SIC 3578

CALCULATING AND ACCOUNTING MACHINES, EXCEPT ELECTRONIC COMPUTERS

This industry covers establishments primarily engaged in manufacturing point-of-sale devices, fund transfer devices, and other calculating and accounting machines, except electronic computers. Included are electronic calculating and accounting machines that must be paced by operator intervention, even when augmented by attachments. These machines may include program control or have input/output capabilities.

NAICS Code(s)

334119 (Other Computer Peripheral Equipment Manufacturing)

333313 (Office Machinery Manufacturing)

Charles Xavier Thomas, of France, is credited with starting the calculating and accounting machines industry when he introduced the arithmometer in the 1870s. Frank Baldwin and William S. Burroughs also were major innovators in early calculating machine technology. During the industrial revolution and until the mid-1900s, mechanical and electrical adding machines dominated industry offerings. The invention of the hand-held calculator in 1948 and the integrated circuit in the late 1960s, however, initiated the demise of traditional adding machines.

Producers of desk-top and hand-held calculators shipped goods worth a total of $1.4 billion in the late 1990s. Both products had essentially become commodity items by that time. Electronic cash registers, an offshoot of calculating machines, offered higher profit margins for manufacturers. Scanning technology and the demand for related inventory tracking systems in the 1980s and early 1990s spurred the development of new "high-tech" cash registers that buoyed profits for some prior producers of traditional calculating machines. Other competitors exited the market or shifted to production of other equipment.

Automatic Teller Machines (ATMs) and Point of Service (POS) devices, which were added to industry offerings in the 1980s, quickly escalated sales of cash registers and adding machines. Sales of ATMs, which store cash and are used primarily by bank customers to conduct account transactions, skyrocketed past a total of 90,000 units by 1993. Less expensive POS devices, which allow consumers to conduct electronic account transactions from a purchase point such as a gas station or supermarket, numbered about 300,000 in 1993.

By the early 1990s, the market for ATMs was becoming saturated in comparison to the 1980s. Manufacturers' earnings were expected to rise as industry analysts projected a growing demand for replacement machines and a 20 percent rise in the number of ATM installations between 1993 and 1997. By the last quarter of 2003, ATM manufacturers were seeing double digit increases in sales. Diebold alone had an increase of about 150 percent. The number of POS devices sold, on the other hand, was expected to increase to more than 1.1 million by 1997 as a growing number of retailers adopted this method of accepting payment. In the 2000s, the move toward self-checkout systems saw this industry growing more and more popular, both increasing revenue and decreasing price.

Industry-wide, the top company in 2001 was NCR Corp. of Dayton, Ohio, with sales of $5.5 billion and 30,400 employees, which had dropped to 29,700 by the following year. NCR posted sales of nearly $5.6 billion in 2003. In distant second place was Diebold Inc. of North Canton, Ohio, with $1.9 billion in sales and 13,100 employees. Rounding out the top three was West Greenwich, Rhode Island-based GTECH Holdings Corp., with $1 billion in sales and 4,500 employees.

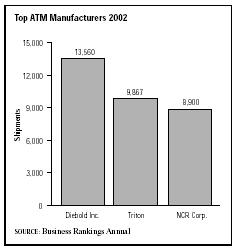

Looking at specific sectors, the top ATM manufacturers in 2002 were Diebold Inc., with a total of 13,560 shipments; Triton, with 9,867 shipments; and NCR Corp., with 8,900 shipments. The top POS manufacturers in 2002 were Verifone, with 31 percent, and Hypercom with more than 30 percent. This sector shipped nearly 2 million POS terminals that year, an increase of more than 12 percent over 2001 figures. By 2004, NCR had acquired

smaller competitors to bring its total market share to 80 percent.

Manufacturers hoped to increase ATM sales by integrating video-conferencing and imaging capabilities into their products. Some banks were also experimenting with selling mutual fund shares through ATMs. Cash register manufacturers were striving to jump-start lagging sales by integrating advanced inventory tracking and information systems technology into new product offerings. As of 2003, however, ATMs were still primarily used to get cash, and more than 75 percent of ATM transactions were for this purpose.

Despite the popularity of ATMs and POS devices in the United States, the technology had been slow to catch on overseas. Only about 40,000 ATMs, for example, had been installed outside the United States. Spain and the United Kingdom combined had approximately 10,000 ATMs, while Austria, Denmark, Germany, Ireland, Norway, and Sweden had none. ATMs in Japan were available for use only during daylight hours.

By 2005, ATMs and POS terminals were required to comply with the standards for Triple DES data encryption, opening up a market not only for replacement machines but for upgrading or retrofitting old units. Upgrading was the more economical solution for ATM owners, since the majority of machines only needed new software or keyboards, a difference of $2,000 versus upwards of $25,000. However, industry giants NCR and Diebold were refusing to offer upgrades as of 2003. This move which was viewed by some industry players as "forced obsolescence," according to American Banker. In addition, requirements from the Americans with Disabilities Act regarding accommodations, as well as new check clearing standards, dubbed "Check 21," assured growth in this industry well into the 2000s.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Breitkopf, David. "Diebold and NCR Benefiting from ATM Replacement Cycle." Electronic Packaging & Production, 3 February 2004.

——. "Replace or Revamp? That's the Triple DES Question." American Banker, 24 November 2003.

"Diebold, NCR Report Fourth Quarter Sales Gains." Cardline, 30 January 2004.

Draper, Deborah J., ed. Business Rankings Annual. Detroit, MI: Thomson Gale, 2004.

Garry, Michael. "NCR to Acquire Optimal's Self-Checkout Business." Electronic Packaging & Production, 23 February 2004.

Hoover's Company Fact Sheet. "Wyman-Gordon Company." 2 March 2004. Available from http://www.hoovers.com .

Keenan, Charles. "ATMs: Finding Ways to Focus the Network." American Banker, 6 May 2003.

Lazich, Robert S., ed. Market Share Reporter. Detroit, MI: Thomson Gale, 2004.

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

——. Employment Statistics. Washington, D.C.: GPO, 2000. Available from http://www.bls.gov .

Comment about this article, ask questions, or add new information about this topic: