SIC 3569

GENERAL INDUSTRIAL MACHINERY AND EQUIPMENT, NOT ELSEWHERE CLASSIFIED

This category covers establishments primarily engaged in manufacturing machinery, equipment, and components for general industrial use, and for which no special classification is provided. Machine shops primarily engaged in producing machine and equipment parts, usually on a job or order basis, are classified in SIC 3599: Industrial and Commercial Machinery and Equipment, Not Elsewhere Classified.

NAICS Code(s)

333999 (All Other General Purpose Machinery Manufacturing)

Companies in this industry produce miscellaneous manufacturing equipment. The plethora of industry offerings includes items such as altitude testing chambers, hydraulic bridge machinery, industrial centrifuges, cremating ovens, industrial fluid filters, swimming pool heaters, fire hoses, hydraulic jacks, and fire sprinkler systems.

The general industrial machinery and equipment industry is heavily dependent upon sales to other manufacturing businesses and to construction industries. In addition, about 30 percent of revenues are derived from exports. Intense capital investments during the U.S. industrial boom of the mid-1900s resulted in steady growth in demand for all types of industrial machinery. By the early 1980s, in fact, domestic producers of miscellaneous industrial machines were shipping about $4.5 billion worth of products each year and employing a workforce of about 65,000.

Rampant growth in U.S. capital spending slowed in the 1980s, as foreign-manufactured goods reduced U.S. producers' share of capital goods markets. Machinery purchases by transportation industries were particularly slow. As a result, sales of miscellaneous machinery stagnated. Industry revenues lagged as a result of inflation and climbed at an average rate of about 2 percent per year during the 1980s to about $5.36 billion. Recessed commercial and residential construction markets added to industry woes in the late 1980s and early 1990s. Ailing manufacturers scrambled to sustain profitability by raising productivity, cutting their workforce, and merging with or acquiring competitors.

Going into the mid-1990s, producers of miscellaneous machinery hoped to benefit from increased capital spending by the Clinton administration, an uptick in capital equipment replacements, and a devalued dollar, which was boosting exports. In addition, sales of machinery to some sectors showed signs of increasing. Construction equipment sales, for example, rose about 3 percent. However, spending on new manufacturing facilities and infrastructure remained flat through the mid-1990s.

Like all other manufacturing industries, the industry was hit hard in the late 1990s and early 2000s due to a falling economy and increased foreign competition. The trend in the 2000s toward efficiency and automation buoyed those companies in the industry that manufactured robotic machines and other automated technologies, and this sector was experiencing large growth in the early part of the century. According to ABB, the industry was concentrating research and development on "the emerging technologies of nanotechnology, microelectromechanical systems (MEMS), wireless applications and software technologies."

According to the Annual Survey of Manufactures, in 2001 the industry employed 58,632 workers, including 34,116 production workers. Total payroll exceeded $2.3 billion, and total shipments for the industry were valued at more than $8.9 billion.

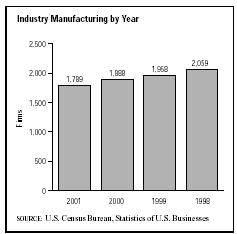

The industry is primarily run by numerous specialty manufacturers. Despite industry consolidation, the U. S. Census Bureau showed 1,789 firms operating in this industry during 2001, the vast majority of which had fewer than 100 employees.

The industry leader for 2001 was ABB Flexible Automation Inc. of Auburn Hills, Michigan, which had sales of $9.6 billion and employed 1,200 people. UNOVA Inc. of Woodland Hills, California, had $1.3 billion in sales and 6,700 employees. Rounding out the top three was East Hills, New York-based Pall Corp., with nearly $1.3 billion in sales and 10,700 employees.

As companies continued to automate production facilities and move manufacturing operations across U.S. borders, the Bureau of Labor Statistics suggested that general industrial machinery industry employment would continue to decline into the mid-2000s. Projections for the Other General Purpose Machinery Manufacturing industry as a whole indicated a slight annual increase through 2012.

Further Reading

"ABB Wins 2003 Global Energy Award," 18 December 2003. Available from http://www.abb.com/global/seitp/seitp202.nsf/0/96cedc36f9678f2a85256dfe006e9e13?Open Document.

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Chang, Joseph. "Wall Street Highlights Industrial Gas Sector in Volatile Times." Chemical Market Reporter, 14 October 2002.

"Core Divisions Post Strong Results," 19 February 2004. Available from http://www.abb.com/global/seitp/seitp202.nsf/0/05f61e2e6e3239c3c1256e3d003b373d!Open Document.

"Emerging Technologies," 2004. Available from http://www.abb.com/global/abbzh/abbzh254.nsf/0/6ed20e4c95ba1716c1256b540034cf54?Open Document.

"Paint to Order." Global Design News, October 2001.

"Robots." Plastics Technology, October 2001.

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Commerce. Annual Survey of Manufactures. Washington: GPO, 2002.

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

U.S. Industrial Outlook 1993. Washington: U.S. Department of Commerce, January 1993.

Comment about this article, ask questions, or add new information about this topic: