COMMODITY EXCHANGES

Commodity exchanges, or futures exchanges, are, like stock exchanges, membership organizations. Their mission is to provide a suitable place where members trade commodities (futures) or options on futures in a controlled, orderly manner. The exchange itself is not a principal to any futures transaction, nor does it trade for its own account. Except for developing, publishing, and enforcing trading rules, including the establishment of daily price limits to ensure fair and equal treatment for all market participants, the exchange does nothing to determine prevailing prices in the market.

The first organized commodity exchange in the United States was the Chicago Board of Trade (CBOT), founded April 3, 1848. When first established, the CBOT was a centralized cash market formed in response to the need for a central marketplace that would bring together large numbers of buyers and sellers; thus providing liquidity, as well as bringing traders together in a place that provided rules for ethical trading practices and reliable standards of weights and measures. Soon after the founding of the exchange, grain brokers began trading in "cash forward contracts" in order to assure buyers a source of supply and sellers the opportunity to sell 12 months a year. As use of cash forward contracts escalated, futures contracts evolved.

Generally, membership on an exchange is individual, and only members may buy and sell futures and options on the exchange trading floor. Administration of the day-to-day operations of the exchange is handled by a paid staff. Members make the ultimate decisions, however, first by committee approval, then by passage by the board of directors or board of trustees. Administrative decisions are subject to full membership vote.

The heart of the exchange is the exchange trading floor, where a specific area, known as a pit or ring, is designated for the trading of each commodity. Bids (propositions to buy a specific quantity of a commodity at a stated price) and offers (propositions to sell a specific quantity of a commodity at a stated price) are made by open outcry. As each transaction is completed in the pit, a pit reporter records it; this information is immediately displayed on the trading floor quotation board and also appears on computer screens in brokerage offices and trading centers worldwide. Each trade is also recorded by the participating member on trading cards; each entry shows the amount bought or sold, with whom the trade was made, the price, and the trading bracket (time period) in which the trade was made. These cards enable each member to recheck his trades, as every trade must be resolved before the start of trading the following day.

The United States hosts five of world's largest top ten exchanges by number of contracts traded. The Chicago Board of Trade (CBOT) is the world's largest exchange, with over 281 million contracts traded in 1998,40 percent of which were futures on U.S. Treasury bonds. Other major U.S. exchanges include, in descending order by volume, the Chicago Mercantile Exchange (CME), the Chicago Board Options Exchange (CBOE), AMEX Commodities, and the New York Mercantile Exchange (NYMEX). The top two U.S. exchanges represent almost 80 percent of U.S. trading volume. Major international exchanges include the London International Financial Futures and Options Exchange (LIFFE), the world's second-largest; Brazil's Bolsa de Mercadorias & Futuros

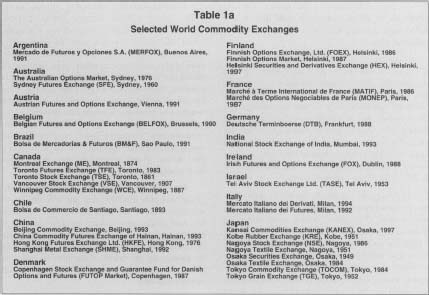

Selected World Commodity Exchanges

|

Argentina

Mercado de Futures y Opciones S.A. (MERFOX), Buenos Aires, 1991 |

Finland

Finnish Options Exchange, Ltd. (FOEX), Helsinki, 1986 Finnish Options Market, Helsinki, 1987 Helsinki Securities and Derivatives Exchange (HEX), Helsinki, 1997 |

|

Australia

The Australian Options Market, Sydney, 1976 Sydney Futures Exchange (SFE), Sydney, 1960 |

France

Marche a Terme International de France (MATIF), Paris, 1986 Marche des Options Negociables de Paris (MONEP). Paris, 1987 |

|

Austria

Austrian Futures and Options Exchange, Vienna, 1991 |

Germany

Deutsche Terminboerse (DTB), Frankfurt, 1988 |

|

Belgium

Belgian Futures and Options Exchange (BELFOX), Brussels, 1990 |

India

National Stock Exchange of India, Mumbai, 1993 |

|

Brazil

Bolsa de Mercadorias & Futuros (BM&F), Sao Paulo, 1991 |

Ireland

Irish Futures and Options Exchange (FOX), Dublin, 1988 |

|

Canada

Montreal Exchange (ME), Montreal, 1874 Toronto Futures Exchange (TFE), Toronto, 1983 Toronto Stock Exchange (TSE), Toronto, 1861 Vancouver Stock Exchange (VSE), Vancouver, 1907 Winnipeg Commodity Exchange (WCE), Winnipeg, 1887 |

Israel

Tel Aviv Stock Exchange Ltd. (TASE), Tel Aviv, 1953 |

|

Chile

Bolsa de Commercio de Santiago, Santiago, 1893 |

Italy

Mercato Italiano dei Derivati, Milan, 1994 Mercato Italiano dei Futures, Milan, 1992 |

|

China

Beijing Commodity Exchange, Beijing, 1993 China Commodity Futures Exchange of Hainan, Hainan, 1993 Hong Kong Futures Exchange Ltd. (HKFE), Hong Kong, 1976 Shanghai Metal Exchange (SHME), Shanghai, 1992 |

Japan

Kansai Commodities Exchange (KANEX), Osaka, 1997 Kobe Rubber Exchange (KRE), Kobe, 1951 Nagoya Stock Exchange (NSE), Nagoya, 1986 Nagoya Textile Exchange, Nagoya, 1951 Osaka Securities Exchange, Osaka, 1949 Osaka Textile Exchange, Osaka, 1984 Tokyo Commodity Exchange (TOCOM), Tokyo, 1984 Tokyo Grain Exchange (TGE), Tokyo, 1952 |

|

Denmark

Copenhagen Stock Exchange and Guarantee Fund for Danish Options and Futures (FUTOP Market), Copenhagen, 1987 |

Selected World Commodity Exchanges

|

Japan (continued)

Tokyo International Financial Futures Exchange (TIFFE), Tokyo, 1989 Tokyo Stock Exchange (TSE), Tokyo, 1949 Tokyo Sugar Exchange, Tokyo, 1952 |

Sweden

OM Stockholm AS, Stockholm, 1985 |

|

Malaysia

Commodity and Monetary Exchange of Malaysia (COMMEX), Kuala Lumpur, 1998 |

Switzerland

Swiss Options and Financial Futures Exchange AG (SOFFEX), Zurich, 1986 |

|

Netherlands

European Options Exchange (EOE-Optiebeurs), Amsterdam, 1978 Financiele Termijnmarkt Amsterdam N.V. (FTA), Amsterdam, 1987 |

Thailand

Stock Exchange of Thailand (SET), Bangkok, 1991 |

|

New Zealand

New Zealand Futures & Options Exchange Ltd. (NZFOE), Auckland, 1984 |

United Kingdom

International Petroleum Exchange of London Ltd. (IPE), London, 1981 London Futures and Options Exchange, London, 1987 London International Financial Futures and Options Exchange (LIFFE), London, 1982 London Metal Exchange (LME) London, 1876 OM London Ltd. (OML), London, 1989 |

|

Norway

Oslo Stock Exchange, Oslo, 1819 |

United States

American Stock Exchange (AMEX), New York, 1908 Chicago Board Options Exchange (CBOE), Chicago, 1973 Chicago Board of Trade (CBOT), Chicago, 1848 Chicago Mercantile Exchange (CME), Chicago, 1919 Coffee, Sugar, and Cocoa Exchange, Inc. (CSCE). New York, 1882 Commodity Exchange, Inc. (COMEX), Kansas City, 1933 Kansas City Board of Trade (KCBT), Kansas City, 1856 MidAmerica Commodity Exchange, Chicago, 1880 Minnesota Grain Exchange (MGE), Minneapolis, 1881 New York Cotton Exchange (NYCE), New York, 1870 New York Futures Exchange (NYFE), New York, 1890 New York Mercantile Exchange (NYMEX), New York, 1872 New York Stock Exchange (NYSE) Options, New York, 1983 Pacific Stock Exchange (PSE), San Francisco, 1882 Philadelphia Board of Trade, Philadelphia, 1985 Philadelphia Stock Exchange (PHLX), Philadelphia, 1790 |

|

Philippines

Manila International Futures Exchange Inc. (MIFE), Makati, 1984 |

|

|

Singapore

RAS Commodity Exchange, Singapore, 1991 Singapore International Monetary Exchange Ltd. (SIMEX), |

|

|

South Africa

South African Futures Exchange (SAFEX), Johannesburg, 1988 |

|

|

South Korea

Korea Stock Exchange, Seoul, 1956 |

|

|

Spain

MEFF Renta Fija, Barcelona, 1990 MEFF Renta Variable, Madrid, 1988 |

(BM&F); Germany's Terminboerse (DTB); and the Marche a Terme International de France (MATIF). Table I lists selected worldwide futures and options exchanges by country with city and date established.

Commodity exchanges in the United States are regulated primarily under the Commodity Exchange Act of 1974, which established the Commodity Futures Trading Commission (CFTC). Exchanges must be authorized by the CFTC in order to operate and are subject to its regulatory oversight. In the late 1990s some members of Congress and senators attempted to dramatically curtail the CFTC's authority, particularly concerning large institutional traders, by amending the Commodity Exchange Act. However, those efforts failed amid fears that deregulation would lead to market instability and disruptive trading practices.

SEE ALSO : Commodities ; Foreign Exchange ; Futures/Futures Contracts ; Options/Options Contracts

FURTHER READING:

Chicago Board of Trade. About the Exchange. Chicago, 1999. Available from www.cbot.com/about-exchange/index.html .

Chicago Mercantile Exchange. "About the Exchange." Chicago, 199S. Available from www.cme.com/exchange/back.html .

Commodity Futures Trading Commission. Commodity Futures Trading Commission Annual Report. Washington, annual. Available from www.cftc.gov .

Futures Industry Institute. Futures and Options Fact Book. Washington, annual. Available from www.fiafii.org/factbook/ .

Comment about this article, ask questions, or add new information about this topic: