REFINANCING

Refinancing is the refunding or restructuring of debt with new debt, equity, or a combination of both. The refinancing of debt is most often undertaken during a period of declining interest rates in order to lower the average cost of a firm's debt. Sometimes refinancing involves the issuance of equity in order to decrease the proportion of debt in the borrower's capital structure. As a result of refinancing, the maturity of the debt may be extended or reduced, or the new debt may carry a lower interest rate, or a combination of both.

Refinancing may be done by any issuer of debt, such as corporations, governmental bodies, or holders of real estate, including home owners. When a borrower retires a debt issue, the payment is in cash and no new security takes the place of the one being paid-off. The term "refunding" is used when a borrower issues new debt to refinance an existing one.

CORPORATE OR GOVERNMENT DEBT

REFINANCING

The most common incentive for corporations or governmental bodies to refinance their outstanding debt is to take advantage of a decline in interest rates since the time the original debt was issued. Another trigger for corporate debt refinancing is when the price of their common stock reaches a level that makes it attractive for a firm to replace its outstanding debt with equity. Aside from reducing interest costs, this latter move gives a firm additional flexibility for future financing because by retiring debt they will have some unused debt capacity. Regardless of the reason for the refinancing, the issuer has to deal with two decisions: (1) is the time right to refinance, and (2) what type of security should be issued to replace the one being refinanced?

If a corporation or governmental body wishes to refinance before the maturity date of the outstanding issue, they will need to exercise the call provision of the debt. The call provision gives the borrower the right to retire outstanding bonds at a stipulated price, usually at a premium over face amount, but never less than face. The specific price that an issuer will need to pay for a call appears in the bond's indenture. The existence of a call premium is designed to compensate the bondholder for the firm's right to pay off the debt earlier than the holder expected. Many bond issues have a deferred call, which means the firm cannot call in the bond until the expiration of the deferment period, usually five to ten years.

The cash outlay required by exercising the call provision includes payment to the holder of the bond for any interest that has accrued to the date of the call and the call price, including premium, if any. In addition, the firm will need to pay a variety of administrative costs, including a fee to the bond's trustee. Of course, there will be flotation costs for any new debt or equity that is issued as part of the refinancing.

Sometimes an issuer may be prohibited from calling in the bonds (e.g., during the deferred call period). In these instances, the issuer always has the opportunity to purchase its bonds in the open market. This strategy may also be advantageous if the outstanding bond is selling in the market at a price lower than the call price. Open market purchases involve few administrative costs and the corporation will recognize a gain (loss) on the repurchase if the market value is below (above) the amount at which the corporation is carrying the bonds on its books (face value plus or minus unamortized premium or discount).

The major difficulty with open market purchases to effect a refinancing is that typically the market for bonds, especially municipals, is "thin." This means that a relatively small percentage of an entire issue may be available on the market over any period. As a result, if a firm is intent on refinancing a bond issue, it almost always needs to resort to a call. This is why virtually every new bond that is issued contains a call provision.

If an outstanding issue does not permit a call or has a deferred call, the issuer can seek tenders (offers to sell) from current bondholders. This is an offer to have the bondholders sell their bonds back to the issuing corporation either at a predetermined price or one set through an auction. To be sure the tender offer is financially feasible to the issuer, boundaries will be set on the repurchase price.

Yet another tactic is available to "retire" a bond issue. This process is called defeasance and is popularly used in the not-for profit sector. It involves placing into trust, generally with a bank, a portfolio of securities, usually U.S. Treasuries with maturities at least as long as the time to the first call or maturity, whichever is earlier. If the transaction is structured properly, the interest and principal from the portfolio deposited in trust will equal or exceed the amount needed to service the bonds (interest, principal, and call premium, if any). Since for all practical purposes the bond issue has been retired, if the deal meets the necessary accounting requirements, the bond issue can be removed from the issuer's balance sheet.

The new debt instrument issued in refinancing can be simple or complex. A corporation could replace an existing bond with traditional bonds, serial bonds (which have various maturity dates), zero coupon bonds (which have no periodic interest payments), or corporate shares (which have no maturity date, but which may have associated dividend payments). One factor that a firm needs to consider is that the administrative and flotation costs of issuing either common or preferred shares are higher than for new debt. Furthermore, dividend payments, if any, are not tax deductible, while interest payments are.

The decision to refinance is a very practical matter involving time and money. Over time the opportunity to refinance varies with changing interest rates and economic conditions. When a corporation anticipates an advantageous interest rate climate, it then analyzes the cash flows associated with the refinancing. Calculating the present value of all the cash outflows and the interest savings assists in comparing refinancing alternatives that have different maturity dates and capitalization schemes.

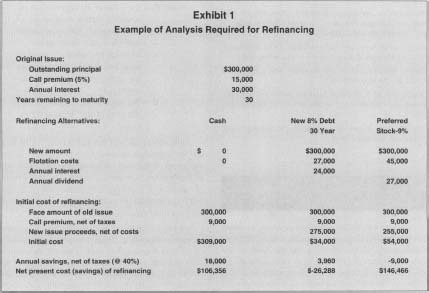

Exhibit 1 demonstrates the type of computation that needs to be made to determine the financial feasibility of refinancing alternatives. We are assuming a call premium (tax deductible) of 5 percent and a tax rate of 40 percent. The discount rate used in the present value computations is the after-tax interest\dividend cost of the respective alternative. For simplicity, we are assuming annual interest payments.

As can be seen, the most favorable alternative is to refinance with the 30-year debt. This results in a net present value savings of $26,288. The other alternatives each have a net present value cost.

MORTGAGE REFINANCING

The above method of analyzing the refinancing decision is also applicable to mortgage refinancing for residential or commercial real estate. To decide which refinancing alternative is the best, the analysis would be similar to the corporate decision illustrated above. For a mortgage one would:

- Calculate the present value of the after-tax cash flows of the existing mortgage.

- Calculate the present value of the after-tax cash flows of the proposed mortgage.

- Compare the outcomes and select the alternative with the lower present value. The interest rate to be used in steps one and two is the after-tax interest cost of the proposed mortgage.

Example of Analysis Required for Refinancing

| Original Issue: | ||||

| Outstanding principal | $300,000 | |||

| Call premium (5%) | 15,000 | |||

| Annual interest | 30,000 | |||

| Years remaining to maturity | 30 | |||

| Refinancing Alternatives: | Cash | New 8% Debt 30 Year | Preferred Stock-9% | |

| New amount | $ 0 | $300,000 | $300,000 | |

| Flotation costs | 0 | 27,000 | 45,000 | |

| Annual interest | 24,000 | |||

| Annual dividend | 27,000 | |||

| Initial cost of refinancing: | ||||

| Face amount of old issue | 300,000 | 300,000 | 300,000 | |

| Call premium, net of taxes | 9,000 | 9,000 | 9,000 | |

| New issue proceeds, net of costs | 275,000 | 255,000 | ||

| Initial cost | $309,000 | $34,000 | $54,000 | |

| Annual savings, net of taxes (@ 40%) | 18,000 | 3,960 | -9,000 | |

| Net present cost (savings) of refinancing | $106,356 | $-26,288 | $146,466 |

All of this needs to be tempered by how long the home owners believe they will be staying in their current home.

Whether it pays to refinance involves a different approach. Previously, in residential real estate the conventional wisdom applied the "2 2-2 rule": if interest rates have fallen two points below the existing mortgage rate, if the owner has already paid two years of the mortgage, and if the owner plans to live in the house another two years, then refinancing is feasible. Because of the tremendous varieties of mortgage options available today, however, this approach is no longer used. In fact, many home owners find it prudent to refinance if interest rates have fallen just 0.25 percent, especially if the refinancing can be done without the payment of points or closing costs.

A much easier approach involves three steps by determining: (1) the reduction in your monthly payment from refinancing, (2) the after-tax cash outflows required to refinance (usually points plus closing costs), and (3) how much longer you anticipate living in your current house. You then do a simple payback computation by dividing the costs from step two by the monthly savings in step one and comparing the result to the time in step three.

[ Ronald M Horwitz ]

FURTHER READING:

Arsan, Noyan, and Eugene Poindexter. "Revisiting the Economics of Mortgage Refinance." Journal of Retail Banking 15, no. 4 (winter 1993-1994); 45-48.

Bierman, Harold, Jr., and Seymour Smidt. Financial Management for Decision Making. New York: Macmillan, 1986.

Haugen, Robert A. Introductory Investment Theory. Englewood Cliffs, NJ: Prentice Hall, 1987.

Sharpe, William F., Gordon J. Alexander, and Jeffery V. Bailey. Investments. 6th ed. Upper Saddler River, NJ: Prentice Hall, 1998.

Short, Daniel G. Fundamentals of Financial Accounting. 7th ed. Homewood, IL: Irwin, 1993.

Comment about this article, ask questions, or add new information about this topic: