SIC 3568

MECHANICAL POWER TRANSMISSION EQUIPMENT, NOT ELSEWHERE CLASSIFIED

The Mechanical Power Transmission Equipment, Not Elsewhere Classified, industry is comprised of companies that manufacture mechanical power transmission equipment and parts for industrial machinery. Products include ball joints, pulleys, bearings, drive chains, sprockets, shafts, couplings, and other parts. Companies that make transmission devices for vehicles and aircraft are classified in SIC 3714: Motor Vehicle Parts and Accessories and SIC 3728: Aircraft Parts and Auxiliary Equipment, Not Elsewhere Classified, respectively.

NAICS Code(s)

333613 (Mechanical Power Transmission Equipment Manufacturing)

The market for miscellaneous transmission equipment is fragmented. Motor vehicle manufacturers were the largest buying sector, accounting for 9.2 percent of industry revenues in the late 1990s. Tanks and tank components accounted for another 5.2 percent of sales, while iron and steel foundries took 4.3 percent. Blast furnaces and steel mills purchased 4.0 percent of the industry's sales, and the logging industry took another 3.0 percent. The construction and farm machinery industries consumed 2.9 percent and 2.8 percent of output, respectively. Motorcycle and bicycle makers purchased about 2.0 percent of production.

Other significant markets for transmission equipment included shipbuilders, lawn and garden equipment manufacturers, nonferrous metals refiners, and the missile industry. About 10.5 percent of production was exported.

Power transmission refers to the transfer of power through mechanical devices. The invention of the steam engine by James Watt in 1765 and the development of the internal combustion engine during the mid-1800s greatly expanded applications for power transmission equipment and played an important role in the industrial revolution. The industry realized its greatest growth during the U.S. economic expansion of the post-World War II era. Indeed, by the early 1980s, makers of miscellaneous transmission equipment were shipping about $2 billion worth of goods annually.

The effects of global competition seriously cut into the profits of U.S. manufacturers during the 1980s. In an effort to sustain profitability, miscellaneous transmission manufacturers increased productivity through automation and restructuring. As real output rose, the industry workforce shrank more than 13 percent during the decade, from more than 27,000 to about 24,000. Employment continued to drop, falling to 21,800 in 1992. With the recovery of the economy in the mid-1990s, however, employment figures began to rise. By 1995, employment in the industry had climbed back to 22,700—a 4 percent increase over the 1992 figures—although still almost 6 percent below the employment figures at the end of the previous decade. However, during the second half of the decade the sector's workforce once again resumed its downward trend, falling to 21,400 in 1997. Further shrinkage of the workforce was projected into the early 2000s.

Despite efficiency gains, a recession in the late 1980s and early 1990s reduced profits for many competitors. Sales dropped about 2.5 percent in 1992. That year, the industry shipped goods worth $2.40 billion. By 1994, the total value of goods shipped reached $2.79 billion—an increase of 16.4 percent—and in 1995 that total rose to $2.89 billion, a further increase of 3.5 percent. Shipments of $3.25 billion in 1997 represented a jump of 12.5 percent over the industry's showing in 1995.

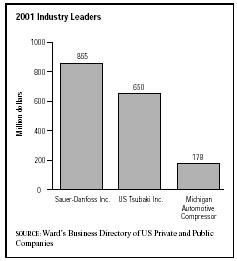

The 2001 industry leader was Sauer-Danfoss Inc. of Ames, Iowa, with sales of $855 million and 6,800 employees. The following year, there were more than 7,200 employees. Sauer-Danfoss had 2003 sales of $1.1 billion. However, the company reported a financial loss for that timeframe despite increased sales, due to the larger increase in manufacturing costs, particularly in the areas of research and development, as well as administration.

In second place was US Tsubaki Inc. of Wheeling, Illinois, with $650 million in 2001 sales and 1,000 employees. Michigan Automotive Compressor of Parma, Michigan, rounded out the top three with sales of $178

million and 600 employees. About 300 companies competed in the industry in 2001, and the total shipment value was nearly $3.2 billion.

Future employment prospects are dim. Productivity gains and the movement of some production facilities across U.S. borders has resulted in continued workforce reductions. Most labor opportunities had declined and will continue declining into the mid-2000s, according to the Bureau of Labor Statistics. Overall prospects for the Engine, Turbine, and Power Transmission Equipment Manufacturing industry as a whole were for employment to be unchanged through 2012.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Darnay, Arsen J., ed. Manufacturing and Distribution USA. Detroit: Thomson Gale, 2003.

Hoover's Company Fact Sheet. Sauer-Danfoss Inc. 3 March 2004. Available from http://www.hoovers.com .

"Sauer-Danfoss Inc." Business Record , 18 August 2003.

"Simpler Skid-Steer Designs: Plus, Hydraulic Cartridge Motor Packs More Propulsion." Design News , 6 October 2003.

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Commerce. Annual Survey of Manufactures. Washington: GPO, 2002.

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

"Wider Loss at Sauer-Danfoss in Third Quarter." Business Record , 3 November 2003.

Comment about this article, ask questions, or add new information about this topic: