SIC 3471

ELECTROPLATING, PLATING, POLISHING, ANODIZING, AND COLORING

This category includes establishments primarily engaged in all types of electroplating, plating, anodizing, coloring, and finishing of metals and formed products for the trade. Also included in this industry are establishments that perform these types of activities on their own account, on purchased metals or formed products. Establishments that both manufacture and finish products are classified according to their products.

NAICS Code(s)

332813 (Electroplating, Plating, Polishing, Anodizing, and Coloring)

Industry Snapshot

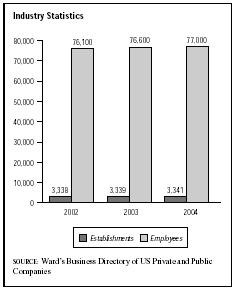

In 2001, there were a total of 3,241 establishments in this industry, with more than 70,000 employees and a payroll exceeding $2 billion. According to the 2001 Annual Survey of Manufactures , 55,652 workers were in production jobs, and shipments were valued at just under $5.9 billion. Employment was projected to rise to 77,000 by the mid-2000s, with shipments estimated to reach a value of nearly $7.4 billion.

There were two types of firms in the industry: small, private corporations and large, publicly held companies that were either subsidiaries or divisions of larger parent corporations. While larger firms were often more diversified in the number of electroplating and finishing processes they utilized, smaller firms tended to specialize in one or two types of finishing processes. During the 1950s and 1960s, many companies established their own finishing operations, but with the onset of increased environmental regulation of the industry in the 1970s many manufacturing firms opted to subcontract for finishing services, thus avoiding the added costs of waste treatment. Later, the trend once again was for manufacturing firms to own and operate their own finishing operations, often integrating production and finishing processes.

Background and Development

Historically, the most important activity in this industry was electroplating. Electroplating entailed adhering a thin metal coating to an object by immersing it into an electrically charged solvent containing the dissolved

plating metal. Metals commonly used in plating included copper, nickel, chromium, zinc, lead, cadmium, tin, brass, and bronze, as well as precious metals such as gold, silver, and platinum. Electroplating served a number of functions, such as protecting from corrosion and wear, decoration, and electrical shielding.

Alessandro Volta's creation of the battery in 1800 first made electroplating possible. Commercial electro-plating began around 1840. Before the development of commercial nickel plating in the 1910s, the metals most commonly used for plating were silver, gold, and brass. Nickel plating tarnished and developed green corrosion, but that problem was eradicated in the late 1920s with the development of commercially practical chromium plating. This was a key development in the history of the industry, especially in regard to plating applications for the automobile and appliance industries. Though nonmetallic materials had been electroplated since the mid-nineteenth century, they became increasingly important for the industry after the 1963 development of ABS plastic, which lent itself to electroplating.

Of increasing importance for the industry in the 1980s and early 1990s was plating utilized as electrical shielding, particularly for the plastic housings of computers. The Crown City Plating Company, based in El Monte, California, developed the electroless process used for such shielding around 1970.

The solvents used to dissolve plating metals often were highly toxic. Cyanide, for example, was a commonly used solvent. In addition to being one of the most toxic of commonly found pollutants, its toxicity was heightened when mixed with certain plating metals. Cyanide also interfered with water treatment processes and formed a toxic gas when converted to an acid. Of the plating metals, cadmium, chromium, and lead were the most problematic. The increasing regulation of the use of such solvents had a great impact on the industry's development.

Key statutes affecting the industry included the Federal Water Pollution Control Act Amendments of 1972; the Resource Conservation and Recovery Act of 1976; the Clean Water Act of 1977; and the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, better known as Superfund.

The number of enforcement actions by the Environmental Protection Agency (EPA) increased steadily from the late 1980s into the 1990s. In 1996 the EPA took a record number of criminal enforcement actions. In that year criminal fines amounted to more than double the previous record. A record 262 criminal cases were referred by the EPA to the Department of Justice in 1996, and $76.7 million in criminal fines were assessed. Total criminal, civil, and administrative fines and penalties in 1996 were the highest in EPA history, totaling $173 million, indicating that pollution abatement would continue to be a key issue for the industry.

The significant effect of environmental and safety regulations on the industry was suggested by the aims of one of the industry's trade organizations. Founded in 1955 and located in Chicago, the National Association of Metal Finishers (NAMF) had 850 members in the late 1990s who were managing executives of firms in the industry. Often committees of the NAMF were devoted to issues of regulation.

Difficulties facing the industry from the 1970s through the 1990s included increasing production costs, excessive competition, and a shortage of experienced employees. Excessive competition had a number of implications, one of which was the relatively slow rate of productivity growth in the industry. From 1958 to 1974 the value added per production worker hour more than quadrupled for computers and related machines and doubled for motor vehicles and parts and household laundry equipment. During the same period, the metal finishing industry experienced only a 17 percent increase. As of 1994, the value added per production worker in the plating industry was only half that of the average of the manufacturing sector as a whole.

A 1992 study of the industry's future concluded that development of the industry lay in the nature of environmental regulations, as well as future demand for more sophisticated finishes. As parts to be finished became larger and more complex, finishing processes also became more complex.

Demand for the industry's products was dependent on the demand for durable goods and thus dependent on growth in the manufacturing sector at large. Growth and profitability also were dependent on the creation of environmentally safe manufacturing techniques. The pace of technical change was brisk entering the 1990s, which suggested that the industry could meet environmental and safety regulations in a cost-effective manner.

The automotive industry represented a significant end-consumer of this industry's products. From the 1970s through approximately 1985, the plating industry enjoyed brisk sales of zincrometal (zinc priming applied to the unexposed side of cold-rolled steel) to the auto industry. In the mid-to-late 1980s, some 1.2 million tons of zincrometal were sold annually. However, in the mid-1980s the auto industry began to use electrogalvanized steel, which was treated right at the steel mill instead of being processed by a separate company. In 1998 all transportation industries (including automotive) bought only 470,000 tons of coated steel coil (including zincrometal.)

In the 1990s capital investment in the industry was very low compared to the average capital expenditure in all other manufacturing industries. In 1994 the average investment per establishment in the metal finishing industry was 83 percent below the national average for manufacturing industries. This enabled relatively easy entry into the industry and accounted for the large number of small, often family-owned, private firms.

The ease of entry into the industry made for highly competitive conditions in which small, independent companies were positioned between large suppliers of finishing machinery and materials and the large corporations for which they provided services. This meant relatively low profits for small manufacturers.

Smaller firms' dilemma of keeping abreast of innovative techniques was exacerbated by their need to adhere to a host of environmental regulations. This problem was deepened by the less sophisticated control procedures many smaller companies were forced to utilize due to lower cost. For example, quality finishes could only be obtained through highly sophisticated processes often unavailable to smaller firms.

One bright spot for smaller companies arose from the EPA's own broad mandate to regulate industry with an overstretched budget. In 1995 the EPA proposed deferring Clean Air Act operating permit requirements for non-major sources in three industries, one being the decorative chromium electroplating and chromium anodizing segment. The EPA recognized the difficulty small businesses had in meeting the requirements and the massive assistance they would require from regulators. The deferral would last for five years; certain electroplating operations would be exempted permanently.

The industry capitalized on studies suggesting trends that its products could address. For example, a late-1990s study revealed that corrosion (or expenses incurred repairing corrosion) amounted to approximately 4 percent of the gross national product. Statistics such as this worked in the industry's favor, as plating represented one of the main means of combating corrosion. Similarly, the nickel used in the industry was thought to be carcinogenic until studies showed this to be false (one non-industry study concluded that potential carcinogenicity was "not able to be determined," according to J. Kelly Mowry in the industry magazine Finishing Line. )

Current Conditions

Like many manufacturing sectors, the industry was looking to consolidate and streamline production facilities. Although industry leader Siegel-Robert closed a few of its facilities from 2001 to 2003, the company expanded and opened others in an effort to "lean manufacturing initiatives," according to comments from a company spokesman in Plastics News. In 2002, Shipley Electronic Finishes acquired a license for Lucent's electroplating portfolio, which included technology for tin and precious metal electroplating.

From the mid-2000s and beyond, the industry was challenged to remain competitive by the development and use of new electroplating techniques to streamline production, increase output, and cut costs. One promising development was the copper electroplating system called the Electra Cu Integrated ECP. Rather than requiring the use of more than one furnace and multiple production steps, this system allowed metal to be processed in one step.

Industry Leaders

St. Louis, Missouri company Siegel-Robert led the industry in 2001 with $487 million in sales and 3,100 employees. Northern Steel Castings Inc. of Wisconsin Rapids, Wisconsin, was second with $158 million in sales and just 100 employees. Rounding out the top three was Jenkintown, Pennsylvania-based International Metals and Chemicals Group with $105 million in sales and 200 employees.

Research and Technology

Throughout the 1990s many significant technical developments in the industry arose in response to environmental regulation. The Torrington Company of Connecticut demonstrated a method to recover cadmium and chromium from electroplating rinsewaters. In one study using the ion exchange method, both cadmium and cyanide were removed, sometimes to below detection levels, while the pH of the rinsewater remained constant. Following the exchange, cadmium was recovered and regenerated, while less cyanide was necessary for wastewater treatment.

In the 1990s pollution prevention methods often took the path of reducing the need to coat or plate at all, sometimes by using coating-free materials such as titanium, reinforced plastics, weathering steel, and aluminum alloys. In addition, alternatives to traditional coating systems were found in emerging technologies. Studies found promise in nonelectroplating methods, including electron beam-cured coatings, super-critical carbon dioxide coating systems, and radiation-induced thermally cured coatings.

Some of the most promising technologies, such as the dry application of metal powders, were classified in SIC 3479: Metal Coating & Allied Services. The success of such techniques was expected to lead to a shift in production away from the plating industry.

Sandia National Laboratories in Albuquerque developed methods for gold-plating onto microelectronic devices that did not use cyanide. Metal-ceramic coatings were substituted for cadmium coatings for certain high-priced parts. Handy and Harman Electronic Metals Corporation, the seventh-largest firm in the industry, developed a formable silver-tin oxide as a replacement for silver-cadmium oxide for coating electrical contacts. Previously used silver-tin oxides were not formable, so the process of applying them was more labor-intensive and costly. In addition to their reduced environmental hazard, silver-tin oxides were also more highly conductive.

GE Research and Development devised a method for nickel-plating plastics to shield computer housings. This process did not use chromium, unlike Crown City Plating's process, and was applied with a water-based solution.

In 2003, a new technology was being touted as an effective alternative to electroplating. Developed by ASB Industries, this cold-spray technique using aluminum, titanium, or copper offered not only a quality product but also increased efficiency of production.

Further Reading

American Electroplaters and Surface Finishers Society. "Corrosion Principles & Control via Metal Finishing," 22 January 2000. Available from http://www.aesf.org/newsflash.htm .

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

"Cold-Spray Alternative to Electroplating." American Machinist , April 2003.

"Copper Electroplating Technology." Solid State Technology , February 2000.

Darnay, Arsen J., ed. Manufacturing and Distribution USA. Detroit: Thomson Gale, 2003.

Hoover's Company Fact Sheet. "Siegel-Robert Inc." 2 March 2004. Available from http://www.hoovers.com .

Mowry, J. Kelly. "NAMF Update—Nickel Controls." Finishing Line , April/May 1999.

"Newsclips." Plastics News , 10 March 2003.

"Shipley EIF Licenses Lucent's Electroplating Technology." Finishing , September 2002.

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

——. Survey of Manufacturers , 10 February 2000. Available from http://www.census.gov/prod/www/abs/97ecmani.html .

U.S. Department of Commerce. Annual Survey of Manufactures. Washington: GPO, 2002.

Comment about this article, ask questions, or add new information about this topic: