INVENTORY ACCOUNTING

A company's inventory is all of its merchandise intended for sale to its customers in the normal course of business. Inventories are considered current assets in that they usually are sold within a year or within a company's operating cycle. Furthermore, inventories make up the most valuable current asset for most retailers. Inventory accounting is the process of determining and keeping track of the inventory costs. Inventory costs refer to all the costs a company incurs to obtain merchandise, including the actual merchandise costs as well as transportation costs. Proper inventory accounting enables companies to represent their net income accurately. To do so, accountants must use the appropriate methods for measuring inventory, because inaccurate inventory amounts or values can make a company seem more profitable than it really is and can misrepresent a company in its financial statements.

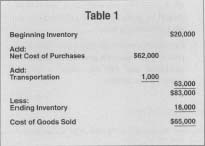

A starting point for inventory accounting is determining the cost of merchandise that has been sold within a given accounting period, which is referred to as the "cost of goods sold." The cost of goods sold is the net acquisition cost of merchandise obtained and sold to customers during an operating period and is calculated by adding the value of the beginning inventory, the cost of new inventory items, and transportation costs, and then by subtracting the ending inventory amount (see Table 1).

| Beginning Inventory | $20,000 | |

| Add: | ||

| Net Cost of Purchases | $62,000 | |

| Add: | ||

| Transportation | 1,000 | |

| 63,000 | ||

| $83,000 | ||

| Less: | ||

| Ending Inventory | 18,000 | |

| Cost of Goods Sold | $65,000 |

When measuring inventories, accountants consider two variables—quantity and price—and refer to inventories by their dollar value (quantity multiplied by price). While the principle of taking inventory is simple—counting all items available for sale, pricing them, and calculating their value—the practice of it can be complicated and time consuming. The complications arise because even medium-sized companies often have numerous items in a host of sizes, types, and qualities, which they purchased at different unit prices and which they store at different sites. In addition, measuring inventory may involve including items that have not been delivered yet, which companies nonetheless technically own. Such items are called "goods in transit."

INVENTORY ACCOUNTING METHODS

SPECIFIC IDENTIFICATION METHOD.

Inventory pricing also becomes complicated when unit prices for inventory items fluctuate during an accounting period. Nevertheless the basic idea of inventory pricing is uncomplicated: a retailer should determine the value of its inventory by figuring out what it cost to acquire that inventory. When an inventory item is sold, the inventory account should be reduced (credited) and cost of goods sold should be increased (debited) for the amount paid for each inventory item. This method works if a company is operating under the Specific Identification Method. That is, a company knows the cost of every individual item that is sold. This method works well when the amount of inventory a company has is limited, the value of its inventory items is high, and each inventory item is relatively unique. Companies that use this method include car dealerships, jewelers, and art galleries.

Problems arise when a company has a large inventory and each specific inventory item is relatively indistinguishable from other items. Some retailers, for example, sell only one line of products, such as blue jeans. Such a retailer may have an inventory that includes various styles and sizes, but the inventory on the whole is similar. Suppose this retailer buys the inventory from a wholesaler or manufacturer and pays $3,000 for 300 pairs of jeans. Hence, the cost per pair is $10. If the cost never changes, then inventory costing is simple. Every pair of jeans costs the exact same amount. Because of inflation as well as discounts and sales, however, prices tend to fluctuate. For instance, this retailer might buy 100 pairs of jeans on Monday for $1,000 ($10 per pair), and 200 pairs of jeans on Friday for $2,150 ($10.75 per pair). Under the Specific Identification Method, the retailer would have to mark or code every pair of jeans, to determine which purchase a particular pair of jeans came from. This method is far too cumbersome for companies with large and even medium-sized inventories, although it is the most precise way of determining inventory prices. As a result, other inventory valuation methods have been developed.

WEIGHTED AVERAGE METHOD.

Under the Weighted Average Method, a company would determine the weighted average cost of the inventory. In the example above, the weighted average cost would be $3,150 / 300 pairs which equals $10.50 per pair of jeans. Therefore, every pair of jeans would have the inventory price of $10.50, regardless of whether they were actually bought in the $10 purchase or the $10.75 purchase. This weighted average would remain unchanged until the next purchase occurs, which would result in a new weighted average cost to be calculated. This inventory accounting method is used primarily by companies that maintain a large supply of undifferentiated inventory items such as fuels and grains.

FIFO METHOD.

Another method used by companies is called the FIFO Method (first-in, first-out). Under FIFO, it is assumed that the oldest inventory—i.e., the inventory first purchased—is always sold first. Therefore, the inventory that remains is from the most recent purchases. So for the given example, the first 100 jeans that are sold will reduce inventory and increase cost of goods sold at a rate of $10 per pair. The next 200 sold will have an inventory price of $10.75 per pair. It is irrelevant whether customers actually buy the older pairs of jean first. Under FIFO, a company always assumes that it sells its oldest inventory first and that ending inventories include more recently purchased merchandise. Companies selling perishable goods such as food and drugs tend to use this method, because cash flow closely resembles goods flow with this method.

LIFO METHOD.

The final method that a company can use is the LIFO Method (last-in, first-out). Under LIFO, it is assumed that the most recent purchase is always sold first. Therefore, the inventory that remains is always the oldest inventory. So for the given example, the first 200 jeans that are sold will reduce inventory and increase cost of goods sold at a rate of $10.75 per pair. Again, It does not matter if customers actually buy the newer pair of jeans first. Under LIFO, a company always assumes that it sells its newest inventory first. Nevertheless, this method represents the true flow of goods for very few companies.

COMPARISON OF THE METHODS

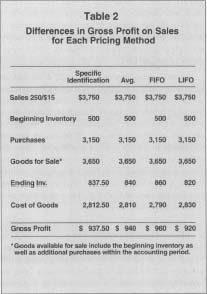

These different methods will affect cash flow, the actual or assumed association of inventory unit costs with goods sold or in stock—not goods flow, the actual movement of goods. Therefore, gross profits will vary among the different methods. The example of 250 pairs of jeans sold at $15 each in Table 2 demonstrates this phenomenon. Suppose that 80 pairs of jeans remain unsold during this period, making up the ending inventory, and apply the inventory prices supplied above for each method: the first 100 pairs of jeans were bought for $10 and the next 200 for $10.75—or $3,150.

Differences in Gross Profit on Sales

for Each Pricing Method

| Specific Identification | Avg. | FIFO | LIFO | |

| Sales250/$15 | $3,750 | $3,750 | $3,750 | $3,750 |

| Beginning Inventory 500 500 | 500 | 500 | 500 | 500 |

| Purchases 3,150 3,150 | 3,150 | 3,150 | 3,150 | 3,150 |

| Goods for Sale* | 3,650 3,650 | 3,650 | 3,650 | 3,650 |

| Ending Inv. 837.50 840 | 837.50 | 840 | 860 | 820 |

| Cost of Goods 2,812.50 2,810 | 2,812.50 | 2,810 | 2,790 | 2,830 |

| Gross Profit | $ 937.50 | $ 940 | $ 960 | $ 920 |

| * Goods available for sale include the beginning inventory aswell as additional purchases within the accounting period. | ||||

The differences in value of the ending inventory stem from the different ways each method calculates the ending inventory—by determining whether newer or older jeans were left, determining the weighted average for the two purchases, assuming the remaining 80 pairs are newer pairs, or assuming the remaining pairs are older pairs, respectively. Consequently, the differences in gross profit shown in Table 2 reflect the assumptions made about cash flow using the various inventory pricing methods, not the actual goods flow.

Of these four inventory methods, the most popular methods used are FIFO and LIFO. Even though LIFO does not reflect the actual flow of goods in most cases, approximately 50 percent of major companies use this method. The FIFO Method may come the closest to matching the actual physical flow of inventory. Since FIFO assumes that the oldest inventory is always sold first, the valuation of inventory still on hand is at the most recent price. Assuming inflation, this will mean that cost of goods sold will be at its lowest possible amount. Therefore, a major advantage of FIFO is that it has the effect of maximizing net income within an inflationary environment. The downside of that effect is that income taxes will be the greatest.

The LIFO Method is preferred by many companies because it has the effect of reducing a company's taxes, thus increasing cash flow. Nevertheless, these attributes of LIFO are present only in an inflationary environment. Under LIFO, a company always sells its newest inventory items first. Given inflation, these items will also be its most expensive items. So cost of goods sold will always be at its greatest amount; therefore, net income before taxes will be at its lowest amount, and taxes will be minimized, which is the major benefit of LIFO.

Another advantage of LIFO is that it can have an income smoothing effect. Again, assuming inflation and a company that is doing well, one would expect inventory levels to expand. Therefore, a company is purchasing inventory, but under LIFO, the majority of the cost of these purchases will be on. the income statement as part of cost of goods sold. Thus, the most recent and most expensive purchases will increase cost of goods sold, thus lowering net income before taxes as well as lowering taxes and net income. Net income may still be high, but not as high as it would if FIFO had been used.

On the other hand, if a company is doing poorly, it will have a tendency to reduce inventories. To do so, the company will have to effectively sell more inventory than it acquires. Since a company using LIFO assumes it sells its most recent purchases first, the inventory that remains is older and less expensive (given inflation). So when a company shrinks its inventory, it sells older, less expensive inventory. Therefore, the cost of goods sold is lower, net income before taxes is higher, and net income is higher than it otherwise would have been.

A disadvantage of LIFO is the effect it has on the balance sheet. If a company always sells its most recent inventory first, then the balance sheet will contain inventory valued at the oldest inventory prices. For instance, if a company were to switch from FIFO to LIFO in 1955, then unless the inventory was zeroed out at some point in time, there may be units of inventory valued at 1955 prices, even though the physical inventory is comprised of the most recent units. As a result, the inventory account can be dramatically undervalued if a company has adopted LIFO, and if during that time, the cost of inventory has increased.

The LIFO Method is justified based upon the matching principle, as the most recent cost of inventory is matched against the current revenue generated from the sale of that inventory. FIFO does not, however, distort the valuation of inventory on the balance sheet like LIFO can potentially do.

Companies generally disclose their inventory accounting methods in their financial statements, usually as a footnote or a parenthetical note in the relevant sections. Therefore, when examining financial statements, it is imperative that the inventory notes be read carefully, to determine the method of inventory valuation chosen by a company. It is most likely that either FIFO or LIFO would have been chosen. Assuming inflation, FIFO will result in higher net income during growth periods and a higher and more realistic inventory balance. In periods of growth, LIFO will result in lower net income and lower income tax payments, thus enhancing a company's cash flow. During periods of contraction, LIFO will result in higher income levels. LIFO also has the potential to greatly undervalue inventory over time.

PERPETUAL INVENTORY PRICING

The previous discussion and examples applied to periodic inventory accounting where a company records the purchases it makes, makes no record of the cost of goods sold at the time of sale, and periodically updates its inventory account. Companies that make numerous sales of products with relatively small unit costs usually employ the periodic accounting method. Such companies include grocery stores, department stores, and drug stores. Companies that make fewer sales of products with higher unit costs, however, use a perpetual inventory system. The perpetual inventory system is updated continuously, not periodically. This systems requires that companies keep track of merchandise purchases at the time of acquisition and the cost of goods sold at the time of sale. Hence, companies using this system have an account for merchandise acquisitions and for the cost of goods sold.

The same four pricing methods apply to this system. With specific identification, the actual cost of the goods sold makes up the cost of goods sold and the value of the remaining inventory equals the specific cost of each unsold item. The average method is called the moving average in the perpetual system. The average is determined each time a new inventory item is purchased. The cost of goods sold for each sale is calculated by multiplying the moving average at the time by the number of items sold.

When using the FIFO method with this system, a company determines the cost of goods sold each time a sale is made by multiplying the cost of the oldest goods on hand by the number of items sold. Finally, when using the LIFO method, a company computes the cost of goods sold each time a sale is made by multiplying the cost of the most recent purchases by the number of goods sold.

The use of the perpetual inventory accounting system requires a company to maintain a detailed perpetual record of inventory transactions, either manually or by computer. This record must include information on the inflow and outflow of inventory items as well as the quantities and prices of items at any given time. While these records are updated continuously, companies generally check their accuracy at least once a year by physically counting available merchandise.

[ William H. Coyle ,

updated by Karl Heil ]

FURTHER READING:

Harper, Robert M., and Denise M. Patterson. "An Alternative Approach for Computing Dollar-Value LIFO." National Public Accountant, December 1998, 20.

Hoffman, Raymond A., and Henry Gunders. Inventories: Control, Costing, and Effect upon Income and Tares. New York: Ronald Press, 1970.

Meigs, Robert F., et al, eds. Accounting: The Basis for Business Decisions. 11 th ed. Homewood, IL: Richard Irwin, 1998.

Walgenbach, Paul H., et al. Principles of Accounting. 5th ed. San Diego: Harcourt Brace Jovanovich, 1990.

Comment about this article, ask questions, or add new information about this topic: