized responses will be continuously updated to reflect the latest available information. Weekly QA meetings will address client concerns and update CSRs on new client promotions and product offerings.

Disaster Recovery and Business Continuity

live e-care is committed to providing seamless, continuous service to our clients in the event of a natural disaster or technology failure. We are currently devising a disaster recovery strategy which includes a combination of alternate sites, network recovery, and offsite storage initiatives.

HUMAN RESOURCES STRATEGY

Attract, develop, retain the best. One of the key success factors identified in the customer support industry is the ability of a company to attract, develop, and retain the best CSRs. The founders' familiarity with the cultural, social, and business conditions in the Philippines will give the company a competitive advantage in this respect.

Benchmark existing best practices. As part of the human resource strategy, research was done to benchmark existing best practices used in similar companies that have been effective in attracting the best talent in the Philippines. Based on research, Infosys and Cisco have been identified as companies whose human resource strategies have been both successful and best suited to the companies' Philippine operations. Infosys, an Indian software company based in Bangalore, India, is one of India's leading IT services companies. It utilizes an extensive offshore infrastructure to provide managed software solutions to clients worldwide. live e-care realizes that our success will also largely depend upon the ability to recruit, train, deploy, and retain highly talented professionals.

Recruiting—Philippines

Focus on campus recruitment, supplemented by experienced hires. The recruiting strategy will be targeted towards two sets of applicants. The first part will involve visiting the top universities and colleges throughout the Philippines in search of the brightest and most talented students. The company will use a series of interviews and tests to identify the best applicants. In an effort to attract the most highly qualified candidates, the founders sent out a survey to the top universities in the Philippines designed to help live e-care understand and create a quality work environment. Initially, our objective will be to create a campus-like environment in order to foster the culture of a learning organization where ideas will flow freely irrespective of title or tenure. The results of the survey (still pending) will be used in designing the ideal workplace for employees in terms of employment.

To supplement the college recruiting efforts, another hiring strategy involves hiring CSRs away from existing e-mail centers. At this moment, AOL is the only company that has been identified as having such a facility set up in the Philippines. Based on recent reports, AOL is currently paying their CSRs an average of $5.50 a day. This is approximately 35 percent above the existing minimum wage laws. We believe that live e-care can easily double or even triple the amount they are earning without significantly affecting the profit margins of the company. By attracting the best people, live e-care will have the basis to serve the U.S. e-mail market with unparalleled excellence.

Skill profile sought in recruitment. From a skill perspective, it imperative that all CSRs be able to comprehend and communicate effectively in both written and spoken English. In addition, the ideal CSR will have excellent problem-solving skills and a superb customer relations approach. Basic computer and Internet-related skills such as sending and receiving e-mail and surfing the World Wide Web are also desirable.

Focus on Metro Manila, Cebu, and Davao. The skills needed for CSRs can be found in many of the colleges and universities around the Philippines, particularly universities based in the cities of Metro Manila, Cebu, and Davao. These are the three largest urban cities in the Philippines that have a combined population of almost 20 million people. These are also the regions with the highest concentration of universities in the country and whose medium of instruction, at all levels, is English in both education and business.

Training

Two-step training process. Based on interviews with an existing competitor, the training of CSRs is a two step process. The first period of training begins when they join the company. The training focuses on the roles and responsibilities of a CSR while teaching them the tools of the job, including how to handle inquiries using the existing technologies. This process is estimated to take about 1-2 weeks. The second part of the training begins once a company has signed on as a client and the information transfer between the client and the personnel in the U.S. office is complete. The nature of this part of the training focuses more on helping the CSR understand the exact nature of the client's business, how to classify, respond, and deliver responses to customers, as well as how to handle questions requiring a higher level of expertise. This portion of the training takes between 2-6 weeks depending on the level of complexity of the business, customer requirements, and information gathered.

Retention

Relationship-oriented atmosphere. The Filipino culture, like many Asian cultures, is very relationship-oriented. So it comes as no surprise that the core strategy for retaining workers in the Philippines is to cultivate a friendly and relationship-building atmosphere.

To build this atmosphere, the company will encourage existing employees to attract friends who may possess the skills needed by giving financial incentives to "successful referees." It was discovered during the course of research that Cisco Systems uses the referral method (called the Friends program) as a critical component to their recruitment and retention strategy. The principle of encouraging referrals to recruit quality talent is a key strategy in the relationship-oriented culture of Filipinos, and does not add any significant cost to the company.

Stock Options. The company plans to use stock options to reward employees, an almost unheard of practice among private companies, not only in the Philippines, but the rest of Asia as well. Infosys Systems of Bangalore, India, was one of the first companies in India to offer such an incentive scheme to all their key employees from the management down to the staff level. It has proven successful in maintaining their low turnover rate. Given their intimate understanding of the Filipino people, the founders believe that live e-care can apply the same strategy as Infosys and achieve the same results by using stock options or some alternate form of equity participation as a way of retaining and motivating employees.

Continuous learning. Finally, the third component of the company's retention strategy is to ensure that employees are continuously learning new skills and being rewarded with promotions and career advancement within the company. One tactic would be to reward and train the Filipino CSRs by sending them for work-related seminars abroad. live e-care will also tie opportunities to travel abroad to their time with the company. For example, the employment contract can be written in such a way that an employee is required to work for the company for a certain number of months or years in return for such an opportunity. This is a strategy used by Arthur Andersen Philippines to retain its employees and it has served the company well in retaining top talent within the firm despite the low salaries allocated to its entry-level employees. Their average turnover rate is about 20 percent annually and their employees stay on average two years.

FINANCIAL PLAN

Projections and Pro-forma Statements

live e-care anticipates that revenues will grow from $370,497 in Year 1 to $72,442,250 by Year 3, with a Net Loss in Year 1 of ($820,640) but reaching Net Income of $18,777,841 by Year 3. Driving this revenue model and growth will be our ability to gain customers at a rate of 5 percent in Year 1, 7 percent in Year 2, and 10 percent in Year 3 and stabilizing. In addition, future revenues will in part be driven by customers' adoption of live chat services and telephony on top of the e-mail support. We project that 80 percent of our customers will adopt this service. Revenues for additional products or services, such as consulting or FAQ database management have not been included in these projections since they are less certain and not expected until late in Year 2 or 3. Based on these revenue and earnings estimates as well as the required investment capital, Return on Invested Equity (ROE) will be 82 percent at the end of Year 3. The ROE will continue to increase substantially in future years as Net Income grows.

| End of Year 1 | End of Year 2 | End of Year 3 | |

| # of Customers | 6 | 93 | 384 |

| Average Daily volume of e-mail | 984 | 23,250 | 153,600 |

| Net Revenues | $370,497 | $11,639,875 | $72,442,250 |

| Net Income | ($820,640) | ($2,358,677) | $18,777,841 |

| Net Margin | -221% | -20% | 26% |

| Return on Invested Equity | -29% | -10% | 82% |

| Total Costs per e-mail | $1.95 | $0.83 | $0.61 |

| Total Costs per Operator Seat | $63,087 | $20,584 | $16,058 |

Revenues

Revenues will come from e-mail and live chat services in the beginning, growing from $370,497 in Year 1 to $72,442,250 by Year 3. The key drivers of revenue are the ability to close on potential customers and the adoption of the additional live chat services by customers.

The customer closing rate is forecast at 5 percent in Year 1 and is expected to increase to 7 percent in Year 2 and 10 percent in Year 3. These rates are based on an estimated 15 new sales calls per salesperson per month. The increased closing rate will result from increased experience of the salespeople with live e-care services and an expectation they will be able to showcase the historical performance of live e-care for its clients. E-mail services will be priced at a fixed fee of $15,000 for the first 15,000 e-mails per quarter. Additional e-mails handled will be priced at $1.00 per e-mail. These prices are between the prices quoted by competitors, from $.75 to $1.50 per e-mail. The fixed price will provide live e-care with a consistent cash flow and provide the customers with a similarly consistent expense to more easily budget for the services. It is expected that pricing will be negotiated with customers individually and live e-care may give discounts to some early adopters to gain a foothold in the industry.

Customer adoption of live chat and telephony services is forecast at 80 percent. For the pro-forma financials, this adoption is forecast to come 9 months after initial sign-up. It is expected that as technology improves and the Internet develops, the number of customers that adopt these live chat services will be even higher in order to be competitive on customer services in the marketplace. The timing of adoption may also decrease as customers sign up immediately for both services. Live chat services are priced at $30,000 per operator seat per month for 24/7 service. Both fees were determined by evaluating competitors and estimating the cost for clients to perform the same services in-house.

Costs

As a service support company, the majority of the costs associated with the company is variable costs, to set-up and staff the center in the Philippines. As noted earlier, the hiring and training of the Customer Support Representatives is currently only about 20 percent of the costs for a similar operation in the U.S. Since the staffing is a significant portion of the total costs, live e-care can be price competitive and maintain strong margins. In our projections, CSR costs are 26 percent of total operating costs at the end of Year 1, but grow to be 55 percent of total operating costs by the end of Year 3. We also will be licensing the software for both e-mail and live chat at the start. The costs are an initial charge of $15,000, monthly fixed fee of about of $1,200. Longer term, we plan to develop our own software for competitive reasons, but licensing allows for much faster ramp-up and client acquisition. Sales and Marketing costs are semi-variable with the number of customers, but reduces as a percentage of total operating costs. It is 36 percent of operating costs at the end of Year 1, but shrinks to 13 percent by the end of Year 3. Initially, overhead costs are a sizable 26 percent of total operating costs, but scalability reduces these costs to only 8 percent by the end of Year 3.

Earnings Growth

Using the revenue and cost assumptions as stated above, live e-care will show net operating losses through Q4 of Year 2. Once operating profits begin in Q1 of Year 3, cumulative losses are forecast to total $3,179,317. Net Income for the remainder of Year 2 and Year 3 will result in cumulative breakeven in Q2 of Year 3.

Based on the net income forecasts, the return on the invested capital is 82 percent at the end of Year 3, from (20%) in Year 1 and (10%) in Year 2. These figures are based on the capital needs of $350,000 initially, $2,500,000 after 6-9 months and $20,000,000 after approximately 18 months after the start of operations.

Funding Requirements

The company has summarized a series of detailed pro-forma financial statements outlining the capital needs of the company over its first three years. The company intends to seek $350,000 for working capital needs at the start of the business. The majority of this capital will be needed to fund the purchase/licensing of hardware and software, as well as human resource needs. An additional $2,500,000 of capital will be needed approximately 6 to 9 months later into the project and $20,000,000 approximately 18 months after start-up. These funds will primarily be used for expansion of the sales force, infrastructure and marketing. The anticipated use of funds for the first three months of operation is shown below.

| Hardware | $80,000 |

| Software | 70,000 |

| Infrastructure | 80,000 |

| Training | 20,000 |

| Salaries | 100,000 |

| Total | $350,000 |

Comment about this article, ask questions, or add new information about this topic: