Automotive Dealer Group

BUSINESS PLAN

POMPEI-SCHMIDT AUTO DEALERS INC.

8625 Collingwood Ave.

Orlando, FL 56835

Pompei-Schmidt's business plan for a nationwide dealer group takes advantage of an emerging industry trend of vehicle leasing. PSAD provides a detailed, well-researched plan to meet the emerging market need and establish a profitable business venture for both auto dealers and PSAD.

- EXECUTIVE SUMMARY

- ENVIRONMENTAL ANALYSIS

- THE COMPANY

- THE PRODUCT

- THE MANAGEMENT TEAM

- MARKET RESEARCH AND PLAN

EXECUTIVE SUMMARY

The automobile industry is experiencing a dramatic transformation that will forever alter the way both new and used vehicles are marketed and sold. As consumers change their operational structure and methods. Pompei-Schmidt Auto Dealers Inc. (PSAD) has recognized these shifting dynamics and positioned itself to take maximum advantage of rapidly-changing consumer and economic trends.

PSAD's mission is to deliver non-prime credit lease and purchase financing, consulting, training and ongoing support that will provide automobile dealerships across the United States with the skills and services they need to improve their competitive posture and increase profitability. Areas of focus include sales techniques, leasing, finance and insurance. The economic results of the successful accomplishment of this mission will be significant profits both for dealer clients and for PSAD.

As the automotive industry becomes increasingly sophisticated, dealers are looking outward for assistance in increasing new and used car sales, improving margins, containing costs, developing additional profit centers and designing programs that will meet consumer demands today and in the coming years. In response to dealer needs, PSAD has developed an integrated system to allow dealers to achieve higher profit levels. Through the system's implementation and maintenance, PSAD shares in its clients' financial success.

PSAD'S three divisions work independently and collectively to provide a customized product package to each dealer client. Insurance Works provides a complete portfolio of insurance products for the franchised automobile dealer market. Development Works provides consulting and training to new and used-car dealers. The training focuses on sales skills, financing alternatives, and leasing options with the goal of increasing the number of closed transactions and correspondingly, enhancing profits. Finance Works provides dealers with a wide range of financial services including additional financing options for their customers and the ability to offer subprime financing and leasing programs for new and used cars.

A Historical Perspective

In the early days of the automobile, horseless carriages were viewed with great suspicion. Adventurous consumers paid cash for the privilege of owning a motorized vehicle that could travel at breathtaking speeds of up to 30 miles per hour.

The passage of time saw an evolution in vehicle technology. Banks began making automobile loans, which put car ownership within reach of the average American. Suspicion turned to tolerance and eventually to enthusiastic acceptance of the automobile as the country's primary method of personal transportation.

After World War II, factories were able to return to manufacturing consumer goods, and the automobile assembly lines were back in action. The interstate highway system was created, and the automobile became an integral part of American culture. Borrowing money for major purchases had become both socially acceptable and increasingly common. Typically new cars were purchased from franchised dealers that were sole proprietors or family-owned businesses. A local bank handled the financing.

In a country hungry for luxuries after years of deprivation caused by the Depression and World War II, selling cars was easy. Consumers established a pattern of buying new cars and replacing them every two or three years. Dealers accepted trade-ins that were either sold on their own used-car lots or wholesaled at auction to independent dealers. In either case, used cars were the industry's stepchild. New car dealers paid little attention to their used car departments primarily because banks were less enthusiastic about making used car loans than they were about financing new vehicles, and used cars were generally viewed as less reliable and less desirable than new ones.

The American automobile industry experienced few significant changes during the 1950s and 1960s. The oil embargo, rising gas prices and increased demand for imports during the 1970s was a wake-up call to American car manufacturers. And as the vehicles themselves changed, so did the outlets through which they were sold.

The 1980s saw the creation of the automobile superstore, which combined franchises within a dealership and offered consumers a greater level of shopping convenience. Megadealers built their own empires, purchasing a variety of franchises in multiple cities and states. Some dealers responded to consumer demands by eliminating high-pressure sales tactics, providing more customer-friendly showroom environments, and increasing after-the-sale service.

The Current Picture

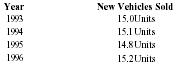

Consistently low interest rates, attractive financing and strong lease programs combined to make 1994 a good year for the auto industry. According to Buyers' Guide , total sales of domestic and imported cars and light trucks totaled nearly 15.1 million units-up almost 9 percent over the previous year.

In 1995, sales were good, but lower than in 1994. New vehicle sales by dealers reach $293.3 billion and 14.75 million units; total annual sales were approximately $500 billion.

Forecasters expect new-vehicle sales to rebound in 1996, reaching and perhaps exceeding the 1994 figures. The year should see 15.1 to 15.2 million units sold.

These statistics indicate that the industry has stabilized and is in the early stages of a strong growth period. Companies such as PSAD with the foresight to develop programs to support this growth can expect to do well in the coming years and into the next century.

| Year | New Vehicles Sold |

| 1993 | 15.0 Units |

| 1994 | 15.1 Units |

| 1995 | 14.8 Units |

| 1996 | 15.2 Units |

Industry Forecast

In any industry, change is inevitable, and the automobile industry is no exception. The industry has entered a new age of selling transportation. Never before has the consumer had so many choices in terms of product selection, financing options and vendors; that trend is likely to continue.

Dealers are listening to and responding to consumers by developing new operational strategies. For example, dealers are responding to consumers who have become frustrated with the traditional wheeling and dealing that has been an accepted part of auto price negotiations by experimenting with techniques such as one-price, haggle-free selling. Silver, with the highest retail sales per dealership in the auto industry, was founded and formulated on the concept of hassle-free selling.

To maintain their own profitability and ability to deliver services, dealers are looking for new and creative ways to establish additional profit centers, such as insurance, service and maintenance agreements.

Leasing is becoming increasingly popular among both dealers and consumers. Leasing can eliminate or reduce the down payment; monthly lease payments are usually significantly lower than payments on a purchase loan. The American Leasing Association (ALA) expected about 33 percent of new personal-use vehicles to be leased in the 1995 model year.

Another key trend is the greater acceptance of used vehicles by the car-buying public. New car quality is improving. Today's cars are built better and last longer, which means used cars are more attractive to consumers than ever before. According to the editor of Cars Today , "It used to be that a three-year old car was considered old. It could be a junker. Today that same car can be considered very clean." Contributing to this trend is the fact that new car prices continue to rise. From 1989 to 1993, the average price of a U.S. made luxury car rose nearly $2,000 each year. These new car price increases have squeezed many would-be buyers out of the new car purchase market and into the used car or leasing market.

PSAD Marketing Strategy

PSAD is positioned to work with franchised and independent auto dealers from every critical business perspective. PSAD's line of products and services are uniquely targeted to a desirable market which produces significant revenues and has clear and unarguable long-term growth potential.

By developing first class products and delivering them with professionalism and integrity, PSAD has built an outstanding reputation that has resulted in a high account retention rate. By helping dealers build ongoing relationships with their customers, PSAD naturally builds strong, long-term relationships with those dealers.

In spite of the maturity of the automotive industry, experienced consultants with firsthand knowledge of the business are not readily available. This is primarily because until recently, automobile dealers have not been inclined to look outward for management and business development assistance. However, dealers are increasingly recognizing and appreciating the overall business trend toward outsourcing, and are admitting the need for and benefits available from the use of outside consultants. Consequently, the demand for services such as those provided by PSAD should increase markedly in the coming years.

New business is obtained through field solicitation, mail solicitation and referrals. Frequent face-to-face contact is made with clients throughout the year by representatives of each PSAD division. This multi-level, multi-departmental contact establishes and maintains a strong relationship between PSAD and the client. It also provides liberal opportunities for cross-selling among PSAD divisions.

In the insurance arena, only an independent agency can respond to the ever-changing market conditions and needs of the clients. By not relying solely on any one line of business, the PSAD insurance division, Insurance Works, will remain flexible and enjoy a quick response capability that other agencies may lack. At the same time, by targeting the automotive niche and diversifying within that niche, Insurance Works can expect consistent ongoing revenues even while reacting to market changes.

In the dealer development arena, Development Works will deliver training that includes a strong focus on purchase dynamics as they truly exist. Leasing is a key area of training; clients are taught techniques that can increase their closing ratio by 25 percent or more. Training is conducted by instructors with years of practical experience in dealership operation; clients respond favorably to this high level of credibility. Dealers aggressively pursue qualified trainers such as Development Works, in anticipation of the training's impact to the dealership's bottom line. Automobile manufacturers also recognize the value of training and many have opted to reimburse the dealerships the training expenses. A member of Development Works has been named as one of three independent advisors to Reynolds Leasing Advisory Board.

In the finance arena, PSAD Finance Works will be on the leading edge of subprime finance and leasing trends. Beyond funding the vehicle transactions, the company has combined its financial expertise with its management, sales and marketing skills to become a key member of the dealer client's business development team as they work with the dealer to place and secure previously leased and program vehicles.

ENVIRONMENTAL ANALYSIS

Industry Trends

A number of basic trends are changing the dynamics of the automobile industry. They include:

- a 25 percent increase in car prices over the last five years

- a growing supply, demand and profit margin for loaded used cars

- the changing dynamics of vehicle ownership

- the explosive growth of leasing

- the need for a broader range of dealer profit centers

- the increased demand for subprime credit options

- the dilution of the traditional dealer franchise system.

Let's take a closer look at these trends. New car prices are rising faster than the overall rate of inflation. According to Leasing Now , this steady increase is forcing potential buyers to reconsider a decision to purchase a new car. For example, when faced with a choice between buying a new car and a major home purchase (a computer, entertainment system, major appliances, etc.), consumers often opt to maintain their existing vehicles in favor of the other purchase. However, studies indicate that this decision is a delay and not a cancellation of a vehicle purchase; the purchase will take place after other needs are met.

In the past, consumers commonly rejected used cars as a primary household vehicle, viewing them as a problem someone else managed to get rid of. Used cars were generally purchased for children or as second cars driven by non-working spouses. The latter has been changed by the increase in dual-income families. Working couples require appropriate vehicles for both partners.

Because of the increased quality and supply of feature-rich used cars, these vehicles are now viewed as a viable and acceptable option to a new car that costs twice as much or has fewer features. Also, because many new cars have factory warranties for periods of up to five years, many late-model used cars on the market are still covered by the original warranty when the second owner takes possession. Plus, many dealers offer warranties on used cars.

The growing popularity of leasing can be attributed in large part to the fact that it is a far more customer-friendly way to sell a car than traditional financing. Leasing eliminates dickering over price, thereby making the transaction more pleasurable and efficient for the customer.

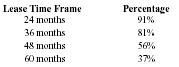

From the dealers' perspective, leasing generates increased sales volume and has a higher customer return rate than straight purchasing. Dealer Council studies indicate that 25 percent of automobile buyers will return to the same dealer for their next vehicle; by contrast, 91 percent of individuals who lease will return to the same dealer for their next car. Because leases are typically of a shorter duration, often as little as half the time of a standard purchase finance agreement, vehicle turnover is significantly higher among leasing customers.

Loyalty Analysis-Industry Average

Lessee likelihood of leasing from the same lessor. All vehicles including light trucks. Source: Dealer Council

| Lease Time Frame | Percentage |

| 24 months | 91% |

| 36 months | 81% |

| 48 months | 56% |

| 60 months | 37% |

New and used automobile superstores have changed the public's perception of dealerships. Consumers expect and demand a wider range of products and easy shopping opportunities. Today, a dealer might carry new vehicles from as many as five or more competing manufacturers and offer a substantial selection of used cars. Brand loyalty on the dealer's part is far less important than putting together a package that appeals to the customer.

The actual sale of a vehicle - especially a new vehicle - represents a very small percent of profit to dealers. The more significant portion of profits is made in areas such as service, financing and insurance programs. Savvy dealers are exploring their options in these areas, and developing products such as service and maintenance agreements that can be sold separately from the vehicle itself.

The fastest growing segment of automobile sales involves buyers with bad or bruised credit. As banks move to decrease their loan risks, it has become increasingly more difficult for a large percentage of the population to qualify for traditional credit. It is estimated that over 70% of the market has bruised credit. For new car dealers able to finance non-prime credit, this situation translates into significantly increased sales and leasing. Originally pioneered by buy-here, pay-here lots, the concept is quickly becoming an important profit center for conventional dealerships. Finance Works is positioned to take advantage of the industry shift with a variety of programs that offer subprime credit in both lease and purchase situations.

Automotive Financing and Financial Services for New and Used Vehicles

Increasing new and used car prices, fluctuating interest rates and personal economic uncertainty on the part of consumers have sparked a number of changes in the way vehicles are financed. Consumers are looking to dealers to find ways to make the cars they want affordable. Consequently, major auto companies have been forced to re-examine their financing capabilities.

The results of this activity are illustrated by companies such as Jones Credit, which wants to use their new subprime finance unit to create customer loyalty. Kelly Motors, and Riota recognize the financing demands and are evaluating the potential for subprime financing programs. Kelly Financing wants to boost its retail financing programs, and plans to shift gears from creating the programs to implementing them. By contrast, the finance groups owned by Brownlee, Manzli and Reynolds say they are not currently interested in offering subprime financing.

Sportz Cars North America Inc. took full control of its captive finance company in January, 1995. This ended a three-year partnership with Credit Corp. The move was made to cut the response time for credit checks, expand a used-car leasing program, and tailor its programs for high-end customers.

An issue automobile financiers must deal with is a large percentage of consumers who are currently able to pay, but who may have suffered a bruised credit rating for one reason or another. These customers are often excellent candidates for leasing.

Local dealers who have good relationships with several local banks who can offer more flexibility in financing terms with their buyers. On average, franchise dealers can arrange financing for 65 percent of their buyers. In comparison, independent used-car dealers can arrange financing for less than 25 percent of their buyers.

However, increased financing options mean increased sales. That's why Joe Caldwell, owner of the Caldwell Automotive Superstore in Chicago, Illinois, has been aggressive in building banking relationships. An October, 1995 issue of Corp. explained that Caldwell sells later-model, well-maintained used cars, and Mr. Caldwell works with at least eight local banks to arrange financing for 80 percent of his buyers. Though that figure is far above the national average, there is no practical reason why other new car dealers cannot operate at or close to the same levels. PSAD offers financing resources to assist dealers in reaching this goal.

In any discussion of automotive finance, it's important to note that within the automobile dealer industry, acquisitions and mergers occur under the umbrella of financial services. As the Market Avenue Journal reported, one of the more interesting of these transactions occurred when Tomorrow's Auto Group, a closely-held auto dealership group, acquired an 80 percent stake in Spike Sales of Little Rock, Arkansas in August 1995. With annual sales of approximately $1.2 billion, Tomorrow's Group is one of several larger dealership organizations that are buying up smaller operations across the country as part of a consolidation of what has been a fragmented industry.

In another notable transaction described in the Market Avenue Journal was Bundren Co.'s acquisition of Auto Touch Group, Inc., an automobile financing company, in September 1995. Bundren Co.'s issued about 10 million shares to pay for the acquisition.

Dealers interested in growth through mergers and acquisitions can benefit from the guidance and proficiency of financial experts with automotive experience. This is precisely the type of expertise PSAD brings to the table.

Used-Car Sales

The used vehicle market is undergoing an extensive image transformation. The Auto Newswire circulated results of a 1995 poll of automotive consumers which indicated that the image and preferability of used vehicles is at its highest level ever. This presents a major opportunity for new car dealerships to capture a much larger share of the used car market than they enjoyed in the past. PSAD is targeting this market in its dealer development programs.

In 1995, used-vehicles sales at franchised and independent dealers totaled $311.4 billion. Vehicle Newspoint reports that the annual U.S. market for used cars now totals more than $50 million cars and trucks changing hands each year.

According to Corp. , the average selling price of a used car had risen from $6,000 to $10,750 over the last 10 years. Even with that increase, the average cost of a used car is half the average cost of a new car. Statistics as of March 1995 from the American Leasing Association (ALA) show the average retail cost of a new car was $19,925.

Luke Skye of the ALA, which represents most new car dealers in the United States, says the average gross profit margin on a new car in March 1995 was 6.7 percent. But, Skye points out, "A dealer's expenses are close to 6.7 percent. So he's really just breaking even on every sale." In 1994, according to the ALA, new car departments of franchise dealers returned less than 1 percent net profit on sales.

In contrast, the average gross profit on used car sales by those same dealers now stands at 12 percent. Moreover, since overhead expenses relating to the used car operations are lower than those for new cars, more money from that department falls to the dealer's bottom line. In 1994, it was 2.2 percent of sales.

The value-added elements a new car dealer brings to a used car transaction are important. There is usually a significant amount of goodwill and name recognition attached to the franchise. Buyers feel more secure because the dealer usually provides a warranty and has a repair shop. New car dealers are also leading the industry in establishing a variety of profit centers which mean the availability of additional products, such as insurance, to the consumer.

However, used-car superstores are on the rise. Examples include CarGo, Caldwell Automotive Superstore, Dada Auto and Auto World, Inc. Industry experts say the reason these superstores have come into being and are thriving is because customers were unhappy with the typical car-buying experience.

Bechtold City has gone into the used-car business through its subsidiary, Carton. In 1994, Carton's Raleigh store sold 4,050 cars at an average price of $13,664 to gross $455.3 million, according to Lisa Merle & Co. That's 30 times the sales of an average used-car dealer. Carton turned over its inventory 8.4 times, more than twice the industry average.

Caldwell Automotive Superstore specializes in selling late-model, well-maintained cars that appeal to many would-be new-car buyers because they cost thousands of dollars less than the same car bought new. The Caldwell stores are successful because they contain several profit centers. They offer financing, insurance, service contracts, rust-proofing and routine service. These areas generated 54 percent of the company's gross profit.

A new chain that will be called Auto World, Inc. will stock 350-650 late-model used cars and trucks at each dealership. Prices will be fixed, and no bargaining will be permitted. Vehicle purchases will include detailed warranties.

In January 1996, Dada Auto Group opened an 800-unit used car dealership in New York. The company's chairman, Bruce Jennere, says there is more profit to be made by selling previously owned vehicles rather than new ones. Jennere said his organization is absolutely interested in becoming a significant player in the used car business. In addition, industry rumors have retailers such as Baker and Brommel thinking of getting into the used car business.

Automotive Leasing

Automotive leasing is on the increase because it provides benefits to both consumers and dealers. For the consumer, leasing means lower monthly payment. It lets consumers drive a higher-priced, better-featured car than they could afford to buy. The under 30 market is more interested in short-term contracts than long-term purchases. Older consumers remember being caught upside-down in car loans during the 1980s, owing more than the car was worth and being forced to sell by circumstances such as a job lay-off; it's an experience they are not eager to repeat. The increase in self-employed individuals and small business owners means a higher number of consumers who may benefit from the tax advantages of leasing.

For dealers, leasing improves customer loyalty. Studies show that customer loyalty among lease customers is roughly double that of regular financing customers. The nature of the transaction means the customer automatically comes back to the dealership to return the car, and the dealership is then more likely to get that customer into another one of their cars. Lease cycles are shorter and therefore turn more frequently as compared to buying/financing cycles.

For salespeople, closing ratios are higher for leasing than buying. Closing ratios are 42.1 percent for leasing, compared with 27.6 percent for vehicle purchases. Cars Today reported that almost 64 percent of salespeople now present leasing as an alternative to buying a vehicle - up from 9 percent in 1991.

From a demographic perspective, it's important to recognize that women purchase 52 percent of all vehicles and influence 85 percent of all purchases. According to the Auto Newswire , women typically dislike the traditional vehicle purchase negotiation process, which is all but eliminated with leasings. They also tend to dislike dealing with car repairs, which is another issue resolved by leasing. Also, women (more than men) tend to appreciate the perceived safety and convenience factors of driving a new car every few years.

Industry statistics show that leasing trends are on the rise. A Cars Today article stated that leasing accounted for 13 percent of overall car sales volume in 1993, up from 4 percent in 1990. More specifically, another Cars Today article reported that leasing accounted for 30 percent of Sportz's volume and 40 percent of MHZ's volume. In trucks, leasing account for 7 percent of overall volume in 1993, up from 2 percent in 1990.

Dolman Communications reported that during the 1994 model year, 28.7 percent of new personal-use vehicles were leased rather than purchased. The American Leasing Association (ALA) expected about 33 percent of new personal-use vehicles to be leased in the 1995 model year.

Jones has been industry's market leader in short-term, 24-month retail leases. In 1993,31 percent of Jones' retail transactions were personal-use leases. Leasing account for 12 percent of Jones' total truck volume and 16 percent of total car volume. Kelly Financing plans to boost its leasing programs by training dealers and employees, and restructuring its organization. In the fall of 1995, Reynolds received the capital and commitment from top management to develop a specific leasing strategy to compete in the leasing market.

Erich Smith, a long-time Boulder area Livingston dealer, expects leasing to get an even bigger chunk of the car market in the next couple of years, especially in the higher-priced autos, which normally lose value quickly.

Used-Car Leasing

Used-car leasing is a relatively new trend, resulting primarily from the increase in popularity and acceptability of the used car market. Used car leasing is becoming more popular in the consumer market because many vehicles coming out of fleets have high residual values, and consumers are turning to leases in some cases to finance them. In particular, luxury car companies are moving toward leasing the same vehicle to several customers before ultimately recycling it.

Consumers who may have been turned away from a new or used car purchase in the past due to poor credit histories may find themselves able to qualify for a used car lease. Another benefit is that leasing a used car rather than a new one allows for lower cost insurance coverage for the driver.

Reasons Why Consumers Choose Leasing

- Less expensive than purchasing

- Lower monthly payment than with a comparable finance contract

- No down payment or a lower one

- Tax advantages

- Easier to get credit approval

As of January 1996, barely 4 percent of used-car buyers were aware that they could lease a used vehicle. However, thanks to awareness programs such as those developed by PSAD, that percentage is growing. Leasing Now projects that over one million used car leases will be signed during 2001.

Dealer Training and Consulting

Along with the ease of qualifying for a lease, stepped-up training has made salespeople eager to promote leasing to customers. Major automobile dealers have demonstrated a clear willingness to spend significant sums on training.

An article in Cars Today says dealers can overcome their average worries about running a successful dealership if they made a commitment to training. Ads can create traffic, but a positive image and sales are built on the showroom floor.

Reynolds Corp. planned to have a national training program in place by January 1996 to help dealers learn the fundamentals of leasing. Dealer and employee training programs are new responsibilities for Kelly Motors Acceptance Corp.'s new market staff. As described in Cars Today , the programs are designed to impact Kelly Financing's retail financing and leasing programs.

Sales & Marketing Management reported that Verleon spent $850,000 on a sales training program which employs comparison shopping. Sales figures for the first two months of 1995 (after the training) were double those of last year for the same period. The sales reps experienced an invaluable gain of confidence and trust in their product.

An April 1995 issue of the Advertising Journal said DeLeon Automotive Group, an auto dealer chain, planned a three-year, $400,000 project to retrain nearly 500 employees. Mr. DeLeon believes his dealerships are only as good as the people working in them. He hired consultants to improve the responsiveness of his personnel. He also hired Main Frame, an national database management company which targets car dealerships, to improve the follow-up process with potential car buyers.

These are just a few of the multitude of examples available that illustrate the growing commitment to training in the automotive industry. With its wide range of training programs, flexible presentation capabilities, and industry knowledge, PSAD is in an excellent position to gain significant market share in this evolving industry.

Automotive and Dealer Insurance

By its nature, the automobile industry is a major consumer of insurance products. For example, dealers carry liability and property and casualty coverage, along with a standard or mandatory insurance package for their employees.

Beyond insurance to meet their own needs, dealers have discovered the issue of insurance as a profit center. Savvy dealers are aggressively marketing insurance products, particularly those that are related to the financing agreement, such as credit life and credit disability. These products are available through PSAD's insurance division, Insurance Works.

THE COMPANY

Each division of PSAD is staffed by professionals - industry experts, attorneys, accountants, etc. - who know and have solid relationships with dealers across the country. The three divisions combine for a powerful product package that also produces economies of scale for both the Company and its clients.

Insurance Works

Formed in 1979, Insurance Works provides a complete portfolio of insurance services for the franchised automobile dealer market. From bonds to repossession insurance, this division allows dealers to turn to one source for all their insurance needs. No other agency addresses all insurance needs for this market.

The Insurance Works division is comprised of 12 employees and agents, each specializing in new car dealers. The high level of expertise and experience of these 12 professionals, arms them with the ability to efficiently and expertly address any insurance need the new car dealer may have.

Through its long-term business relationships, Insurance Works has gained the value of incumbency in over half the Georgia market. This is beginning to greatly assist the cross-selling of products, since Insurance Works is a well-known and highly respected agency to the dealers. Years of building personal and professional relationships with the dealers has allowed Insurance Works to achieve a greater account penetration and write multiple lines of business in an increasing number of accounts.

The principals of Pompei-Schmidt Auto Dealers believe that only an independent agency structured like Insurance Works can respond to the ever-changing market conditions and needs of the automotive industry. This organization has uniquely targeted a desirable market which generates high premiums in all lines. By not relying on any one line of business, Insurance Works is able to survive and grow regardless of overall market conditions.

Development Works

The Development Works division provides a variety of much-needed consulting services and training programs to new and used car dealerships. By hosting on-site training workshops and designing unique management programs, the Development Works division offers a wide selection of programs, each designed to increase sales and make the operation more profitable.

Under the direction of Charlie Salinger and Grace Long, this division has grown and now thrives. Through two distinct avenues, this division enhances the profitability of automobile dealerships. On one front, Development Works delivers comprehensive sales training to dealership employees. The training focuses on sales techniques, the use of financing alternatives to close and increase the profitability of sales, and leasing alternatives. On a second front, Development Works provides corporate financial assistance to the dealership itself. For example, they can restructure for increased profitability, package for sale or succession planning and refinance corporate debt.

Development Works is the nation's leading independent Jones lease training company, and second in the number of enrolled Jones dealers.

Development Works staff of instructors and consultants offer personal training and individualized solutions for the problems dealers and their sales teams face every day, all designed to increase the overall profitability of the dealership. Each member of the training and consulting teams brings a minimum of 15 years experience in dealership operations. In addition to providing valuable training which has resulted in significantly increased sales, their advice and expertise has been the prelude to turning many dealerships around - making them profitable for the first time in several years.

The most popular Development Works program is lease training, also known as the Lucrative Equity Program. When industry trends reflected an increased demand by consumers to lease automobiles, Development Works recognized a potential need for sales teams to learn how to promote the leasing option. From a dealership's perspective, this provides sales teams with more products to offer potential buyers without deviating from their current selling system.

In keeping with the ideals of Pompei-Schmidt, the goal of Development Works is to provide top-rated training and consulting to automotive dealerships throughout the United States. The service is a natural fit for the Pompei-Schmidt Dealers as they continue to position the company as a one-stop shop for all automobile dealerships.

Finance Works

Staffed by financial experts, Finance Works presents a unique profit center for the Pompei-Schmidt Auto Dealers. The other divisions of PSAD make dealerships more profitable and allow them to sell or lease more cars. It is only natural for a third division to be poised to benefit from this increased growth. Finance Works is that third profit center.

When an automobile dealership turns to PSAD for assistance with training or consulting, the dealership is likely to increase their business. This increased business, whether it is through the leasing of cars or an acquisition of new business, presents an opportunity for the Pompei-Schmidt Auto Dealers to assist the dealership in yet another way. By offering financial products through the Finance Works, the dealerships may enjoy the comfort of working with the same organization which helped them grow.

The industry's average yield on subprime notes financing used cars is 25-30 percent. Add to this the fact that the same car can potentially be financed 2-4 times, and the profit opportunities increase even more. An additional benefit for the consumer is the opportunity to improve their personal credit rating, and through trading up, provide them with a newer, nicer vehicle in the process.

Used car lease financing is a virgin market and Finance Works is at the forefront of this innovative financial market. These points clearly indicate why, from a corporate standpoint, Finance Works has an extremely large profit potential for the Pompei-Schmidt Auto Dealers. Through thorough planning and development, Pompei-Schmidt Auto Dealers realized that Finance Works is a natural compliment to their services. Through financing the growth of each dealership they work with, Finance Works allows profits to be made on virtually every level.

Finance Works was created to acquire existing non-prime credit companies. At this time, it is involved in several negotiations to acquire a base of business in non-prime credit. It plans to complete at least one of these transactions in the first quarter of 1996. Finance Works has established a top notch management team of professionals in the automotive finance business.

THE PRODUCT

The various PSAD products can be used separately or collectively. In any case, the goal is to guide dealers in turning all functions in selling cars into distinct profit centers.

In many instances, dealers recognize the need for a creative approach to the process of designing innovative profit centers for a variety of related products and services. They also recognize the advantage of outsourcing that process.

Insurance Works has always had the objective of becoming a full-service agency for the franchised auto dealer market. No other agency currently addresses all insurance needs for this market.

Insurance Works

Insurance Works provides services to more than 400 Georgia dealers, including license and other bonds for more than 350 dealers; garage liability and group health for 10 dealers; workers' compensation for more than 80 dealers; credit insurance for approximately 10 dealers; and repossession insurance. Insurance Works is the largest independent writer of cost-reducing workers' compensation plans and services for franchise dealers in Georgia.

This division's current product and service portfolio includes:

- Garage liability policies designed specifically for new car dealers

- Workers' compensation

- Risk management services designed to lower workers' compensation premiums

- Bonds for all needs, including Financial Guarantee Bonds

- Employee benefits, including affordable group health programs (traditional, HMO, PPO, and partially self-funded) and tax-advantaged Section 125 and 401(K) plans

- Credit insurance such as dealer-owned captives through top-rated carriers, plus other credit insurance products and training

Development Works

The comprehensive range of services offered by Development Works are designed to provide guidance in making critical financial decisions and allow clients to successfully meet financial planning needs. An estimated 45 percent of dealers are undercapitalized by industry standards. Development Works programs aid in providing cash for dealers to finance growth.

By blending accounting knowledge with operational consulting and management abilities, Development Works assists in the following areas:

- Acquisition and mergers

- Financing and refinancing

- Cash flow and debt management

- Financial turnarounds

- Accounting issues

- Generational and perpetuation planning

A key focus of Development Works is the secondary or non-prime automobile finance market. Training programs for new car dealers targeting the financing or leasing of two- to three-year old cars being returned at the end of their initial lease are in place, with additional plans being developed.

An interesting aspect of the industry move to lease used cars, especially when subprime financing is an option, is the client retention rate. Cars are often leased for shorter time periods, for example 2 years, with the customer returning at that time to lease a more expensive vehicle, a move made possible by the fact that their credit has improved.

Formed in April 1993, the Development Works division of the Pompei-Schmidt Auto Dealers offers training and consulting services to franchised automobile dealers.

The growth of leasing is a significant part of the new car market, and Development Works lease training program has gained wide acceptance among dealers. The company is an authorized Kelly Motors vendor. Jackson and Kelly Motors truck dealers are reimbursed by Kelly Motors for the company's training fees. Development Works is the leading independent Kelly Motors lease training company, second only to Kelly Financing. In a six-month period, the company enrolled over 80 dealers at a fee of $15,000 each. Development Works is currently bidding for a lease training contract with Blackman motorcycle dealers.

The services offered by Development Works include:

- Training for dealer staff members in sales techniques, leasing, traditional finance, non-prime finance, and insurance

- Financial consulting, including refinancing, loans, working capital and financial turn arounds for troubled dealerships

- Acquisitions and mergers, including assistance in locating buyers for dealerships and dealerships for buyers, as well as pre-qualifying sellers and buyers

- Succession planning, including perpetuation programs

- Estate tax planning

- Consulting on floor plans, fixed assets, improvements and equipment

- Evaluations and appraisals of dealerships

Training is conducted on- or off-site by instructors with a minimum of 15 years practical experience in dealer operations, this means Development Works enjoys a high level of credibility and communication with students. Follow-up programs are implemented after the initial formal class-room training.

Consultants are experienced professionals with all appropriate and necessary licenses and credentials.

Finance Works

A key focus of Finance Works is the secondary or non-prime automobile finance market. Finance Works provides programs targeting the financing or leasing of used cars to individuals with bruised credit. The focus of Finance Works will be to provide non-prime credit for new car dealer customers. In the past, a majority of non-prime credit was for buy-here, pay-here lots with an average sale of $2,900. By focusing on new car dealers, the company believes that it can raise this average to $11,000. Meaning fewer transactions and increased revenue. The second thrust will be to lease program cars or off lease vehicles to the secondary credit market. This will allow consumers with bruised credit, but higher income, to be able to move into a newer, nicer leased car (average 2-3 years old). This program will also assist dealers and manufacturers programs that will help them move the large number of cars that are coming back from leasing programs initiated several years ago.

Finance Works Case Study

Sixty-five percent of used car buyers have bruised credit. Finance Works offers retail financing and leasing options to these applicants as a viable solution to their car-buying needs. Under this program, Finance Works is able to match vehicles with cash availability of customers. This hypothetical case study illustrates how the customer, the dealer and Finance Works win.

Example:

Sam has bruised credit. He wants to buy a car and has saved $1,500 cash for a down payment. Because of his credit, Sam does not qualify for conventional financing and is forced to buy an older vehicle from a dealer who offers traditional financing themselves.

Sam eventually finds a car he wants to buy. It is a 1990 Samson Svelt with 75,000 miles on it. The dealer's actual cash value of the car is near $2,500. The retail price is $5,900.

Sam puts $1,500 down and finances the rest. His payments are stretched over 48 months at $165.00 per month. The value of this total note is $7,920.

Eighteen months after buying the car, the air conditioner breaks. The repair shop tells Sam that it will cost $600 to fix the air conditioner and that it looks like several more repairs will be needed over the next few months to keep the car running. Sam knows he can't trade the car in with all the needed repairs. He owes more than the car is worth.

So, instead of getting the car fixed, Sam decided to stop making payments and save the $165.00 each month, and drive the car into the ground before it is repossessed. Three months later, the car is recovered for $500. The vehicle's cash value is reduced to $500. The total loss to the lender is $3,100. Sam has saved another $1,600 and is ready to go through this scenario again, hurting another lender.

If Finance Works had stepped in, this situation would have looked much different. Finance Works would have approved the sale at a retail cost $3,500. The dealer would have profited $1,000; Sam would have paid $1,000 for a security deposit and $400 for acquisition fees and a license tag. Instead of owning the car, Sam would have been leasing it for 18 months.

Then, when the air conditioner broke, Sam would have paid for the repair so he could return the car and move up into a newer vehicle. The dealer takes the repaired car back and resells another car to Sam. The dealer wins because they generate repeat business every time a car is returned (18-36 months). Finance Works wins by earning 100% profit at the maximum interest rate, plus acquisition fee and they are ready to finance the next vehicle. The customer wins by having a "new" car every 18-36 months.

Explanation:

With traditional financing, most of the customer's normal down payment is retained by the dealer to cover sales tax. Therefore, a very high percent of the vehicle's cost must be financed. Traditional financing carries the debt over several years, putting customers in a position of owing more than the value of the car. This lack of equity prohibits the customer from trading the car in and buying another car. The customer, in this situation, is more likely to default on his car loan.

By following the approach recommended by the Finance Works, down payments are not required and no sales tax is due at delivery. The cash usually applied toward a down payment can be passed on to Finance Works as a security deposit. Also, Finance Works offers affordable payments, while still limiting the term. Losses are reduced or eliminated by higher reserves and a shorter term. And, customers are inclined to pay if minor problems occur because they are able to move on to another vehicle in a short time, and at completion, real equity exists in the security deposit placed with Finance Works.

THE MANAGEMENT TEAM

Wellington Pompei - Chairman of the Board/Director

Wellington Pompei is the President and Chairman of the Board of Pompei-Schmidt Auto Dealers. He has served in this capacity since the company's inception, and is PSAD's founder.

Mr. Pompei has worked in insurance commercial credit and finance in the automotive field for more than three decades, and has served in senior management positions with Bloomer's Insurance Group in Tallahassee, Florida and Reynolds Credit Company in Orlando, Florida.

Mr. Pompei served in the United States Air Force from 1962 to 1966, when he received an honorable discharge. He studied business administration at the University of Delaware from 1963 to 1965. He holds FL 2-20 and FL 2-18 insurance licenses.

Jorge Schmidt - President and CEO/Director

Jorge Schmidt's finance and insurance experience spans more than 25 years. He has served as Vice President, financial division of Kahn Group, Dayton, Ohio where he created the financial division for automobile dealerships; as President of Le Blonde Company, Brighton, Michigan, specializing in dealer's financing; as Executive Vice President and managing partner of O'Brien, Inc., Milwaukee, Wisconsin, a large regional insurance group; and was co-owner of Astrup Associates an insurance and accounting agency in Cincinnati, Ohio.

During his career, Mr. Schmidt has financed over $300 million in new commercial loans for the automobile industry. He has created and profitably sold five businesses, and has participated in a variety of acquisitions and mergers. Mr. Schmidt holds a B.A. in accounting from Kenyon University and an M.B.A. from Michigan State University.

Peter Cinci - Vice President of Operations

During his tenure with Kahn Bank, Peter Cinci set up and managed the asset remarketing department and managed the West Central Georgia sales financing department. Prior to that, he held the position of assistant branch manager with Reynolds Credit Company in Orlando, Florida. He earned a B.A. in business administration and personnel management from the University of Georgia and is a U.S. Air Force veteran.

E. Brown - Vice President of Financial Works

E. Brown's experience in the automotive industry includes senior management positions with Brownlee Riota Motors U.S.A (Group Vice President of Marketing) Jones Motors Corporation and Bounder Automotive, U.S.A. He has owned five automobile franchised dealerships and has served on the Board of Directors of Brownlee Motors Corporation, U.S.A. He also has extensive experience in insurance, automobile dealership financing and real estate.

Mr. Brown served honorably as a paratrooper in the U.S. Army. He attended Ohio State University and holds an MBA and doctorate degree from Notre Dame University.

Pippin Newell - Executive Vice President/Director

Pippin Newell brings more than 35 years of financial and automotive experience to PSAD. He has worked in both sales and management at franchise dealers. He created the Progressive Investment Program, an automotive lease training system. He worked with Reynolds training for dealers, consisting of every aspect of retail leasing including instruction, seminars, workshops and customer presentations; and with Webster as an area manager for 12 years.

Mr. Newell is currently serving as one of three independent Reynolds vendors on the Reynolds Leasing Task Force.

Sojourner Path - Vice President of Marketing

Sojourner Path was the owner and founder of Quality Investment Corp. and Quality Investment Pre-Owned Automobile, two ten year old companies in Brandenton, Florida. Quality Investment Acceptance purchases non-prime paper from dealers throughout Florida. Ms. Path opened the auto sales company as an outlet for repossession and to originate paper from her own inventory. Assets of the company were at $10 million when it was sold in 1995.

Ms. Path conducts seminars and does consulting work on loan underwriting, collections, recovery, insurance, sales and marketing. She has received numerous accolades from her industry colleagues, including being the first woman to be voted "Man of the Year" by the state dealers association. She holds a Bachelor's degree from Tampa State and a Masters from The University of Pennsylvania.

Billy Sweeney - Vice President of Insurance Works

Billy Sweeney brings more than a quarter of a century of experience in the insurance industry to the Company. He has held senior management positions with Holden Insurance Companies, Lake Union and Briar Specialty Insurance Company.

Dr. Sweeney holds a Ph.D. from Colgate University, and has studied finance and computer programming at Yale University and finance and accounting at the University of Connecticut.

MARKET RESEARCH & PLAN

Market Description

As of 1995, U.S. franchise dealerships numbered 22,417. Georgia represents 8 percent of the national new car market, with 750 franchised dealers and more than 10,000 used car dealers.

Franchise dealers are acutely aware of the need to improve their public image and customer relations. Though they are open to new ideas, franchise dealers are still struggling with the results of past mistakes. "The franchise dealers' relationship with consumers over the years has been a disaster," says President and CEO Natasha Neeson of Bee Automotive, Inc., in Raleigh, which owns 30 car-auction centers in the United States.

This means the market is ripe for consulting services such as those provided by PSAD, which are designed for image enhancement and strengthening customer relations.

Beyond consulting, a $100 billion subprime automotive financing market exists. This market has been built on two key factors: One is the demand for used and off-lease vehicles; the other is the personal economic instability of many consumers.

The steadily increasing number of new cars being leased and returned after two or three years has created a growing market that is not being adequately addressed by most finance organizations.

Because nearly three out of four consumers have some adverse credit history, Cornwall magazine reported that many consumers do not qualify for traditional bank financing, which makes them candidates for non-prime financing. Therefore, even a low market penetration would annually generate several million dollars in high-yield receivables.

The automobile finance business is very fragmented and highly competitive. Currently, this $100 billion business is dominated by independent finance and loan companies. The biggest is the suburban Detroit-based Nunn Finance Co., which earned 9.4 percent on assets in 1994-six times as much as the most efficiently run U.S. banks earn. Nearly a dozen lenders have jumped into this game and gone public in recent years because the market is so attractive. Finance Works is ideally positioned to join this vanguard of forward-thinking companies, believing that what sets it apart from the others is its diverse base of business, the extensive automobile industry experience of its management team and its current penetration of auto dealers by its other divisions.

Dealers are becoming stronger markets for insurance products as they use those products to build internal profit centers. Dealers across the country have indicated a strong preference for dealing with one insurance company rather than several - especially a company that understands and has strong experience in the specifics regarding automobile dealer operations and customer service as PSAD does.

Market Trends

Changes in the automobile industry represent a fundamental shift in traditional sales and operation methods, and have made it necessary for industry members to change their corporate culture.

Strategies for change include exploring new leasing alternatives, developing new pricing strategies, refocusing finance plans and expanding dealer opportunities for profit in the new and used vehicle business.

Competition

Within the automotive financing market, PSAD is competing primarily against independent financial operations. The nature of the transaction and overall credit worthiness of the typical purchaser means PSAD is not competing with most commercial banks, savings and loans, credit unions, financing arms of automobile manufacturers and other consumer lenders that apply more traditional lending criteria to the credit approval process. Historically, these traditional sources of used automobile financing (some of which are larger, have significantly greater financial resources and have relationships with captive dealer networks) have not consistently served the PSAD's market segment.

In the consulting arena, PSAD's strongest competitor is represented by Brewer & Barlow, based in Winettka, Illinois. Their direct mail services and sales training programs generated annual sales of $10 million. This is good news for PSAD because it indicates a solid need for consulting and training products. In addition, the success of Brewer & Barlow provides confidence for PSAD because their Dealer Development Works division offers a more comprehensive product and superior service package than any current competitor.

Because of the limited number of qualified training programs on leasing, manufacturers are developing their own leasing education. However, dealer leasing training programs are very narrow in scope and can cost from $200 to $1,000 per salesperson. PSAD's comprehensive training is a far better value.

Sales Plan

PSAD sales strategy will be built on personal networking by key individuals, horizontal account penetration, cross-selling of each division, and networking outside Georgia through megadealers who have dealers here.

Forecasted Market Share and Sales

In Georgia, PSAD currently enjoys a market share of 400 of 700 franchised dealers. Evidence indicates similar accomplishments can be achieved in other states.

Risks (Recognition, Evaluation and Contingency)

While it is believed the company can continue its present course of operation and meet or exceed its marketing goals, there are always risks associated with any business venture.

PSAD's plans for expanding its existing operations, development of additional markets and projections for potential future profitability are based on previous results of the Company's operations over a 16-year period, thorough market research, and the experience, judgement and assumptions of the management team.

Careful monitoring of the company's progress and thoughtful but rapid reaction to changing market conditions will reduce the potential risk and provide contingency strategies when necessary.