SIC 5571

MOTORCYCLE DEALERS

This category includes establishments engaged in the retail sale of new and used motorcycles. This classification also includes those dealers who sell motor scooters, mopeds, and all-terrain vehicles.

NAICS Code(s)

441221 (Motorcycle Dealers)

Industry Snapshot

Motorcycling remains one of America's most popular forms of recreation and transportation. The number of people who enjoy motorcycle activities is comparable to the number of people who engage in fishing, golfing, and camping. Because there are many sizes of vehicles available, motorcycling has become a family recreational activity. In addition to providing enjoyment, motorcycles, scooters, and all-terrain vehicles are used in industry in various ways.

Retail motorcycle, moped, and all-terrain vehicle dealers are divided according to whether they are engaged primarily in selling new or used vehicles. Vendors of new motorcycles, mopeds, and all-terrain vehicles own franchises to sell products of specific vehicle manufacturers. Dealers who do not operate as new vehicle franchises sell used motorcycles in addition to vehicle parts, accessories, and clothing. Almost all dealers, however, have vehicle service departments, which are also sources of significant revenue.

In 2001, the U.S. Census Bureau recorded approximately 4,271 establishments engaged in the retail sale of new and used motorcycles. There were about 43,249 people employed within the industry that shared $1.4 billion in annual payroll. In 2003, the total number increased to 9,603 and together they generated about $9.9 billion in sales. The average business represented approximately $1.10 million. The total number of people working within the industry also climbed to 55,658. The majority of these businesses, 1,149, were located in California, followed by Texas with 652, Florida with 609, and Pennsylvania with 425.

There were a total of 3,583 businesses engaged in the retail of motorcycles and they controlled almost 40 percent of the market. Motorcycle parts and accessories numbered 2,886, or about 30 percent of the market. Motorcycle dealers numbered 2,381 establishments, or more than 24 percent of the market. There were 471 businesses that sold all—terrain vehicles, as well as parts and accessories. In addition, there were 133 motor scooter retailers, 84 moped retailers, and 65 motorized bicycle retailers.

As a public service and a sign of commitment to their customers, most franchise dealers have joined or formed nonprofit associations to act as advocates for their products and to provide education about the use and enjoyment of these vehicles. They provide information about safe riding practices and work to increase owners' awareness of the impact that their motorcycles, scooters, and all-terrain vehicles can have on the environment.

Organization and Structure

Although there were more than 7,000 nonfranchised retailers in the industry, it was the 3,400 franchised outlets that garnered more than 80.0 percent of the industry's business. According to industry statistics, the average franchised motorcycle outlet had total motorcycle related sales and services of $700,000 in the mid-1990s, compared to $122,500 for the average nonfranchised outlet. On average, sales of new motorcycles, scooters, and all-terrain vehicles made up approximately 54.0 percent of a franchised dealer's business, while 23.2 percent was attributed to sales of parts, accessories, and apparel. In contrast, 68.0 percent of nonfranchised outlet sales was parts, accessories, and apparel.

There were franchised and nonfranchised retail outlets in all 50 states and the District of Columbia. Although California had almost two times more retail outlets than any other state, the business was otherwise evenly distributed across the United States. According to MIC statistics from 1997, approximately 6.5 million motorcycles were owned in the United States, representing approximately 2.5 motorcycles for every 100 persons. In terms of rider distribution, California, Texas, New York, Florida, and Ohio accounted for more than one-third of all motorcycle ownership in the United States, while the West enjoyed the highest motorcycle penetration, with 2.9 motorcycles per 100 persons. In 1995 outlets in the Midwest generated 27.9 percent of the industry's retail sales of new motorcycles. The South was the second leading region, representing 27.2 percent of the total. Retail outlets in the East sold 22.3 percent of new motorcycles, and businesses in the West garnered 22.1 percent.

Background and Development

The history of the motorcycle dealer industry is closely related to the development of the U.S. motorcycle manufacturing industry. The earliest motorcycles were basically bicycles powered by small engines, and the motorcycle was considered a relatively cheap alternative to the more expensive, early automobiles. Many U.S. manufacturers produced motorcycles before World War I, contributing to a dynamic, if not booming, domestic market. Literature from the Harley-Davidson company reported that by 1911, their motorcycles were among the 150 brands of vehicles vying for space on America's roads. Orient, Henderson, Cyclone, and Indian were the primary competitors of Harley-Davidson at that time. Henry Ford's affordable Model-T, however, doomed many motorcycle manufacturers. In fact, by the end of the Great Depression, the only remaining manufacturers and sellers of motorcycles were Indian and Harley-Davidson. Indian closed down production and distribution in 1953.

Harley-Davidson is one of the most recognizable brand names in the United States. The company began production in 1903 in Milwaukee, Wisconsin. By 1907, William and Arthur Davidson and William Harley had incorporated and issued their first advertising catalog. Their business grew by diversifying their product lines to include a variety of vehicles with different-sized engines, improving engine technology, and increasing sales of their motorcycles to the U.S. government for military use. Harley-Davidson watched carefully as the "motorcycle culture" developed in the late 1950s and early 1960s, often being labeled an "outlaw" lifestyle. Motorcycle gangs, in particular, prompted the public's negative opinions of cycling; in the early 1990s, however, the company maintained that fewer than 1 percent of all motorcyclists fit that category.

New motorcycles sales (including on-and off-highway models as well as scooters) increased 23 percent through the first three quarters of 1999 as compared to the same period in 1998, according to the Retail Sales Report conducted by the Motorcycle Industry Council (MIC). This increase marked the seventh consecutive year of rising new motorcycle sales. Retail sales of new motorcycles in 1997 amounted to $2.9 billion, or 28.3 percent of the estimated $10.2 billion generated by the motorcycle industry overall from consumer sales and services, state taxes, and licensing that year. Apparel sales and accessory sales in 1998 each amounted to $1.2 billion, while repairs and parts sales contributed $1.5 billion to the combined $3.9 billion aftermarket, according to the 1998 Motorcycle Owner Survey conducted by Irwin Broh & Associates for the MIC.

Competition. The late 1950s and early 1960s saw the first influx of low-priced, smaller Japanese motorcycles and scooters into the United States. Honda began U.S. distribution of its products in 1959, with the slogan, "You meet the nicest people on a Honda," to combat the negative image associated with the sport. Yamaha starting selling motorcycles in the United States during 1960; Suzuki followed in 1963; and Kawasaki joined the competition in 1967. BMW opened a U.S. distribution arm in 1975, incorporating in New Jersey. Harley-Davidson ended years of private ownership in 1965 with a public offering of its stock, and eventually merged with industrial giant AMF in 1969.

The oil crisis in the 1970s prompted the popularity of the smaller motorcycles, mopeds, and scooters that were made primarily by Japanese manufacturers. Dealers sold vehicles to those interested in conserving gas and finding cheap transportation. Harley-Davidson's market share, already dropping, was further threatened by Honda's 1969 entrance into the heavy and super heavyweight segment of the market. By the late 1970s Harley-Davidson faced severe production quality problems in addition to stiff competition. A management buyout in early 1981 set the course for the company's revitalization. It was protection under higher tariffs however, recommended by the International Trade Commission, that helped shut Honda out of Harley-Davidson's key market. In response, Japanese manufacturers evaded the tariffs by setting up assembly plants in the United States. For example, Honda built a plant in Ohio and Kawasaki opened a facility in Nebraska.

Harley-Davidson's resurrection and Honda's sagging sales worked to even the motorcycle market by the early 1990s. Harley-Davidson's bikes, in particular, were enjoying increasing popularity, and the company also received praise for its marketing initiatives, innovations in customer service, and improved dealer-customer communications. In 1997 the company had 340,000 members in its Harley Owners Group (HOG), 275,000 of whom were located in the United States. Members received a bimonthly magazine, a touring handbook that included city and state maps and a list of dealers in each state, and other benefits. Each authorized Harley-Davidson dealer may sponsor a local HOG chapter. In 1997 there were 590 HOG chapters in the United States and 940 worldwide.

Safety Concerns. The public's perception of motorcycling safety also has a large impact on the industry's prospects. In the ten years after 1988, motorcycle injury crashes dropped 47 percent and fatalities declined 42 percent. Since 1973 the nonprofit Motorcycle Safety Foundation developed motorcycle rider education courses for beginning and experienced riders. More than 120,000 riders were trained annually in these courses, most of which received state funding.

In the mid-1980s, three-wheel, all-terrain vehicle sales were negatively affected by concern over their safety. The Consumer Product Safety Commission targeted the vehicles and disabled Honda's sales efforts. Business Week reported that before the "crusade," 40 percent of Honda's North American business had been in all-terrain vehicles. Consequently, Honda quickly lost its market dominance to Yamaha, whose four-wheel vehicles were considered safer and therefore less controversial.

Economic Trends. The retail motorcycle, moped, and all-terrain industry is strongly affected by national economic trends. Recessionary and expansionary trends essentially dictate the retail consumption levels of vehicles. The number of new motorcycle registrations climbed until the early 1980s, but fell dramatically in the second half of that decade. Total motorcycle registrations dropped from a high of 5.7 million in 1980 to 4.1 million in 1991. The U.S. Industrial Outlook 1994, however, reported that this trend had bottomed out, and projected an increase in shipments from motorcycle manufacturers to dealers in the mid-1990s. After letting their inventories drop in the late 1980s, dealers began replenishing their stocks of motorcycles, mopeds, and all-terrain vehicles in the early 1990s, as buyers began shopping for new, larger motorcycles.

In 1995 the industry generated approximately $4.8 billion in revenues. Sales of new vehicles accounted for about 45.0 percent, or $2.2 billion of total revenues; 30.7 percent, or about $1.5 billion, came from sales of parts, accessories, and riding apparel. Sales of used vehicles accounted for 13.8 percent, or approximately $668 million of the industry's 1995 revenues; and service labor charges accounted for 9.1 percent, or $440 million. Income from other motorcycle-related sales, primarily insurance and extended warranties, represented 1.3 percent of total industry sales, or approximately $63 million in 1995. The 53,589 industry employees earned an approximate payroll of $987 million in 1996, including owner and manager salaries and advances. Business was conducted at 10,715 retail outlets in all 50 states and the District of Columbia.

Market-share rankings fluctuated dramatically in the years leading up to the 1995 figures. While Honda remained the market-share leader, its share slipped almost 10 percentage points from 39.0 percent in 1988 to 29.2 percent in 1995. Gains made by other brands, therefore, had come at Honda's expense. In 1988 Kawasaki was the third-largest brand, holding 13.9 percent of the market. By 1995 Kawasaki actually gained market share but was in fourth place among the six major brands, with 14.1 percent of the market. Yamaha was the third-largest player, holding 15.2 percent of the market in 1995, and Suzuki accounted for 13.2 percent of new motorcycle sales. German manufacturer BMW, with 1.6 percent of the total, was sixth among the top brands. Harley-Davidson, fifth in 1988 with 9.4 percent of the market, experienced an 11-point market-share increase over four years, moving into second place in the early 1990s. In 1995 Harley-Davidson still held second place, with 23.3 percent of the market.

The livelihood of franchised dealers depends on the franchise they hold. In the mid-1990s, the industry was dominated by six brands of motorcycles. The MIC indicated that together, these brands accounted for 96 percent of the new motorcycles sold in 1997. Harley-Davidson's domestic motorcycle shipments broke the 100,000 unit mark in 1998, rising to 110,902 from 96,216 in 1997. Harley-Davidson's domestic shipments of 97,540 for the first three quarters of 1999 already surpassed 1997 totals. Meanwhile, Honda motorcycle sales slipped 9 percent over the second quarter of 1999, though this figure represented international sales, which were sluggish in Asia.

The average motorcycle rider was a 38-year-old married male with a college education earning $44,250 per year, according to Irwin Broh & Associates's 1998 survey. More than a third of motorcycle owners surveyed earned at least $50,000 per year, up from 20 percent in 1990. This profile represented an increase from just two years earlier, when the average motorcycle owner was 32 years old, with a median household income of $33,100, according to the Motorcycle Statistical Annual 1996. These older, more affluent riders of 1998 could afford heavier, more comfortable, more expensive motorcycles. Also, the ranks of women motorcyclists continued to grow in the 1990s, rising from 6.4 percent of riders in 1990 to 8.2 percent in 1998.

Industry experts suggested that dealers would see more showroom traffic from middle-aged (35-54-year-old males and females) consumers as manufacturers focused on designing new products targeted at this market segment. This group has historically had the highest levels of disposable income. Motorcycle dealers had success selling technologically advanced, luxury vehicles to this generation of buyers in the past and hoped to capitalize on them in future. Manufacturers also began offering improved safety features on popular heavyweight (850 cc and up) bikes.

Current Conditions

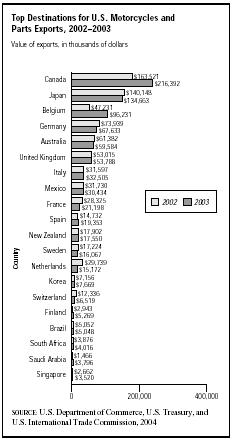

The growth from exports became a major player for the motorcycle industry in 2000. In fact, exports totaled about $563 million, which was up 20 percent and accounted for 30 percent of the overall domestic sales in 2001. The dominant player was Japan, followed by Canada, Australia and Germany. The demand by the foreign market was expected to continue well into 2007. Some countries such as India, and China were experiencing larger cash flows, which could generate sales of mopeds, scooters, and motorcycles. The Freedonia Group predicted

an annual increase of 5.2 percent to more than 35 million units valued at $46 billion in 2007.

On December 23, 2003, the Environmental Protection Agency (EPA) enacted the newest set of emission standards for highway motorcycles. According to Mike Leavitt, EPA administrator, "motorcycles currently produce more harmful exhaust emissions per mile than cars or even large sport utility vehicles." Beginning in 2006, motorcycle manufacturers would have "to reduce emissions of HC and oxides of nitrogen NOx by 60 percent." The new standards would also include the previously exempt small scooters mopeds. In 2010, the new standards will cost about $75 for each motorcycle.

Japan generated about $216.4 million in U.S. motorcycle sales in 2003. Belgium accounted for $96.2 million, which warranted a 103.7 percent jump over 2002. Most impressive was Saudi Arabia with an increase in demand of 158.9 percent.

Further Reading

"Briefing American—Style Motorcycles to International Consumers." Export America, August 2001. Available from http://exportamerica.doc.gov .

D&B Sales & Marketing Solutions, May 2004. Available from http://www.zapdata.com .

Millett, John. "New Standards for Highway Motorcycles Contribute to Air Quality Improvements." 23 December 2003. Available from http://www.epa.gov/cgi—bin/epaprintonly.cgi .

"Top 20 Export Destinations for Motorcycles and Parts." U.S. Department of Commerce, U.S. Treasury, and U.S. International Trade Commission. 10 March 2004. Available from http://www.trade.gov/td/ocg/exp37512.htm .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. April 2004. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .

"World Motorcycles Demand to Reach 35.6 Million Units in 2007." The Freedonia Group, 10 September 2003. Available from http://www.the-infoshop.com/press/fd15765_en.shtml .

Comment about this article, ask questions, or add new information about this topic: